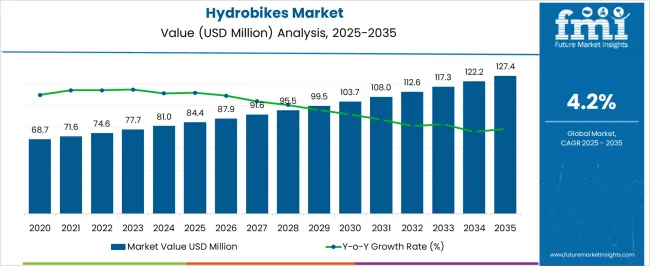

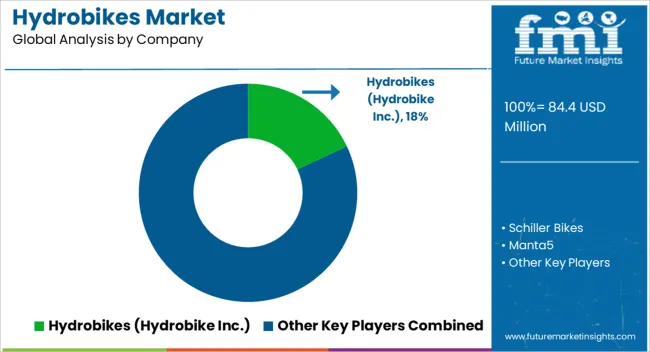

The hydrobikes market is valued at USD 84.4 million in 2025 and is expected to reach USD 127.4 million by 2035, reflecting a CAGR of 4.2%. From 2021 to 2025, the market grows from USD 68.7 million to USD 84.4 million, representing the early growth phase. Annual increments show moderate gains with the market reaching USD 71.6 million in 2022, USD 74.6 million in 2023, USD 77.7 million in 2024, and USD 81.0 million just before 2025. This period is marked by gradual adoption in recreational and tourism sectors, limited awareness in emerging regions, and steady expansion of water sports infrastructure, supporting initial growth without dramatic surges.

Between 2026 and 2030, the market continues a steady trajectory with incremental increases, rising from USD 84.4 million to USD 108.0 million. Values progress to USD 87.9 million in 2026, USD 91.6 million in 2027, USD 95.5 million in 2028, USD 99.5 million in 2029, and USD 103.7 million in 2030. This period reflects widening penetration in fitness and recreational facilities, along with rising consumer interest in low-impact water sports activities. From 2031 to 2035, the late growth phase shows a sustained, steady increase from USD 108.0 million to USD 127.4 million, with annual values reaching USD 112.6 million in 2031, USD 117.3 million in 2032, USD 122.2 million in 2033, and USD 127.4 million in 2035.

| Metric | Value |

|---|---|

| Hydrobikes Market Estimated Value in (2025 E) | USD 84.4 million |

| Hydrobikes Market Forecast Value in (2035 F) | USD 127.4 million |

| Forecast CAGR (2025 to 2035) | 4.2% |

The hydrobikes market is shaped by multiple parent markets that define its demand and adoption across tourism, sports, and leisure applications. The water sports equipment market is the most significant driver, with hydrobikes contributing about 15-18% of the share. Their popularity stems from offering a stable and fitness-oriented alternative to motorized watercraft, appealing to both enthusiasts and beginners. The recreational boating market accounts for nearly 12-15%, as hydrobikes are positioned as a unique boating experience that combines portability, safety, and ease of use. They are increasingly popular with individuals and rental operators looking for innovative boating products. The fitness and outdoor recreation market contributes around 10-12%, as hydrobikes serve as a form of low-impact exercise, combining cardiovascular workouts with enjoyable water-based leisure, making them attractive to health-focused consumers seeking active outdoor lifestyles.

The tourism and adventure travel market holds nearly 8-10% of the share, as resorts, lakeside operators, and coastal destinations integrate hydrobikes into their offerings to attract tourists with novel water-based activities. They are becoming valuable additions to water parks and recreational centers as well. Lastly, the personal watercraft market contributes approximately 6-8%, where hydrobikes are positioned alongside kayaks, canoes, and paddleboards as compact, fun, and easy-to-handle water vehicles.

The market is experiencing consistent growth, driven by rising interest in eco-friendly water recreation and the increasing popularity of low-impact aquatic exercise. Demand has been encouraged by growing awareness of health and fitness benefits, alongside a shift toward sustainable tourism and leisure activities. The market is benefiting from advancements in lightweight, durable materials and design innovations that improve stability, safety, and user comfort.

Increasing investment by waterfront resorts, rental service providers, and adventure tourism operators is further stimulating adoption. The versatility of hydrobikes for both recreational use and fitness purposes, combined with their accessibility for users of varying skill levels, is widening their appeal across diverse consumer groups.

Additionally, promotional activities by tourism boards and environmental organizations are enhancing public engagement, positioning hydrobikes as both a recreational and eco-conscious choice. With rising disposable incomes and expansion of water-based leisure facilities, the market outlook remains positive, supported by technological improvements and a growing focus on active outdoor lifestyles.

The hydrobikes market is segmented by product, application, material, distribution channel, end use, and geographic regions. By product, hydrobikes market is divided into Single-person hydrobikes and Multi-person hydrobikes. In terms of application, hydrobikes market is classified into Recreational, Fitness, Tourism, and Others. Based on material, hydrobikes market is segmented into Aluminum, Stainless steel, Carbon fiber, and Plastic. By distribution channel, hydrobikes market is segmented into Online stores, Specialty stores, Sporting goods stores, and Others. By end use, hydrobikes market is segmented into Personal and Commercial. Regionally, the hydrobikes industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

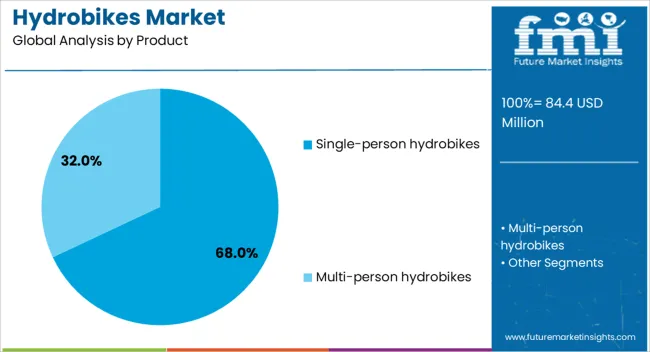

The single-person hydrobikes segment is projected to hold 68% of the Hydrobikes market revenue share in 2025, making it the dominant product type. This leadership position has been supported by the segment’s suitability for individual recreational activities, fitness routines, and personal leisure use. Single-person models offer greater maneuverability, simpler handling, and lower storage requirements, making them an attractive choice for both private owners and rental operators.

Their design has been optimized for balance and ease of pedaling, allowing users to enjoy extended rides without excessive fatigue. The affordability of single-person hydrobikes compared to multi-person models has also contributed to higher adoption rates among individual buyers.

Additionally, their compatibility with a wide range of water conditions, including lakes, rivers, and coastal areas, enhances their market penetration. The segment’s growth is reinforced by demand from adventure tourism and fitness enthusiasts seeking an efficient, solo watercraft experience that delivers both exercise benefits and leisure enjoyment.

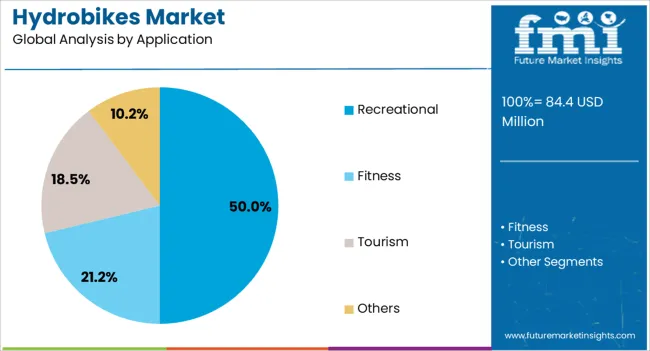

The recreational segment is anticipated to command 50% of the Hydrobikes market revenue share in 2025, maintaining its position as the leading application. This dominance has been driven by the increasing use of hydrobikes in leisure activities, adventure tourism, and casual water sports. Recreational use aligns well with consumer preferences for enjoyable, low-impact physical activity that can be experienced individually or in small groups.

Resorts, rental services, and waterfront destinations have been integrating hydrobikes into their offerings to attract visitors and enhance customer engagement. The segment’s expansion is further supported by the rise in eco-conscious tourism, as hydrobikes require no fuel and produce no emissions, aligning with environmental sustainability goals.

Ease of operation without specialized training has broadened the user base, making recreational hydrobikes accessible to a wide demographic. Seasonal events, community water festivals, and waterfront development initiatives are also contributing to greater exposure and adoption in this application category.

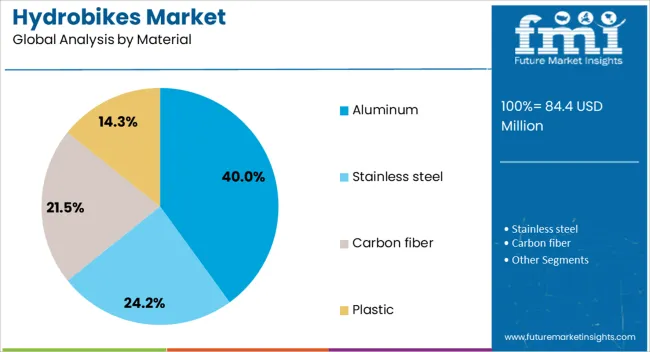

The aluminum segment is expected to account for 40% of the Hydrobikes market revenue share in 2025, establishing itself as the leading material type. This preference is attributed to aluminum’s combination of strength, corrosion resistance, and lightweight properties, which are essential for performance and longevity in watercraft applications. Aluminum hydrobike frames offer durability against harsh marine environments while maintaining ease of transport and handling.

The material’s recyclability also supports its appeal in a market that is increasingly focused on sustainability and environmental responsibility. Manufacturing advancements have enabled the production of aluminum components with enhanced structural integrity and reduced weight, improving overall user experience.

Additionally, aluminum’s cost-effectiveness relative to other premium materials allows manufacturers to balance performance with affordability, increasing accessibility for a broader consumer base. The segment’s growth has been reinforced by consistent demand from both commercial rental operations and individual buyers seeking a long-lasting, low-maintenance hydrobike solution.

The hydrobikes market is expanding, driven by rising interest in recreational water activities and low-impact fitness options. Their appeal lies in combining cycling and aquatic leisure, making them popular in tourism and fitness applications. Barriers include high purchase costs, limited awareness, and maintenance concerns, which restrict broader adoption. Opportunities are emerging in resorts, rental businesses, and wellness-focused programs, supported by innovative designs and partnerships. With regional expansion, social media promotion, and product improvements, hydrobikes are evolving from niche offerings into versatile solutions for leisure, tourism, and health-focused consumers.

Hydrobikes combine cycling with aquatic environments, offering a unique mix of exercise, leisure, and adventure. They are increasingly popular at lakes, resorts, and waterfront rental businesses, attracting individuals and families seeking low-impact outdoor activities. The health and fitness community is also embracing hydrobikes for cardiovascular exercise and rehabilitation, as they provide joint-friendly workouts. Tourism operators view hydrobikes as attractive additions to rental fleets, appealing to travelers looking for eco-friendly and engaging experiences. Their ease of use and safety compared to traditional watercraft make them accessible to broader demographics, including beginners and older participants. As demand for novel leisure options rises, hydrobikes are carving out a distinctive position in the global water recreation industry, combining fitness with entertainment in a way that appeals to multiple consumer groups.

Hydrobikes require specialized materials and engineering for buoyancy, stability, and durability, which raises production expenses. As a result, they are often priced higher than common recreational alternatives such as kayaks or paddleboards. This restricts adoption among casual users and budget-conscious buyers. Limited awareness further constrains growth, as hydrobikes are not as widely recognized or promoted as mainstream watercraft. Rental operators may hesitate to invest due to concerns about demand consistency and return on investment. In regions where water-based leisure activities are less common, penetration remains slow. Maintenance requirements, including storage and periodic servicing, also discourage some buyers. These factors collectively reduce accessibility, limiting hydrobike adoption primarily to niche markets such as resorts, specialty fitness enthusiasts, and water sports rental businesses.

The hydrobikes market is witnessing strong opportunities in tourism and fitness segments, where demand for unique recreational products continues to rise. Resorts, waterfront parks, and adventure tourism operators are increasingly incorporating hydrobikes into their offerings to attract visitors seeking fresh experiences. In the fitness sector, hydrobikes are being adopted for rehabilitation and training, offering low-impact exercise with cardiovascular benefits. Rental operators are exploring business models around group rides, guided tours, and fitness classes on water, creating diversified revenue streams. Manufacturers are responding with lightweight designs, customizable models, and improved portability to attract individual buyers as well as businesses. Partnerships with fitness centers, wellness retreats, and tourism agencies are expanding awareness and adoption. These opportunities demonstrate how hydrobikes are evolving from niche recreational equipment into versatile products with growing appeal across both leisure and fitness-driven applications.

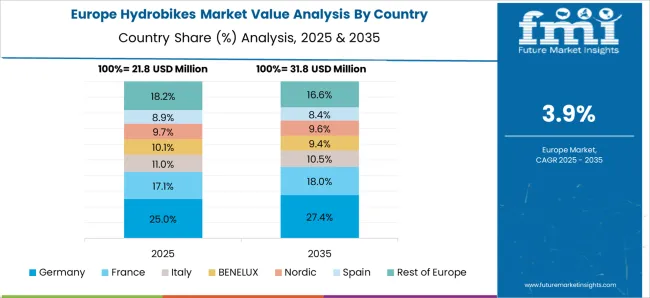

Manufacturers are focusing on improving design features such as ergonomic seating, adjustable pedals, and modular frames that enhance comfort and usability. Compact and foldable models are being developed to address storage challenges, while premium variants target enthusiasts seeking enhanced speed and performance. Regionally, demand is rising in North America and Europe, where outdoor recreation and fitness culture are well established, while the Asia Pacific is showing emerging growth due to expanding tourism infrastructure. Rental services are adopting online booking systems and promotional campaigns to increase accessibility and awareness. Social media visibility and influencer marketing are also boosting consumer interest. These trends highlight the role of design innovation, regional expansion, and evolving customer engagement in shaping the hydrobikes market’s future trajectory.

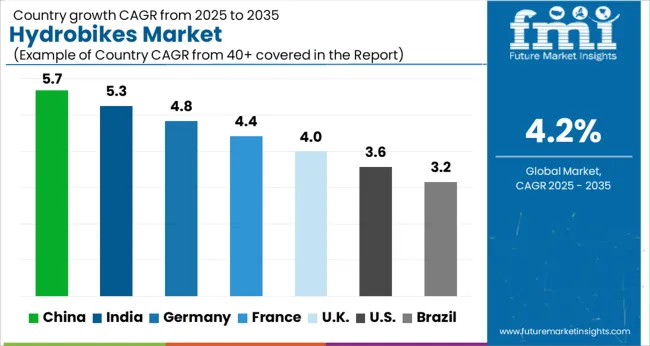

| Country | CAGR |

|---|---|

| China | 5.7% |

| India | 5.3% |

| Germany | 4.8% |

| France | 4.4% |

| UK | 4.0% |

| USA | 3.6% |

| Brazil | 3.2% |

The hydrobikes market is projected to expand globally at a CAGR of 4.2% from 2025 to 2035. China leads at 5.7%, followed by India at 5.3% and France at 4.4%, while the United Kingdom records 4.0% and the United States posts 3.6%. China and India achieve the largest growth premiums of +1.5% and +1.1% above the global average, driven by expanding tourism, recreational water projects, and affordable product offerings. France sustains demand through strong outdoor leisure culture, while the UK benefits from seasonal rentals. The USA, though slower, remains a stable market with fitness-focused adoption and a strong rental ecosystem. The analysis includes over 40+ countries, with the leading markets detailed below.

China is forecasted to grow at a CAGR of 5.7% from 2025 to 2035 in the hydrobikes market. The rising interest in recreational water activities, coupled with tourism development in coastal provinces and inland lakes, is driving demand for hydrobikes. Public parks and water-based leisure facilities are incorporating hydrobikes as part of their activity offerings, while private resorts are adding them to attract visitors. Domestic manufacturers are scaling production with cost-effective models, while global players are introducing premium versions with lightweight materials and advanced stability features. Growing participation in fitness-oriented water sports also supports adoption, as hydrobikes are increasingly marketed as both leisure and health-focused equipment.

The hydrobikes market in India is projected to expand at a CAGR of 5.3% between 2025 and 2035. Rising popularity of outdoor leisure and water sports among younger demographics is fueling market adoption. Tourist destinations, particularly in Kerala, Goa, and the northeastern states, are introducing hydrobikes as part of adventure tourism packages. Government focus on developing water-based recreational facilities and urban waterfront projects further supports the market. Domestic manufacturers are experimenting with low-cost models to make hydrobikes accessible to a broader consumer base. International brands are also exploring partnerships with hospitality groups to introduce premium hydrobikes at resorts and luxury properties. Awareness of fitness benefits is gradually positioning hydrobikes as more than just recreational equipment.

France is expected to record a CAGR of 4.4% from 2025 to 2035 in the hydrobikes market. The country’s strong boating and water recreation culture provides a solid base for hydrobike adoption. Lakeside resorts, camping sites, and coastal towns are increasingly offering hydrobikes as rental options for tourists. The market is also benefiting from the rising demand for eco-friendly leisure activities, as hydrobikes are marketed as emission-free alternatives for exploring waterways. French consumers value outdoor recreation, and hydrobikes are gaining visibility through tourism campaigns that highlight unique leisure experiences. Manufacturers are focusing on lightweight, durable designs that appeal to both individual buyers and rental operators.

The United Kingdom is projected to grow at a CAGR of 4.0% from 2025 to 2035 in the hydrobikes market. Growth is being shaped by tourism at lakes, rivers, and coastal towns, where hydrobikes are increasingly offered by water sports operators. Domestic interest in family-oriented recreational activities is supporting adoption, especially in holiday parks and adventure resorts. Local authorities are also introducing hydrobikes in public recreational projects as part of waterfront revitalization. The rising focus on health and outdoor exercise has created an additional niche for hydrobikes as low-impact fitness equipment. Rental operators are driving visibility by including hydrobikes in activity packages, while private consumers remain a smaller but growing segment.

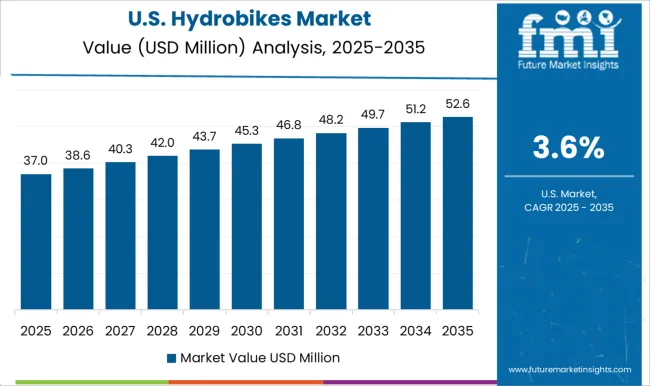

The United States is forecasted to expand at a CAGR of 3.6% from 2025 to 2035 in the hydrobikes market. The country’s wide network of lakes, rivers, and coastal recreation areas provides a large base for adoption. Hydrobikes are popular in rental markets at resorts, campgrounds, and vacation towns. Fitness-focused consumers are also showing interest, with hydrobikes marketed as both exercise and leisure products. Growth is moderate compared to Asia and Europe, primarily due to competition from established watercraft categories like kayaks and paddleboards. Manufacturers are focusing on premium models with advanced stability and ergonomic seating to attract higher-end consumers.

In the hydrobikes market, competition is centered on design innovation, recreational appeal, and positioning within the eco-friendly water sports segment. Hydrobike Inc. leads with its flagship water bikes, emphasizing stability, durability, and ease of use, appealing to recreational users, rental operators, and resorts. Schiller Bikes competes by offering premium water bikes with sleek, high-performance designs that combine cycling ergonomics with advanced flotation systems, targeting adventure and fitness enthusiasts. Manta5 differentiates with hydrofoil electric-assist water bikes, bringing cycling dynamics onto water surfaces with emphasis on speed, endurance training, and unique sporting experiences. Aurea Bike contributes with pedal-powered designs aimed at leisure riders, balancing affordability with practical use in calm-water environments. Austin Water Bikes competes primarily in regional rental markets, promoting accessibility for tourists and casual users seeking water-based recreation without ownership.

Strategies among these players focus on niche positioning, technology integration, and targeting tourism and recreational markets. Hydrobike Inc. capitalizes on its established reputation and rental partnerships to maintain visibility across lakes and resorts. Schiller Bikes emphasizes premium branding, sleek engineering, and high-margin consumer sales. Manta5 continues to expand its global footprint through distributors and sports retailers, highlighting electric-assist hydrofoil performance as a unique selling point. Aurea Bike focuses on affordability to appeal to leisure riders, while Austin Water Bikes leverages local rental services to introduce the concept to broader audiences.

| Item | Value |

|---|---|

| Quantitative Units | USD 84.4 Million |

| Product | Single-person hydrobikes and Multi-person hydrobikes |

| Application | Recreational, Fitness, Tourism, and Others |

| Material | Aluminum, Stainless steel, Carbon fiber, and Plastic |

| Distribution Channel | Online stores, Specialty stores, Sporting goods stores, and Others |

| End Use | Personal and Commercial |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Hydrobikes (Hydrobike Inc.), Schiller Bikes, Manta5, Aurea Bike, and Austin Water Bikes |

| Additional Attributes | Dollar sales by product type (manual, electric-assisted), frame material (aluminum, carbon fiber, stainless steel), and target usage (recreational, fitness, professional). Demand dynamics are influenced by interest in outdoor water activities, fitness trends, and eco-friendly recreational solutions. Regional trends show growing adoption in North America and Europe, supported by tourism, waterway accessibility, and recreational infrastructure investments. |

The global hydrobikes market is estimated to be valued at USD 84.4 million in 2025.

The market size for the hydrobikes market is projected to reach USD 127.4 million by 2035.

The hydrobikes market is expected to grow at a 4.2% CAGR between 2025 and 2035.

The key product types in hydrobikes market are single-person hydrobikes and multi-person hydrobikes.

In terms of application, recreational segment to command 50.0% share in the hydrobikes market in 2025.

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA