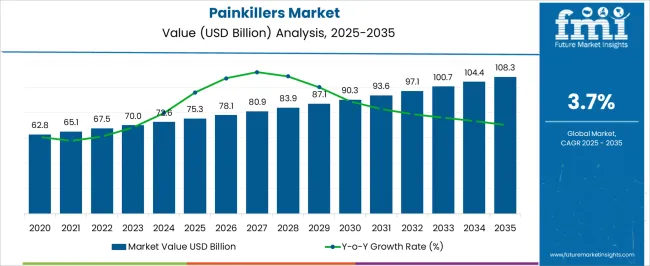

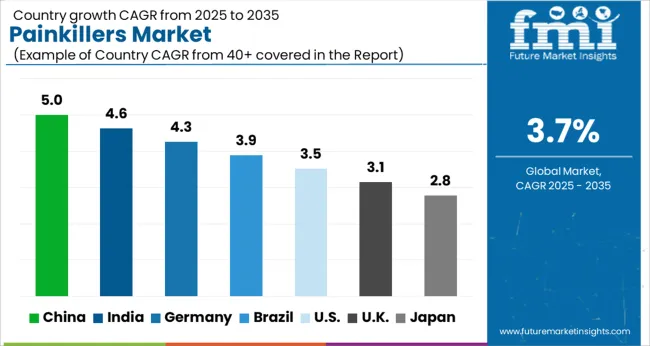

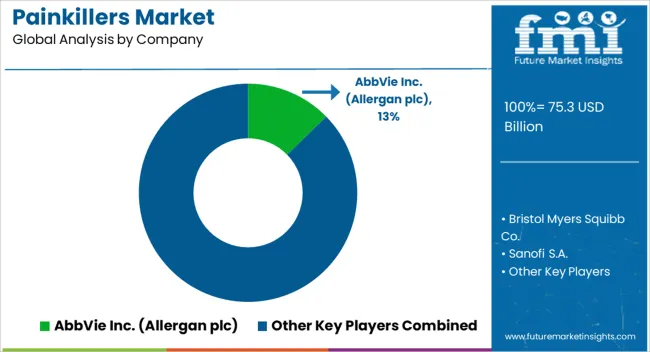

The Painkillers Market is estimated to be valued at USD 75.3 billion in 2025 and is projected to reach USD 108.3 billion by 2035, registering a compound annual growth rate (CAGR) of 3.7% over the forecast period.

| Metric | Value |

|---|---|

| Painkillers Market Estimated Value in (2025 E) | USD 75.3 billion |

| Painkillers Market Forecast Value in (2035 F) | USD 108.3 billion |

| Forecast CAGR (2025 to 2035) | 3.7% |

The painkillers market is expanding steadily as rising cases of chronic illnesses, post operative pain management needs, and lifestyle related conditions drive consistent demand for effective analgesics. Advancements in pharmaceutical formulations and improved accessibility to both prescription and over the counter medications are strengthening adoption worldwide.

The growing preference for self medication in minor pain conditions and the availability of generic variants at affordable costs are further accelerating uptake. Regulatory efforts to balance accessibility with the prevention of misuse, especially for opioids, are shaping product innovation and compliance strategies across the market.

The future outlook remains positive as healthcare systems prioritize both effective pain management and patient safety, creating opportunities for personalized therapies and safer alternatives in pain relief.

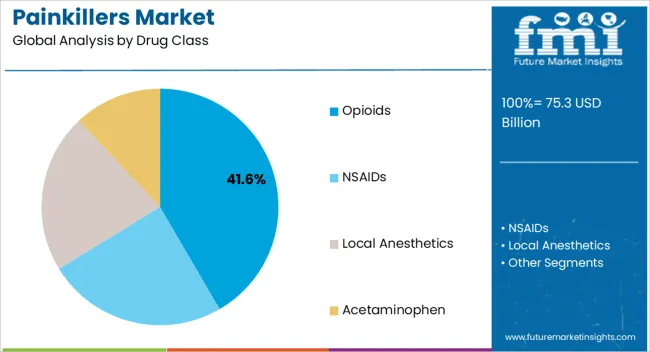

The opioids segment is projected to contribute 41.60% of total revenue by 2025 within the drug class category, making it a significant segment in the market. This growth is being driven by their effectiveness in managing moderate to severe pain, particularly in cases where other analgesics fail to provide adequate relief.

The continued use of opioids in controlled medical environments, especially for cancer and post surgical patients, has supported their adoption. Regulatory measures and monitoring frameworks have been reinforced to ensure safe usage while minimizing risks of dependency.

The balance between therapeutic necessity and controlled accessibility has maintained opioids as a cornerstone in clinical pain management, supporting their strong revenue share in the painkillers market.

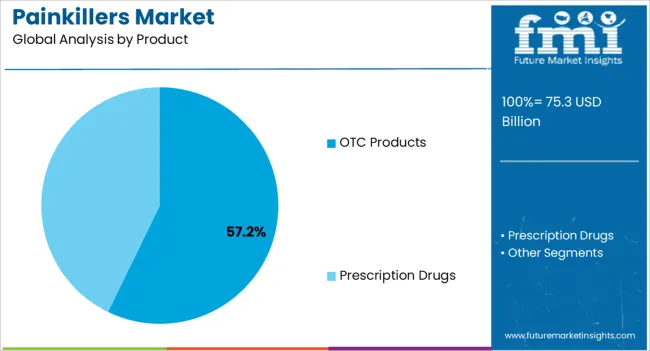

The OTC products segment is expected to account for 57.20% of total revenue by 2025 under the product category, making it the leading segment. The high share is attributed to the widespread use of OTC painkillers for mild to moderate conditions such as headaches, muscle aches, and joint pain.

Consumer preference for self management, coupled with the ease of availability in pharmacies and retail outlets, has driven rapid adoption. The segment also benefits from affordability and the presence of multiple well established brands that cater to diverse demographics.

Increasing awareness about preventive healthcare and lifestyle management has reinforced the demand for OTC solutions, positioning this category at the forefront of market growth.

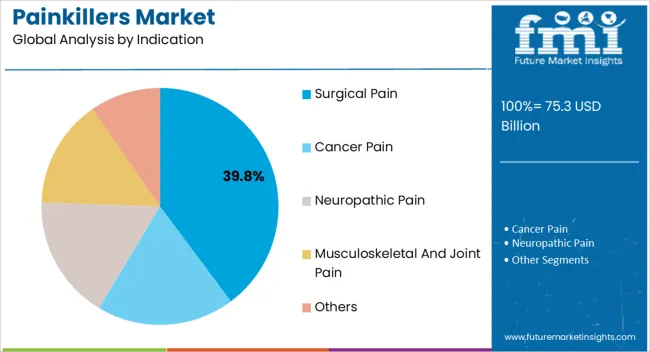

The surgical pain segment is projected to hold 39.80% of total revenue by 2025 within the indication category, making it a leading application area. Rising surgical volumes across elective and emergency procedures have contributed significantly to the growing demand for pain management solutions.

Enhanced recovery protocols, which emphasize effective post operative pain control, have supported the use of both prescription and OTC products in this segment. The segment has also gained traction as minimally invasive procedures continue to expand globally, requiring targeted and efficient pain relief strategies.

As surgical interventions increase in frequency due to aging populations and lifestyle related health conditions, the demand for painkillers tailored to surgical pain management continues to dominate.

The market value for painkillers was around 4.8% of the overall ~USD 1,400.5 Billion of the global pharmaceuticals market in 2025.

An increasing number of patients suffering from chronic diseases such as cancer and chronic obstructive pulmonary disease (COPD), various prescription drugs for postoperative pain management, and various traumas leading to pain are expected to fuel the growth of global market for painkillers.

Certain health conditions such as diabetes, cancer, and autoimmune diseases are known to increase the risk of developing chronic pain and neuropathic pain. Therefore, it is important that healthcare providers are aware of the increasing prevalence of these conditions and provide appropriate treatment strategies to improve patients’ quality of life.

Overall, the global market is projected to expand at a CAGR of 3.7% during the forecast period (2025 to 2035).

The regulatory scenario for painkillers can have a significant impact on the growth of the market. In recent years, opioid pain medications have come under increased scrutiny, resulting in stricter regulations and restrictions on their use. This has created opportunities for non-opioid pain medications such as NSAIDs and other non-narcotic medications to gain market share. In addition, regulatory initiatives to improve pain management and reduce opioid abuse, such as prescription drug monitoring programs and physician education programs, may create opportunities for companies offering alternative pain management solutions.

Overall, the regulatory scenario for painkillers is complex and evolving. However, regulatory initiatives that promote safe and effective pain management can create growth opportunities for the painkillers manufacturers, especially for companies that offer innovative solutions.

The companies that navigate the regulatory landscape and invest in innovative solutions to meet the evolving needs of patients and healthcare providers offer lucrative growth opportunities for the market and will raise the market to new heights during the forecast period from 2025 to 2035.

Per capita use of opioids is low in Asian countries. According to the Global Opioids Policy Initiative (GOPI), some of the main factors responsible for low opioid use in Asia and Africa include: full patient cost coverage is required, patient registration required before prescribing opioids, and physicians must obtain special permission to prescribe opioids.

The availability of painkillers in Asian and African countries may have a significant impact on the growth of the painkiller market in these regions. In many of these countries, access to painkillers is limited due to various factors such as lack of infrastructure, regulatory issues, and economic constraints. This can lead to a significant unmet need for painkillers, which can ultimately impact the growth of the market.

These factors are negatively impacting the growth of the painkillers market in Asia and Africa and projections have been made which are restraining the growth of the market during the forecast period from 2025 to 2035 in the world.

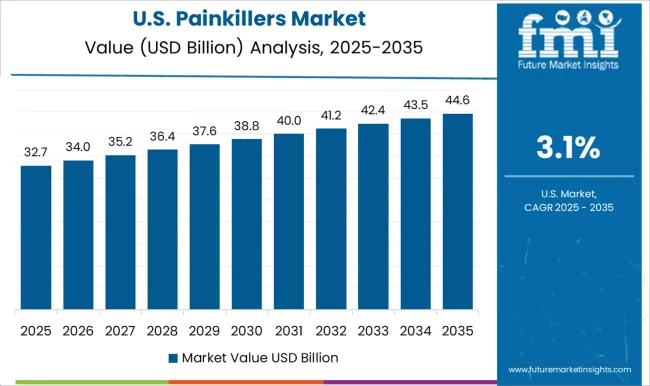

With a market share of 91.5% in 2025, the USA will continue to dominate the North American region. This large market share is expected to continue throughout the forecast period.

In the USA, palliative care facilities are provided in accordance with government and commercial reimbursement guidelines. Palliative care programs in hospitals in the USA include dedicated inpatient palliative care units and palliative care consultation teams.

Also, the American Chronic Pain Association has designated September as Pain Awareness Month, and more than 80 organizations and healthcare professionals, and consumer groups have supported the initiative. This will result in the propulsion of demand for painkillers in the country during the forecast period of 2025 to 2035.

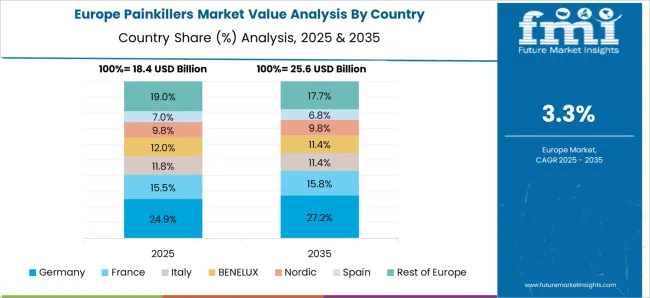

Germany dominates the Western European region with a total market share of about 25.6% in 2025 and is expected to continue to experience the same growth throughout the forecast period.

In Germany, there is a growing interest in personalized medicine, which is also reflected in the painkillers market. Pharmaceutical companies are developing painkillers tailored to specific patient groups, such as the elderly or people with kidney problems, in order to achieve more targeted and effective pain relief. This will foster profitable market growth over the course of the forecast period.

Japan dominates the East Asia region with market share of 45.1% in 2025 and will expand with growing numbers in the future.

Japan has taken various initiatives to improve pain management, including the establishment of pain clinics, the development of clinical guidelines for pain management, and the training of healthcare professionals in pain management.

The Japan market for painkillers is expected to continue to grow in the coming years, driven by changing demographics, shifting consumer preferences, and increasing investment in pain management R&D all suggest that Japan will continue to be an important market for painkillers.

Opioids are expected to present growth at a CAGR of 2.1% throughout the forecast period, with a market share of 53.4% in the global market in 2025.

Opioids are relatively inexpensive compared to some of the newer non-opioid pain medications. Opioids have been used for pain relief for centuries, and many healthcare providers are familiar with their use and feel comfortable prescribing them.

As the demand for non-opioids continues to grow, the market for painkillers is expected to expand significantly in the coming years.

Prescription Drugs dominated the global market with a value share of 58.8% in 2025.

Prescription drugs are leading in the global market for painkillers over over-the-counter (OTC) drugs because they are often more effective at providing pain relief for moderate to severe pain. Prescription painkillers are also often covered by health insurance, which can make them more affordable for patients who need them.

Surgical pain is leading the market with a market share of 43.3% in the global market in 2025.

Surgical pain is leading in the market over other indications because surgery is a common cause of acute pain, and pain relief is an important part of the post-surgical recovery process. Many surgical procedures can be painful, and without adequate pain control, patients may experience significant discomfort, which can delay healing and recovery.

The oral route of administration is leading the market with a revenue share of 38.7% in 2025 as oral painkillers are easy to take and can be self-administered, which can make them more convenient for patients and also it is generally less invasive than other routes, such as injections or transdermal patches, which can make it more appealing for patients.

Retail pharmacies hold a market share value of 27.5% during the year 2025. Retail pharmacies typically stock a wide range of painkillers, including both prescription and over-the-counter options and they are easily accessible to consumers, which makes it convenient for them to purchase painkillers.

Key market players in the painkillers market launch their products. This promotional strategy is expected to be highly impactful to enter into the market.

A few of the recent instances include

Similarly, recent developments have been tracked by the team at Future Market Insights related to companies in the Painkillers market, which are available in the full report.

| Attribute | Details |

|---|---|

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2025 |

| Market Analysis | USD Million for Value |

| Key Regions Covered | North America; Latin America; Western Europe; Eastern Europe; Russia & Belarus; Balkan & Baltic Countries; South Asia & Pacific; East Asia; Central Asia; and Middle East & Africa |

| Key Countries Covered | USA, Canada, Brazil, Mexico, Argentina, United Kingdom, Germany, Italy, Spain, France, BENELUX, Nordic Countries, Poland, Hungary, Czech Republic, Romania, Russia and Belarus, Balkan & Baltic Countries, India, Thailand, Indonesia, Malaysia, Vietnam, Philippines, Japan, China, South Korea, Central Asia, Australia and New Zealand, Türkiye, GCC Countries, Kingdom of Saudi Arabia, Israel, North Africa, and South Africa |

| Key Market Segments Covered | Drug Class, Product, Indication, Route of Administration, Distribution Channel, and Region |

| Key Companies Profiled | AbbVie Inc. (Allergan plc); Bristol Myers Squibb Co.; Sanofi S.A.; Boehringer Ingelheim International GmbH; Pfizer Inc.; Zydus Lifesciences Ltd. (Cadila Pharmaceuticals); GSK plc.; Abbott Laboratories, Inc.; Novartis AG; Johnson & Johnson (Janssen Pharmaceuticals, Inc.); Sun Pharmaceutical Industries Ltd.; Teva Pharmaceuticals Ltd.; Mallinckrodt Pharmaceuticals; Endo Pharmaceuticals Inc.; Bayer AG; F. Hoffmann-La Roche Ltd.; Procter & Gamble; AstraZeneca; Cardinal Health; Perrigo Company Plc.; Bausch Health Companies Inc.; Viatris; Amneal Pharmaceuticals; Purdue Pharmaceuticals L.P. |

| Report Coverage | Market Forecast, Competition Intelligence, DROT Analysis, Market Dynamics and Challenges, Strategic Growth Initiatives |

| Pricing | Available upon Request |

The global painkillers market is estimated to be valued at USD 75.3 billion in 2025.

The market size for the painkillers market is projected to reach USD 108.3 billion by 2035.

The painkillers market is expected to grow at a 3.7% CAGR between 2025 and 2035.

The key product types in painkillers market are opioids, _tramadol, _oxycodone, _hydrocodone, _other opioids, nsaids, local anesthetics and acetaminophen.

In terms of product, otc products segment to command 57.2% share in the painkillers market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA