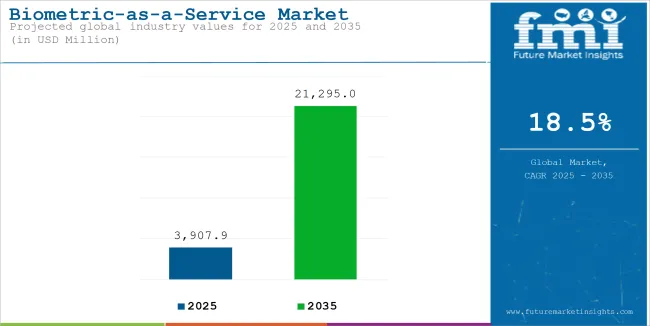

The global biometric-as-a-service market is poised for significant growth, expanding from 3,907.9 Million in 2025 to 21,295.0 Million by 2035. The market grows at a CAGR 18.5% from the period 2025 to 2035.

The biometric-as-a-service market is about cloud-based biometric that allows organizations to authenticate or identify through the fingerprint, face, iris, and voice linked to unique biological distinctions (comparing it with traditional on-premises systems in which these solutions could burden costly infrastructure spending).

However, such services are much more scalable, flexible, and cheaper in implementing (cash-flow-wise, for maintenance, etc.). Their application could be seen through a range of distributed industries, namely banking, healthcare, retail, government, and travel altogether clearly designed to ensure security, prevent fraud, and ensure improved customer experiences.

The importance of the BaaS market involves solving emerging concerns on data security and identity theft, especially in this digital-first world. With increased regulatory demands for the verification of identity and access, BaaS solutions support businesses in implementing advanced and cost-effective security without compromising user convenience or privacy.

| Attributes | Description |

|---|---|

| Historical Size, 2024 | USD 3,318.7 million |

| Estimated Size, 2025 | USD 3,907.9 million |

| Projected Size, 2035 | USD 21,295.0 million |

| Value-based CAGR (2025 to 2035) | 18.5% |

Biometric-as-a-Service: cloud-based storage of biometric data, real-time authentication, integration of multi-modal biometrics-fingerprint, face, iris, voice recognition-scalable, with increased data encryption for security. Its flexibility allows easy integration with already existing systems.

BaaS finds its applications in a wide array of industries: banking, to provide secure transactions; healthcare, for verification of patients; retail, to offer personalized experiences; government, for e-governance and border control; and travel, for smooth processing of passengers. It finds wide application in access control, fraud detection, and employee management systems. BaaS solutions address the growing demand for advanced identity verification in a digital economy by providing robust security and user convenience.

The below table presents the expected CAGR for the global biometric-as-a-service market over several semi-annual periods spanning from 2025 to 2035. This assessment outlines changes in the memory interconnect industry and identify revenue trends, offering key decision makers an understanding about market performance throughout the year.

H1 represents first half of the year from January to June, H2 spans from July to December, which is the second half. In the first half (H1) of the year from 2024 to 2034, the business is predicted to surge at a CAGR of 18.8%, followed by a slower growth rate of 18.4% in the second half (H2) of the same decade.

| Particular | Value CAGR |

|---|---|

| H1 | 18.8% (2024 to 2034) |

| H2 | 18.4% (2024 to 2034) |

| H1 | 18.2% (2025 to 2035) |

| H2 | 18.8% (2025 to 2035) |

Moving into the subsequent period, from H1 2025 to H2 2035, the CAGR is projected to increase slightly to 18.2% in the first half and remain higher at 18.8% in the second half. In the first half (H1) the market witnessed a decrease of 60 BPS and in the second half (H2), the market witnessed an increase of 40 BPS.

The section provides detailed insights into key segments of the biometric-as-a-service market. This section analyzes the growth and market share in the market among key segments.

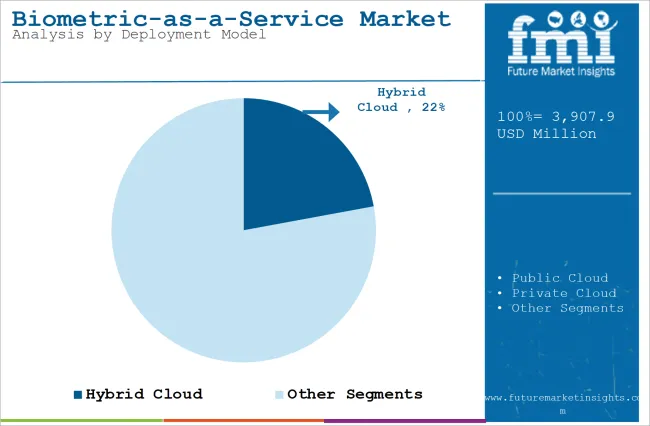

Hybrid cloud enables the organizations to store sensitive biometric data in private clouds and utilize the resources of the public cloud for scalability and cost efficiency. Hybrid cloud solutions are especially sought after by those industries where security regarding data privacy is prime-for instance, banking and healthcare.

Growing digital transformation initiatives along with increased development related to secure integration and management of data have driven demand further for hybrid cloud-based biometric services, hence making them the first preference globally.

| Segment | CAGR (2025 to 2035) |

|---|---|

| Hybrid Cloud (Deployment Model) | 22.1% |

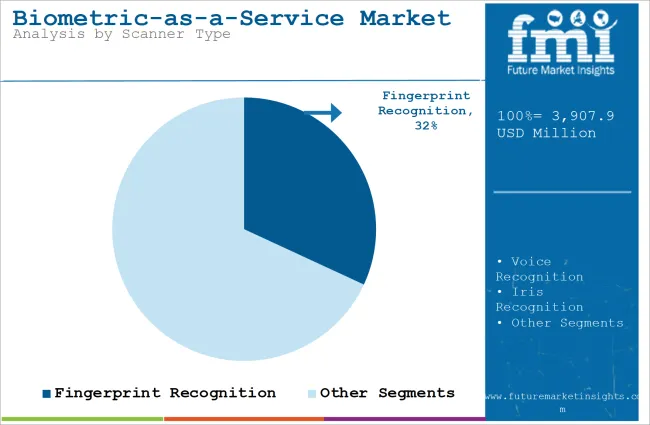

The fingerprint recognition is among the most mature biometric technologies that assure high accuracy while keeping the hardware requirement quite low. Due to the vast integration of fingerprint recognition into smartphones, access control systems, and even payment solutions, it has become a preferred choice for both consumer and enterprise applications.

Its ease of compatibility with legacy systems and ease of implementation in varied environments further enhance its dominance. Besides that, with improvements in sensor technology making them accommodate in-display fingerprint readers, their growth has been driven further as the most affordable and versatile biometric modality.

| Segment | Value Share (2025) |

|---|---|

| Fingerprint Recognition (Scanner Type) | 31.9% |

Growing Demand for Enhanced Security Solutions Creates Demand for Biometric Solutions

Owing to the increase in cybersecurity threats and incidents pertaining to identity theft worldwide, businesses and governments have taken up robust methods for authentication that secure sensitive data and systems. BaaS leverages the unique physical and behavioral traits of a person-fingerprint, face recognition, and voice-for verification purposes.

Because they are virtually impossible to reproduce, these biometric markers are naturally very secure and present an effective alternative to traditional authentication, such as passwords or even PINs that can be readily compromised. The flexibility inherent in cloud-based biometric services lets organizations implement security solutions faster without making any considerable investment in physical infrastructure.

Growing demands from industries like banking, healthcare, and government for scalable and secure authentication propel prominent growth in the BaaS market. Besides, advanced technologies like AI and machine learning integrated into biometric systems drive higher accuracy and speed, thus increasing the adoption of these solutions further.

Expansion of Digital Transformation Initiatives Fuels the Market Growth

The rapid digitalization of industries has created an unprecedented demand for secure and user-friendly identity verification systems. Companies that are transitioning their operations online for service delivery, digital payments, and remote working incorporate biometric solutions to enhance user experience and reduce fraud. BaaS does this at an affordable solution through the provision of real-time authentication via cloud platforms, hence allowing scalability in businesses.

E-commerce, retail, and healthcare-where digital operations have been growing rapidly-are deploying biometric technologies to enhance efficiency and customer confidence. Government-driven digital initiatives like smart cities and e-governance programs also spur the adoption of BaaS to verify citizens' identities and ensure smoother delivery of public services.

Privacy and Data Security Concerns Could Hinder the Market Demand

The widespread adoption of cloud-based biometric solutions creates significant challenges related to privacy and data security. Biometric data is irreplaceable, unlike passwords or PINs, and hence cannot be replaced or changed once compromised. Storage and transmission of sensitive biometric information on the cloud raise a very critical concern.

Major breaches in biometric database leaks can have irreversible effects, such as identity fraud or any misuse of information related to an individual's identity. The BaaS market also has to find an ordeal of a path with respect to different regional and global regulations around data protection, such as GDPR in Europe and CCPA in the United States.

The service providers need to assure compliance with these laws through advanced encryption, secure access controls, and periodic audits for a regain of consumer trust. Such concerns make various organizations and individuals very skeptical, hence slowing down the adoption rate in certain regions and sectors.

The industry showcased a CAGR of 17.7% during the period between 2020 and 2024. The industry reached a value of USD 3,318.7 million in 2024 from USD 1,728.0 million in 2020.

Data privacy and regulatory compliance concerns, especially related to the storage and sharing of sensitive biometric information, restrained market growth. Despite these setbacks, continuous development in AI-driven biometric technologies and growing investments in digital transformation drove steady growth during the period. It is expected that from 2025 to 2035, the BaaS market will exhibit exponential growth driven by the penetration of biometric solutions into global digital ecosystems.

On the other hand, the market is estimated to grow at a CAGR of 18.5% during the forecasted period between 2025 and 2035. The market is expected to grow swiftly as it has a potential to reach a value of USD 21,295.0 million in 2035 from USD 3,907.9 million in 2025.

The proliferation of smart cities, increasing IoT-enabled devices, and blockchain-based identity management systems would surge demand for sophisticated biometric authentication. Development of multimodal biometric solutions-including fingerprint, iris, and voice recognition-is increasing accuracy and reliability in different application fields.

5G technology will also permit real-time processing and authentication, further expanding its use cases across transportation, retail, and entertainment. Most governments in the world are expected to deploy large-scale biometric-based e-governance initiatives, thereby increasing the market penetration.

Tier 1 firms in the Biometric-as-a-Service market are forerunners due to their ubiquity, wide range of product offerings, and continuous investment in R&D. Well-recognized players include NEC Corporation, IDEMIA, and Thales Group, well-entrenched and established with large, scalable, secure biometric authentication solutions in face, fingerprint, iris, voice, and vein modalities.

These players target high-end sectors such as banking, government, and healthcare with high demand due to stringent security and compliance requirements. These Tier 1 vendors contribute around 45% - 50% toward the total contribution of the overall market size.

Tier 2 companies are regional or focused on niche applications in a more specific industry, such as retail, education, and small government applications. This would include companies like BioID and Innovatrics, who offer very specialized solutions for more localized needs. These compete on cost and customizability of biometric services and often at the backs of partnerships with Tier 1 companies on technology or infrastructure. Tier 2 would probably constitute around 15%-20% market size capture.

Participants in Tier 3 include startups and small-scale providers with local business areas or smaller sets of customers. Innovation in niche biometric technologies-such as behavioral biometrics, AI-powered face recognition-motivates such companies like M2SYS Technology and Trueface.

They also include lightweight, cloud-based solutions designed for SMEs or those applications requiring low levels of infrastructure. Hence, it could be estimated that the share of Tier 3 vendors would make up about 25% - 30% of total market size.

The section highlights the CAGRs of countries experiencing growth in the biometric-as-a-service market, along with the latest advancements contributing to overall market development. Based on current estimates USA, India and Germany are expected to see steady growth during the forecast period.

| Countries | CAGR from 2025 to 2035 |

|---|---|

| India | 22.9% |

| China | 19.1% |

| Germany | 18.1% |

| KSA | 16.9% |

| United States | 18.8% |

Large-scale government initiatives in India, such as Aadhaar, which is the largest biometric ID system in the world, are driving the growth of the BaaS market. The integration of Aadhaar has increased demand for cloud-based biometric services in banking, welfare schemes, and digital identity verification.

Additionally, the Digital India initiative has accelerated the adoption of biometric authentication in sectors such as education, healthcare, and retail. Biometric systems for citizens have formed a major deal, including USD 3 billion of investment in smart city projects. Private players, on the other hand, increase their presence in India with NEC and IDEMIA looking at partnerships to scale up their biometric solution demands.

The United States is anticipated to lead the BaaS market, having well-developed technological infrastructure coupled with increasing traction for cloud-based solutions from government and private sectors. Demand has also been driven by high-value federal investments, such as the USA Department of Homeland Security's USD 2.4 billion Biometric Entry-Exit Program.

Private investments are also high to integrate biometric authentication on the cloud offerings of companies like Amazon and Microsoft. The rapid growth of e-commerce and fintech industries is also pushing the demand for strong biometric authentication with the backing of regulatory frameworks for secure and compliant services, such as the California Consumer Privacy Act.

The country has fast-tracked the adoption of BaaS on the back of high usage of biometric technologies for surveillance, enabling payments, and public service delivery. The government-backed, USD 22 billion "Skynet" project relies on biometric systems for nationwide surveillance. At the point of making mobile payments, the inclusion of face recognition through giants like Alipay and WeChat Pay flags commercial growth in the market.

Additionally, China's investments in AI and 5G infrastructure allow for faster and more accurate biometric processing. Innovation is driven by companies such as SenseTime and Megvii, raising huge funds-innovation rounds, like the USD 1.2 billion Series C round of SenseTime-to develop next-generation biometric solutions.

The biometric-as-a-service market is highly competitive, with players focusing on innovation, scalability, and enhanced security to gain a competitive edge. Companies are investing heavily in AI-powered biometric solutions, multimodal authentication, and integration capabilities with existing systems. Partnerships with governments and enterprises are key strategies to expand market presence.

The rise of cloud-based services and the growing demand for compliance with data protection regulations have intensified competition. Additionally, regional providers are challenging global players by offering localized solutions tailored to specific industries. The market is also witnessing significant consolidation, with larger firms acquiring niche players to enhance their technological capabilities.

Industry Update

In terms of modality, the segment is divided into Unimodal and Multimodal.

In terms of deployment model, the segment is segregated into Public Cloud, Private Cloud and Hybrid Cloud.

In terms of scanner type, the segment is segregated into Fingerprint recognition, Voice Recognition, Iris Recognition, Palm Recognition and Facial Recognition.

A regional analysis has been carried out in key countries of North America, Latin America, East Asia, South Asia & Pacific, Western Europe, Eastern Europe and Middle East and Africa (MEA).

The Global Biometric-as-a-Service industry is projected to witness CAGR of 18.5% between 2025 and 2035.

The Global Biometric-as-a-Service industry stood at USD 3,907.9 million in 2025.

The Global Biometric-as-a-Service industry is anticipated to reach USD 21,295.0 million by 2035 end.

South Asia & Pacific is set to record the highest CAGR of 21.2% in the assessment period.

The key players operating in the Global Biometric-as-a-Service industry includes Fujitsu, Bio ID, Aware, inc., OT-Morph, Image Ware Systems, Polygon Innovation, Sky Biometry among others.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2017 to 2032

Table 2: Global Market Value (US$ Million) Forecast by Component, 2017 to 2032

Table 3: Global Market Value (US$ Million) Forecast by Application, 2017 to 2032

Table 4: Global Market Value (US$ Million) Forecast by Type, 2017 to 2032

Table 5: North America Market Value (US$ Million) Forecast by Country, 2017 to 2032

Table 6: North America Market Value (US$ Million) Forecast by Component, 2017 to 2032

Table 7: North America Market Value (US$ Million) Forecast by Application, 2017 to 2032

Table 8: North America Market Value (US$ Million) Forecast by Type, 2017 to 2032

Table 9: Latin America Market Value (US$ Million) Forecast by Country, 2017 to 2032

Table 10: Latin America Market Value (US$ Million) Forecast by Component, 2017 to 2032

Table 11: Latin America Market Value (US$ Million) Forecast by Application, 2017 to 2032

Table 12: Latin America Market Value (US$ Million) Forecast by Type, 2017 to 2032

Table 13: Europe Market Value (US$ Million) Forecast by Country, 2017 to 2032

Table 14: Europe Market Value (US$ Million) Forecast by Component, 2017 to 2032

Table 15: Europe Market Value (US$ Million) Forecast by Application, 2017 to 2032

Table 16: Europe Market Value (US$ Million) Forecast by Type, 2017 to 2032

Table 17: South Asia Market Value (US$ Million) Forecast by Country, 2017 to 2032

Table 18: South Asia Market Value (US$ Million) Forecast by Component, 2017 to 2032

Table 19: South Asia Market Value (US$ Million) Forecast by Application, 2017 to 2032

Table 20: South Asia Market Value (US$ Million) Forecast by Type, 2017 to 2032

Table 21: East Asia Market Value (US$ Million) Forecast by Country, 2017 to 2032

Table 22: East Asia Market Value (US$ Million) Forecast by Component, 2017 to 2032

Table 23: East Asia Market Value (US$ Million) Forecast by Application, 2017 to 2032

Table 24: East Asia Market Value (US$ Million) Forecast by Type, 2017 to 2032

Table 25: Oceania Market Value (US$ Million) Forecast by Country, 2017 to 2032

Table 26: Oceania Market Value (US$ Million) Forecast by Component, 2017 to 2032

Table 27: Oceania Market Value (US$ Million) Forecast by Application, 2017 to 2032

Table 28: Oceania Market Value (US$ Million) Forecast by Type, 2017 to 2032

Table 29: MEA Market Value (US$ Million) Forecast by Country, 2017 to 2032

Table 30: MEA Market Value (US$ Million) Forecast by Component, 2017 to 2032

Table 31: MEA Market Value (US$ Million) Forecast by Application, 2017 to 2032

Table 32: MEA Market Value (US$ Million) Forecast by Type, 2017 to 2032

Figure 1: Global Market Value (US$ Million) by Component, 2022 to 2032

Figure 2: Global Market Value (US$ Million) by Application, 2022 to 2032

Figure 3: Global Market Value (US$ Million) by Type, 2022 to 2032

Figure 4: Global Market Value (US$ Million) by Region, 2022 to 2032

Figure 5: Global Market Value (US$ Million) Analysis by Region, 2017 to 2032

Figure 6: Global Market Value Share (%) and BPS Analysis by Region, 2022 to 2032

Figure 7: Global Market Y-o-Y Growth (%) Projections by Region, 2022 to 2032

Figure 8: Global Market Value (US$ Million) Analysis by Component, 2017 to 2032

Figure 9: Global Market Value Share (%) and BPS Analysis by Component, 2022 to 2032

Figure 10: Global Market Y-o-Y Growth (%) Projections by Component, 2022 to 2032

Figure 11: Global Market Value (US$ Million) Analysis by Application, 2017 to 2032

Figure 12: Global Market Value Share (%) and BPS Analysis by Application, 2022 to 2032

Figure 13: Global Market Y-o-Y Growth (%) Projections by Application, 2022 to 2032

Figure 14: Global Market Value (US$ Million) Analysis by Type, 2017 to 2032

Figure 15: Global Market Value Share (%) and BPS Analysis by Type, 2022 to 2032

Figure 16: Global Market Y-o-Y Growth (%) Projections by Type, 2022 to 2032

Figure 17: Global Market Attractiveness by Component, 2022 to 2032

Figure 18: Global Market Attractiveness by Application, 2022 to 2032

Figure 19: Global Market Attractiveness by Type, 2022 to 2032

Figure 20: Global Market Attractiveness by Region, 2022 to 2032

Figure 21: North America Market Value (US$ Million) by Component, 2022 to 2032

Figure 22: North America Market Value (US$ Million) by Application, 2022 to 2032

Figure 23: North America Market Value (US$ Million) by Type, 2022 to 2032

Figure 24: North America Market Value (US$ Million) by Country, 2022 to 2032

Figure 25: North America Market Value (US$ Million) Analysis by Country, 2017 to 2032

Figure 26: North America Market Value Share (%) and BPS Analysis by Country, 2022 to 2032

Figure 27: North America Market Y-o-Y Growth (%) Projections by Country, 2022 to 2032

Figure 28: North America Market Value (US$ Million) Analysis by Component, 2017 to 2032

Figure 29: North America Market Value Share (%) and BPS Analysis by Component, 2022 to 2032

Figure 30: North America Market Y-o-Y Growth (%) Projections by Component, 2022 to 2032

Figure 31: North America Market Value (US$ Million) Analysis by Application, 2017 to 2032

Figure 32: North America Market Value Share (%) and BPS Analysis by Application, 2022 to 2032

Figure 33: North America Market Y-o-Y Growth (%) Projections by Application, 2022 to 2032

Figure 34: North America Market Value (US$ Million) Analysis by Type, 2017 to 2032

Figure 35: North America Market Value Share (%) and BPS Analysis by Type, 2022 to 2032

Figure 36: North America Market Y-o-Y Growth (%) Projections by Type, 2022 to 2032

Figure 37: North America Market Attractiveness by Component, 2022 to 2032

Figure 38: North America Market Attractiveness by Application, 2022 to 2032

Figure 39: North America Market Attractiveness by Type, 2022 to 2032

Figure 40: North America Market Attractiveness by Country, 2022 to 2032

Figure 41: Latin America Market Value (US$ Million) by Component, 2022 to 2032

Figure 42: Latin America Market Value (US$ Million) by Application, 2022 to 2032

Figure 43: Latin America Market Value (US$ Million) by Type, 2022 to 2032

Figure 44: Latin America Market Value (US$ Million) by Country, 2022 to 2032

Figure 45: Latin America Market Value (US$ Million) Analysis by Country, 2017 to 2032

Figure 46: Latin America Market Value Share (%) and BPS Analysis by Country, 2022 to 2032

Figure 47: Latin America Market Y-o-Y Growth (%) Projections by Country, 2022 to 2032

Figure 48: Latin America Market Value (US$ Million) Analysis by Component, 2017 to 2032

Figure 49: Latin America Market Value Share (%) and BPS Analysis by Component, 2022 to 2032

Figure 50: Latin America Market Y-o-Y Growth (%) Projections by Component, 2022 to 2032

Figure 51: Latin America Market Value (US$ Million) Analysis by Application, 2017 to 2032

Figure 52: Latin America Market Value Share (%) and BPS Analysis by Application, 2022 to 2032

Figure 53: Latin America Market Y-o-Y Growth (%) Projections by Application, 2022 to 2032

Figure 54: Latin America Market Value (US$ Million) Analysis by Type, 2017 to 2032

Figure 55: Latin America Market Value Share (%) and BPS Analysis by Type, 2022 to 2032

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by Type, 2022 to 2032

Figure 57: Latin America Market Attractiveness by Component, 2022 to 2032

Figure 58: Latin America Market Attractiveness by Application, 2022 to 2032

Figure 59: Latin America Market Attractiveness by Type, 2022 to 2032

Figure 60: Latin America Market Attractiveness by Country, 2022 to 2032

Figure 61: Europe Market Value (US$ Million) by Component, 2022 to 2032

Figure 62: Europe Market Value (US$ Million) by Application, 2022 to 2032

Figure 63: Europe Market Value (US$ Million) by Type, 2022 to 2032

Figure 64: Europe Market Value (US$ Million) by Country, 2022 to 2032

Figure 65: Europe Market Value (US$ Million) Analysis by Country, 2017 to 2032

Figure 66: Europe Market Value Share (%) and BPS Analysis by Country, 2022 to 2032

Figure 67: Europe Market Y-o-Y Growth (%) Projections by Country, 2022 to 2032

Figure 68: Europe Market Value (US$ Million) Analysis by Component, 2017 to 2032

Figure 69: Europe Market Value Share (%) and BPS Analysis by Component, 2022 to 2032

Figure 70: Europe Market Y-o-Y Growth (%) Projections by Component, 2022 to 2032

Figure 71: Europe Market Value (US$ Million) Analysis by Application, 2017 to 2032

Figure 72: Europe Market Value Share (%) and BPS Analysis by Application, 2022 to 2032

Figure 73: Europe Market Y-o-Y Growth (%) Projections by Application, 2022 to 2032

Figure 74: Europe Market Value (US$ Million) Analysis by Type, 2017 to 2032

Figure 75: Europe Market Value Share (%) and BPS Analysis by Type, 2022 to 2032

Figure 76: Europe Market Y-o-Y Growth (%) Projections by Type, 2022 to 2032

Figure 77: Europe Market Attractiveness by Component, 2022 to 2032

Figure 78: Europe Market Attractiveness by Application, 2022 to 2032

Figure 79: Europe Market Attractiveness by Type, 2022 to 2032

Figure 80: Europe Market Attractiveness by Country, 2022 to 2032

Figure 81: South Asia Market Value (US$ Million) by Component, 2022 to 2032

Figure 82: South Asia Market Value (US$ Million) by Application, 2022 to 2032

Figure 83: South Asia Market Value (US$ Million) by Type, 2022 to 2032

Figure 84: South Asia Market Value (US$ Million) by Country, 2022 to 2032

Figure 85: South Asia Market Value (US$ Million) Analysis by Country, 2017 to 2032

Figure 86: South Asia Market Value Share (%) and BPS Analysis by Country, 2022 to 2032

Figure 87: South Asia Market Y-o-Y Growth (%) Projections by Country, 2022 to 2032

Figure 88: South Asia Market Value (US$ Million) Analysis by Component, 2017 to 2032

Figure 89: South Asia Market Value Share (%) and BPS Analysis by Component, 2022 to 2032

Figure 90: South Asia Market Y-o-Y Growth (%) Projections by Component, 2022 to 2032

Figure 91: South Asia Market Value (US$ Million) Analysis by Application, 2017 to 2032

Figure 92: South Asia Market Value Share (%) and BPS Analysis by Application, 2022 to 2032

Figure 93: South Asia Market Y-o-Y Growth (%) Projections by Application, 2022 to 2032

Figure 94: South Asia Market Value (US$ Million) Analysis by Type, 2017 to 2032

Figure 95: South Asia Market Value Share (%) and BPS Analysis by Type, 2022 to 2032

Figure 96: South Asia Market Y-o-Y Growth (%) Projections by Type, 2022 to 2032

Figure 97: South Asia Market Attractiveness by Component, 2022 to 2032

Figure 98: South Asia Market Attractiveness by Application, 2022 to 2032

Figure 99: South Asia Market Attractiveness by Type, 2022 to 2032

Figure 100: South Asia Market Attractiveness by Country, 2022 to 2032

Figure 101: East Asia Market Value (US$ Million) by Component, 2022 to 2032

Figure 102: East Asia Market Value (US$ Million) by Application, 2022 to 2032

Figure 103: East Asia Market Value (US$ Million) by Type, 2022 to 2032

Figure 104: East Asia Market Value (US$ Million) by Country, 2022 to 2032

Figure 105: East Asia Market Value (US$ Million) Analysis by Country, 2017 to 2032

Figure 106: East Asia Market Value Share (%) and BPS Analysis by Country, 2022 to 2032

Figure 107: East Asia Market Y-o-Y Growth (%) Projections by Country, 2022 to 2032

Figure 108: East Asia Market Value (US$ Million) Analysis by Component, 2017 to 2032

Figure 109: East Asia Market Value Share (%) and BPS Analysis by Component, 2022 to 2032

Figure 110: East Asia Market Y-o-Y Growth (%) Projections by Component, 2022 to 2032

Figure 111: East Asia Market Value (US$ Million) Analysis by Application, 2017 to 2032

Figure 112: East Asia Market Value Share (%) and BPS Analysis by Application, 2022 to 2032

Figure 113: East Asia Market Y-o-Y Growth (%) Projections by Application, 2022 to 2032

Figure 114: East Asia Market Value (US$ Million) Analysis by Type, 2017 to 2032

Figure 115: East Asia Market Value Share (%) and BPS Analysis by Type, 2022 to 2032

Figure 116: East Asia Market Y-o-Y Growth (%) Projections by Type, 2022 to 2032

Figure 117: East Asia Market Attractiveness by Component, 2022 to 2032

Figure 118: East Asia Market Attractiveness by Application, 2022 to 2032

Figure 119: East Asia Market Attractiveness by Type, 2022 to 2032

Figure 120: East Asia Market Attractiveness by Country, 2022 to 2032

Figure 121: Oceania Market Value (US$ Million) by Component, 2022 to 2032

Figure 122: Oceania Market Value (US$ Million) by Application, 2022 to 2032

Figure 123: Oceania Market Value (US$ Million) by Type, 2022 to 2032

Figure 124: Oceania Market Value (US$ Million) by Country, 2022 to 2032

Figure 125: Oceania Market Value (US$ Million) Analysis by Country, 2017 to 2032

Figure 126: Oceania Market Value Share (%) and BPS Analysis by Country, 2022 to 2032

Figure 127: Oceania Market Y-o-Y Growth (%) Projections by Country, 2022 to 2032

Figure 128: Oceania Market Value (US$ Million) Analysis by Component, 2017 to 2032

Figure 129: Oceania Market Value Share (%) and BPS Analysis by Component, 2022 to 2032

Figure 130: Oceania Market Y-o-Y Growth (%) Projections by Component, 2022 to 2032

Figure 131: Oceania Market Value (US$ Million) Analysis by Application, 2017 to 2032

Figure 132: Oceania Market Value Share (%) and BPS Analysis by Application, 2022 to 2032

Figure 133: Oceania Market Y-o-Y Growth (%) Projections by Application, 2022 to 2032

Figure 134: Oceania Market Value (US$ Million) Analysis by Type, 2017 to 2032

Figure 135: Oceania Market Value Share (%) and BPS Analysis by Type, 2022 to 2032

Figure 136: Oceania Market Y-o-Y Growth (%) Projections by Type, 2022 to 2032

Figure 137: Oceania Market Attractiveness by Component, 2022 to 2032

Figure 138: Oceania Market Attractiveness by Application, 2022 to 2032

Figure 139: Oceania Market Attractiveness by Type, 2022 to 2032

Figure 140: Oceania Market Attractiveness by Country, 2022 to 2032

Figure 141: MEA Market Value (US$ Million) by Component, 2022 to 2032

Figure 142: MEA Market Value (US$ Million) by Application, 2022 to 2032

Figure 143: MEA Market Value (US$ Million) by Type, 2022 to 2032

Figure 144: MEA Market Value (US$ Million) by Country, 2022 to 2032

Figure 145: MEA Market Value (US$ Million) Analysis by Country, 2017 to 2032

Figure 146: MEA Market Value Share (%) and BPS Analysis by Country, 2022 to 2032

Figure 147: MEA Market Y-o-Y Growth (%) Projections by Country, 2022 to 2032

Figure 148: MEA Market Value (US$ Million) Analysis by Component, 2017 to 2032

Figure 149: MEA Market Value Share (%) and BPS Analysis by Component, 2022 to 2032

Figure 150: MEA Market Y-o-Y Growth (%) Projections by Component, 2022 to 2032

Figure 151: MEA Market Value (US$ Million) Analysis by Application, 2017 to 2032

Figure 152: MEA Market Value Share (%) and BPS Analysis by Application, 2022 to 2032

Figure 153: MEA Market Y-o-Y Growth (%) Projections by Application, 2022 to 2032

Figure 154: MEA Market Value (US$ Million) Analysis by Type, 2017 to 2032

Figure 155: MEA Market Value Share (%) and BPS Analysis by Type, 2022 to 2032

Figure 156: MEA Market Y-o-Y Growth (%) Projections by Type, 2022 to 2032

Figure 157: MEA Market Attractiveness by Component, 2022 to 2032

Figure 158: MEA Market Attractiveness by Application, 2022 to 2032

Figure 159: MEA Market Attractiveness by Type, 2022 to 2032

Figure 160: MEA Market Attractiveness by Country, 2022 to 2032

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA