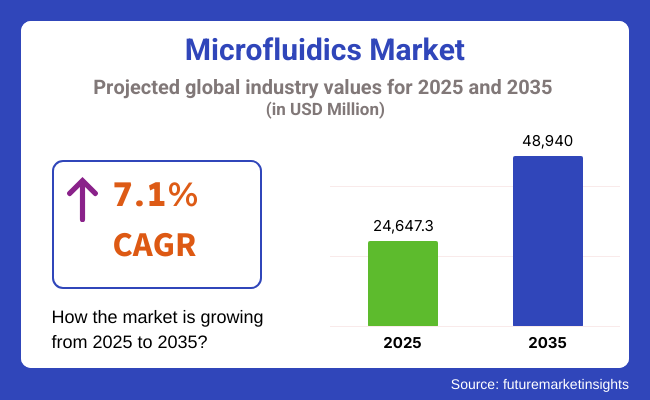

The global Microfluidics Market is estimated to be valued at USD 24,647.3 million in 2025 and is projected to reach USD 48,940.0 million by 2035, registering a compound annual growth rate (CAGR) of 7.1% over the forecast period. This growth is driven by the increasing demand for point-of-care (POC) diagnostics, advancements in drug discovery processes, and the rising adoption of lab-on-a-chip technologies.

The integration of microfluidics in various applications, including genomics, proteomics, and cell-based assays, has enhanced the efficiency and accuracy of biomedical research. Furthermore, the miniaturization of devices and the reduction in reagent consumption have contributed to cost-effective solutions, propelling market expansion. The shift towards personalized medicine and the need for rapid diagnostic tools in both developed and developing regions are expected to further bolster the market's growth trajectory.

Prominent players in the microfluidics market include Danaher Corporation, Illumina Inc., PerkinElmer Inc., Bio-Rad Laboratories, and Fluidigm Corporation. These companies are actively engaged in product innovation, strategic collaborations, and mergers and acquisitions to strengthen their market positions.

In 2024, Takara Bio Inc., today announced the launch of the Lenti-X Transduction Sponge, a first-to-market dissolvable microfluidic transduction enhancer that innovates in vitro lentivirus-mediated gene delivery techniques. “The Lenti-X Transduction Sponge will transform the viral transduction landscape with its simple yet elegant design,” said Carol Lou, President & CEO of Takara Bio USA. These innovations are instrumental in addressing the growing demand for precise and efficient analytical tools in biomedical research.

North America is expected to maintain its dominance in the microfluidics market. This leadership is attributed to the region's robust healthcare infrastructure, substantial investments in research and development, and the presence of key market players. The increasing prevalence of chronic diseases and the demand for rapid diagnostic solutions have further propelled the adoption of microfluidic technologies.

Europe is projected to experience a significant growth in the microfluidics market, driven by the rising demand for advanced diagnostic tools and personalized medicine. Countries such as Germany, the UK and France are at the forefront of adopting microfluidic technologies in clinical and research settings. Further, regulatory support and funding for healthcare innovation have facilitated the integration of microfluidics into mainstream medical practices across the region

In 2025, microfluidic-based devices are projected to dominate the market with a 42.0% revenue share due to their broad utility across diagnostics, drug delivery, and research applications. This leading position has been supported by the ability of these devices to enable real-time analysis while requiring minimal reagent volumes, thereby improving operational efficiency and lowering costs.

Demand has risen sharply due to the push for miniaturized platforms in clinical diagnostics and biopharma labs, where rapid, sensitive, and multiplexed analysis is essential. The integration of these devices with lab-on-a-chip systems has advanced their adoption across decentralized healthcare settings. Additionally, the ongoing innovation in materials such as PDMS, thermoplastics, and paper-based substrates has expanded their commercial viability.

Regulatory acceptance of microfluidic cartridges for infectious disease testing and genetic screening has also contributed to increased institutional adoption. These factors, combined with increased funding in personalized medicine, have firmly established microfluidic-based devices as the market’s largest and most dynamic product category.

In 2025, the point-of-care (POC) testing segment is expected to account for 37% of the total microfluidics market revenue, making it the leading application. This dominance has been driven by the growing need for rapid, reliable, and portable diagnostic solutions in both high- and low-resource settings.

Microfluidic platforms have enabled significant advances in POC diagnostics by allowing real-time results with minimal sample volume, making them particularly valuable in infectious disease screening, chronic disease monitoring, and emergency care. The segment’s growth has been further supported by government health initiatives focused on decentralizing diagnostic services and expanding access in rural and underserved areas.

Technological advancements such as integration with smartphones, AI-enabled data interpretation, and wearable microfluidic sensors have elevated the clinical utility of these devices. The increased prevalence of diseases requiring routine monitoring such as diabetes, cardiovascular conditions, and respiratory infections has reinforced POC testing as the most commercially viable application within the microfluidics ecosystem.

Integration Complexity and High Initial Investment in Microfluidics

Microfluidics Market Challenges Integrating microfluidic systems into existing laboratory and clinical workflows can be complex, presenting challenges in terms of compatibility and ease of adoption for users. Many research facilities and health-care institutions do not have interoperability between microfluidic devices, laboratory information management systems (LIMS) and traditional diagnostic instruments.

Lab-on-a-Chip Technologies for Point-of-Care Testing and Personalized Medicine

These factors provide the Microfluidics Market with immense prospects due to the rising need for rapid and economical solutions for diagnostics and drug discovery. Our lab-on-a-chip technology is transforming the field of point-of-care testing, allowing for the rapid and real-time analysis of biological samples while minimizing reagent usage.

In 2020 and 2024, the Microfluidics Market did witness prosperous improvements, which had been driven by significant developments inside phase of level-of-treatment diagnostics, laboratory automation, and drug discovering improvements. The use of microfluidic chips simplified lots of laboratory processes, reducing reagent consumption, testing time as well as operational costs.

Health care and life sciences industries embraced microfluidics-based diagnostic platforms to realize efficiency in disease detection and monitoring. Microfabrication skills and 3D printing were also further advanced, which allowed for more sophisticated and cheaper microfluidic devices. However, issues with manufacturing scalability, regulatory obstacles, and requiring specialized technical staff slowed widespread adoption.

In the coming future you can connect with the different considerations that will assume a crucial part in forming the development of the Microfluidics Market. Integrating microfluidics with AI will provide a breakthrough in real-time disease monitoring, allowing for personalized treatment regimens to be developed depending on ongoing biomarker analysis. Such organ-on-a-chip models will revolutionize preclinical drug testing by minimizing the use of animal models and increasing the predictability of human responses to new therapeutics.

Sustainability will also be a major focus, with companies developing environmentally friendly, recyclable microfluidic components to reduce waste. The ability to perform quick tests thanks to the rapid advancement of microfluidics combined with decentralized healthcare models will allow on-site healthcare tests to take place, reducing reliance on centralized testing facilities and improving global access to healthcare.

With a growing number of biotech companies, pharmaceutical companies and research institutions collaborating, the market growth is going to skyrocket as new breakthroughs in disease diagnostics and therapeutic development are achieved. These emerging trends are resulting in paradigm-shifting innovations in diagnostics, drug development, and healthcare monitoring in Microfluidics Market.

Industry partners, including research institutions, biotech companies, and pharmaceutical firms, should leverage the new advanced microfluidic methodologies and techniques to increase efficiencies, drive down costs, and provide better patient outcomes.

As we advance toward precision medicine - a medical model that proposes the prevention and treatment of disease is tailored to the individual patient’s biological make-up - microfluidics will be instrumental in getting such treatments to market efficiently so researchers can enable real-time decisions around diagnostics and treatments by crossing the limits of health research.

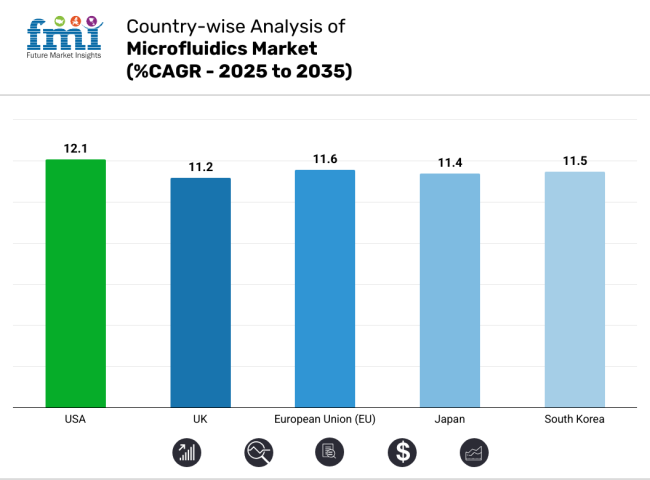

The USA microfluidics industry is expanding significantly due to aggressive investment in biotech, expansion of point-of-care diagnostic applications, and advancements in lab-on-a-chip technology. Densely populated clusters of cutting-edge biotech firms, research centers, and encouraging government incentives for precision medicine are fueling microfluidics applications in drug discovery and diagnostics.

Microfluidics is playing an increasingly critical role in next-generation sequencing (NGS), point-of-need infectious disease diagnosis, and personalized medicine. The USA Food and Drug Administration (FDA) has also attempted to render regulatory strategies more logical toward microfluidic-based medical devices as a way of promoting innovation and commercialization.

Pharmaceuticals is one of the usual industries that have companies making use of microfluidic platforms during drug discovery, organ-on-a-chip technology, and nanomedicine design. In addition, AI-automated microfluidics are improving diagnostic capacity and the biomedical research procedure.

As investment in bioengineering, digital health, and microfluidic-based drug delivery keeps growing, the USA microfluidics market will keep growing at a large scale.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 12.1% |

The rapidly proliferating applications of genomics, personalized medicine, and biopharmaceutical research and development have expanded the United Kingdom microfluidics market continuously. Massive initiatives spearheaded by UK Biobank and Genomics England have aided the embracing of next-generation microfluidic sequencing technologies nationwide. In addition, strategic investments in artificial intelligence-driven diagnostics and automated platforms serving as laboratories have acted to catalyze further market growth.

Within the UK's National Health Service, the increasing employment of point-of-care testing for monitoring chronic illness and diagnosing infectious disease has stimulated demand for cutting-edge microfluidic biosensors and portable devices functioning as laboratories on chips. Simultaneously, pharmaceutical giants like AstraZeneca and GlaxoSmithKline have masterfully capitalized on the power of high-throughput microfluidic screening platforms to transform drug discovery workflows.

With enduring governmental support for ground-breaking initiatives in precision medicine and transformative digital health solutions, market forecasters anticipate the UK microfluidics sector will continue following an upward trajectory steady in the years ahead.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 11.2% |

The burgeoning European microfluidics marketplace is propelling forward due to robust biotechnology exploration, increasing adoption of lab-on-a-chip innovations, and supportive rules. Nations for instance Germany, France, and the Netherlands are at the vanguard of pharmaceutical R&D and diagnostic breakthroughs, energizing requirements for microfluidic analytical instruments.

Persistent concentration on point-of-care diagnostics and persistent disease administration is fueling necessities for microfluidic biosensors and organ-on-a-chip models. Additionally, regulations encouraging in-vitro diagnostic tools underneath the new European Union Medical Device Regulation are accelerating the commercialization of microfluidic-based diagnostics.

As Europe's premier hub for medical technologies, Germany is driving developments in artificial intelligence-combined microfluidic platforms for high-throughput screening with enhanced accuracy in oncology applications too as real-time disease tracking. Meanwhile, the biopharmaceutical sectors in France and Switzerland have as well heavily put money into microfluidic-assisted drug development and nanomedicine investigation. Some initiatives incorporate microfluidics with body-on-a-chip organ models for testing drug toxicity or customized responses.

With the EU's stress on healthcare innovation and automated laboratories, the intricate microfluidics industry is anticipated to experience significant growth and help transform medication through customized diagnostics and personalized remedies.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 11.6% |

The rapidly evolving Japanese microfluidics sector continues advancing due to steady improvements in miniaturized testing, consistent government backing of biomedical study, and a growing societal value of digital lab technologies. Meanwhile, major pharmaceutical giants like Takeda and Astellas strategically integrate sophisticated microfluidic screening platforms to dramatically accelerate the pace of medication discovery and tailored therapeutic development.

With massive ongoing investments in forward-thinking regenerative medicine, artificially intelligent disease modelling, and a computerized experimental workflow, analysts foresee Japan’s microfluidics industry appearing poised for notable expansion in coming years since the depth and breadth of the nation’s intricate microfluidic tools gradually unveil tremendous potential across a wide range of critically important areas including accelerated drug screening, single cell analyte extraction, and computer-aided diagnosis.

Japan’s preeminent leadership in microchip fabrication and ultraprecise engineering fuel creation of highly complex microfluidic devices focused on promising applications within novel medication discovery, molecular-level biological examination, and artificially guided experimentation. Furthermore, Japan’s progressively aging population also stimulates interest in portable rapid diagnostic gear, serving to accelerate widespread adoption of microfluidic biosensors designed for ongoing medical tracking directly at the point of care.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 11.4% |

The South Korean microfluidics market has exploded due to the increasing applications in clinical diagnostics, amplified investment in digital health, and robust backing from the government for biotechnology progress. South Korea has emerged as a nexus for lab automation and AI-driven healthcare technology, propelling the adoption of microfluidic-based lab-on-a-chip platforms.

With advanced semiconductor fabrication abilities, South Korea is remarkably postured to evolve highly precise microfluidic chips for biomedical research, pathogen identification, and fluid biopsy uses. In addition, pharmaceutical companies and study institutes are capitalizing on microfluidic-centred screening platforms for high-throughput medication discovery.

South Korea’s amplified telemedicine and remote diagnostics sector is also fueling demand for portable microfluidic biosensors for real-time affected person tracking. With continuous investments in AI-integrated lab automation and precision medication, the microfluidics market is anticipated to develop steadily, though some experts forecast temporary setbacks as tech transitions accelerate.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 11.5% |

Microfluidics market is expanding owing to rising need for point-of-care diagnosis, drug discovery automation, lab-on-a-chip technologies, and personalized medicine. To improve efficiency, accuracy, and cost-effectiveness in life sciences, pharmaceuticals, and diagnostics, firms are concentrating on AI-based microfluidic systems, biochip technology, and high-throughput screening platforms. This framework encapsulates a place in the global marketplace for companies utilizing healthcare technology as well as enterprises building out their specialized microfluidics products.

Danaher Corporation (15-20%)

Danaher is the leading player in microfluidics, providing automated microfluidic lab solutions primarily used in Diagnostics, Genomics, and drug discovery. The company combines lab-on-a-chip devices powered by AI to get results faster and more efficiently.

Thermo Fisher Scientific, Inc. (12-16%)

Thermo Fisher focuses on AI-based microfluidic bioanalysis, rapid high-throughput screening devices, and portable diagnostics, all of which are necessary for accuracy and speed in medical testing.

PerkinElmer, Inc. (10-14%)

PerkinElmer Microfluidics offers genomic sequencing, proteomics and precision medicine tools to accelerate cell analysis and hit-to-lead approaches for drug discovery, discover microfluidic-based high cellular density dose-response and diminishing returns assays designed to optimize at whole plate or plate group levels.

Agilent Technologies, Inc. (8-12%)

Agilent technologies designs microfluidic bioassay platforms for clinical and industrial applications based on microfluidic bioassay platforms, automated electrophoresis and high-sensitivity analysis.

Bio-Rad Laboratories, Inc. (5-9%)

Bio-Rad focuses on molecular diagnostics based on microfluidics (e.g.: digital droplet PCR (ddPCR) and single-cell analysis systems) that increase the sensitivity and accuracy of biomarker detection.

Other Key Players (40-50% Combined)

Several biotechnology and medical device companies contribute to next-generation microfluidic diagnostics, high-speed lab automation, and biochip innovations. These include:

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Units) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Material, 2018 to 2033

Table 4: Global Market Volume (Units) Forecast by Material, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 6: Global Market Volume (Units) Forecast by Application, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by Industry, 2018 to 2033

Table 8: Global Market Volume (Units) Forecast by Industry, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 10: North America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Material, 2018 to 2033

Table 12: North America Market Volume (Units) Forecast by Material, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 14: North America Market Volume (Units) Forecast by Application, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast by Industry, 2018 to 2033

Table 16: North America Market Volume (Units) Forecast by Industry, 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 18: Latin America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 19: Latin America Market Value (US$ Million) Forecast by Material, 2018 to 2033

Table 20: Latin America Market Volume (Units) Forecast by Material, 2018 to 2033

Table 21: Latin America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 22: Latin America Market Volume (Units) Forecast by Application, 2018 to 2033

Table 23: Latin America Market Value (US$ Million) Forecast by Industry, 2018 to 2033

Table 24: Latin America Market Volume (Units) Forecast by Industry, 2018 to 2033

Table 25: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Western Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 27: Western Europe Market Value (US$ Million) Forecast by Material, 2018 to 2033

Table 28: Western Europe Market Volume (Units) Forecast by Material, 2018 to 2033

Table 29: Western Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 30: Western Europe Market Volume (Units) Forecast by Application, 2018 to 2033

Table 31: Western Europe Market Value (US$ Million) Forecast by Industry, 2018 to 2033

Table 32: Western Europe Market Volume (Units) Forecast by Industry, 2018 to 2033

Table 33: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 34: Eastern Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 35: Eastern Europe Market Value (US$ Million) Forecast by Material, 2018 to 2033

Table 36: Eastern Europe Market Volume (Units) Forecast by Material, 2018 to 2033

Table 37: Eastern Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 38: Eastern Europe Market Volume (Units) Forecast by Application, 2018 to 2033

Table 39: Eastern Europe Market Value (US$ Million) Forecast by Industry, 2018 to 2033

Table 40: Eastern Europe Market Volume (Units) Forecast by Industry, 2018 to 2033

Table 41: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 42: South Asia and Pacific Market Volume (Units) Forecast by Country, 2018 to 2033

Table 43: South Asia and Pacific Market Value (US$ Million) Forecast by Material, 2018 to 2033

Table 44: South Asia and Pacific Market Volume (Units) Forecast by Material, 2018 to 2033

Table 45: South Asia and Pacific Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 46: South Asia and Pacific Market Volume (Units) Forecast by Application, 2018 to 2033

Table 47: South Asia and Pacific Market Value (US$ Million) Forecast by Industry, 2018 to 2033

Table 48: South Asia and Pacific Market Volume (Units) Forecast by Industry, 2018 to 2033

Table 49: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 50: East Asia Market Volume (Units) Forecast by Country, 2018 to 2033

Table 51: East Asia Market Value (US$ Million) Forecast by Material, 2018 to 2033

Table 52: East Asia Market Volume (Units) Forecast by Material, 2018 to 2033

Table 53: East Asia Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 54: East Asia Market Volume (Units) Forecast by Application, 2018 to 2033

Table 55: East Asia Market Value (US$ Million) Forecast by Industry, 2018 to 2033

Table 56: East Asia Market Volume (Units) Forecast by Industry, 2018 to 2033

Table 57: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 58: Middle East and Africa Market Volume (Units) Forecast by Country, 2018 to 2033

Table 59: Middle East and Africa Market Value (US$ Million) Forecast by Material, 2018 to 2033

Table 60: Middle East and Africa Market Volume (Units) Forecast by Material, 2018 to 2033

Table 61: Middle East and Africa Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 62: Middle East and Africa Market Volume (Units) Forecast by Application, 2018 to 2033

Table 63: Middle East and Africa Market Value (US$ Million) Forecast by Industry, 2018 to 2033

Table 64: Middle East and Africa Market Volume (Units) Forecast by Industry, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Material, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Application, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Industry, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 5: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 6: Global Market Volume (Units) Analysis by Region, 2018 to 2033

Figure 7: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 8: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 9: Global Market Value (US$ Million) Analysis by Material, 2018 to 2033

Figure 10: Global Market Volume (Units) Analysis by Material, 2018 to 2033

Figure 11: Global Market Value Share (%) and BPS Analysis by Material, 2023 to 2033

Figure 12: Global Market Y-o-Y Growth (%) Projections by Material, 2023 to 2033

Figure 13: Global Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 14: Global Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 15: Global Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 16: Global Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 17: Global Market Value (US$ Million) Analysis by Industry, 2018 to 2033

Figure 18: Global Market Volume (Units) Analysis by Industry, 2018 to 2033

Figure 19: Global Market Value Share (%) and BPS Analysis by Industry, 2023 to 2033

Figure 20: Global Market Y-o-Y Growth (%) Projections by Industry, 2023 to 2033

Figure 21: Global Market Attractiveness by Material, 2023 to 2033

Figure 22: Global Market Attractiveness by Application, 2023 to 2033

Figure 23: Global Market Attractiveness by Industry, 2023 to 2033

Figure 24: Global Market Attractiveness by Region, 2023 to 2033

Figure 25: North America Market Value (US$ Million) by Material, 2023 to 2033

Figure 26: North America Market Value (US$ Million) by Application, 2023 to 2033

Figure 27: North America Market Value (US$ Million) by Industry, 2023 to 2033

Figure 28: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 29: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 30: North America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 31: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 32: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 33: North America Market Value (US$ Million) Analysis by Material, 2018 to 2033

Figure 34: North America Market Volume (Units) Analysis by Material, 2018 to 2033

Figure 35: North America Market Value Share (%) and BPS Analysis by Material, 2023 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by Material, 2023 to 2033

Figure 37: North America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 38: North America Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 39: North America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 40: North America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 41: North America Market Value (US$ Million) Analysis by Industry, 2018 to 2033

Figure 42: North America Market Volume (Units) Analysis by Industry, 2018 to 2033

Figure 43: North America Market Value Share (%) and BPS Analysis by Industry, 2023 to 2033

Figure 44: North America Market Y-o-Y Growth (%) Projections by Industry, 2023 to 2033

Figure 45: North America Market Attractiveness by Material, 2023 to 2033

Figure 46: North America Market Attractiveness by Application, 2023 to 2033

Figure 47: North America Market Attractiveness by Industry, 2023 to 2033

Figure 48: North America Market Attractiveness by Country, 2023 to 2033

Figure 49: Latin America Market Value (US$ Million) by Material, 2023 to 2033

Figure 50: Latin America Market Value (US$ Million) by Application, 2023 to 2033

Figure 51: Latin America Market Value (US$ Million) by Industry, 2023 to 2033

Figure 52: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 53: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 54: Latin America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 55: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 57: Latin America Market Value (US$ Million) Analysis by Material, 2018 to 2033

Figure 58: Latin America Market Volume (Units) Analysis by Material, 2018 to 2033

Figure 59: Latin America Market Value Share (%) and BPS Analysis by Material, 2023 to 2033

Figure 60: Latin America Market Y-o-Y Growth (%) Projections by Material, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 62: Latin America Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 63: Latin America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 64: Latin America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) Analysis by Industry, 2018 to 2033

Figure 66: Latin America Market Volume (Units) Analysis by Industry, 2018 to 2033

Figure 67: Latin America Market Value Share (%) and BPS Analysis by Industry, 2023 to 2033

Figure 68: Latin America Market Y-o-Y Growth (%) Projections by Industry, 2023 to 2033

Figure 69: Latin America Market Attractiveness by Material, 2023 to 2033

Figure 70: Latin America Market Attractiveness by Application, 2023 to 2033

Figure 71: Latin America Market Attractiveness by Industry, 2023 to 2033

Figure 72: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 73: Western Europe Market Value (US$ Million) by Material, 2023 to 2033

Figure 74: Western Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 75: Western Europe Market Value (US$ Million) by Industry, 2023 to 2033

Figure 76: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 77: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 78: Western Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 79: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 80: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 81: Western Europe Market Value (US$ Million) Analysis by Material, 2018 to 2033

Figure 82: Western Europe Market Volume (Units) Analysis by Material, 2018 to 2033

Figure 83: Western Europe Market Value Share (%) and BPS Analysis by Material, 2023 to 2033

Figure 84: Western Europe Market Y-o-Y Growth (%) Projections by Material, 2023 to 2033

Figure 85: Western Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 86: Western Europe Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 87: Western Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 88: Western Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 89: Western Europe Market Value (US$ Million) Analysis by Industry, 2018 to 2033

Figure 90: Western Europe Market Volume (Units) Analysis by Industry, 2018 to 2033

Figure 91: Western Europe Market Value Share (%) and BPS Analysis by Industry, 2023 to 2033

Figure 92: Western Europe Market Y-o-Y Growth (%) Projections by Industry, 2023 to 2033

Figure 93: Western Europe Market Attractiveness by Material, 2023 to 2033

Figure 94: Western Europe Market Attractiveness by Application, 2023 to 2033

Figure 95: Western Europe Market Attractiveness by Industry, 2023 to 2033

Figure 96: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 97: Eastern Europe Market Value (US$ Million) by Material, 2023 to 2033

Figure 98: Eastern Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 99: Eastern Europe Market Value (US$ Million) by Industry, 2023 to 2033

Figure 100: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 101: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 102: Eastern Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 103: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 104: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 105: Eastern Europe Market Value (US$ Million) Analysis by Material, 2018 to 2033

Figure 106: Eastern Europe Market Volume (Units) Analysis by Material, 2018 to 2033

Figure 107: Eastern Europe Market Value Share (%) and BPS Analysis by Material, 2023 to 2033

Figure 108: Eastern Europe Market Y-o-Y Growth (%) Projections by Material, 2023 to 2033

Figure 109: Eastern Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 110: Eastern Europe Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 111: Eastern Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 112: Eastern Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 113: Eastern Europe Market Value (US$ Million) Analysis by Industry, 2018 to 2033

Figure 114: Eastern Europe Market Volume (Units) Analysis by Industry, 2018 to 2033

Figure 115: Eastern Europe Market Value Share (%) and BPS Analysis by Industry, 2023 to 2033

Figure 116: Eastern Europe Market Y-o-Y Growth (%) Projections by Industry, 2023 to 2033

Figure 117: Eastern Europe Market Attractiveness by Material, 2023 to 2033

Figure 118: Eastern Europe Market Attractiveness by Application, 2023 to 2033

Figure 119: Eastern Europe Market Attractiveness by Industry, 2023 to 2033

Figure 120: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 121: South Asia and Pacific Market Value (US$ Million) by Material, 2023 to 2033

Figure 122: South Asia and Pacific Market Value (US$ Million) by Application, 2023 to 2033

Figure 123: South Asia and Pacific Market Value (US$ Million) by Industry, 2023 to 2033

Figure 124: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 125: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 126: South Asia and Pacific Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 127: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 128: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 129: South Asia and Pacific Market Value (US$ Million) Analysis by Material, 2018 to 2033

Figure 130: South Asia and Pacific Market Volume (Units) Analysis by Material, 2018 to 2033

Figure 131: South Asia and Pacific Market Value Share (%) and BPS Analysis by Material, 2023 to 2033

Figure 132: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Material, 2023 to 2033

Figure 133: South Asia and Pacific Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 134: South Asia and Pacific Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 135: South Asia and Pacific Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 136: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 137: South Asia and Pacific Market Value (US$ Million) Analysis by Industry, 2018 to 2033

Figure 138: South Asia and Pacific Market Volume (Units) Analysis by Industry, 2018 to 2033

Figure 139: South Asia and Pacific Market Value Share (%) and BPS Analysis by Industry, 2023 to 2033

Figure 140: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Industry, 2023 to 2033

Figure 141: South Asia and Pacific Market Attractiveness by Material, 2023 to 2033

Figure 142: South Asia and Pacific Market Attractiveness by Application, 2023 to 2033

Figure 143: South Asia and Pacific Market Attractiveness by Industry, 2023 to 2033

Figure 144: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 145: East Asia Market Value (US$ Million) by Material, 2023 to 2033

Figure 146: East Asia Market Value (US$ Million) by Application, 2023 to 2033

Figure 147: East Asia Market Value (US$ Million) by Industry, 2023 to 2033

Figure 148: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 149: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 150: East Asia Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 151: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 152: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 153: East Asia Market Value (US$ Million) Analysis by Material, 2018 to 2033

Figure 154: East Asia Market Volume (Units) Analysis by Material, 2018 to 2033

Figure 155: East Asia Market Value Share (%) and BPS Analysis by Material, 2023 to 2033

Figure 156: East Asia Market Y-o-Y Growth (%) Projections by Material, 2023 to 2033

Figure 157: East Asia Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 158: East Asia Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 159: East Asia Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 160: East Asia Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 161: East Asia Market Value (US$ Million) Analysis by Industry, 2018 to 2033

Figure 162: East Asia Market Volume (Units) Analysis by Industry, 2018 to 2033

Figure 163: East Asia Market Value Share (%) and BPS Analysis by Industry, 2023 to 2033

Figure 164: East Asia Market Y-o-Y Growth (%) Projections by Industry, 2023 to 2033

Figure 165: East Asia Market Attractiveness by Material, 2023 to 2033

Figure 166: East Asia Market Attractiveness by Application, 2023 to 2033

Figure 167: East Asia Market Attractiveness by Industry, 2023 to 2033

Figure 168: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 169: Middle East and Africa Market Value (US$ Million) by Material, 2023 to 2033

Figure 170: Middle East and Africa Market Value (US$ Million) by Application, 2023 to 2033

Figure 171: Middle East and Africa Market Value (US$ Million) by Industry, 2023 to 2033

Figure 172: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 173: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 174: Middle East and Africa Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 175: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 176: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 177: Middle East and Africa Market Value (US$ Million) Analysis by Material, 2018 to 2033

Figure 178: Middle East and Africa Market Volume (Units) Analysis by Material, 2018 to 2033

Figure 179: Middle East and Africa Market Value Share (%) and BPS Analysis by Material, 2023 to 2033

Figure 180: Middle East and Africa Market Y-o-Y Growth (%) Projections by Material, 2023 to 2033

Figure 181: Middle East and Africa Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 182: Middle East and Africa Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 183: Middle East and Africa Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 184: Middle East and Africa Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 185: Middle East and Africa Market Value (US$ Million) Analysis by Industry, 2018 to 2033

Figure 186: Middle East and Africa Market Volume (Units) Analysis by Industry, 2018 to 2033

Figure 187: Middle East and Africa Market Value Share (%) and BPS Analysis by Industry, 2023 to 2033

Figure 188: Middle East and Africa Market Y-o-Y Growth (%) Projections by Industry, 2023 to 2033

Figure 189: Middle East and Africa Market Attractiveness by Material, 2023 to 2033

Figure 190: Middle East and Africa Market Attractiveness by Application, 2023 to 2033

Figure 191: Middle East and Africa Market Attractiveness by Industry, 2023 to 2033

Figure 192: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

The overall market size for Microfluidics Market was USD 24,647.3 million in 2025.

The Microfluidics Market expected to reach USD 48,940.0 million in 2035.

The demand for the Microfluidics Market will be driven by advancements in diagnostics, drug development, and personalized medicine. The increasing need for faster, more accurate testing, along with the rise in point-of-care applications, will further fuel market growth.

The top 5 countries which drives the development of Microfluidics Market are USA, UK, Europe Union, Japan and South Korea.

Polymer and Glass Drive Market to command significant share over the assessment period.

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.