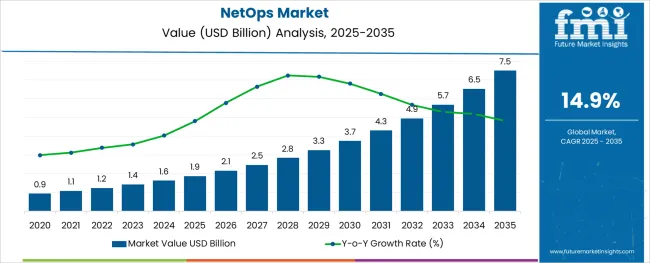

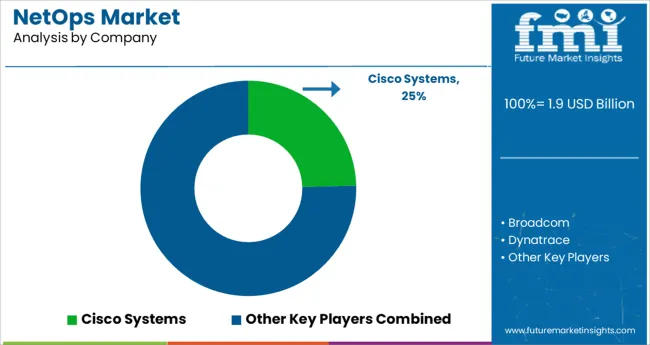

The NetOps Market is estimated to be valued at USD 1.9 billion in 2025 and is projected to reach USD 7.5 billion by 2035, registering a compound annual growth rate (CAGR) of 14.9% over the forecast period.

The NetOps market is gaining strong traction as organizations place growing emphasis on real time network visibility, predictive analytics, and operational efficiency. The increasing complexity of IT infrastructures, driven by cloud migration, remote workforces, and hybrid environments, is compelling enterprises to adopt more agile and intelligent network operations frameworks.

NetOps strategies are being redefined with the integration of automation, AI, and machine learning to streamline fault management, performance optimization, and policy enforcement. Security centric network management practices are also influencing the market as enterprises aim to proactively detect and mitigate threats without impacting service availability.

With the convergence of NetOps and DevOps, businesses are moving toward a more collaborative and responsive network environment. The outlook for the market remains optimistic as enterprises seek to modernize legacy network systems and transition toward software defined and intent based networking models that support digital transformation goals.

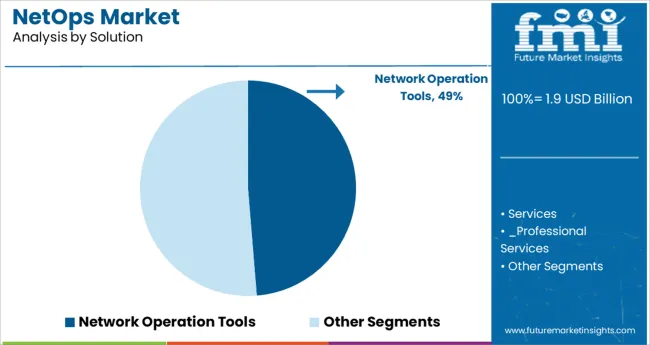

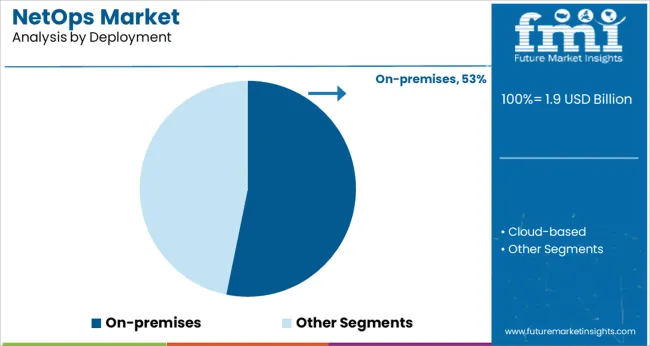

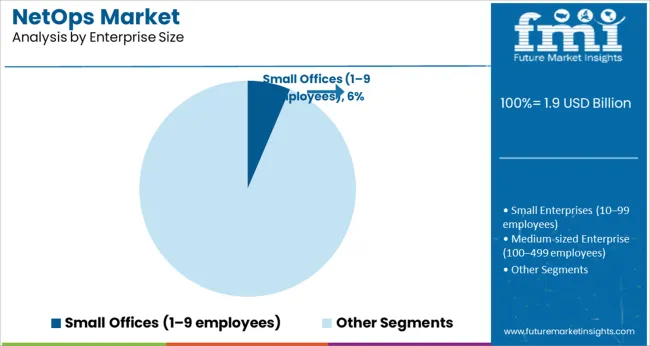

The market is segmented by Solution, Deployment, Enterprise Size, Network Type, and Industry and region. By Solution, the market is divided into Network Operation Tools, Services, and Managed Services. In terms of Deployment, the market is classified into On-premises and Cloud-based. Based on Enterprise Size, the market is segmented into Small Offices (1-9 employees), Small Enterprises (10-99 employees), Medium-sized Enterprise (100-499 employees), Large Enterprises (500-999 employees), and Very Large Enterprises (1,000+ employees).

By Network Type, the market is divided into Physical, Virtual, and Hybrid. By Industry, the market is segmented into Finance, Manufacturing & Resources, Distribution Services, Services, Public Sector, and Infrastructure. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The network operation tools segment is anticipated to account for 48.70% of the total market revenue by 2025 within the solution category, establishing it as the leading segment. This position is driven by the growing demand for centralized control, real time monitoring, and streamlined automation across enterprise networks.

These tools support efficient fault isolation, bandwidth management, and traffic analysis, enabling IT teams to maintain high performance standards across increasingly complex infrastructures. The shift toward hybrid and multi cloud environments has made robust network visibility and analytics indispensable, prompting widespread deployment of advanced toolsets.

Their role in minimizing downtime, optimizing resource use, and supporting compliance has reinforced their importance in modern NetOps ecosystems, securing their leading position in the solution segment.

The on premises deployment model is projected to capture 53.20% of total market revenue by 2025, making it the dominant segment in deployment. This preference is attributed to heightened control, data sovereignty requirements, and low latency benefits associated with on site management.

Enterprises operating in regulated industries or handling sensitive data often prioritize on premises infrastructure to meet stringent compliance mandates and ensure system integrity. Additionally, legacy system integration and customizability make this deployment type favorable for organizations with established IT frameworks.

While cloud based alternatives are gaining momentum, the ability to fine tune configurations, maintain direct oversight, and uphold security standards continues to drive the on premises model’s prominence within the NetOps market.

The small offices segment comprising one to nine employees is expected to represent 6.40% of total market revenue by 2025 under the enterprise size category. Although smaller in share, its growth reflects increasing digital adoption among micro enterprises seeking reliable and cost effective network management solutions.

As remote collaboration, cloud application use, and cybersecurity concerns rise even among the smallest organizations, demand for simplified and scalable NetOps solutions is emerging. Tools that offer plug and play functionality, low maintenance, and remote monitoring capabilities are being adopted by this segment to ensure connectivity, productivity, and data protection.

The segment’s participation in the market is also supported by software vendors tailoring their offerings to suit small scale operational needs, highlighting a gradual but steady inclusion of micro businesses in the broader NetOps ecosystem.

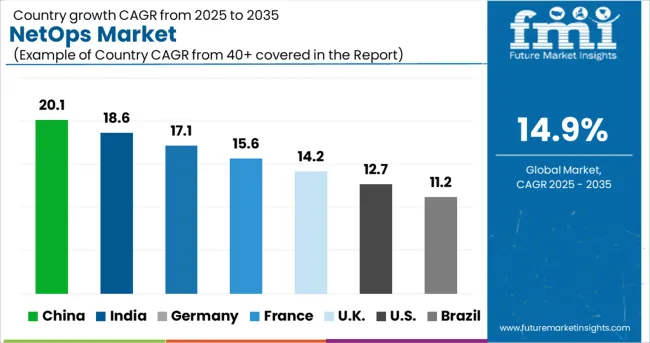

The NetOps market demand is expected to increase at 14.9% CAGR between 2025 to 2035 in comparison with the 6.4% CAGR registered during 2020 to 2024. Several IT solution vendors have started deploying their solutions to clients using DevOps tools and methods. The present-day network faces difficulties keeping up with the developments that are occurring.

NetOps deployment could assist enterprises in handling the rapidly and continuously developing DevOps solutions. Because of the growth in DevOps solutions, enterprises could find the need to deploy NetOps solutions and tools to keep up with the pace, thus allowing the NetOps market to grow.

Traditional network operations refer to the tasks performed by the network team of any organization to monitor the performance of the organization's network. This task is often performed from the network operation center (NOC) of the organization, and upon the detection of errors and anomalies, they perform these tasks for both the hardware and software components of the organization.

NetOps solutions, tools, and practices allow the NOCs of any organization to improve their efficiency, performance, and speed, something that could be a beneficial necessity for organizations, especially large organizations with numerous networks being worked upon. It also allows the implication of infrastructure as a code (IAC) for services and applications at the NOCs.

The two countries in North America, the USA, and Canada, have similar economic conditions, reducing revenue volatility; the presence of numerous large enterprises improves demand consistency; and the presence of several well-developed industries pushes the scope of differentiation.

Latin America has several countries with different economic conditions, increasing revenue volatility. The infrastructure necessary for NetOps is not up to the mark in some countries, raising the capital intensiveness.

Europe has several countries that are technologically advanced and also have several large enterprises, allowing the consistency of demand to be high; however, there are numerous stringent regulatory rules and regulations in the region, raising the regulatory complexity.

South Asia and the Pacific is a developing region, with numerous enterprises entering the large enterprise segment, hence improving the demand for NetOps. Infrastructure deployment would require moderate investment, causing the region to have capital intensity.

East Asia is a well-developed region with countries with similar economic conditions. Barriers to entry could be high because of well-established local vendors.

The Middle East and Africa have high revenue volatility and would require high initial investments. Consistency in demand can be less in this region because only certain specific industries are well-developed and do not have the latest technological solutions.

North America had the largest market share of the NetOps market for the year 2025, with a market share of 36.1%. While South Asia and the Pacific are expected to be the fastest-growing region with a CAGR of 19.4%.

One of the reasons why South Asia and the Pacific region is the fastest growing region is because the IT & TELECOM sector is growing at a rapid pace and the use of network automation, orchestration, and virtualization, as network operators, is increasing.

NetOps offers advantages like it as the capability to make network changes more rapidly utilizing automated tools. The NetOps approach would generally necessitate the utilization of tools that can determine the optimal configuration built on the demands of the network, and in many cases execute it automatically.

This kind of network automation supports the continual enhancement of application delivery and services. Due to these factors, sales in India are predicted to increase at the CAGR of 23.8% during the predicted period 2025-32.

NetOps solutions are utilized in business procedure because it offers advantages like reduction in network operating costs, time and labor saved, management of security, and immediate handling of network incidents at all times. It also offers increased support through around clock networking monitoring, the latest infrastructure with the highest quality, and prevention from network attacks. Thus, the advantages offered by NetOps in business are driving the market demand in Germany.

It is anticipated that workplace teams would be able to get over the traditional barriers between operational, network, and data teams with the use of NetOps. Any NetOps project must therefore go beyond the realm of networking. The entire procedure is made digital, virtual, and software-defined by the contemporary NetOps methodology.

It facilitates simple management and improves the organization's adaptability and agility. Thus, it is anticipated that market demand in the UK region will be driven by the benefits that NetOps offers.

The cloud deployment model is expected to dominate the market. NetOps in the cloud balances the total cost of ownership involved with managing the development and internal runtime infrastructure with the flexibility and speed with which services may be deployed.

By enhancing agility and efficiency while providing IT resources quickly and at an affordable price, the cloud has made it feasible to narrow the gap between the IT industry and enterprises. The adoption of the cloud model has accelerated, nevertheless, because transitioning between cloud models is expensive. In the upcoming years, the market expansion would be accelerated.

Due to this, cloud deployment is estimated to grow at a CAGR of 18.4% over the forecast period.

The virtual network type segment is estimated to grow at a CAGR of 20.2% over the forecast period. Instead of using numerous screens, each dedicated to a separate monitoring tool, a virtual network-type segment can assist teams in collaborating during the incident management process, diagnosing and resolving problems through a single perspective.

Small enterprises and medium-sized enterprises are expected to drive segment growth due to the increasing adoption of NetOps in network optimization and development.

NetOps have several benefits like it saves time for network implementation, network designing, and testing for business development; thus most of the small and medium-sized enterprises are increasing the implementation of NetOps technologies to provide network automating procedure, which is estimated to increase the development of the market.

NetOps technology companies are primarily investing in product enhancements, and upgradation for network implementation to address the unmet needs of the customers. Vendors are also focusing on strategic partnerships and collaborations to expand their customer base.

| Attribute | Details |

|---|---|

| Market value in 2025 | USD 1.9 billion |

| Market CAGR 2025 to 2035 | 14.9% |

| Share of top 5 players | Around 35% |

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2024 |

| Market Analysis | million for Value |

| Key Regions Covered | North America; Latin America; Europe; East Asia; South Asia & Pacific; and the Middle East & Africa |

| Key Countries Covered | USA, Canada, Germany, UK, France, Italy, Spain, Russia, China, Japan, South Korea, India, Malaysia, Indonesia, Singapore, Australia & New Zealand, GCC Countries, Turkey, North Africa, and South Africa |

| Key Segments Covered | The solution, Deployment, Enterprise Size Network Type, and Region |

| Key Companies Profiled | Cisco; Broadcom; Dynatrace; Microsoft; Logic Monitor; Datadog; NinjaOne; Motadata; Nefeli Networks; Progress Software; SolarWinds; Opengear; Auvik; Atera; Zabbix |

| Report Coverage | Market Forecast, Company Share Analysis, Competition Intelligence, DROT Analysis, Market Dynamics and Challenges, and Strategic Growth Initiatives |

| Customization & Pricing | Available upon Request |

The global netops market is estimated to be valued at USD 1.9 billion in 2025.

It is projected to reach USD 7.5 billion by 2035.

The market is expected to grow at a 14.9% CAGR between 2025 and 2035.

The key product types are network operation tools, services, _professional services, _network consulting and planning, _network integration and implementation, _support and maintenance and managed services.

on-premises segment is expected to dominate with a 53.2% industry share in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA