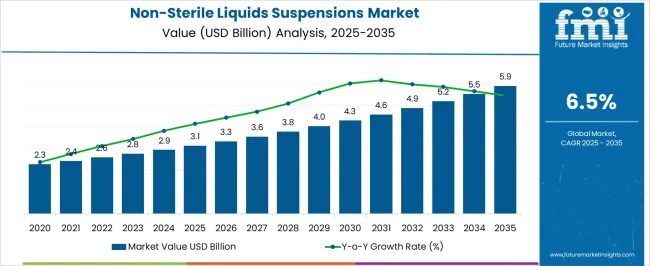

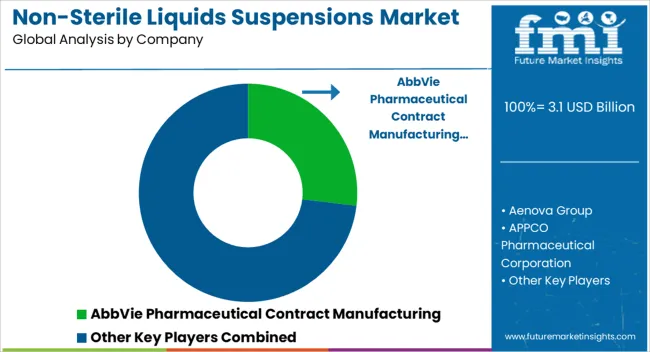

The Non-Sterile Liquids Suspensions Market is estimated to be valued at USD 3.1 billion in 2025 and is projected to reach USD 5.9 billion by 2035, registering a compound annual growth rate (CAGR) of 6.5% over the forecast period.

| Metric | Value |

|---|---|

| Non-Sterile Liquids Suspensions Market Estimated Value in (2025 E) | USD 3.1 billion |

| Non-Sterile Liquids Suspensions Market Forecast Value in (2035 F) | USD 5.9 billion |

| Forecast CAGR (2025 to 2035) | 6.5% |

The non sterile liquids suspensions market is experiencing robust growth driven by rising demand for patient friendly dosage forms, particularly among pediatric and geriatric populations. The oral delivery format is increasingly preferred due to ease of administration, better patient compliance, and suitability for individuals who face challenges with solid dosage forms.

The market is also supported by a surge in chronic and infectious disease treatments that rely on liquid formulations for efficient drug delivery. Advances in formulation technologies have improved suspension stability, taste masking, and bioavailability, enhancing acceptance among patients and healthcare providers.

Increasing outsourcing to contract manufacturers is further shaping the competitive landscape, as pharmaceutical companies seek to optimize production flexibility and reduce operational costs. The outlook remains positive as regulatory focus on quality standards and ongoing R&D in formulation science continue to strengthen adoption across multiple therapeutic areas.

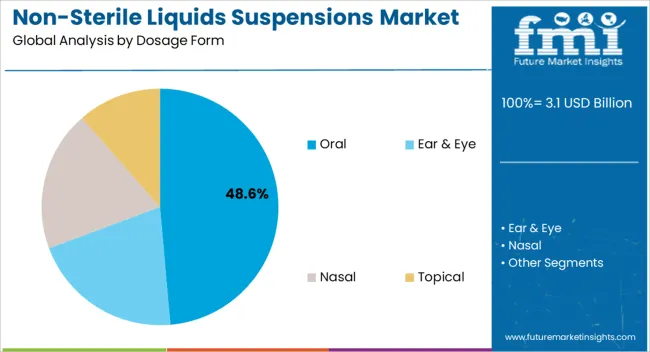

The oral segment is projected to account for 48.60% of total revenue by 2025 within the dosage form category, making it the most dominant segment. Growth in this segment is supported by patient centric preferences, especially for populations requiring flexible and easily administered treatments.

Oral suspensions offer advantages such as customizable dosing, ease of swallowing, and improved palatability, which are particularly valued in pediatric and geriatric care. Pharmaceutical innovation in taste masking, viscosity enhancement, and controlled release technologies has reinforced adoption.

These advantages, coupled with rising demand for long term treatment formats, have secured the oral dosage form segment as the market leader.

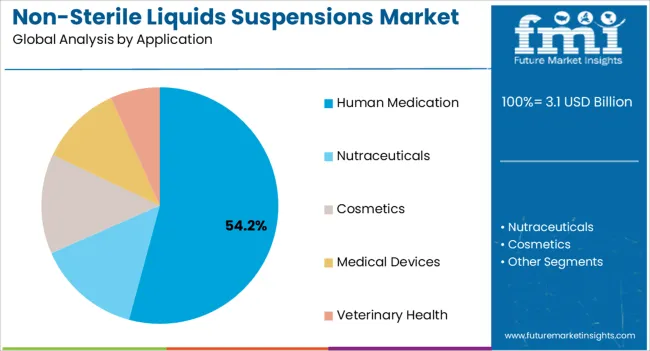

The human medication segment is expected to hold 54.20% of overall market revenue by 2025, positioning it as the primary application area. This dominance is driven by the increasing prevalence of chronic diseases, infectious conditions, and the growing preference for liquid formulations that enhance patient adherence.

Human health applications rely on suspensions for precise dosing and improved absorption rates, which are critical for treatment outcomes. Expanding global healthcare coverage and increased awareness of accessible treatment formats are further reinforcing the use of suspensions in human medicine.

As healthcare providers continue to prioritize treatment compliance and patient convenience, this segment is projected to maintain its leading role.

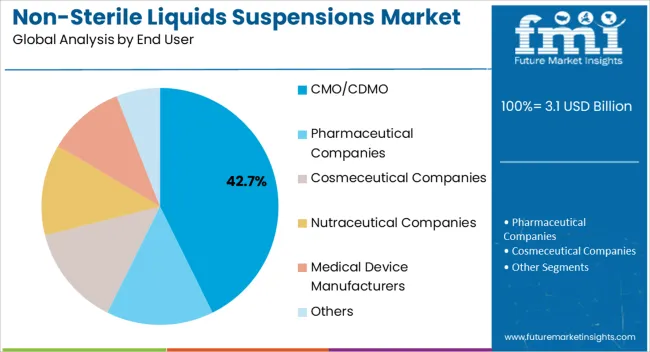

The CMO CDMO segment is projected to contribute 42.70% of total market revenue by 2025, making it the leading end user category. This trend is driven by pharmaceutical companies increasingly outsourcing production to achieve scalability, cost efficiency, and regulatory compliance.

CMOs and CDMOs provide expertise in formulation development, process optimization, and quality control, enabling pharmaceutical brands to focus on core R&D and commercialization. The rising complexity of non sterile liquid suspensions and the need for flexible production capabilities have further supported this outsourcing model.

As global demand for efficient supply chain management grows, CMOs and CDMOs continue to strengthen their role, making them the dominant end users in the non sterile liquids suspensions market.

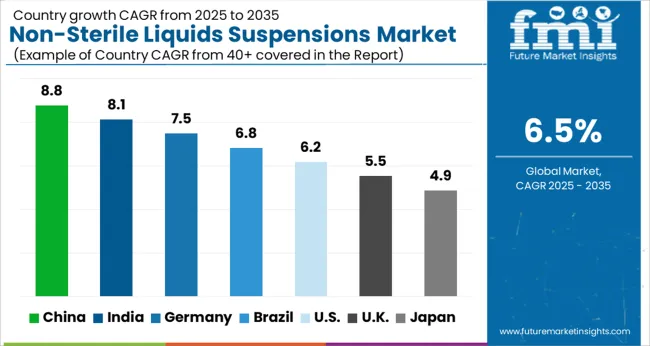

The global sales of the market are anticipated to rise at a CAGR of 6.5% between 2025 and 2035, owing to the various applications in a wide range of medication formulations.

The demand for these products is increasing with respect to the pediatric and geriatric formulations and apart from this, the convenience and compliance provided by the products like mouth washes, gels, creams in reference to the way they are applied or consumed is something which fuels the growth of this market.

The global market holds around 7.3% share of the overall global solvent market with a value of around USD 3.1 Billion, in 2025.

Non-sterile liquids/suspensions can be used to deliver a variety of medications, including prescription drugs, non-prescription drugs, vitamins, dietary supplements, and nutraceuticals. As the population ages, there is a growing demand for formulations that address the specific needs of the elderly. Pediatric formulations are also gaining traction, driven by the need for dosage forms that are easier to administer in children, example oral dosage forms.

Pharmaceutical formulations, such as oral syrups, cough medicines, and other liquid drugs, frequently contain non-sterile liquids and suspensions. The demand for medicines may be influenced by the expanding access to healthcare in emerging nations, the rising prevalence of chronic diseases, and the expanding use of non-sterile fluids or suspensions.

It is also typical practice to produce nutraceuticals and nutritional supplements, such as vitamins, minerals, and botanical extracts, using non-sterile liquid or suspension formulations. The demand for non-sterile liquid or suspension formulations in this sector may rise as a result of rising consumer knowledge of the advantages of nutraceuticals and dietary supplements for health and wellness.

The aforementioned factors are expected to cause the global market to expand swiftly and reach an estimated value of USD 5.9 Billion in 2035.

Due to ease of administration, better taste, and easier swallowing, many consumers, especially kids and elderly patients, may choose liquid formulations over solid dose forms like tablets or capsules. This can result in a rise in demand for non-sterile suspension or liquid formulations. This growing preference of liquid formulations would present lucrative opportunities for the market in the coming years.

Moreover, the creation of non-sterile liquids or suspensions with improved drug stability, bioavailability, and therapeutic efficacy may be made possible by the development of innovative drug delivery technologies like nanotechnology, liposomes, and microencapsulation.

The market for non-sterile liquid or suspension formulations may be stimulated by these developments. In fact, companies today are utilizing cutting-edge technologies to improve both patient compliance and the bioavailability of dose forms.

Non-sterile liquid or suspension formulations may need to adhere to stringent regulatory criteria, such as those for quality assurance, safety, labeling, and manufacturing procedures. The market may be constrained by meeting these legal standards because they can be time-consuming and expensive, especially for startups or smaller firms.

Other than this, in comparison to solid dosage forms, non-sterile liquids or suspensions may have a shorter shelf life because they may be more prone to deterioration, microbial development, and other stability issues. This could shorten the shelf life of non-sterile liquid or suspension items, which might lead to product waste and higher expenditures for product expiry or recalls.

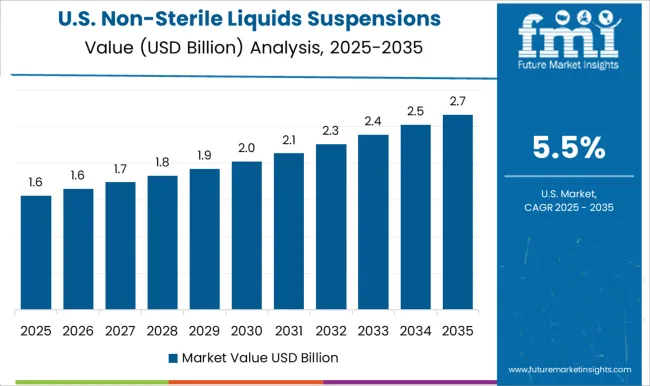

The USA dominated the North American region with market share of around 23.3% in the global market in 2025.

The USA market for non-sterile liquids/suspensions is driven by several factors, including the increasing demand for oral and topical dosage forms, the need for customized solutions that are designed for palatability and patient compliance, and the cost-effectiveness of non-sterile formulations compared to sterile formulations.

The USA market is characterized by a high level of innovation and technological advancement, which drives the development of new and improved non-sterile liquid/suspension formulations. The use of advanced technologies such as nanotechnology, microencapsulation, and spray drying can improve the stability, bioavailability, and efficacy of non-sterile liquid/suspension formulations.

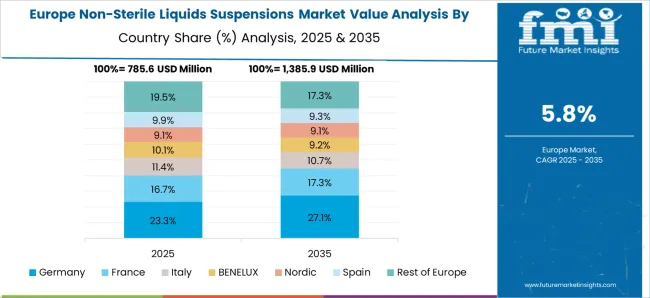

Germany held a market share of 4.9% in 2025 in the global market. Non-sterile liquids/suspensions are frequently used to treat a variety of medical conditions such as cough, cold, allergies, and pain relief. The rising demand for OTC medications is propelling this market forward in this region.

With a focus on enhancing the patient experience and medication adherence, there is an increasing emphasis on patient-centric treatment in Germany. Non-sterile liquid or suspension formulations may have benefits for patients in terms of dosing flexibility, ease of administration, and patient convenience, all of which are consistent with patient-centric care paradigms.

The elderly population in Germany may have particular demands and preferences when it comes to the administration of medications. Older adults who may have trouble swallowing pills or capsules may prefer non-sterile liquid or suspension forms, which could increase demand for these formulations.

India had a market share of 8.8% in the global market in 2025. India's population is large and growing, which is driving demand for non-sterile liquids/suspensions. Chronic diseases such as diabetes, cardiovascular disease, and cancer are becoming more common in India.

With a population of over 1.3 Billion people, India has a high demand for pharmaceutical products, including non-sterile liquids/suspensions. The increasing population and urbanization in India have led to a rise in the prevalence of diseases and health conditions, which has increased the demand for medications.

The oral dosage form held a market share of 29.5% in the global market in 2025.

For patients who might have trouble swallowing solid dosage forms like pills or capsules, non-sterile liquid or suspension formulations are frequently simple to administer. They are thus especially well-suited for certain patient groups, including kids, the elderly, and people who have trouble swallowing or who have other medical issues that make it difficult to take solid dosage forms.

Many patients prefer liquid or suspension formulations due to their ease of use, convenience, and familiarity. This can contribute to the wide acceptance of oral dosage forms in the non-sterile liquid or suspensions market, as patient preference and convenience are important factors in medication selection and adherence.

The human medication segment held a market share of 40.1% in the global market in 2025. It is expected to expand due to technological advancements in disease diagnosis and treatment and increasing human populations with various acute diseases like acute pain and cold symptoms, and chronic diseases like cancer and diabetes. This further increases the adoption of pharmaceutical medicines.

Overall, the use of non-sterile liquids/suspensions in human medication offers advantages like enhanced bioavailability, rapid onset of action, improved medication adherence, and flexible dosing, thus driving the global market.

Pharmaceutical companies held a market share of 33.1% in the year 2025. Pharmaceutical companies are using more non-sterile liquids/suspensions in the production of medications due to the various advantages associated with formulations in human medications and veterinary medications.

Pharmaceutical companies are taking non-sterile liquids/suspensions in bulk or package form for various applications like various dosage formulations with parenteral as well for rinsing of equipment. Apart from this, the rising number of pharmaceutical companies around the globe is another point as to which it dominates this segment.

Key players are focusing on agreements, mergers, partnerships, collaborations, and acquisitions as well as the introduction and commercialization of novel products and pharmaceuticals in order to broaden their clientele and raise business income. A few examples of strategies acquired by the key players:

Similarly, recent developments related to non-sterile liquids/suspensions market has been tracked by the team at Future Market Insights. These are available in the full report.

| Attribute | Details |

|---|---|

| Historical Data Available for | 2025 to 2035 |

| Forecast Period | 2012 to 2025 |

| Market Analysis | USD Million for Value |

| Key Regions Covered | North America; Latin America; Europe; South Asia; East Asia; Oceania; and the Middle East & Africa |

| Key Countries Covered | USA, Canada, Mexico, Brazil, Argentina, United Kingdom., Germany, Italy, Spain, France, Russia, Benelux, India, Thailand, Indonesia, Malaysia, Japan, China, South Korea, Australia, New Zealand, Türkiye, GCC Countries, and South Africa |

| Key Market Segments Covered | Dosage Form, Application, End User, and Region |

| Key Companies Profiled | AbbVie Pharmaceutical Contract Manufacturing; Aenova Group; APPCO Pharmaceutical Corporation; Atral Pharmaceutical; Aurigene Pharmaceutical Services (Dr. Reddy’s); Biological E. Ltd.; BioPlus Life Sciences; Bora Pharmaceuticals; Cambrex Corporation; COC Farmaceutici; Contract Pharmaceuticals Limited (CPL); DPT Laboratories, Ltd.; Eurofins; JGL d.d.; Mikart; PharmaVision (Vizyon Holding); Pierre Fabre; TriRx Pharmaceutical Services; UI Pharmaceuticals; Wasdell Group; Aphena Pharma; Syngene International |

| Pricing | Available upon Request |

The global non-sterile liquids suspensions market is estimated to be valued at USD 3.1 billion in 2025.

The market size for the non-sterile liquids suspensions market is projected to reach USD 5.9 billion by 2035.

The non-sterile liquids suspensions market is expected to grow at a 6.5% CAGR between 2025 and 2035.

The key product types in non-sterile liquids suspensions market are oral, _mixtures, _linctures, _syrups, _elixirs, _mouth washes/gargles, _drops, ear & eye, _drops, _lotions, nasal, _drops, _sprays, topical, _gel, _creams and _parenteral.

In terms of application, human medication segment to command 54.2% share in the non-sterile liquids suspensions market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA