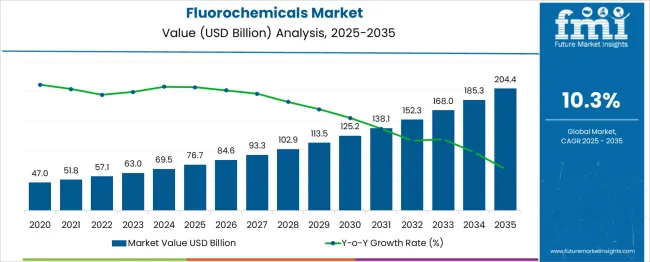

The Fluorochemicals Market is estimated to be valued at USD 76.7 billion in 2025 and is projected to reach USD 204.4 billion by 2035, registering a compound annual growth rate (CAGR) of 10.3% over the forecast period.

| Metric | Value |

|---|---|

| Fluorochemicals Market Estimated Value in (2025 E) | USD 76.7 billion |

| Fluorochemicals Market Forecast Value in (2035 F) | USD 204.4 billion |

| Forecast CAGR (2025 to 2035) | 10.3% |

The fluorochemicals market is experiencing steady growth, fueled by expanding industrial applications and environmental regulations that encourage the use of efficient chemical compounds. Industry trends show increased adoption of fluorochemicals due to their unique chemical properties such as thermal stability and resistance to degradation. These characteristics make fluorochemicals essential in many manufacturing processes.

The refrigerant segment is a major driver as the demand for efficient cooling solutions grows across commercial and residential sectors. Innovations in low global warming potential refrigerants have further stimulated market expansion.

Additionally, stricter environmental policies have encouraged the shift from traditional refrigerants to more sustainable fluorocarbon-based alternatives. As global refrigeration needs rise and technology advances, the fluorochemicals market is expected to maintain an upward trajectory. Growth is anticipated to be led by the fluorocarbon product segment and the refrigerant application segment.

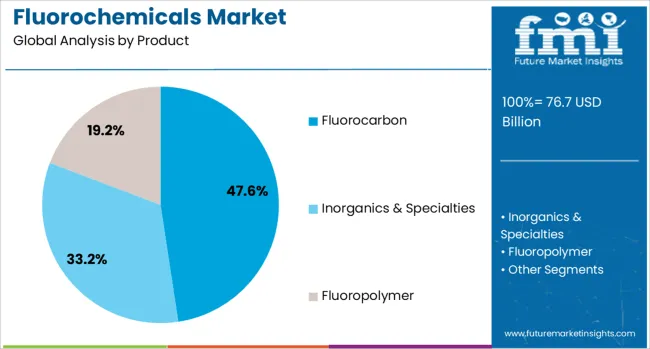

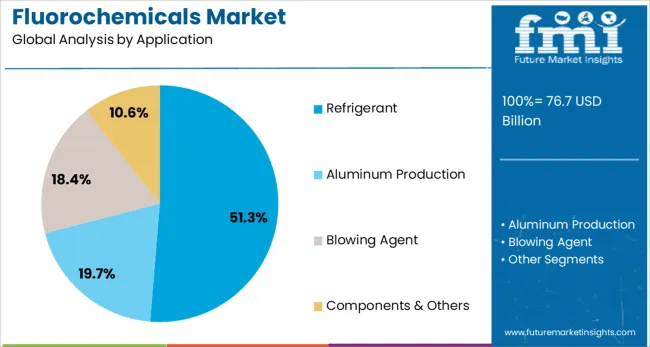

The fluorochemicals market is segmented by product and application, and geographic regions. The fluorochemicals market is divided into Fluorocarbon, Inorganics & Specialties, and Fluoropolymer. The fluorochemicals market is classified into Refrigerant, Aluminum Production, Blowing Agent, and Components & Others. Regionally, the fluorochemicals industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The fluorocarbon segment is projected to hold 47.6% of the fluorochemicals market revenue in 2025, maintaining its leading position among products. This segment’s prominence is driven by fluorocarbons’ superior chemical stability, low toxicity, and excellent performance in refrigeration and air conditioning systems. Their ability to withstand high temperatures and resist chemical breakdown has made fluorocarbons the preferred choice in many industrial processes.

Additionally, ongoing efforts to develop environmentally friendly fluorocarbons with reduced ozone depletion and global warming potential have increased their market appeal.

These attributes have contributed to widespread use in applications requiring reliable and efficient cooling agents. As demand for sustainable refrigerants grows, the fluorocarbon product segment is expected to sustain its market dominance.

The refrigerant application segment is expected to account for 51.3% of the fluorochemicals market revenue in 2025, securing its position as the largest application. The segment’s growth is linked to the increasing demand for refrigeration and air conditioning worldwide, driven by urbanization and rising consumer living standards. Regulatory frameworks aimed at reducing environmental impact have accelerated the adoption of fluorocarbon-based refrigerants with low global warming potential.

Refrigeration in commercial, residential, and automotive sectors has increasingly shifted toward these advanced refrigerants to meet energy efficiency and sustainability goals.

Additionally, advancements in climate control technology have expanded fluorochemical refrigerant usage. With global cooling requirements projected to grow, the refrigerant segment is anticipated to remain the key application area for fluorochemicals.

The fluorochemicals market is driven by rising demand in refrigeration, electronics, and high-performance sectors, supported by regulatory shifts toward low-GWP refrigerants. Emerging opportunities lie in electric mobility, hydrogen fuel cells, medical devices, and eco-friendly fluoropolymer applications across diverse industries

The fluorochemicals market growth is being propelled by increasing applications across refrigeration, air conditioning, and electronics manufacturing. Rising demand for fluoropolymers in wire insulation and coatings has driven consistent utilization in automotive and industrial segments. Stringent regulations around low-global-warming-potential refrigerants have accelerated the adoption of next-generation hydrofluoroolefins, boosting market penetration in HVAC systems. Expanding semiconductor and lithium-ion battery production has enhanced the use of fluorochemicals for electrolyte salts and etching gases. Escalating requirements for non-stick coatings in cookware and industrial processing add momentum to market expansion. The steady shift toward fluoropolymer-based components in high-performance sectors, including aerospace and chemical processing, is expected to strengthen revenue streams for major players in the coming years

Fluorochemicals present notable opportunities in electric mobility and renewable energy systems due to their role in advanced batteries, membranes, and specialty coatings. Growing investments in hydrogen fuel cells and electrolyzers are increasing demand for fluorinated ion exchange membranes. Rapid industrialization in electronics manufacturing regions is creating a strong base for high-purity fluorinated gases in semiconductor etching processes. Market players are also focusing on developing eco-friendly alternatives to traditional refrigerants, which aligns with the tightening regulatory framework for environmental compliance. The integration of fluoropolymer solutions in medical devices, pharmaceuticals, and specialty textiles represents another growth avenue, driven by durability and chemical resistance requirements. These applications provide significant scope for innovation in product formulations and customized solutions.

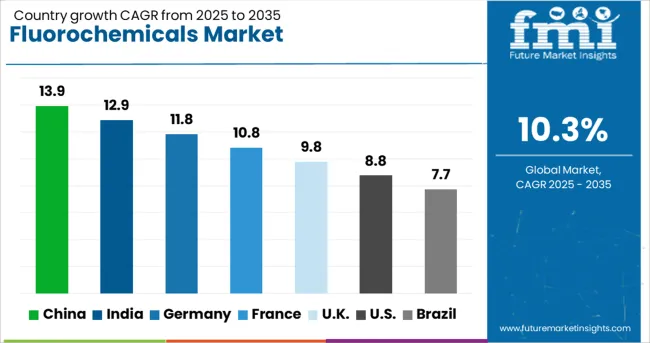

| Country | CAGR |

|---|---|

| China | 13.9% |

| India | 12.9% |

| Germany | 11.8% |

| France | 10.8% |

| UK | 9.8% |

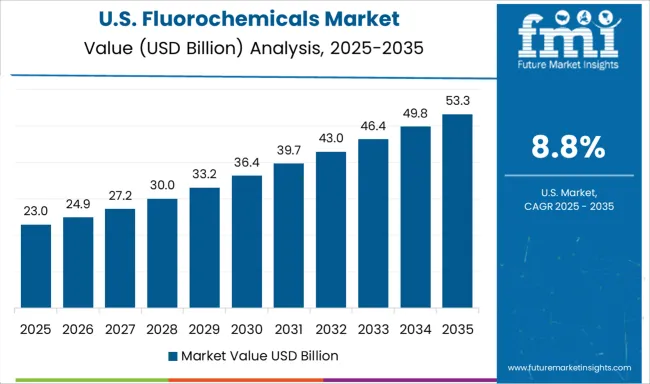

| USA | 8.8% |

| Brazil | 7.7% |

The fluorochemicals market, projected to grow at a global CAGR of 10.7% from 2025 to 2035, exhibits strong but varied performance across leading economies. China leads with a CAGR of 13.9%, supported by high-volume fluoropolymer production, domestic electronics demand, and expansion in HVAC applications. India follows at 12.9%, driven by robust growth in pharmaceuticals, agrochemicals, and demand for refrigerants in emerging cooling infrastructure.

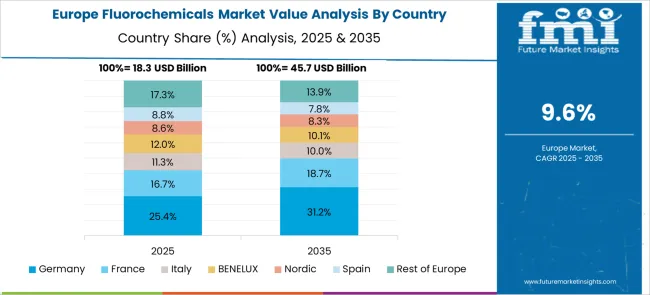

Germany posts 11.8%, reflecting strong chemical industry innovation, EU compliance mandates, and adoption in automotive coatings and energy-efficient systems. The UK reports a 9.8% CAGR, shaped by demand in specialty chemicals and refrigerant retrofitting but moderated by regulatory constraints.

The USA registers 8.8%, with growth influenced by green refrigerant transitions and advanced material demand in the semiconductor and aerospace sectors. BRICS economies dominate through large-scale manufacturing and downstream integration, while OECD markets focus on high-value applications, regulatory-driven innovation, and sustainable formulations. The report provides a comprehensive analysis of 40+ countries, with the five leading regions highlighted as reference.

The CAGR for the United States fluorochemicals market stood at approximately 7.9% during 2020-2024 and is expected to rise to nearly 8.8% for 2025-2035, driven by new demand for hydrofluoroolefins in refrigeration and sustainable refrigerant transitions. The phase-down of HFCs under the AIM Act encouraged manufacturers to accelerate the adoption of low-GWP alternatives across HVAC and automotive systems. Industrial fluoropolymers are finding expanding use in energy storage, contributing to a higher growth trajectory. Domestic chemical producers prioritized capacity expansion and R&D partnerships to cater to lithium-ion battery segments. Investments in semiconductor-grade fluorochemicals positioned the country as a major supplier in high-precision applications.

The CAGR in the United Kingdom advanced from about 7.6% in 2020-2024 to 9.8% during 2025-2035, outpacing historical performance as automotive electrification accelerated demand for fluoropolymers in battery components. The transition toward low-GWP refrigerants under F-gas regulation spurred innovation in HVAC and commercial refrigeration segments. Increased adoption of fluorochemical coatings in pharmaceuticals and medical devices also contributed to the stronger outlook. UK-based specialty chemical companies introduced eco-friendly product lines, aligning with EU directives for refrigerant management. Integration into high-performance applications in aerospace and chemical processing further enhanced market penetration.

The CAGR in Germany rose from nearly 9.1% during 2020-2024 to 11.8% between 2025 and 2035, supported by heavy investment in industrial automation and high-precision electronics. Expanding semiconductor capacity encouraged the consumption of high-purity fluorinated gases for etching processes. The push for environmentally compliant refrigerants across HVAC systems accelerated deployment of next-generation fluorochemicals. German producers invested in capacity upgrades for PTFE and specialty polymers, targeting automotive and aerospace sectors. Public procurement in clean energy and hydrogen projects created additional prospects for fluorinated membranes and electrolyte materials.

China’s CAGR moved from about 10.8% in 2020-2024 to an estimated 13.9% during 2025-2035, the highest among major markets, due to strong industrial diversification and electronics manufacturing growth. Government-led HFC phase-out initiatives drove adoption of hydrofluoroolefins and other low-GWP refrigerants. The rise of electric mobility and large-scale battery production accelerated demand for PVDF and fluorinated electrolyte additives. Domestic manufacturers expanded R&D alliances with global chemical leaders to strengthen supply capabilities in specialty fluoropolymers. Electronics hubs in Jiangsu and Guangdong contributed to soaring consumption of semiconductor etching gases.

The CAGR in India increased from nearly 9.7% in 2020-2024 to 12.9% between 2025 and 2035, fueled by industrial refrigeration upgrades and expanding automotive electrification. Growing reliance on cold-chain infrastructure raised requirements for fluorochemical refrigerants in food and pharmaceutical storage. The rollout of production-linked incentive (PLI) schemes for electronics manufacturing supported investments in high-purity fluorinated gases. Local fluorochemical producers partnered with global companies to enhance domestic supply of specialty polymers. The healthcare and coatings industries adopted fluoropolymer-based solutions for performance-critical applications.

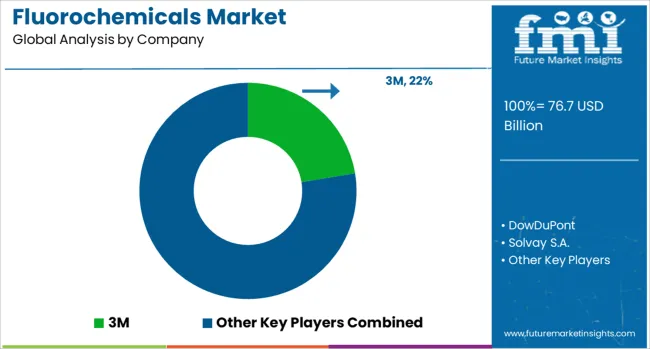

In the fluorochemicals market, leading companies are focusing on high-performance applications across refrigeration, automotive, electronics, and energy storage sectors. Industry giants like 3M, DowDuPont, and Solvay S.A. are advancing fluoropolymer technologies for coatings, semiconductors, and lithium-ion batteries. Daikin Industries Limited and Asahi Glass Company are investing in next-generation refrigerants with low global warming potential, aligning with stringent international regulatory frameworks. Specialty chemical producers like Arkema and Honeywell International, Inc. are strengthening portfolios through innovations in hydrofluoroolefins for HVAC and automotive systems. Emerging and regional players such as Dongyue Group Ltd., Pelchem SOC Ltd., and Halocarbon Products Corporation are expanding production capacities to cater to the rising demand for PTFE and fluorinated gases in the Asia-Pacific and Africa. Mexichem Fluor S.A. de C.V. continues to scale up refrigerant manufacturing and distribution in Latin America, supporting regional cold-chain and industrial growth.

In May 2024, Daikin Industries Limited announced the updated Daikin Group Philosophy for its centennial celebration.

| Item | Value |

|---|---|

| Quantitative Units | USD 76.7 Billion |

| Product | Fluorocarbon, Inorganics & Specialties, and Fluoropolymer |

| Application | Refrigerant, Aluminum Production, Blowing Agent, and Components & Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | 3M, DowDuPont, Solvay S.A., Daikin Industries Limited, Asahi Glass Company, Arkema, Honeywell International, Inc., Dongyue Group Ltd., Pelchem SOC Ltd., Halocarbon Products Corporation, and Mexichem Fluor S.A. de C.V. |

| Additional Attributes | Dollar sales trends, share by application and region, demand forecast for refrigerants and fluoropolymers, regulatory impact on low-GWP products, competitive landscape analysis, raw material price outlook, capacity expansions, and end-user industry growth insights. |

The global fluorochemicals market is estimated to be valued at USD 76.7 billion in 2025.

The market size for the fluorochemicals market is projected to reach USD 204.4 billion by 2035.

The fluorochemicals market is expected to grow at a 10.3% CAGR between 2025 and 2035.

The key product types in fluorochemicals market are fluorocarbon, _hcfc, _hfc, _hfo, inorganics & specialties and fluoropolymer.

In terms of application, refrigerant segment to command 51.3% share in the fluorochemicals market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA