The market for hydrogel is growing strongly, fueled by rising demand for advanced wound care, drug delivery systems, personal care products, and agricultural uses. Hydrogels, which have high water absorption, biocompatibility, and controlled release characteristics, are used extensively in healthcare, pharmaceuticals, and industrial applications.

With the development of biodegradable formulations, smart hydrogels, and regenerative medicine uses, the market is likely to grow significantly in the next decade.

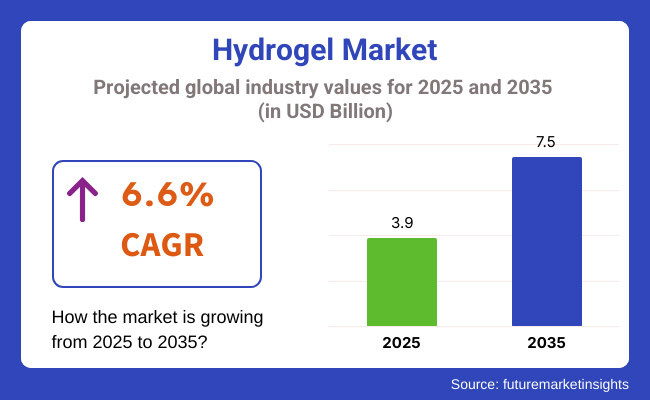

The size of the hydrogel market is expected to be an estimated value of USD 3.9 Billion in 2025 and is anticipated to expand at a 6.6% CAGR between 2025 and USD 7.5 Billion by 2035. The growth is driven by growing demand for wound healing products, expanding applications in tissue engineering, and advancements in stimuli-responsive and self-healing hydrogels. Further, advancements in nanocomposite hydrogels and green formulations are also contributing to market adoption.

Market growth is also facilitated by improved hydrogel stability, water retention, and bioactivity. Growing use of sustainable and biodegradable hydrogel solutions, government support for regenerative medicine, and investments in AI-based drug delivery research are major drivers of market growth. Moreover, the combination of hydrogels with wearable biosensors, targeted therapy systems, and agricultural soil conditioners is adding value to the market.

Key Market Metrics

| Metric | Value |

|---|---|

| Market Size in 2025 | USD 3.9 Billion |

| Projected Market Size in 2035 | USD 7.5 Billion |

| CAGR (2025 to 2035) | 6.6% |

The hydrogel market will be steered by Asia-Pacific in the view of rapid improvement in healthcare, increased demand for personal care products, and high investments in agricultural as well as medical applications. Demand for hydrogels A in wound dressing, contact lenses, and drug delivery systems are also being witnessed in countries like China, India, and Japan..

Advancements in biodegradable and self-healing hydrogel technologies, cost-effective production techniques, and automation in biomedical research have given impetus to the market growth in the region. These also include government schemes to favor regenerative medicine and sustainable agriculture that promote innovation. Moreover, Asia-Pacific further strengthens local production capabilities as global pharmaceutical and skincare manufacturers increase their footprints in the region.

North America is one of the largest hydrogel markets mainly due to the increasing demand from the medical, pharmaceutical, and personal care industries. Now the two countries leading this region with advanced technology in smart hydrogels, bioactive wound dressings, and AI-driven drug delivery include the United States and Canada. Besides, there are increasing investments in hydrogel-based biosensors applicable to tissue engineering, which enhance market potential.

These factors are reshaping market dynamics: the shift toward biodegradable and eco-friendly hydrogel formulations and the regulatory policies for sustainability and healthcare innovations. Increased R&D funding in high-performance, temperature-sensitive, and injectable hydrogel technologies will also support market growth. The recent trends include the application of smart wearable biosensors based on hydrogels, as well as moisture-retaining applications in agriculture, which will improve product efficiency and functions.

There are quite a few reasons why Europe factors hugely into the hydrogel market, from strong regulations demanding biocompatibility to the demand for better wound care and rising activities in regenerative medicine. Major countries like Germany, France, and the United Kingdom have been leaders in innovation concerning bioengineered hydrogels, 3D bioprinting, and controlled drug release technologies.

The market will continue to be influenced by policies that promote sustainability in medical materials, limit plastic waste in personal care goods, and encourage the use of smart hydrogels for biomedical applications. Demand for hydrogels with improved biocompatibility, biodegradability, and antibacterial properties thus favors this market growth.

Strong partnerships between research institutions, medical device manufacturers, and pharmaceutical companies further the advancement of next-generation hydrogel solutions for tissue engineering and targeted therapies. Anticipated innovations in the market might include AI-guided synthesis of hydrogels, bioelectric healing applications for wounds, and nanotechnology-based hydrogels.

Challenges

Opportunities

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Early focus on biocompatibility and FDA approvals for medical use. |

| Material and Formulation Innovations | Development of temperature-sensitive and bioactive hydrogels. |

| Industry Adoption | Widely used in wound care, contact lenses, and skincare. |

| Market Competition | Dominated by traditional hydrogel manufacturers. |

| Market Growth Drivers | Growth fueled by demand for moisture-retaining and biocompatible hydrogels. |

| Sustainability and Environmental Impact | Initial adoption of eco-friendly hydrogel formulations. |

| Integration of AI and Process Optimization | Limited AI use in hydrogel formulation and defect detection. |

| Advancements in Biomedical Applications | Basic improvements in hydrogel-controlled drug release and wound healing. |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Stricter global mandates on biodegradable, bioengineered, and smart hydrogel formulations. |

| Material and Formulation Innovations | Expansion of AI-driven, self-healing, and regenerative medicine-based hydrogel technologies. |

| Industry Adoption | Increased adoption in drug delivery, biosensors, regenerative medicine, and self-healing materials. |

| Market Competition | Rise of biotechnology-driven startups and high-tech medical firms integrating digital and smart hydrogel solutions. |

| Market Growth Drivers | Market expansion driven by AI-based formulation, 3D bioprinting, and biodegradable smart hydrogels. |

| Sustainability and Environmental Impact | Large-scale transition to biodegradable, reusable, and bioengineered hydrogels for medical and agricultural use. |

| Integration of AI and Process Optimization | AI-driven predictive analytics, automated hydrogel manufacturing, and real-time medical data integration. |

| Advancements in Biomedical Applications | Development of AI-driven biosensors, nanocomposite hydrogels, and self-regenerative tissue scaffolds. |

The Unites States market is the largest in hydrogels, driven by growing demand from several industries, including medical, pharmaceutical, personal care, and agricultural businesses. Increasing applications of hydrogels in wound care, drug delivery, contact lenses, and tissue engineering are now viewed as catalysts for market growth.

Additionally, the rising demand for biodegradable, biocompatible, and stimuli-responsive hydrogels is pushing the manufacturers to invest in advanced formulations. Regulatory initiatives encourage the development of non-toxic, bio-based, and sustainable hydrogel solutions, thereby accelerating expansion within the market.

Developing novel smart and thermo-responsive polymers and nano-engineered hydrogel materials is expected to improve product functionality and thus efficiency in healthcare as well as industrial sectors. Further, this thrust of precision medicine, regenerative therapies, and controlled-drug release mechanisms is also boosting the market demand for these advanced technologies in hydrogels.

Besides, real-time health monitoring through wearable medical devices had boosted opportunities for hydrogel-based biosensors. Another research area of conductive hydrogels is increasing their range of applications toward neural interfaces and bioelectronics. In addition to these, investment is made by USA companies on 3D-printed hydrogel scaffolds for use in tissue engineering and regenerative medicine applications.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 6.2% |

At present, the UK hydrogel market is flourishing in terms of research and product development, as industries are continuously concentrating on producing hydrogel solutions that are eco-friendly, bio-based, and technologically advanced. Healthcare is still the leading end-use market where there are rising applications in wound healing, transdermal patches, and soft tissue engineering.

The demand for consumer goods in the cosmetics, personal care products, and smart agricultural hydrogels sectors grows the market scope. Apart from such market drivers, government initiatives such as those advocating for the sustainable materials and water retention solutions composition, including biodegradable packaging, can act as a stimulus for hydrogel penetration.

Development in hybrid hydrogels, superabsorbent polymers, and bioactive materials is also enhancing product versatility. Moreover, innovative companies are interested in the explorations of 3D-printed hydrogels, intelligent drug carriers, and hydrogel-based wearable sensors.

Innovations in the biosensitive form of hydrogels towards their future applicability in pharmaceuticals for the next generation are being directed. Increased investment in the area of hydrogel-based flexible electronics and bioelectronics currently expands the reach of their applications in the space of digital health solutions. In addition, companies in the UK are focusing on AI-assisted hydrogel synthesis for precision engineering materials and development of products driven by sustainability.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 5.7% |

Japan's hydrogel market is growing with a steady hand due to developments within the fields of biomedical engineering, skincare formulations, and high-tech industrial applications. Companies manufacture ultra-pure, high-swelling, and antibacterial hydrogels while complying with Japan's extremely stringent standards of quality and safety.

Expanding applications of hydrogels in advanced wound care, ophthalmic products, and robotics are paving the way for innovations in smart and adaptive hydrogel systems. Regulatory focus on non-toxic, environment-friendly, and highly functional biomaterials is further stimulating research into biodegradable and bioinspired hydrogels.

AI-assisted hydrogel development, nanotechnology-assisted improvements, and self-healing hydrogel materials all add to the durability and efficiency of the product. Increasing applications of hydrogels in water purification, precision agriculture, and wearable medical devices are providing further impetus for the growth of the Japanese market.

Furthermore, hydrogel-based artificial organs for next-generation medical applications are being researched seriously by Japanese scientists. Hydrogel coatings are becoming increasingly accepted as antimicrobial surfaces in hospitals and clinical applications. Besides, advances in UV-responsive and electrically conductive hydrogels are opening doors to their applications in smart textiles and electronic skin devices.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 5.5% |

The hydrogel market in South Korea is growing exponentially with the rising biomedical, cosmetic, and agricultural demand rapidly increasing. These innovations in advanced polymer science have been propelled by the rising use of hydrogels in regenerative medicine and targeted drug delivery, as well as skincare products within the cosmetic industry.

Government initiatives are promoting high-tech medical material systems, sustainability, and precision agriculture, thereby increasing the growth of the market. Moreover, temperature-responsive, pH-responsive, and self-healing hydrogels are increasingly researched, augmenting material applications in different sectors.

Organizations are working toward improvement in performance, efficiency, and adaptability by integrating AI with formulation technologies, nanocomposite hydrogels, and bioengineered smart hydrogels. Research is being brought forth to expand the use of hydrogel applications within anti-pollution air filters, flexible electronics, and wearable biobiosensors, rendering robust growth in the market of South Korea.

In addition, hydrogel-based bioink for 3D bioprinting applications for tissue engineering is currently conducted. Hydrogel-based drug-eluting implants are improving targeted drug release and patient compliance, expanding the scope of medical applications within South Korea.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 5.9% |

The medical, personal care, and industrial segments are actively propelling the hydrogel market as industries seek high-absorption, moisture-retentive, and biocompatible materials. Manufacturers are improving hydrogel elasticity, mechanical strength, and response to external stimuli to expand their applications. Additionally, companies are focusing on developing biodegradable, drug-loaded, and hybrid hydrogel solutions to enhance product performance and environmental sustainability.

On the other hand, the medical hydrogel sector is found to have the matchless dominance of hospitals and clinics. Hence, healing dressings, systems for drug delivery, and tissue engineering solutions are in trend in the industries.

Companies such as Johnson & Johnson and ConvaTec are developing and designing hydrogels as antimicrobial, thermosensitive, and injectable formulations to create innovative therapeutic uses. Additionally, most research on the personal medicine and regenerative therapy boom includes hydrogel-based scaffolds. Bioactive hydrogels used in smart wound monitoring and controlled drug release further stimulate the growth momentum of hydrogels in healthcare.

Personal care hydrogel market is experiencing growth with industries being driven towards high-hydration, anti-ageing, and cooling products. Firms are investing in hydrogel face masks, patches, and transdermal systems as solutions for focal skin care. Also, advances in bio-cellulose, marine-derived, and temperature-sensitive hydrogels are driving development. Also, the clean beauty trend, eco-friendly packaging, and biodegradable hydrogel products are spurring market demand in the personal care industry.

The agricultural and industrial hydrogel market is witnessing tremendous growth with the emergence of water-absorbing polymers, soil moisture-retaining solutions, and sensors based on hydrogel. The companies are emphasizing high-retention, biodegradable, and pH-sensitive hydrogels to enhance water management in agriculture.

Material engineering driven by AI is also making hydrogels more efficient and sustainable for resource remediation, pollution abatement, and smart irrigation systems. In addition, companies are investigating superabsorbent polymers, hybrid hydrogels, and cross-linked hydrogel composites to improve the durability and responsiveness of products across various industrial sectors.

Research into biomimetic hydrogels, nanocomposite materials, and AI-powered hydrogel synthesis would improve the performance and sustainability of hydrogel-based solutions. Shape memory, self-healing, and adaptive smart hydrogels are gaining wide acceptance in various industries. AI-powered optimization of the supply chain also enhances production efficiency and minimizes wastage in hydrogel production.

While the transition toward biocompatible, sustainable, and high-performance hydrogel solutions will ensure steady growth for the hydrogel market, advances in materials science, regenerative medicine, and eco-friendly hydrogel applications will pave the way ahead for this market in which hydrogels will become indispensable to the medical, personal care, industrial, and agricultural sectors.

The hydrogel market is experiencing significant growth, driven by increasing demand across various industries, including healthcare, agriculture, cosmetics, and industrial applications. Hydrogels are highly absorbent polymeric materials with unique properties such as biocompatibility, flexibility, and water retention, making them essential in wound care, drug delivery, and personal care products.

The rising emphasis on sustainability, technological advancements, and regulatory compliance is shaping the market landscape. Manufacturers are focusing on bio-based and biodegradable hydrogel formulations to meet evolving industry standards and reduce environmental impact.

The demand for hydrogels is increasing across multiple industries due to their ability to retain moisture, provide controlled drug release, and enhance wound healing. Innovations in smart hydrogels, temperature-sensitive formulations, and stimuli-responsive technologies are further driving market adoption.

The medical and pharmaceutical industries are key contributors to the growth of the hydrogel market, as these materials are widely used in wound dressings, tissue engineering, and contact lenses.

Regulatory approvals from organizations such as the FDA and EMA are essential for ensuring the safety and efficacy of hydrogel-based medical products.

Hydrogels are widely used in agriculture for soil moisture retention, improving crop yield, and reducing water consumption. In industrial applications, hydrogels serve as absorbent materials in diapers, sanitary products, and water purification processes.

Despite their advantages, challenges such as high production costs, limited biodegradability, and stability concerns persist. However, ongoing research in nanotechnology, cross-linking techniques, and hybrid hydrogels is helping overcome these hurdles and fueling market expansion.

New investments are also made in the field of material innovations, biomedical research, and ecofriendly formulations in the hydrogel market. Companies are looking toward nanotechnology and smart polymers to improve the properties of hydrogels.

Strategic alliances among research institutions, the healthcare organization, and industrial stakeholders drive innovation in commercial applications of hydrogels.

Furthermore, advancements in 3D bioprinting integrate hydrogel-based scaffolds as part of tissue engineering and regenerative medicine for an extended scope of those applications.

Coming up with hybrid hydrogels, combining synthetic and natural polymers, has proved improved mechanical properties, as well as biocompatibility, more extensive applications.

Expenditure on AI-based material discovery is enhancing the development of next-gen hydrogels, which can be able to deliver much more functions and tunability. Consumer demand for non-toxic, biodegradable hydrogel products is fuelling innovations in formulations in the personal care and cosmetics industries.

Augmented uses of hydrogels applications in soil moisture retention and crop enhancement practices have been attributed to the growing trend towards climate-resilient agriculture.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| 3M Company | 12-16% |

| Johnson & Johnson | 10-14% |

| Cardinal Health | 8-12% |

| B. Braun Melsungen AG | 6-10% |

| Smith & Nephew | 4-8% |

| Other Companies (combined) | 45-55% |

| Company Name | Key Offerings/Activities |

|---|---|

| 3M Company | Specializes in advanced wound care hydrogels and biomedical hydrogel formulations. |

| Johnson & Johnson | Develops hydrogel-based wound dressings and skin care solutions. |

| Cardinal Health | Expands its hydrogel portfolio with drug delivery and medical device applications. |

| B. Braun Melsungen AG | Focuses on high-absorbency and biodegradable hydrogels for medical and industrial use. |

| Smith & Nephew | Invests in smart hydrogels for wound healing and tissue regeneration. |

Key Company Insights

Other Key Players (45-55% Combined) Several specialized hydrogel manufacturers contribute to the growing hydrogel market. These include:

The overall market size for the Hydrogel Market was USD 3.9 Billion in 2025.

The Hydrogel Market is expected to reach USD 7.5 Billion in 2035.

The market will be driven by increasing demand from the healthcare, pharmaceutical, agriculture, and personal care industries, along with rising investments in bio-based and smart hydrogel technologies.

Key challenges include high production costs, limited biodegradability, and regulatory hurdles. However, advancements in nanotechnology and sustainable hydrogel development are addressing these challenges.

North America and Europe are expected to dominate due to strong healthcare infrastructure, high R&D investments, and rising demand for medical hydrogels. The Asia-Pacific region is also growing rapidly, driven by increasing adoption in agricultural and personal care applications.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (MT) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Raw Material, 2018 to 2033

Table 4: Global Market Volume (MT) Forecast by Raw Material, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Composition, 2018 to 2033

Table 6: Global Market Volume (MT) Forecast by Composition, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 8: Global Market Volume (MT) Forecast by Application, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 10: North America Market Volume (MT) Forecast by Country, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Raw Material, 2018 to 2033

Table 12: North America Market Volume (MT) Forecast by Raw Material, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by Composition, 2018 to 2033

Table 14: North America Market Volume (MT) Forecast by Composition, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 16: North America Market Volume (MT) Forecast by Application, 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 18: Latin America Market Volume (MT) Forecast by Country, 2018 to 2033

Table 19: Latin America Market Value (US$ Million) Forecast by Raw Material, 2018 to 2033

Table 20: Latin America Market Volume (MT) Forecast by Raw Material, 2018 to 2033

Table 21: Latin America Market Value (US$ Million) Forecast by Composition, 2018 to 2033

Table 22: Latin America Market Volume (MT) Forecast by Composition, 2018 to 2033

Table 23: Latin America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 24: Latin America Market Volume (MT) Forecast by Application, 2018 to 2033

Table 25: Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Europe Market Volume (MT) Forecast by Country, 2018 to 2033

Table 27: Europe Market Value (US$ Million) Forecast by Raw Material, 2018 to 2033

Table 28: Europe Market Volume (MT) Forecast by Raw Material, 2018 to 2033

Table 29: Europe Market Value (US$ Million) Forecast by Composition, 2018 to 2033

Table 30: Europe Market Volume (MT) Forecast by Composition, 2018 to 2033

Table 31: Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 32: Europe Market Volume (MT) Forecast by Application, 2018 to 2033

Table 33: Asia Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 34: Asia Pacific Market Volume (MT) Forecast by Country, 2018 to 2033

Table 35: Asia Pacific Market Value (US$ Million) Forecast by Raw Material, 2018 to 2033

Table 36: Asia Pacific Market Volume (MT) Forecast by Raw Material, 2018 to 2033

Table 37: Asia Pacific Market Value (US$ Million) Forecast by Composition, 2018 to 2033

Table 38: Asia Pacific Market Volume (MT) Forecast by Composition, 2018 to 2033

Table 39: Asia Pacific Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 40: Asia Pacific Market Volume (MT) Forecast by Application, 2018 to 2033

Table 41: MEA Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 42: MEA Market Volume (MT) Forecast by Country, 2018 to 2033

Table 43: MEA Market Value (US$ Million) Forecast by Raw Material, 2018 to 2033

Table 44: MEA Market Volume (MT) Forecast by Raw Material, 2018 to 2033

Table 45: MEA Market Value (US$ Million) Forecast by Composition, 2018 to 2033

Table 46: MEA Market Volume (MT) Forecast by Composition, 2018 to 2033

Table 47: MEA Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 48: MEA Market Volume (MT) Forecast by Application, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Raw Material, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Composition, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Application, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 5: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 6: Global Market Volume (MT) Analysis by Region, 2018 to 2033

Figure 7: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 8: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 9: Global Market Value (US$ Million) Analysis by Raw Material, 2018 to 2033

Figure 10: Global Market Volume (MT) Analysis by Raw Material, 2018 to 2033

Figure 11: Global Market Value Share (%) and BPS Analysis by Raw Material, 2023 to 2033

Figure 12: Global Market Y-o-Y Growth (%) Projections by Raw Material, 2023 to 2033

Figure 13: Global Market Value (US$ Million) Analysis by Composition, 2018 to 2033

Figure 14: Global Market Volume (MT) Analysis by Composition, 2018 to 2033

Figure 15: Global Market Value Share (%) and BPS Analysis by Composition, 2023 to 2033

Figure 16: Global Market Y-o-Y Growth (%) Projections by Composition, 2023 to 2033

Figure 17: Global Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 18: Global Market Volume (MT) Analysis by Application, 2018 to 2033

Figure 19: Global Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 20: Global Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 21: Global Market Attractiveness by Raw Material, 2023 to 2033

Figure 22: Global Market Attractiveness by Composition, 2023 to 2033

Figure 23: Global Market Attractiveness by Application, 2023 to 2033

Figure 24: Global Market Attractiveness by Region, 2023 to 2033

Figure 25: North America Market Value (US$ Million) by Raw Material, 2023 to 2033

Figure 26: North America Market Value (US$ Million) by Composition, 2023 to 2033

Figure 27: North America Market Value (US$ Million) by Application, 2023 to 2033

Figure 28: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 29: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 30: North America Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 31: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 32: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 33: North America Market Value (US$ Million) Analysis by Raw Material, 2018 to 2033

Figure 34: North America Market Volume (MT) Analysis by Raw Material, 2018 to 2033

Figure 35: North America Market Value Share (%) and BPS Analysis by Raw Material, 2023 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by Raw Material, 2023 to 2033

Figure 37: North America Market Value (US$ Million) Analysis by Composition, 2018 to 2033

Figure 38: North America Market Volume (MT) Analysis by Composition, 2018 to 2033

Figure 39: North America Market Value Share (%) and BPS Analysis by Composition, 2023 to 2033

Figure 40: North America Market Y-o-Y Growth (%) Projections by Composition, 2023 to 2033

Figure 41: North America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 42: North America Market Volume (MT) Analysis by Application, 2018 to 2033

Figure 43: North America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 44: North America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 45: North America Market Attractiveness by Raw Material, 2023 to 2033

Figure 46: North America Market Attractiveness by Composition, 2023 to 2033

Figure 47: North America Market Attractiveness by Application, 2023 to 2033

Figure 48: North America Market Attractiveness by Country, 2023 to 2033

Figure 49: Latin America Market Value (US$ Million) by Raw Material, 2023 to 2033

Figure 50: Latin America Market Value (US$ Million) by Composition, 2023 to 2033

Figure 51: Latin America Market Value (US$ Million) by Application, 2023 to 2033

Figure 52: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 53: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 54: Latin America Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 55: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 57: Latin America Market Value (US$ Million) Analysis by Raw Material, 2018 to 2033

Figure 58: Latin America Market Volume (MT) Analysis by Raw Material, 2018 to 2033

Figure 59: Latin America Market Value Share (%) and BPS Analysis by Raw Material, 2023 to 2033

Figure 60: Latin America Market Y-o-Y Growth (%) Projections by Raw Material, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) Analysis by Composition, 2018 to 2033

Figure 62: Latin America Market Volume (MT) Analysis by Composition, 2018 to 2033

Figure 63: Latin America Market Value Share (%) and BPS Analysis by Composition, 2023 to 2033

Figure 64: Latin America Market Y-o-Y Growth (%) Projections by Composition, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 66: Latin America Market Volume (MT) Analysis by Application, 2018 to 2033

Figure 67: Latin America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 68: Latin America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 69: Latin America Market Attractiveness by Raw Material, 2023 to 2033

Figure 70: Latin America Market Attractiveness by Composition, 2023 to 2033

Figure 71: Latin America Market Attractiveness by Application, 2023 to 2033

Figure 72: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 73: Europe Market Value (US$ Million) by Raw Material, 2023 to 2033

Figure 74: Europe Market Value (US$ Million) by Composition, 2023 to 2033

Figure 75: Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 76: Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 77: Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 78: Europe Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 79: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 80: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 81: Europe Market Value (US$ Million) Analysis by Raw Material, 2018 to 2033

Figure 82: Europe Market Volume (MT) Analysis by Raw Material, 2018 to 2033

Figure 83: Europe Market Value Share (%) and BPS Analysis by Raw Material, 2023 to 2033

Figure 84: Europe Market Y-o-Y Growth (%) Projections by Raw Material, 2023 to 2033

Figure 85: Europe Market Value (US$ Million) Analysis by Composition, 2018 to 2033

Figure 86: Europe Market Volume (MT) Analysis by Composition, 2018 to 2033

Figure 87: Europe Market Value Share (%) and BPS Analysis by Composition, 2023 to 2033

Figure 88: Europe Market Y-o-Y Growth (%) Projections by Composition, 2023 to 2033

Figure 89: Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 90: Europe Market Volume (MT) Analysis by Application, 2018 to 2033

Figure 91: Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 92: Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 93: Europe Market Attractiveness by Raw Material, 2023 to 2033

Figure 94: Europe Market Attractiveness by Composition, 2023 to 2033

Figure 95: Europe Market Attractiveness by Application, 2023 to 2033

Figure 96: Europe Market Attractiveness by Country, 2023 to 2033

Figure 97: Asia Pacific Market Value (US$ Million) by Raw Material, 2023 to 2033

Figure 98: Asia Pacific Market Value (US$ Million) by Composition, 2023 to 2033

Figure 99: Asia Pacific Market Value (US$ Million) by Application, 2023 to 2033

Figure 100: Asia Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 101: Asia Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 102: Asia Pacific Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 103: Asia Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 104: Asia Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 105: Asia Pacific Market Value (US$ Million) Analysis by Raw Material, 2018 to 2033

Figure 106: Asia Pacific Market Volume (MT) Analysis by Raw Material, 2018 to 2033

Figure 107: Asia Pacific Market Value Share (%) and BPS Analysis by Raw Material, 2023 to 2033

Figure 108: Asia Pacific Market Y-o-Y Growth (%) Projections by Raw Material, 2023 to 2033

Figure 109: Asia Pacific Market Value (US$ Million) Analysis by Composition, 2018 to 2033

Figure 110: Asia Pacific Market Volume (MT) Analysis by Composition, 2018 to 2033

Figure 111: Asia Pacific Market Value Share (%) and BPS Analysis by Composition, 2023 to 2033

Figure 112: Asia Pacific Market Y-o-Y Growth (%) Projections by Composition, 2023 to 2033

Figure 113: Asia Pacific Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 114: Asia Pacific Market Volume (MT) Analysis by Application, 2018 to 2033

Figure 115: Asia Pacific Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 116: Asia Pacific Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 117: Asia Pacific Market Attractiveness by Raw Material, 2023 to 2033

Figure 118: Asia Pacific Market Attractiveness by Composition, 2023 to 2033

Figure 119: Asia Pacific Market Attractiveness by Application, 2023 to 2033

Figure 120: Asia Pacific Market Attractiveness by Country, 2023 to 2033

Figure 121: MEA Market Value (US$ Million) by Raw Material, 2023 to 2033

Figure 122: MEA Market Value (US$ Million) by Composition, 2023 to 2033

Figure 123: MEA Market Value (US$ Million) by Application, 2023 to 2033

Figure 124: MEA Market Value (US$ Million) by Country, 2023 to 2033

Figure 125: MEA Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 126: MEA Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 127: MEA Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 128: MEA Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 129: MEA Market Value (US$ Million) Analysis by Raw Material, 2018 to 2033

Figure 130: MEA Market Volume (MT) Analysis by Raw Material, 2018 to 2033

Figure 131: MEA Market Value Share (%) and BPS Analysis by Raw Material, 2023 to 2033

Figure 132: MEA Market Y-o-Y Growth (%) Projections by Raw Material, 2023 to 2033

Figure 133: MEA Market Value (US$ Million) Analysis by Composition, 2018 to 2033

Figure 134: MEA Market Volume (MT) Analysis by Composition, 2018 to 2033

Figure 135: MEA Market Value Share (%) and BPS Analysis by Composition, 2023 to 2033

Figure 136: MEA Market Y-o-Y Growth (%) Projections by Composition, 2023 to 2033

Figure 137: MEA Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 138: MEA Market Volume (MT) Analysis by Application, 2018 to 2033

Figure 139: MEA Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 140: MEA Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 141: MEA Market Attractiveness by Raw Material, 2023 to 2033

Figure 142: MEA Market Attractiveness by Composition, 2023 to 2033

Figure 143: MEA Market Attractiveness by Application, 2023 to 2033

Figure 144: MEA Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Hydrogel Face Mask Market Trends – Growth & Demand Forecast 2025 to 2035

Hydrogel-based Drug Delivery Market Analysis – Trends & Future Outlook 2024-2034

Hydrogel Contact Lenses Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA