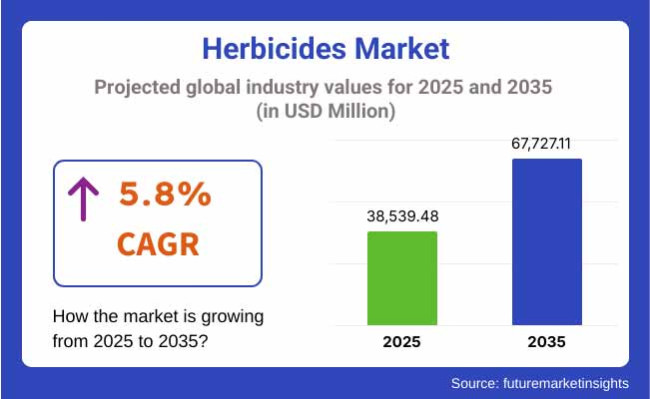

The global herbicides market is projected to expand from USD 38,539.4 Million in 2025 to USD 67,727.1 Million by 2035, advancing at a CAGR of 5.8% during the forecast period. The growth is primarily driven by rising food security concerns, shrinking arable land, and an increasing focus on crop yield optimization. Widespread adoption of conservation tillage and no-till farming systems-especially in North America, South America, and Asia-Pacific-has augmented the demand for herbicides that enable efficient weed control with minimal soil disruption.

| Metric | Value |

|---|---|

| Market Size in 2025 | USD 38,539.4 Million |

| Projected Market Size in 2035 | USD 67,727.1 Million |

| CAGR (2025 to 2035) | 5.8% |

Rapid agricultural mechanization, especially in emerging economies, along with government subsidies and integrated weed management programs, is reinforcing market expansion. Moreover, climate change-induced weed pressure and evolving resistance in major crops are prompting the development and deployment of innovative herbicidal molecules and combination products. In particular, glyphosate remains a dominant molecule, supported by its broad-spectrum activity and compatibility with genetically modified (GM) crops.

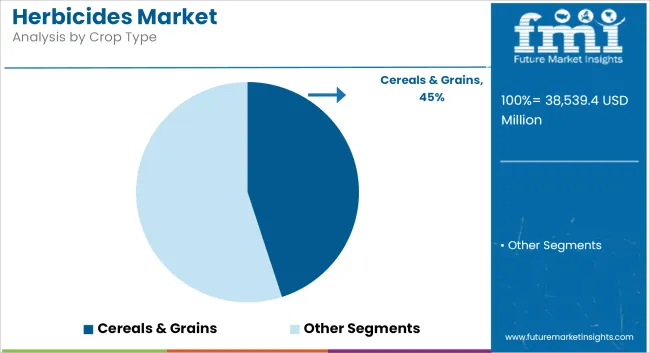

Cereal and grain production especially corn, wheat, and rice constitutes the largest segment of herbicide application. Leading agribusinesses are investing in eco-efficient herbicide formulations that comply with stricter environmental and residue standards, while also addressing the growing demand for residue-free and sustainable farming practices.

Technological advancements such as drone-assisted spraying, precision farming, and AI-based weed detection are increasing application efficiency and reducing input waste. Simultaneously, new bio-based herbicides and resistance management solutions are gaining traction in markets with stringent chemical usage norms like the EU and Japan.

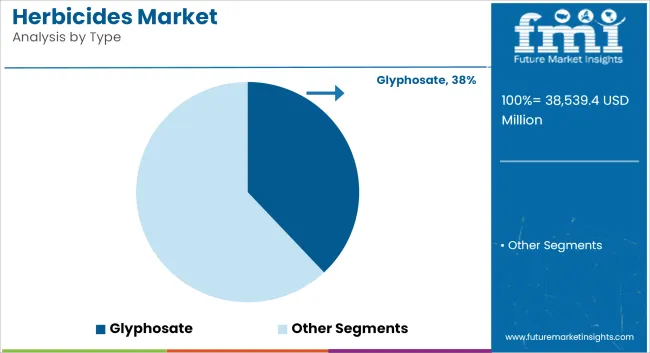

Glyphosate is expected to retain its position as the leading herbicide type, accounting for approximately 38% of global herbicide sales in 2025, with projected growth at a CAGR of 5.8% through 2035. Despite regulatory scrutiny in certain regions, glyphosate remains the backbone of weed control programs due to its broad-spectrum efficacy, affordability, and systemic action.

Its widespread integration with glyphosate-resistant GM crops in the USA, Brazil, and Argentina has solidified its usage in large-scale commercial farming. With rising labor shortages and increasing demand for zero-tillage practices, glyphosate-based solutions are being rapidly adopted to support efficient weed management with fewer field operations.

Leading companies such as Bayer and Corteva are investing in next-generation glyphosate formulations with enhanced safety profiles, drift control features, and resistance management additives. Even in regions facing tighter regulatory control, glyphosate remains indispensable due to the lack of cost-effective alternatives that offer comparable field performance.

Furthermore, the integration of glyphosate with digital agriculture platforms, real-time field mapping, and automated sprayers is improving application precision, reducing environmental impact, and enhancing return on investment for farmers worldwide.

The cereals and grains segment led by corn, rice, and wheat is forecast to account for over 45% of herbicide consumption in 2025, growing at a CAGR of 6.6% over the next decade. These staple crops require consistent and timely weed control to protect yields, particularly in intensively cultivated regions like Asia-Pacific, North America, and Eastern Europe.

Surging food demand, particularly in populous nations such as India and China, is prompting farmers to increase yield per hectare, making herbicides a vital component of modern crop protection programs. In Brazil and Argentina, herbicide use in soybean-corn rotation cycles is increasing due to its efficiency in controlling both broadleaf and grassy weeds.

The integration of herbicides into pre- and post-emergence treatment programs ensures season-long weed suppression, improves nutrient availability, and reduces competition for sunlight and water. Companies are tailoring crop-specific and climate-resilient herbicide solutions for key grain-growing belts, aligning with region-specific agronomic practices.

Government incentives to boost grain productivity and reduce import dependency are catalyzing the adoption of herbicide-tolerant crops and enabling more frequent herbicide usage, especially in India, Sub-Saharan Africa, and Southeast Asia.

Regulatory Restrictions and Environmental Concerns

Stringent regulations in the herbicides market are expected to cool down the market growth due to rising concerns over its impact on human and environmental health. Around the world, government agencies are mulling or implementing curtailments of chemical herbicides like glyphosate based in part on their suggested connections to soil degradation, groundwater contamination and possible health risks.

This increases compliance costs for manufacturers and restricts product availability across different regions. To both comply with regulations and retain competitive advantage in the marketplace, companies need to devote resources to developing sustainable herbicide formulations and exploring bio-based alternatives.

Growing Herbicide Resistance in Weeds

The rising resistance of weeds to widely used herbicide poses a serious threat to nowpect agricultural industry. The overuse of chemical herbicides has created weed species resistant to these chemical products, making traditional herbicides less effective. This requires the discovery of new active substances, but also integrated approaches of weed control to electrical weed management (EWM), which combines chemical, mechanical and biological methods in order to overcome resistance problems.

Rising Demand for Bio-Based and Organic Herbicides

The importance given to sustainable agriculture and organic farming is increasing and hence the market for bio-based and organic herbicides is expected to grow. Farmers are also gradually moving towards natural solutions for weed control to reduce the environmental impacts and satisfy consumers looking for organic products. Therefore, organizations involved with the research and development of eco-friendly formulations targeted for herbicides are likely to profit in this market.

Technological Advancements in Precision Agriculture

AI is also playing its part in progressing precision agriculture by improving spraying systems, unleashing drones or even applying precision herbicides with a GPS system that minimizes chemical waste. Such technologies allow farmers to use herbicides more accurately, reducing impact on the environment and increasing crop yield. Adoption of digital farming technologies and smart click here herbicide classification methods by the companies can help in capitalize on this trend and expand their market presence.

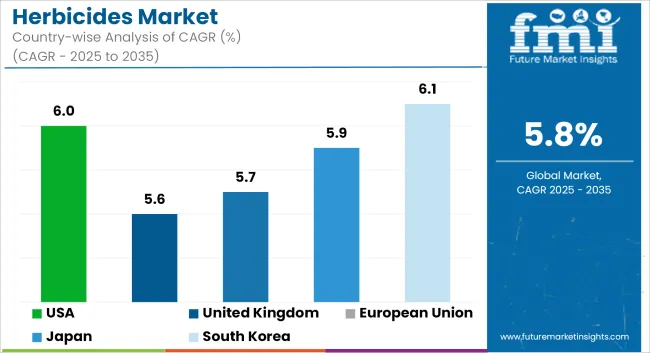

The demand for herbicides in the USA is steadily increasing due to the growing adoption of advanced weed management solutions. Moreover, increasing concerns regarding crop yield optimization and growing demand for sustainable farming practices are promoting the utilization of selective and non-selective herbicides.

Moreover, increasing planting of genetically modified (GM) crops resistant to herbicides and active investment in precision agriculture are also driving the growth of the market. Industry Trends: The move towards bio-based herbicides and regulatory policies surrounding the organic applications of chemicals.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 6.0% |

The UK herbicides market is expanding amid increased concerns about food security and the effectiveness of agriculture. To minimize crop losses and improve productivity, farmer are rapidly adopting herbicides.

Moreover, government regulations favoring sustainable agriculture and integrated weed management strategies, are stimulating the need for eco-friendly and bio-based herbicides. Market dynamics are also being impacted by developments in agrochemical formulations and increasing research on herbicide-resistant weeds.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 5.6% |

The EU herbicides market negatively impacted by stringent rules towards the use of chemical pesticides and rise in organic farming. Soaring adoption of bio-herbicides in sustainable agriculture are prompting countries like Germany, France, and Spain to move towards sustainable agricultural practices.

With the European Green Deal and the Farm to Fork strategy encouraging farmers across the EU to limit chemical herbicide consumption, there is continuing innovation in why new methods of weed control. The presence of key agrochemical companies and increasing R&D spending are also supporting market growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 5.7% |

There is growing demand for herbicides in Japan, driven by the country’s emphasis on precision agriculture and reducing labor needs in farming. Due to the aging farmer population, herbicide use for weed control is only going to continue for the short term.

Moreover, innovations in technology, such as slow-release and targeted application products (along with other herbicide formulations) are propelling market demand. AI and drone technologies are also getting integrated for precision herbicide application, and this is also shaping the market trends.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 5.9% |

The growth in agricultural modernization and enhanced government support for smart farming in South Korea is driving the market for herbicides in the country.

The trend for sustainable or less harmful herbicides, along with a more nuanced knowledge about the role of chemical residues in soil health, is affecting market demand. Research on new generation of herbicides with less environmental impact is on the rise which is further supporting the market growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 6.1% |

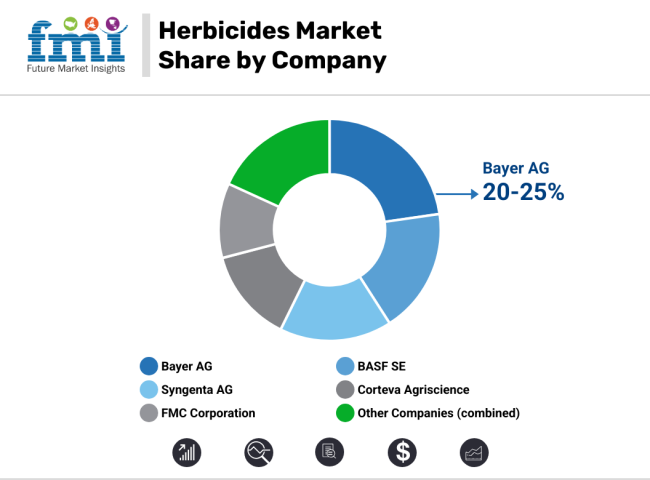

The herbicides market is characterized by a dynamic competitive landscape shaped by consolidation, innovation, and regulatory adaptation. Key players including Bayer AG, Syngenta, Corteva Agriscience, FMC, BASF, and UPL are pursuing aggressive strategies in both molecule innovation and geographic expansion. Emphasis is being placed on the development of low-drift, low-residue, and multi-mode-of-action herbicides to combat weed resistance and meet environmental standards.

Global leaders are scaling up R&D investments in bio-herbicides and precision application tools to enable sustainable weed control. Strategic acquisitions and partnerships are being used to build resilient product pipelines and distribution networks in high-growth regions like Africa, ASEAN, and Latin America. Notable examples include collaborations for AI-powered spray optimization and drone-compatible formulations.

The overall market size for herbicides market was USD 38,539.4 million in 2025.

The herbicides market expected to reach USD 67,727.1 million in 2035.

Rising global food demand, increasing adoption of modern farming techniques, expanding agricultural land, and growing concerns over weed management will drive the herbicides market during the forecast period.

The top 5 countries which drives the development of herbicides market are USA, UK, Europe Union, Japan and South Korea.

Cereals & grains segment driving market growth to command significant share over the assessment period.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Non-Selective Broadleaf Herbicides Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA