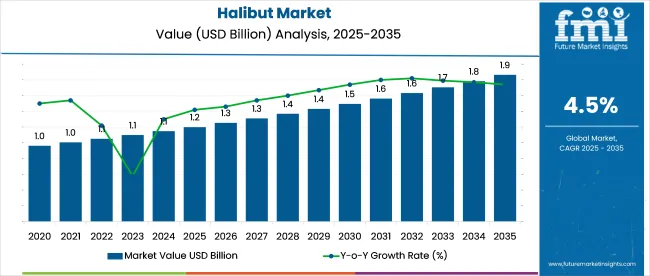

The global halibut market is forecasted to grow from USD 1.2 billion in 2025 to approximately USD 1.9 billion by 2035, expanding at a CAGR of 4.5%.

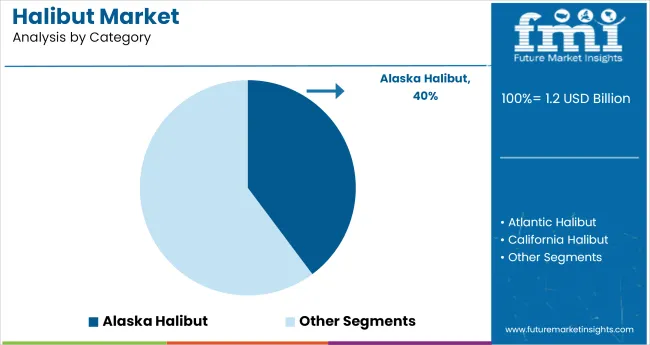

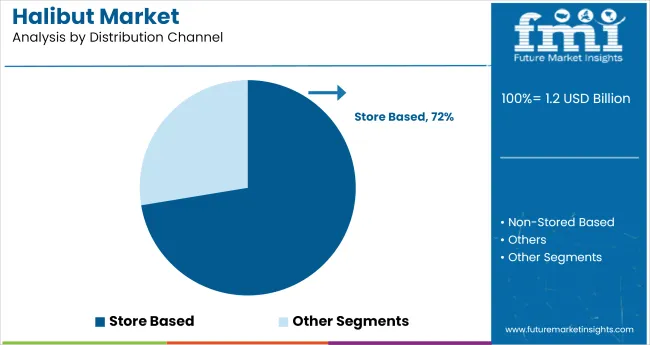

Among species, Alaska Halibut is expected to lead the market with a 39.8% share in 2025, owing to its rich flavor, and dominant supply volume. In terms of sales channel, store-based retail formats are projected to dominate with a 72.4% share in 2025, as consumers continue to prefer trusted in-person seafood purchases over online channels.

The halibut market accounts for a niche share across its parent markets due to relatively lower global consumption compared to species like tuna or salmon. Within the seafood market, halibut holds an estimated 0.5% to 0.7% share, primarily influenced by premium pricing and strict catch quotas. In the fish market, its share ranges between 1.2% and 1.5%, reflecting moderate demand in North America and parts of Europe.

Halibut represents less than 1% of the aquaculture market, as farming is limited by high production costs and slow growth cycles. In the marine fisheries market, its share is estimated at 1.8% to 2.3%. Within the food protein market, halibut contributes under 0.2% due to its position as a specialty protein source.

As reported by National Fisherman on December 20, 2024, more than 74% of the 28.86 million-pound commercial Pacific halibut quota was harvested before the season closed on December 7, 2024. Of this, Alaska contributed 18.47 million pounds, reaffirming its position as the dominant halibut-producing region. the article also raised critical concerns about stock sustainability, noting that the spawning biomass is nearing its lowest level since the 1970s.

The average size of caught fish has declined, pointing to a demographic shift toward younger halibut. This trend may impact long-term resource availability, necessitating more stringent catch controls and adaptive management strategies over the coming decade.

Alaska Halibut dominates the halibut category, restaurants remain the top end-use segment, and store-based channels continue to drive sales due to their freshness assurance and widespread consumer access.

Alaska Halibut is expected to account for 39.8% of the halibut market by species in 2025. Its popularity stems from consistent quality, firm white flesh, and rich nutritional profile, especially omega-3 fatty acids. The species is favored across premium foodservice channels due to its mild flavor, large fillet yield, and visual appeal when plated. Alaska Halibut is harvested under the strict oversight of NOAA and the North Pacific Fishery Management Council, ensuring stock longevity.

Store-based retail is projected to dominate halibut distribution with a 72.4% share in 2025. Supermarkets, fishmongers, and premium seafood outlets remain the preferred points of purchase due to their ability to showcase product freshness and quality through visual merchandising and counter service. These channels allow consumers to inspect texture, aroma, and color before purchase, factors that strongly influence seafood buying behavior.

Retailers also offer cut-to-order services, in-store sampling, and bundled meal kits that feature halibut fillets with sauces or marinades. Despite the growth of e-commerce, limitations in fresh seafood cold chain logistics continue to restrict online adoption in several markets.

Restaurants are projected to lead halibut consumption with a commanding 94.7% market share in 2025. This dominance is driven by the species' suitability for upscale dining formats, including pan-seared entrées, ceviche, and seasonal tasting menus. Halibut’s mild flavor, low-fat profile, and flaky texture enable it to hold up under various cooking methods while retaining visual appeal.

Culinary professionals prefer frozen pre-trimmed portions for standardization and yield efficiency. Post-pandemic recovery in tourism, cruise dining, and hotel foodservice is further supporting strong demand in hospitality segments.

Health-driven demand and green sourcing shape the halibut industry. Producers focus on fillet convenience, traceability, and eco-friendly fishing to meet nutrition-conscious consumers and support responsible supply chains.

Nutritional Awareness and Culinary Integration Expand Consumption Base

Halibut is gaining share in both retail and foodservice due to its lean composition and omega-3 content. Skinless, portion-controlled fillets are being introduced across North American retail chains, where average unit sales rose 12% YoY in H1 2025. Meal kit distributors in Western Europe have added halibut SKUs paired with seasonal sauces, targeting consumers seeking high-protein, low-fat dinner options.

Recipe volumes featuring halibut across leading culinary platforms grew 18% between Q3 2024 and Q2 2025, with pan-seared and grilled formats ranking highest in engagement. Demand pressure on wild catch is prompting increased output from aquaculture sites in Norway and Canada, where production expanded by 9.4% during the same period to stabilize availability.

Catch Control Mechanisms and Cold-Chain Optimization Shape Supply

Fisheries supplying halibut are aligning with quota-based management and bycatch reduction protocols to meet evolving certification thresholds. As of mid to 2025, 58% of global halibut landings were sourced from certified fisheries under MSC or equivalent frameworks. QR-enabled traceability is being implemented at pack level, providing batch-level verification of origin and harvest method.

Investment in cold-chain enhancements-including real-time temperature logging and sealed-gel cooling-has reduced spoilage rates by 15% from vessel to retailer. Recirculating aquaculture systems (RAS) are being adopted by farm operators to reduce water intake and limit discharge, particularly in land-based facilities targeting urban distribution centers.

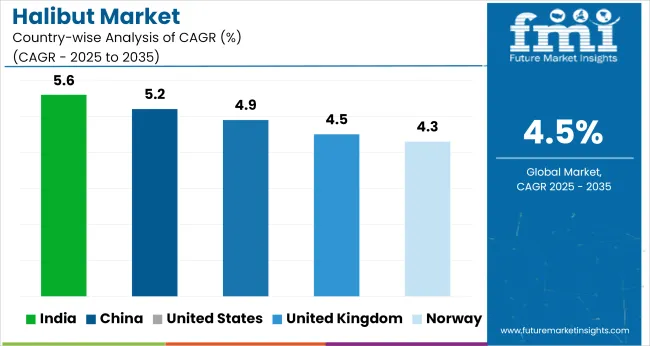

| Countries | CAGR (2025 to 2035) |

|---|---|

| India | 5.6% |

| China | 5.2% |

| United States | 4.9% |

| United Kingdom | 4.5% |

| Norway | 4.3% |

Global demand for halibut is projected to grow at a 4.5% CAGR between 2025 and 2035. Of the five profiled markets, India and China exceed the baseline at 5.6% (+24%) and 5.2% (+16%), respectively, reflecting rising protein demand and increased aquaculture investments. The USA matches global expansion trends with a 4.9% CAGR (+9%). The UK remains at parity with the global average, while Norway trails at 4.3% (-4%) due to market saturation and export dependency. The BRICS economies-India and China-are outperforming traditional OECD players, driven by dietary diversification and domestic production growth.

The report covers detailed analysis of 40+ countries, with the top five countries shared as a reference

The halibut industry is projected to expand at a CAGR of 5.6% from 2025 to 2035. Demand has been shaped by a shift in dietary habits favoring high-protein seafood and an expanding palate for global cuisines. Although domestic production is minimal, demand for imported halibut has gained momentum, particularly in metro cities. Retailers catering to gourmet food segments have begun stocking cold-water halibut products with an emphasis on texture and taste. Health-centric food trends have also driven uptake in premium restaurant chains.

The halibut industry in China is expected to grow at a CAGR of 5.2% between 2025 and 2035. Expansion is being driven by growing seafood consumption in coastal provinces, where consumers are showing greater willingness to explore premium fish varieties. Halibut has gained ground as an alternative to conventional freshwater fish due to its mild taste and lean meat. Marine aquaculture advancements, including recirculating aquaculture systems (RAS), have supported domestic production, although import volumes remain robust.

In the United States, the halibut industry is projected to grow at a CAGR of 4.9% during the forecast period. Alaskan halibut remains the cornerstone of domestic supply, underpinned by longstanding management frameworks and traceable sourcing practices. The industry has evolved to prioritize value-added processing, including boneless cuts and vacuum-sealed packaging. Increasing demand for lean protein has driven product innovation across frozen, smoked, and marinated halibut formats.

The halibut market in the United Kingdom is forecast to grow at a CAGR of 4.5% through 2035. Scottish aquaculture farms have strengthened domestic availability, making halibut a viable year-round product. High demand from chef-driven establishments and seafood wholesalers is being observed, with halibut regarded as a versatile centerplate item. Packaged retail formats are marketed around low-fat, omega-rich content, aiding its inclusion in everyday meal plans.

Norway’s halibut market is growing at a CAGR of 4.3%, supported by specialized aquaculture models and high export-grade product consistency. Norwegian halibut, raised in cold, clean fjords, has become a benchmark for quality in the European and Asian markets. Domestic consumption is rising within health-focused consumer segments, and chefs often cite its clean flavor as a strength.

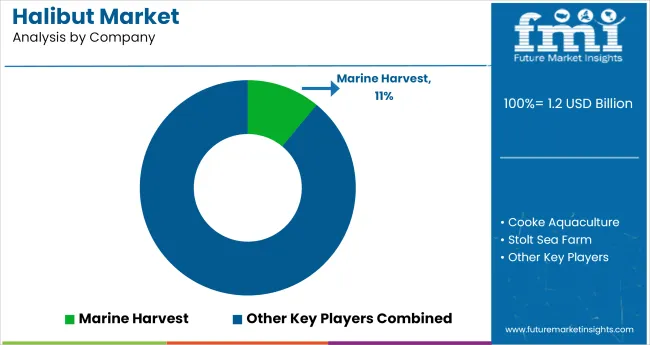

Leading Company - Marine Harvest holding 11% industry share.

Leading halibut suppliers such as Marine Harvest, Cooke Aquaculture, and Stolt Sea Farm maintain competitive positions through vertical integration, licensing control, and access to optimized breeding programs. These firms benefit from large-scale farming operations and well-established distribution networks, which create cost advantages and ensure year-round supply reliability. For example, Stolt Sea Farm has expanded its land-based aquaculture capacity, also the Cooke Aquaculture has invested in refining feed management protocols to improve yield quality and volume.

Entry into the halibut industry is restricted by factors including stringent regulatory frameworks, capital-intensive infrastructure, and limited access to high-quality juvenile stock. Emerging players such as Clearwater Seafoods and Fiskerikjøp AS focus on value differentiation through traceable sourcing and selective breeding. Recent efforts by Cermaq Group and High Liner Foods include R&D initiatives targeting disease management and shelf-life extension.

Recent Industry News

| Report Attributes | Details |

|---|---|

| Market Size (2025) | USD 1.2 billion |

| Projected Market Size (2035) | USD 1.9 billion |

| CAGR (2025 to 2035) | 4.5% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD billion for value and kilotons for volume |

| Category Types Analyzed (Segment 1) | Pacific Halibut, Atlantic Halibut, California Halibut, Alaska Halibut |

| Distribution Channels Analyzed (Segment 2) | Store Based, Non-Store Based, Others |

| End Users Analyzed (Segment 3) | Restaurants, Personal, Others |

| Countries Covered | United States, Canada, Chile, Norway, UK, France, Germany, Japan, South Korea, China, India, UAE, South Africa |

| Regions Covered | North America, Latin America, East Asia, South Asia & Pacific, Western Europe, Eastern Europe, and Middle East & Africa |

| Key Players | Marine Harvest, Cooke Aquaculture, Stolt Sea Farm, Cermaq Group, Clearwater Seafoods, Fiskerikjøp AS, Ocean Choice International, High Liner Foods, Norwegian Seafood Council, Young's Seafood |

| Additional Attributes | Dollar sales by halibut category, premium pricing trends in Atlantic halibut, restaurant channel recovery post-pandemic, frozen vs. fresh halibut trade flows, sustainability certifications, regional export-import gaps |

The industry is segmented into Pacific Halibut, Atlantic Halibut, California Halibut, and Alaska Halibut.

The industry includes Store-Based, Non-Store-Based, and Others.

The industry is segmented into Restaurants, Personal, and Others.

The industry is categorized into North America, Latin America, East Asia, South Asia & Pacific, Western Europe, Eastern Europe, and Middle East & Africa.

The industry is expected to be valued at USD 1.2 billion in 2025.

The industry is forecast to reach USD 1.9 billion by 2035.

The industry is projected to grow at a CAGR of 4.5% over the forecast period.

Alaska halibut holds the top position in the halibut market, accounting for 39.8% of the share in 2025.

Marine harvest leads the halibut market with an 11% market share.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA