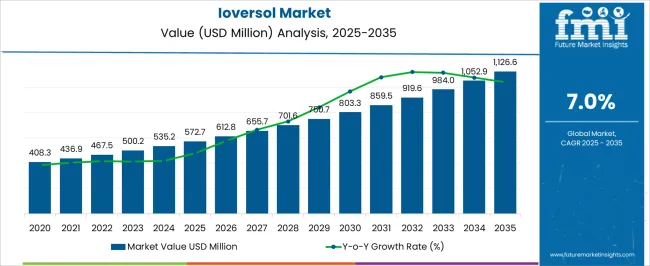

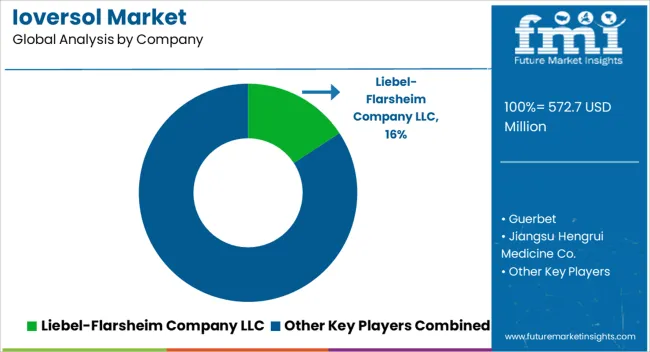

The Ioversol Market is estimated to be valued at USD 572.7 million in 2025 and is projected to reach USD 1126.6 million by 2035, registering a compound annual growth rate (CAGR) of 7.0% over the forecast period.

| Metric | Value |

|---|---|

| Ioversol Market Estimated Value in (2025 E) | USD 572.7 million |

| Ioversol Market Forecast Value in (2035 F) | USD 1126.6 million |

| Forecast CAGR (2025 to 2035) | 7.0% |

The Ioversol market is witnessing steady growth due to its widespread adoption as a non-ionic iodinated contrast agent for diagnostic imaging. Increasing demand in hospitals, diagnostic centers, and specialty clinics is being driven by the rising volume of imaging procedures, particularly in cardiovascular and neurological diagnostics. The safety profile and efficacy of Ioversol in enhancing image clarity without significant adverse reactions are supporting its continued preference among radiologists and clinicians.

Technological advancements in imaging modalities such as CT scans and angiography are further boosting demand, as high-quality contrast media are essential for accurate diagnosis. Growing awareness of early disease detection and increasing healthcare expenditure in both developed and emerging markets are also contributing to market expansion.

Additionally, regulatory approvals and enhancements in formulation stability are encouraging wider adoption in clinical practice As medical imaging becomes increasingly central to patient diagnosis and treatment planning, the Ioversol market is expected to maintain a strong growth trajectory, with opportunities for product innovations and expanded use across diverse imaging applications.

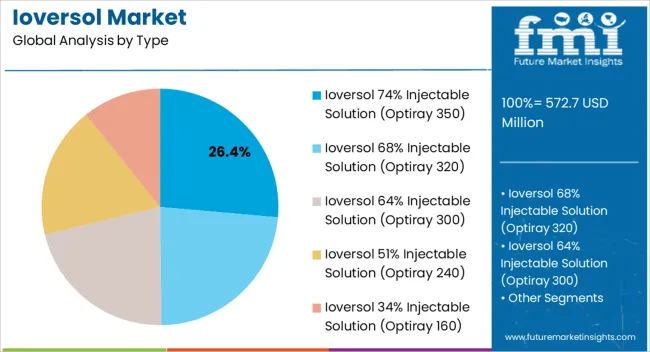

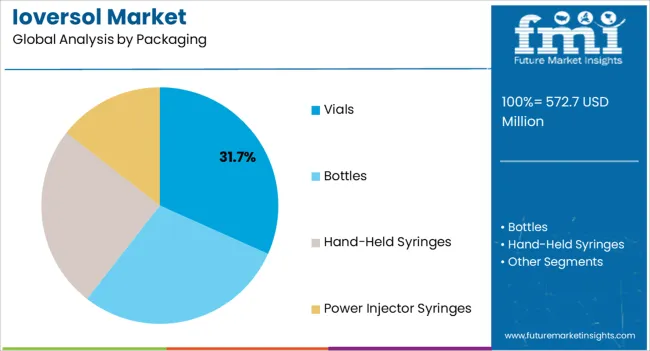

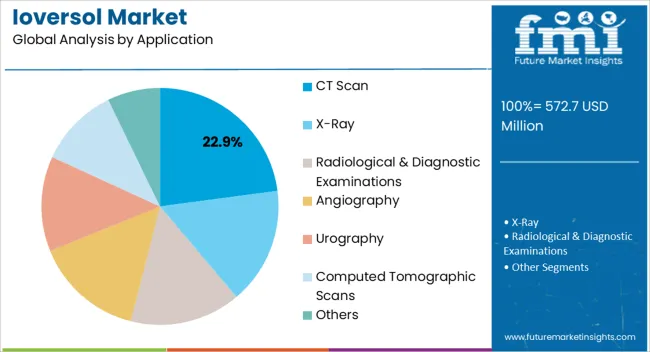

The ioversol market is segmented by type, packaging, application, and geographic regions. By type, ioversol market is divided into Ioversol 74% Injectable Solution (Optiray 350), Ioversol 68% Injectable Solution (Optiray 320), Ioversol 64% Injectable Solution (Optiray 300), Ioversol 51% Injectable Solution (Optiray 240), and Ioversol 34% Injectable Solution (Optiray 160). In terms of packaging, ioversol market is classified into Vials, Bottles, Hand-Held Syringes, and Power Injector Syringes. Based on application, ioversol market is segmented into CT Scan, X-Ray, Radiological & Diagnostic Examinations, Angiography, Urography, Computed Tomographic Scans, and Others. Regionally, the ioversol industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The Ioversol 74% injectable solution segment, represented by Optiray 350, is projected to hold 26.4% of the market revenue share in 2025, making it the leading product type. Its dominance is driven by its optimized iodine concentration, which enhances image quality in radiographic procedures while minimizing potential side effects. The solution’s non-ionic properties improve patient tolerance and reduce the risk of adverse reactions, making it a preferred choice in diagnostic imaging.

Its versatility across multiple imaging applications, coupled with ease of administration, supports widespread adoption in hospitals and imaging centers. The segment benefits from consistent demand due to standardization in imaging protocols and established clinical preference, which also ensures steady supply and distribution.

Technological improvements in formulation and storage stability have further reinforced confidence among healthcare providers As the volume of diagnostic imaging procedures continues to rise globally, this injectable solution is expected to maintain its leadership position in the market.

The vials packaging segment is anticipated to capture 31.7% of the Ioversol market revenue share in 2025, establishing itself as the leading packaging format. This dominance is being driven by its convenience in storage, dosing flexibility, and compatibility with automated dispensing systems in hospitals and diagnostic facilities. Vials allow precise measurement of contrast agent per patient, which reduces waste and ensures cost-effectiveness, particularly in high-volume imaging centers.

The format is widely compatible with standard syringes and injector systems, facilitating ease of administration and operational efficiency. Growing adoption of outpatient imaging services and centralized radiology departments has further increased the demand for vial-based packaging.

Additionally, the ability to maintain sterility and stability of the injectable solution over extended periods supports the segment’s market leadership As healthcare facilities continue to optimize imaging workflows and reduce operational overheads, vials are expected to remain the preferred packaging format for Ioversol.

The CT scan application segment is projected to account for 22.9% of the Ioversol market revenue share in 2025, positioning it as the leading application. Its growth is being driven by the increasing volume of CT imaging procedures performed globally for diagnostic purposes, including vascular, neurological, and abdominal examinations. Ioversol enhances image resolution and contrast, enabling accurate detection of pathologies while maintaining patient safety.

The segment benefits from the rising demand for non-invasive, rapid diagnostic procedures in both hospital and outpatient settings. Integration of advanced imaging technologies, including multi-slice and high-resolution CT systems, has further amplified the need for high-performance contrast agents. Growing awareness of early disease detection, alongside rising healthcare expenditure, particularly in developing markets, is supporting segment expansion.

Regulatory approvals for broader clinical use and enhancements in solution formulation also contribute to its leadership As CT scanning remains a cornerstone of modern diagnostic imaging, the use of Ioversol in this application is expected to sustain strong market growth.

Ioversol, a non-ionic radiographic contrast agent contains Iodine Which Absorbs X-rays and is a member of the group of drugs known as radiopaque contrast agents because of its unique property. During a CT scan or X-ray examination, Ioversol improves the visibility of blood vessels, non-bony tissues, and organs. Due to its distinctiveness and versatility, its usage in magnetic resonance imaging and ultrasonic scattering has increased. Intravenous (IV) Ioversol is injected into an artery or vein. Because it mixes well with water and provides the required imaging results, Ioversol is water-soluble.

It is specifically used in computed tomography, angiography, and urography for contrast enhancement. The chemical ioversol is used as a base for both contrast media and medicines. It is a white to off-white crystalline powder with a noticeable sulfurous odour. Ioversol becomes clear and colourless when it is turned into a solution. Ioversol is also used to treat, avoid, control, and enhance heart, blood vessel, and brain problems. Due to its widespread usage, the Ioversol market is anticipated to experience rising demand from consumers and clinics.

The expanding x-ray and imaging business is the key factor driving the Ioversol market. A contrast agent that absorbs x-rays and improves image clarity is required for a flawless x-ray. The main factors driving the Ioversol market are the increase in accidents, diseases, and difficulties associated with bone, and kidney-related issues. As a result, the market for ioversol is seeing growth due to the rise in the number of patients suffering from respiratory and heart illnesses. The global expansion of the healthcare infrastructure is also boosting the market for ioversol.

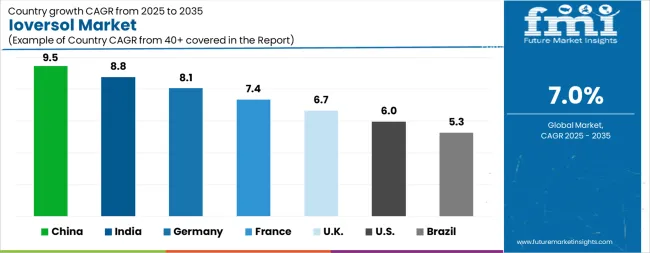

| Country | CAGR |

|---|---|

| China | 9.5% |

| India | 8.8% |

| Germany | 8.1% |

| France | 7.4% |

| UK | 6.7% |

| USA | 6.0% |

| Brazil | 5.3% |

The Ioversol Market is expected to register a CAGR of 7.0% during the forecast period, exhibiting varied country level momentum. China leads with the highest CAGR of 9.5%, followed by India at 8.8%. Developed markets such as Germany, France, and the UK continue to expand steadily, while the USA is likely to grow at consistent rates. Brazil posts the lowest CAGR at 5.3%, yet still underscores a broadly positive trajectory for the global Ioversol Market. In 2024, Germany held a dominant revenue in the Western Europe market and is expected to grow with a CAGR of 8.1%. The USA Ioversol Market is estimated to be valued at USD 204.2 million in 2025 and is anticipated to reach a valuation of USD 364.0 million by 2035. Sales are projected to rise at a CAGR of 6.0% over the forecast period between 2025 and 2035. While Japan and South Korea markets are estimated to be valued at USD 30.0 million and USD 16.7 million respectively in 2025.

| Item | Value |

|---|---|

| Quantitative Units | USD 572.7 Million |

| Type | Ioversol 74% Injectable Solution (Optiray 350), Ioversol 68% Injectable Solution (Optiray 320), Ioversol 64% Injectable Solution (Optiray 300), Ioversol 51% Injectable Solution (Optiray 240), and Ioversol 34% Injectable Solution (Optiray 160) |

| Packaging | Vials, Bottles, Hand-Held Syringes, and Power Injector Syringes |

| Application | CT Scan, X-Ray, Radiological & Diagnostic Examinations, Angiography, Urography, Computed Tomographic Scans, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Liebel-Flarsheim Company LLC, Guerbet, Jiangsu Hengrui Medicine Co., Mallinckrodt Pharmaceuticals, Ultraject, China Resources Pharmaceutical Co., HB Ocean, Changzhou Highassay Chemical Co., Ltd., Novalek Pharmaceuticals Pvt. Ltd, Stellence Pharmscience Pvt. Ltd., and A.S. Joshi & Company |

The global ioversol market is estimated to be valued at USD 572.7 million in 2025.

The market size for the ioversol market is projected to reach USD 1,126.6 million by 2035.

The ioversol market is expected to grow at a 7.0% CAGR between 2025 and 2035.

The key product types in ioversol market are ioversol 74% injectable solution (optiray 350), ioversol 68% injectable solution (optiray 320), ioversol 64% injectable solution (optiray 300), ioversol 51% injectable solution (optiray 240) and ioversol 34% injectable solution (optiray 160).

In terms of packaging, vials segment to command 31.7% share in the ioversol market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA