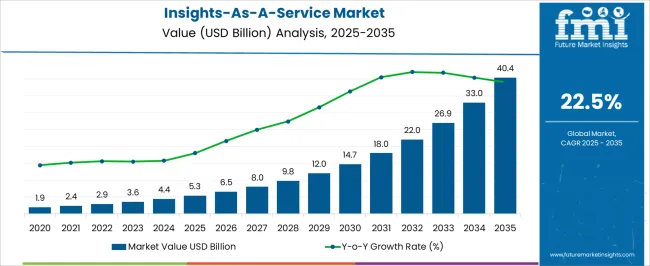

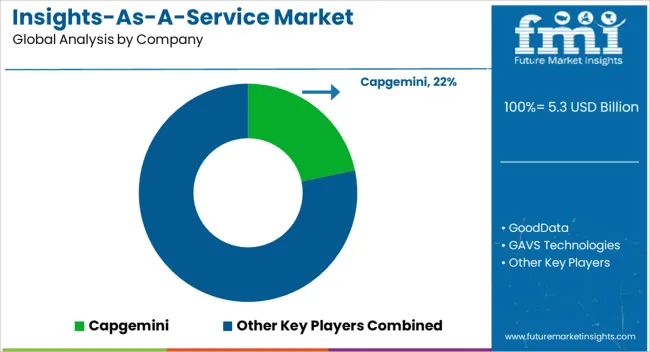

The Insights-As-A-Service Market is estimated to be valued at USD 5.3 billion in 2025 and is projected to reach USD 40.4 billion by 2035, registering a compound annual growth rate (CAGR) of 22.5% over the forecast period.

| Metric | Value |

|---|---|

| Insights-As-A-Service Market Estimated Value in (2025 E) | USD 5.3 billion |

| Insights-As-A-Service Market Forecast Value in (2035 F) | USD 40.4 billion |

| Forecast CAGR (2025 to 2035) | 22.5% |

The insights as a service market is expanding rapidly due to the growing need for real time data driven decision making and the rising adoption of cloud based analytics platforms. Organizations are leveraging insights to enhance operational efficiency, streamline customer engagement, and develop predictive strategies.

The shift toward digital transformation across industries has accelerated demand for scalable and cost effective analytics solutions that deliver actionable intelligence without requiring heavy infrastructure investments. Integration of AI and machine learning technologies has further improved the ability to process large data sets and extract meaningful patterns.

With increasing competition, enterprises are prioritizing insight driven strategies to improve branding, marketing, and overall business agility. The future outlook remains strong as both large enterprises and small and medium enterprises continue to integrate insights as a service solutions into their core business models to maintain competitiveness and achieve measurable growth.

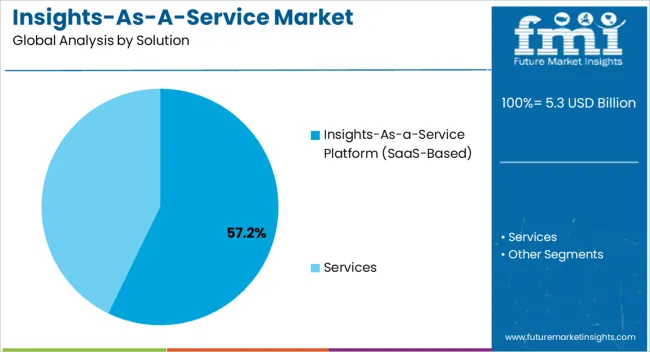

The insights as a service platform SaaS based solution is projected to represent 57.20% of total market revenue by 2025 within the solution category, making it the dominant segment. This growth is attributed to the scalability, flexibility, and cost effectiveness of SaaS based models which allow organizations to access advanced analytics without significant infrastructure or maintenance costs.

Continuous updates, integration with multiple data sources, and simplified deployment have increased adoption rates among enterprises of varying sizes. Furthermore, SaaS based solutions support faster innovation cycles and seamless collaboration across teams, enabling data democratization.

These advantages have reinforced the leadership of SaaS based platforms in the insights as a service market.

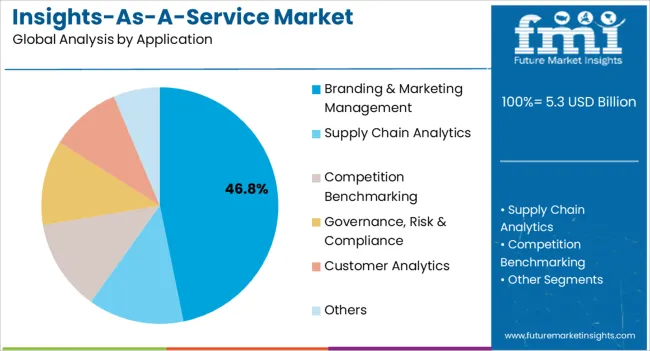

The branding and marketing management application segment is expected to account for 46.80% of total revenue by 2025 under the application category, making it the most prominent use case. This is driven by the increasing need for consumer behavior analysis, personalized marketing campaigns, and brand positioning strategies based on data backed insights.

Enterprises are utilizing analytics to measure campaign effectiveness, optimize customer journeys, and improve return on marketing investments. Real time insights are empowering businesses to predict customer needs and enhance engagement across multiple digital touchpoints.

As companies prioritize data centric marketing strategies to remain competitive, branding and marketing management has emerged as the leading application area within the market.

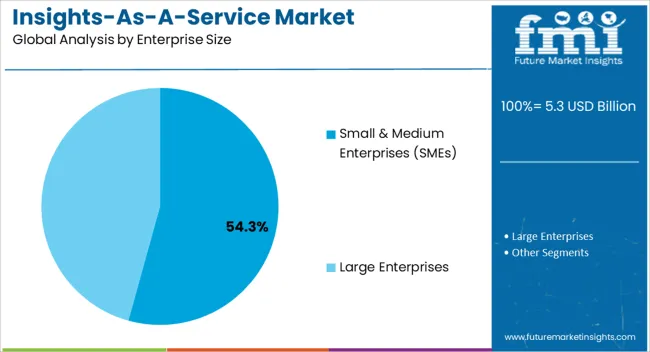

The small and medium enterprises segment is projected to capture 54.30% of total market revenue by 2025 within the enterprise size category, positioning it as the largest segment. This dominance is due to the rising adoption of cloud based analytics platforms by SMEs seeking affordable and scalable solutions to enhance competitiveness.

Limited resources and budget constraints have driven SMEs to opt for insights as a service models that eliminate the need for heavy infrastructure investments. These enterprises are increasingly relying on insights to optimize operations, improve customer engagement, and make faster business decisions.

As digital transformation accelerates within the SME landscape, adoption of insights as a service is expected to grow further, reinforcing their position as the leading enterprise size segment.

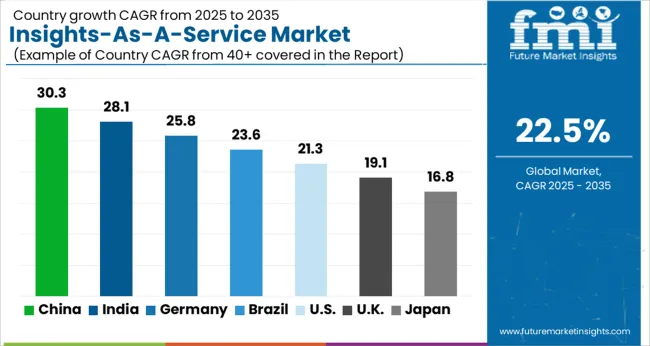

The global market for the insights-as-a-service market has grown at the rate of 21.4% from 2020 to 2025. Increasing the focus of businesses to scale up to achieve their business goals will result in higher prospects for growth.

A focus on improving customer lifecycle management among SMEs and large enterprises will result in increasing the application of insights-as-a-service across organizations.

FMI identifies Europe, followed by North America, as the leading market. Expansion in Europe is supported by the region’s developed infrastructure that encourages the adoption of advanced technologies such as the Internet of Things (IoT), artificial intelligence (AI), and machine learning (ML) in data analytics. Driven by these factors, the global market is projected to reach a valuation of USD 29,911 million by 2035, rising at a CAGR of 23.5%.

Cloud services and digital transformation help companies to increase agility, improve efficiencies and ROI, and curb unnecessary expenses in small and mid-sized enterprises.

The adoption of insights-as-a-service burgeoned as remote working became highly prevalent following the COVID-19 outbreak. This trend is expected to continue even as the pandemic passes, creating demand for remote and mobile access applications, services, systems, and data both in the cloud and on premise.

In recent years, the growth of big data analytics has been significant. Insights-as-a-Service solutions provide insights to companies that help them to create unprecedented opportunities. It provides companies with predictive analytics and business intelligence with the help of company data such as stocks, financial data and results, keyword performance, employee details, and business process data.

Such insights help the company to increase the sales of products and services. It also uses different data types such as company data, usage data, and syndicated data, and provides insights on the ROI, and important decisions to be taken in the future. Therefore Insights-as-a-Service solutions help companies/SMEs to scale up to achieve their business goals in coming years fueling the demand for the insights-as-a-service platform.

The rise in the adoption of IoT technology across diverse industries is expected to drive the demand for insights-as-a-service. Insights-as-a-service is a cloud based service offered to companies, which helps them to increase their ROI. Demand for insights-as-a-service solutions is expected to increase as a result of the integration of advanced technologies such as 5G and 4G Internet across industries.

As per the New Eclipse Foundation’s IoT commercial adoption survey, about 40% of industry leaders responding to the survey say that their organizations are using IoT solutions, and 22 percent more plan to deploy IoT in the coming years.

In addition, IoT investment is expected to increase as 40 percent of organizations are planning to spend more on IoT solutions from 2025 to 2025. Rising adoption of IoT ultimately propels the demand for insights-as-a-service solutions in coming years.

IaaS is a cloud-mediated tool that interacts with a company and processes the data. It helps companies to provide insights and business intelligence in real time and figure out future steps. IaaS increases data prioritization from collected data and identifies challenges that need a company needs to overcome.

It focuses on the higher-level strategy and reduces the in-house cost which ultimately results in better decisions. IaaS provides the most effective path for the company to capture insights, which ultimately increases returns on all investments. Also, up-front cost of IaaS is lower as compared to traditional methods of data analysis. Owing to lower up-front costs and the high ROI of insights-as-a-service solutions, their demand is expected to rise.

The Indonesia market is expected to be one of the leading markets for insights-as-a-service and is anticipated to surge at a CAGR of 35% over the forecasted period.

As per the Indonesian Internet Service Providers Association (APJII) survey, the number of internet users has increased by 14.6%. Also, the internet penetration rate of the country has increased from 64.8% to 73.7%. Thus increasing the internet penetration rate in the country will augment the demand for the insights-as-a-service offering.

Government support also will emerge as a chief growth driver. For instance, in August 2024, the Indonesia government announced the allocation of USD2.1 billion budget for Information and Communication Technology (ICT) development to accelerate the digital transformation.

Insights-as-a-service solutions are cloud based and the cloud is directly dependent on the availability of the infrastructure for internet connectivity. Thus, favorable initiatives adopted by the government are expected to fuel the demand for the insights-as-a-service in the country.

Currently, the United States market accounts for the largest consumption of insights-as-a-service in North America and is expected to expand at a CAGR of around 23%.

Demand for insights-as-a-service is increasing in the United States due to factors such as increasing adoption of advanced technology like IoT, use of AI and ML in data analytics, and increasing investment in insights-as-a-service in the region. The United States has also developed infrastructure for the cloud based solutions.

The United States has a presence in major tech companies such as C3, AWS, and Google which promotes their products and analytics toolsets. These vendors offer cloud based solutions or services which help SMEs to grow at a significant rate. Thus rapid-adoption of cloud computing solutions in almost every sector ultimately fuels the demand for the insights-as-a-service offering.

Stringent rules and regulations of the United States government to develop ICT propels the demand for insights-as-a-service in the country. In June 2020, according to the United States Federal Cloud Computing Strategy, the government instituted the CloudFirst policy to accelerate the pace of cloud adoption. It also promotes the innovation, service management, and adoption of emerging advanced technologies. Such initiatives taken by the United States government are developing advanced technologies that fuel the demand for insights-as-a-service.

The German market accounts for the largest consumption of insights-as-a-service in Europe and is expected to expand at a CAGR of around 27% by 2035.

Germany has been forecast to register high adoption of advanced telecommunication infrastructure and technological innovations. This trend is more prevalent across large telecom companies in the country. Germany has developed infrastructure for the adoption of new technologies such as Artificial Intelligence (AI), Machine Learning (ML), and other digital technologies that are pushing the frontier of applications in the private, public, and social sectors in Germany. This in turn is driving the demand for insights-as-a-service solutions.

The segment insights-as-a-Service Platforms accounted for a market share of around 58.1% in 2025, owing to reasons such as the increase in adoption of IoT technology by many industries is expected to drive the demand for the insights-as-a-service market.

The customer analytics segment accounted for a market share of around 27.1% in 2025 owing to the emergence of new vendors in insights-as-a-service and the investment in cloud based offerings by the key vendors in recent years.

The use of insights-as-a-service solutions in industries such as business, finance, retail, media, and telecommunications has increased in recent years. As per the study, the investments towards other cloud-based and insights-as-a-service offerings are expected to increase wing to stringent government rules and regulations to promote start-ups in developed as well as developing countries.

Thus the emergence of new vendors and increasing investment in cloud based offerings by key players is expected to fuel the demand for insights-as-s-service solutions.

The large enterprises' segment is expected to contribute a maximum revenue share of 71.6% in the global demand for insights-as-s-Service in 2025.

IaaS provides the most effective path for the company to capture insights it ultimately increases the returns on all investments. In addition, up-front cost of IaaS is lower as compared to traditional methods of data analysis.

Thus owing to lower up-front cost and high ROI of insights-as-a-service solutions fuels the demand for insights-as-s-service in the large enterprise's segment.

The BFSI segment accounts for the largest consumption of insights-as-a-service and is expected to expand at a CAGR of around 19.6%. The BFSI segment held a 19.7% share of the total market share of insights-as-a-service in 2025.

There are many key vendors across the globe that offers insights-as-a-service solutions to clients and it helps to increase their ROI and customer lifecycle management. In recent years, along with such key vendors the emergence of new vendors in insights-as-a-service solutions has been increased and it’s been one of the driving factors for the BFSI segment.

Many key cloud-based service suppliers are inclined at investing heavily in innovation, research, and development practices to uncover increased applications of insights-as-a-service. With the use of technology, players are also focusing on ensuring safety, quality, and customer satisfaction for captivating an increased customer base.

| Attribute | Details |

|---|---|

| Market Value in 2025 | USD 5.3 billion |

| Market Value in 2035 | USD 40.4 billion |

| Market CAGR 2025 to 2035 | 22.5% |

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2025 |

| Market Analysis | USD Million for Value |

| Key regions covered | north america; latin america; europe; east asia; south asia; oceania; middle east & africa |

| Key countries covered | united states, canada, germany, united kingdom, france, italy, spain, india, indonesia, singapore, thailand, china, japan, south korea, australia, new zealand, gcc countries, south africa, israel |

| Key market segments covered | solution, application, enterprise size, industry, region |

| Key companies profiled | capgemini; gooddata; gavs technologies; oracle corporation; ibm corporation; accenture; crediwatch; civica; analytics wise; deloitte; thinkbridge software; totango; 9lenses; jbara; actico gmbh |

| Customization & Pricing | Available upon request |

The global insights-as-a-service market is estimated to be valued at USD 5.3 billion in 2025.

The market size for the insights-as-a-service market is projected to reach USD 40.4 billion by 2035.

The insights-as-a-service market is expected to grow at a 22.5% CAGR between 2025 and 2035.

The key product types in insights-as-a-service market are insights-as-a-service platform (saas-based), services, _consulting & advisory, _implementation & integration and _support & maintenance.

In terms of application, branding & marketing management segment to command 46.8% share in the insights-as-a-service market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA