Food-grade Glycerin Market is focused towards high-purity glycerine used in food and beverage application as a humectant, sweetener, thickener, and preservative. Due to its water retention capacity and low-caloric sweetening properties, food-grade glycerine is extensively utilized in bakery products, confectionery, beverages, dairy substitutes, and dietary supplements.

Growing demand for natural food ingredients, increasing application in plant-based and functional foods, and government support for food safety and clean-label offerings are driving the growth. Furthermore, the rising use of bio-based and palm-free glycerine is influencing the trends in the market.

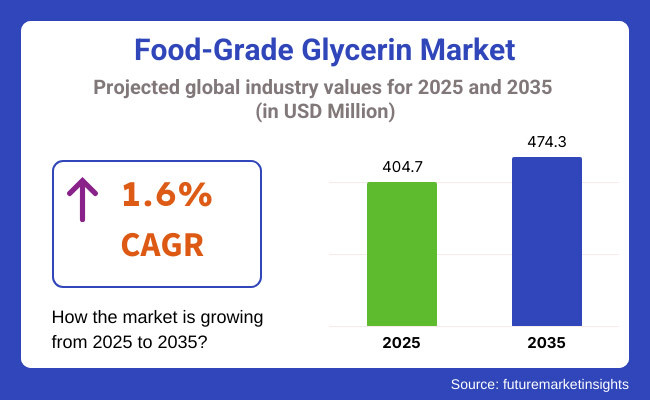

In 2025, the global food-grade glycerine market is projected to reach approximately USD 404.7 million, with expectations to grow to around USD 474.3 million by 2035, reflecting a Compound Annual Growth Rate (CAGR) of 1.6% during the forecast period.

The projected CAGR highlights the increasing use of glycerine in sugar-free and keto-foods, increasing demand from functional food markets, and increase in sustainable glycerine supply. The fermentation-based production's expansion of glycerine is likely to drive innovation throughout the market as well.

Due to need for clean label & functional food ingredients, increase in the use of sugar substitutes and strong regulatory favour for bio-based glycerine, North America holds a substantial share of the food-grade glycerine market. The United States and Canada lead this trend with a significant share in plant-based glycerine applications, specifically in dairy substitutes, sports nutrition, and confections. Furthermore, augmented investments in the manufacture of sustainable and non-GMO glycerine are propelling growth in the region.

Europe represents a large proportion of the market owing to Germany, France, and the United Kingdom being pioneers in the adoption of natural food ingredients and bio-based food processing technologies. The EU regulatory framework in support of clean-label, and non-GMO food additives are driving the demand of food-grade glycerine derived from non-palm and sustainable feedstock. The market is also driven by increasing demand from vegan-friendly and functional foods.

The growing food and beverage manufacturing in China, India, Japan, and Australia, increasing usage for sugar substitutes, and an evolving interest among consumers for functional food ingredients is expected to drive the Asia-Pacific food-grade glycerine market more than other regions. The lucrative bakery, confectionery and processed foods industries in the region are bolstering demand for glycerine to be used as a humidity-retaining agent and texture regulator. Growing biodiesel-derived glycerine manufacturing in Southeast Asia is supporting availability in the region.

Challenges

Price Volatility and Raw Material Sourcing Issues

The food-grade glycerine market is facing challenges from the volatility of raw material prices, especially the vegetable oils (palm, soybean, coconut) and the by-products of biodiesel. You have increased demand for sustainable and non-GMO glycerine feedstocks that has created supply chain shortages and cost volatility. Production constraints and deforestation issues regarding palm oil are also pushing producers toward alternative feedstocks that in some cases are more expensive or less available.

Opportunities

Growth in Natural Sweeteners, Functional Foods, and Clean-Label Ingredients

Food-grade glycerine is in stronger demand to use as a humectant, sweetener, and preservative in bakery, confectionery, dairy products, and beverages amid escalating consumer interest in nature-based, non-GMOs, and plant-based constituents. Bio-based glycerine production, glycerine from fermentation, and non-palm glycerine alternatives are increasing the market opportunities. Another factor boosting adoption is the functional foods application - glycerine’s use in sugar replacement, keto diets and helping retain moisture in plant-based foods.

The demand for low-calorie sweeteners, plant-based food items, and food preservation applications drove the rise in food-grade glycerine consumption between 2020 and 2024. However, palm oil sustainability issues and price variations, as well as a lack of awareness on the functional value of glycerine, prevented the accelerated adoption of glycerine in some regions.

The market will shift to sustainability, bio-based and multi-functional glycerine solutions by 2025 to 2035. Industry revolution through fermentation-derived glycerine, AI based formulation, and regulatory sustainability. In addition, personalized nutrition, functional hydration items, and growth of keto-diet-friendly food formulations will widen glycerine scope as clean-label, multifunctional ingredient, adding up to FDA's 2022 data.

Market Shifts: A Comparative Analysis 2020 to 2024 vs. 2025 to 2035

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Compliance with FDA, EFSA, and organic certification guidelines |

| Technology Innovations | Development of vegetable-based and biodiesel-derived glycerine |

| Market Adoption | Growth in food emulsifiers, sugar substitutes, and humectants |

| Sustainability Trends | Shift toward non-GMO and responsibly sourced vegetable glycerine |

| Market Competition | Dominated by food ingredient manufacturers (Cargill, P&G Chemicals, Emery Oleo chemicals, BASF, Godrej Industries, Dow Chemical) |

| Consumer Trends | Demand for low-calorie sweeteners, sugar replacements, and natural emulsifiers |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Stricter regulations on sustainable sourcing, non-GMO certification, and palm-free glycerine alternatives |

| Technology Innovations | Advancements in synthetic biology, fermentation-derived glycerine, and AI-powered food formulation |

| Market Adoption | Expansion into functional foods, personalized nutrition, and bio-based food preservatives |

| Sustainability Trends | Large-scale adoption of carbon-neutral glycerine production, alternative feedstocks, and regenerative agriculture-based sourcing |

| Market Competition | Rise of biotech startups, AI-driven food science firms, and sustainable glycerine innovation companies |

| Consumer Trends | Growth in keto-friendly, clean-label, and personalized food solutions using functional glycerine |

The United States food-grade glycerine market is growing at a CAGR of 1.8% in forecasted period of 2025 to 2035. The growing demand for alternative sources of glycerine that are plant-based and environment-friendly is also contributing to the market growth.

Presence of major food processing companies and ongoing progressions in food formulations is supporting market growth. In addition, other major factors boosting the uptake of glycerine include increasing utilization in low-calorie and sugar-free food products.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 1.8% |

Based on application, the food-grade glycerine segment accounted for the largest share of the United Kingdom food-grade glycerine market by 2024, as it encompasses a range of food products and play significant role for human health. The increasing use of glycerine in bakery, confectionery, and beverage products as a humectant is driving the market growth.

Market trends continue to be driven by the need for sustainable and bio-based ingredients in foods. Additionally, the increasing trend for vegan and plant-based diets is boosting demand for glycerine from non-animal sources.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 1.5% |

Food grade glycerine market in EU is a diversified market with the focus being on clean food standards and customer preferences of using natural and sustainable ingredients. Market demand is also driven by the application of glycerine in food preservation, emulsification, and sugar reduction.

It is a strategic market for Germany, France, and Italy applications in processed food, beverages, and pharmaceutical sectors. In addition, the EU's eco-friendly initiatives are driving the trend in bio-based glycerine production.

| Country | CAGR (2025 to 2035) |

|---|---|

| EU | 1.4% |

The food-grade glycerine market of Japan is developing because of the prosperous food processing market of Japan and liking for top-class, purposeful food components. Increasing use of glycerine in confectionery, frozen food and drinks is improving market.

With this, there is also demand for the plant-based glycerine due to the growing clean-label and naturally sourced ingredients trend. At Japan, advanced food technologies and premium additives are also shaping the market.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 1.6% |

The South Korea food-grade glycerine market is in growing phase, largely due to the increasing consumption of functional food ingredients and in processed foods. Expansion of the country's confectionery and bakery businesses is additionally facilitating market growth.

The rise in demand among health-conscious consumers for sugar substitutes and humectant food additives also contributes to the growing demand. The growing demand for sustainable and non-GMO glycerine influences the trends in the products as well.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 1.5% |

Vegetable oil-based glycerine remains the preferred choice in the food industry due to its natural origin, high purity, and wide acceptance in clean-label formulations. Naturally sourced, highly pure and widely acceptable for clean-label formulations, the trend further establishes vegetable oil-based glycerine as the food industry’s first choice.

Increasing demand for natural and organic food products is one of the factors driving the adoption of vegetable oil-based glycerine. By switching to plant-based glycerine in their clean label formulations, food manufacturers can improve their competitive edge among health-minded consumers. Non-GMO, vegan and RSPO compliant certifications helped global malt shall be increased penetration in special food segments.

In fact, vegetable oil-derived glycerine is also more stable and taste-neutral and is, therefore, an ideal ingredient for bakery foods, beverages, and confectionery. Functional foods, energy bars, and gluten-free food brands are using this style of glycerine to give superior texture and extended shelf life.

Nonetheless, instability in supply chains of vegetable oil manufacturing (palm oil and soybean-extracted glycerine) remain a challenge for cost control and availability of raw material. In response, manufacturers expand sourcing channels to ensure consistent availability of plant-derived sustainable forms of glycerine.

Glycerol derived from biodiesel presents a low-cost and renewable alternative with food-grade purity. Biodiesel production is on the rise around the world, and food manufacturers are using crude glycerine, the by-product of biodiesel production once it has been refined for food-grade applications.

The cost of glycerine derived from biodiesel is lower than that derived from vegetable oil, and therefore, it can be an economical option for industrial food processing at large volumes. Cheap biodiesel glycerine is for the most part used by producers in making processed food sweeteners and emulsifiers and humectants without affecting the quality of the product.

Glycerine derived from biodiesel enhances sustainable circular economy practices whereby food manufacturing industries leverage renewable by-products in circular manufacturing of foods. However, the majority of food brands manufacture their carbon-neutral sourcing systems by using the glycerine acquired in the processing of biodiesel to further sustainability goals and corporate sustainability missions.

While beneficial, matters of contamination and residual trace amounts in glycerine extracted from biodiesel require advanced purification technologies. Some manufacturers spend a lot of money developing highly accurate refining processes that render the product non-toxic, and able to meet ultrafine physical requirements in food manufacturing processes.

Glycerine which is essential for bakery products, soft texture, moisture retention, and shelf life for products. Glycerine is used by most bread, cake, muffin and pastry manufacturers to prevent staling, promote dough consistency, and sweetness with less added sugar.

Glycerine knows how to eliminate and restore equilibrium in hydration levels, which prevents baked foods from going stale, is one of the major reasons for the use of glycerine in bakery foods. The prevalence of adding glycerine to low-carb and gluten-free baked goods is found among most of these bakery companies as it provides functional benefits in low-sugar, reduced-sugar formulations by adding flavor, texture and mouthfeel without increasing added sugars.

Glycerine is widely used in the confectionery market, including chewing gum, soft candies, marshmallows, and chocolate coatings for chewiness, texture retention, and moisture management.

One of the use of glycerine in confectionary is to reduce the crystallization of sugar so that the candies and syrups are smooth and of even consistency. Glycerine is used by a number of confectionery companies as a sugar substitute for reduced-calorie and sugar-free product lines.

Glycerine is increasingly being utilized in energy drinks, flavored water, and plant milk varieties to impart smooth mouthfeel and texture, as well as cut added sugar. In the competitive landscape of low-sugar and sports drink brands, glycerine is used as a functional humectant to add hydration benefits and sweetness balance.

Dairy Industry Incorporates Glycerine for Creamy Texture and Fat Replacement In the food industry, glycerine is added to dairy desserts, yogurts, and ice creams to encourage creaminess and emulsification. Many low-fat and non-dairy products assure indulgent texture without superfluous fat, which glycerine serves as a fat replacement for.

The food-grade glycerine market is experiencing steady growth due to increasing demand in food and beverage applications, pharmaceuticals, and personal care industries. Food grade glycerine is a multifunctional ingredient that is commonly used as a sweetener, humectant, preservative, and emulsifier and thus an important component in bakery, confectionery, dairy, processed foods, and beverages. Because of increasing consumer interest in natural and plant-based ingredients, growing demand for sugar substitutes, and regulatory incentives for food safety standards, the market is receiving thrust.

Market Share Analysis by Key Players

| Company/Organization Name | Estimated Market Share (%) |

|---|---|

| Cargill, Incorporated | 18-22% |

| Dow Chemical Company | 14-18% |

| BASF SE | 12-16% |

| Wilmar International Limited | 10-14% |

| Emery Oleo chemicals | 8-12% |

| Others | 26-32% |

| Company/Organization Name | Key Offerings/Activities |

|---|---|

| Cargill, Incorporated | Produces plant-based, non-GMO food-grade glycerine used in food processing and pharmaceutical applications. |

| Dow Chemical Company | Develops high-purity synthetic glycerine for food emulsification, moisture retention, and preservatives. |

| BASF SE | Manufactures bio based and synthetic food-grade glycerine, focusing on clean-label and sustainable sourcing. |

| Wilmar International Limited | Supplies refined, vegetable-derived glycerine for sweeteners, stabilizers, and texture enhancers in food products. |

| Emery Oleo chemicals | Specializes in natural, sustainable glycerine extraction for organic food and beverage formulations. |

Key Market Insights

Cargill, Incorporated (18-22%)

Cargill leads the food-grade glycerine market, offering plant-based, high-purity glycerine widely used in processed foods, dairy, and pharmaceutical formulations.

Dow Chemical Company (14-18%)

Dow Chemical specializes in synthetic glycerine for food applications, including emulsifiers, humectants, and sugar replacements.

BASF SE (12-16%)

BASF provides bio-based food-grade glycerine, catering to clean-label trends and sustainable ingredient sourcing.

Wilmar International Limited (10-14%)

Wilmar produces vegetable-derived glycerine, used in bakery, confectionery, and beverage stabilization applications.

Emery Oleo chemicals (8-12%)

Emery Oleo chemicals focuses on sustainable and organic glycerine extraction, targeting natural and health-conscious food brands.

Other Key Players (26-32% Combined)

The overall market size for food-grade glycerine market was USD 404.7 million in 2025.

The food-grade glycerine market is expected to reach USD 474.3 million in 2035.

Rising demand for natural sweeteners, increasing applications in food and beverage formulations, and growing use as a humectant in bakery and confectionery products will drive market growth.

The top 5 countries which drives the development of food-grade glycerine market are USA, European Union, Japan, South Korea and UK.

Biodiesel-derived glycerine growth to command significant share over the assessment period.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (MT) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Source, 2018 to 2033

Table 4: Global Market Volume (MT) Forecast by Source, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by End-Use, 2018 to 2033

Table 6: Global Market Volume (MT) Forecast by End-Use, 2018 to 2033

Table 7: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 8: North America Market Volume (MT) Forecast by Country, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Source, 2018 to 2033

Table 10: North America Market Volume (MT) Forecast by Source, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by End-Use, 2018 to 2033

Table 12: North America Market Volume (MT) Forecast by End-Use, 2018 to 2033

Table 13: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 14: Latin America Market Volume (MT) Forecast by Country, 2018 to 2033

Table 15: Latin America Market Value (US$ Million) Forecast by Source, 2018 to 2033

Table 16: Latin America Market Volume (MT) Forecast by Source, 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by End-Use, 2018 to 2033

Table 18: Latin America Market Volume (MT) Forecast by End-Use, 2018 to 2033

Table 19: Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 20: Europe Market Volume (MT) Forecast by Country, 2018 to 2033

Table 21: Europe Market Value (US$ Million) Forecast by Source, 2018 to 2033

Table 22: Europe Market Volume (MT) Forecast by Source, 2018 to 2033

Table 23: Europe Market Value (US$ Million) Forecast by End-Use, 2018 to 2033

Table 24: Europe Market Volume (MT) Forecast by End-Use, 2018 to 2033

Table 25: Asia Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Asia Pacific Market Volume (MT) Forecast by Country, 2018 to 2033

Table 27: Asia Pacific Market Value (US$ Million) Forecast by Source, 2018 to 2033

Table 28: Asia Pacific Market Volume (MT) Forecast by Source, 2018 to 2033

Table 29: Asia Pacific Market Value (US$ Million) Forecast by End-Use, 2018 to 2033

Table 30: Asia Pacific Market Volume (MT) Forecast by End-Use, 2018 to 2033

Table 31: MEA Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 32: MEA Market Volume (MT) Forecast by Country, 2018 to 2033

Table 33: MEA Market Value (US$ Million) Forecast by Source, 2018 to 2033

Table 34: MEA Market Volume (MT) Forecast by Source, 2018 to 2033

Table 35: MEA Market Value (US$ Million) Forecast by End-Use, 2018 to 2033

Table 36: MEA Market Volume (MT) Forecast by End-Use, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Source, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by End-Use, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 4: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 5: Global Market Volume (MT) Analysis by Region, 2018 to 2033

Figure 6: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 7: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 8: Global Market Value (US$ Million) Analysis by Source, 2018 to 2033

Figure 9: Global Market Volume (MT) Analysis by Source, 2018 to 2033

Figure 10: Global Market Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 11: Global Market Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 12: Global Market Value (US$ Million) Analysis by End-Use, 2018 to 2033

Figure 13: Global Market Volume (MT) Analysis by End-Use, 2018 to 2033

Figure 14: Global Market Value Share (%) and BPS Analysis by End-Use, 2023 to 2033

Figure 15: Global Market Y-o-Y Growth (%) Projections by End-Use, 2023 to 2033

Figure 16: Global Market Attractiveness by Source, 2023 to 2033

Figure 17: Global Market Attractiveness by End-Use, 2023 to 2033

Figure 18: Global Market Attractiveness by Region, 2023 to 2033

Figure 19: North America Market Value (US$ Million) by Source, 2023 to 2033

Figure 20: North America Market Value (US$ Million) by End-Use, 2023 to 2033

Figure 21: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 22: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 23: North America Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 24: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 25: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 26: North America Market Value (US$ Million) Analysis by Source, 2018 to 2033

Figure 27: North America Market Volume (MT) Analysis by Source, 2018 to 2033

Figure 28: North America Market Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 29: North America Market Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 30: North America Market Value (US$ Million) Analysis by End-Use, 2018 to 2033

Figure 31: North America Market Volume (MT) Analysis by End-Use, 2018 to 2033

Figure 32: North America Market Value Share (%) and BPS Analysis by End-Use, 2023 to 2033

Figure 33: North America Market Y-o-Y Growth (%) Projections by End-Use, 2023 to 2033

Figure 34: North America Market Attractiveness by Source, 2023 to 2033

Figure 35: North America Market Attractiveness by End-Use, 2023 to 2033

Figure 36: North America Market Attractiveness by Country, 2023 to 2033

Figure 37: Latin America Market Value (US$ Million) by Source, 2023 to 2033

Figure 38: Latin America Market Value (US$ Million) by End-Use, 2023 to 2033

Figure 39: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 40: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 41: Latin America Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 42: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 43: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 44: Latin America Market Value (US$ Million) Analysis by Source, 2018 to 2033

Figure 45: Latin America Market Volume (MT) Analysis by Source, 2018 to 2033

Figure 46: Latin America Market Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 47: Latin America Market Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 48: Latin America Market Value (US$ Million) Analysis by End-Use, 2018 to 2033

Figure 49: Latin America Market Volume (MT) Analysis by End-Use, 2018 to 2033

Figure 50: Latin America Market Value Share (%) and BPS Analysis by End-Use, 2023 to 2033

Figure 51: Latin America Market Y-o-Y Growth (%) Projections by End-Use, 2023 to 2033

Figure 52: Latin America Market Attractiveness by Source, 2023 to 2033

Figure 53: Latin America Market Attractiveness by End-Use, 2023 to 2033

Figure 54: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 55: Europe Market Value (US$ Million) by Source, 2023 to 2033

Figure 56: Europe Market Value (US$ Million) by End-Use, 2023 to 2033

Figure 57: Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 58: Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 59: Europe Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 60: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 61: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 62: Europe Market Value (US$ Million) Analysis by Source, 2018 to 2033

Figure 63: Europe Market Volume (MT) Analysis by Source, 2018 to 2033

Figure 64: Europe Market Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 65: Europe Market Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 66: Europe Market Value (US$ Million) Analysis by End-Use, 2018 to 2033

Figure 67: Europe Market Volume (MT) Analysis by End-Use, 2018 to 2033

Figure 68: Europe Market Value Share (%) and BPS Analysis by End-Use, 2023 to 2033

Figure 69: Europe Market Y-o-Y Growth (%) Projections by End-Use, 2023 to 2033

Figure 70: Europe Market Attractiveness by Source, 2023 to 2033

Figure 71: Europe Market Attractiveness by End-Use, 2023 to 2033

Figure 72: Europe Market Attractiveness by Country, 2023 to 2033

Figure 73: Asia Pacific Market Value (US$ Million) by Source, 2023 to 2033

Figure 74: Asia Pacific Market Value (US$ Million) by End-Use, 2023 to 2033

Figure 75: Asia Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 76: Asia Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 77: Asia Pacific Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 78: Asia Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 79: Asia Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 80: Asia Pacific Market Value (US$ Million) Analysis by Source, 2018 to 2033

Figure 81: Asia Pacific Market Volume (MT) Analysis by Source, 2018 to 2033

Figure 82: Asia Pacific Market Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 83: Asia Pacific Market Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 84: Asia Pacific Market Value (US$ Million) Analysis by End-Use, 2018 to 2033

Figure 85: Asia Pacific Market Volume (MT) Analysis by End-Use, 2018 to 2033

Figure 86: Asia Pacific Market Value Share (%) and BPS Analysis by End-Use, 2023 to 2033

Figure 87: Asia Pacific Market Y-o-Y Growth (%) Projections by End-Use, 2023 to 2033

Figure 88: Asia Pacific Market Attractiveness by Source, 2023 to 2033

Figure 89: Asia Pacific Market Attractiveness by End-Use, 2023 to 2033

Figure 90: Asia Pacific Market Attractiveness by Country, 2023 to 2033

Figure 91: MEA Market Value (US$ Million) by Source, 2023 to 2033

Figure 92: MEA Market Value (US$ Million) by End-Use, 2023 to 2033

Figure 93: MEA Market Value (US$ Million) by Country, 2023 to 2033

Figure 94: MEA Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 95: MEA Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 96: MEA Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 97: MEA Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 98: MEA Market Value (US$ Million) Analysis by Source, 2018 to 2033

Figure 99: MEA Market Volume (MT) Analysis by Source, 2018 to 2033

Figure 100: MEA Market Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 101: MEA Market Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 102: MEA Market Value (US$ Million) Analysis by End-Use, 2018 to 2033

Figure 103: MEA Market Volume (MT) Analysis by End-Use, 2018 to 2033

Figure 104: MEA Market Value Share (%) and BPS Analysis by End-Use, 2023 to 2033

Figure 105: MEA Market Y-o-Y Growth (%) Projections by End-Use, 2023 to 2033

Figure 106: MEA Market Attractiveness by Source, 2023 to 2033

Figure 107: MEA Market Attractiveness by End-Use, 2023 to 2033

Figure 108: MEA Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Nitroglycerin Market Size and Share Forecast Outlook 2025 to 2035

Vegetable Glycerin Market Size and Share Forecast Outlook 2025 to 2035

Sustainable Glycerin Alternatives Market Size and Share Forecast Outlook 2025 to 2035

Medical Nitroglycerin Sprays Market - Demand, Innovations & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA