There is a steady revenue growth in the melamine pyrophosphate market, with an estimated value of USD 364.85 million in the year 2025, and it is set to grow around USD 651.7 million by 2035 at a CAGR of roughly 6.0%. The increase is being fuelled by increasing demand for halogen-free flame retardants in various industries.

The electrical and electronics industry is one of the driving growth industries. MPP is utilized for printed circuit boards (PCBs), connectors, and insulating materials. With ongoing miniaturization and increased power of technology, the need for reliable flame protection without compromising function continues to become increasingly critical.

In the building industry, melamine pyrophosphate is extensively applied to coatings, sealants, and structural products for compliance with strict building regulations. Increased urbanization and investment in commercial infrastructure in Asia-Pacific and the Middle East are anticipated to support persistent regional demand.

Melamine pyrophosphate is more costly than conventional halogen-based systems, and thus, its use is restricted to low-cost applications. Maximizing performance with other material properties-such as mechanical toughness or UV stability-can also induce formulation complexity.

Manufacturers are seeking to surmount these limitations through advanced formulations and hybrid systems marrying MPP with synergists like ammonium polyphosphate or zinc borate, which provide enhanced flame retarding and lower costs.

Efforts are also being made to enhance the recyclability and toughness of flame-retardant plastics using MPP-based systems, which aligns with the circular economy and sustainability goals of large chemical producers and consumers. The melamine pyrophosphate industry is benefiting from a clear industry trend towards high-performance, environment-friendly flame retardants. As safety standards improve and green products become mainstream, MPP will be a leading player in fire protection in today's industries.

Market Metrics – Melamine Pyrophosphate Market

| Market Metrics | Values |

|---|---|

| Industry Size (2025E) | USD 364.85 million |

| Industry Value (2035F) | USD 651.7 million |

| CAGR (2025 to 2035) | 6.0% |

In 2025, the Synthetic Resins application will dominate the industry with a total revenue share of 15.75%, making it the leading application in the industry. Thermoplastic Elastomers (TPEs) will follow with a revenue share of 10.5%.

Due to applications in a wide range of industries, such as automotive, construction, and electronics, the Synthetic Resins category is expected to maintain a good industry share. Synthetic resins are extensively used in coatings, adhesives, and composite materials, requiring flame-retardant properties.

Melamine pyrophosphate has excellent fire-retardant properties, which makes the resins safe and durable for usein detrimental environments. It is worth noting that companies like Huntsman Corporation and BASF have been very keen on enabling the resin industry with flame-retardant additives that meet the rigorous fire safety standards required in products such as insulation materials, circuit boards, and protective coatings.

The Thermoplastic Elastomer segment is expected to hold 10.5% in 2025. TPEs were considered for industries ranging from automotive to consumer goods and industrial applications because of their flexibility, durability, and ease of processing. The addition of melamine pyrophosphate to TPEs further enhances their flame-retardant properties, allowing them to be used in critical applications such as automotive components and electrical housings.

Companies manufacturing TPEs, including Kraton Polymers and Dow Chemical, are increasingly utilizing fire-retardant additives in their formulations to satisfy fire safety requirements, simultaneously encouraging the growth of the TPE segment.

As a result, both segments are poised to gain enormous strength from industries that keep emphasizing safety, performance, and compliance with fire-resistant materials on a global scale.

The synthetic resins segment had an estimated revenue share of 21%. This will be followed by the automotive segment, which has an 18.9% revenue share. The synthetic resins segment would mainly contribute to the growth of the industry due to the increasing demand for flame retardants in the production of resins widely used in construction, electronics, and automotive applications.

In these applications, melamine pyrophosphate is favored as a flame retardant that improves flame resistance and stability of resins, thereby making them safer for use under high-risk conditions. The largest chemical companies, such as Huntsman Corporation and Lanxess, make resins using flame-retardant additives, which are applicable in those cases that require high-performance materials, such as circuit boards, insulation materials, and coatings. For example, several flame-retardant resins have been developed by BASF that comply with worldwide application fire safety regulations and promote sales growth.

Based on projections by 2025, the Automotive segment is expected to occupy a significant share of the revenue, amounting to 18.9%. The eminent focus of car manufacturers on safety has contributed to the increasing purchase of fire-resistant materials for use on the interior and components of vehicles.

Melamine pyrophosphate is used in upholstery and panels as part of the plastic and fabric portions of a vehicle to ensure compliance with very stringent safety regulations. Ford, General Motors, and Volkswagen are among the companies using combustion-retardant materials in vehicle production to meet global fire safety standards. However, they are also looking for ways of enhancing the internal durability and safety characteristics of vehicles through other improved materials like melamine pyrophosphate-treated fabrics.

These two segments have a bright future in terms of growth with respect to safety and performance standards. The increased demand for flame retardants will continue to increase due to the trend toward safer and more durable materials in construction and automotive manufacturing.

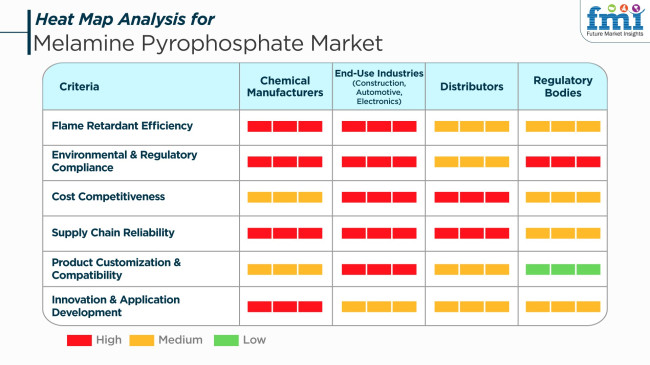

The Melamine Pyrophosphate (MPP) market is showing high growth with a rising need for halogen-free flame retardants in all industries. MPP has excellent thermal stability, low toxicity, and efficient fire retardance capacity in decreasing the inflammability of the materials used for plastics, clothing, and coating.

End-use applications like construction, automotive, and electronics place importance on flame retardant performance and environmental regulatory requirements. MPP finds application in construction products like insulation products and coatings for improved fire resistance. Automotive companies use MPP in interior parts to meet safety standards, whereas the electronics industry applies MPP to circuit boards and casings to prevent fire hazards.

Regulatory Agencies impose regulations that ensure the adoption of eco-friendly flame retardants like MPP. They drive growth by enforcing rules that limit the use of harmful chemicals, thereby driving the adoption of safer products.Stakeholders collectively put efforts into providing and using performance-approved flame retardants to meet performance, environmental, and changing customer demand requirements.

Melamine Pyrophosphate (MPP) Market - Stakeholder Priorities

In the period 2020 to 2024, the melamine pyrophosphate industry grew steadily as it started to find applications in industries requiring flame-resistant products, most importantly textiles, electricals, and construction. The period was also characterized by a shift towards stronger safety procedures, which allowed industries to employ more efficient and eco-friendly products. However, there was a low awareness of MPP in some parts of the country and the slow rate at which product formulation technology developed.

Producers aimed to enhance the effectiveness of MPP in fire resistance, especially in plastics and paint. Between 2025 and 2035, a tremendous change towards innovation and sustainability is expected. The focus will be on creating environmentally friendly, halogen-free formulations of MPP conforming to world environmental regulations.

Advanced technology will see the manufacture of specialty MPP grades aligned to specific industrial requirements, with increasingly growing concerns over sustainability fuelling demand in developing economies. Joint ventures and alliances between chemical and materials companies will deliver advanced fire retardants. Regulations will keep changing, requiring better and safer performance materials, pushing the limits of the industry.

Comparative Market Shift Analysis (2020 to 2024 vs. 2025 to 2035)

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Enhancement of flame retardant properties and compatibility of materials. | Creation of halogen-free and eco-friendly formulations. |

| Flame retardant is applied to textiles, coatings, plastics, and adhesives. | Leading new markets like automotive, electronics, and construction materials. |

| Increased safety requirements call for efficient flame retardants. | Stricter environmental regulation makes the balance shift towards more environmentally friendly alternatives. |

| Asia Pacific keeps expanding, with new demand in Europe. | Continued leadership in Asia Pacific, along with robust growth in North America. |

| Focus on increasing phosphorus content to increase fire resistivity. | Progressive MPP formulations built on selected industrial applications. |

| Initiation of sustainability initiatives, with some projects towards the use of environmentally friendly formulations. | Sustainability emerges as a key driver, with a movement towards non-toxic and biodegradable solutions. |

The industry is sensitive to fluctuations in raw material prices, particularly melamine and phosphoric acid. The volatility of input costs can be a burden to production costs, which can render production uncompetitive in terms of pricing levels and can even affect profit margins.

Strict environmental and safety standards are a significant threat to the industry. Compliance with diverse regional requirements is maintained. Non-compliance may lead to legal sanctions and loss of brand image, impacting industry share and customer confidence.

Supply chain disruptions, such as transportation loss of service or geopolitical tensions, can prevent raw material and finished product delivery in a timely manner. Disruptions can lead to production shutdowns and missed customer demand, which adversely affects sales and long-term relationships.

The industry faces competition and technological innovation. Firms are required to make investments in research and development so that they can innovate and enhance product offerings periodically. Otherwise, they risk falling into obsolescence and loss of revenue share to more competitive players.

Recreation in major industries like construction, automobiles, and electronics implies that declining performance in such sectors has the potential to influence demand for MPP directly. Diversification of customers to different industries is one way that can assist in offsetting such risk.

In short, the melamine pyrophosphate industry is under threat from raw material price volatility, regulatory challenges, supply chain risks, technological change, and industry-specific economic declines. Anticipatory action towards these factors must be taken in order to continue growth and competitiveness in this ever-changing industry.

| Countries | CAGR (2025 to 2035) |

|---|---|

| USA | 4.7% |

| UK | 4.2% |

| France | 4.0% |

| Germany | 4.4% |

| Italy | 3.8% |

| South Korea | 5.1% |

| Japan | 4.5% |

| China | 6.0% |

| Australia | 4.1% |

| New Zealand | 3.6% |

The USA is expected to register a CAGR of 4.7% from 2025 to 2035. Increased demand for halogen-free flame retardants in construction materials, textiles, and electronics is propelling growth. Stringent fire protection policies and environmental regulations are compelling the transition from traditional flame retardants to phosphorus-nitrogen-based chemicals like melamine pyrophosphate.

Major players such as Chemours and ICL Group are developing advanced formulations of higher thermal stability by focusing on R&D and product development. These players are expected to support growth in the forecast period due to the increasing use of environmentally sustainable flame retardants in automotive interior parts and consumer electronics.

The UK is anticipated to grow with a CAGR of 4.2% during the forecast period of 2025 to 2035. Regulatory policies are inducing fire-resistant construction materials and green consumer products, thereby driving the applications of non-halogenated flame retardants. The versatility of the material in thermoplastics, coatings, and fiber applications is driving differentiated demand.

Specialty chemical business companies that are in operation are matching product lines with changing safety needs. Polymer compounding and composite materials technology are adding value. A sustained focus on the sustainable development of infrastructure will probably continue driving the long-term use of melamine pyrophosphate in the UK market.

France is predicted to register a CAGR of 4.0% during the forecast period in the market for melamine pyrophosphate. Local demand is spurred by increasing fire protection needs in transport, public buildings, and consumer appliances. The suitability of the product with polyolefins and epoxy resins favors its usage across a wide range of sectors.

Leading companies engaged in flame retardant technology are concentrating on performance improvement and environmental compliance. Joint efforts by government research organizations and private sectors are encouraging the development of advanced flame retardant systems based on regional safety standards and performance specifications.

Germany's melamine pyrophosphate industry is expected to have a CAGR of 4.4% during the forecast period of 2025 to 2035. The chemical is used in themaking of flame-retardants for plastics for applications in the automotive, electronic, and building industries. Advanced fire protection technology is being integrated into higher-performing materials via strong engineering and manufacturing capabilities.

Global leaders like BASF and Lanxess are playing a key role in the development of product efficiency and fire retardance properties. EU sustainability goals compliance is driving the substitution of brominated retardants with phosphorus-based systems, thereby making melamine pyrophosphate an essential component of environmentally friendly flame retardant formulations.

Italy is anticipated to expand at a CAGR of 3.8% during the forecast period. Reasonable growth is fueled by specialty coating, construction material, and automotive usage. Growing awareness regarding halogen-free fire retardant solutions is progressively modifying material producers' decisions.

Italian firms are investing in compliance-driven innovation, with a focus directed toward the design of products that meet European fire defense and environmental regulations. Even though penetration is less, as compared to leading Western European nations, increasing consciousness and local supply chain development are expected to amplify adoption rates in the next decade.

South Korea will expand at a CAGR of 5.1% from 2025 to 2035. Consistent industrial production in the electronics and automotive sectors is boosting demand for environmentally friendly and high thermal resistance flame retardants. Melamine pyrophosphate's halogen-free nature is compliant with local regulatory directions and export standards.

Leading South Korean chemical firms are applying the compound to blend in with thermoplastics and advanced polymers. New resin modification technology and polymer blends are providing new application opportunities as technology ability via government-private collaborations is improving in developing sustainable flame retardants.

Japan is expected to register a CAGR of 4.5% for melamine pyrophosphate sales in the forecast period. The market shows a continued demand for non-halogen flame retardants to be used in electronics, transportation, and consumer goods. Emphasis on precision engineering and compliance boosts the contribution of advanced flame-retardant additives to manufacturing processes.

Key drivers such as Mitsubishi Gas Chemical and ADEKA Corporation are now leading the research in process compatibility and additive performance. With the industry moving towards greener technologies, melamine pyrophosphate is increasingly becoming valuable and dependable for fire protection in sensitive applications.

China will dominate with an estimated CAGR of 6.0% between 2025 and 2035. Growth is driven primarily by industrialization and rising fire safety regulations in construction, textiles, and electrical appliances. High production capacity and cost leadership form the basis of the country's dominance both in the domestic and international markets.

Producers like Shian Chem and Zhenjiang Sanwa Flame Retardant are increasing manufacturing capacity and product lines to international standards. The government focuses on green chemicals, and product safety is encouraging the broader application of halogen-free retardants, consolidating China's strategic position in global supply chains.

Australia is also anticipated to maintain a CAGR of 4.1% during the forecast period. Demand is being sustained due to the application of flame retardants in materials of construction, building materials, and mining equipment. Increasing concern for wildfire danger and the necessity for fireproof homes are adding to an increasing application of fire retardant chemicals.

Regional distributors and specialty chemical manufacturers are gaining strength through import alliances and compliance with global safety standards. Environmental benign flame retardant demand is propelling the adoption of melamine pyrophosphate in protective coverings and insulating products.

New Zealand is expected to expand at a CAGR of 3.6% from 2025 to 2035. The industry is niche, with applications confined to construction products and low-production-volume electronics production. Adoption is enabled by regulatory policy supporting safety and environmental stewardship.

Research institutions and domestic sectors are also scouting the possibility of introducing halogen-free flame retardants in the domestic industry. Although the industry size is small, growing attention on sustainability and fire protection in government-sponsored infrastructure projects will persist in driving demand for melamine pyrophosphate increasingly over the forecast period.

The industry is highlycompetitive, with leading manufacturers specializing in fire-retardant technologies for plastics, coatings, and electronic applications. Companies such as Puyang Chengke Chemical, Shouguang Weidong Chemical, and Tianyi enjoy a leading position due to developing high-performance MPP products for industries with greater thermal stability as well as halogen-free fire resistance. Improvements in polymer compatibility and optimization of product formulations further help them keep the company in leadership positions.

Regional players such as Shian Chemical, Sichuan Institute of Fine Chemical Industry Research and Design, and Cnsolver Technology strengthen the competition by providing cheaper alternatives along with better purity levels for MPPs. These are the players who have a global presence for eco-friendly, efficient, and cost-effective solutions in flame retardants.

Innovators like JLS Chemical, Zhenjiang Sanwa Flame Retardant Technology, and Century Multech Inc. are becoming popular by incorporating MPP in advanced polymer applications such as thermoplastics, textiles and coatings. Their focus on tailored formulations distinguishes them from the rest of the pack, helping them carve strong relationships in the industry.

Rigorous fire safety requirements, the shifting environment standards, and the dynamic innovations in polymer engineering influence the market. To meet the requirements, leading companies such as Zhenjiang Xingxing Flame Retardants are expanding production capacity and investing in research partnerships with chemical institutions seeking efficient yet next-generation sustainable flame-retardant solutions.

Market Share Analysis by Company

| Company Name | Market Share (%) |

|---|---|

| Puyang Chengke Chemical | 18-22% |

| Shouguang Weidong Chemical | 14-18% |

| Tianyi | 12-16% |

| Shian Chemical | 10-14% |

| Sichuan Institute of Fine Chemical Industry Research and Design | 8-12% |

| Others (combined) | 25-35% |

| Company Name | Key Offerings and Activities |

|---|---|

| Puyang Chengke Chemical | Produces high-purity MPP for plastics, coatings, and electronic applications, ensuring thermal stability and fire resistance. |

| Shouguang Weidong Chemical | Specializes in cost-effective MPP solutions with enhanced dispersion properties for industrial applications. |

| Tianyi | Focuses on halogen-free flame retardants, improving polymer compatibility and environmental safety. |

| Shian Chemical | Develops customized MPP formulations for advanced polymer applications and coatings. |

| Sichuan Institute of Fine Chemical Industry Research and Design | Expand its reach through innovative flame-retardant solutions and strategic research partnerships. |

Key Company Insights

Puyang Chengke Chemical (18-22%)

Leads in high-performance MPP production, focusing on halogen-free and environmentally friendly flame retardant solutions.

Shouguang Weidong Chemical (14-18%)

Strengthens its market position with cost-effective, high-purity MPP for plastic and coating applications.

Tianyi (12-16%)

Innovates in flame retardant solutions, optimizing MPP properties for thermoplastics and advanced materials.

Shian Chemical (10-14%)

Expand its portfolio with customized MPP formulations tailored for diverse industrial applications.

Sichuan Institute of Fine Chemical Industry Research and Design (8-12%)

Invests in R&D collaborations to develop next-generation MPP with improved dispersion and processing efficiency.

Other Key Players

The segmentation is into experimental grade, industrial grade, and commercial grade.

The primary application segments include synthetic resins, thermoplastic elastomers, and others.

End-use sub-segments comprise synthetic resins, automotive, textile, aerospace & defense, packaging, and others.

Geographically, the market is divided into North America, Latin America, Western Europe, Eastern Europe, South Asia and Pacific, East Asia, and the Middle East and Africa.

The global market is estimated to be worth USD 364.85 million in 2025.

Sales are projected to grow steadily, reaching USD 651.7 million by 2035, driven by increased demand for halogen-free flame retardants in construction and electronics.

China is expected to record a CAGR of 6.0%, supported by growth in industrial manufacturing and synthetic resin applications.

Synthetic resins are leading, benefiting from enhanced fire resistance and environmental compliance.

Prominent companies include Puyang Chengke Chemical, Shouguang Weidong Chemical, Tianyi, Shian Chemical, Sichuan Institute of Fine Chemical Industry Research and Design, Cnsolver Technology, JLS Chemical, Zhenjiang Sanwa Flame Retardant Technology, Century Multech Inc., and Zhenjiang Xingxing Flame Retardants.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Tons) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 4: Global Market Volume (Tons) Forecast by Type, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 6: Global Market Volume (Tons) Forecast by Application, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by End Use Industry, 2018 to 2033

Table 8: Global Market Volume (Tons) Forecast by End Use Industry, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 10: North America Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 12: North America Market Volume (Tons) Forecast by Type, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 14: North America Market Volume (Tons) Forecast by Application, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast by End Use Industry, 2018 to 2033

Table 16: North America Market Volume (Tons) Forecast by End Use Industry, 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 18: Latin America Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 19: Latin America Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 20: Latin America Market Volume (Tons) Forecast by Type, 2018 to 2033

Table 21: Latin America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 22: Latin America Market Volume (Tons) Forecast by Application, 2018 to 2033

Table 23: Latin America Market Value (US$ Million) Forecast by End Use Industry, 2018 to 2033

Table 24: Latin America Market Volume (Tons) Forecast by End Use Industry, 2018 to 2033

Table 25: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Western Europe Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 27: Western Europe Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 28: Western Europe Market Volume (Tons) Forecast by Type, 2018 to 2033

Table 29: Western Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 30: Western Europe Market Volume (Tons) Forecast by Application, 2018 to 2033

Table 31: Western Europe Market Value (US$ Million) Forecast by End Use Industry, 2018 to 2033

Table 32: Western Europe Market Volume (Tons) Forecast by End Use Industry, 2018 to 2033

Table 33: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 34: Eastern Europe Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 35: Eastern Europe Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 36: Eastern Europe Market Volume (Tons) Forecast by Type, 2018 to 2033

Table 37: Eastern Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 38: Eastern Europe Market Volume (Tons) Forecast by Application, 2018 to 2033

Table 39: Eastern Europe Market Value (US$ Million) Forecast by End Use Industry, 2018 to 2033

Table 40: Eastern Europe Market Volume (Tons) Forecast by End Use Industry, 2018 to 2033

Table 41: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 42: South Asia and Pacific Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 43: South Asia and Pacific Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 44: South Asia and Pacific Market Volume (Tons) Forecast by Type, 2018 to 2033

Table 45: South Asia and Pacific Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 46: South Asia and Pacific Market Volume (Tons) Forecast by Application, 2018 to 2033

Table 47: South Asia and Pacific Market Value (US$ Million) Forecast by End Use Industry, 2018 to 2033

Table 48: South Asia and Pacific Market Volume (Tons) Forecast by End Use Industry, 2018 to 2033

Table 49: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 50: East Asia Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 51: East Asia Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 52: East Asia Market Volume (Tons) Forecast by Type, 2018 to 2033

Table 53: East Asia Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 54: East Asia Market Volume (Tons) Forecast by Application, 2018 to 2033

Table 55: East Asia Market Value (US$ Million) Forecast by End Use Industry, 2018 to 2033

Table 56: East Asia Market Volume (Tons) Forecast by End Use Industry, 2018 to 2033

Table 57: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 58: Middle East and Africa Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 59: Middle East and Africa Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 60: Middle East and Africa Market Volume (Tons) Forecast by Type, 2018 to 2033

Table 61: Middle East and Africa Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 62: Middle East and Africa Market Volume (Tons) Forecast by Application, 2018 to 2033

Table 63: Middle East and Africa Market Value (US$ Million) Forecast by End Use Industry, 2018 to 2033

Table 64: Middle East and Africa Market Volume (Tons) Forecast by End Use Industry, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Application, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by End Use Industry, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 5: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 6: Global Market Volume (Tons) Analysis by Region, 2018 to 2033

Figure 7: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 8: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 9: Global Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 10: Global Market Volume (Tons) Analysis by Type, 2018 to 2033

Figure 11: Global Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 12: Global Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 13: Global Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 14: Global Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 15: Global Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 16: Global Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 17: Global Market Value (US$ Million) Analysis by End Use Industry, 2018 to 2033

Figure 18: Global Market Volume (Tons) Analysis by End Use Industry, 2018 to 2033

Figure 19: Global Market Value Share (%) and BPS Analysis by End Use Industry, 2023 to 2033

Figure 20: Global Market Y-o-Y Growth (%) Projections by End Use Industry, 2023 to 2033

Figure 21: Global Market Attractiveness by Type, 2023 to 2033

Figure 22: Global Market Attractiveness by Application, 2023 to 2033

Figure 23: Global Market Attractiveness by End Use Industry, 2023 to 2033

Figure 24: Global Market Attractiveness by Region, 2023 to 2033

Figure 25: North America Market Value (US$ Million) by Type, 2023 to 2033

Figure 26: North America Market Value (US$ Million) by Application, 2023 to 2033

Figure 27: North America Market Value (US$ Million) by End Use Industry, 2023 to 2033

Figure 28: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 29: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 30: North America Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 31: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 32: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 33: North America Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 34: North America Market Volume (Tons) Analysis by Type, 2018 to 2033

Figure 35: North America Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 37: North America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 38: North America Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 39: North America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 40: North America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 41: North America Market Value (US$ Million) Analysis by End Use Industry, 2018 to 2033

Figure 42: North America Market Volume (Tons) Analysis by End Use Industry, 2018 to 2033

Figure 43: North America Market Value Share (%) and BPS Analysis by End Use Industry, 2023 to 2033

Figure 44: North America Market Y-o-Y Growth (%) Projections by End Use Industry, 2023 to 2033

Figure 45: North America Market Attractiveness by Type, 2023 to 2033

Figure 46: North America Market Attractiveness by Application, 2023 to 2033

Figure 47: North America Market Attractiveness by End Use Industry, 2023 to 2033

Figure 48: North America Market Attractiveness by Country, 2023 to 2033

Figure 49: Latin America Market Value (US$ Million) by Type, 2023 to 2033

Figure 50: Latin America Market Value (US$ Million) by Application, 2023 to 2033

Figure 51: Latin America Market Value (US$ Million) by End Use Industry, 2023 to 2033

Figure 52: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 53: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 54: Latin America Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 55: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 57: Latin America Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 58: Latin America Market Volume (Tons) Analysis by Type, 2018 to 2033

Figure 59: Latin America Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 60: Latin America Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 62: Latin America Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 63: Latin America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 64: Latin America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) Analysis by End Use Industry, 2018 to 2033

Figure 66: Latin America Market Volume (Tons) Analysis by End Use Industry, 2018 to 2033

Figure 67: Latin America Market Value Share (%) and BPS Analysis by End Use Industry, 2023 to 2033

Figure 68: Latin America Market Y-o-Y Growth (%) Projections by End Use Industry, 2023 to 2033

Figure 69: Latin America Market Attractiveness by Type, 2023 to 2033

Figure 70: Latin America Market Attractiveness by Application, 2023 to 2033

Figure 71: Latin America Market Attractiveness by End Use Industry, 2023 to 2033

Figure 72: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 73: Western Europe Market Value (US$ Million) by Type, 2023 to 2033

Figure 74: Western Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 75: Western Europe Market Value (US$ Million) by End Use Industry, 2023 to 2033

Figure 76: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 77: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 78: Western Europe Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 79: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 80: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 81: Western Europe Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 82: Western Europe Market Volume (Tons) Analysis by Type, 2018 to 2033

Figure 83: Western Europe Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 84: Western Europe Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 85: Western Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 86: Western Europe Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 87: Western Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 88: Western Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 89: Western Europe Market Value (US$ Million) Analysis by End Use Industry, 2018 to 2033

Figure 90: Western Europe Market Volume (Tons) Analysis by End Use Industry, 2018 to 2033

Figure 91: Western Europe Market Value Share (%) and BPS Analysis by End Use Industry, 2023 to 2033

Figure 92: Western Europe Market Y-o-Y Growth (%) Projections by End Use Industry, 2023 to 2033

Figure 93: Western Europe Market Attractiveness by Type, 2023 to 2033

Figure 94: Western Europe Market Attractiveness by Application, 2023 to 2033

Figure 95: Western Europe Market Attractiveness by End Use Industry, 2023 to 2033

Figure 96: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 97: Eastern Europe Market Value (US$ Million) by Type, 2023 to 2033

Figure 98: Eastern Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 99: Eastern Europe Market Value (US$ Million) by End Use Industry, 2023 to 2033

Figure 100: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 101: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 102: Eastern Europe Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 103: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 104: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 105: Eastern Europe Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 106: Eastern Europe Market Volume (Tons) Analysis by Type, 2018 to 2033

Figure 107: Eastern Europe Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 108: Eastern Europe Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 109: Eastern Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 110: Eastern Europe Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 111: Eastern Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 112: Eastern Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 113: Eastern Europe Market Value (US$ Million) Analysis by End Use Industry, 2018 to 2033

Figure 114: Eastern Europe Market Volume (Tons) Analysis by End Use Industry, 2018 to 2033

Figure 115: Eastern Europe Market Value Share (%) and BPS Analysis by End Use Industry, 2023 to 2033

Figure 116: Eastern Europe Market Y-o-Y Growth (%) Projections by End Use Industry, 2023 to 2033

Figure 117: Eastern Europe Market Attractiveness by Type, 2023 to 2033

Figure 118: Eastern Europe Market Attractiveness by Application, 2023 to 2033

Figure 119: Eastern Europe Market Attractiveness by End Use Industry, 2023 to 2033

Figure 120: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 121: South Asia and Pacific Market Value (US$ Million) by Type, 2023 to 2033

Figure 122: South Asia and Pacific Market Value (US$ Million) by Application, 2023 to 2033

Figure 123: South Asia and Pacific Market Value (US$ Million) by End Use Industry, 2023 to 2033

Figure 124: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 125: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 126: South Asia and Pacific Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 127: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 128: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 129: South Asia and Pacific Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 130: South Asia and Pacific Market Volume (Tons) Analysis by Type, 2018 to 2033

Figure 131: South Asia and Pacific Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 132: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 133: South Asia and Pacific Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 134: South Asia and Pacific Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 135: South Asia and Pacific Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 136: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 137: South Asia and Pacific Market Value (US$ Million) Analysis by End Use Industry, 2018 to 2033

Figure 138: South Asia and Pacific Market Volume (Tons) Analysis by End Use Industry, 2018 to 2033

Figure 139: South Asia and Pacific Market Value Share (%) and BPS Analysis by End Use Industry, 2023 to 2033

Figure 140: South Asia and Pacific Market Y-o-Y Growth (%) Projections by End Use Industry, 2023 to 2033

Figure 141: South Asia and Pacific Market Attractiveness by Type, 2023 to 2033

Figure 142: South Asia and Pacific Market Attractiveness by Application, 2023 to 2033

Figure 143: South Asia and Pacific Market Attractiveness by End Use Industry, 2023 to 2033

Figure 144: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 145: East Asia Market Value (US$ Million) by Type, 2023 to 2033

Figure 146: East Asia Market Value (US$ Million) by Application, 2023 to 2033

Figure 147: East Asia Market Value (US$ Million) by End Use Industry, 2023 to 2033

Figure 148: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 149: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 150: East Asia Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 151: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 152: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 153: East Asia Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 154: East Asia Market Volume (Tons) Analysis by Type, 2018 to 2033

Figure 155: East Asia Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 156: East Asia Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 157: East Asia Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 158: East Asia Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 159: East Asia Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 160: East Asia Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 161: East Asia Market Value (US$ Million) Analysis by End Use Industry, 2018 to 2033

Figure 162: East Asia Market Volume (Tons) Analysis by End Use Industry, 2018 to 2033

Figure 163: East Asia Market Value Share (%) and BPS Analysis by End Use Industry, 2023 to 2033

Figure 164: East Asia Market Y-o-Y Growth (%) Projections by End Use Industry, 2023 to 2033

Figure 165: East Asia Market Attractiveness by Type, 2023 to 2033

Figure 166: East Asia Market Attractiveness by Application, 2023 to 2033

Figure 167: East Asia Market Attractiveness by End Use Industry, 2023 to 2033

Figure 168: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 169: Middle East and Africa Market Value (US$ Million) by Type, 2023 to 2033

Figure 170: Middle East and Africa Market Value (US$ Million) by Application, 2023 to 2033

Figure 171: Middle East and Africa Market Value (US$ Million) by End Use Industry, 2023 to 2033

Figure 172: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 173: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 174: Middle East and Africa Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 175: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 176: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 177: Middle East and Africa Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 178: Middle East and Africa Market Volume (Tons) Analysis by Type, 2018 to 2033

Figure 179: Middle East and Africa Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 180: Middle East and Africa Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 181: Middle East and Africa Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 182: Middle East and Africa Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 183: Middle East and Africa Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 184: Middle East and Africa Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 185: Middle East and Africa Market Value (US$ Million) Analysis by End Use Industry, 2018 to 2033

Figure 186: Middle East and Africa Market Volume (Tons) Analysis by End Use Industry, 2018 to 2033

Figure 187: Middle East and Africa Market Value Share (%) and BPS Analysis by End Use Industry, 2023 to 2033

Figure 188: Middle East and Africa Market Y-o-Y Growth (%) Projections by End Use Industry, 2023 to 2033

Figure 189: Middle East and Africa Market Attractiveness by Type, 2023 to 2033

Figure 190: Middle East and Africa Market Attractiveness by Application, 2023 to 2033

Figure 191: Middle East and Africa Market Attractiveness by End Use Industry, 2023 to 2033

Figure 192: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Melamine Formaldehyde (MF) Market Size and Share Forecast Outlook 2025 to 2035

Melamine Market Size and Share Forecast Outlook 2025 to 2035

Global Melamine Beauty Product Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Melamine Foam Market

Alkylation Melamine-Formaldehyde Resin for Coating Market Size and Share Forecast Outlook 2025 to 2035

Sulfonated Melamine Formaldehyde Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA