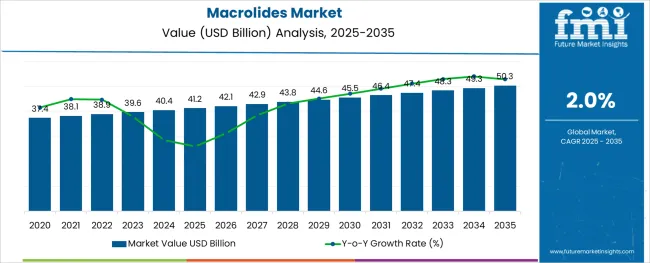

The Macrolides Market is estimated to be valued at USD 41.2 billion in 2025 and is projected to reach USD 50.3 billion by 2035, registering a compound annual growth rate (CAGR) of 2.0% over the forecast period.

The macrolides market is expanding steadily due to the ongoing demand for effective antibiotic therapies against respiratory and soft tissue infections. Medical literature highlights the continued importance of macrolides in treating bacterial infections, especially amid growing antibiotic resistance concerns. Healthcare providers are relying on these antibiotics for their broad-spectrum activity and favorable safety profile.

Innovations in drug formulation and delivery have improved patient compliance and treatment outcomes. Regulatory focus on antimicrobial stewardship has also emphasized the responsible use of macrolides, ensuring their continued clinical relevance.

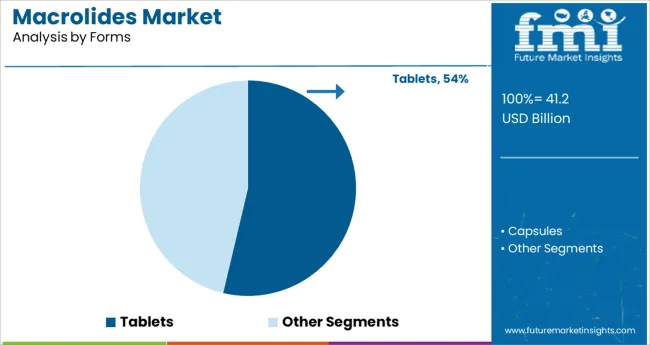

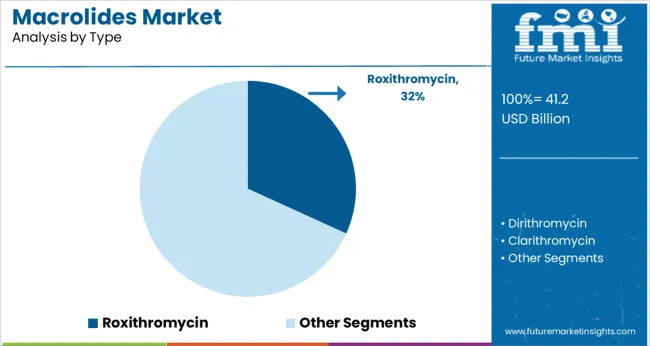

Increasing incidence of infections in both developed and emerging markets alongside improved healthcare infrastructure has supported market growth. The market outlook remains positive with expected advances in macrolide derivatives and combination therapies. Segmental growth is expected to be led by Tablets as the preferred form and Roxithromycin as the leading type.

The market is segmented by Forms and Type and region. By Forms, the market is divided into Tablets and Capsules. In terms of Type, the market is classified into Roxithromycin, Dirithromycin, Clarithromycin, Azithromycin, Erythromycin, and Others (Fidaxomicin, Telithromycin, Troleandomycin). Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The Tablets segment is projected to hold 53.7% of the macrolides market revenue in 2025, sustaining its lead among dosage forms. This segment’s prominence has been supported by the convenience of oral administration, which enhances patient adherence to prescribed regimens.

Tablets offer precise dosing and stability advantages, making them suitable for outpatient treatment and long-term therapy. The widespread availability of generic tablet formulations has improved affordability and accessibility, particularly in resource-limited settings.

Additionally, tablets are preferred by physicians for their ease of use across diverse patient populations including children and elderly. As patient-centric care and treatment adherence continue to influence prescribing practices, the Tablets segment is expected to maintain its dominant position.

The Roxithromycin segment is anticipated to capture 31.8% of the macrolides market revenue in 2025, establishing itself as the leading macrolide antibiotic type. This growth is attributable to Roxithromycin’s efficacy in treating a broad range of respiratory tract infections and its favorable pharmacokinetic profile.

Roxithromycin has been widely utilized due to its better tissue penetration and reduced dosing frequency compared to other macrolides. Clinical guidelines have recognized Roxithromycin as an effective alternative in regions with high resistance to older antibiotics.

The drug’s tolerability and lower incidence of gastrointestinal side effects have supported patient compliance. As antibiotic resistance patterns evolve and new therapeutic needs arise, Roxithromycin is expected to remain a key option in macrolide therapy.

Macrolide antibiotics are a well-established class of antimicrobial agents that have played a significant role in the chemotherapy of infectious diseases and other bacterial diseases. As a result of the increasing bacterial infection across the globe hence sales of macrolides agents aid in the fight against various bacterial infections due to demand for macrolides is increasing.

Additionally, with the rise of multidrug-resistant bacterial strains and the added advantages of sales of macrolides over standard antibiotics, macrolides have been found to be more effective. This element contributes to the sales of macrolides in the present market.

Additionally, reduced government participation in the approval of patents in the drug or pharmaceutical sector resulted in a shorter term of patent exclusivity for new drug applications in the pharmaceutical industry, which boosted the sales of macrolides in a number of locations throughout the world.

It is discovered that individuals are becoming more health concerned and protective of their health in comparison to the past. This expanding patient knowledge, health consciousness, and increased medical spending all contribute to the sales of macrolides in both established and emerging areas.

Thus, occasionally, owing to overdosing or the use of expired macrolides, customers' livers may be harmed. This side effect may have a negative impact on the sales of macrolides, which may act as a restraint on demand for macrolides during the forecasted period.

However, this is a minor issue that manufacturers can address by raising consumer awareness and educating them about the expiry date and the negative consequences of using expired macrolides where we can minimize negative consequences and also assist firms in improving the macrolides market share

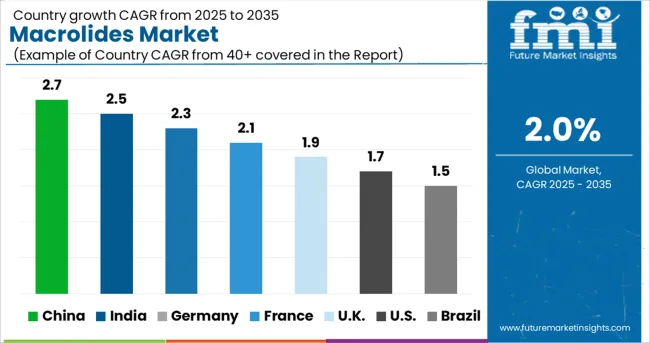

The worldwide macrolides market may be split geographically into North America, Asia Pacific (APAC), Europe, Latin America, the Middle East and Africa, and the Rest of the World (RoW), where it has been discovered that the Asia Pacific is currently leading the demand for macrolides market, followed by North America.

These areas are projected to maintain their current positions with demand for macrolides during the projection period. Due to a lack of understanding about macrolides and their advantages, the Middle East and Africa are expected to have low sales of macrolides in the macrolides market.

Apart from this, Latin America is a significant region where we may anticipate moderate growth with strong demand for macrolides during the projection time.

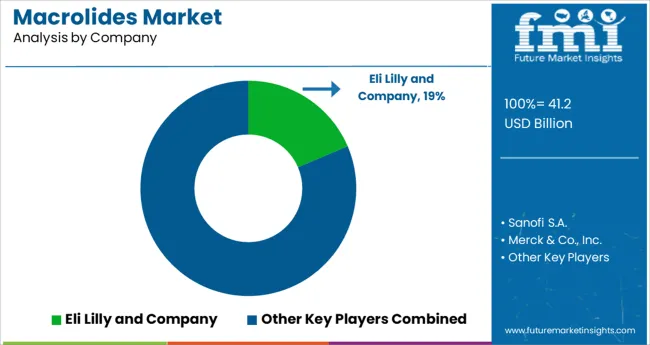

Eli Lilly and Company, Sanofi S.A., Merck & Co., Inc., Pfizer, Inc., Akorn Inc., Abbott Laboratories, Fresenius Kabi USA, LLC, Sandoz International GmbH, Neo Química, Mylan N.V., Wockhardt Ltd., Merck Sharp & Dohme Corp. and Gland Pharma Limited are some of the leading participants in the macrolides market.

| Report Attribute | Details |

|---|---|

| Growth rate | CAGR of 2% from 2025 to 2035 |

| Base year for estimation | 2024 |

| Historical data | 2020 to 2024 |

| Forecast period | 2025 to 2035 |

| Quantitative units | Revenue in billion, volume in kilotons and CAGR from 2025 to 2035 |

| Report coverage | Revenue forecast, volume forecast, company ranking, competitive landscape, growth factors and trends, Pricing Analysis |

| Segments covered | Form, type, region |

| Regional scope | North America; Western Europe; Eastern Europe; Middle East; Africa; ASEAN; South Asia; Rest of Asia; Australia and New Zealand |

| Country scope | USA, Canada, Mexico, Germany, UK, France, Italy, Spain, Russia, Belgium, Poland, Czech Republic, China, India, Japan, Australia, Brazil, Argentina, Colombia, Saudi Arabia, UAE, Iran, South Africa |

| Key companies profiled | Eli Lilly and Company; Sanofi S.A.; Merck & Co., Inc.; Pfizer, Inc.; Akorn Inc.; Abbott Laboratories; Fresenius Kabi USA, LLC; Sandoz International GmbH; Neo Química; Mylan N.V.; Wockhardt Ltd.; Merck Sharp & Dohme Corp.; Gland Pharma Limited |

| Customization scope | Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

| Pricing and purchase options | Avail of customized purchase options to meet your exact research needs. |

The global macrolides market is estimated to be valued at USD 41.2 billion in 2025.

It is projected to reach USD 50.3 billion by 2035.

The market is expected to grow at a 2.0% CAGR between 2025 and 2035.

The key product types are tablets and capsules.

roxithromycin segment is expected to dominate with a 31.8% industry share in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA