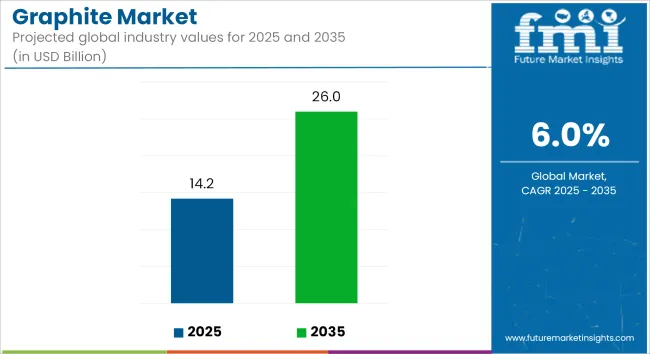

The global graphite market is estimated to report a value of USD 14.2 billion in 2025 and further reach USD 26 billion by 2035, achieving a CAGR of 6.0% during the forecast period. Graphite demand is increasingly being shaped by its role in electric vehicle batteries and energy storage systems, as well as longstanding industrial uses such as lubricants and refractories.

Recent strategic investments have targeted synthetic graphite capacity in North America. In early 2025, Vianode secured a USD 300 million loan guarantee from Germany’s Euler Hermes to support construction of a North American synthetic graphite plant targeting 70,000 tpa output by 2027. The guarantee was described in a company statement as “an important step in establishing overall funding, which will provide local supply of anode graphite.” This marks the first major project aimed at reducing dependency on Asia, where more than 95% of battery‑grade graphite production is currently concentrated.

In the same year, NOVONIX announced a second synthetic graphite plant in Chattanooga, Tennessee, planned to support a capacity of 31,500 tpa by 2028. NOVONIX confirmed that construction is being supported by a conditional USD 754.8 million Department of Energy loan guarantee. CEO Chris Burns was quoted as saying, “We are thrilled to be announcing this next step in our further expansion in Chattanooga.”

Commercial partnerships have reinforced this shift. In January 2025, General Motors signed a multi‑year supply agreement with Vianode for synthetic graphite beginning in 2027. GM Senior Vice President Jeff Morrison was quoted in the agreement announcement stating that it will “advance our battery technology and drive greater value to our customers.”

These developments signal growing momentum in the graphite sector. Investments in synthetic graphite are being aligned with EV battery demand. Government-backed financing is being used to support domestic supply chain resilience. Off-take agreements with automakers are being finalized to secure feedstock for large-scale battery production. Technological progress is being focused on ensuring purer and more consistent graphite output.

Over the next decade, growth in graphite consumption is being driven by continued industrial demand in steel, refractories, and lubricants, and accelerating uptake of battery-grade material. Ongoing plant expansions, financing commitments, and supply agreements demonstrate that the graphite market is being positioned to support clean energy transitions and industrial modernization.

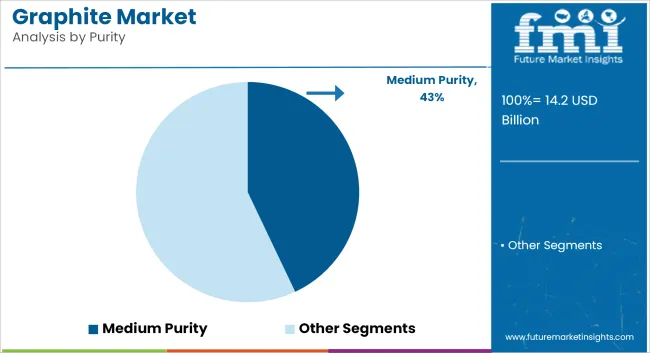

Medium purity graphite is estimated to account for approximately 43% of the global graphite market share in 2025 and is projected to grow at a CAGR of 5.5% through 2035. This grade, typically containing carbon content between 85% and 95%, is widely used in steelmaking, foundries, brake linings, and thermal management products due to its balance between cost and performance. Demand remains strong across Asia-Pacific and the Middle East, where infrastructure growth and industrial activity are driving refractories and casting operations.

Manufacturers are focusing on process consistency, particle size control, and customized blending to meet specifications across metallurgy, lubricants, and battery casings. As industries seek thermally conductive and chemically stable materials at scale, medium-purity graphite continues to offer a commercially viable solution.

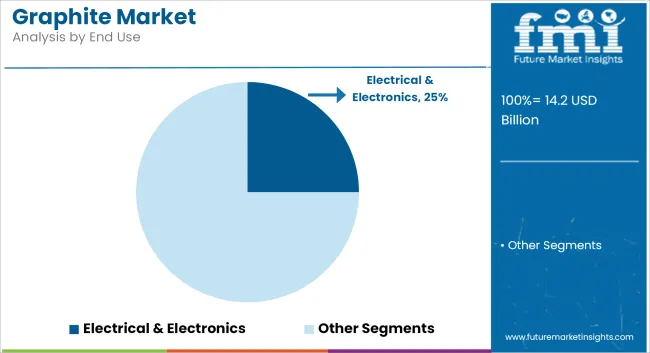

The electrical and electronics segment is projected to hold approximately 25% of the global graphite market share in 2025 and is expected to grow at a CAGR of 4.9% through 2035. Graphite is extensively used in conductive pastes, semiconductors, batteries, and thermal interface materials due to its high electrical conductivity and thermal dissipation capabilities. Synthetic graphite, particularly in anode materials for lithium-ion batteries and fuel cells, continues to see growing adoption in consumer electronics and electric vehicle components.

The shift toward 5G infrastructure, miniaturization of devices, and electrification of mobility is creating a sustained need for high-performance graphite solutions. With manufacturers seeking scalable and cost-efficient alternatives to metal-based components, graphite's role in power electronics, energy conversion, and circuit protection remains foundational to the sector’s growth.

Supply Chain Disruptions and Dependence on China

The major obstacle faced by the graphite market is the global supply chain dependency on China. Most countries are still investing in local graphite production, while China by far remains the biggest supplier, and thus holds a large part of the market share.

The shortage of raw materials, geopolitical tensions, and recent regulations on cheap graphite products coming from China can directly impact the global supply chain and thus can create price instability. Furthermore, a reliable supply of high-purity graphite for advanced applications continues to be an important issue for producers across manufacturers globally. In an effort to diminish the exposure, firms are undertaking such measures as freshwater mining initiatives, standalone synthetic graphite, or sub process graphite recycling.

High Processing Costs for Battery-Grade Graphite

The cost of processing and purifying natural graphite for battery-making processes is quite high as it includes the use of complicated and costly thermal and chemical purification methods. Moving towards environmentally friendly processing methods, and when adhering to such strict purity norms for EV battery manufacture, overall production costs are further increased.

Moreover, making synthetic anode graphite energy-efficient is an expensive process and raises environmental issues as well. The only way to overcome these issues is through developing more cost-efficient processing technologies and creating structured synthetic graphite along with effective disability recycling.

Expanding Demand for Graphite in Lithium-Ion Battery Production

The surge in sales of electric vehicles (EVs) worldwide brings with it the inevitable climb in demand for high-purity graphite for lithium-ion battery anodes. Governments across the globe are backing local battery manufacturing, promoting decentralized energy storage, and supporting a higher share of renewables in the energy mix; all these measures create an enormous potential market for graphite manufacturers. At the same time, solid-state battery technologies and hybrid systems mandate a special line of R&D in the form of high-performance graphite for storage application.

Technological Advancements in Graphene and Composite Materials

The advent of graphene-based materials is making a significant impact in a range of industries such as electronics, aerospace, and advanced composites. Notably, graphene provides not only low weight and high conductivity but also thermal stability, which creates a key material for high-performance applications like wearable electronics, supercapacitors, and flexible displays. As graphene manufacturing becomes more scalable and cost-effective, its adoption in thermal management solutions, sensors, and high-strength coatings is expected to expand, opening new revenue streams for graphite producers.

The United States graphite market is in an active stage of development, primarily driven by the high demand from electric vehicle (EV) battery production, the growth in energy storage solutions, and also the expansion of aerospace and defense industries with more and more applications.

The Inflation Reduction Act (IRA) and federal incentives for local battery production are thereby leading to an increase in investments in the production of both natural and synthetic graphite, thus supporting the country's strategic initiative to achieve independence from foreign veins in the EV supply chain.

With the intense growth of lithium-ion batteries, its demand for graphite is growing due to its primary anode material use which is critical. Moreover, the transformation in the format of carbon in the aerospace sector is highly responsible for the high-purity graphite materials demand. The implementation of nuclear energy and fuel cell technologies is also achieving the target of top-grade graphite for high-performance thermal management and structural applications.

| Country | CAGR (2025 to 2035) |

|---|---|

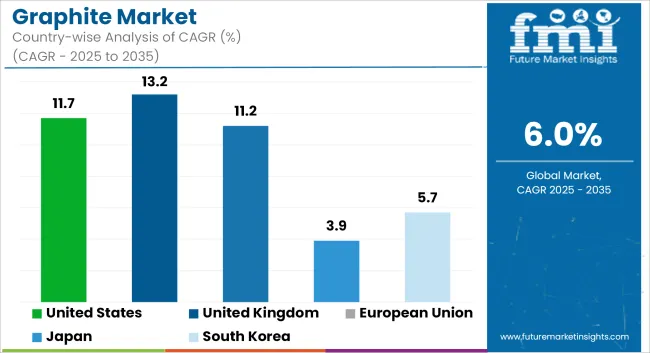

| United States | 11.7% |

The United Kingdom graphite market is soaring due to the rise of EV battery manufacturing, increasing use of environmentally friendly technologies, and a robust quest for high-performance graphite in the various industrial sectors. The UK's commitment to achieving net-zero emissions by 2050 has led to a surge in investments in battery materials and alternative energy storage solutions that are responsible for higher demand for graphite anodes in EV batteries.

At the same time, cutting-edge companies, such as semiconductor manufacturers, the aerospace industry, and 3D printing, are elevating their use of high-purity graphite, for instance, in thermal management and structural applications. The advancement of the hydrogen fuel cell technology sector is equally a factor that causes the increasing consumption of graphite in the parts of the fuel cells.

With an emphasis on sustainability and security of critical minerals, the UK is turning into a country with domestic graphite refining and synthetic graphite production, which will eliminate the reliance on foreign imports.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 13.2% |

The European Union graphite market experiences a steady growth trajectory, fueled by the enormous demand surge from the electric vehicle (EV) segment, the transition to green energy, and the increasing need for essential materials in high-tech industries. The EU’s Critical Raw Materials Act, by promoting domestic investment in graphite sourcing and refining, is cutting the reliance on Chinese imports.

The need for battery-grade graphite is soaring predominantly in Germany, France, and Sweden, where gigafactories are built amid the fierce EV transition across Europe. Wind and solar power storage are also the supportive factors of graphite demand in next-generation energy storage technology applications. Aerospace, metallurgy, and additive manufacturing as well, are observing the use of high-purity graphite in heat-resistant and structural applications, which adds significantly to the market development.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union | 11.2% |

The developing graphite market in Japan is characterized by a moderate growth pace which is a result of the advancements in battery technologies, semiconductor applications, and fuel cell manufacturing. The extremely advanced EV and hybrid vehicle business in Japan is the one that causes the increase of demand for battery-grade graphite as lithium-ion anodes.

The semiconductor sector, which has made Japan the leading country, is the one that increases the use of high-purity graphite in thermal management solutions, such as graphene heat spreaders in electronic devices. The rise of hydrogen fuel cells vehicles (FCVs) additionally assists to increasing the need for graphite for bipolar plates and electrode applications.

The transformation of the energy source from conventional to advanced nuclear, and the added demand from high-temperature industrial processes is responsible for further utilization of specialty graphite materials.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 3.9% |

The South Korea graphite market is being pushed by the climbing EV battery production, the advanced electronics manufacturing, and the investments in the clean energy technologies. Apart from being the lithium-ion battery manufacturer, the South Korea has a role of high demand for battery-grade graphite thanks to the main companies: LG Energy Solution and Samsung SDI.

Simultaneously with the South Korea investment in hydrogen fuel cell infrastructure, the graphite used in fuel cell stacks is also increasing. The country dominance in the semiconductor industry is the reason behind the demand for ultra-high-purity graphite components, which are used in chip fabrication and thermal management solutions. A surge in green manufacturing and energy efficiency programs is facilitating the move towards the use of synthetic and low-carbon graphite products.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 5.7% |

The graphite market is experiencing increased competition as industries invest in localizing production and expanding capacity to meet the rising demand for battery-grade materials, driven by the shift toward electric vehicles (EVs) and energy storage. Key players are strategically opening processing facilities in regions like North America and Brazil, targeting high-purity natural graphite production for lithium-ion batteries. These investments are aimed at reducing dependency on traditional graphite supply hubs in Asia, aligning with global efforts to secure critical mineral supply chains.

Natural, Synthetic

High Purity, Medium Purity, Low Purity

Metallurgy, Electrical & Electronics, Automotive & Transportation, Energy Generation, Others

Refractories, Lubricant, Foundry Facing, Batteries, Fire Retardant, Others

North America, Latin America, Eastern Europe, Western Europe, East Asia, South Asia and Pacific, Middle East and Africa

The global graphite market is projected to reach USD 14.2 billion by the end of 2025.

The market is anticipated to grow at a CAGR of 6.0% over the forecast period.

By 2035, the graphite market is expected to reach USD 26.0 billion.

The high-purity graphite segment is expected to dominate due to its increasing demand in electric vehicle (EV) batteries, fuel cells, and advanced industrial applications, where superior conductivity and thermal resistance are essential.

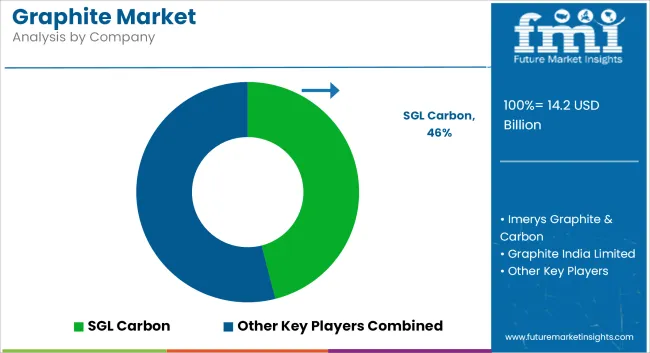

Key players in the graphite market include Syrah Resources Limited, Northern Graphite Corporation, Imerys Graphite & Carbon, Tokai Carbon Co., Ltd., and SGL Carbon.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Graphite Materials Market Size and Share Forecast Outlook 2025 to 2035

Aerographite Market Size and Share Forecast Outlook 2025 to 2035

Flake Graphite Market

Compacted Graphite Iron Market Size and Share Forecast Outlook 2025 to 2035

Demand for Graphite Materials in UK Size and Share Forecast Outlook 2025 to 2035

Carbon And Graphite Felt Market Size and Share Forecast Outlook 2025 to 2035

Microfined Graphite Powder Market Insights – Size, Trends & Forecast 2025-2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA