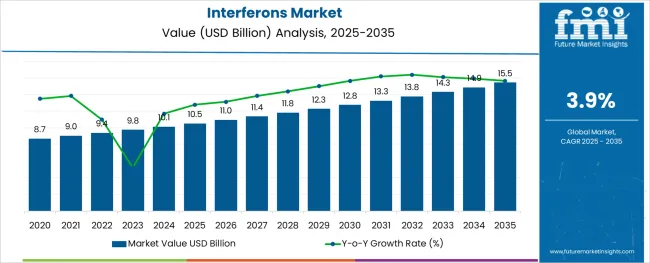

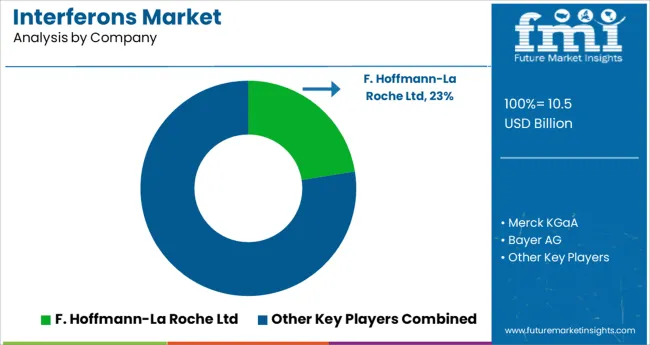

The Interferons Market is estimated to be valued at USD 10.5 billion in 2025 and is projected to reach USD 15.5 billion by 2035, registering a compound annual growth rate (CAGR) of 3.9% over the forecast period.

The interferons market is progressing steadily, driven by ongoing demand for effective immunomodulatory therapies in chronic diseases. Clinical insights have highlighted the increasing prevalence of autoimmune disorders, which has heightened the need for therapies that regulate immune system activity. Advances in biotechnology have enhanced the efficacy and safety profiles of interferon products, making them a key option in disease management.

Healthcare providers have expanded access to interferon treatments through hospital pharmacies, ensuring consistent supply and patient adherence. The market has benefited from increased diagnosis rates and earlier intervention, especially in neurological and viral conditions.

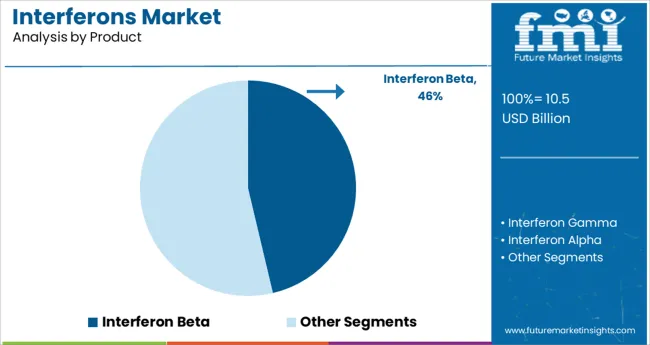

Future growth is expected as therapeutic pipelines advance and treatment guidelines evolve to include interferons in combination therapies. Segmental growth is led by interferon beta products, particularly for multiple sclerosis treatment, with hospital pharmacies as the primary distribution channel.

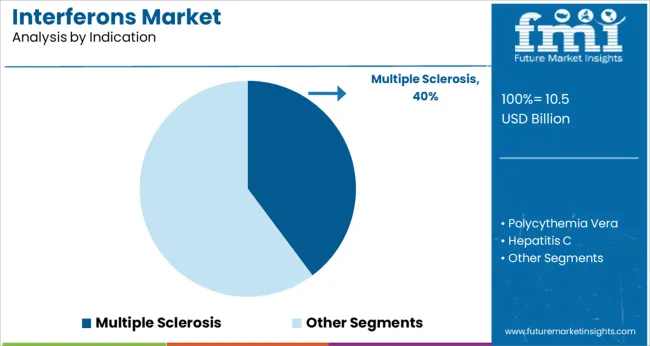

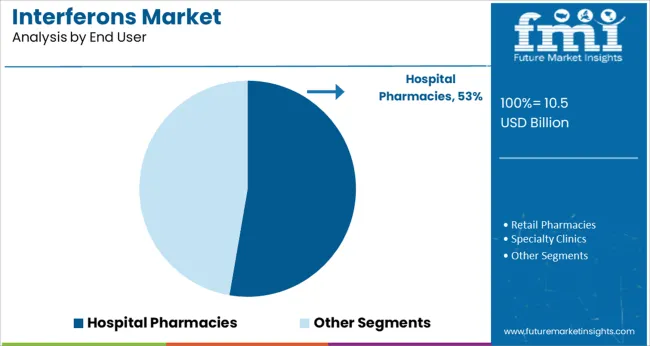

The market is segmented by Product, Indication, and End User and region. By Product, the market is divided into Interferon Beta, Interferon Gamma, and Interferon Alpha. In terms of Indication, the market is classified into Multiple Sclerosis, Polycythemia Vera, Hepatitis C, Melanoma, Chronic Granulomatous Disease (CGD), and Other Indications. Based on End User, the market is segmented into Hospital Pharmacies, Retail Pharmacies, Specialty Clinics, and Online Pharmacies. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The Interferon Beta segment is expected to hold 46.3% of the interferons market revenue in 2025, maintaining its position as the dominant product category. This growth is fueled by its established role in managing multiple sclerosis, where it helps modulate the immune response to reduce relapse rates and disease progression.

The segment has benefited from clinical validation and widespread physician acceptance due to consistent efficacy and safety data. Furthermore, interferon beta formulations have evolved with improved delivery methods and reduced side effects, enhancing patient compliance.

Its use in other autoimmune and viral conditions also supports market demand. The Interferon Beta segment continues to be a cornerstone in immunotherapy, contributing significantly to market revenues.

The Multiple Sclerosis segment is projected to contribute 39.8% of the interferons market revenue in 2025, reflecting its leading role among indications. The increasing prevalence of multiple sclerosis worldwide has driven demand for effective disease-modifying therapies like interferons.

Improved diagnostic techniques have led to earlier detection and treatment initiation, improving patient outcomes and increasing therapy duration. Clinical guidelines frequently recommend interferon beta as a first-line treatment, further solidifying its role.

The chronic nature of multiple sclerosis necessitates ongoing treatment, ensuring steady demand. As awareness and diagnosis improve globally, the Multiple Sclerosis segment is expected to sustain growth in the interferons market.

The Hospital Pharmacies segment is expected to account for 52.7% of the interferons market revenue in 2025, securing its position as the dominant end user. Hospitals play a crucial role in dispensing interferon therapies due to the need for controlled administration, monitoring, and patient support.

The segment benefits from hospital infrastructure that facilitates safe handling and storage of biologic drugs. Additionally, hospital pharmacies ensure reliable access to interferon products and provide healthcare professionals with resources for patient education.

The trend toward hospital-centric treatment models, especially for chronic and complex diseases, supports the segment's leading market share. With increasing hospital-based treatment programs, the Hospital Pharmacies segment is anticipated to maintain its significance.

Interferon-beta is a naturally occurring protein that regulates the body's antiviral responses. The rising number of approvals of interferon-beta by organizations such as the Medicines and Healthcare Products Regulatory Agency (MHRA) and the Health Research Authority (HRA) is anticipated to spur growth. SNG001, for instance, is an interferon-beta-1a inhalation formulation that is nebulized directly into the lungs.

In addition, the increasing prevalence of various chronic diseases such as hepatitis B, hepatitis C, cancer, and multiple sclerosis in both developed and developing countries is expected to augment the market. More than fifteen human interferons are already available in the market and the number is expected to rise in the upcoming decade.

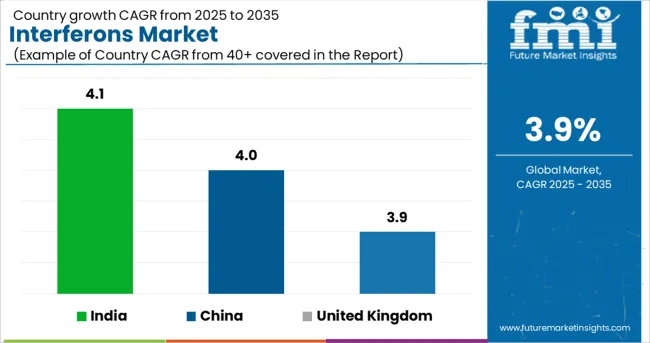

Owing to the aforementioned factors, the global interferons market is set to grow at a CAGR of 3.9% from 2025 to 2035.

As therapy with biologics is expensive, it is imposing significant financial pressure on the healthcare system globally. The increasing prevalence of cancer, hepatitis, and multiple sclerosis is creating a new opportunity for key players to assess biosimilar clinical applications.

On account of this, several pharmaceutical companies are developing interferon biosimilar medications to compete with or replace the original products, as well as more expensive brands. Increasing investments in Research and Development and ongoing advancements in technology are some of the other factors contributing to growth in the global interferons market.

The development process of interferons is more expensive than chemically-derived small molecules. Also, it involves higher operating costs and requires a larger capital investment. It is attributed to the need for premium-quality manufacturing techniques as biological medications are more complicated than small molecules.

Companies must submit in-depth information to prove the safety and effectiveness of biologics in pre-clinical and clinical studies in order to get approvals. Consequently, biologics licensing is a high cost incurring and time-consuming process, which may hamper growth.

Due to significant Research and Development costs and a lengthy testing and manufacturing process, marketed pharmaceuticals would be priced far higher than actual manufacturing costs. Therefore, demand for interferons may decline during the forecast period from 2025 to 2035.

High Prevalence of Cancer to Push Growth in the USA

The USA rules the North American interferons market and it generated a share of about 92.8% in 2024. The rising prevalence of cancer and hepatitis in the USA is one of the most significant factors that would foster growth in the country.

As per the Centers for Disease Control and Prevention (CDC), nearly 1,752,735 new cancer cases were reported in the USA in 2020 and about 599,589 people died of the disease in the same year. Thus, rising government support to healthcare facilities in terms of funding is expected to propel Research and Development activities in the USA for the launch of unique interferons.

Rapid Acceptance of Human Interferons to Augment Growth

The United Kingdom is set to exhibit a CAGR of nearly 3.9% in the Europe interferons market during the forecast period. Government initiatives to increase healthcare expenditure and acceptance of interferon therapy in the country are likely to boost the market during the evaluation period from 2025 to 2035.

Ongoing Trials to Develop Interferon Biosimilar Medications to Aid Growth

China held nearly 43.4% share in the East Asia interferons market in 2024 and is projected to grow at a CAGR of 4.0% during the forecast period. Growth is attributed to the increasing number of HCV cases in the country, which have been identified as a result of ongoing trials on various pharmacological candidates, including interferons.

Growing healthcare expenditure and rapid development of medical infrastructure are likely to propel market expansion in China over the next few years.

Manufacturers Are Developing Nebulized Products for TB Screening

India generated around 45.3% of the share in the South Asia interferons market in 2024 and is projected to showcase a CAGR of 4.1% during the forecast period. Growth is primarily attributed to surging awareness of the availability of advanced treatment options, including interferons among patients.

The ongoing development of relatively low-cost interferon-gamma release assays for latent tuberculosis infection screening is expected to drive the Indian market. These assays are set to be widely adopted in low- and middle-income parts of India.

Interferon-Beta to Gain Impetus with Usage in Multiple Sclerosis Treatment

By product, the interferon beta segment held a share of around 47.2% in 2024 in the global interferons market. Interferon beta therapy is widely adopted for indications and management of multiple sclerosis, which would propel its demand. Also, such therapies have proven to be effective in the management of the disease.

Patients of Multiple Sclerosis to Opt for Orally Administered Drugs

Based on indication, the multiple sclerosis segment held nearly 35.0% of the global interferons market share in 2024 and is expected to remain at the forefront throughout the forthcoming years. Rapid advancements in novel orally administered drugs approved for the treatment of multiple sclerosis are set to create new growth opportunities for key players in the market.

Hospital Pharmacies to Push Demand for Biologics

In terms of end use, the hospital pharmacies segment generated around 43.5% of the global interferons market share in 2024. Hospital pharmacies are considered to be the most lucrative segment in terms of dispensing prescribed medications and consumables to patients.

Several medicinal administrations require the presence of a trained physician. Therefore, a hospital setting is expected to gain traction in terms of sales and adoption of medicinal compounds by consumers.

Key players in the global interferons market are focusing on collaborations, geographic expansions, and improvement of their product offerings to gain a competitive edge. These strategies will help market players to enhance product portfolios and strengthen their presence worldwide.

Given below are a few examples of key industry developments by renowned manufacturers:

| Attribute | Details |

|---|---|

| Estimated Market Size (2024) | USD 10.5 Billion |

| Projected Market Valuation (2035) | USD 15.5 Billion |

| Value-based CAGR (2025 to 2035) | 3.9% |

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2024 |

| Market Analysis | million for Value |

| Key Regions Covered | North America; Latin America; Europe; South Asia; East Asia; Oceania; and the Middle East & Africa |

| Key Countries Covered | USA, Canada, Brazil, Mexico, Argentina, Germany, Italy, France, United Kingdom, Spain, BENELUX, Russia, China, Japan, South Korea, India, Thailand, Malaysia, Indonesia, Australia, New Zealand, GCC countries, Turkey, South Africa, and North Africa. |

| Key Market Segments Covered | Product, Indication, End User, and Region |

| Key Companies Profiled | Roche; Merck & Co.; Bristol-Myers Squibb; Biogen Inc.; Bayer AG; Zydus Cadila; Novartis AG; Pfizer Inc.; Biosidus; Synairgen; Nanogen; Amega Biotech; Rhein Minapharm Biogenetics; PROBIOMED; Schering-Plough Corporation; 3Sbio; F. Hoffmann La-Roche Ltd. |

The global interferons market is estimated to be valued at USD 10.5 billion in 2025.

It is projected to reach USD 15.5 billion by 2035.

The market is expected to grow at a 3.9% CAGR between 2025 and 2035.

The key product types are interferon beta, interferon gamma and interferon alpha.

multiple sclerosis segment is expected to dominate with a 39.8% industry share in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA