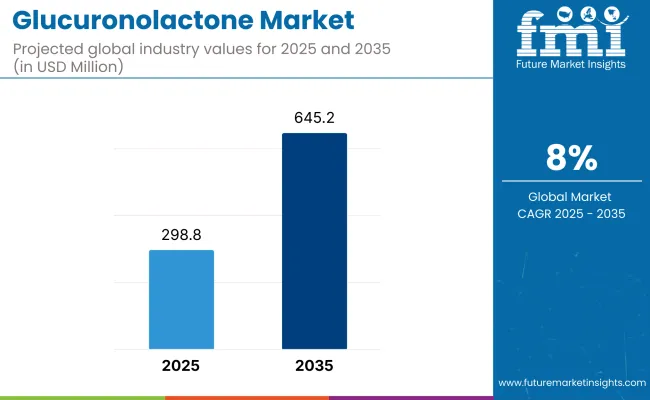

The glucuronolactone market is anticipated to grow significantly from USD 298.8 million in 2025 to USD 645.2 million by 2035, registering a strong CAGR of 8.0% over the forecast period.

| Metrics | Values |

|---|---|

| Industry Size (2025E) | USD 298.8 million |

| Industry Value (2035F) | USD 645.2 million |

| CAGR (2025 to 2035) | 8.0% |

North America stands out as the most lucrative regional market, driven by the high consumption of energy drinks and sports supplements. Meanwhile, East Asia is projected to exhibit the fastest growth owing to an uptick in fitness culture, the expansion of the functional food sector, and increased awareness about performance-enhancing ingredients.

The market is being shaped by rising demand for ingredients that support liver detoxification, reduce fatigue, and improve physical and mental performance. Glucuronolactone is increasingly favored in the formulation of energy drinks and dietary supplements due to its role in enhancing alertness and stamina.

Key trends include the proliferation of clean-label performance drinks and a preference for synergistic blends with caffeine and taurine. Despite this momentum, limited consumer education in emerging markets and inconsistent global regulatory frameworks may pose hurdles to broader adoption. Industry players are actively addressing these gaps by reinforcing R&D pipelines, ensuring purity compliance, and optimizing sourcing strategies to meet evolving customer expectations.

Looking forward, the market is expected to expand into new functional categories, including cognitive support and detoxification supplements, especially as scientific validation and clinical evidence continue to build. Product differentiation through innovative formats-such as capsules, sachets, and RTD (ready-to-drink) blends-will likely be central to growth strategies.

Furthermore, sustainability in manufacturing, transparent labeling, and pharmaceutical-grade certification are anticipated to become pivotal differentiators. Market success will increasingly depend on the ability to cater to high-performance lifestyle consumers while aligning with regulatory and clean-label demands.

The table below presents a comparative assessment of the variation in CAGR over six months for the base year (2024) and the current year (2025) for the industry. This analysis highlights crucial shifts in industry performance and provides insights into revenue realization patterns, offering stakeholders a clear perspective on the industry’s growth trajectory.

| Particular | H1 |

|---|---|

| Year | 2024 to 2034 |

| Value CAGR | 7.0% |

| Particular | H2 |

|---|---|

| Year | 2024 to 2034 |

| Value CAGR | 7.6% |

| Particular | H1 |

|---|---|

| Year | 2025 to 2035 |

| Value CAGR | 7.2% |

| Particular | H2 |

|---|---|

| Year | 2025 to 2035 |

| Value CAGR | 7.8% |

The first half (H1) of the year spans from January to June, while the second half (H2) includes the months from July to December. From H1 2024 to H2 2034, the industry is expected to grow at a CAGR of 3.9%, followed by a higher growth rate of 4.1% in the second half (H2) of the same decade.

Moving forward, from H1 2025 to H2 2035, the industry is projected to expand at a CAGR of 4.5% in the first half and maintain an upward trend at 4.7% in the second half. In H1, the industry observed an increase of 20 BPS, while in H2, the industry experienced a further rise of 20 BPS.

The industry is growing because the product is found in widespread application in energy drinks, dietary supplements, pharmaceuticals, and functional foods. Production is given preference by manufacturers as high-quality manufacturing, regulatory approvals, and cheap synthesis are undertaken to cater to increasing demand. Distributors take actions to maintain supply chain efficiency in order to guarantee availability across industries.

Retailers provide health-conscious consumers with mixes of branded and store-brand products containing it using price matching versus premium product positioning. Final consumers, e.g., healthy-conscious consumers, athletes, and body builders, demand purity, efficacy, and value in choosing products.

Consumers' increased inclination toward performance enhancement and clean-label ingredients are pressurizing formulators with their drive towards the former and favorable consumer reception with the latter. Regulatory approvals, safety evaluations, and scientific studies supporting the advantages of it for cognitive functions and detoxification also fuel purchases across segments.

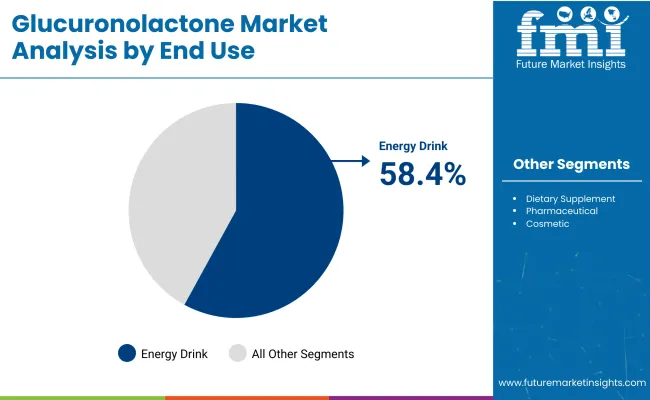

Accounting for 58.4% of global market share in 2025, the energy drinks segment anchors glucuronolactone demand and is projected to grow in line with the overall 8.0% CAGR through 2035. This commanding position reflects glucuronolactone’s entrenched role in performance-focused functional beverages, particularly those targeting mental acuity, physical endurance, and rapid recovery.

Energy drink brands have long favored glucuronolactone for its synergistic interaction with caffeine and taurine, enhancing perceived energy and alertness without increasing sugar loads. As consumer profiles shift toward health-conscious millennials and Gen Z athletes, demand is migrating from traditional carbonated formats to clean-label, plant-forward formulations, where glucuronolactone continues to offer a scientific edge. Regulatory acceptance in major markets like the USA, Europe, and Japan has further validated its inclusion in high-performance beverage portfolios.

Leading manufacturers are innovating around bioavailability and stability-integrating glucuronolactone into novel RTD blends, shots, and functional waters. The segment’s continued strength also hinges on its adaptability to broader positioning, including cognitive function, mood elevation, and liver health.

While competition from nootropics and adaptogens is intensifying, glucuronolactone’s established presence and expanding clinical evidence base support its strategic value in next-generation energy beverages. Forward-looking players are leveraging this molecule not merely as a stimulant adjunct, but as a core driver of performance differentiation.

The dietary supplements segment is projected to grow at a CAGR exceeding 8.5% through 2035, gradually capturing a larger share of the global glucuronolactone market. While energy drinks remain the dominant application, supplements are emerging as a high-potential growth vector, fueled by consumer interest in multifunctional health products that support detoxification, cognitive performance, and overall vitality.

Glucuronolactone’s bioactive profile aligns well with trends favoring natural liver support and fatigue mitigation, especially in urban populations exposed to stress, pollution, and lifestyle-induced toxin buildup. Supplement manufacturers are increasingly incorporating it into standalone capsules, liver health blends, and metabolic booster stacks-often positioned alongside ingredients such as milk thistle, B-vitamins, and alpha-lipoic acid. These combinations target preventive wellness users seeking daily detoxification and long-term organ support without pharmaceutical intervention.

Some significant threats that the industry contends with include strict regulation, raw material price fluctuations, changes in consumer preference, pressure from rivals, and unreliable supply chains.

Regulatory scrutiny is the most alarming factor, especially considering that it is an ingredient found in energy drinks, dietary supplements, and уф medications. There are voices from certain health authorities questioning its adverse health effects at high concentrations, and that could probably cause a ban on it. The European Food Safety Authority (EFSA) and the USA Food and Drug Administration (FDA) have issued their directives, however, amendments in regulations may have an effect on the inclusion of this substance in energy drinks and functional foods.

With the price volatility of raw materials, the production costs are also affected, since it is made from glucose that has been fermented or was synthesized chemically. Variations in sugar supply chains, an increase in manufacturing costs, or a rise in demand for glucose-based products may impact industry pricing and availability.

Changing consumer preferences have a direct influence on demand, particularly in the functional beverage and dietary supplement sectors. Even if the energy drink industry is still booming, rising worries about caffeine and stimulant overuse could have a detrimental effect on the glucuronolactone product consumption. The shift to natural ingredients and plant-based alternatives is also another way of dealing with it.

Competitive forces are both synthetics and naturals such as taurine, L-carnitine, or even herbal extracts which do almost the same work, increase energy and detoxify the body. They must set their glucuronolactone products apart from the rest to hold on to their industry share.

Decentralized gasps in supply chains including transport hurdles, raw materials, or war-related factors may guide the availability of it. On top of that, there is the issue of reliance on China, the USA, and Europe for production which in turn means that barriers to trade or global crises would bring on uncertainties.

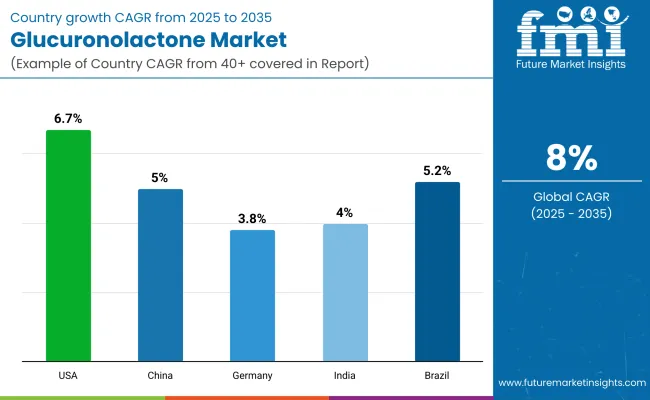

| Countries | CAGR (2025 to 2035) |

|---|---|

| USA | 6.7% |

| China | 5.0% |

| Germany | 3.8% |

| India | 4.01% |

| Brazil | 5.2% |

The USA industry is witnessing steady growth, with an expected CAGR of 6.7% over 2025 to 2032, cites FMI. Rising demand for energy drinks and dietary supplements has driven the development, with customers demanding products that improve cognitive ability and combat fatigue. Functional drinks containing it are becoming increasingly popular among professionals, sportspeople, and fitness enthusiasts.

Major players continue to include this ingredient in their products to cater to an emerging health-conscious consumer base. Moreover, the pharmaceutical industry is looking into its use in detoxification and mental health, further expanding industry potential. FMI believes that the USA industry will expand at 6.7% CAGR over the forecast period.

Growth Drivers in the USA

| Key Drivers | Details |

|---|---|

| Growing demand for energy drinks | Consumers look for improvement in cognitive and physical performance. |

| Rising health awareness | Functional ingredients are mainstream in well-being trends. |

| Growing dietary supplement industry | It finds application in sports and mental supplements. |

| Well-established retailer shelf presence | Easy access by online and offline channels. |

The Chinese industry is anticipated to expand at a CAGR of 5.0% during the forecast period, cites FMI. A surging middle-class population, higher disposable incomes, and health-focused choices of consumers contribute to this expansion.

It is already found in most present-day energy beverages as a dominant ingredient in augmenting mental and physical performance. Additionally, government-sponsored well-being programs have supported functional foods and dietary supplements. China remains a leading producer, with a secure supply to accommodate domestic and export demand.

Growth Drivers in China

| Key Drivers | Details |

|---|---|

| The growing functional beverage industry | Glucuronolactone-fortified energy drinks have increased in popularity. |

| Expanding consumer group of middle-class | Growing disposable income supports the uptake of premium products. |

| Government-funded health programs | Health awareness promotions stimulate the use of functional ingredients. |

| Stable local production | China continues to be a major producer in global supply. |

The German industry is anticipated to expand at a CAGR of 3.8% during 2025 to 2032 as consumers highly sought natural and science-backed health products. Pharmaceutical and nutraceutical firms concentrate on research-backed, high-value formulations. It has been recognized as an ingredient with cognitive effects and for energy boosts in dietary supplements. With strict regulatory measures guaranteeing product safety, consumers trust it.

It is also used extensively in liver health supplements and detoxification in the pharmaceutical sector. FMI anticipates the German industry will register a 3.8% CAGR during the forecast period.

Growth Drivers in Germany

| Key Drivers | Details |

|---|---|

| Healthy focus on wellness and well-being | Clients favor science-established functional ingredients. |

| Expanding growth of nutraceuticals | Rising demand for dietary supplements containing it. |

| Stringent regulatory requirements | Safeguards high-value products and ensures consumer safety. |

| Pharmaceutical use expansion | Increasing use of it in detox and cognitive health products. |

India's industry is expected to grow consistently at a CAGR of 4.01% from 2025 to 2032. The increasing trend of functional beverages and energy supplements has driven industry growth. With increasingly active lifestyles, the demand for glucuronolactone-based products has been rising. Online and offline platforms have made these products more accessible. The pharmaceutical sector also investigates its applications in well-being and liver health products.

Growth Drivers in India

| Key Drivers | Details |

|---|---|

| Enhanced health awareness | Consumers opt for functional and performance-improving ingredients. |

| Growing energy drink industry | Improved distribution of glucuronolactone-based beverages. |

| Retail and e-commerce growth | Internet stores offer more convenient access to the supplement. |

| Rising pharmaceutical use | Research establishes the detoxification effect of it. |

The growing popularity of sports nutrition products and energy drinks due to an increasing fitness culture has played a pivotal role in industry expansion. It is currently a standard ingredient in functional drinks targeting endurance and cognitive performance.

International players are increasing their foothold in Brazil, bringing innovative formulations that align with evolving health trends. The nutraceutical industry is also rising, with increased supplement consumption across various consumer groups. According to FMI, the Brazilian industry is expected to grow at 5.2% CAGR throughout the forecast period.

Growth Drivers in Brazil

| Key Drivers | Details |

|---|---|

| Growing sports nutrition needs | A stronger fitness culture promotes supplement intake. |

| Functional drink development | Energy beverages containing it are increasingly popular. |

| Expansion by international brands | International firms introduce new formulations based on health trends. |

| Heightened use of supplements | Consumers seek mental and physical performance enhancers. |

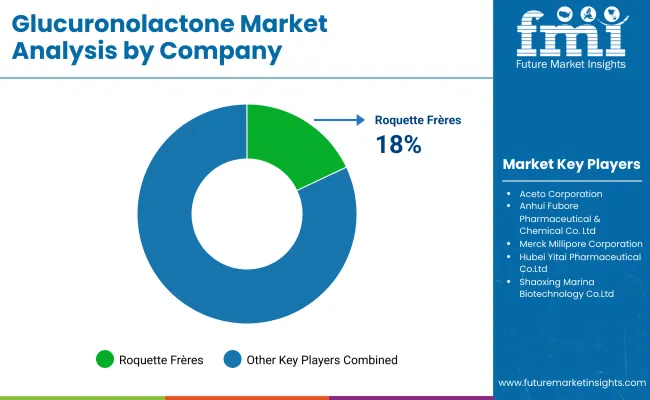

Roquette Frères (18-22%)

A significant player, being well-known for high-purity formulations, servicing the energy drink and pharmaceutical industries.

Jungbunzlauer Suisse AG (12-16%)

The company specializes in sustainable production and high-quality for nutraceutical applications.

Foodchem International Corporation (10-14%)

One of the important suppliers of it for food, beverage, and pharmaceutical manufacturers all around the world.

Shandong Fuyang Bio-Tech Co., Ltd. (9-13%)

Enhanced production capacity with an eye on increasing demand for functional beverages and supplements.

Anhui Fubare Pharmaceutical & Chemical Co. (8-12%)

Manufacturer of pharmaceutical-grade, which benefits from R&D for product newness.

Other Key Players (25-35% Combined)

By form, the industry is segmented into powder, liquid, and tablet & capsules.

By end use, the industry is segmented into dietary supplements, energy drinks, pharmaceuticals, cosmetics, and functional foods.

By region, the industry is segmented into North America, Latin America, Europe, Asia Pacific, and the Middle East & Africa (MEA).

The industry is expected to reach USD 298.8 million in 2025.

The industry is projected to reach USD 645.2 million by 2035.

The key players in the industry include Aceto Corporation, Anhui Fubore Pharmaceutical & Chemical Co., Ltd., Merck Millipore Corporation, Hubei Yitai Pharmaceutical Co., Ltd., Shaoxing Marina Biotechnology Co., Ltd., Foodchem International Corporation, Shandong Fuyang Bio-Tech Co., Ltd., Roquette Frères, Jungbunzlauer Suisse AG, and Suzhou Fifth Pharmaceutical Factory Co.

The USA, slated to grow at a CAGR of 6.7% during the forecast period, is expected to see fastest growth.

Powdered form is being widely used.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA