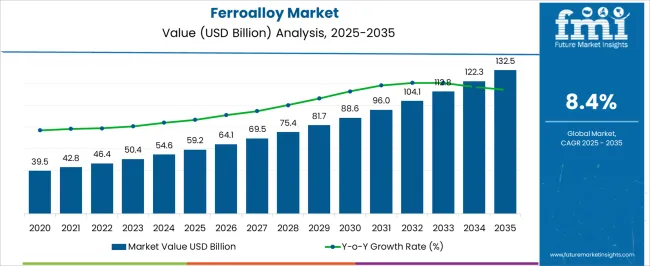

The Ferroalloy Market is estimated to be valued at USD 59.2 billion in 2025 and is projected to reach USD 132.5 billion by 2035, registering a compound annual growth rate (CAGR) of 8.4% over the forecast period.

| Metric | Value |

|---|---|

| Ferroalloy Market Estimated Value in (2025 E) | USD 59.2 billion |

| Ferroalloy Market Forecast Value in (2035 F) | USD 132.5 billion |

| Forecast CAGR (2025 to 2035) | 8.4% |

The Ferroalloy market is witnessing steady expansion driven by its indispensable role in enhancing the properties of steel and other alloys across various industries. The current market environment reflects growing demand from sectors such as construction, automotive, infrastructure, and energy, where high-performance materials are essential. Increasing investments in industrial development, coupled with the rising consumption of alloyed steel in emerging economies, are contributing to this growth.

The shift toward higher strength and corrosion-resistant materials is pushing the adoption of ferroalloys, as they offer superior mechanical and chemical properties. Technological advancements in steel manufacturing and a focus on sustainable production methods are further accelerating the demand for ferroalloys.

The future outlook for the market is shaped by increasing urbanization, infrastructure upgrades, and a growing focus on advanced manufacturing processes The ability to integrate ferroalloys into high-performance applications is expected to create new opportunities across global industrial sectors, supporting both short-term expansion and long-term investments in advanced materials.

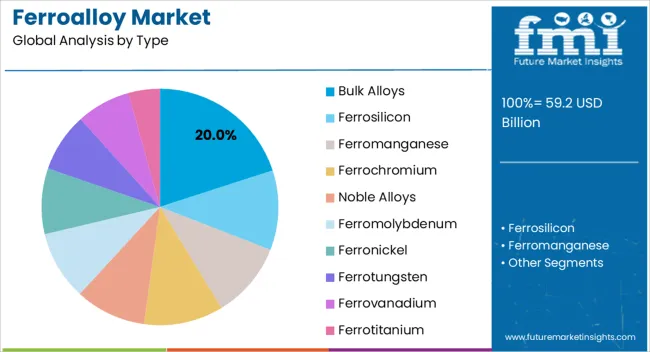

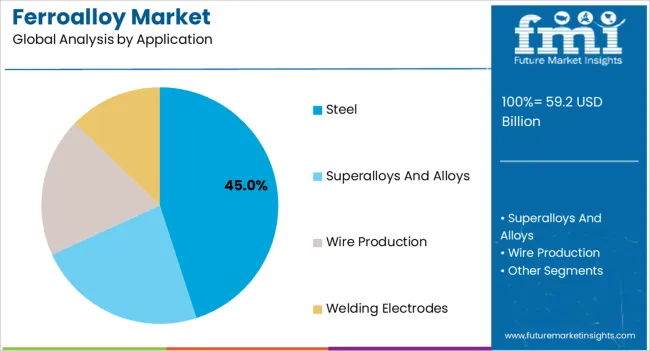

The ferroalloy market is segmented by type, application, and geographic regions. By type, ferroalloy market is divided into Bulk Alloys, Ferrosilicon, Ferromanganese, Ferrochromium, Noble Alloys, Ferromolybdenum, Ferronickel, Ferrotungsten, Ferrovanadium, and Ferrotitanium. In terms of application, ferroalloy market is classified into Steel, Superalloys And Alloys, Wire Production, and Welding Electrodes. Regionally, the ferroalloy industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The bulk alloys segment is expected to account for 20.00% of the Ferroalloy market’s revenue share in 2025, making it one of the prominent segments in terms of type. This position has been supported by the increasing use of bulk ferroalloys in steel production, where large volumes are required to meet industrial demands. The segment’s growth has been accelerated by investments in large-scale steel manufacturing and the need for cost-effective solutions that enhance the strength and durability of metals.

Bulk alloys are preferred for applications that require uniformity and efficiency in blending with base metals, making them suitable for sectors like construction and heavy engineering. The growing demand for alloyed materials that offer enhanced tensile strength and resistance to wear has further supported the adoption of bulk ferroalloys.

The flexibility to supply these materials in larger quantities with consistent quality has contributed to their wider use As industries continue to seek scalable and efficient solutions, the bulk alloys segment is expected to maintain its significance in the overall Ferroalloy market.

The steel application segment is projected to hold 45.00% of the Ferroalloy market’s revenue share in 2025, establishing it as the leading end-use sector. This dominance has been driven by the growing need for alloyed steel in infrastructure development, construction, automotive manufacturing, and energy projects. The demand for stronger, lighter, and corrosion-resistant steel products has encouraged greater adoption of ferroalloys in steel production processes.

The segment’s growth has been supported by increasing urbanization and government initiatives aimed at enhancing industrial capacities in developing regions. Ferroalloys are used extensively to improve steel’s mechanical properties, making it suitable for high-stress applications in transportation, construction, and energy sectors.

The expanding steel production capacity, along with innovations in manufacturing techniques, has enabled more efficient integration of ferroalloys As industries increasingly focus on material efficiency and product performance, the use of ferroalloys in steel is expected to remain at the forefront, with continued investments supporting long-term growth in both established and emerging markets.

Ferroalloy is an alloy of iron which contains one or more chemical elements - primarily manganese, aluminium and silicon; and others such as nickel, chromium, tungsten, cobalt, vanadium, molybdenum and others. Added during steelmaking, ferroalloys play a vital role in addition of distinct characters to various alloy steels and cast irons.

Ferroalloys have an indispensable role in the diverse end-use industries and absence of alternative further ensure future market sustainability of the ferroalloy market. However, the ferroalloy industry is currently witnessing a significant impact of ongoing trade disputes.

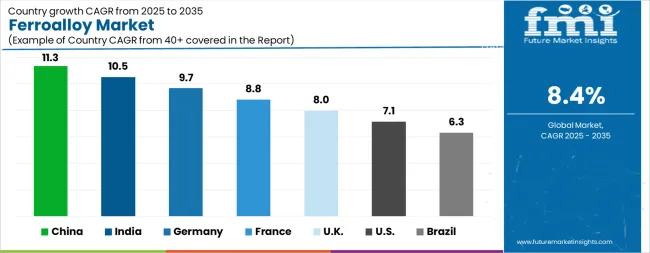

| Country | CAGR |

|---|---|

| China | 11.3% |

| India | 10.5% |

| Germany | 9.7% |

| France | 8.8% |

| UK | 8.0% |

| USA | 7.1% |

| Brazil | 6.3% |

The Ferroalloy Market is expected to register a CAGR of 8.4% during the forecast period, exhibiting varied country level momentum. China leads with the highest CAGR of 11.3%, followed by India at 10.5%. Developed markets such as Germany, France, and the UK continue to expand steadily, while the USA is likely to grow at consistent rates. Brazil posts the lowest CAGR at 6.3%, yet still underscores a broadly positive trajectory for the global Ferroalloy Market. In 2024, Germany held a dominant revenue in the Western Europe market and is expected to grow with a CAGR of 9.7%. The USA Ferroalloy Market is estimated to be valued at USD 21.1 billion in 2025 and is anticipated to reach a valuation of USD 42.1 billion by 2035. Sales are projected to rise at a CAGR of 7.1% over the forecast period between 2025 and 2035. While Japan and South Korea markets are estimated to be valued at USD 2.8 billion and USD 1.9 billion respectively in 2025.

| Item | Value |

|---|---|

| Quantitative Units | USD 59.2 Billion |

| Type | Bulk Alloys, Ferrosilicon, Ferromanganese, Ferrochromium, Noble Alloys, Ferromolybdenum, Ferronickel, Ferrotungsten, Ferrovanadium, and Ferrotitanium |

| Application | Steel, Superalloys And Alloys, Wire Production, and Welding Electrodes |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

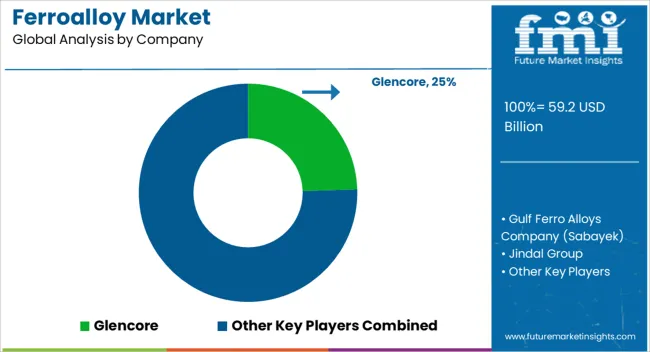

| Key Companies Profiled | Glencore, Gulf Ferro Alloys Company (Sabayek), Jindal Group, S.C. Feral S.R.L, SAIL, Samancore Chrome, Shanghai Shenjia Ferroalloys Co. Ltd, and Tata Steel Limited |

The global ferroalloy market is estimated to be valued at USD 59.2 billion in 2025.

The market size for the ferroalloy market is projected to reach USD 132.5 billion by 2035.

The ferroalloy market is expected to grow at a 8.4% CAGR between 2025 and 2035.

The key product types in ferroalloy market are bulk alloys, ferrosilicon, ferromanganese, ferrochromium, noble alloys, ferromolybdenum, ferronickel, ferrotungsten, ferrovanadium and ferrotitanium.

In terms of application, steel segment to command 45.0% share in the ferroalloy market in 2025.

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA