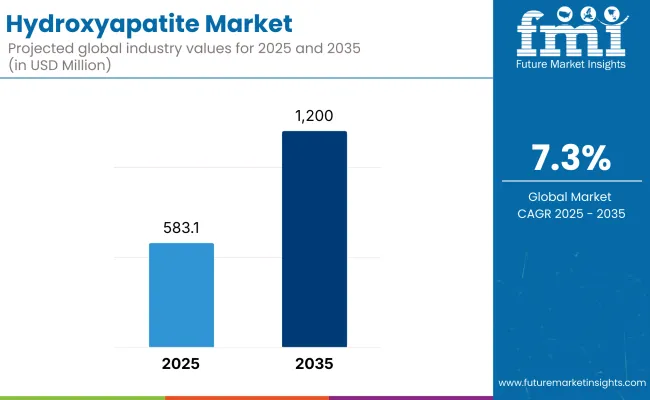

The global hydroxyapatite market was estimated at USD 583.1 million in 2025. By 2035, it is projected to reach USD 1.2 billion. This reflects a CAGR of 7.3%, driven by increasing adoption in biomedical applications, including orthopedic implants and dental care. Substitutes for synthetic bone grafts have been sought due to biocompatibility concerns, prompting demand for hydroxyapatite.

In 2024, DePuy Synthes, the orthopedics arm of Johnson & Johnson, introduced HA-coated hip and knee implants across European markets. A company spokesperson emphasized in a press release that “bioactive coatings like hydroxyapatite have significantly enhanced patient outcomes in early recovery trials.” The coating was selected based on its proven ability to support osseointegration, reducing implant rejection.

Hydroxyapatite has also seen increased adoption in the dental sector, primarily in fluoride-free oral care products. In its 2024 innovation bulletin, Colgate-Palmolive reported a 23% increase in North American sales of its HA-based toothpaste within six months of launch. The product was designed for enamel re-mineralization and sensitivity reduction. According to the company’s R&D division, “hydroxyapatite offered a compelling alternative for health-conscious consumers seeking scientifically validated performance without fluoride.”

By 2025, attention turned toward pharmaceutical-grade HA nanoparticles. A research team at the National Center for Nanoscience and Technology of China published findings on controlled-release chemotherapy systems utilizing hydroxyapatite as a delivery matrix. The study reported a 40% increase in drug bioavailability and minimized cytotoxicity in pre-clinical settings. Progress has been cited as a precursor to formal trials scheduled in late 2025.

Purity and production scalability of hydroxyapatite remain vital. In Q4 2024, Berkeley Advanced Biomaterials completed a major upgrade to its California facility, enabling ion-exchange synthesis with trace heavy metal control below 0.01 ppm. CEO Dr. Mark Reynolds noted, “This overhaul was critical to meet updated FDA and EMA regulatory frameworks for implant-grade materials.”

On a regional level, Asia Pacific promises significant potential in the forthcoming years, supported by rising implant surgeries and public health funding in India, China, and South Korea. Concurrently, Europe demonstrated strong demand following the MDR compliance mandate implemented in 2023, which prioritized biocompatible materials like HA for orthopedic procedures.

Despite strong growth, challenges such as supply variability and cost of nano-scale production have persisted. However, 2025 saw pilot-scale implementation of green-sourced hydroxyapatite extraction from fishbone and eggshell waste in Canada and Japan. Such sustainability innovations are expected to reshape cost structures by 2027.

The hydroxyapatite market is making significant strides, with a growing acceptance of biocompatible and bioactive material by the medical, dental, cosmetic, and biochemical industries. Hydroxyapatite (HA) is a naturally occurring calcium phosphate that has catalytic properties and is an essential mineral for bone regeneration in the human body, dental implants, orthopedic coatings, and bio ceramics.

As the biomedical engineering, regenerative medicine, and implantable materials sectors increasingly advance, development of high-purity hydroxyapatite formulations across applications is a focus for manufacturers. Segmentation: The market is broken down into two segments: by Grade (Medical Grade, Cosmetics Grade, Research Grade) and by Application (Dental, Orthopedic, Biochemical research, Surgical, Bioceramic Coatings, Food, Medicine, Others).

Hydroxyapatite is extensively used in dental and orthopedic applications owing to its excellent biocompatibility, osteoconductive capabilities, and integration with natural bone tissues; thereby, after the medical grade segment, this application has the largest market share. Osteoconductive ceramics. Such as bone graft substitutes, orthopedic implants, dental fillings, and prosthetic coatings, medical-grade hydroxyapatite serves to promote bone regeneration and stability of the implant.

An upsurge in demand for minimally invasive bone grafting procedures (both in the context of dental restorations and for use in tissue engineering applications) has propelled manufacturers to create up-and-up medical-grade hydroxyapatite reagents which possess improved bioactivity and structural stability.

Additionally, the growth of 3D printing technologies in the fields of orthopedic and dental implant manufacturing is also increasing the demand for personalized, medical-grade hydroxyapatite formulations.

Investment in cosmetics grade is also on a surge especially in skin care, anti-aging formulations and personal care. Due to its calcium-rich composition, demineralization properties, and skin-enhancing benefits, hydroxyapatite is used in dermal fillers, teeth-whitening products, and exfoliating skincare treatments.

As the demand for natural, non-toxic, and bioactive cosmetic ingredients continues to grow, the market for hydroxyapatite in cosmetic formulation, anti-aging creams, and bio ceramic-based skincare products is also increasing.

Hydroxyapatite is widely used in dental implants, restorative procedures, enamel demineralization, and oral care formulations, thus making the Dental segment a leading segment in the Hydroxyapatite Market. Hydroxyapatite is commonly used in toothpaste formulations, demineralization agents, cavity prevention treatments, etc. because of its structural similarity to human teeth enamel.

A growing demand for biomimetic dental materials, non-invasive dental restorations, and bioactive enamel-repair solutions has resulted in a large number of manufacturers developing hydroxyapatite-based toothpaste, mouth washes and restorative dental coatings with potential oral health and demineralization prevention benefits.

Strong demand is seen in the bio ceramic coatings segment, especially in orthopedic and dental implant coatings. Biomechanical properties avoiding post-operative failure of dental implants remains vital to maximize their longevity and ensure Osseo integration. Hydroxyapatite coatings of dental implants may improve the longevity of the implants, Osseo integration and may decrease the incidence of post-surgical complications.

The growing need for hydroxyapatite-based implant coatings in orthopedic, dental, and maxillofacial surgeries, associated with rapid developments in surface modification and nanostructured coatings, as well as in bioactive ceramic materials, worldwide.

hydroxyapatite market in North America is due to well-established healthcare infrastructure and intense focus of end-users/industry partners on innovative medical devices and implants in the region.

In particular, the United States plays an important role, where the growing demand for devices such as orthopedic implants, dental materials, and biocompatible coatings drives the need for high-tech solutions. The growth of market is fueled by the high healthcare spending and the strong research activities in this region.

In Europe where the medical device industry is well-established, the prevalence of osteoarticular and dental diseases is substantial, and regulatory requirements are reasonably stringent, is the other main market. Germany, France and the United Kingdom are basic in hydroxyapatite used in orthopedics and dentists. The emphasis on quality and sustainable materials in the region further supports the growth of the hydroxyapatite market.

Due to rapid economic growth, increased access to healthcare and rise in awareness of advanced treatment alternatives, Asia-Pacific is expected to be the fastest growing market over the forecast period.

Over the forecast period, the global market for Dental implants (Implant Dentistry) seems potentially very strong in the coming years due to the rising regional markets of China, Japan, and India. Due to continued industrialization and increased investment in healthcare in Asia-Pacific, this is expected to be one of the fastest-growing markets over the next decade.

Challenges: High Production Costs, Biocompatibility Standards, and Supply Chain Constraints

The hydroxyapatite (HA) market faces several challenges, primarily due to high production costs associated with synthetic and natural HA extraction and processing. The synthetic methods used to manufacture hydroxyapatite highlight the cost-effectiveness of production of this calcium phosphate compound used in many biomedical applications due to the need for well-controlled biocompatibility and purity, as well as structural features.

In addition, the regulations of biocompatibility and compliance are particularly stringent as hydroxyapatite is widely employed in orthopedic implants, dental coatings, and bone graft substitutes. Regulatory agencies like the FDA, CE Mark and ISO 10993 for biocompatibility require extensive testing requirements which delay product approvals.

Moreover, the sourcing of raw materials and the limitations of supply chains impact the consistency of production and cost to market, particularly when it comes to naturally derived hydroxyapatite derived from animal sources.

Opportunities: Growth in Orthopedic and Dental Implants, AI-Driven Biomaterials Research, and Nano-Hydroxyapatite Innovations

Despite these challenges, the hydroxyapatite market continues to grow despite many challenges with factors such as demand for orthopedic and dental implants, AI-assisted biomaterials research, and nano-hydroxyapatite innovations.

North America dominated the market share and is anticipated to maintain its top position during the forecast period owing to an increasing aging population, increase in osteoporosis cases, and dental restoration procedures which support the demand for HA-based implants, coatings, and scaffolds.

Moreover, the development of nanotechnology also improved HA's bioactivity, enhanced its integration with bone tissues, and broadened its applications in cosmetics, drug delivery, and 3D bio printing. The exploration of innovative hydroxyapatite composites with enhanced mechanical and biological characteristics is likewise facilitated by the use of AI-powered biomaterials research and disease prediction algorithms.

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Compliance with FDA, CE, and ISO standards for biocompatibility and medical-grade HA applications. |

| Consumer Trends | Demand for HA in orthopedic implants, dental applications, and bone regeneration therapies. |

| Industry Adoption | High usage in dental coatings, bone grafting, and medical implant surface treatments. |

| Supply Chain and Sourcing | Dependence on synthetic and animal-derived HA sources. |

| Market Competition | Dominated by biomedical material manufacturers, dental implant companies, and orthopedic device firms. |

| Market Growth Drivers | Growth fueled by aging population, increasing bone-related disorders, and advancements in medical coatings. |

| Sustainability and Environmental Impact | Moderate adoption of eco-friendly HA production techniques and biocompatible waste management. |

| Integration of Smart Technologies | Early adoption of 3D bioprinting for HA scaffolds, AI-driven material characterization, and surface modification techniques. |

| Advancements in Bioceramics | Development of high-purity HA coatings and porous HA scaffolds for improved bone integration. |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Stricter nanomaterial safety regulations, AI-driven biomaterials compliance, and sustainable HA production mandates. |

| Consumer Trends | Growth in 3D-printed HA scaffolds, AI-optimized biomaterials, and nano-hydroxyapatite for drug delivery and skincare. |

| Industry Adoption | Expansion into smart bioactive coatings, AI-driven regenerative medicine, and nanotechnology-enhanced tissue engineering. |

| Supply Chain and Sourcing | Shift toward lab-grown hydroxyapatite, biomimetic HA production, and AI-assisted supply chain optimization. |

| Market Competition | Entry of AI-driven biomaterial startups, 3D bioprinting firms, and nano-engineered HA developers. |

| Market Growth Drivers | Accelerated by smart bioactive implants, AI-optimized HA formulations, and bioengineered bone tissue substitutes. |

| Sustainability and Environmental Impact | Large-scale shift toward carbon-neutral biomaterials manufacturing, circular economy models, and AI-driven HA lifecycle analysis. |

| Integration of Smart Technologies | Expansion into machine learning-assisted implant design, IoT-enabled medical implant monitoring, and smart HA-based regenerative medicine. |

| Advancements in Bioceramics | Evolution toward self-healing HA biomaterials, nano-engineered drug delivery systems, and hybrid HA-polymer composites. |

Market growth is driven by the increasing incidence of bone disorders, dental implants, and reconstructive surgeries. Further, bio ceramic coatings, synthetic bone graft, and biomedical advancement are some of the factors enhancing industry growth.

| Country | CAGR (2025 to 2035) |

|---|---|

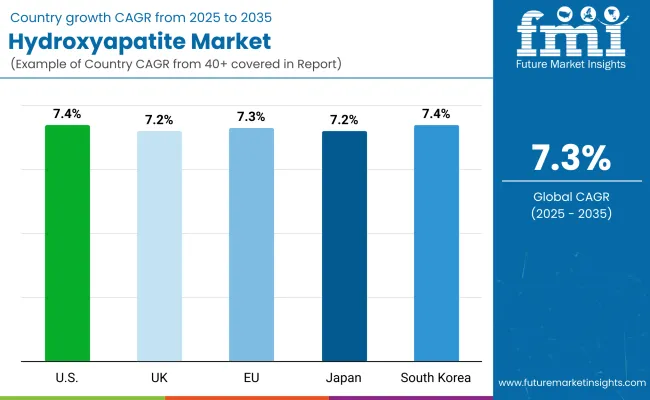

| USA | 7.4% |

Due to the increasing use of biocompatible materials in dentistry and orthopedics, the hydroxyapatite market is expanding in the United Kingdom. Increasing cosmetic dental procedures, trauma surgeries, and joint replacements are likely to drive demand for hydroxyapatite-based implants. Further market outlook is being bolstered by government investments in the fields of biomedical and regenerative medicine.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 7.2% |

The hydroxyapatite market in the European Union continues to keep growing as healthcare professionals integrate bio ceramic materials into medical applications. Market demand is being bolstered by the region’s presence of leading dental and orthopedic implant manufacturers and increasing geriatric population in need of bone grafting and joint replacements. Moreover, studies on nanostructured hydroxyapatite for advanced healthcare applications are influencing market trends.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 7.3% |

The Japan hydroxyapatite market provides an integrated analysis of the hydroxyapatite market trends, outlook, growth drivers, and the competitive landscape. This is driven in large part by the country’s aging population, as demand for dental prosthetics, artificial joints and bone grafts continues to increase. Market growth is being further propelled due to initiatives being taken both by the government for tissue engineering and 3D bio printing using hydroxyapatite.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 7.2% |

Demand for hydroxyapatite in dental restorations, orthopedic implants, and cosmetic surgery applications is driving the growth of the hydroxyapatite market in South Korea. This is being driven as a result of the country’s strong performance in biotechnology research and biomaterials innovation, which is leading to more nanoparticle-based hydroxyapatite coatings. The growing medical tourism for dental and orthopedic services is also contributing to the industry growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 7.4% |

The hydroxyapatite market is witnessing growth on account of the rising demand for biocompatible material in applications including orthopedics, dental implants, and bone grafting. And we are seeing innovation in AI-based biomaterial synthesis, nano-hydroxyapatite technology and 3D-printed bone scaffolds.

Key Players: Leading companies are investing in high-purity hydroxyapatite development, AI and machine learning-based material optimization; Companies are promoting sustainable materials for bone regeneration market in bone integration, medical implants and tissue engineering.

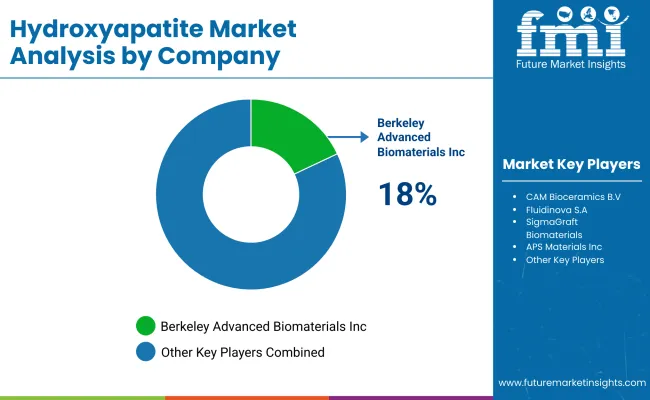

Market Share Analysis by Key Players & Hydroxyapatite Manufacturers

| Company Name | Estimated Market Share (%) |

|---|---|

| Berkeley Advanced Biomaterials Inc. | 18-22% |

| CAM Bioceramics B.V. | 12-16% |

| Fluidinova S.A. | 10-14% |

| SigmaGraft Biomaterials | 8-12% |

| APS Materials Inc. | 5-9% |

| Other Biomaterial Suppliers (combined) | 30-40% |

| Company Name | Key Offerings/Activities |

|---|---|

| Berkeley Advanced Biomaterials Inc. | Develops AI-optimized bone graft substitutes, medical-grade hydroxyapatite coatings, and orthopedic biomaterials. |

| CAM Bioceramics B.V. | Specializes in high-purity hydroxyapatite powders, AI-driven ceramic material synthesis, and implant coatings. |

| Fluidinova S.A. | Provides nano-hydroxyapatite for medical and dental applications, AI-assisted particle size optimization, and bioceramic scaffolds. |

| SigmaGraft Biomaterials | Focuses on calcium phosphate-based bone grafting materials, AI-powered synthetic bone integration, and biomimetic hydroxyapatite solutions. |

| APS Materials Inc. | Offers AI-enhanced hydroxyapatite plasma spray coatings, biomedical ceramics, and dental implant surface modification solutions. |

Key Market Insights

Berkeley Advanced Biomaterials Inc. (18-22%)

Berkeley Advanced Biomaterials leads the hydroxyapatite market, offering AI-powered biomaterial synthesis, advanced bone regenerative solutions, and high-performance implant coatings.

CAM Bioceramics B.V. (12-16%)

CAM Bioceramics specializes in medical-grade hydroxyapatite powders, ensuring AI-driven ceramic processing, orthopedic coating advancements, and high-purity bioceramics.

Fluidinova S.A. (10-14%)

Fluidinova provides nano-hydroxyapatite for tissue engineering, optimizing AI-assisted particle size control and high-surface-area biomaterials.

SigmaGraft Biomaterials (8-12%)

SigmaGraft focuses on synthetic bone grafting solutions, integrating AI-powered bioactive hydroxyapatite and advanced bone integration technologies.

APS Materials Inc. (5-9%)

APS develops plasma-sprayed hydroxyapatite coatings for implants, ensuring AI-enhanced adhesion properties and improved osteoconductivity.

Other Key Players (30-40% Combined)

Several biomedical companies, ceramic material suppliers, and dental implant coating providers contribute to next-generation hydroxyapatite innovations, AI-powered material processing advancements, and bone regenerative biomaterial solutions. These include:

The overall market size for the hydroxyapatite market was USD 583.1 Million in 2025.

The hydroxyapatite market is expected to reach USD 1.2 Billion in 2035.

Growth is driven by the rising demand for bone graft substitutes, increasing applications in dental and orthopedic implants, and advancements in biomaterial research for regenerative medicine.

The top 5 countries driving the development of the hydroxyapatite market are the USA, Germany, China, Japan, and India.

Medical Grade and Dental Applications are expected to command a significant share over the assessment period.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Tons) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Grade, 2018 to 2033

Table 4: Global Market Volume (Tons) Forecast by Grade, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 6: Global Market Volume (Tons) Forecast by Application, 2018 to 2033

Table 7: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 8: North America Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Grade, 2018 to 2033

Table 10: North America Market Volume (Tons) Forecast by Grade, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 12: North America Market Volume (Tons) Forecast by Application, 2018 to 2033

Table 13: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 14: Latin America Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 15: Latin America Market Value (US$ Million) Forecast by Grade, 2018 to 2033

Table 16: Latin America Market Volume (Tons) Forecast by Grade, 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 18: Latin America Market Volume (Tons) Forecast by Application, 2018 to 2033

Table 19: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 20: Western Europe Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 21: Western Europe Market Value (US$ Million) Forecast by Grade, 2018 to 2033

Table 22: Western Europe Market Volume (Tons) Forecast by Grade, 2018 to 2033

Table 23: Western Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 24: Western Europe Market Volume (Tons) Forecast by Application, 2018 to 2033

Table 25: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Eastern Europe Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 27: Eastern Europe Market Value (US$ Million) Forecast by Grade, 2018 to 2033

Table 28: Eastern Europe Market Volume (Tons) Forecast by Grade, 2018 to 2033

Table 29: Eastern Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 30: Eastern Europe Market Volume (Tons) Forecast by Application, 2018 to 2033

Table 31: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 32: South Asia and Pacific Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 33: South Asia and Pacific Market Value (US$ Million) Forecast by Grade, 2018 to 2033

Table 34: South Asia and Pacific Market Volume (Tons) Forecast by Grade, 2018 to 2033

Table 35: South Asia and Pacific Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 36: South Asia and Pacific Market Volume (Tons) Forecast by Application, 2018 to 2033

Table 37: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 38: East Asia Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 39: East Asia Market Value (US$ Million) Forecast by Grade, 2018 to 2033

Table 40: East Asia Market Volume (Tons) Forecast by Grade, 2018 to 2033

Table 41: East Asia Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 42: East Asia Market Volume (Tons) Forecast by Application, 2018 to 2033

Table 43: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 44: Middle East and Africa Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 45: Middle East and Africa Market Value (US$ Million) Forecast by Grade, 2018 to 2033

Table 46: Middle East and Africa Market Volume (Tons) Forecast by Grade, 2018 to 2033

Table 47: Middle East and Africa Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 48: Middle East and Africa Market Volume (Tons) Forecast by Application, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Grade, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Application, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 4: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 5: Global Market Volume (Tons) Analysis by Region, 2018 to 2033

Figure 6: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 7: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 8: Global Market Value (US$ Million) Analysis by Grade, 2018 to 2033

Figure 9: Global Market Volume (Tons) Analysis by Grade, 2018 to 2033

Figure 10: Global Market Value Share (%) and BPS Analysis by Grade, 2023 to 2033

Figure 11: Global Market Y-o-Y Growth (%) Projections by Grade, 2023 to 2033

Figure 12: Global Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 13: Global Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 14: Global Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 15: Global Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 16: Global Market Attractiveness by Grade, 2023 to 2033

Figure 17: Global Market Attractiveness by Application, 2023 to 2033

Figure 18: Global Market Attractiveness by Region, 2023 to 2033

Figure 19: North America Market Value (US$ Million) by Grade, 2023 to 2033

Figure 20: North America Market Value (US$ Million) by Application, 2023 to 2033

Figure 21: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 22: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 23: North America Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 24: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 25: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 26: North America Market Value (US$ Million) Analysis by Grade, 2018 to 2033

Figure 27: North America Market Volume (Tons) Analysis by Grade, 2018 to 2033

Figure 28: North America Market Value Share (%) and BPS Analysis by Grade, 2023 to 2033

Figure 29: North America Market Y-o-Y Growth (%) Projections by Grade, 2023 to 2033

Figure 30: North America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 31: North America Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 32: North America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 33: North America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 34: North America Market Attractiveness by Grade, 2023 to 2033

Figure 35: North America Market Attractiveness by Application, 2023 to 2033

Figure 36: North America Market Attractiveness by Country, 2023 to 2033

Figure 37: Latin America Market Value (US$ Million) by Grade, 2023 to 2033

Figure 38: Latin America Market Value (US$ Million) by Application, 2023 to 2033

Figure 39: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 40: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 41: Latin America Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 42: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 43: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 44: Latin America Market Value (US$ Million) Analysis by Grade, 2018 to 2033

Figure 45: Latin America Market Volume (Tons) Analysis by Grade, 2018 to 2033

Figure 46: Latin America Market Value Share (%) and BPS Analysis by Grade, 2023 to 2033

Figure 47: Latin America Market Y-o-Y Growth (%) Projections by Grade, 2023 to 2033

Figure 48: Latin America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 49: Latin America Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 50: Latin America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 51: Latin America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 52: Latin America Market Attractiveness by Grade, 2023 to 2033

Figure 53: Latin America Market Attractiveness by Application, 2023 to 2033

Figure 54: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 55: Western Europe Market Value (US$ Million) by Grade, 2023 to 2033

Figure 56: Western Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 57: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 58: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 59: Western Europe Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 60: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 61: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 62: Western Europe Market Value (US$ Million) Analysis by Grade, 2018 to 2033

Figure 63: Western Europe Market Volume (Tons) Analysis by Grade, 2018 to 2033

Figure 64: Western Europe Market Value Share (%) and BPS Analysis by Grade, 2023 to 2033

Figure 65: Western Europe Market Y-o-Y Growth (%) Projections by Grade, 2023 to 2033

Figure 66: Western Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 67: Western Europe Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 68: Western Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 69: Western Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 70: Western Europe Market Attractiveness by Grade, 2023 to 2033

Figure 71: Western Europe Market Attractiveness by Application, 2023 to 2033

Figure 72: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 73: Eastern Europe Market Value (US$ Million) by Grade, 2023 to 2033

Figure 74: Eastern Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 75: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 76: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 77: Eastern Europe Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 78: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 79: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 80: Eastern Europe Market Value (US$ Million) Analysis by Grade, 2018 to 2033

Figure 81: Eastern Europe Market Volume (Tons) Analysis by Grade, 2018 to 2033

Figure 82: Eastern Europe Market Value Share (%) and BPS Analysis by Grade, 2023 to 2033

Figure 83: Eastern Europe Market Y-o-Y Growth (%) Projections by Grade, 2023 to 2033

Figure 84: Eastern Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 85: Eastern Europe Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 86: Eastern Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 87: Eastern Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 88: Eastern Europe Market Attractiveness by Grade, 2023 to 2033

Figure 89: Eastern Europe Market Attractiveness by Application, 2023 to 2033

Figure 90: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 91: South Asia and Pacific Market Value (US$ Million) by Grade, 2023 to 2033

Figure 92: South Asia and Pacific Market Value (US$ Million) by Application, 2023 to 2033

Figure 93: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 94: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 95: South Asia and Pacific Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 96: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 97: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 98: South Asia and Pacific Market Value (US$ Million) Analysis by Grade, 2018 to 2033

Figure 99: South Asia and Pacific Market Volume (Tons) Analysis by Grade, 2018 to 2033

Figure 100: South Asia and Pacific Market Value Share (%) and BPS Analysis by Grade, 2023 to 2033

Figure 101: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Grade, 2023 to 2033

Figure 102: South Asia and Pacific Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 103: South Asia and Pacific Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 104: South Asia and Pacific Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 105: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 106: South Asia and Pacific Market Attractiveness by Grade, 2023 to 2033

Figure 107: South Asia and Pacific Market Attractiveness by Application, 2023 to 2033

Figure 108: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 109: East Asia Market Value (US$ Million) by Grade, 2023 to 2033

Figure 110: East Asia Market Value (US$ Million) by Application, 2023 to 2033

Figure 111: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 112: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 113: East Asia Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 114: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 115: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 116: East Asia Market Value (US$ Million) Analysis by Grade, 2018 to 2033

Figure 117: East Asia Market Volume (Tons) Analysis by Grade, 2018 to 2033

Figure 118: East Asia Market Value Share (%) and BPS Analysis by Grade, 2023 to 2033

Figure 119: East Asia Market Y-o-Y Growth (%) Projections by Grade, 2023 to 2033

Figure 120: East Asia Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 121: East Asia Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 122: East Asia Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 123: East Asia Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 124: East Asia Market Attractiveness by Grade, 2023 to 2033

Figure 125: East Asia Market Attractiveness by Application, 2023 to 2033

Figure 126: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 127: Middle East and Africa Market Value (US$ Million) by Grade, 2023 to 2033

Figure 128: Middle East and Africa Market Value (US$ Million) by Application, 2023 to 2033

Figure 129: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 130: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 131: Middle East and Africa Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 132: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 133: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 134: Middle East and Africa Market Value (US$ Million) Analysis by Grade, 2018 to 2033

Figure 135: Middle East and Africa Market Volume (Tons) Analysis by Grade, 2018 to 2033

Figure 136: Middle East and Africa Market Value Share (%) and BPS Analysis by Grade, 2023 to 2033

Figure 137: Middle East and Africa Market Y-o-Y Growth (%) Projections by Grade, 2023 to 2033

Figure 138: Middle East and Africa Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 139: Middle East and Africa Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 140: Middle East and Africa Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 141: Middle East and Africa Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 142: Middle East and Africa Market Attractiveness by Grade, 2023 to 2033

Figure 143: Middle East and Africa Market Attractiveness by Application, 2023 to 2033

Figure 144: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Bio-ceramics and Hydroxyapatite Market 2025-2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA