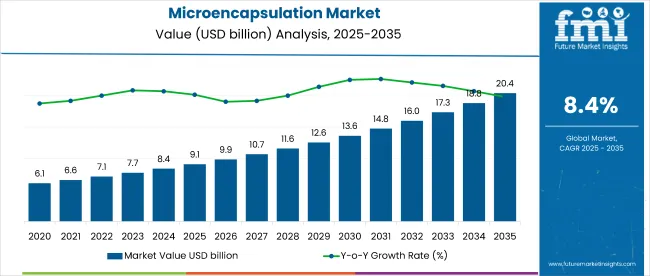

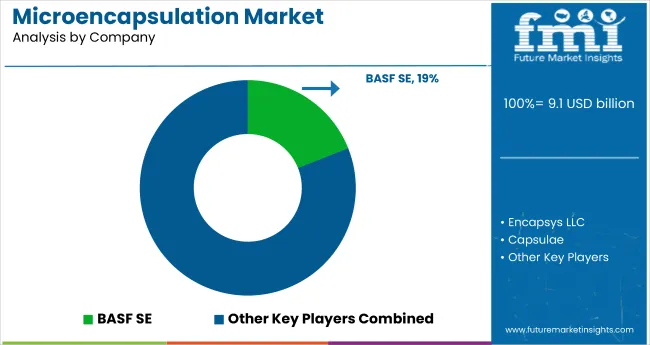

The global microencapsulation market is projected to grow from USD 9.1 billion in 2025 to USD 20.4 billion by 2035, registering a CAGR of 8.4%.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 9.1 billion |

| Industry Value (2035F) | USD 20.4 billion |

| CAGR (2025 to 2035) | 8.4% |

The growth is driven by increasing demand for controlled release technologies across pharmaceuticals, food and beverages, personal care, and agriculture. The rising focus on enhancing the bioavailability, stability, and targeted delivery of active ingredients is accelerating the adoption of microencapsulation techniques. Innovations in polymer coatings, spray technologies, and nanocapsules are further expanding the range of applications across industrial and healthcare sectors, supporting sustained market expansion globally.

The market holds an estimated 100% share in the controlled release technologies market as it represents the primary technological approach used for targeted and timed delivery of substances. It contributes about 28% to the functional food ingredients market, aiding in nutrient stability and delivery. In the drug delivery systems market, it accounts for nearly 17%, especially in enhancing pharmaceutical formulations. Within the cosmetic ingredients market, its share stands at 12% due to its application in encapsulating active skincare ingredients. In the agrochemical formulations market, it holds 9%, supporting controlled pesticide and fertilizer release.

Governments and regulatory bodies across the globe are encouraging the use of microencapsulation by enforcing quality, safety, and efficacy standards in consumer health, agriculture, and food products. For instance, the USA Food and Drug Administration (FDA) and European Medicines Agency (EMA) provide guidance on encapsulated drug delivery systems, ensuring product integrity.

In food and nutrition, regulations by EFSA and Codex Alimentarius support encapsulation of vitamins and probiotics. In agriculture, standards by EPA and global pesticide regulatory agencies promote safe encapsulation of agrochemicals, driving the market forward through mandated innovation and consumer safety assurance.

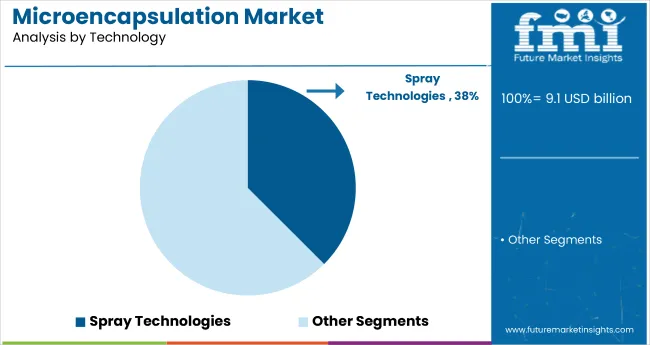

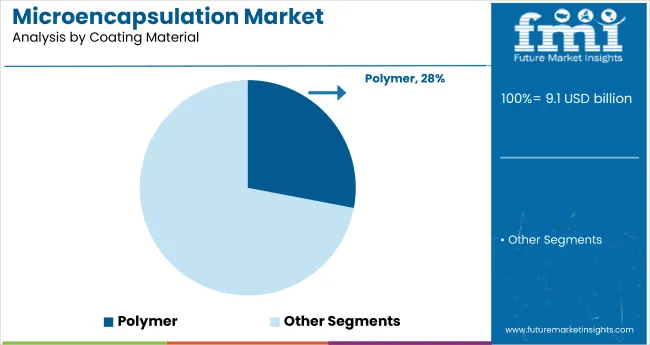

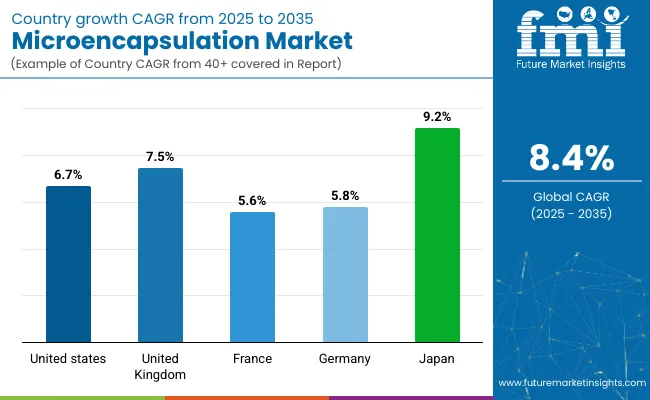

Japan is projected to be the fastest-growing market, expected to expand at a CAGR of 9.2% from 2025 to 2035. Spray technologies will continue leading the technology segment with a 37.5% market share, while polymers will dominate the coating material segment with a 28% share. The USA and UK markets are also expected to grow steadily at CAGRs of 6.7% and 7.5%, respectively.

The market is segmented by technology, coating material, application, and region. By technology, the market is divided into emulsion, coating, spray technologies, dripping, and others (fluid bed coating, supercritical fluid techniques, electrostatic spray, freeze-drying). In terms of coating material, the market includes proteins, carbohydrates, gums & resins, polymers, lipids, and others (silica-based shells, cyclodextrins, modified starches, bioceramics).

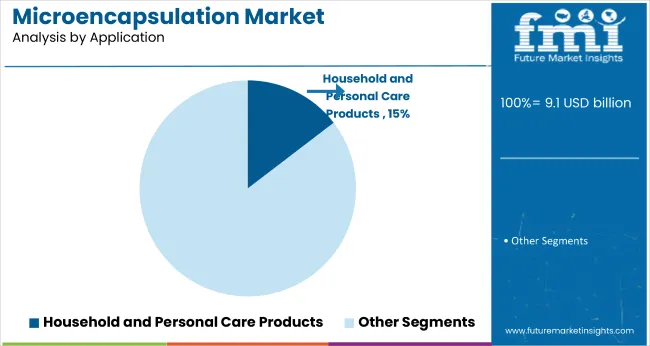

Based on application, the market is segmented into pharmaceuticals, food and beverages, household & personal care products, agrochemicals, construction materials, textiles, paper and printing, and others (nutraceutical blends, veterinary formulations, adhesives & sealants, lubricant additives). Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkans & Baltic, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, Middle East & Africa.

Spray technologies are projected to lead the technology segment, capturing 37.5% of the market share by 2025. These methods are widely used across multiple industries for encapsulating active ingredients with precision and consistency.

Polymers are projected to dominate the coating material segment with a 28% market share in 2025, driven by their adaptability across diverse end-use sectors including pharmaceuticals, food, and cosmetics.

The household and personal care products segment is anticipated to account for 14.6% of the global market in 2025, driven by growing demand for enhanced functionality in skincare and hygiene formulations.

The global microencapsulation market is experiencing consistent growth, fueled by rising demand for targeted delivery, prolonged efficacy, and enhanced stability of active ingredients across diverse industries. Microencapsulation plays a pivotal role in improving product performance in pharmaceuticals, food and beverages, cosmetics, and agriculture.

Recent Trends in the Microencapsulation Market

Challenges in the Microencapsulation Market

| Countries | CAGR (2025 to 2035) |

|---|---|

| Japan | 9.2% |

| UK | 7.5% |

| USA | 6.7% |

| Germany | 5.8% |

| France | 5.6% |

Japan leads the market among OECD nations with a CAGR of 9.2%, driven by innovations in functional nutrition and pharma. The UK follows at 7.5%, reflecting strong growth in personalized health and clean-label trends. The USA grows at 6.7%, fueled by pharma and supplement applications.

Germany and France both expand at 5.8% CAGR, supported by EU-backed initiatives in cosmetics and food. While Japan is the fastest-growing, all five countries demonstrate consistent growth, driven by increasing demand for stability, targeted delivery, and high-performance formulations across health, wellness, and personal care sectors.

The report covers an in-depth analysis of 40+ countries; five top-performing OECD countries are highlighted below.

The Japan microencapsulation revenue is growing at a CAGR of 9.2%. Demand is driven by food, pharma, and wellness sectors with strong regulatory alignment and compact, high-efficiency formulation preferences.

The UK microencapsulation market will grow at a 7.5% CAGR. Demand is supported by personalized health, veterinary pharma, and skincare, with growing interest in clean-label product development.

The USA microencapsulation revenue is projected to grow at 6.7% CAGR. Pharma, supplements, and fortified foods dominate, backed by strong FDA regulations and innovation in delivery systems.

The Germany microencapsulation revenue is growing at 5.8% CAGR. Strong demand stems from pharmaceutical, food, and cosmetics sectors, supported by EU regulations and a preference for premium, high-quality formulations.

The French microencapsulation demand is expected to expand at 5.6% CAGR. Growth is led by food enrichment, pharma, and luxury cosmetics, supported by EU health initiatives and scalable manufacturing technologies.

The market is moderately consolidated, with leading players like Capsulae, Encapsys LLC, BASF SE, Lycored, and Balchem Corporation dominating the industry. These companies provide advanced, efficient encapsulation solutions catering to industries such as pharmaceuticals, nutraceuticals, food and beverage, and cosmetics. Capsulae specializes in custom microencapsulation services, while Encapsys LLC focuses on high-performance encapsulation technologies for various industrial applications.

BASF SE delivers innovative, sustainable encapsulation solutions leveraging advanced polymer chemistry. Lycored offers natural, carotenoid-based encapsulation solutions aimed at enhancing product stability and consumer appeal. Balchem Corporation is recognized for its encapsulated nutrient solutions enhancing product functionality and shelf-life.

Other key players like Koninklijke DSM N.V., AVEKA, Inc., TasteTech Ltd., Microtek Laboratories, Inc., and Reed Pacific Pty Limited contribute by providing specialized, high-quality encapsulation technologies for diverse industrial applications.

Recent Microencapsulation Industry News

In January 2025, Balchem Corporation announced its participation in the CJS Securities Virtual Conference, where senior executives will present insights on specialty ingredients in human health, animal nutrition, and specialty chemical applications.

| Report Attributes | Details |

|---|---|

| Market Size (2025) | USD 9.1 billion |

| Projected Market Size (2035) | USD 20.4 billion |

| CAGR (2025 to 2035) | 8.4% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Report Parameter | USD billion for value/volume in units |

| Technologies Analyzed | Emulsion, Coating, Spray Technologies, Dripping, and Others (Fluid Bed Coating, Supercritical Fluid Techniques, Electrostatic Spray, and Freeze-Drying) |

| Coating Material Analyzed | Proteins, Carbohydrates, Gums & Resins, Polymers, Lipids, and Others (Silica-Based Shells, Cyclodextrins, Modified Starches, and Bioceramics) |

| Applications Analyzed | Pharmaceuticals, Food & Beverages, Household & Personal Care Products, Agrochemicals, Construction Materials, Textiles, Paper & Printing, and Others (Nutraceutical Blends, Veterinary Formulations, Adhesives & Sealants, and Lubricant Additives) |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, Balkans & Baltic, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, Middle East & Africa |

| Countries Covered | United States, United Kingdom, Germany, France, Japan, China, India, Brazil, South Korea, Australia |

| Key Players Influencing the Market | Capsulae, Encapsys LLC, BASF SE, Lycored, Balchem Corporation, Koninklijke DSM N.V., AVEKA, Inc., TasteTech Ltd., Microtek Laboratories, Inc., Reed Pacific Pty Limited |

| Additional Attributes | Dollar sales by technology type, share by coating material, regional demand growth, policy influence, sustainability trends, competitive benchmarking |

As per technology, the industry has been categorized into Emulsion, Coating, Spray technologies, Dripping, and Others.

This segment is further categorized into Proteins, Carbohydrates, Gums and Resins, Polymers, Lipids, and Others.

This segment is further categorized into Pharmaceuticals, Food and beverages, Household and personal care products, Agrochemicals, Construction materials, Textiles, Paper and Printing, and Others.

Industry analysis has been carried out in key countries of North America, Latin America, Western Europe, Eastern Europe, Balkans & Baltic, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The market is valued at USD 9.1 billion in 2025.

The market is forecasted to reach USD 20.4 billion by 2035, reflecting a CAGR of 8.4%.

Spray technologies will lead the technology segment, accounting for 37.5% of the global market share in 2025.

Polymers will dominate the coating material segment with a 28% share in 2025.

Japan is projected to grow at the fastest rate, with a CAGR of 9.2% from 2025 to 2035.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA