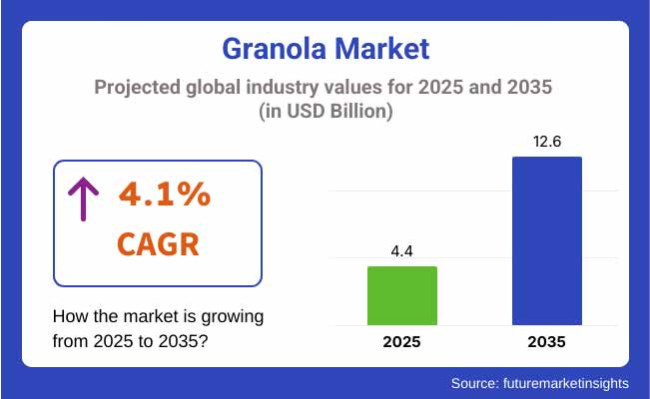

The global market for granola was USD 4.0 billion in 2024. The demand for granola grew by a year-on-year value of 4.2% in 2025 and thus the global market would be USD 4.4 billion in 2025. In the forecast period (2025 to 2035), global sales would have a 4.1% CAGR and be USD 12.6 billion in value of sales in 2035.

Granola market is expanding and expanding with shifting consumer attitudes towards healthy and convenience breakfast food and snack. Increased awareness of the nutritional profile of granola, i.e., protein-rich, fiber-rich, and packed with vital vitamins, has created demand exponentially. Shift of consumers from traditional breakfast cereals towards consumption of granola products as a healthy option is on a full swing basis with clean-label, organic, and non-GMO.

Increasing health-conscious population and wellness lifestyle have increased demand for convenience food that can be eaten on the go. Packaged granola and ready-to-eat granola are most in demand, especially among urban consumers. Increasing veganism and plant-based food culture have also increased competition to launch lactose-free and sugar-free granola for lactose-intolerant and health-conscious consumers.

Ingredient, texture, and novelty in taste have also driven the market. The firms are incorporating superfoods like dried fruits, flaxseeds, and chia seeds in the granola for enhanced level of nutrition. Gluten-free granola is also being used by health-conscious individuals.

North America will remain the biggest regional market for granola due to increasing demand for breakfast cereal and healthy snack. Asia-Pacific will, however, be expanding the most due to increasing Western lifestyle imitation and greater consumption of healthy food. Online stores and online marketplace also helped in promoting growth within the market through making brands accessible to many people.

The functional food and health-favouring snack foods trend will continue to be strong in the case of granola. The firms are moving towards product innovation, sustainability, and clean label in a bid to gain health-favouring consumers.

The following table gives comparative outlooks of six-month CAGR fluctuation between base year (2024) and current year (2025) in the global granola market. The outlooks reflect extreme fluctuation in performance and take into account trends in revenues attained, hence giving stakeholders a better understanding for development over the year period.

| Particular | Value CAGR |

|---|---|

| H1 (2024 to 2034) | 3.8% |

| H2 (2024 to 2034) | 4.0% |

| H1 (2025 to 2035) | 4.0% |

| H2 (2025 to 2035) | 4.1% |

During the first half (H1) of the decade 2025 to 2035, the company will expand at a CAGR of 4.0%, and during the second half (H2) of the same decade, it will expand at 4.1%. Now, coming to the second phase, H1 2025 through H2 2035, CAGR remains the same. In H1 2025, the industry recorded a 20 BPS rise, and in H2 2025, the firm recorded a 10 BPS rise compared to the previous analysis.

With ongoing product innovation, more investment in healthier food, and changing consumer behavior towards clean-label and functional foods, the granola market will expand over the next decade. As more and more individuals look for healthy, convenient food, food companies will be compelled to create high-quality, sustainable granola products so that they remain competitive with evolving dietary needs.

In Tier 1, the granola market is led by high revenue, high market penetration, and broad product portfolio (breakfast cereals, snacks and healthy food) multinational food and snack entities. These companies spend heavily on branding, advertising and innovation in health trends like high-protein, low-sugar and plant-based granolas.

General Mills is another powerhouse to which granolas can turn to for bars, cereals and clusters alike: This company accounts for many grocery store shelves around the world along with its Nature Valley and Cascadian Farm brands. Kellogg’s also plays in the Tier 1 space with its Bear Naked brand, catering to health-conscious consumers with clean-label, organic and fiber-boosted granola solutions. These companies enjoy economies of scale, widespread retail and foodservice reach.

Regional and premium brands with a hold on their market and loyal consumers fall under Tier 2. Kind Snacks owned by Mars Inc. is a notable name for its granola clusters and bars that emphasize whole good ingredients, transparency and (especially in North America and Europe).

Bob’s Red Mill is classified as Tier 2 with its natural and gluten-free granola varieties primarily sold through health stores and online platforms. These companies often compete based on ingredient sourcing, product quality, and specialty certifications such as organic, non-GMO or gluten free and compete on the premium price point and wellness branding.

Tier 3 includes small upstarts, artisanal granola makers and niche health brands targeting local markets and online or subscription sales. Specialty granolas (e.g., ancient grain, keto or probiotic-infused) are products of brands like Purely Elizabeth and Thrive Market that target certain dietary needs and lifestyle preferences.

Many of these companies succeed on direct-to-consumer sales, social media marketing and kitchen partnerships with gyms, wellness centers and boutique retailers. Their agility enables them to pivot quickly to innovate, to release limited-edition offerings, and to speak to eco-conscious consumers through sustainable packaging and clean-label ingredients.

Similarities in the Granola Market: Brands, Walnuts, and Chocolates

Shift: Consumer interest in personalized nutrition based on specific health goals, unique dietary restrictions, and taste preferences is growing. And the granola market is undergoing a shift toward customized blends, in which users can choose their ingredients, from grains to types of nuts to fruits to sweeteners. When it comes to buying, they are making purchases based on claims like gluten-free, vegan, keto-friendly, and allergen-free.

In response to this paradigm shift, Millennials and Gen Z (Gen Y) consumers in the United States, Germany and South Korea favor brands that provide home-grade granola solutions (via e-commerce channels or subscriptions) through a personalized approach.

Strategic Response: Hoping to cash in on this demand, several brands have launched online customization tools and pre-curated granola kits. As part of a 15% uptick in its direct-to-consumer (DTC) sales, Germany’s MyMuesli allows users to customize granola mixes from over 80 ingredients on its website. So, this year, for example, Lark Ellen Farm added a Build-Your-Own Granola Pack feature on its web site in the USA, which increased customer engagement and led to an 11% lift in online sales.

In South Korea, Morning Spoon introduced customizable granola pouches tailored to specific health objectives, such as weight management and energy boosts, and saw a 9% growth in repeat customer rates. Niche DTC markets are broadening out: Subscriptions for customized granola to be delivered every month are becoming popular.

Functional Ingredients & Superfood Blends

Shift: That is beaconing in today’s consumers that they want their food to deliver functional health benefits beyond basic nutrition. Consumers increasingly want granola products with superfoods (e.g., chia seeds, quinoa, goji berries), functional ingredients (e.g., collagen, adaptogens, MCT oil) and probiotics that aid digestion or immune or cognitive function. This has been a particular demand in health-conscious markets - the USA, Canada, Australia and the UK - where granola is consumed as breakfast food, but also as a snack and post-workout recovery food.

Strategic Response: Brands are reacting to this in the way they include ingredients that support wellness goals. Love Crunch launched a plant-based and probiotics-fortified granola line in Canada, resulting in an overall gain of 10% over the segment sales of health food stores.

Nature’s Path, which is a global company, introduced Superfood Granola Clusters containing turmeric, flax seeds and goji berries, which gave a 7 percent boost to North American share. Carman’s Kitchen has launched a Functional Muesli Range to tackle gut health and energy in Australia, providing a 12% uplift to its overall granola category. These launches are often supported by education campaigns around the benefits associated with these ingredients, helping with consumer engagement and ultimately brand loyalty.

Sustainability and Ethical Sourcing: Top Purchase Consideration

Shift: Granola-buyers are more and more concerned about being eco-friendly and consuming ethically. Consumers are flocking to brands that put sustainable packaging, ethically sourced ingredients and carbon-neutral production methods at their core. This phenomenon is widespread - especially in Nordic countries - and exploding in the USA, UK and Japan. Granola owners that supply those, in compostable or recyclable packaging, appeal to eco-minded buyers who are willing to pay more for transparency in the supply chain and fair-trade certifications.

Strategic Response: Brands are responding with sustainability-inspired innovations. In the UK, Rude Health has released Eco-Pack Granola containing compostable pouches, delivering a 9% sales increase in organic retailers. The USA-based granola brand Bear Naked packs its product in 100% recyclable bags and sources all its ingredients via certified sustainable partners, yielding a 6% increase in eco-conscious buyers engaged with the brand.

For instance, Calbee in Japan launched a Zero Waste Granola Line that utilized upcycled fruits and nuts from food processing (reducing food waste) and helped them gain additional market share (up to 8%) specifically targeting premium sustainability niches. When it comes to trust and long-term customer loyalty, brands are investing in certifications (Rainforest Alliance, Fair Trade, et.)

Expansion into Non-Traditional Consumption Occasions

Shift: Granola is being eaten at times of the day beyond breakfast, too, with demand growing for granola to serve as a functional ingredient for use in desserts, salads, smoothies, baking and savory cooking. There also has been a trend in drinks infused with granola, like granola milk and granola smoothies.

This multiplicity of usages is especially true in cities in the USA, UK and France, where consumers want versatile, multi-segment food products. Granola is being marketed as a healthy dessert option as well, particularly among flexitarians and those looking to cut back on sugar but still enjoy flavors.

Strategic Response: New format granola innovations to appeal to diverse consumption occasions. In France, Michel et Augustin launched Granola Dessert Toppings, which was up 10 percent in high-end food retail outlets. KIND Snacks also introduced new Granola Clusters for smoothies and Savory Granola Croutons for salads in the USA, which opened up more consumption occasions for the brand and led to +12% growth in grocery.

In the UK space, Graze launched Granola Bites for Desserts, marketed as a healthier version of candy to sprinkle over ice cream and yogurt, seeing an incremental 9% lift in sales. Granola brands are extending into food services channels as well via co-branding with smoothie chains and dessert cafés.

Granola Accessibility: The Rise of Digital-First and E-commerce

Shift: The retail world is going digital driven processes, and similarly, consumers are buying granola online at an increasing rate, through e-commerce website, health food apps, and brand website. Convenience, access to a wider variety of products, and niche offerings-all 3 are driving the shift.

The pandemic has greatly accelerated online food shopping, and the habit has stuck, especially in North America, Europe and some of Asia. When it comes to digital sales of granola products, subscription models, bundled health boxes and influencer-fueled marketing have only added to the mix.

Strategic Response: Investments in digital and DTC presence by brands. In the USA - where Purely Elizabeth expanded its e-commerce experience with personalized product recommendations - online sales were up 14%. In the UK, digital granola sales for MOMA Foods through major e-grocery platforms were 12% up.

Yogabar launched a mobile app in India through which users could buy subscription granola packs at a discounted price and saw a 17% jump in monthly active users. A plethora of brands capitalize on social media through influencer collaborations or recipe-based content, allowing them to engage with the consumer space and encourage new demographics to try their product.

The following table shows the estimated growth rates of the top five territories. These markets are set to experience high consumption through 2035.

| Countries | CAGR, 2025 to 2035 |

|---|---|

| USA | 3.9% |

| Germany | 4.3% |

| China | 4.0% |

| Japan | 3.8% |

| India | 4.5% |

The USA granola market is booming in response to rising consumer demand for nutritious, convenient, and wholesome breakfast foods. Health-conscious consumers also searched for alternatives to traditional cereals which led to the rise in demand for organic, gluten-free, and low-sugar granola varieties.

As interest in protein- and fiber-rich diets has spiked, manufacturers have introduced innovative granola products that are enriched with superfoods, nuts and seeds. The boom of e-commerce and DTC brands has been instrumental to increasing market accessibility, and growing interest of on-the-go snack formats only acts as a tailwind. In addition, trends such as clean-label and sustainably sourced ingredients have deepened consumer trust in the USA market.

The increasing demand for better-quality granola products is attributed to the preference of Germany's consumers for organic and clean label food products. The country’s focus on sustainable agriculture and natural ingredients complements the burgeoning demand for additive-free, whole-grain granola.

This sort of wellness trend, especially among urbanites, has launched functional granola items packed with proteins, probiotics, and natural sweeteners (think honey and maple syrup). With its well-developed retail infrastructure comprising a wide range of supermarkets, health food shops, and online shops, Germany can guarantee the widespread distribution of products which further enhances market growth.

The growth of the middle-class population and improved health consciousness in China has boosted the adoption of granola as a healthy breakfast and snack option. Western eating habits, and the increasing demand for fiber-rich and protein-rich foods, have led domestic and international brands to explore granola products catered toward Chinese tastes.

The likes of Alibaba and JD. `com are instrumental in expanding the market by providing consumers access to a large number of granola products. Also, granola with added nutritional benefits from functional ingredients such as goji berries, green tea, and nuts in response to nutrition focus in China has gained popularity.

The dynamic food industry in Japan and focus on innovation are two key drivers creating a rise in demand for granola products. In response, consumers increasingly looking for healthier food options have driven the adoption of Western-style breakfasts, and, by extension, granola to Japanese consumers.

Granola enriched with traditional Japanese flavors like matcha, black sesame and soy protein has taken off. While convenience store chains and supermarkets filled shelves with store-brand granola, premium and artisanal granola brands target niche segments. Moreover, the adoption of portion-controlled and resalable packaging caters to the on-the-go consumption trend in Japan.

Growing interest in health and wellness in India has increased demand for granola as a healthy breakfast option. So, with everything from urban consumers' craving for foods that are high in fiber, protein, and naturally sweetened, granola has taken off for health-conscious individuals and working professionals alike.

During the rise of e-commerce platforms, online grocery retailers have made them more accessible, with a wider array of granola brands available. Domestic manufacturers are also developing new products using indigenous ingredients like jaggery, tropical dried fruits, and nuts that appeal to regional tastes. With consumer awareness and knowledge over granola advantages improving, the market is set to keep flourishing in India.

| Segment | Value Share (2025) |

|---|---|

| By Product Type | 55% |

Granola, belongs to the cereals and bars market, where both segments have a rapid growth because of the portability and healthy nutrition these are serving. Granola bars are the most popular type of product among consumers, due to the fact that they are easy to pack and provide a quick healthy snack option. Growing fashion for on-the-go nutrition is expected to offer potential growth opportunities to granola bars especially among busy professionals, gym goers, and students.

In response, manufacturers are rolling out new granola bars that are protein-rich, fiber-fortified and low in sugar to please consumers who care about health. Sales of plant-based and gluten-free granola bars are also growing in popularity, bolstered by dietary preferences and food sensitivities.

Granola cereals hold a dominant market share, often taken as a meal or sprinkled on yogurt. In particular, consumer demand for high-fiber, whole-grain breakfast items fuel innovation in more niche presentations like low-carb and keto-friendly as well as new organic varieties.

A customizable granola blend, which enables consumers to mix and match different nuts, seeds, and dried fruits, has become very popular in this segment, thereby further escalating the demand. With a rising need for clean-label products, transparency in ingredient sourcing, and a move towards functional foods that promote gut health and immunity, the granola market is projected to grow. That's one of the reasons why bars and cereals remain a mainstay in the world of health food they are flexible and can adapt to the current trends.

| Segment | Value Share (2025) |

|---|---|

| By Application | 45% |

Granola can do all sorts of things: salads, cookies, cupcakes, gratins, trail mix, puddings, breakfast baked goods, fruit crisps, among others. The breakfast segment dominated the granola application, consisting of baked goods, fruit crisps and puddings, since it is considered a healthy each meal option during the morning.

Granola has time-tested appeal, and it fits in well with consumer demand for clean foods, fiber-rich breakfasts and even good-for-you energy bars it’s a popular topping in dishes like overnight oats and smoothie bowls. ‘Granola bar trail mix and snacking applications are also driving strong growth as granola is combined with nuts, dried fruits, and seeds to generate high energy, nutrient dense snack food,’ he added. Due to its high levels of protein and fiber levels, granola trail mix is especially popular amongst those who are athletic, hiking, or living active lifestyles.

Another significant application area is for the bakery and dessert industry. Cookies, cupcakes and gratins infused with granola are emerging as healthier alternatives to baked goods. Its crunchy texture and nutritional profile also make granola an ideal topping for desserts and yogurt-based products, increasing demand in this segment.

Mounting consumer interest in functional and plant-based ingredients has manufacturers getting creative with their experimentation, from granola-infused savory dishes to protein bars and through creative food formulations. While the conventional application of granola is driving market growth, new applications are also emerging, ensuring steady growth of the market as consumer preference for healthy, natural, and minimally processed foods show no sign of declining in the near future.

There are increasing competitive insights in the granola market. Key players in the industry like Kellogg, General Mills, and Nature Valley market share is increasing rapidly through brand recognition, product development, and innovation. Some key players are leading the consumer choice with gluten-free, high-protein granola products, flavored granola, etc., in services which pop out the most and provide ready-to-eat nutritional breakfast or snacks.

With these additions, such as low-sugar, keto-friendly and organic varieties, they are drawing health-conscious consumers while expanding sales. Manufacturers are model to stay competitive by ensuring product quality, formulation, and packaging enhancement. Now companies are introducing high-fiber, nutrient-dense granola with functional ingredients like chia seeds, flaxseeds and probiotics, drawing in consumers who want nutrition as well as taste.

They also cost more to distribute than other packaging types, and the result is generally a minor increase in shelf space and sales as compared to previous packaging options, so the shelf space can be more difficult to have for some companies.

For instance

Market segmented into Plants, Unpasteurized Milk, Calabar Bean, Nuts, Rapeseed, Seeds, Vegetables, Soybean, Medicinal Herbs, and Legumes.

Market segmented into Food, Feed, Pharmaceutical, and Cosmetic.

Market segmented into North America, Latin America, Europe, Asia Pacific, Oceania, and the Middle East & Africa (MEA).

The global granola market is projected to grow at a CAGR of 4.1% during the forecast period.

The market is estimated to reach approximately USD 12.6 billion by 2035.

The organic granola segment is expected to witness the fastest growth due to rising consumer preference for clean-label, natural, and minimally processed breakfast and snack options.

Key growth drivers include increasing health consciousness, growing demand for convenient and nutritious on-the-go snacks, and expanding product innovation with high-protein and gluten-free granola varieties.

Leading companies in the market include Kellogg Company, Kraft Foods Inc., Sunnycrunch Foods Ltd., ConAgra foods and Clif Bar & Co.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA