The global ligament augmentation market is projected to reach USD 84.7 million by 2035, rising from USD 51.5 million in 2025 at a CAGR of 5.1%. Market expansion is being driven by the increasing incidence of sports injuries, a growing volume of ACL reconstruction procedures, and the rising adoption of biologic and synthetic graft technologies.

Artificial ligament scaffolds are being recognized for enhancing biomechanical stability and accelerating recovery. A shift toward outpatient and minimally invasive surgeries is boosting the demand for augmentation systems. Regulatory approvals for scaffold-based and bio-absorbable grafts are also being secured, improving global acceptance and clinical application.

In February 2025, a synthetic ligament augmentation implant was launched by Medline at the ACFAS Annual Scientific Conference. The innovation was introduced under the Medline UNITE portfolio, which is being expanded to support soft tissue fixation in foot and ankle surgeries.

According to Scott Goldstein, Vice President of Product Management, the implant is being backed by over 30 years of global clinical history in sports medicine. Designed with open-weave scaffold architecture, the product is being developed to enhance tissue integration while minimizing donor site morbidity. Additionally, augmented reality-guided surgical workflows and bioactive coating technologies are being advanced across the industry.

North America has been dominating the ligament augmentation market, led by high ACL repair cases, sports medicine advancements, and favorable insurance for synthetic implants. The USA contributes nearly 92% of regional demand. Regulatory approvals and academic support have been accelerating adoption of magnesium-alloy scaffolds.

In Europe, countries like Germany, the UK, and France have witnessed growing uptake of collagen-based scaffolds. Public reimbursement, clinical trials, and expanding outpatient centers have been enhancing market growth, supported by rising demand for quicker recovery and minimal donor morbidity

In 2025, artificial tendons and ligaments will dominate the ligament augmentation market, driven by advancements in biomaterials and their use in orthopedic surgeries. ACL and PCL repair procedures, along with hospital-led specialized care, will further fuel growth, making them key players in addressing high-demand ligament injuries and related treatments.

In 2025, the artificial tendons and ligaments segment is expected to hold 62.4% of the revenue share in the ligament augmentation market.

In 2025, ACL and PCL repair/reconstruction procedures are projected to account for 42.5% of the ligament augmentation market share.

Hospitals are expected to hold a dominant 39.1% share of the ligament augmentation market in 2025.

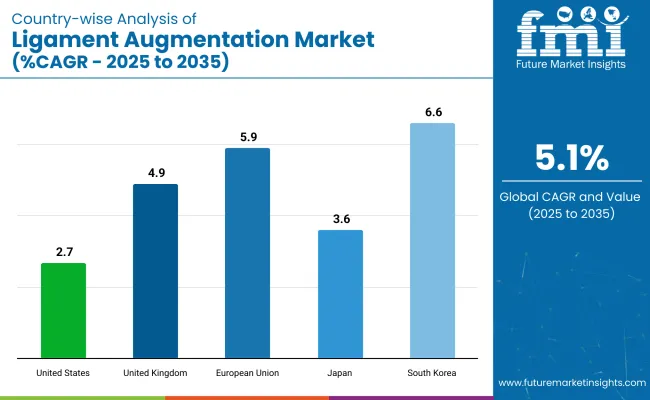

The global ligament augmentation market is being shaped by orthopedic innovations, growing sports injury prevalence, and minimally invasive surgical trends. Leading countries United States, United Kingdom, Germany (EU), Japan, and South Korea are accelerating the development and clinical adoption of artificial ligament technologies.

| Country | Projected CAGR (2025 to 2035) |

|---|---|

| United States | 2.7% |

| United Kingdom | 4.9% |

| European Union | 5.9% |

| Japan | 3.6% |

| South Korea | 6.6% |

The USA market is projected to grow at a CAGR of 2.7%, driven by its strong sports medicine infrastructure and high orthopedic surgical volumes. Adoption of ligament scaffolds and synthetic augmentation systems is supported by favorable reimbursement policies and growing specialist awareness.

The UK market is expected to grow at a 4.9% CAGR due to rising sports rehabilitation needs and joint preservation surgeries among the aging population. NHS support for outpatient and arthroscopic procedures is strengthening market accessibility.

The EU market, growing at 5.9% CAGR, is bolstered by a strong orthopedic device manufacturing base and rising ligament injury rates among elderly and athletic groups.

Japan’s ligament augmentation market is expanding at a CAGR of 3.6%, supported by its aging population and increasing focus on high-precision orthopedic interventions.

South Korea’s market is projected to grow at a 6.6% CAGR, benefiting from strong orthopedic infrastructure and growing interest in medical tourism.

| Report Attributes | Details |

|---|---|

| Market Size (2025) | USD 51.50 million |

| Projected Market Size (2035) | USD 84.7 million |

| CAGR (2025 to 2035) | 5.1% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD million for value |

| Product Segments Analyzed | Artificial Tendons & Ligaments, Devices |

| End-user Segments Analyzed | Hospitals, Ambulatory Surgical Centres, Specialty Surgical Centres, Academic & Research Institutes |

| Regions Covered | North America, Latin America, East Asia, South Asia & Pacific, Eastern Europe, Western Europe, Middle East & Africa |

| Countries Covered | United States, Canada, Brazil, Mexico, Germany, France, United Kingdom, Italy, Spain, China, Japan, South Korea, India, Australia, UAE, South Africa |

| Leading Players Influencing the Market | Arthrex, Smith & Nephew, Zimmer Biomet, Stryker, CONMED, Corin Group, Medline Industries, Medtronic Plc., Neoligament (Xiros Ltd) |

| Additional Attributes | Dollar sales growth by product type (artificial tendons/ligaments, devices), end-user trends (hospitals, surgical centres), regional demand variations, competitive landscape, and technological advancements in ligament augmentation. |

The overall market size for ligament augmentation market was USD 51.15 million in 2025.

The ligament augmentation market is expected to reach USD 84.12 million in 2035.

Rising demand for enhanced taste and aroma in processed foods and beverages, growing preference for natural and clean-label flavor solutions, and increasing innovation in flavor customization will drive market growth.

The top 5 countries which drives the development of ligament augmentation market are USA, European Union, Japan, South Korea and UK

Organic liquid flavour systems expected to grow to command significant share over the assessment period.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Leading Providers & Market Share in Body Augmentation Fillers

Human Augmentation Technology Market Growth - Trends & Forecast 2025 to 2035

Buttock Augmentation Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA