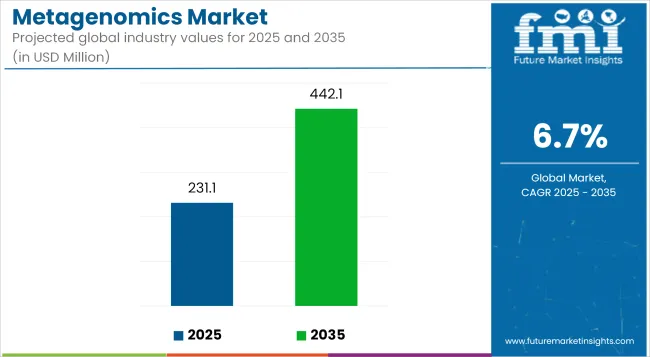

The global Metagenomics Market is estimated to be valued at USD 231.1 million in 2025 and is projected to reach USD 442.07 million by 2035, registering a CAGR of 6.7% over the forecast period.

| Metric | Value |

|---|---|

| Market Size in 2025 | USD 231.1 Million |

| Projected Market Size in 2035 | USD 442.07 Million |

| CAGR (2025 to 2035) | 6.7% |

The metagenomics market has witnessed robust expansion as next-generation sequencing and bioinformatics technologies have become integral to understanding complex microbial communities across human, environmental, and industrial ecosystems.

Advances in shotgun sequencing, marker gene analysis, and computational pipelines have enabled precise profiling of unculturable organisms, supporting applications ranging from infectious disease diagnostics to agricultural optimization.

Growing awareness of the microbiome’s role in health and disease has spurred significant research funding and collaborative initiatives among academic institutions, public health agencies, and life science companies. Regulatory frameworks endorsing metagenomic testing for pathogen surveillance and antimicrobial resistance monitoring have further accelerated adoption.

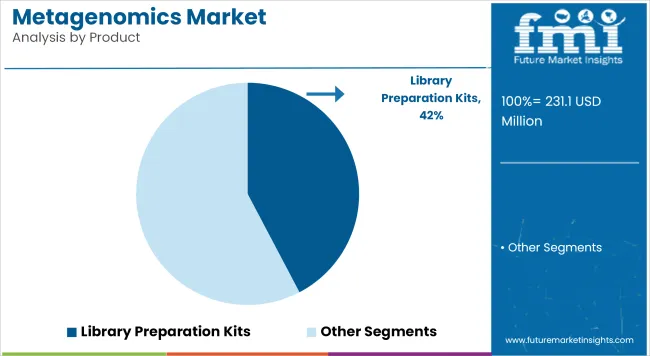

Product Analysis: Library Preparation Kits

In 2025, a revenue shares of 42.3% has been attributed to library preparation kits, highlighting their critical role in enabling high-quality metagenomic data generation. The growth of this segment has been driven by the need for streamlined workflows that reduce hands-on time and variability in sample processing. Kits offering automation compatibility and pre-validated protocols have been widely adopted to improve reproducibility and shorten turnaround times in both research and clinical labs.

Manufacturers have invested in chemistries supporting low-input DNA, degraded samples, and pathogen-rich matrices, expanding their utility across diverse applications. Cost-effective library preparation solutions is expected as metagenomic sequencing becomes an integral part of microbiome studies and infectious disease diagnostics.

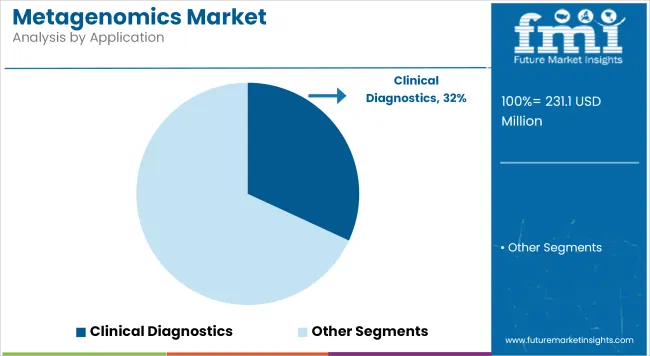

Clinical Diagnostics contributes a revenue share of 31.9% has been attributed to clinical diagnostics, reflecting the rising use of metagenomic sequencing in identifying infectious agents and characterizing dysbiosis-linked disorders. Adoption has been driven by the capability of unbiased sequencing to detect a broad range of pathogens, including viruses, bacteria, and fungi, in a single assay.

Clinicians have increasingly relied on metagenomics to guide treatment decisions for sepsis, meningitis, and antimicrobial resistance cases where conventional culture-based methods are limited. Regulatory support for validated sequencing workflows has further encouraged clinical deployment. Continued investment in clinical-grade pipelines, reimbursement pathways, and point-of-care solutions is anticipated to support strong growth in this segment.

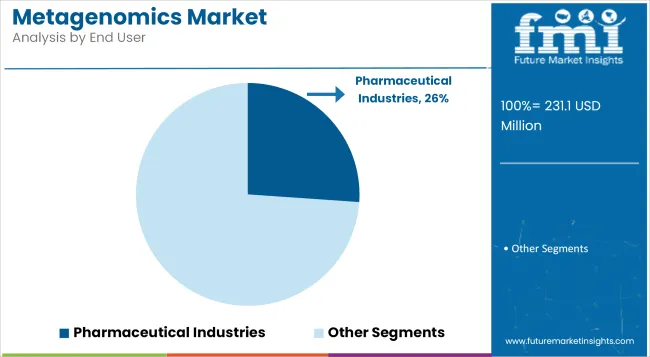

Pharmaceutical Industries is estimated to be accounting for a revenue share of 26.1% which is attributed to their key role in driving metagenomics adoption for therapeutic innovation. Utilization has been driven by the need to understand host-microbiome interactions, identify novel drug targets, and develop microbiome-based therapeutics and diagnostics.

Companies have incorporated metagenomic data into discovery pipelines to inform biomarker development and stratify patient populations. Strategic collaborations with sequencing platform developers and bioinformatics providers have further strengthened this segment’s growth. Over the forecast period, the expansion of microbiome drug development programs and investment in companion diagnostics are expected to reinforce pharmaceutical industry leadership in the market.

Data interpretation complexity, standardization gaps, and high infrastructure costs

The inherent complexity of metagenomics data and the requisite advanced computational tools and trained personnel have remained the bigger challenges. The entire range, from sampling to methodology, sequencing protocol, and data interpretation framework, is yet to be standardized across laboratories and contexts of research.

Installation of high-throughput sequencing and computing resources is still devastatingly unaffordable, even for the low and middle-income settings. The World Health Organization calls for the equitable development of global health equity standards for genomic surveillance metagenomics tools.

Personalized microbiome-based medicine, AMR monitoring, and environmental diagnostics

There are emerging opportunities in the personalized health segments such as microbiome-based diagnostics, products development, and therapeutic response prediction. In clinical microbiology, metagenomic sequencing is almost single-handedly revolutionizing the diagnostics for those rare and polymicrobial infections that can simply not be cultured.

The environmental potential areas like soil health monitoring, water quality assessment, and remediation are rapidly on the rise. WHO indicates that providing metagenomics data into the functioning surveillance system of public health and environment could significantly boost the preparedness of the whole world against pandemics and threats related to climate change.

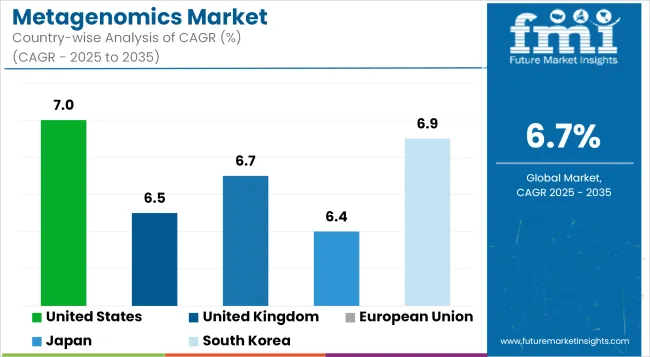

The metagenomics market in the USA shows an unwavering growth attributable to the advancement in next-generation sequencing (NGS), microbiome study, and infectious disease surveillance. Institutions and biotechnologies are employing metagenomics for applications in drug discovery, environmental monitoring, and precision medicine.

As per OECD, there are federal efforts in support of microbiome and pathology innovation under NIH Human Microbiome Program and grants from DARPA and BARDA. The growing application of metagenomics in agriculture and food safety in terms of microbial diversity assessment can further stimulate growth in this area.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 7.0% |

Much of the advancement of the metagenomics market in the UK takes place on the back of microbial genomic research, AMR (antimicrobial resistance) surveillance, and personalized health, strongly supported by academia and the government.

As per OECD, the United Kingdom is the global leader in genomic medicine, and organizations such as Wellcome Sanger Institute use metagenomics to study gut flora, environmental biodiversity, and zoonotic transmission. NHS-supported genomic projects and public health microbiology programs also expand demand for metagenomic sequencing in clinical and environmental settings.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 6.5% |

The EU market for metagenomics is gaining traction through investments in food safety, environmental microbiome research, and translational medicine. Germany, France, and the Netherlands are applying metagenomics to monitor wastewater, soil biodiversity, and chronic disease studies.

According to UN data, programs such as Horizon Europe and One Health fund applications of metagenomics in agriculture, human health, and antimicrobial stewardship. EU laboratories are also adopting portable NGS platforms and cloud analysis tools to improve response to microbial surveillance and outbreak.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union | 6.7% |

Like any other country, Japan's metagenomics market is maturing steadily, thanks to the applications enhanced by probiotic development, gastrointestinal health, and even fermentation studies. However, the focus of the country towards healthy aging and traditional studies on their diet has motivated the public to be inspired by the gut microbiota profiling and functional genomics.

According to the OECD, investments of the Japanese government and universities are at work with microbial biotechnology platforms, thereby widening the scope of metagenomic studies in basic and clinical research. The food industry is also the largest user of metagenomic tools and applications in the metagenomics arena by ensuring food safety and quality.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 6.4% |

The South Korea metagenomics market has been expanded at a fast pace with applications increasingly being applied towards health, agriculture, and bioenvironmental research. National investments towards developing genomic medicine and bioinformatics platforms integrated with AI, as per OECD data, are speeding up the country's lead in precision health.

Research institutes in Korea use metagenomic sequencing to study a number of dimensions including surveillance of hospital-acquired infections, antibiotic resistance genes, and the environmental microbial ecosystem. These are joint public-private partnerships between university and biotech startups for developing innovative microbiome-based diagnostics and therapeutics.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 6.9% |

The competitive landscape has been defined by companies investing in optimized library preparation kits, automated workflows, and bioinformatics platforms. Leading players are expanding portfolios to include complete metagenomic solutions combining sequencing, cloud-based analysis, and regulatory support.

Strategic alliances with hospitals and pharmaceutical companies are fostering validation studies and expanding clinical adoption. Investment in education and training initiatives is helping to drive awareness and accelerate integration into diagnostic labs. These activities are expected to sustain strong competition and continuous innovation in the metagenomics market.

Key Development:

In 2024, MGI Tech has launched its Human Microbiome Metagenomics Sequencing Package, now available for pre-order. This comprehensive solution covers the entire sequencing workflow-from sample collection to analysis-offering high automation and flexible throughput. Validated with numerous biological samples, it's an ideal tool for human microbiome research.

In 2024, Atrandi Biosciences has launched the Flux microfluidic system and Single-Microbe DNA Barcoding Kit. This novel kit enables labeling of up to 10,000 microbial genomes in one experiment for high-throughput genomics. They're also offering a proof-of-concept program for researchers to assess single-cell DNA sequencing.

The overall market size for the metagenomics market was approximately USD 231.1 million in 2025.

The metagenomics market is expected to reach approximately USD 442.07 million by 2035.

The demand for metagenomics is rising due to its ability to study every type of microorganism, regardless of whether it can be cultured or not.

The top 5 countries driving the development of the metagenomics market are the United States, China, Germany, Japan, and the United Kingdom.

Library preparation kits and pharmaceutical & biotechnology company adoption are expected to command significant shares over the assessment period.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA