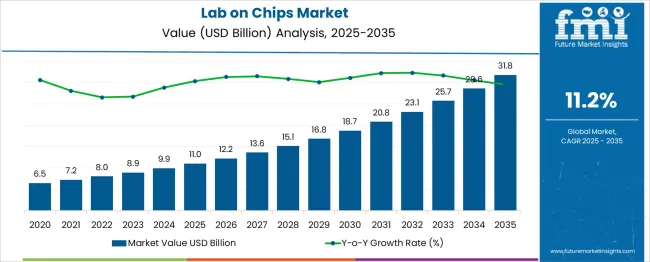

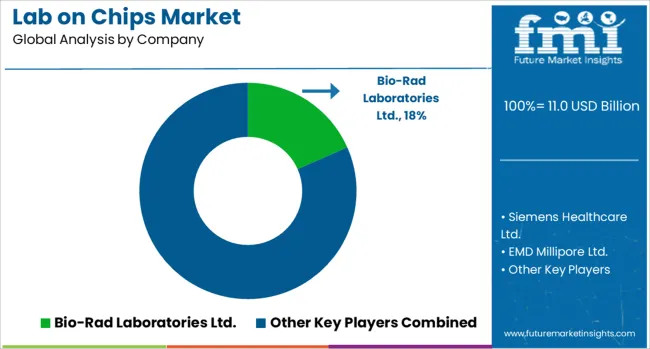

The lab-on-chips market is estimated to be valued at USD 11.0 billion in 2025 and is projected to reach USD 31.8 billion by 2035, registering a compound annual growth rate (CAGR) of 11.2% over the forecast period. This growth is being driven by increasing demand for miniaturized diagnostic systems that allow rapid, point-of-care testing across healthcare, biotechnology, and pharmaceutical industries. Rising prevalence of chronic and infectious diseases, coupled with the global need for efficient, cost-effective diagnostics, supports widespread adoption.

Lab-on-chip platforms are also gaining traction in genomics, proteomics, and drug discovery, where their ability to perform high-throughput analysis with minimal sample volumes enhances research efficiency.

Technological advancements, such as microfluidics integration, biosensor improvements, and portable diagnostic devices, are further propelling market growth. In parallel, the surge in personalized medicine and home-based testing is opening new commercial opportunities. However, challenges related to fabrication costs, standardization, and regulatory compliance remain barriers for broader implementation.

| Metric | Value |

|---|---|

| Lab-On-Chips Market Estimated Value in (2025 E) | USD 11.0 billion |

| Lab-On-Chips Market Forecast Value in (2035 F) | USD 31.8 billion |

| Forecast CAGR (2025 to 2035) | 11.2% |

The Lab on Chips market is experiencing robust growth driven by the demand for miniaturized, high-throughput diagnostic and analytical platforms. The shift toward decentralized and point-of-care testing has led to increased adoption of lab-on-chip systems that enable rapid results with minimal reagent use. The scalability, portability, and reduced processing time associated with these devices have made them ideal for clinical and research environments where speed and accuracy are paramount.

Significant technological progress in the fields of nanotechnology, microfabrication, and biomolecular engineering is further enabling multifunctional integration on single-chip platforms. Regulatory encouragement for faster diagnostic solutions and rising investment in personalized medicine are also contributing to the expansion of the market.

The growing collaboration between academic institutions, research labs, and biotech companies is fostering innovation and accelerating the translation of lab-on-chip prototypes into commercially viable solutions. As global health systems focus on early disease detection and real-time monitoring, lab-on-chip technology is expected to remain at the forefront of next-generation diagnostic tools.

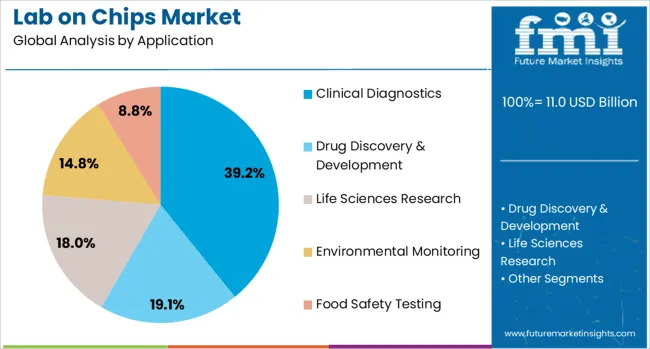

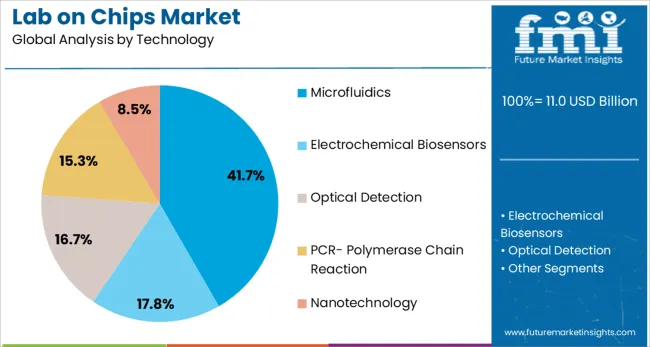

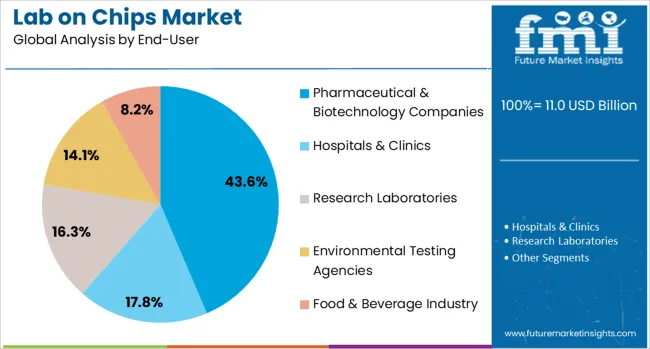

The lab-on-chips market is segmented by application, technologyend-user, and geographic regions. By application of the lab-on-chips market is divided into Clinical Diagnostics, Drug Discovery & Development, Life Sciences Research, Environmental MonitoringFood Safety Testing. In terms of technology of the lab-on-chips market is classified into Microfluidics, Electrochemical Biosensors, Optical Detection, PCR- Polymerase Chain ReactionNanotechnology. Based on end-user of the lab-on-chips market is segmented into Pharmaceutical & Biotechnology Companies, Hospitals & Clinics, Research Laboratories, Environmental Testing AgenciesFood & Beverage Industry. Regionally, the lab-on-chips industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The clinical diagnostics application segment is projected to account for 39.2% of the Lab on Chips market revenue share in 2025, establishing it as the leading application area. This dominance is being driven by the rising demand for rapid, accurate, and point-of-care diagnostic testing, especially in infectious disease detection, oncology, and prenatal screening.

The ability of lab-on-chip systems to integrate sample preparation, amplification, and detection within a compact device has made them ideal for clinical use, especially in remote or resource-limited settings. Increased focus on early disease identification and real-time patient monitoring has further supported the widespread deployment of these platforms in diagnostic labs and healthcare institutions.

Additionally, growing awareness around personalized healthcare and the need for low-cost, high-throughput solutions has boosted the segment’s adoption. The evolution of clinical workflows toward automation and miniaturization, along with regulatory support for rapid testing technologies, is reinforcing the segment’s sustained leadership in the market.

The microfluidics technology segment is expected to hold 41.7% of the revenue share in the Lab on Chips market by 2025, marking it as the dominant technological enabler. The growth of this segment is being supported by the ability of microfluidics to manipulate minute fluid volumes with precision, allowing integration of multiple laboratory processes into a single chip. This has made it an essential technology for biochemical assays, cellular analysis, and molecular diagnostics.

The compactness and efficiency of microfluidic systems have enabled their adoption in areas requiring portable and real-time data generation. Moreover, the compatibility of microfluidics with emerging fabrication methods, such as 3D printing and soft lithography, has enhanced scalability and cost efficiency.

As the industry moves toward automation and reduced reagent consumption, microfluidics is becoming central to lab-on-chip design strategies. Continued innovation in chip material science and microchannel architecture is expected to drive further growth of this segment.

Pharmaceutical and biotechnology companies are anticipated to capture 43.6% of the total Lab on Chips market share in 2025, leading among all end users. This segment's growth is being fueled by the increasing demand for high-throughput screening, drug discovery acceleration, and toxicity testing in compact, automated formats. Lab-on-chip systems are being increasingly used in preclinical research to evaluate pharmacokinetics and pharmacodynamics with greater precision and less material consumption.

The segment is also benefiting from the integration of these systems into personalized drug development pipelines, where rapid prototyping and real-time cellular response tracking are critical. Adoption has been further driven by the alignment of lab-on-chip technology with the industry's push for digitization, miniaturization, and sustainability in research processes.

The ability to streamline experimental workflows, reduce assay costs, and accelerate go-to-market timelines has positioned these systems as essential tools in biotech innovation. As biopharmaceutical pipelines expand and demand for flexible R&D infrastructure increases, the segment is expected to maintain its leadership.

The lab-on-chip market is advancing through growth in portable diagnostics, integration with pharmaceutical R&D, expansion into food and environmental testing, and rising use in academic research. These factors are shaping its diverse and sustained adoption.

The lab-on-chip market is witnessing significant growth due to increased adoption of portable diagnostic devices across healthcare and research settings. These systems allow rapid testing at the point of care, reducing the need for centralized laboratory facilities. Their application in detecting infectious diseases, monitoring chronic conditions, and conducting genetic testing is driving wider acceptance. The ability to provide results in minutes supports faster treatment decisions, making them invaluable in emergency and remote healthcare scenarios. Governments and NGOs are also promoting their use in public health campaigns, further accelerating adoption. Compact design, reduced sample requirements, and operational simplicity are reinforcing their role as essential diagnostic tools in a variety of medical environments.

Lab-on-chip technology is becoming integral to pharmaceutical research by enabling high-throughput screening and rapid drug efficacy testing. These platforms facilitate the miniaturization of complex biochemical assays, lowering reagent consumption and improving cost efficiency. Their precision in handling micro-scale fluid volumes supports the development of targeted therapies and personalized medicine approaches. Pharmaceutical companies are incorporating lab-on-chip devices into early-stage research to accelerate discovery timelines and reduce development costs. The capability to simulate physiological conditions on a chip also helps in preclinical testing, offering insights without extensive animal trials. As demand for faster drug development grows, this integration is becoming a critical driver in the market.

Lab-on-chip systems are finding increasing use in food safety testing and environmental surveillance. They can rapidly detect pathogens, contaminants, and toxins in food products, helping prevent outbreaks and ensuring compliance with regulatory standards. In environmental monitoring, these devices are used for on-site analysis of water and air quality, enabling faster intervention in case of pollution or contamination. Their portability and real-time data generation capabilities make them suitable for fieldwork, where traditional lab infrastructure is not available. As regulatory bodies tighten safety requirements, industries are adopting lab-on-chip solutions to meet compliance standards efficiently while maintaining operational productivity.

Academic institutions and clinical research centers are increasingly leveraging lab-on-chip devices for teaching, experimental analysis, and clinical trial support. Their versatility allows integration into multiple disciplines, from biomedical engineering to molecular biology. In clinical research, they enable cost-effective sample analysis with high accuracy, supporting studies in genetics, oncology, and infectious diseases. The ability to customize chip designs for specific applications makes them attractive for niche research fields. Moreover, partnerships between universities, research organizations, and manufacturers are fostering innovation in device capabilities. This growing research adoption is ensuring a steady demand pipeline while enhancing the technology’s credibility and application scope globally.

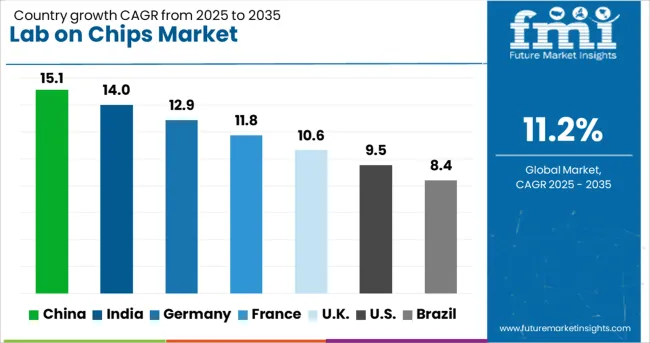

| Country | CAGR |

|---|---|

| China | 15.1% |

| India | 14.0% |

| Germany | 12.9% |

| France | 11.8% |

| UK | 10.6% |

| USA | 9.5% |

| Brazil | 8.4% |

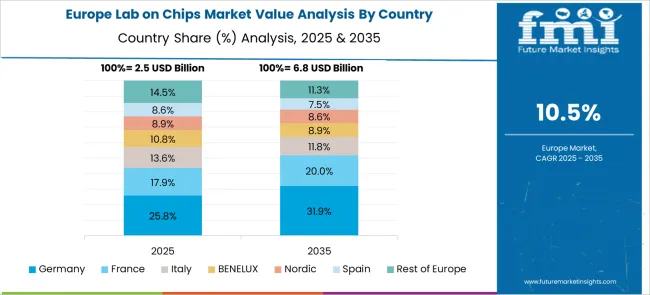

The lab-on-chip market is projected to expand globally at a CAGR of 11.2% from 2025 to 2035, fueled by rising demand for portable diagnostics, high-throughput screening in drug discovery, and rapid testing solutions in healthcare and environmental monitoring. China leads with a CAGR of 15.1%, driven by significant investments in biomedical research, widespread adoption in point-of-care testing, and government-backed innovation programs. India follows at 14.0%, supported by growing healthcare infrastructure, local manufacturing capabilities, and adoption in rural diagnostics. France records 11.8%, influenced by academic research partnerships, hospital integration of rapid diagnostics, and public health initiatives. The United Kingdom posts 10.6%, supported by precision medicine programs, clinical trial integration, and investment in microfluidic research. The United States registers 9.5%, driven by established biotech sectors, commercialization of advanced lab-on-chip devices, and rising demand in decentralized healthcare delivery. This growth reflects the expanding role of lab-on-chip technology in transforming diagnostics and research, with Asia-Pacific emerging as the fastest-growing region and Europe maintaining strong, innovation-driven adoption.

The United Kingdom is projected to record a 10.6% CAGR for the lab-on-chip market during 2025–2035. Based on proportional scaling to the global benchmark of 11.2%, the CAGR for 2020–2024 is estimated at 8.9%. In the earlier period, adoption was steady but limited by slower integration into primary healthcare diagnostics and budget constraints in publicly funded institutions. The shift to 10.6% in the next decade is supported by precision medicine initiatives, increased funding for microfluidics research, and wider adoption in clinical trials. Demand is also expanding in food safety testing, environmental monitoring, and academic research programs. Strong collaborations between UK universities, biotech startups, and device manufacturers are accelerating commercialization and enhancing device versatility, which is expected to drive higher adoption rates across both public and private sectors.

China is expected to post a CAGR of 15.1% for 2025–2035, with the 2020–2024 CAGR estimated at 12.6% when aligned with global growth ratios. Earlier gains were fueled by government investment in biotech infrastructure and adoption of point-of-care devices in urban healthcare centers. The stronger growth outlook for the next decade stems from large-scale integration into rural healthcare, rapid expansion of domestic microfluidics manufacturing, and targeted R&D funding for infectious disease diagnostics. Partnerships between academic institutions and commercial producers are yielding devices tailored for both clinical and industrial applications, including food safety and environmental testing. China’s growing export capacity in low-cost, high-performance lab-on-chip devices is also enhancing its competitive position globally.

India is projected to achieve a 14.0% CAGR for 2025–2035, compared to an estimated 11.7% in 2020–2024 based on proportional scaling. Earlier growth was largely driven by public health initiatives, adoption in diagnostic chains, and gradual entry into pharmaceutical research workflows. The rise in CAGR is attributed to government-backed healthcare digitization, wider penetration of portable testing in rural clinics, and expansion of domestic microfluidics manufacturing. Collaborative programs with global biotech firms are enhancing technology transfer and skill development, enabling higher-quality production. Increasing interest from private healthcare providers in rapid, low-cost diagnostics for chronic and infectious diseases is further accelerating adoption in both urban and semi-urban regions.

France is forecast to record an 11.8% CAGR for 2025–2035, up from an estimated 9.8% in 2020–2024 using proportional scaling to the global trend. Initial market growth was supported by public health integration of point-of-care devices and adoption in research-led hospitals. The projected rise is linked to expansion in oncology diagnostics, stronger regulatory focus on early disease detection, and integration with telemedicine platforms. Government funding for innovation in biomedical engineering is fostering partnerships between French research institutions and global device manufacturers. Lab-on-chip devices are also gaining traction in food safety labs and environmental agencies, widening the market scope beyond healthcare into industrial and regulatory applications.

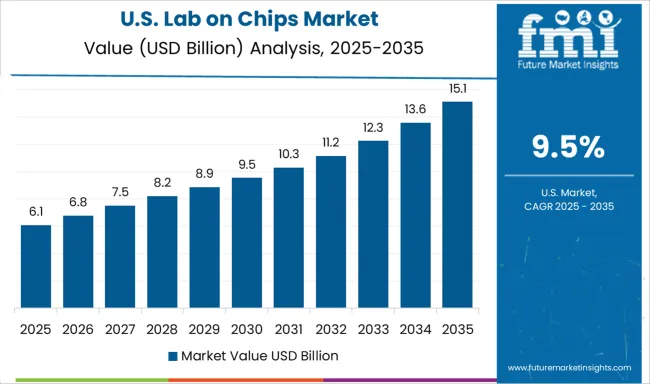

The United States is projected to post a CAGR of 9.5% during 2025–2035, compared to an estimated 7.9% in 2020–2024 based on proportional scaling. Earlier growth was supported by adoption in academic research and niche medical diagnostics, but broader clinical integration was slower due to regulatory and reimbursement challenges. The increase in CAGR is tied to advancements in precision diagnostics, commercialization of FDA-cleared portable devices, and growing adoption in decentralized healthcare settings such as pharmacies and urgent care centers. Collaborations between biotech firms and major healthcare networks are streamlining validation and procurement processes. Additionally, expanding use in defense, environmental monitoring, and industrial safety testing is diversifying market demand.

The lab-on-chip market is characterized by strong competition among global biotechnology firms, diagnostics leaders, and life science solution providers aiming to deliver advanced, miniaturized testing platforms for rapid and precise analysis. Bio-Rad Laboratories Ltd. is a notable player with expertise in microfluidics and molecular diagnostics, offering high-performance platforms for genomic and proteomic analysis. Siemens Healthcare Ltd. leverages its extensive diagnostics portfolio to integrate lab-on-chip technologies into point-of-care testing solutions, enhancing accessibility in clinical settings. EMD Millipore Ltd. (Merck KGaA) focuses on lab-on-chip-enabled filtration, biosensing, and drug discovery tools, catering to research and pharmaceutical industries. Danaher Corporation, through its subsidiaries, delivers microfluidic-based systems for diagnostics and life sciences, emphasizing precision and scalability. Abbott Laboratories applies its diagnostics capabilities to create portable lab-on-chip devices for infectious disease detection and chronic condition monitoring. Hoffman-La Roche AG is advancing personalized healthcare through lab-on-chip-based diagnostic platforms integrated with its molecular diagnostics expertise. Life Technologies Corporation (Thermo Fisher Scientific) offers microfluidics-enabled platforms for genetic analysis, sequencing preparation, and high-throughput screening. Key competitive strategies include expanding product lines into multi-application platforms, forming partnerships with research institutions and healthcare providers for technology validation, and investing in cost-effective, scalable manufacturing. Companies are prioritizing accuracy, faster turnaround times, and compatibility with digital health ecosystems to strengthen market presence. Those offering integrated solutions that bridge diagnostics, research, and industrial testing are well-positioned for growth in the evolving lab-on-chip ecosystem.

| Item | Value |

|---|---|

| Quantitative Units | USD 11.0 Billion |

| Application | Clinical Diagnostics, Drug Discovery & Development, Life Sciences Research, Environmental Monitoring, and Food Safety Testing |

| Technology | Microfluidics, Electrochemical Biosensors, Optical Detection, PCR- Polymerase Chain Reaction, and Nanotechnology |

| End-User | Pharmaceutical & Biotechnology Companies, Hospitals & Clinics, Research Laboratories, Environmental Testing Agencies, and Food & Beverage Industry |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Bio-Rad Laboratories Ltd., Siemens Healthcare Ltd., EMD Millipore Ltd., Danaher Corporation, Abbott Laboratories, Hoffman La Roche AG, and Life Technologies Corporation (Thermo Fisher Scientific) |

| Additional Attributes | Dollar sales, share, competitive landscape, end-user adoption trends, regional demand patterns, regulatory impact, emerging applications in diagnostics, and opportunities in pharmaceutical research integration. |

The global lab-on-chips market is estimated to be valued at USD 11.0 billion in 2025.

The market size for the lab-on-chips market is projected to reach USD 31.8 billion by 2035.

The lab-on-chips market is expected to grow at a 11.2% CAGR between 2025 and 2035.

The key product types in lab-on-chips market are clinical diagnostics, drug discovery & development, life sciences research, environmental monitoring and food safety testing.

In terms of technology, microfluidics segment to command 41.7% share in the lab-on-chips market in 2025.

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA