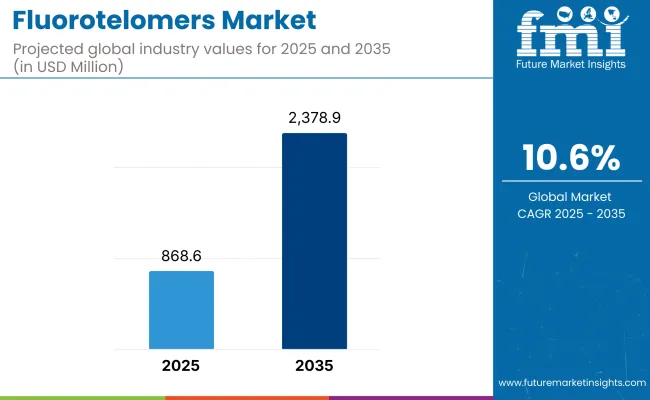

The fluorotelomers market is projected to reach approximately USD 868.6 million by 2025, progressing robustly to USD 2,378.9 million by 2035, reflecting a Compound Annual Growth Rate (CAGR) of 10.6%.

The United States stands as the most lucrative market owing to substantial industrial demand, stringent regulatory adherence, and robust growth in textiles and specialty coatings. China emerges as the fastest-growing market driven by rapid industrialization, burgeoning demand from the textile and construction sectors, and escalating applications in water-repellent coatings.

The global fluorotelomers market is witnessing dynamic growth primarily due to heightened demand from various end-use industries, notably textiles and construction. Rising consumer expectations for high-performance, durable, water-repellent clothing and textiles are significantly fueling demand for fluorotelomers, particularly in outdoor and protective apparel. Additionally, expanding applications in firefighting foams, carpet treatments, and food packaging enhance market growth prospects.

However, regulatory scrutiny related to environmental concerns, particularly regarding long-chain fluorotelomers and their potential ecological impacts, poses substantial constraints. Key industry trends include a marked shift toward short-chain fluorotelomers, seen as environmentally safer alternatives, coupled with increased R&D activities aimed at developing sustainable, eco-friendly formulations. Market participants actively pursue strategic partnerships, technological innovations, and product reformulations to comply with evolving environmental standards and capture emerging opportunities.

Looking forward to 2035, significant advancements are anticipated in sustainable fluorotelomer chemistry, with an increasing shift from long-chain to short-chain variants, driven by regulatory pressures and sustainability mandates.

Innovations are likely to focus on achieving similar performance attributes with reduced ecological impact, fostering opportunities in eco-friendly coatings, repellents, and advanced industrial applications. Enhanced collaboration among market stakeholders, regulatory bodies, and scientific communities is expected to drive forward-looking research, facilitating the broader adoption of sustainable practices.

Overall, the fluorotelomers market is poised for sustained growth and transformation, navigating environmental challenges while capitalizing on expanding industrial demand through strategic innovation and regulatory alignment.

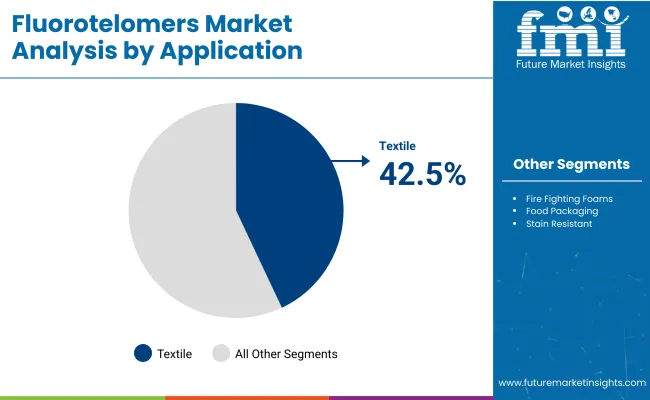

The textile segment holds a dominant 42.5% share in the global fluorotelomers market in 2025 and is expected to retain its lead through 2035, propelled by consistent demand from performance fabrics and outdoor apparel. This segment benefits from a projected CAGR that closely mirrors the overall market rate of 10.6%, underpinned by consumer preferences for long-lasting, stain- and water-resistant textile treatments.

Historically, textiles have served as the proving ground for fluorotelomer-based repellents due to their ability to meet durability standards while maintaining fabric flexibility. However, intensifying regulatory scrutiny—particularly over long-chain perfluorinated compounds-has catalyzed a fundamental shift in formulation strategies.

As regulatory frameworks in the USA, EU, and parts of Asia tighten, textile manufacturers are accelerating their transition toward short-chain fluorotelomer alternatives that meet both performance and safety expectations. Brands and manufacturers alike are increasingly embedding sustainability into their R&D priorities, spurring demand for fluorotelomer products that align with global green chemistry standards.

Strategic collaboration between chemical producers and textile brands is becoming instrumental in driving innovation pipelines, especially in emerging markets such as Southeast Asia. As consumers and regulators demand lower environmental persistence, the textile segment is positioned to act as both the risk catalyst and innovation leader in shaping the future of fluorotelomer adoption.

The construction segment is projected to grow at a CAGR of approximately 9.8% from 2025 to 2035, fueled by increasing demand for weather-resistant coatings, sealants, and architectural finishes. While holding a comparatively smaller market share than textiles, this segment demonstrates robust, regulation-resilient momentum amid rising infrastructure investments and building safety standards worldwide.

Fluorotelomers in construction are being increasingly specified for their ability to impart stain resistance, UV durability, and water repellency to a broad range of surfaces, from exterior facades to interior composites.

Unlike consumer-facing applications, construction end-uses often allow for longer product development cycles and greater formulation flexibility, enabling the integration of short-chain fluorotelomer technologies with minimal performance trade-offs. As global infrastructure spending rebounds and climate-adaptive architecture gains relevance, demand for advanced coatings that enhance material longevity is expected to surge.

Importantly, construction stakeholders are less sensitive to marginal cost increases compared to consumer sectors, positioning them as early adopters of reformulated, eco-aligned fluorotelomer solutions. This tolerance offers chemical manufacturers a viable testbed for scaling sustainable innovations.

With urbanization and green building certifications driving material specification trends, the construction segment is anticipated to play a pivotal role in anchoring demand stability and enabling compliance-driven innovation across the fluorotelomers value chain.

Challenges

Regulatory Restrictions and Environmental Concerns

The fluorotelomers market faces challenges due to increasing regulatory action on per- and polyfluoroalkyl substances (PFASs) which have notable environmental persistence. Governments and green agencies, including the EPA (Environmental Protection Agency), European Chemicals Agency (ECHA), and fictional regulatory authorities, are gradually enforcing stricter bans and restrictions on products that contain PFAS.

Additionally, the high cost of production, coupled with the limited availability of alternatives to fluorotelomer-based coatings in the textile, food packaging and firefighting foams industries, present further challenges

Opportunities

Growth in Sustainable and PFAS-Free Alternatives

Demand for high-performance water- and oil-repellent coatings is driving the growth of fluorotelomer-free alternatives in the market. Green chemistry, biodegradable coatings and non-fluorinated surfactants are being developed to offer new replacements for sustainable alternatives to fill specific gaps in firefighting foams, textiles and paper coatings.

Furthermore, additional study on short-chain fluorotelomers with lower toxicity and bioaccumulation potential may provide a compliant alternative for industrial application of fluorotelomer chemistry.

The United States fluorotelomers are chemical compounds that find diverse applications in various industries, including firefighting foams, textiles, food packaging, and the semiconductor industry in the United States. Increasing application of fluorotelomer type surfactants in stain-resistant coatings and water-repellent in the making material is driving the industry demand.

Regulatory pressure against per- and polyfluoroalkyl substances (PFAS) is spurring innovation to find greener, non-toxic alternatives to fluorotelomers. In addition, growing demand for high-performance chemicals in aerospace and automotive sectors is anticipated to bolster the market growth.

| Country | CAGR (2025 to 2035) |

|---|---|

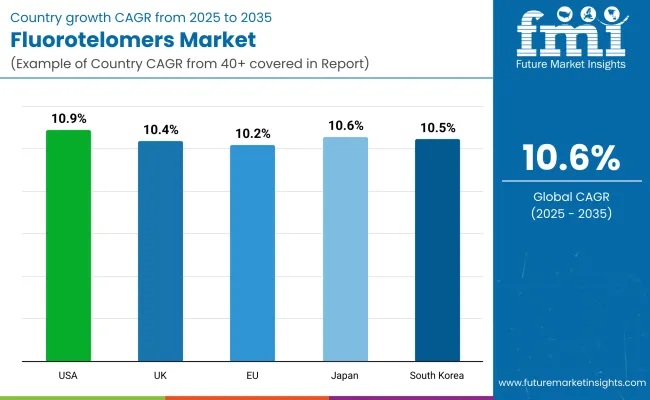

| USA | 10.9% |

The UK fluorotelomers market is expanding due to rising applications in textiles, coatings, and industrial manufacturing. By addressing the regulations surrounding per-and polyfluoroalkyl substances (PFAS) in the chemical industry, this trend will continue, as companies seek greener solutions, expanding their demand for eco-friendly fluorotelomers that are PFAS free.

Additionally, booming construction sector and rising use of non-stick and water-repellent coatings in industrial operations are contributing to the growth of this market. Moreover, the emergence of research institutions conveying sustainable fluorotelomer innovations is propelling the market.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 10.4% |

The demand for sustainable surfactants and coating applications is further driving the market, especially in developed nations like the European Union (EU), where environmental regulations are strict and stringently followed. Growing Demand for Stain-Resistant and Water-Repellent High-Performance Materials in Textiles and Food Packaging is expected to Fuel Market Growth

Key markets include Germany, France and Italy, with solid R&D investments in sustainable alternatives to traditional fluorotelomers. The introduction of REACH (Registration, Evaluation, Authorization and Restriction of Chemicals) regulations is prompting manufacturers to focus on the creation of greener fluorotelomer-based options.

| Country | CAGR (2025 to 2035) |

|---|---|

| EU | 10.2% |

In the electronics, semiconductors and coatings industry, demanding of high-performance fluorochemicals are expected to provide tremendous growth for the Japan Fluorotelomers market. Strong emphasis on technological innovation and high-quality industrial materials in the country is expected to boost the demand for fluorotelomer-based products.

Meanwhile, the increasing shift towards sustainable and environment-friendly options in reaction to governmental regulations and sustainable development goals (SDGs) is also influencing the market with eco-friendly options replacing traditional fluorotelomers. Also, new polymer coatings are being developed along with new stain-resistant textiles that contribute to increased demand.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 10.6% |

The South Korean fluorotelomers market is expected to witness a steady growth during the forecast period, owing to rising applications in electronics, automotive, and industrial coating. Demand for fluorotelomer-based performance coatings and surfactants is being driven by the country’s rapidly expanding semiconductor and display panel industries.

Consumer knowledge about eco-friendly fluorotelomers and regulatory measures to ban harmful PFAS compounds are driving innovation in sustainable alternatives. Furthermore, the expansion in the textile and fashion sector of South Korea is anticipated to boost the adoption of fluorotelomers that offer stain- and water-repellant properties.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 10.5% |

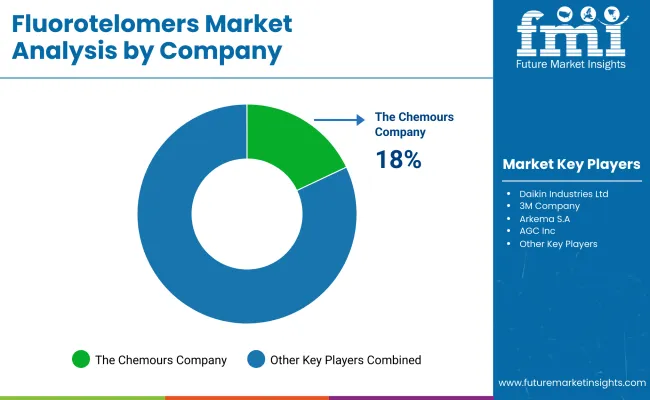

The Chemours Company (18-22%)

Chemours has a strong presence in the fluorotelomers market with advanced delivery methods with fluorotelomer-based coatings, repellents, and surfactants for firefighting foams, textiles, and high-performance industrial applications.

Daikin Industries Ltd. (14-18%)

Daikin specializes in fluorotelomer technology for textiles, electronics, and surface treatments, emphasizing sustainability and regulatory compliance.

3M Company (12-16%)

3M provides fluorotelomer-based firefighting foams and protective coatings, targeting defense, aerospace, and industrial safety applications.

Arkema S.A. (10-14%)

Arkema focuses on fluorotelomer-based surfactants and coatings, enhancing heat and chemical resistance for industrial applications.

AGC Inc. (Asahi Glass Co.) (8-12%)

AGC develops fluorotelomer solutions for specialty coatings, electronics, and water-repellent applications.

Other Key Players (26-32% Combined)

Several emerging and regional players are expanding the market with custom fluorotelomer solutions, including:

The overall market size for fluorotelomers market was USD 868.6 million in 2025.

The fluorotelomers market is expected to reach USD 2,378.9 million in 2035.

Rising demand for non-stick and stain-resistant coatings, increasing applications in firefighting foams, and growing use in textiles and food packaging will drive market growth.

The top 5 countries which drives the development of fluorotelomers market are USA, European Union, Japan, South Korea and UK.

Fluorotelomer acrylate growth to command significant share over the assessment period.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA