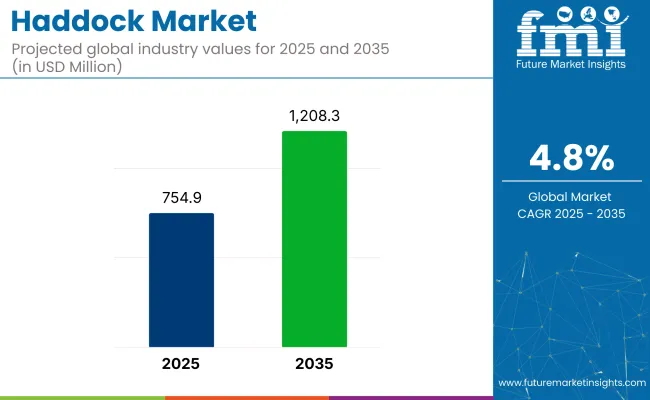

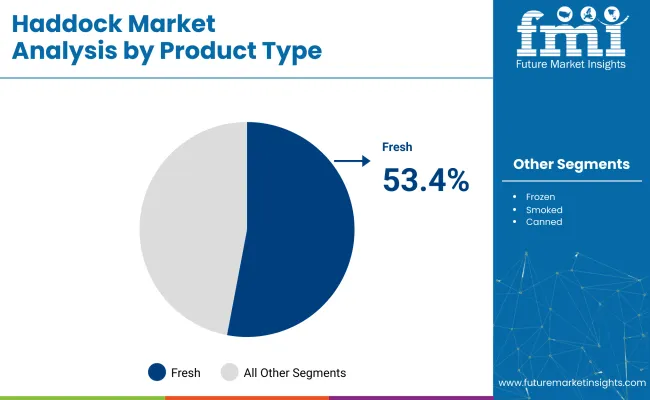

The global haddock market is expected to grow steadily from USD 754.9 million in 2025 to USD 1,208.3 million by 2035, progressing at a CAGR of 4.8%. A key factor in this growth is rising global demand for whitefish species used in value-added formats such as frozen fillets and fish-and-chips. Fresh haddock, known for its mild flavor and low fat content, remains the top product category with 53.4% share in 2025.

| Metric | Values |

|---|---|

| Estimated Size (2025E) | USD 754.9 million |

| Projected Value (2035F) | USD 1,208.3 million |

| CAGR (2025 to 2035) | 4.8% |

The industry faces significant supply-side challenges. In May 2023, the Associated Press reported that the USA federal regulators had imposed an 80% reduction in haddock quotas in the Gulf of Maine, citing scientific findings of an unexpected stock decline.

The measure, enforced by NOAA and the New England Fishery Management Council, aims to avert a potential population collapse, despite objections from regional fishermen who reported abundant daily catches. The decision has sparked concern within the New England seafood economy, as it threatens economic stability and supply reliability for a species central to North American seafood offerings.

The industry holds a specialized share within its parent markets. Within the seafood market, haddock accounts for approximately 2-3%, as it is one of the popular white fish species, but less common compared to other fish like cod and salmon. In the fish and seafood processing market, its share is around 3-4%, due to its significant role in processed seafood products like fillets, frozen portions, and prepared meals.

Within the frozen food market, fish represents about 2-3%, as it is widely available in frozen form. In the broader food and beverage market, its share is approximately 1-2%, reflecting its specific consumption in certain regions. Within the aquaculture market, the fish accounts for a smaller share of 0.5-1%, as it is predominantly wild-caught, although some farmed production exists.

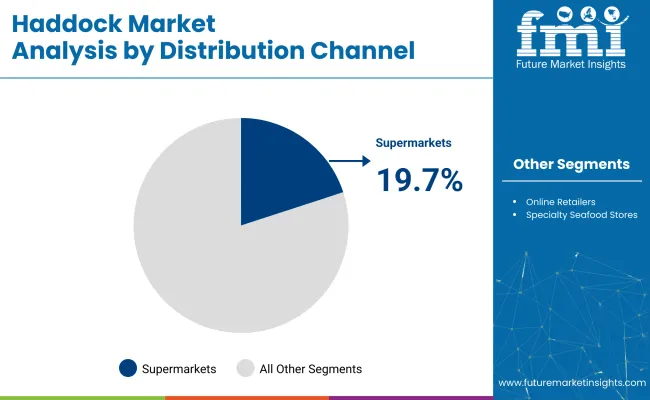

The industry is projected to see fresh haddock lead with a 53.4% share in 2025. Supermarkets are expected to dominate the distribution channel with 19.7% industry share. These trends are driven by consumer preferences for minimally processed fish and the expanding infrastructure for seafood in urban areas.

Fresh haddock is expected to dominate the product type segment, capturing 53.4% of the industry share in 2025. This preference is driven by consumer demand for high-quality, minimally processed fish. The fresh variety is favored for its taste, nutritional value, and perceived natural qualities.

Coastal and urban areas with strong cold chain infrastructure support the direct supply of fresh fillets to supermarkets, restaurants, and fishmongers. Health-conscious consumers are increasingly opting for fresh seafood, viewing it as healthier and more natural. The fish also benefits from premium menu inclusion and chef endorsements, further boosting its appeal in foodservice outlets.

Supermarkets are projected to lead the distribution channel segment with a 19.7% industry share in 2025. This dominance is driven by their ability to serve a wide consumer base with consistent inventory turnover and integrated refrigeration systems that handle both fresh and frozen haddock.

They offer a variety of haddock products, including both private-label and branded options, which enhances consumer trust and purchasing convenience. With increased seafood awareness, many of them now feature certified options and interactive counters for customer education. Promotional campaigns, seafood weeks, and value bundles further strengthen their position in the industry.

The industry is growing due to increasing consumer demand for mild white fish, with the popularity of haddock driven by its mild flavor and nutritional benefits. Fishery regulations and certifications are ensuring responsible sourcing and product transparency, enhancing consumer confidence and driving industry growth.

Surging Demand from Seafood Consumption Trends

The industry is benefiting from the growing demand for mild white fish. Consumers value the fish for its lean protein, mild flavor, and low-mercury content, making it an attractive option for healthy meals. Restaurants and retailers are increasingly offering the fish in a variety of formats, including grilled, breaded, and fish-and-chips dishes, as well as skin-on fillets and fully cooked portions for home cooking.

Culinary influences from the UK and New England continue to fuel interest in Northern Atlantic haddock, with frozen and vacuum-packed options helping preserve freshness and reduce waste. As consumers seek healthier protein alternatives, the fish is emerging as a premium seafood choice.

Fishery Management and Certification Standards

The industry is influenced by stringent fishery management regulations and industry certifications. In regions like the North Atlantic, quota systems are enforced to ensure balanced fish stocks and prevent overfishing. Seafood producers are increasingly seeking certification from reputable bodies to build trust with consumers, ensuring proper sourcing and handling practices.

Additionally, traceability systems are being adopted to maintain transparency in product origins and quality. These measures are helping strengthen the integrity of the haddock supply chain and boosting consumer confidence in the product.

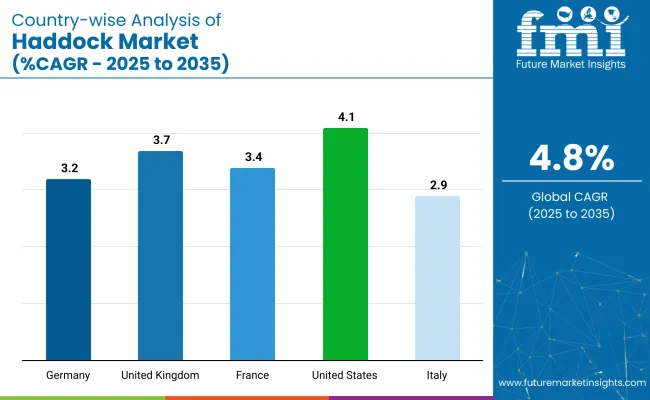

| Countries | CAGR (2025 to 2035) |

|---|---|

| United States | 4.1% |

| United Kingdom | 3.7% |

| France | 3.4% |

| Germany | 3.2% |

| Italy | 2.9% |

The industry demand is projected to rise at a 4.8% CAGR from 2025 to 2035. Of the five profiled countries out of 40 covered, the United States leads at 4.1%, followed by the United Kingdom at 3.7% and France at 3.4%, while Germany posts 3.2% and Italy records 2.9%.

These rates translate to a growth premium of -14% for the United States, -22% for the United Kingdom, and -29% for France versus the baseline, while Germany and Italy show more moderate declines. Divergence reflects local catalysts: a more mature industry with limited growth in Western Europe, while rising health-consciousness and seafood consumption in the USA continue to drive steady demand for the fish. However, slower growth in traditional fish-consuming nations, such as Germany and Italy, reflects shifting consumer preferences and competition from other fish species.

The industry in the United States is set to record a CAGR of 4.1% from 2025 to 2035. Expansion has been propelled by a preference for frozen, pre-portioned seafood carrying Marine Stewardship Council labels and verifiable North Atlantic origins. Fast-casual chains and grocery freezer cases have adopted value-added formats such as breaded fillets and seasoned loins, widening household access.

Lean-protein messaging has aligned with the rise of pescatarian diets, while domestic processors collaborate with retailers to supply shelf-ready cuts that meet traceability requirements. Broadline distributors have leveraged cold-chain infrastructure to maintain quality across foodservice and e-commerce channels.

Sales of haddock in the United Kingdom are projected to grow at a CAGR of 3.7% through 2035. Enduring popularity in fish-and-chip outlets withstands demand, yet household shoppers increasingly choose skinless, boneless fillets positioned as heart-healthy protein.

Post-Brexit quota management and domestic fleet investments have stabilized raw-material supplies for processors. Retailers highlight omega-3 content and responsibly sourced labels to comply with nutrition guidelines and consumer ethics. Skin-pack technology lengthens shelf life in chilled cases, while culinary influencers promote baked and grilled recipes that reduce batter and fry oil usage.

Demand for haddock in Germany is estimated to grow at a CAGR of 3.2% through 2035. Individually quick frozen fillets deliver portion control for value-oriented consumers, and resealable pouches reinforce freshness perception.

Enhanced cold-chain coverage allows Icelandic and Norwegian imports to reach inland discount grocers without quality loss. Sustainability messaging positions the fish as an alternative to overfished cod, satisfying environmentally aware shoppers. Flavor-infused glaze and herb-butter portions support convenience cooking trends in urban households.

Growing at a CAGR of 3.4%, the industry in France benefits from culinary versatility and nutrition-forward positioning. Smoked loins and seasoned portions populate both supermarket deli counters and HoReCa menus.

Ready-to-cook formats address time-pressed households, while low-fat and high-protein claims fit dietary trends. Processors innovate with Mediterranean herb marinades and vacuum-skin packaging that extends chilled shelf life. Ethical-harvest narratives and origin labeling resonate with seafood-literate consumers who value traceability.

Haddock sales in Italy are forecast to grow at a CAGR of 2.9% through 2035. Mediterranean cuisine embraces filleted and marinated haddock in stews, pasta sauces, and upscale ready meals. Urban gourmet retailers stock chilled loins promoted by food influencers, while artisanal fishmongers introduce herb-infused cuts for weekend shoppers.

Although domestic catch remains limited, efficient distribution of North Atlantic imports ensures continuity. Health messaging underscores low-fat attributes, and the link between seafood intake and wellness supports steady demand.

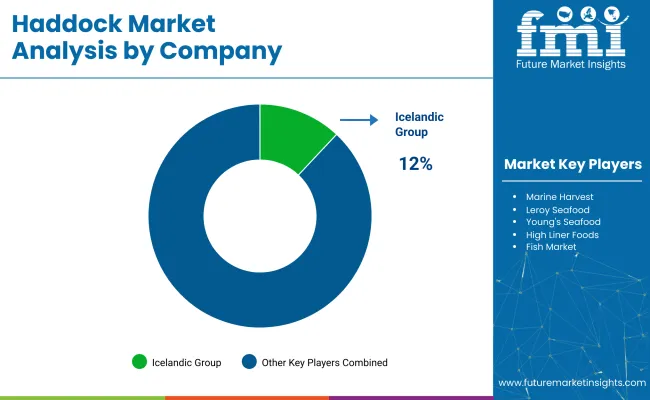

Leading Company - Icelandic Group Industry Share 12%

The global industry exhibits a semi-consolidated structure, divided among dominant players, key suppliers, and emerging processors. Dominant players such as Icelandic Group, Leroy Seafood, and Marine Harvest lead the industry with vertically integrated operations, ecological fishing practices, and robust export networks across Europe and North America.

Key suppliers like High Liner Foods, Young’s Seafood, and Kroger focus on value-added processing, private-label offerings, and wide retail distribution. Emerging players such as Fish Market are gaining regional traction by emphasizing traceability, eco-label certifications, and competitive pricing within local seafood channels and wholesale distribution networks.

Recent Industry News

| Report Attributes | Details |

|---|---|

| Industry Size (2025) | USD 754.9 million |

| Projected Industry Size (2035) | USD 1,208.3 million |

| CAGR (2025 to 2035) | 4.8% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD million for value and thousand metric tons for volume |

| Product Types Analyzed (Segment 1) | Fresh, Frozen, Smoked, Canned |

| Distribution Channels Analyzed (Segment 2) | Supermarkets, Specialty Seafood Stores, Online Retailers |

| Countries Covered | United States, Canada, Germany, United Kingdom, France, Italy, Spain, China, Japan, South Korea, Australia, Brazil, Mexico, Saudi Arabia, UAE, South Africa |

| Key Players Influencing the Industry | Icelandic Group, Marine Harvest, Leroy Seafood, Young's Seafood, High Liner Foods, Fish Market, Kroger |

| Additional Attributes | Dollar sales by product type and distribution channel, demand shifts due to viable sourcing and traceability, chilled vs. processed fish trends, cold chain logistics innovations, retail and e-commerce growth in seafood consumption |

By product type, the industry is segmented into fresh, frozen, smoked, and canned.

By distribution channel, the industry includes supermarkets, specialty seafood stores, and online retailers.

By region, the industry is categorized into North America, Latin America, East Asia, South Asia and Pacific, Western Europe, Eastern Europe, and the Middle East and Africa.

The industry is expected to be valued at USD 754.91 million in 2025.

The industry is forecast to reach USD 1,208.34 million by 2035.

The industry is projected to grow at a CAGR of 4.8% over the forecast period.

Fresh haddock holds the top position in the industry, accounting for 53.4% of the share in 2025.

Icelandic Group leads the industry with a 12% industry share.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA