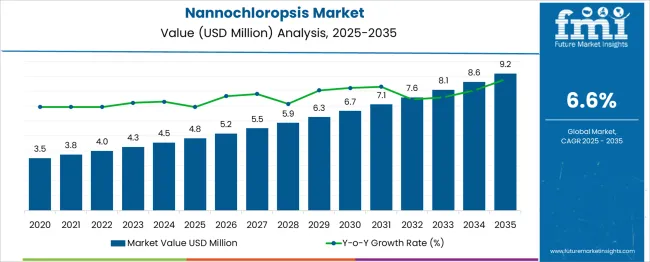

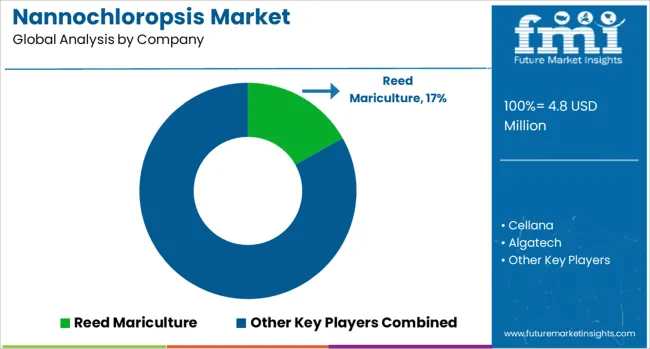

The Nannochloropsis Market is estimated to be valued at USD 4.8 million in 2025 and is projected to reach USD 9.2 million by 2035, registering a compound annual growth rate (CAGR) of 6.6% over the forecast period.

| Metric | Value |

|---|---|

| Nannochloropsis Market Estimated Value in (2025E) | USD 4.8 million |

| Nannochloropsis Market Forecast Value in (2035F) | USD 9.2 million |

| Forecast CAGR (2025 to 2035) | 6.6% |

The Nannochloropsis market is gaining traction due to its high nutritional value, rich lipid content, and broad applicability across aquaculture, nutraceuticals, and biofuel industries. Its microalgal properties make it a sustainable and efficient source of omega-3 fatty acids, proteins, and antioxidants, driving demand among manufacturers seeking plant-based alternatives.

The growing emphasis on sustainable aquaculture practices and rising awareness regarding algae-derived nutritional supplements have positively influenced market dynamics. Technological advancements in cultivation, harvesting, and downstream processing are improving production efficiency, further expanding its commercial viability.

With the increasing need for eco-friendly feedstock and natural ingredients, Nannochloropsis is positioned as a high-potential input in multiple end-use sectors. The market outlook remains favorable, supported by rising environmental regulations, R&D investments, and a shift toward renewable and functional bio-based products.

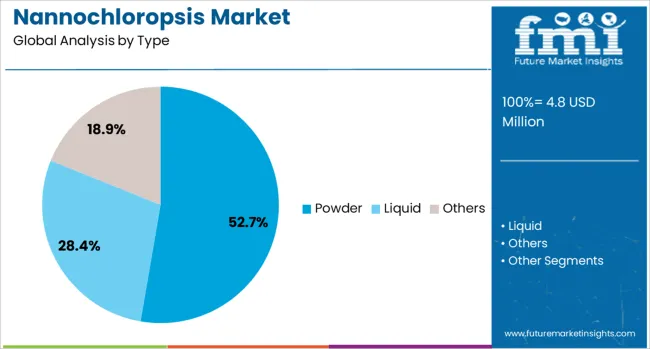

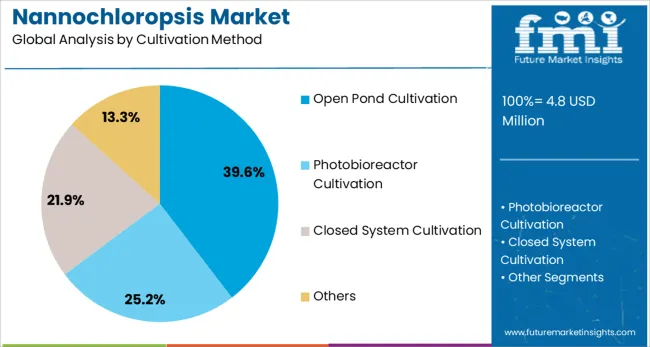

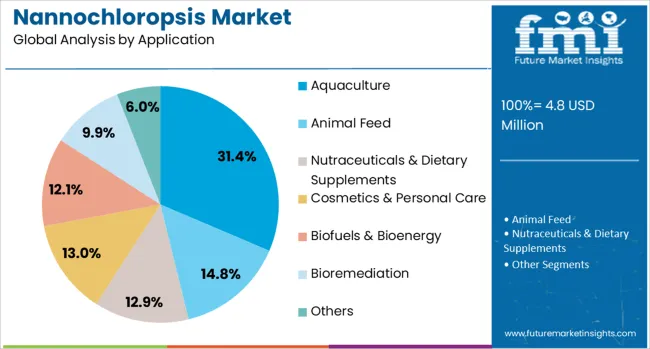

The nannochloropsis market is segmented by type, cultivation method, and application and geographic regions. By type of the nannochloropsis market is divided into Powder, Liquid, and Others. In terms of cultivation method of the nannochloropsis market is classified into Open Pond Cultivation, Photobioreactor Cultivation, Closed System Cultivation, and Others. Based on application of the nannochloropsis market is segmented into Aquaculture, Animal Feed, Nutraceuticals & Dietary Supplements, Cosmetics & Personal Care, Biofuels & Bioenergy, Bioremediation, and Others. Regionally, the nannochloropsis industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The powder segment accounts for a commanding 52.7% share in the type category, highlighting its widespread preference across industries for its stability, ease of transport, and extended shelf life. Powdered Nannochloropsis is extensively utilized in feed, nutraceutical, and cosmetic formulations due to its high concentration of essential nutrients and versatility in product development.

Its dehydrated form enables better dosage control, efficient storage, and simpler incorporation into various processing systems. Manufacturers favor this format for its compatibility with encapsulation and mixing technologies, enhancing functional ingredient delivery.

Additionally, the reduced transportation and handling costs associated with powder form bolster its appeal in both domestic and export markets. As demand for algae-derived protein and antioxidants grows, the powdered form is expected to retain its market dominance due to its multifunctionality and supply chain efficiency.

Open pond cultivation leads the cultivation method category with a 39.6% market share, owing to its cost-effective and scalable production approach suited for mass cultivation of microalgae. This traditional method continues to be widely adopted, particularly in regions with favorable climates and land availability, where it enables large-volume biomass generation with relatively low energy inputs.

Open ponds offer economic viability for producers targeting commodity markets like feed and biofuel, where price competitiveness is critical. Despite some limitations in contamination control and yield consistency, continuous process optimization and improved strain management are enhancing its performance.

The method’s sustainability and adaptability make it a preferred choice for large-scale operations focused on bulk applications. With ongoing research aimed at boosting productivity and minimizing water use, open pond systems are expected to maintain a significant share in the global Nannochloropsis production landscape.

Aquaculture dominates the application category with a 31.4% share, driven by the increasing reliance on microalgae as a high-quality feed additive for fish, shrimp, and shellfish farming. Nannochloropsis is valued in aquaculture for its rich content of essential fatty acids, proteins, and pigments that support immune health, growth rates, and pigmentation in aquatic species.

The industry's growing focus on sustainable and plant-based feed inputs is accelerating the adoption of algae-based products. As regulatory scrutiny around traditional fishmeal and synthetic additives intensifies, Nannochloropsis offers a natural, renewable alternative with proven efficacy.

The rise of intensive aquaculture practices and the expansion of marine farming activities are further fueling demand for nutrient-dense, bioavailable feed components. The segment is expected to witness continued growth as producers seek performance-boosting, eco-friendly inputs that align with evolving environmental standards and consumer expectations for responsibly farmed seafood.

Growth in the Nannochloropsis market is fueled by rising demand in aquaculture, dietary supplements, and biofuels, along with supportive government policies. Challenges include high production expenses, contamination risks, and regulatory inconsistencies limiting broader adoption

The Nannochloropsis is being driven by its extensive use in aquaculture feed due to high concentrations of omega-3 fatty acids and essential nutrients that improve fish health and growth. Its role as a sustainable protein alternative for livestock and poultry feed has also gained traction, particularly in regions with growing animal protein requirements. Expanding applications in functional foods and dietary supplements are fueling adoption, as consumers increasingly seek plant-based sources of EPA and antioxidants. The integration of Nannochloropsis-derived compounds in biofuel production and pharmaceuticals has strengthened its value proposition across multiple sectors. Government initiatives promoting algae-based products further enhance production and commercialization, accelerating global acceptance.

Despite significant growth potential, the Nannochloropsis market faces challenges related to high production costs and operational complexity in large-scale cultivation systems. Maintaining optimal growth conditions for high lipid yields often requires advanced photobioreactors or controlled environments, raising capital expenditure for producers. Contamination risks during cultivation and drying processes increase quality control expenses and impact product consistency. Limited infrastructure for efficient harvesting and extraction of bioactive compounds adds another layer of cost burden. Market penetration is further restricted by the lack of standardized regulations for algae-based ingredients, which complicates global trade compliance. Price competitiveness against traditional protein and oil sources remains a critical obstacle for achieving mass-market adoption.

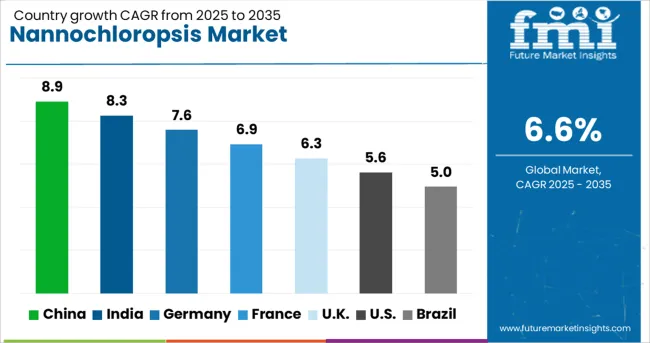

| Country | CAGR |

|---|---|

| China | 8.9% |

| India | 8.3% |

| Germany | 7.6% |

| France | 6.9% |

| UK | 6.3% |

| USA | 5.6% |

| Brazil | 5.0% |

The Nannochloropsis market, projected to grow at a global CAGR of 7.4% from 2025 to 2035, is witnessing diverse momentum across major economies. China leads with a CAGR of 8.9%, driven by expanding applications in aquafeed, biofuel initiatives, and government-supported algae-based research programs. India follows at 8.3%, supported by rising adoption in nutraceuticals, microalgae cultivation subsidies, and demand for sustainable protein alternatives. Germany posts 7.6%, reflecting strong demand for algae-derived omega-3 in dietary supplements and research partnerships with biotechnology firms. The UK records 6.3%, boosted by functional food launches and academic R&D collaborations, but constrained by regulatory clearance timelines. The USA shows a 5.6% CAGR, influenced by niche uptake in biofuel pilot projects and health-oriented algae product lines, though commercialization remains gradual. BRICS economies are leading growth through production scalability and cost competitiveness, whereas OECD nations are focusing on high-value applications, regulatory harmonization, and novel product development. The report offers detailed insights across 40+ nations, with the top five growth markets highlighted here.

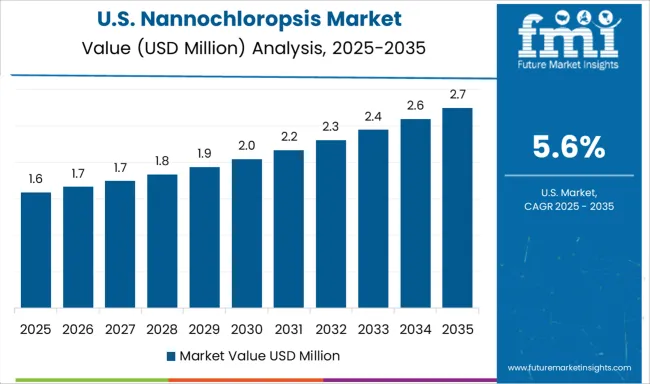

The CAGR for the Nannochloropsis market in the United States increased from about 4.8% during 2020–2024 to approximately 5.6% between 2025–2035, supported by growing interest in algae-derived omega-3 supplements and feed ingredients for aquaculture. Government-backed initiatives for sustainable marine feed systems have improved adoption in fish hatcheries and shrimp farming clusters. Regulatory clarity by the FDA on algae-based nutritional applications has further encouraged investment in domestic cultivation facilities. Increasing health-conscious consumer demand for plant-based EPA formulations has strengthened retail supplement sales. Strategic alliances between algae biomass producers and nutraceutical companies are creating vertically integrated supply chains.

The CAGR in the United Kingdom moved from approximately 5.2% during 2020–2024 to nearly 6.3% for 2025–2035, driven by enhanced focus on algae-derived functional ingredients in nutraceutical and specialty food sectors. NHS-linked nutrition guidelines for EPA intake opened niche opportunities for algae oil suppliers. Consumer preference for clean-label plant-based alternatives has further driven supplement demand. Academic collaborations with algae R&D labs in Scotland and Wales have accelerated strain improvement and lipid optimization. Retail channels are witnessing greater adoption of powdered and encapsulated algae products for health-focused diets. Post-Brexit trade adjustments have influenced domestic sourcing strategies, promoting local cultivation projects.

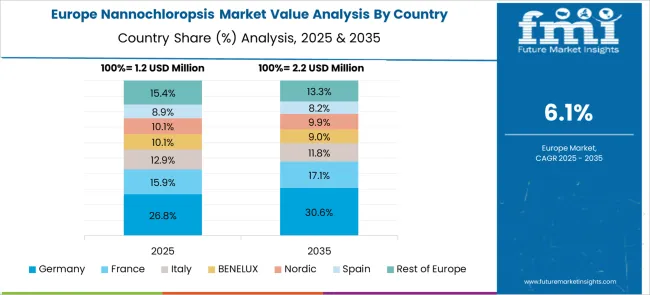

The CAGR in Germany grew from around 6.4% during 2020–2024 to approximately 7.6% between 2025–2035, supported by EU-driven incentives for sustainable feed alternatives and protein diversification programs. Nannochloropsis adoption in aquafeed has surged as regulatory frameworks encourage reduced fishmeal dependency. Nutraceutical applications are expanding, with fortified omega-3 powders and algae-based capsules gaining consumer confidence. Leading German biotech firms are optimizing closed-system photobioreactors for high-yield lipid production. Partnerships with European feed manufacturers are enabling large-scale integration into livestock diets. Investment by public research agencies in algae-based bioproduct innovation continues to accelerate industrial-scale applications.

The CAGR in China advanced from nearly 7.4% during 2020–2024 to about 8.9% in 2025–2035, propelled by national strategies for marine resource utilization and rapid expansion of the aquaculture sector. Demand for algae-based EPA oils in infant nutrition and fortified beverages has increased sharply in urban markets. E-commerce platforms have accelerated direct-to-consumer distribution, while regional biomass clusters in Jiangsu and Zhejiang provinces strengthened local supply chains. Domestic manufacturers are securing partnerships with international biotech companies to gain proprietary cultivation technologies. Industrial-scale algae cultivation aligns with China’s feed security goals and supports its position as a major aquaculture exporter.

The CAGR for India rose from 6.9% during 2020–2024 to around 8.3% during 2025–2035, supported by the fast-growing aquaculture industry and government-backed protein security initiatives. Demand is accelerating for cost-effective algae biomass to replace imported fishmeal in shrimp and carp farming. Nutraceutical brands are expanding product lines with algae-based omega-3 supplements as plant-origin formulations gain consumer trust. Startups in India’s coastal regions are investing in low-cost open-pond cultivation systems optimized for tropical climates. Export-oriented algae processing units are strengthening India’s position as a global supplier of functional lipids. State-level subsidy programs are further incentivizing algae-based feed production.

In the Nannochloropsis market, leading players are advancing algae cultivation technologies and diversifying applications across aquaculture, nutraceuticals, and biofuels. Reed Mariculture has built a strong presence in aquaculture feed, supplying high-density microalgae concentrates for hatcheries worldwide. Cellana is expanding its algae-derived omega-3 oils portfolio, targeting both food supplements and renewable energy sectors. Algatech, known for expertise in photobioreactor systems, is focusing on bioactive compound extraction for premium nutritional products. Emerging brands like Varicon Aqua Solutions and Nutrex Hawaii are scaling algae-based solutions, with emphasis on sustainable biomass production and functional ingredient development. Chinese players such as Guangdong Runke Bioengineering and Qingdao Jingling Ocean Technology are strengthening domestic algae processing infrastructure to cater to the Asia-Pacific’s growing aquafeed demand. Phyco Biotech continues to pioneer research in lipid optimization for high-value EPA extracts.

| Item | Value |

|---|---|

| Quantitative Units | USD 4.8 Million |

| Type | Powder, Liquid, and Others |

| Cultivation Method | Open Pond Cultivation, Photobioreactor Cultivation, Closed System Cultivation, and Others |

| Application | Aquaculture, Animal Feed, Nutraceuticals & Dietary Supplements, Cosmetics & Personal Care, Biofuels & Bioenergy, Bioremediation, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Reed Mariculture, Cellana, Algatech, Varicon Aqua Solutions, Nutrex Hawaii, Guangdong Runke Bioengineering, Qingdao Jingling Ocean Technology, and Phyco Biotech |

| Additional Attributes | Dollar sales trends, share by application (aquafeed, nutraceuticals, biofuel), regional growth hotspots, competitive landscape, pricing benchmarks, regulatory frameworks, production cost analysis, and future demand forecasts for omega-3 and EPA products |

The global nannochloropsis market is estimated to be valued at USD 4.8 million in 2025.

The market size for the nannochloropsis market is projected to reach USD 9.2 million by 2035.

The nannochloropsis market is expected to grow at a 6.6% CAGR between 2025 and 2035.

The key product types in nannochloropsis market are powder, liquid and others.

In terms of cultivation method, open pond cultivation segment to command 39.6% share in the nannochloropsis market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA