The global isomaltulose market is on track to grow steadily between the years 2025 and 2035 owing to demand for low-glycemic, functional sweeteners in various food and beverage applications. One sugar substitute growing in popularity is isomaltulose, a naturally derived ingredient that is slowly digested in the intestines, providing steady energy release and contributing to improved dental health.

Isomaltulose is gaining popularity as a healthier alternative to conventional sweeteners across industries including sports nutrition, functional foods and diabetic-friendly products. Elevation of metabolic health awareness among consumers and growing regulatory approvals for usage of isomaltulose in food formulations are among other factors expected to be surfacing in the industry to propel the market growth. Further, progress in food processing technologies and sustainable sourcing of ingredients are positioning to improve production efficiency and reliability of supply chains.

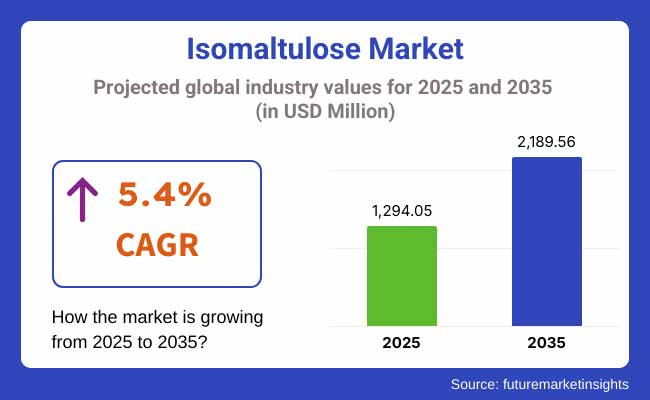

In 2025, the isomaltulose market was valued at approximately USD 1,294.05 million. By 2035, it is projected to reach USD 2,189.56 million, reflecting a compound annual growth rate (CAGR) of 5.4%. Market expansion is being fueled by the growing use of isomaltulose in infant nutrition, dairy products, and sugar-free confectionery. Additionally, the increasing prevalence of lifestyle diseases such as diabetes and obesity is prompting consumers to seek low-GI sugar substitutes, thereby driving demand.

The market is also benefiting from extensive R&D efforts focused on improving product stability, taste enhancement, and cost-effective production methods. Companies are strategically investing in expanding their production capabilities and forming partnerships with food manufacturers to integrate isomaltulose into a broader range of consumer products. Moreover, the rise in e-commerce platforms and health-conscious consumer preferences is creating lucrative opportunities for isomaltulose-based products globally.

In North America, isomaltulose is in high demand owing to consumer trends becoming more health-oriented, increasing diabetic population and demand for functional food ingredients. The growth in product launches of isomaltulose based energy drinks, meal replacements and dietary supplements in North America will contribute to the market growth in this region.

The region's strong regulatory framework favorable for the use of low-GI sweeteners in processed foods is driving more market development as well. Additionally, availability of major food and beverage companies investing in alternative sweeteners and a strong research and innovation base also support the North America isomaltulose market.

The demand for sugar replacements, stringent food safety regulations, and consumer preference for low-GI foods drive the European isomaltulose market. Isomaltulose-based products are primarily being used in confectionery, sports nutrition, and functional beverages in countries such as Germany, the UK, France, and Italy which are the leading root countries.

Finally, the growth of vegan and organic food movements in Europe is encouraging manufacturers to utilize isomaltulose as a natural, plant-based sweetener. That said, the market is also being held back by the rising adoption of sustainable ingredient sourcing and growths in investment in clean-label food product development.

A significant market isomaltulose is emerging in the Asia-Pacific region owing to increasing health-conscious consumers, changing food habits, and higher disposable income. China, Japan, South Korea, and India countries from where demands for bakery products, dairy applications, and low-GI beverages is growing, and thereby boosting the sales of isomaltulose in these markets.

Factors like dynamic food processing industry in the region and innovative trends of urbanization and consumer preferences, drives the regional market. In addition to that, the sugar reduction policy and strong focus of government towards healthy diet are undoubtedly paving the way for the usage of alternative sweeteners where it is complementing to the growth of the isomaltulose in Asia-Pacific.

According to the report published by Future Market Insights, the demand for isomaltulose is expected to witness steady growth in the coming decade due to rising consumer shift towards healthy sugar alternatives, technological advancements in food science, growing regulatory support. Continuous advancements in specific end-product applications, manufacturing processes, and distribution channels will contribute toward maintaining isomaltulose's foothold as a preferred functional sweetener globally.

Challenges

High Production Costs and Limited Raw Material Availability

There are also challenges to the growth of the Isomaltulose market; High production costs associated with the enzymatic conversion process and limited availability of raw materials could hamper growth. Isomaltulose is predominantly obtained from sucrose, involving complex fermentation and purification processes, resulting in high operating costs.

Supply chain dynamics that influence price fluctuations are also deeply impacted by the fluctuations in the production of both sugarcane and beet. In order to overcome these hurdles, manufacturers need to invest in different sources of sugars, enhance production efficiency, and focus on less expensive enzymatic processes.

Regulatory Hurdles and Market Awareness

Implementation of strict food safety regulations along with need for approved products in certain regions create obstacles for the Isomaltulose market. Global food production and distribution involve highly complex systems that must comply with global health standards, labeling requirements, and novel food regulations all of which can slow down time to market or expansion to global potential.

Additionally, consumers are also unaware of the usefulness of isomaltulose compared to other organic sweetening agents, which can restrict the fast uptake of isomaltulose. Solutions for these challenges could include regulatory consultations, consumer education campaigns, and partnerships with health organizations to position isomaltulose as a functionally advantageous component.

Opportunities

Rising Demand for Low-Glycemic and Functional Sweeteners

Rapidly rising incidence of diabetes and obesity disorders coupled with the growing demand for low-glycemic sweeteners is anticipated to boost growth on Isomaltulose market. Isomaltulose is a slowly digestible carbohydrate that provides steady energy over an extended period of time without causing large increases in blood sugar levels, making it suitable for diabetic-friendly and Sports nutrition applications (due to its glycemic index of around 32, which is lower than traditional sugars).

Health needs to improve the better alternative conditions trend dripping towards the dietary deli will allow the manufacturers which emphasize on the metabolic advantages of isomaltulose in functional foods as well as in beverages and nutritional supplements to achieve the competitive market edge.

Expanding Applications in Sports Nutrition and Functional Beverages

Isomaltulose has a range of applications with the demand from a growing sports nutrition industry and the increasing popularity of functional beverages. Unlike high-fructose and artificial sweeteners, isomaltulose enables athletes and health-conscious individuals to boost endurance, cognitive function and energy management.

As brands are doubling down on natural and performance-boosting ingredients, its use in energy drinks, protein bars, and fortified foods is on the rise. Investments in product diversification, strategic partnerships, and targeted marketing are expected to benefit companies as demand for functional sweeteners continues to expand.

The isomaltulose market is expected to see moderate growth from 2020 to 2024, due to rising health consciousness, regulatory approvals, and ongoing product innovations in functional foods. However, the market was limited by high production costs, low consumer awareness, and supply chain issues. In response, firms focused on mentoring and optimizing fermentation occasions, allocating resources to research, and improving distribution outlet channels to facilitate market accessibility.

2025 to 2035: The market will experience advancements in biotechnological production, plant-based sugar alternatives, and personalized nutrition. AI-Enabled Consumer Insight Leading to Personalized Formulations: Moreover, eco-responsible packaging and carbon-neutral production are also being adopted through sustainability initiatives, which will dictate the market dynamics. Fuelling further isomaltulose market growth will be companies that not only embrace digital marketing but also study dietary trends and develop clean-label formulations.

Market Shifts: A Comparative Analysis (2020 to 2024 vs. 2025 to 2035)

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Compliance with food safety and novel ingredient regulations |

| Technological Advancements | Improvements in enzymatic conversion and purification processes |

| Industry Adoption | Growth in diabetic-friendly and sports nutrition products |

| Supply Chain and Sourcing | Dependence on sugarcane and beet-based sucrose |

| Market Competition | Presence of established functional sweetener manufacturers |

| Market Growth Drivers | Rising demand for low-glycemic and natural sweeteners |

| Sustainability and Energy Efficiency | Initial exploration of eco-friendly packaging and production methods |

| Integration of Smart Monitoring | Limited digital tools in production and distribution |

| Advancements in Product Innovation | Development of isomaltulose-based energy drinks and snacks |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Harmonization of global standards and fast-track approvals for functional sweeteners |

| Technological Advancements | Adoption of AI-driven production optimization and sustainable sugar extraction methods |

| Industry Adoption | Expansion into personalized nutrition, meal replacements, and clean-label formulations |

| Supply Chain and Sourcing | Exploration of alternative sugar sources and climate-resilient crop varieties |

| Market Competition | Entry of biotech startups and sustainability-focused ingredient producers |

| Market Growth Drivers | Increasing focus on metabolic health, gut-friendly sugars, and cognitive performance |

| Sustainability and Energy Efficiency | Large-scale adoption of carbon-neutral production and regenerative agriculture |

| Integration of Smart Monitoring | AI-powered supply chain tracking, real-time quality monitoring, and predictive analytics |

| Advancements in Product Innovation | Smart nutritional solutions, customizable sweetener blends, and bio fortified sweeteners |

Rising health consciousness and growing demand for low-glycemic index sweeteners are key factors driving growth of the isomaltulose market in the United States. Isomaltulose is being increasingly utilized in functional foods, beverages, and sports nutrition products, which is driving the market growth.

Thus, manufacturers are investing in research & development in order to launch innovative formulations catering to the diabetic & weight vascular individuals. Additionally, the incorporation of isomaltulose by several major food and beverage companies as an alternative sweetener is reinforcing the solid growth of the market. Also, the trend of clean-label and natural ingredients is supporting the rising demand of isomaltulose in the USA market.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 5.6% |

The isomaltulose market in the United Kingdom is growing on account of increasing consumer awareness about sugar substitutes and their advantages in managing blood sugar dosage. The increasing utilization of functional food and beverages, especially in the sphere of fitness and wellness is aiding market growth in this space.

Government regulations mandating sugar reduction in processed foods and beverages have encouraged manufacturers to use isomaltulose as a better substitute. In addition, the transition towards using plant-based and naturally derived components is increasing the attractiveness of isomaltulose with health-consumed customers.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 5.3% |

Increasing focus on healthier diet among consumers, has been responsible for increasing EU market for isomaltulose. Thus, European countries like Germany, France, and Italy are leading the market growth due to increasing cases of obesity and diabetes disorders.

Additionally, increasing regulatory support for sugar alternatives and continuous innovations in food processing technologies is supporting the adoption of isomaltulose. Moving to the functional food and nutraceutical space, where the major applications are energy drinks, meal replacement, and dietary supplements.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 5.5% |

Japan’s isomaltulose market is driven by the growing health-conscious population and mature functional foods and beverages industry of the country. The growing use of sugar substitutes in traditional and modern food products is contributing to market growth.

Japanese customers are particularly conscientious of gut wellness and late vitality discharge alleviate, settling on isomaltulose an ideal food formulation. Technological advancements in the food sector are fuelling the use of isomaltulose in a variety of products, such as confectionery, dairy alternatives and sports drinks.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 5.7% |

The isomaltulose market in South Korea is growing because of the increasing knowledge of sugar alternatives and their effect on metabolic health. In addition, the growing focus on wellness on a global scale, as well as the growing demand for functional foods, are further propelling the market growth.

The presence of key food and beverage companies investing in strategies aimed at reducing sugar consumption is also supporting the uptake of isomaltulose. Furthermore, the emphasis on natural, non-GMO components resonates with the changing consumer trends within the country.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 5.8% |

The isomaltulose market is undergoing rapid expansion as consumers consistently favor slow-digesting, low-glycemic carbohydrates that sustainably deliver energy and improve metabolic health. On the basis of grade, the market is divided into food-grade isomaltulose and pharma-grade isomaltulose.

Low Glycemic Index foods are highly demanded in the market place which leads to the demand for isomaltulose food grade that provides good amount of energy as a slow release in the body and the energy boost released could be utilized by the body after exercise and regain slowly which leads to high utilization ratio of isomaltulose food-grade in functional food, confectionery and beverages.

In contrast, pharmaceutical-grade isomaltulose is increasingly being used under nutraceuticals and medicines formulations category, particularly diabetic-friendly and energy boosting supplements. A shift towards health-centric dietary consumption habits as well as a rising prevalence of lifestyle diseases including diabetes and obesity are expected to propel the market growth.

The manufacturers are also focusing towards production capacities, supply chain optimization and product formulations to sustain the demand from health conscious consumers, pharmaceutical players and sports nutrition sector.

This isomaltulose market has been segmented on the basis of its end-use, which includes confectionery, bakery products, dairy, frozen desserts, beverages, and pharmaceuticals. Isomaltulose serves as a healthier alternative to conventional sweeteners and therefore is widely used in chewing gums, hard candy, soft candy, gummies, and chocolates in confectionery.

Its unique properties make an excellent addition to texture, flavor and shelf stability, leading it to be a weapon of choice in sugar-free and functional confectionery product applications. Also, the need for isomaltulose-based sugar substitutes in chocolates and baked items has increased as consumers emphasize low-calorie and low-glycemic food products.

For use in bakery products and breakfast cereals, isomaltulose is appreciated for its slow energy release, well-suited for sports nutrition and health-oriented consumers. Isomaltulose has found its ground in the dairy and frozen desserts segment as well with its low glycemic response that makes it a healthy alternative for lactose-intolerant and diabetic customers. With an increasing demand for functional foods that promote these factors, isomaltulose is emerging as an important ingredient in clean-label product innovations.

Applications of isomaltulose in the beverage industry include fruit and malt beverages, powder-based drinks, and carbonated beverages, where it is regarded as a natural alternative to high-glycemic table sugars, allowing for a slow release of energy and no sudden increases in blood sugar levels. This has driven its use in sports drinks, protein shakes and functional beverages, where sustained energy release and improved metabolic response are two key factors.

Then, also due to its non-carcinogenic characteristics, isomaltulose is being adopted in fluoridated salt, as well as in table-top sweeteners and spoon-for-spoon sugar substitutes for diabetic and weight-management formulations. The surging demand for polyols, intense sweeteners, and noncarcinogenic sweetener is propelling applications of isomaltulose in health-oriented food innovations.

Another trend shaping the market for natural sweeteners are new combinations of functional ingredients, with companies developing hybrid formulations by combining isomaltulose with stevia, monk fruit, or erythritol to promote health benefits and consumer acceptance.

Rising demand for low-glycemic and functional sweeteners in food and beverage, as well as an increasing presence of isomaltulose in dietary supplements are numerous market drivers. Product innovation, sustainable sourcing, and advanced manufacturing techniques are enabling companies to improve product quality and respond to changing consumer preferences.

Constant product launches and regulatory approvals have impacted isomaltulose application, catering to its demand in the sports nutrition market and functional, diabetic-friendly foods. Furthermore, increased awareness among end-users about the health benefits of isomaltulose is driving market growth, and this in turn is encouraging manufacturers to invest in R&D activities in order to develop advanced formulations depending on the consumer demand and to increase their production efficiency.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| BENEO GmbH | 28-32% |

| Cargill, Inc. | 18-22% |

| Sudzucker AG | 14-18% |

| Matsutani Chemical Industry | 10-14% |

| Other Companies (combined) | 24-30% |

| Company Name | Key Offerings/Activities |

|---|---|

| BENEO GmbH | Leading provider of isomaltulose derived from sugar beets with applications in functional foods and sports nutrition. |

| Cargill, Inc. | Develops innovative isomaltulose-based sweeteners catering to health-conscious consumers and diabetic-friendly products. |

| Sudzucker AG | Specializes in high-quality isomaltulose solutions for bakery, confectionery, and beverage applications. |

| Matsutani Chemical Industry | Focuses on advanced carbohydrate formulations, including isomaltulose, for enhanced nutritional benefits and product stability. |

Key Company Insights

BENEO GmbH (28-32%)

BENEO GmbH is a key player in isomaltulose which utilizes its expertise in sugar beet processing and has strong in functional ingredient development. Based on sustainable production methods, it guarantees high-purity isomaltulose for health-conscious consumers.

BENEO is focusing on the sports nutrition and infant food sectors with the introduction of isomaltulose, where its slow energy release and high digestive tolerance deliver tremendous benefits, allowing the company to grow its application portfolio even further. A commitment to ongoing investment in both scientific research & industry initiatives keeps BENEO at the forefront of innovation within the functional sweetener sector.

Cargill, Inc. (18-22%)

Key companies operating in the global isomaltulose market include Cargill, Inc. which is known for its product innovation and tailoring products to the food and beverage industry. With the incorporation of advanced processing technologies, the company has established unique manufacturing process that greatly improves production efficiency while ensuring top quality.

Cargill’s isomaltulose-based sweeteners are emerging in the diabetic-friendly and low-glycemic food market, an indication of the company’s efforts to meet consumer health concerns. Cargill is also making strides in the market by working closely with food manufacturers to create more customized sweetening solutions, thus expanding their footprint and kitty as a brand.

Sudzucker AG (14-18%)

Established players such as Sudzucker AG have a long experience in isomaltulose market with a background of its main core business sugar production and alternative sweeteners. We are a quality isomaltulose manufacturer focusing on high-quality isomaltulose formulations for bakery, confectionery, and functional beverage applications.

It has strong research and development initiatives that aim at providing more stability to products, along with enhancing their nutritional benefits. The company's strategic collaborations and expansion into developing markets also strengthen its foothold in the highly competitive ecosystem.

Matsutani Chemical Industry (10-14%)

Matsutani Chemical Industry is a prominent player in the isomaltulose market, as a company focused on research-centric capabilities to develop innovation and technical understanding about carbohydrate formulation. It makes functional ingredients made with isomaltulose that suit a health-conscious diet such as with functional foods and drinks.

Matsutani’s dedication to sustainably sourced ingredients and innovative processing capabilities are what allow for the range of their high-end sweeteners, as well as their fresh taste and functional attributes. Matsutani aims to increase its share in the global market by strengthening its distribution network and pursuing joint ventures.

Other Key Players (24-30% Combined)

Several regional and multinational companies contribute to the growing isomaltulose market, focusing on innovation, sustainability, and product differentiation. Key players in this segment include:

The competitive landscape of the isomaltulose market is shaped by strategic expansions, product innovations, and increased investment in research and development. With rising consumer awareness and demand for healthier sweetener alternatives, market players are continuously enhancing their product offerings to capture a larger market share.

The overall market size for isomaltulose market was USD 1,294.05 million in 2025.

The isomaltulose market expected to reach USD 2,189.56 million in 2035.

The demand for the isomaltulose market will be driven by increasing consumer preference for low-glycemic and slow-digesting sweeteners, rising demand for healthier sugar alternatives in functional foods and beverages, growing adoption in sports nutrition, and expanding applications in diabetes-friendly and weight management products.

The top 5 countries which drives the development of isomaltulose market are USA, UK, Europe Union, Japan and South Korea.

Expanding end-use applications driving market growth to command significant share over the assessment period.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (MT) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Grade, 2018 to 2033

Table 4: Global Market Volume (MT) Forecast by Grade, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 6: Global Market Volume (MT) Forecast by End Use, 2018 to 2033

Table 7: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 8: North America Market Volume (MT) Forecast by Country, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Grade, 2018 to 2033

Table 10: North America Market Volume (MT) Forecast by Grade, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 12: North America Market Volume (MT) Forecast by End Use, 2018 to 2033

Table 13: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 14: Latin America Market Volume (MT) Forecast by Country, 2018 to 2033

Table 15: Latin America Market Value (US$ Million) Forecast by Grade, 2018 to 2033

Table 16: Latin America Market Volume (MT) Forecast by Grade, 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 18: Latin America Market Volume (MT) Forecast by End Use, 2018 to 2033

Table 19: Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 20: Europe Market Volume (MT) Forecast by Country, 2018 to 2033

Table 21: Europe Market Value (US$ Million) Forecast by Grade, 2018 to 2033

Table 22: Europe Market Volume (MT) Forecast by Grade, 2018 to 2033

Table 23: Europe Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 24: Europe Market Volume (MT) Forecast by End Use, 2018 to 2033

Table 25: Asia Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Asia Pacific Market Volume (MT) Forecast by Country, 2018 to 2033

Table 27: Asia Pacific Market Value (US$ Million) Forecast by Grade, 2018 to 2033

Table 28: Asia Pacific Market Volume (MT) Forecast by Grade, 2018 to 2033

Table 29: Asia Pacific Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 30: Asia Pacific Market Volume (MT) Forecast by End Use, 2018 to 2033

Table 31: MEA Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 32: MEA Market Volume (MT) Forecast by Country, 2018 to 2033

Table 33: MEA Market Value (US$ Million) Forecast by Grade, 2018 to 2033

Table 34: MEA Market Volume (MT) Forecast by Grade, 2018 to 2033

Table 35: MEA Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 36: MEA Market Volume (MT) Forecast by End Use, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Grade, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by End Use, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 4: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 5: Global Market Volume (MT) Analysis by Region, 2018 to 2033

Figure 6: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 7: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 8: Global Market Value (US$ Million) Analysis by Grade, 2018 to 2033

Figure 9: Global Market Volume (MT) Analysis by Grade, 2018 to 2033

Figure 10: Global Market Value Share (%) and BPS Analysis by Grade, 2023 to 2033

Figure 11: Global Market Y-o-Y Growth (%) Projections by Grade, 2023 to 2033

Figure 12: Global Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 13: Global Market Volume (MT) Analysis by End Use, 2018 to 2033

Figure 14: Global Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 15: Global Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 16: Global Market Attractiveness by Grade, 2023 to 2033

Figure 17: Global Market Attractiveness by End Use, 2023 to 2033

Figure 18: Global Market Attractiveness by Region, 2023 to 2033

Figure 19: North America Market Value (US$ Million) by Grade, 2023 to 2033

Figure 20: North America Market Value (US$ Million) by End Use, 2023 to 2033

Figure 21: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 22: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 23: North America Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 24: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 25: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 26: North America Market Value (US$ Million) Analysis by Grade, 2018 to 2033

Figure 27: North America Market Volume (MT) Analysis by Grade, 2018 to 2033

Figure 28: North America Market Value Share (%) and BPS Analysis by Grade, 2023 to 2033

Figure 29: North America Market Y-o-Y Growth (%) Projections by Grade, 2023 to 2033

Figure 30: North America Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 31: North America Market Volume (MT) Analysis by End Use, 2018 to 2033

Figure 32: North America Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 33: North America Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 34: North America Market Attractiveness by Grade, 2023 to 2033

Figure 35: North America Market Attractiveness by End Use, 2023 to 2033

Figure 36: North America Market Attractiveness by Country, 2023 to 2033

Figure 37: Latin America Market Value (US$ Million) by Grade, 2023 to 2033

Figure 38: Latin America Market Value (US$ Million) by End Use, 2023 to 2033

Figure 39: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 40: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 41: Latin America Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 42: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 43: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 44: Latin America Market Value (US$ Million) Analysis by Grade, 2018 to 2033

Figure 45: Latin America Market Volume (MT) Analysis by Grade, 2018 to 2033

Figure 46: Latin America Market Value Share (%) and BPS Analysis by Grade, 2023 to 2033

Figure 47: Latin America Market Y-o-Y Growth (%) Projections by Grade, 2023 to 2033

Figure 48: Latin America Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 49: Latin America Market Volume (MT) Analysis by End Use, 2018 to 2033

Figure 50: Latin America Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 51: Latin America Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 52: Latin America Market Attractiveness by Grade, 2023 to 2033

Figure 53: Latin America Market Attractiveness by End Use, 2023 to 2033

Figure 54: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 55: Europe Market Value (US$ Million) by Grade, 2023 to 2033

Figure 56: Europe Market Value (US$ Million) by End Use, 2023 to 2033

Figure 57: Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 58: Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 59: Europe Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 60: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 61: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 62: Europe Market Value (US$ Million) Analysis by Grade, 2018 to 2033

Figure 63: Europe Market Volume (MT) Analysis by Grade, 2018 to 2033

Figure 64: Europe Market Value Share (%) and BPS Analysis by Grade, 2023 to 2033

Figure 65: Europe Market Y-o-Y Growth (%) Projections by Grade, 2023 to 2033

Figure 66: Europe Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 67: Europe Market Volume (MT) Analysis by End Use, 2018 to 2033

Figure 68: Europe Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 69: Europe Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 70: Europe Market Attractiveness by Grade, 2023 to 2033

Figure 71: Europe Market Attractiveness by End Use, 2023 to 2033

Figure 72: Europe Market Attractiveness by Country, 2023 to 2033

Figure 73: Asia Pacific Market Value (US$ Million) by Grade, 2023 to 2033

Figure 74: Asia Pacific Market Value (US$ Million) by End Use, 2023 to 2033

Figure 75: Asia Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 76: Asia Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 77: Asia Pacific Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 78: Asia Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 79: Asia Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 80: Asia Pacific Market Value (US$ Million) Analysis by Grade, 2018 to 2033

Figure 81: Asia Pacific Market Volume (MT) Analysis by Grade, 2018 to 2033

Figure 82: Asia Pacific Market Value Share (%) and BPS Analysis by Grade, 2023 to 2033

Figure 83: Asia Pacific Market Y-o-Y Growth (%) Projections by Grade, 2023 to 2033

Figure 84: Asia Pacific Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 85: Asia Pacific Market Volume (MT) Analysis by End Use, 2018 to 2033

Figure 86: Asia Pacific Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 87: Asia Pacific Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 88: Asia Pacific Market Attractiveness by Grade, 2023 to 2033

Figure 89: Asia Pacific Market Attractiveness by End Use, 2023 to 2033

Figure 90: Asia Pacific Market Attractiveness by Country, 2023 to 2033

Figure 91: MEA Market Value (US$ Million) by Grade, 2023 to 2033

Figure 92: MEA Market Value (US$ Million) by End Use, 2023 to 2033

Figure 93: MEA Market Value (US$ Million) by Country, 2023 to 2033

Figure 94: MEA Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 95: MEA Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 96: MEA Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 97: MEA Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 98: MEA Market Value (US$ Million) Analysis by Grade, 2018 to 2033

Figure 99: MEA Market Volume (MT) Analysis by Grade, 2018 to 2033

Figure 100: MEA Market Value Share (%) and BPS Analysis by Grade, 2023 to 2033

Figure 101: MEA Market Y-o-Y Growth (%) Projections by Grade, 2023 to 2033

Figure 102: MEA Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 103: MEA Market Volume (MT) Analysis by End Use, 2018 to 2033

Figure 104: MEA Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 105: MEA Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 106: MEA Market Attractiveness by Grade, 2023 to 2033

Figure 107: MEA Market Attractiveness by End Use, 2023 to 2033

Figure 108: MEA Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA