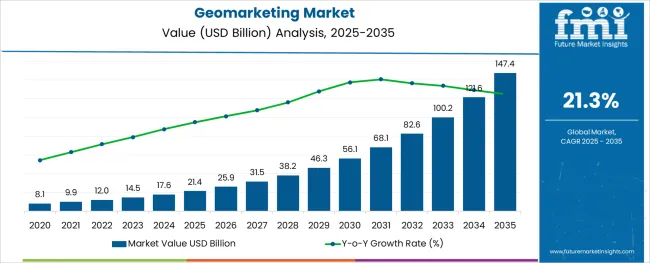

The Geomarketing Market is estimated to be valued at USD 21.4 billion in 2025 and is projected to reach USD 147.4 billion by 2035, registering a compound annual growth rate (CAGR) of 21.3% over the forecast period.

The geomarketing market is expanding rapidly as organizations increasingly prioritize location intelligence to drive strategic decision making, enhance customer engagement, and optimize resource allocation. The rise in mobile device usage, GPS-enabled services, and digital footprints has made spatial data a critical asset for businesses across sectors.

Advances in AI, data analytics, and GIS technologies are further accelerating adoption by enabling real time consumer behavior tracking and geospatial targeting. Enterprises are leveraging these capabilities to refine marketing strategies, personalize offerings, and improve customer experiences based on location specific insights.

Regulatory developments surrounding data privacy and consent are shaping platform innovation and compliance-focused implementation strategies. As industries adopt data centric models for growth, the geomarketing landscape is poised to benefit from ongoing investments in cloud computing, machine learning, and geospatial infrastructure.

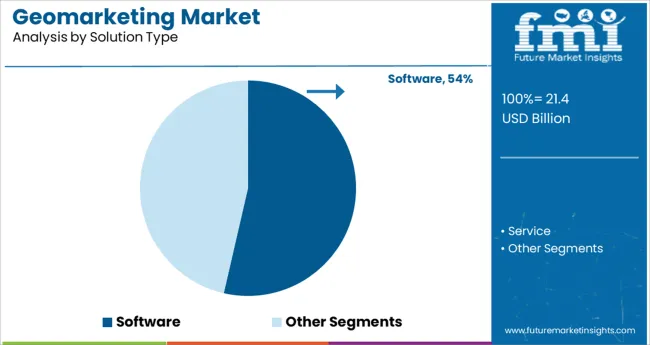

The software segment is projected to contribute 53.60 percent of total market revenue by 2025 under the solution type category, positioning it as the dominant segment. This leadership is attributed to the growing need for scalable and customizable platforms that can analyze, visualize, and interpret geospatial data efficiently.

Software solutions offer robust tools for demographic analysis, location based targeting, and campaign performance tracking, making them indispensable to modern marketing teams. Their integration with CRM systems, business intelligence tools, and mapping interfaces enhances strategic planning and decision support.

As enterprises continue to prioritize data driven marketing operations, software remains the foundational component of geomarketing initiatives, enabling high impact, location specific strategies across industries.

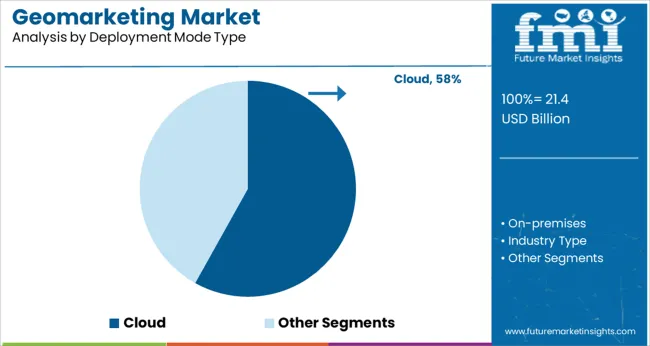

The cloud segment is expected to account for 58.10 percent of total revenue by 2025 within the deployment mode category, making it the leading segment. This growth is being driven by the need for cost effective, flexible, and easily scalable solutions that support real time access to geospatial analytics.

Cloud based geomarketing platforms eliminate the need for on premise infrastructure while enabling faster deployment, automatic updates, and seamless integration with third party data sources. The model supports remote collaboration, enhances data security protocols, and allows organizations to respond quickly to market changes.

With the increasing complexity of location data and demand for cross channel marketing insights, cloud deployment continues to gain momentum as the preferred choice among enterprises seeking agility, efficiency, and operational scalability in their geomarketing strategies.

Businesses have started switching over to digital marketing solutions from traditional ones due to the higher client engagement and affordability they provide, which are driving the industry. In addition, expanding interest in the use of location analysis and a vast amount of information to acquire individualized data about potential markets and customers is one of the factors contributing to the high growth rate.

Due to their capacity to analyze and distribute real-time geo-data, smart devices (smartphones, smart wearables, laptops), wireless connectivity, the Internet of Things, and cloud computing have increased traffic and fueled the demand for analytical services. Additionally, by enhancing the customer experience and using area analysis, marketers can identify even more of these clients and find the most advantageous ones, which spurs improvements in geomarketing market trends.

The market has grown as brands increasingly rely on location-based service providers to ascertain client requirements, confirm customer requirements, and ensure that their products are on par with competitors. In addition, businesses use automation, advanced analytics, and location-based technologies to develop highly customized consumer experiences, foster brand loyalty, and lower churn rates as a result of fierce competition.

Suppliers of geomarketing solutions are keeping up with their cost-effective technical advancement and investing in engaging clients at a time of panic buying and the stay-at-home mentality on a global scale. By applying advertising and marketing tactics through digital media, firms can assist customers' access to technology and infrastructure, preventing productivity decreases at least.

The primary factors driving a rise in the use of geomarketing solutions are the providers' new and innovative business continuity solutions, which have advantages and benefits like increased business productivity to produce valuable content, higher conversion rates, and management of companies to conduct business.

The statistics accumulated by Future Market Insights reveal the global geomarketing market, has witnessed an unprecedented surge over the past few years. The key providers in the market are in conjunction with the increasing demand for geomarketing. There has been a gradual rise from a CAGR of 19.5% registered from 2025 to 2035, and it is likely to expand at a steady 21.3% in the forecast period.

In the previous five years, the geomarketing market has historically expanded by 20% to 22% internationally. Globally, the expected market size for geomarketing in 2025 ranged from USD 10 billion to USD 12 billion. Geomarketing was a wonder among desktop users, but when portable devices (smartphones, tablets, etc.) suddenly became popular, marketing companies had to adjust to how individuals conducted internet searches. However, this kind of advertising discovered that the GPS was the ideal instrument for producing relevant adverts in connection to precise locations and general client preferences.

The demand for geomarketing is anticipated to grow since it offers a variety of data and information that can be utilized to recognize potential customers and employ marketing strategies to convert them into paying customers. Additionally, geomarketing offers a means of overcoming the difficulties experienced by Communication Service Providers which contributes to the growth of the market.

Location-based services have drawn a lot of attention from a variety of industries, including government, telecommunications, transportation, and retail, and they have given businesses the ability to provide promotional services based on the preferences and vicinity of customers. Furthermore, businesses can save time and improve the effectiveness of internal processes by utilizing cloud-based technologies which contribute to the global geomarketing market growth.

Customers and suppliers may be concerned about the rate at which cyberattacks are growing because of privacy issues and the potential of identity theft rise whenever firms begin to develop data profiles, especially if the information is not retained. This may limit the market's ability to expand. Furthermore, a lack of IT skills or qualified professionals may further hinder the market growth.

On the contrary, during the projection period, it is anticipated that the rising demand for mobile computing and social media use would present lucrative chances for market development. Moreover, the rising use of cutting-edge technology has boosted device connectivity, which has enhanced data availability on things like retail consumer behavior, real-time marketing research, etc., which may open up new options in the future.

By deployment mode type, the market is segmented into cloud and on-premises geomarketing solutions. It has been studied by the analysts at Future Market Insights that the cloud segment is estimated to hold a major market share, recording a CAGR of 23.7% through the forecast period.

The pivotal aspects determining the momentum of this segment are:

By industry type, the market is segmented into distribution services, finance, public sector, manufacturing & resources, and infrastructure. It has been studied by the analysts at Future Market Insights that the manufacturing & resources segment is estimated to hold a major market share, recording a CAGR of 17.2% through the forecast period.

The vital elements determining the momentum of this segment are:

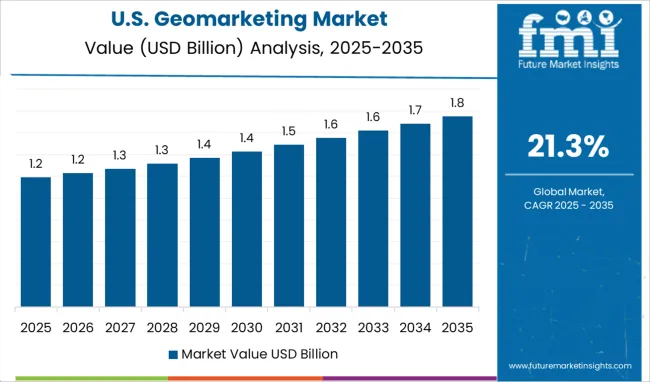

North America holds a significant share of the geomarketing market, growing at a significant CAGR of 15.1%. Of this, the USA is the most profitable region with a notable CAGR of 13.8%. This is attributed to the presence of several significant vendors in the region, increasing IT spending, and acceptance of advanced and innovative technologies. Moreover, the region’s market growth is further attributed to the high adoption of IoT technologies.

The demand for geomarketing in the USA is likely to rise with the deployment of the latest 5G-enabled smartphones with high-speed data and location accuracy. Furthermore, businesses target individual clients by distributing and customizing advertisements and notifications in real-time, which is likely to contribute to global market growth.

To help companies devise their marketing strategies and campaigns, key companies have been involved in investments to develop geomarketing software tools that use location-based information. Moreover, these aid end-user organizations display and organizing data using digital mapping to analyze this data by a particular physical location. For instance, a certain key player uses PTV server developer components for marketing, geographical, and logistical functions. These factors are estimated to propel the adoption of geomarketing.

Most of the key market players are experts in market analytics and geo-intelligence and are efficient in developing projects that use geographic dimensions to improve business decisions. Additionally, they also develop new analysis methods about the potency of the demand and become partners of their customers in the processes of network sale expansion, evolution, and communication of their offer. Additionally, they build new demand analysis methods and become clients' partners in the processes of network selling extension, evolution, and communication of their product.

Europe holds the second largest share of the geomarketing market with a revenue share of 16.4%. This is owing to the presence of key market players in the region. Moreover, heavy investments in the IT sector are further expected to surge the market growth. In addition, the implementation of ground-breaking technologies in the area of market development is likely to propel the adoption of geomarketing.

Key players in assisting their end users in choosing the foothold of their sales location by providing them with a targeted strategy. They encourage the end users to use geomarketing software, to collect commercial information related to geolocation. Furthermore, key players also offer immediate access to mobile app data, as their team streamlines location data management to save end users time and money. These factors enable the growth of the geomarketing market share.

A certain key player’s enterprise dashboards include 24/7 access to the UK’s daily mobile location data. Moreover, their platforms combine superior mobile data with intuitive premium analytics tools and allow people to facilitate the making of detailed insights. Through this, customers can simply select their location of choice and their dashboards present them with a detailed visitor profile of their selection.

Germany is a remunerative geomarketing market with a CAGR of 17.8%. This is owing to mergers and partnerships between key players which help supplement geo data with official data for 22.5 Mn buildings with accurate information. Furthermore, financial institutions are capitalizing by delivering services and products tailored to customers based on location, which has led to the collaboration of many BFSI organizations with IT providers.

Key players in Germany are using geomarketing software to distribute advertisements in a more targeted fashion. Moreover, they have a team of experts for geomarketing who abstract the real position of end users and provide them with a better option for both business and research purposes. Additionally, they keep a detailed track record to satisfy their customers availing the geomarketing services which surge demand for geomarketing.

Top players also offer a differentiated media management portfolio in their capacity as leading specialist media agencies for printed advertising. Moreover, they optimize the delivery and distribution of concerning advertising to households, using geomarketing. Their customer-oriented media planning concentrates on return on media investment, response, and coverage.

Market players also involve themselves in continuous innovations to offer new solutions to their end users. They do this with the analysts in their geomarketing unit and the use of the latest media technologies which aids them in developing various approaches for their customers even in challenging projects in the space of direct mail. This is likely to expand the global geomarketing market size.

India is a prospective geomarketing market, growing at a profit of 24.1%. This lucrative growth is attributed to the increasing retail and e-commerce sectors and collective digitalization which are estimated to advance the geomarketing market, especially in the Asia Pacific region. Moreover, the market growth is further owing to the rise in popularity of location-based solutions amongst retailers, transportation services, etc. in the region.

Key players in India help to analyze and integrate all the data from across a company’s data silos to develop efficient sales and marketing strategies and to acquire deeper insights into how different business processes affect one another. Furthermore, they maintain excellent customer relationships through targeted communication, along with relevant and profitable marketing actions. They further possess an effective organization, team responsiveness, and cost optimization with balanced sales territories.

Start-up companies are implementing innovations or improving the current scenario, to transform the geomarketing landscape:

The key market players are coming up with different solutions for a seamless user experience for both personal use, as well as business. With the growing advent of technology and social media saturation, market players are constantly coming up with newer innovations that are anticipated to keep the demand for geomarketing fastened, in the market.

Top 5 Players of the Geomarketing Market:

Recent advancements in the geomarketing market are:

| Attribute | Details |

|---|---|

| Growth Rate | CAGR of 21.3 from 2025 to 2035 |

| Base Year of Estimation | 2025 |

| Historical Data | 2020 to 2024 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | Revenue in million and Volume in Units and F-CAGR from 2025 to 2035 |

| Report Coverage | Revenue Forecast, Volume Forecast, Company Ranking, Competitive Landscape, growth factors, Trends, and Pricing Analysis |

| Key Segments Covered | By Solution Type, By Deployment Mode, By Industry, By Region |

| Regions Covered | North America; Latin America; Europe; East Asia; South Asia; Middle East & Africa; Oceania |

| Key Countries Profiled | The United States of America, Canada, Brazil, Mexico, Germany, Italy, France, United Kingdom, Spain, Russia, China, Japan, India, GCC Countries, Australia |

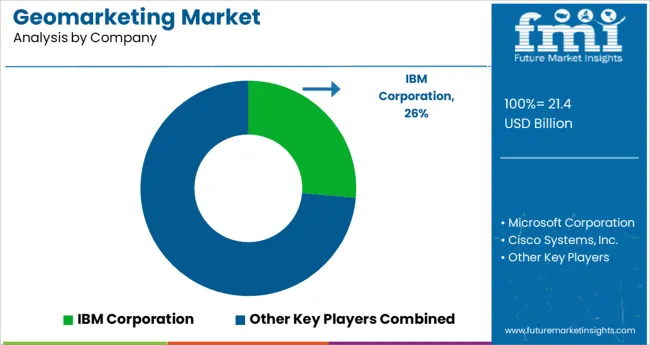

| Key Companies Profiled | IBM Corporation; Microsoft Corporation; Cisco Systems Inc.; Oracle Corporation; Adobe Inc.; Salesforce.com Inc.; Qualcomm; Xtremepush; Software AG; MobileBridge; Saksoft |

| Customization & Pricing | Available upon Request |

The global geomarketing market is estimated to be valued at USD 21.4 billion in 2025.

It is projected to reach USD 147.4 billion by 2035.

The market is expected to grow at a 21.3% CAGR between 2025 and 2035.

The key product types are software and service.

cloud segment is expected to dominate with a 58.1% industry share in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA