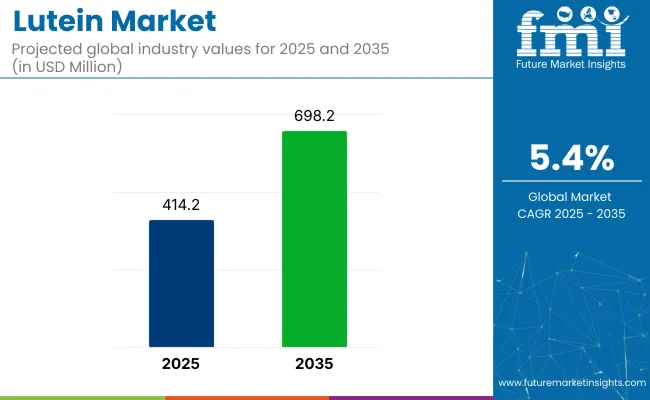

The lutein market is projected to grow from USD 414.2 million in 2025 to USD 698.2 million by 2035, registering a CAGR of 5.4%.

| Metric | Value |

|---|---|

| Industry Size (2025) | USD 414.2 Million |

| Industry Value (2035) | USD 698.2 Million |

| CAGR (2025 to 2035) | 5.4% |

The market expansion is driven by rising consumer awareness regarding eye health, increasing demand for natural ingredients in dietary supplements and functional foods, and expanding applications in pharmaceuticals and personal care products. The demand is increasing by innovations in extraction techniques and the growing trend towards clean-label and plant-based formulations.

The market holds an approximately 100% share within the carotenoid-based eye health supplements segment, underscoring its central role in this field. It contributes around 10-12% to the functional food ingredients market, where it plays a significant role in fortification and antioxidant applications.

In the dietary supplements market, its share is approximately 4-6%, emphasizing its importance as a specialized ingredient. Within the natural colorants market, it accounts for roughly 3-5%, supporting its use as a natural yellow-orange pigment in food and beverages.

Government regulations impacting the market focus on improving extraction efficiency, purity, and bioavailability. Advancements such as supercritical CO2 extraction, microencapsulation technologies, and lipid-based delivery systems are enhancing lutein stability, solubility, and absorption in human diets.

These technological developments are being integrated with sustainability-focused sourcing, particularly marigold flower cultivation, to ensure consistent supply and minimal environmental impact, thereby enhancing market penetration and meeting regulatory standards for natural products.

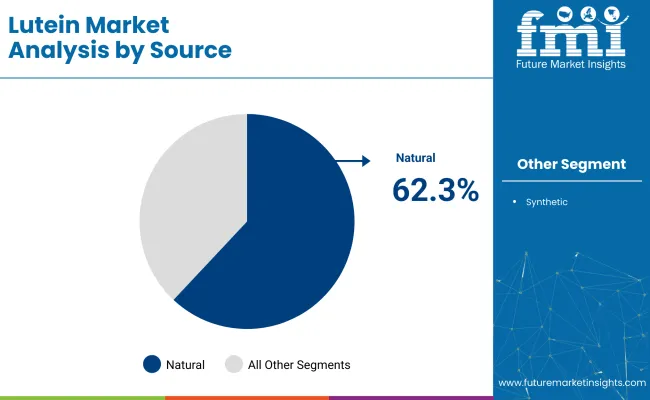

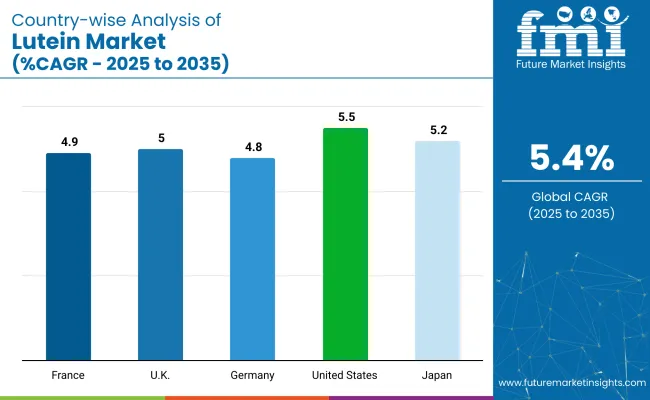

The USA is expected to be the fastest-growing market, with a projected CAGR of 5.5% from 2025 to 2035. The natural will dominate the source segment, accounting for over 62.3% of the market share in 2025. Powder and crystalline forms will lead the form segment, capturing 35.6% of the market share in 2025. Japan is forecasted to grow at a CAGR of 5.2%, while France is projected to grow at a CAGR of 4.9%.

The lutein market is segmented by source, form, production process, application, and region. By source, the market is bifurcated into natural and synthetic. Based on form, the market is categorized into powder &crystalline, oil suspension, beadlet, and emulsion.

By production process, the market is segmented into chemical synthesis, extraction from botanical material, fermentation, and algae route. In terms of application, the market is divided into food, beverages, dietary supplements, animal feed, pharmaceuticals, and cosmetics & personal care products. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkans & Baltic, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and Middle East & Africa.

Natural is projected to lead the source segment, accounting for over 62.3% of the global market share by 2025. Derived mainly from marigold flowers, natural lutein is preferred due to its clean-label positioning, non-GMO status, and superior bioavailability compared to synthetic alternatives.

Powder and crystalline are expected to lead the form segment, accounting for approximately 35.6% market share in 2025. These forms are widely used due to their stability, ease of formulation, and compatibility with multiple end-use applications.

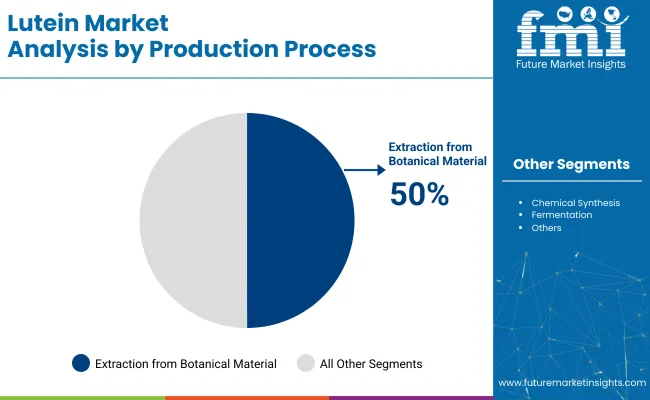

Extraction from botanical materials is projected to lead the production process segment, accounting for over 50% of the global market share by 2025. This process is widely adopted due to its alignment with natural ingredient trends and consumer preference for plant-derived products.

Dietary supplements are expected to lead the application segment, accounting for approximately 40% market share in 2025. Rising consumer awareness about eye health, cognitive benefits, and antioxidant properties is driving the inclusion of lutein in supplements.

The lutein market has been experiencing steady growth, driven by increasing consumer awareness of eye health benefits, rising demand for natural and plant-based ingredients in dietary supplements and functional foods, and advancements in extraction and formulation technologies enhancing bioavailability and stability.

Recent Trends in the Lutein Market

Challenges in the Lutein Market

The USA leads with a CAGR of 5.5%, driven by strong demand in dietary supplements and functional foods. While the Japan market is growing at 5.2% CAGR, UK at 5% CAGR, Germany at 4.8%, and France at 4.9% CAGR.

The USA shows the highest growth, while Germany records the lowest CAGR among these leading countries in the lutein market. These countries play a vital role in regulating, supplying, and distributing lutein globally, with structured regulatory frameworks and strong cross-border supply chains.

While, the USA leads in volume and innovation; Japan’s market is shaped by healthcare-driven demand. Together, the UK, Germany, and France collectively support market expansion through innovation in nutraceutical applications, functional foods, and export-grade formulations aligned with clean-label and wellness trends.

The report covers an in-depth analysis of 40+ countries; five top-performing OECD countries are highlighted below.

The demand for lutein in the USA is projected to grow at a CAGR of 5.5% from 2025 to 2035. Growth is driven by increasing awareness of eye health benefits, rising dietary supplement consumption, and food fortification trends.

The UK lutein revenue is forecast to expand at a CAGR of 5% over the forecast period. Demand is driven by clean-label dietary supplement trends, high awareness of lutein’s eye health benefits, and fortified food innovations.

The demand for lutein in Germany is projected to expand at a CAGR of 4.8% between 2025 and 2035. Growth is supported by advanced food ingredient technologies, high focus on natural antioxidants, and increasing dietary supplement usage.

The French lutein market is expected to grow at a CAGR of 4.9% from 2025 to 2035. Growth is driven by increasing demand for plant-based supplements, expanding eye health product portfolios, and clean-label consumer trends.

The sales of lutein in Japan are forecast to grow at a CAGR of 5.2% during the forecast period. Growth is driven by an aging population, high consumer awareness of eye health, and integration of lutein into functional foods and nutraceuticals.

The lutein market is moderately consolidated, with global leaders and regional firms shaping competition through advanced extraction methods, microencapsulation technologies, and a growing range of applications in dietary supplements, functional foods, and personal care formulations.

Tier-one companies such as DSM Nutritional Products, BASF SE, Kemin Industries, Chr. Hansen Holding, and Allied Biotech Corporation focus heavily on proprietary extraction and purification techniques that ensure high-purity lutein with superior bioavailability. These players have also prioritized formulation stability, enabling broader product integration in heat- and light-sensitive delivery systems.

Strategic investments in clean-label ingredients and vertical integration help secure reliable sourcing, particularly from marigold flowers. In parallel, regional firms across Asia and Latin America are enhancing competitive intensity through cost-efficient production and tailored blends. Partnerships with contract manufacturers and branded nutraceutical companies are also growing, expanding lutein’s presence in eye health, skincare, and anti-aging applications across major global markets.

Recent Lutein Industry News

| Report Attributes | Details |

|---|---|

| Current Total Market Size (2025) | USD 414.2 million |

| Projected Market Size (2035) | USD 698.2 million |

| CAGR (2025 to 2035) | 5.4% |

| Base Year for Estimation | 2024 |

| Historical Period | 2019 to 2024 |

| Projections Period | 2025 to 2035 |

| Report Parameters | Revenue in USD million/Volume in tons |

| By Source | Natural and Synthetic |

| By Form | Powder and Crystalline, Oil Suspension, Beadlet, and Emulsion |

| By Production Process | Chemical Synthesis, Extraction from Botanical Material, Fermentation, and Algae Route |

| By Application | Food, Beverages, Dietary Supplements, Animal Feed, Pharmaceuticals, and Cosmetics & Personal Care Products |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, Balkans & Baltic, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and Middle East & Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, Brazil, Australia |

| Key Players | DSM Nutritional Products, BASF SE, Kemin Industries, Chr. Hansen Holding, Allied Biotech Corporation, E.I.D. Parry (India) Ltd., OmniActive Health, Zhejiang Medicine Co., Ltd., Fenchem Biotek Ltd., PIVEG, Inc., Valensa International, Lycored Limited, Synthite Industries, Vidya Herbs Pvt. Ltd. |

| Additional Attributes | Market share analysis by source and form, country-wise CAGR analysis, and supplier positioning insights |

As per Source, the industry has been categorized into Natural, and Synthetic.

As per Form, the industry has been categorized into Powder and Crystalline, Oil Suspension, Beadlet, and Emulsion.

As per Production Process, the industry has been categorized into Chemical Synthesis, Extraction from Botanical Material, Fermentation, and Algae Route.

This segment is further categorized into Food, Beverages, Dietary Supplements, Animal Feed, Pharmaceuticals, and Cosmetics & Personal Care Products.

Industry analysis has been carried out in key countries of North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, Central Asia, Russia and Belarus, Balkan & Baltics, and the Middle East & Africa.

The market is expected to reach USD 698.2 million by 2035.

The market is projected to grow at a CAGR of 5.4% during this period.

Natural lutein is expected to hold the highest share, accounting for over 62.3% of the market in 2025.

Powder and crystalline forms are expected to hold the highest share, accounting for approximately 35.6% of the market in 2025.

The USA is anticipated to be the fastest-growing market with a CAGR of 5.5% from 2025 to 2035.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA