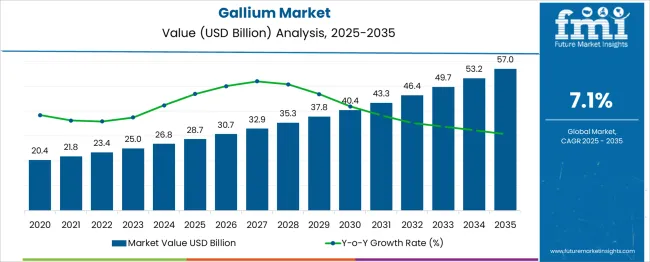

The global gallium market is anticipated to reach from USD 28.7 million in 2025 to approximately USD 57 million by 2035, recording an absolute increase of USD 28.28 million over the forecast period. This translates into a total growth of 98.5%, with the market forecast to expand at a compound annual growth rate (CAGR) of 7.1% between 2025 and 2035. The market size is expected to grow by nearly 2.0X during the same period, supported by the rising adoption of gallium-based semiconductors and increasing demand for advanced electronic applications.

Between 2025 and 2030, the gallium market is projected to expand from USD 28.7 million to USD 40.8 million, resulting in a value increase of USD 12.1 million, which represents 42.8% of the total forecast growth for the decade. This phase of growth will be shaped by rising penetration of gallium-based semiconductors in global electronics manufacturing, increasing demand for high-performance optoelectronic devices, and growing awareness among manufacturers about the superior properties of gallium compounds. Electronic component producers are expanding their gallium utilization to address the growing complexity of modern semiconductor applications.

From 2030 to 2035, the market is forecast to grow from USD 40.8 million to USD 57 million, adding another USD 16.18 million, which constitutes 57.2% of the overall ten-year expansion. This period is expected to be characterized by expansion of gallium applications in next-generation semiconductors, integration of advanced gallium arsenide technologies, and development of standardized gallium processing protocols across different manufacturing facilities. The growing adoption of 5G technology and advanced computing systems will drive demand for more sophisticated gallium-based components and specialized material expertise.

Between 2020 and 2025, the gallium market experienced steady expansion, driven by increasing semiconductor manufacturing rates and growing awareness of gallium requirements in advanced electronic applications. The market developed as electronics manufacturers recognized the need for specialized gallium compounds to properly service high-performance electronic systems. Technology companies and semiconductor manufacturers began emphasizing proper gallium utilization procedures to maintain product performance and manufacturing efficiency.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 28.7 million |

| Forecast Value in (2035F) | USD 57 million |

| Forecast CAGR (2025 to 2035) | 7% |

Market expansion is being supported by the rapid increase in semiconductor-equipped electronic devices worldwide and the corresponding need for specialized gallium compounds in manufacturing processes. Modern electronic devices rely on precise gallium-based materials to ensure proper functioning of high-frequency systems including 5G communications, advanced computing processors, and high-efficiency solar cells. Even minor improvements in gallium purity can require comprehensive material upgrades to maintain optimal system performance and device reliability.

The growing complexity of semiconductor technologies and increasing performance demands are driving demand for professional gallium materials from certified suppliers with appropriate processing capabilities and expertise. Electronics manufacturers are increasingly requiring proper gallium quality documentation to maintain production standards and ensure device performance compliance. Regulatory requirements and technology specifications are establishing standardized gallium processing procedures that require specialized materials and trained technicians.

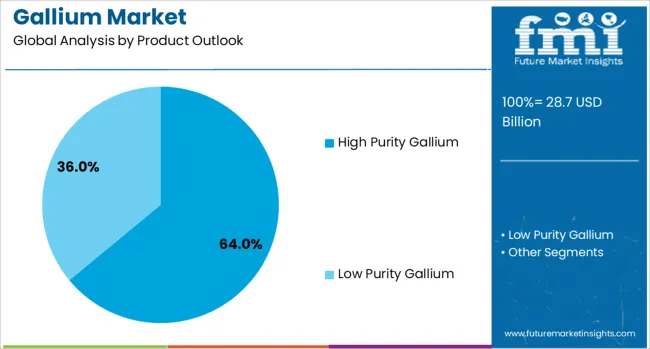

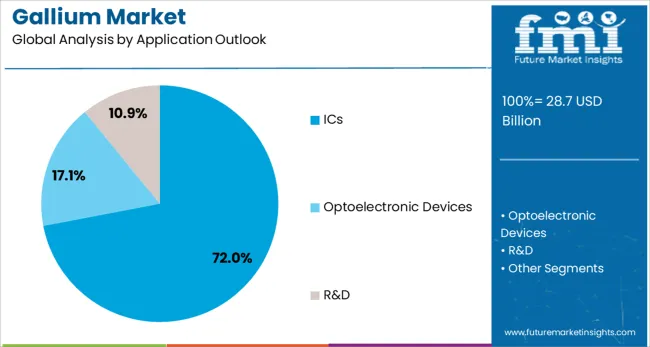

The market is segmented by product type, application, and region. By product type, the market is divided into high purity gallium and low purity gallium. By application, the market is categorized into integrated circuits (ICs), optoelectronic devices, and research & development. Regionally, the market is divided into China, India, Germany, France, United Kingdom, United States, and Brazil.

High purity gallium is projected to account for 64% of the gallium market in 2025. This leading share is supported by the widespread adoption of high purity gallium for advanced semiconductor applications, which represent the majority of current electronic technologies. High purity gallium provides superior performance characteristics for critical electronic components, making it the preferred material for most semiconductor manufacturing and advanced electronic systems. The segment benefits from established processing procedures and comprehensive supply availability from multiple specialized suppliers.

Integrated circuits are expected to represent 72% of gallium application demand in 2025. This dominant share reflects the high utilization of gallium materials in the semiconductor manufacturing segment and the large population of electronic devices requiring gallium-based components. Modern integrated circuits increasingly feature gallium-based materials that require coordinated processing and quality control throughout manufacturing activities. The segment benefits from growing electronics industry awareness of gallium functionality and increasing technology requirements for proper material specifications.

The gallium market is advancing steadily due to increasing semiconductor adoption and growing recognition of gallium material importance. However, the market faces challenges including high processing costs, need for continuous development of new gallium applications, and varying quality requirements across different manufacturing processes. Standardization efforts and certification programs continue to influence material quality and market development patterns.

The growing deployment of advanced gallium processing technologies is enabling enhanced material purity and improved performance characteristics across manufacturing applications. Modern processing equipment and refined purification techniques provide superior quality control and reduced material waste for manufacturers while expanding application possibilities. These technologies are particularly valuable for semiconductor manufacturers and high-performance electronics producers that require consistent gallium quality without material performance variations.

Modern gallium suppliers are incorporating advanced testing equipment and automated quality control systems that improve material consistency and reduce processing time. Integration of advanced analytical databases and real-time material monitoring systems enables more precise gallium processing procedures and comprehensive quality documentation. Advanced equipment also supports processing of next-generation gallium applications including advanced semiconductor technologies and specialized electronic components.

| Country | CAGR |

|---|---|

| China | 9.6% |

| India | 8.9% |

| Germany | 8.2% |

| France | 7.5% |

| United Kingdom | 6.7% |

| United States | 6% |

| Brazil | 5.3% |

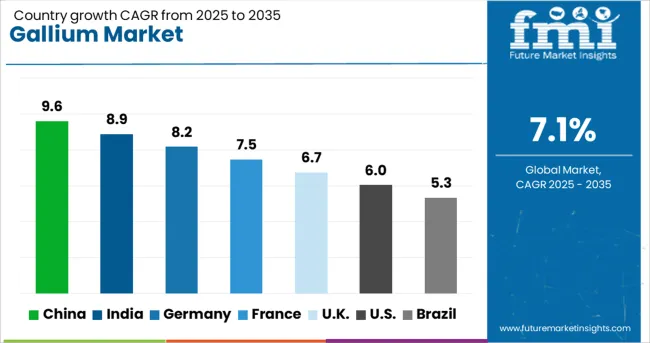

The gallium market demonstrates significant regional variation, with China leading at USD 9.6 million in 2025, driven by extensive semiconductor manufacturing capabilities and advanced electronics production infrastructure. India follows closely at USD 8.9 million, supported by growing electronics manufacturing and increasing technology sector development. Germany maintains a strong position at USD 8.2 million, emphasizing precision manufacturing and advanced material processing expertise. France represents a substantial market at USD 7.5 million, leveraging its robust aerospace and defense industries alongside established semiconductor research facilities and growing renewable energy sector applications. The United Kingdom contributes USD 6.7 million to the global gallium market, supported by its strong telecommunications infrastructure and emerging compound semiconductor initiatives. The United States accounts for USD 6.0 million, driven by defense applications and high-performance computing requirements, while Brazil rounds out the analysis at USD 5.3 million, reflecting its expanding electronics manufacturing base and increasing industrial modernization efforts. The report covers an in-depth analysis of 40+ countries; seven top-performing countries are highlighted below.

Revenue from gallium in China is projected to exhibit the highest growth rate with a CAGR of 9.6% through 2035, establishing China as the fastest-growing market globally for gallium applications. This exceptional growth rate reflects the country's aggressive expansion in semiconductor manufacturing capabilities and rapid advancement in electronics production infrastructure. The accelerated development of China's technology sector, combined with substantial government investments in advanced manufacturing, positions the market for superior growth performance compared to other global regions.

The robust 9.6% CAGR demonstrates China's commitment to becoming a dominant force in gallium-dependent technologies, particularly in high-performance semiconductor applications and next-generation electronics manufacturing. Major technology companies are establishing extensive gallium processing capabilities to support the anticipated demand surge, while government policies actively promote domestic gallium supply chain development and advanced material processing expertise across key manufacturing regions.

Revenue from gallium in India is projected to expand at a CAGR of 8.9% through 2035, representing the second-highest growth rate globally and demonstrating India's emerging position as a major gallium consumer. This impressive growth trajectory reflects the country's rapidly expanding electronics manufacturing sector and accelerating technology industry development. The strong CAGR indicates India's transition from a developing market to a significant global player in gallium applications, supported by increasing foreign investment and domestic technology advancement initiatives.

The 8.9% CAGR positions India as an attractive market for gallium suppliers seeking high-growth opportunities, with the country's expanding semiconductor capabilities and growing technology sector creating substantial demand increases. Electronics manufacturers are rapidly scaling gallium utilization capabilities to meet the projected growth demands, while professional development programs are building the technical expertise necessary to support the anticipated market expansion across diverse technology applications.

Demand for gallium in Germany is projected to grow at a CAGR of 8.2% through 2035, representing robust growth that reflects the country's leadership in precision manufacturing and advanced material processing technologies. This strong growth rate demonstrates Germany's continued investment in high-technology applications and commitment to maintaining competitive advantages in advanced manufacturing sectors. The 8.2% CAGR indicates sustained demand growth driven by Germany's emphasis on quality, precision, and technological excellence in gallium applications.

The substantial growth trajectory reflects Germany's strategic focus on advanced gallium applications in automotive electronics, industrial automation, and precision manufacturing systems. German companies are leveraging the projected 8.2% CAGR to expand gallium processing capabilities and develop specialized applications that meet the country's stringent quality standards and advanced technology requirements, positioning Germany as a premium market for high-value gallium applications.

Demand for gallium in France is projected to grow at a CAGR of 7.5% through 2035, representing solid growth performance that reflects the country's established position in advanced technology applications and sophisticated electronics manufacturing. This healthy growth rate demonstrates France's continued investment in high-performance technology sectors and commitment to maintaining competitive capabilities in specialized gallium applications. The 7.5% CAGR indicates consistent demand increases driven by France's focus on aerospace, defense, and advanced electronics applications.

The steady growth trajectory reflects France's strategic emphasis on high-value gallium applications in technology-intensive industries, with companies leveraging the 7.5% CAGR to develop specialized processing capabilities and advanced material applications. French manufacturers are positioning themselves to capitalize on the projected growth through investments in gallium utilization technologies and development of expertise in specialized applications that serve the country's advanced technology requirements.

Demand for gallium in the United Kingdom is projected to grow at a CAGR of 6.7% through 2035, representing moderate but consistent growth that reflects the country's emphasis on technology innovation and advanced electronics development. This growth rate demonstrates the United Kingdom's strategic focus on high-value applications and research-driven gallium utilization. The 6.7% CAGR indicates steady demand growth supported by the country's strength in technology innovation and specialized electronics applications.

The moderate growth trajectory reflects the United Kingdom's mature market position and focus on value-added gallium applications in research and development activities. British companies are leveraging the 6.7% CAGR to develop innovative gallium applications and advanced processing technologies, while research institutions contribute to growth through specialized projects and technology development initiatives that advance gallium utilization capabilities.

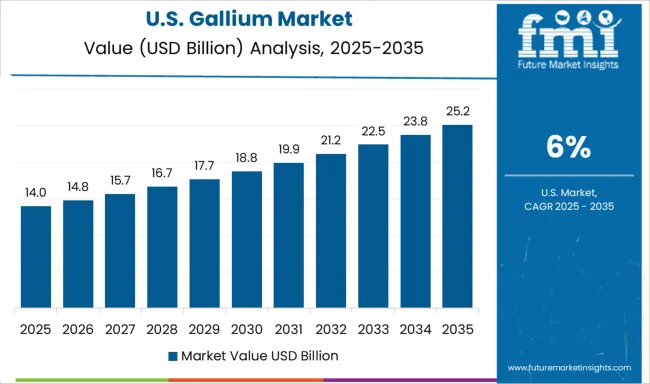

Demand for gallium in the United States is projected to grow at a CAGR of 6% through 2035, representing steady growth that reflects the country's established position in technology innovation and advanced manufacturing capabilities. This growth rate demonstrates the United States' mature market characteristics and focus on high-value gallium applications in technology sectors. The 6% CAGR indicates consistent demand increases supported by the country's strength in semiconductor technology and advanced electronics manufacturing.

The steady growth trajectory reflects the United States' strategic emphasis on technology innovation and advanced manufacturing applications, with companies leveraging the 6% CAGR to maintain competitive positions in gallium-dependent technologies. American manufacturers are focusing on efficiency improvements and advanced processing capabilities to maximize value from the projected growth while maintaining leadership in technology innovation and specialized gallium applications.

Demand for gallium in Brazil is projected to grow at a CAGR of 5.3% through 2035, representing foundational growth that reflects the country's developing position in electronics manufacturing and emerging technology applications. This growth rate demonstrates Brazil's potential for market development and increasing participation in gallium-dependent technologies. The 5.3% CAGR indicates steady progress in building gallium utilization capabilities and expanding electronics manufacturing infrastructure.

The foundational growth trajectory reflects Brazil's strategic development of electronics capabilities and gradual expansion into gallium applications, with companies leveraging the 5.3% CAGR to build processing capabilities and develop technical expertise. Brazilian manufacturers are establishing the foundation for future growth through investments in gallium utilization technologies and development of capabilities that will support expanded electronics manufacturing and technology applications.

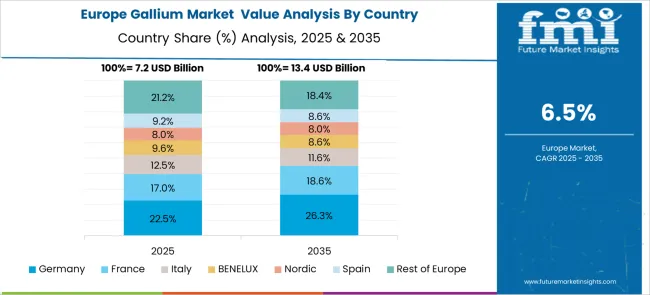

The Gallium market in Europe is projected to reach USD 22.365 million in 2025, with Germany leading the regional market at USD 8.165 million, representing 36.5% of European demand. France follows with USD 7.455 million, accounting for 33.3% of the regional market, while the United Kingdom contributes USD 6.745 million, representing 30.2% of European gallium consumption. The European market demonstrates strong emphasis on high purity gallium applications, particularly in advanced semiconductor manufacturing and precision electronics production. Germany's leadership position reflects its robust automotive electronics sector and advanced manufacturing capabilities, while France's substantial market share indicates significant investment in technology applications and aerospace electronics. The United Kingdom maintains a strong position through its focus on advanced electronics research and specialized technology development programs.

European gallium demand patterns show concentration in high-technology applications, with integrated circuits representing the dominant application segment across all three major markets. The region's stringent quality standards and advanced manufacturing requirements drive preference for high purity gallium materials, supporting premium pricing structures and specialized supplier relationships. Germany's automotive electronics cluster, France's aerospace and defense applications, and the United Kingdom's research and development activities collectively establish Europe as a critical market for advanced gallium applications. Regional supply chain integration and technical expertise development continue to strengthen European market position in global gallium utilization across semiconductor and advanced technology sectors.

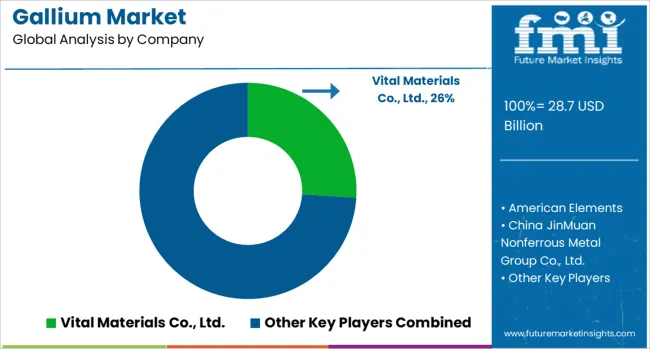

The gallium market is defined by competition among specialized material suppliers, electronics manufacturers, and advanced technology companies. Companies are investing in advanced gallium processing equipment, material quality capabilities, standardized procedures, and technical expertise to deliver precise, reliable, and cost-effective gallium solutions. Strategic partnerships, technological innovation, and supply chain optimization are central to strengthening material portfolios and market presence.

Vital Materials Co., Ltd. offers comprehensive gallium materials with a focus on quality, consistency, and technical expertise. American Elements provides specialized gallium compounds and materials for diverse electronics applications. China JinMuan Nonferrous Metal Group Co., Ltd. delivers advanced gallium processing with standardized procedures and supply integration. Dowa Electronics Materials Co., Ltd. emphasizes quality control and comprehensive material specifications.

NEO Performance Materials offers gallium solutions integrated with advanced material processing and quality assurance. Nichia Corporation provides specialized gallium applications with technical expertise and manufacturing integration across global and regional networks.

| Items | Values |

|---|---|

| Quantitative Units | USD 28.7 million |

| Product Type | High Purity Gallium, Low Purity Gallium |

| Application | Integrated Circuits (ICs), Optoelectronic Devices, Research & Development |

| Regions Covered | Asia Pacific, Europe, North America, Latin America |

| Country Covered | China, India, Germany, France, United Kingdom, United States, Brazil |

| Key Companies Profiled | Vital Materials Co., Ltd., American Elements, China JinMuan Nonferrous Metal Group Co., Ltd., Dowa Electronics Materials Co., Ltd., NEO Performance Materials, Nichia Corporation |

| Additional Attributes | Market analysis by product type and application segments, regional demand trends across major markets, competitive landscape with established players, technology advancement integration with advanced semiconductor manufacturing, innovations in gallium processing capabilities and material quality systems, and adoption of advanced material solutions with enhanced performance characteristics for specialized electronics applications. |

The global gallium market is estimated to be valued at USD 28.7 billion in 2025.

The market size for the gallium market is projected to reach USD 57.0 billion by 2035.

The gallium market is expected to grow at a 7.1% CAGR between 2025 and 2035.

The key product types in gallium market are high purity gallium and low purity gallium.

In terms of application outlook, ics segment to command 72.0% share in the gallium market in 2025.

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA