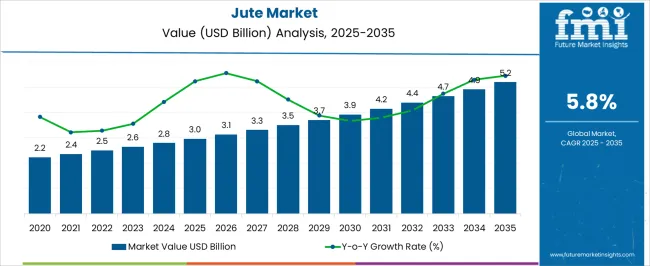

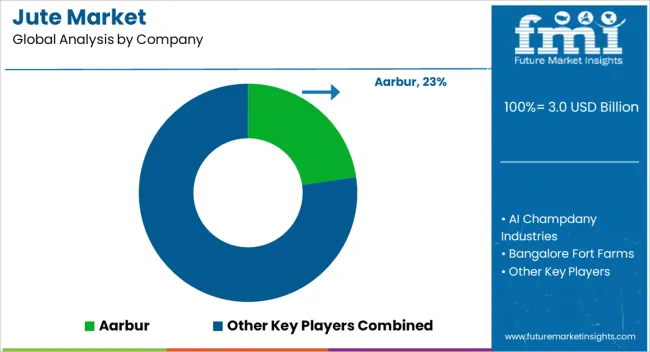

The jute market is estimated to be valued at USD 3.0 billion in 2025 and is projected to reach USD 5.2 billion by 2035, registering a compound annual growth rate (CAGR) of 5.8% over the forecast period.

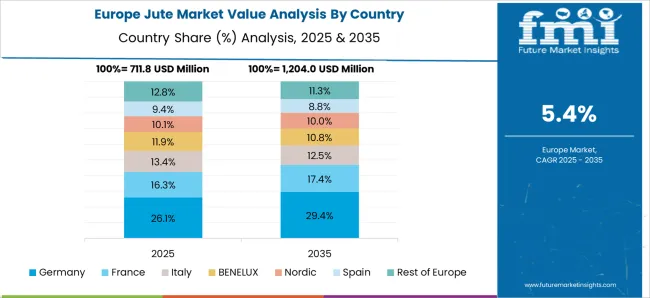

The jute market, estimated at USD 3.0 billion in 2025 and projected to reach USD 5.2 billion by 2035 with a CAGR of 5.8%, exhibits distinct regional growth imbalances driven by production capabilities, consumption patterns, and trade dynamics. Asia-Pacific dominates the market due to its strong cultivation base, particularly in countries such as India and Bangladesh, which are leading global producers and exporters of jute fibers. The region’s expansion is fueled by increasing applications in packaging, geotextiles, and eco-friendly products, contributing to steady annual growth from USD 3.0 billion in 2025 to approximately USD 3.9 billion by 2030, reflecting its continued technological improvements and government-backed initiatives for natural fiber utilization.

Europe demonstrates moderate growth, moving from an estimated USD 3.0 billion to about USD 4.2 billion by 2030 when regional consumption of jute-based sustainable products increases. The market expansion is supported by regulatory emphasis on eco-friendly packaging and circular economy policies, although the reliance on imports limits its rapid adoption compared with Asia-Pacific. North America shows comparatively slower growth, reaching around USD 4.4 billion by 2030, constrained by limited domestic production and the availability of alternative synthetic fibers. The market is highly concentrated in Asia-Pacific, with Europe gradually adopting jute applications, while North America lags behind, highlighting a persistent regional imbalance in growth, production, and consumption across the forecast period.

| Metric | Value |

|---|---|

| Jute Market Estimated Value in (2025 E) | USD 3.0 billion |

| Jute Market Forecast Value in (2035 F) | USD 5.2 billion |

| Forecast CAGR (2025 to 2035) | 5.8% |

The jute market represents a specialized segment within the global natural fibers and textile industry, emphasizing eco-friendly applications, durability, and versatility in industrial and consumer products. Within the broader natural fibers sector, it accounts for about 5.6%, driven by demand in packaging, sacks, and geotextiles. In the textile and nonwoven materials segment, it holds nearly 5.0%, reflecting adoption in rugs, carpets, home furnishings, and industrial fabrics. Across the biodegradable and sustainable packaging market, the share is 4.3%, supporting its role as an alternative to synthetic materials.

Within the agricultural and horticultural applications category, it represents 3.9%, highlighting use in erosion control, plant support, and soil reinforcement. In the composites and specialty materials sector, it secures 3.5%, emphasizing integration with polymers and building materials for enhanced mechanical properties. Recent developments in this market have focused on product diversification, eco-friendly applications, and performance improvement. Innovations include blending jute with other natural or synthetic fibers, surface treatments for water resistance, and development of lightweight, durable composites.

Key players are collaborating with packaging companies, textile manufacturers, and construction material producers to expand adoption and improve functional properties. Adoption of jute-based geotextiles, biodegradable bags, and reinforced composites is gaining traction to meet environmental regulations and consumer demand for sustainable alternatives. The research into enhanced fiber extraction techniques and value-added products is being deployed to improve quality, consistency, and market competitiveness. These trends demonstrate how sustainability, functional innovation, and application diversification are shaping the market.

The jute market is experiencing steady expansion due to growing global emphasis on sustainable materials and the replacement of synthetic fibers with biodegradable alternatives. Rising environmental concerns and regulatory restrictions on single use plastics have accelerated the adoption of jute across diverse industries.

Manufacturers are investing in innovative weaving techniques, value added finishes, and diversified product lines to enhance durability and aesthetic appeal. Additionally, the cost effectiveness and availability of jute in major producing countries are reinforcing its competitiveness in both domestic and international markets.

Demand is further supported by eco conscious consumer behavior, expanding retail presence, and government backed initiatives promoting natural fiber use. The outlook remains positive as more sectors integrate jute products into packaging, home decor, and industrial applications to align with sustainability goals.

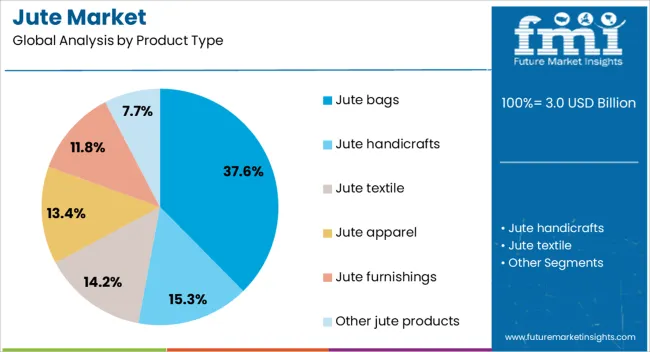

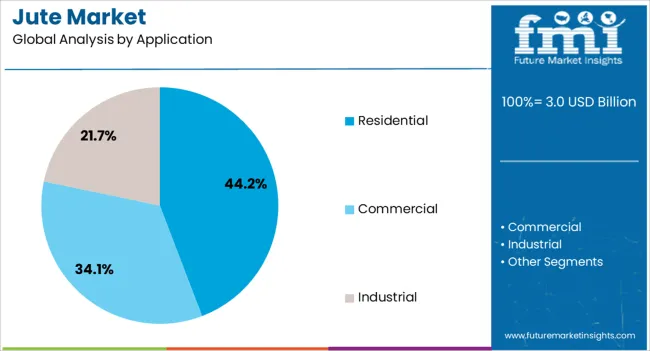

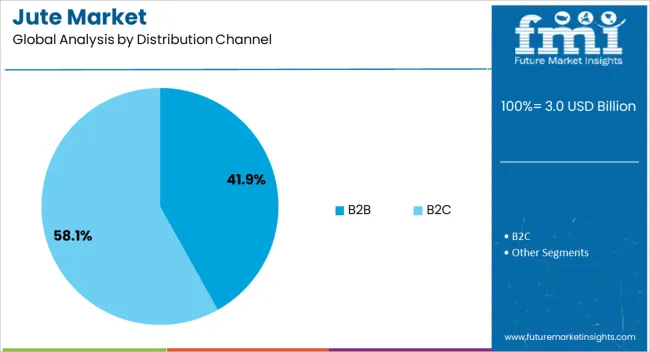

The jute market is segmented by product type, application, distribution channel, and geographic regions. By product type, jute market is divided into jute bags, jute handicrafts, jute textile, jute apparel, jute furnishings, and other jute products. In terms of application, jute market is classified into residential, commercial, and industrial. Based on distribution channel, jute market is segmented into B2B and B2C. Regionally, the jute industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The jute bags segment is projected to contribute 37.6% of the total market revenue by 2025 within the product type category, making it the leading segment. Growth is being fueled by their reusability, biodegradability, and increasing application in retail and promotional packaging.

Businesses are increasingly opting for jute bags to align with corporate sustainability goals while enhancing brand visibility through customization. The durability and versatility of jute bags, combined with cost competitiveness, have further strengthened their market position.

The residential segment is expected to hold 44.2% of the total market share by 2025 under the application category, making it the dominant area of use. This is driven by increasing consumer preference for eco friendly lifestyle products, including jute based furnishings, storage solutions, and decorative items.

The natural aesthetic of jute products, combined with their durability, is appealing to households focused on sustainable living.

Rising online and offline retail availability is also boosting adoption in the residential sector.

The B2B segment is anticipated to account for 41.9% of the overall market revenue by 2025 in the distribution channel category, positioning it as the leading channel.

Demand is being driven by bulk procurement from retailers, exporters, and corporate buyers seeking sustainable packaging and promotional solutions.

Long term supply contracts, customization capabilities, and the ability to meet large order volumes have reinforced the dominance of the B2B channel in the jute market.

The market has experienced steady growth due to increasing demand for eco-friendly, biodegradable, and sustainable materials in packaging, textiles, and industrial applications. Jute fibers are widely used in sacks, bags, mats, ropes, and composites, providing an alternative to plastics. Market expansion has been driven by rising awareness of environmental impacts, government initiatives promoting natural fibers, and the global push for sustainable packaging solutions. Improvements in jute processing, fiber quality, and manufacturing techniques have enhanced product usability. Growing demand from e-commerce, agriculture, and construction sectors, combined with export opportunities from major producing countries, has contributed to stronger adoption and integration of jute-based products across multiple industries.

The packaging industry has increasingly turned to jute as a renewable and biodegradable alternative to synthetic materials. Jute sacks, bags, and wrapping materials are used extensively in agriculture, retail, and logistics to reduce plastic dependency. Growth has been supported by environmental regulations limiting single-use plastics and the preference of consumers for eco-friendly packaging. Manufacturers have adopted jute blends and coated fibers to enhance durability, water resistance, and printability, allowing broader product applications. The ability to integrate jute with other natural or synthetic fibers has increased versatility for packaging designs, promoting adoption across food, retail, and industrial sectors globally, while supporting sustainability goals and corporate social responsibility initiatives.

Advances in jute processing technology have improved fiber quality, strength, and application potential. Modern retting methods, mechanical decortication, and chemical treatments have enhanced tensile strength and reduced impurities, enabling the production of finer and more uniform fibers. Innovations in spinning, weaving, and composite manufacturing have expanded jute applications in textiles, geotextiles, and reinforced materials. Research into jute-based composites and hybrid materials has opened opportunities in automotive, construction, and packaging industries. Improved machinery and quality control systems have reduced labor intensity, enhanced yield, and enabled standardized production, making jute a more competitive and reliable material compared to synthetic alternatives across multiple industrial and consumer applications.

Jute continues to find applications beyond traditional packaging, including apparel, home décor, and technical textiles. Rugs, carpets, wall coverings, and upholstery products increasingly incorporate jute for its texture, durability, and natural appearance. Industrial uses include ropes, mats, geo-textiles, and reinforced composites in construction and automotive sectors. Integration into nonwoven fabrics and blended products has further increased market potential. Demand for lightweight, renewable, and aesthetically appealing materials has created new opportunities for product diversification. Adoption is particularly strong in regions focusing on eco-conscious manufacturing and sustainable industrial solutions, where jute’s natural properties meet both functional and environmental requirements.

Despite growth, the jute market faces challenges related to supply stability, climatic dependence, and price volatility. Production is largely concentrated in countries such as India, Bangladesh, and China, making global supply sensitive to monsoon patterns, soil fertility, and agricultural practices. Market fluctuations in fiber availability, quality, and export regulations impact pricing, creating uncertainty for manufacturers and end-users. High labor costs and traditional cultivation methods can further constrain supply. Addressing these issues requires investment in mechanization, sustainable farming practices, and processing infrastructure. Ensuring consistent fiber quality and stable supply is critical for supporting global demand across packaging, textile, and industrial applications.

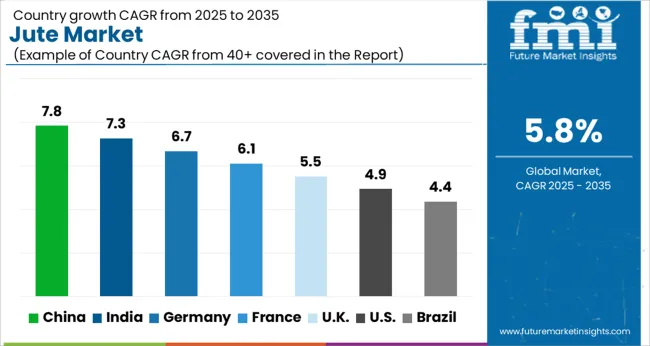

| Countries | CAGR |

|---|---|

| China | 7.8% |

| India | 7.3% |

| Germany | 6.7% |

| France | 6.1% |

| UK | 5.5% |

| USA | 4.9% |

| Brazil | 4.4% |

The market is projected to grow at a CAGR of 5.8% between 2025 and 2035, driven by rising demand for eco-friendly packaging and textiles. India recorded 7.3%, reflecting strong domestic cultivation and export activities. China reached 7.8%, supported by large-scale manufacturing and adoption in industrial applications. Germany achieved 6.7%, where sustainable textile integration and technical jute products contributed to steady growth. The United Kingdom posted 5.5%, with market expansion focused on green packaging solutions. The United States reached 4.9%, driven primarily by niche applications in textiles and composites. Together, these countries represent key contributors to production, innovation, and adoption in the global market. This report includes insights on 40+ countries; the top markets are shown here for reference.

China is projected to grow at a CAGR of 7.8%, driven by increasing demand for sustainable packaging, textiles, and industrial applications. Adoption has been reinforced by government incentives promoting eco-friendly materials and investments in mechanized jute processing technologies. Domestic manufacturers focus on high quality jute fibers, yarns, and blended fabrics, while exports to Europe and North America further enhance market expansion. Innovations in composite materials for automotive, construction, and geotextile applications create new opportunities. The integration of mechanized cultivation and fiber processing has improved efficiency and reduced production costs, supporting the competitiveness of Chinese jute in both domestic and global markets.

India is expected to expand at a CAGR of 7.3%, supported by the country being a leading global producer and exporter of raw jute. Adoption has been reinforced by government initiatives like minimum support price for raw jute, subsidies for modernized machinery, and promotion of value added jute products. Major producing states including West Bengal, Bihar, and Assam focus on both packaging and textile applications. Rising awareness of biodegradable materials and increasing demand in retail, agriculture, and industrial sectors drive the market. Domestic manufacturers are innovating with blended fabrics, jute ropes, mats, and geotextiles to meet both local and export demand.

Germany is projected to grow at a CAGR of 6.7%, driven by demand for eco-friendly packaging, composites, and specialty textiles. Adoption has been reinforced by imports of raw jute fibers and semi processed products from Asia. Industrial applications such as automotive composites, insulation materials, and reinforced fabrics contribute to growth. Domestic manufacturers focus on sustainability compliance, high quality fiber integration, and blending jute with synthetic or natural fibers for enhanced performance. Regulatory emphasis on biodegradable materials and renewable resources encourages companies to adopt jute in packaging, geotextiles, and construction sectors.

The United Kingdom is expected to grow at a CAGR of 5.5%, supported by adoption in biodegradable packaging, specialty textiles, and industrial applications. Imports dominate premium jute supply, primarily from India and Bangladesh, while domestic manufacturers focus on small scale production of decorative and functional jute products. Consumer preference for eco-friendly materials in packaging, retail bags, and home décor reinforces market growth. Government regulations promoting biodegradable alternatives and reducing plastic usage further support adoption in commercial and industrial segments.

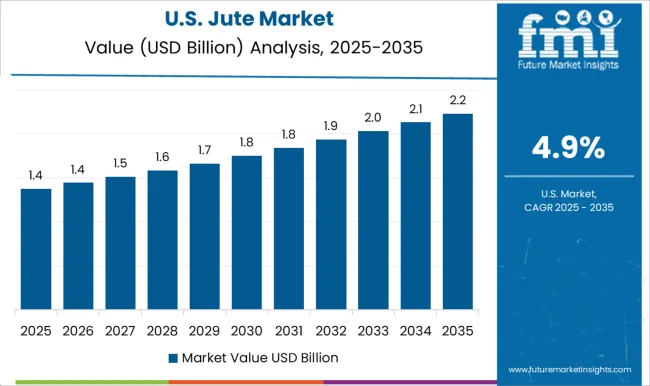

The United States is projected to grow at a CAGR of 4.9%, driven by adoption in biodegradable packaging, home textiles, and composite applications. Imports from India, Bangladesh, and China dominate supply, while domestic production focuses on high value and specialty jute products such as rugs, mats, reinforced composites, and upholstery fabrics. Market expansion is reinforced by environmental regulations promoting natural fibers as alternatives to synthetics. Technological innovations in fiber processing, weaving, and composite integration continue to enhance product performance and widen applications across industrial, consumer, and agricultural sectors.

The market is shaped by a combination of long-established manufacturers, regional producers, and specialized fiber processors. Aarbur and AI Champdany Industries are recognized for large-scale production capabilities, offering a wide range of jute fibers, yarns, and fabrics catering to both domestic and international markets. Bangalore Fort Farms and Budge Budge Company focus on high-quality raw jute and processed materials for packaging, textiles, and industrial applications, ensuring consistent supply and product reliability. Cheviot and Gloster Limited emphasize diversification in jute-based products, including eco-friendly packaging solutions, mats, and geotextiles, addressing sustainability-driven demand.

Hitaishi-KK and Howrah Mills Co. Ltd. leverage traditional processing techniques combined with modern machinery to enhance fiber quality and efficiency. Ludlow Jute & Specialities and Premchand Jute Industries cater to niche applications such as specialty yarns, composite materials, and decorative jute products. Shree Jee International India extends its focus to export markets, providing competitively priced jute goods while adhering to international quality standards. The competition in the jute market is driven by product quality, processing efficiency, diversification of applications, and the ability to serve both industrial and consumer-oriented sectors, with a growing emphasis on sustainable and environmentally friendly jute solutions.

| Items | Values |

|---|---|

| Quantitative Units | USD 3.0 billion |

| Product Type | Jute bags, Jute handicrafts, Jute textile, Jute apparel, Jute furnishings, and Other jute products |

| Application | Residential, Commercial, and Industrial |

| Distribution Channel | B2B and B2C |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Aarbur, AI Champdany Industries, Bangalore Fort Farms, Budge Budge Company, Cheviot, Gloster Limited, Hitaishi-KK, Howrah Mills Co. Ltd., Ludlow Jute & Specialities, Premchand Jute Industries, and Shree Jee International India |

| Additional Attributes | Dollar sales by fiber type and application, demand dynamics across textiles, packaging, and industrial sectors, regional trends in natural fiber adoption, innovation in processing, durability, and biodegradability, environmental impact of cultivation and manufacturing, and emerging use cases in sustainable packaging, eco-friendly composites, and fashion accessories. |

The global jute market is estimated to be valued at USD 3.0 billion in 2025.

The market size for the jute market is projected to reach USD 5.2 billion by 2035.

The jute market is expected to grow at a 5.8% CAGR between 2025 and 2035.

The key product types in jute market are jute bags, jute handicrafts, jute textile, jute apparel, jute furnishings and other jute products.

In terms of application, residential segment to command 44.2% share in the jute market in 2025.

Explore Similar Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA