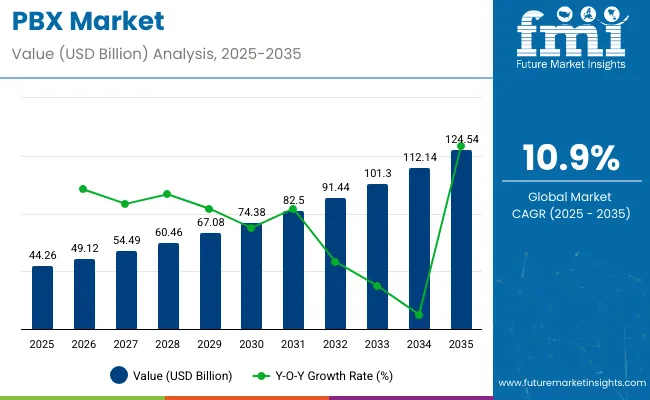

The global private branch exchange (PBX) market is projected to be significantly expanded, with its value anticipated to grow from USD 44.26 billion in 2025 to USD 124.54 billion by 2035, reflecting a strong CAGR of 10.9%.

This expansion is expected to be driven primarily by the widespread adoption of cloud-based communication platforms that are being favored for their scalability, cost-effectiveness, and operational flexibility. Traditional PBX systems are being steadily phased out and replaced by advanced IP-based and hosted PBX solutions, which are designed to improve connectivity, reduce operational expenses, and enhance collaboration among geographically dispersed teams.

Innovations in Voice over Internet Protocol (VoIP) technology and unified communication tools have been incorporated into modern PBX solutions, resulting in greater functionality and broader market acceptance. Across various industries such as IT, BFSI, healthcare, and retail, the benefits of PBX systems are being increasingly recognized, especially as they support remote working models and efficient contact center operations. Additionally, these systems are being preferred for enabling real-time analytics and seamless communication processes that are essential in the contemporary digital business environment.

A higher growth trajectory for the PBX market is being anticipated in the Asia-Pacific region, where small and medium-sized enterprises (SMEs) are being rapidly established, and internet penetration rates are improving consistently. Favorable government policies aimed at accelerating digital transformation are also contributing to the market's development in this region.

Meanwhile, North America’s substantial market share is being maintained by virtue of its advanced telecommunications infrastructure and the early adoption of state-of-the-art technologies. Organizations in this region have been focusing heavily on digital transition strategies that rely on modern PBX systems for improved productivity and cost management.

As highlighted in a 2023 official press release by Cisco Systems, its CEO Chuck Robbins emphasized, “We’re thrilled to share groundbreaking innovation and a robust set of new capabilities across our portfolio with our customers this year at Cisco Live. We believe there’s a huge opportunity ahead for Cisco, as we’re uniquely positioned to help our customers solve many of their biggest business challenges using technology.” This remark reflects the industry's ongoing commitment to advancing PBX technologies that are being relied upon for enhanced organizational communication.

| Metric | Value (USD billion) |

|---|---|

| Market Size (2025E) | USD 44.26 billion |

| Market Value (2035F) | USD 124.54 billion |

| CAGR (2025 to 2035) | 10.9% |

Private Branch Exchange (PBX) systems have evolved significantly with the integration of smart technologies like cloud computing, AI-driven call analytics, unified communications (UC), and VoIP enhancements. These advancements enable businesses to streamline communication, reduce costs, and improve user experience.

Government regulations in the PBX market focus on data security, telecommunications interoperability, emergency access, and lawful compliance. As PBX systems increasingly use cloud and internet-based technologies, regulatory oversight ensures they operate safely and responsibly across business and public networks.

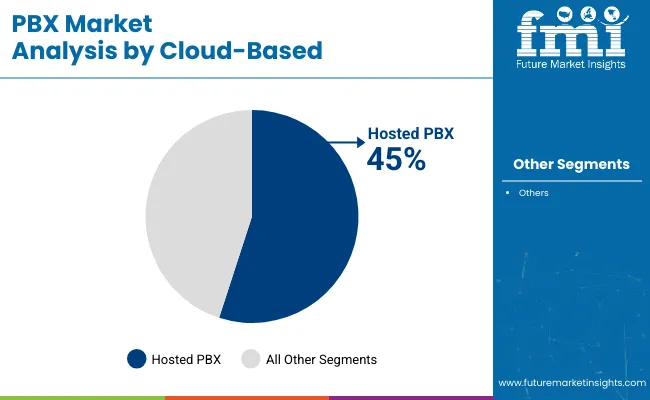

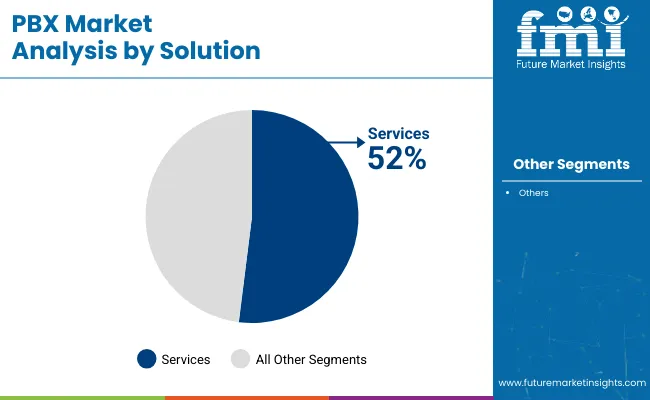

The PBX market is being transformed by the growing adoption of cloud-based solutions, which offer scalability, flexibility, and cost-efficiency, driving their dominance. Simultaneously, service-based PBX solutions are gaining traction as businesses seek managed and hosted communication platforms to reduce infrastructure costs and improve operational efficiency across diverse industries globally.

Cloud-based PBX systems have been established as the leading segment in the market, driven by their scalable and flexible communication capabilities. Organizations have increasingly adopted cloud-hosted PBX solutions to reduce capital expenditure on hardware and gain access to advanced features such as remote accessibility, easy integration, and rapid deployment.

Leading providers like RingCentral, 8x8, and Vonage have been instrumental in expanding cloud PBX adoption through continuous innovation and service reliability. The cloud model supports business continuity with automatic updates and disaster recovery options, which has been particularly valued amid evolving work-from-home trends.

Cost-effectiveness and pay-as-you-grow pricing models have further contributed to the rapid uptake of cloud-based PBX systems. Additionally, enterprises across sectors such as IT, healthcare, and finance have prioritized cloud solutions for seamless global communications and enhanced collaboration. These factors have collectively positioned cloud-based PBX as the dominant market segment by 2025.

Service-based PBX solutions, including managed and hosted PBX offerings, have been experiencing steady growth as organizations seek to outsource their communication infrastructure management. This segment has gained prominence due to its ability to provide businesses with expert support, reduced operational complexity, and lower upfront investments.

Providers like Cisco, Mitel, and NEC have been key players delivering robust service-based PBX platforms tailored to various industry needs. The increasing complexity of on-premise PBX management has prompted businesses to prefer service-based models that allow them to focus on core operations while leaving communication system maintenance to specialized vendors.

Enhanced security, compliance adherence, and seamless integration with CRM and other business tools have also driven the adoption of managed PBX services. The service-based PBX market share of 52% in 2025 reflects this growing trend, supported by enterprises’ preference for flexibility, scalability, and cost predictability.

PBX (Private Branch Exchange) market is struggling as they face challenges integrating with current generation unified communication vendors and don't mesh well with the legacy systems in place. As enterprises make the transition to cloud-based, mobile-first communication solutions, traditional PBX systems particularly on premise hardware-based solutions cannot keep up with the demands for hybrid work and real-time collaboration.

Many companies continue to rely on outdated analogy or digital PBX arrangements that are largely incompatible with VoIP, video conferencing, and mobile integration, needing expensive upgrades or difficult-to-manage middleware. Moreover, the continuing growth in remote work is compelling companies to migrate away from PBX for hardware and instead adopt scalable, cloud-based solutions.

The increasing demand for flexible, cost-effective, and scalable communication solutions has created a significant opportunity for the PBX market. The scalability, remote access, integration with existing systems, lower maintenance costs, etc., offered by cloud-based PBX systems make them a perfect fit for SMEs and distributed teams.

Technologies such as VoIP, SIP trunking, and AI-based call routing are improving call management effectiveness, and UC systems are available to unify with video, messaging, and work stream components. The adoption of hosted and hybrid PBX systems will especially rise due to the use of hybrid work models, a mobile workforce and virtual contact centers, particularly in finance, healthcare, education and e-commerce sectors.

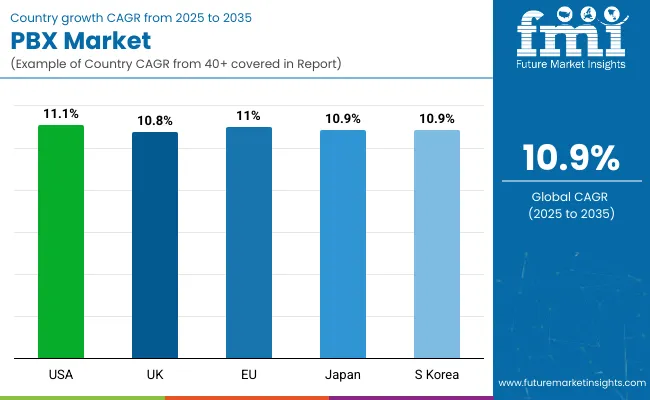

Driven by this shift towards IP-based communication and the adoption of hybrid work model and increasing demand for unified communication platforms, United States PBX market is expected to grow in the coming years. As businesses move from traditional analog systems to cloud-based and VoIP-enabled PBX solutions, communication has become much more efficient and scalable.

Also, increasing small and medium-sized enterprises (SMEs) and demand for cost-effective and feature-rich internal communication infrastructure will support spending on hosted PBX systems. The advances in 5G and network infrastructure and the presence of dominant technology players are also driving the adoption of next-gen PBX systems featuring AI-powered call routing and CRM integration.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 11.1% |

The UK PBX market is growing with accelerated digital transformation across enterprises, global cloud telephony sweeping trends, and adoption of UCaaS (Unified Communications as a Service). Firms are adopting IP-PBX systems, and hosted PBX to lower operational costs and improving collaboration capabilities in remote workspaces.

Government-sponsored programs facilitating SME digitization and flexible communication tools to workforces in a hybrid model further contribute to the growth of the market. The end of ISDN services and the PSTN switch-off route brings the reliability and flexibility of VoIP-based PBX solutions to an expanding number of sectors, including healthcare, finance, and education.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 10.8% |

The growth of the European Union PBX market is supported by factors such as the widespread adoption of IP telephony, the increasing use of cloud-based communication, and regulatory incentives for the digitization of infrastructure. Germany, France, and the Netherlands are outperformers in deploying hosted PBXs at the enterprise level with unified communication tools and CRM solutions integrated.

PBX vendors are concentrating on secure communications solutions, including end-to-end encryption, remote administration, and centralized management, with a focus on cybersecurity and GDPR compliance. The increasing trend of switching to mobile-ready PBX applications is changing enterprise communication strategies in the region as well.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union | 11.0% |

Revival in Japan’s PBX Market as Corporate Modernization Efforts Surge; Demand for Integrated Communication Tools and Growing Popularity of VoIP Solutions Expected to Drive Growth Old analog systems are still found in some cases, but the transition toward IP-PBX and cloud-hosted PBX platforms is gaining ground across both large enterprises and SMEs.

Japan's increasing focus on digital workplace initiatives and automation has propelled the adoption of PBX systems integrated with chat, video conferencing, AI-based call analytics, and speech recognition. Local telecom providers are also bolstering next-gen communication infrastructure, which contributed to adoption increase.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 10.9% |

Dynamic growth is observed in the South Korean PBX market backed by the advanced telecom setup in the country and rising demand for unified communications and smart office solutions. This has led businesses to deploy hosted PBX systems for improved scalability and support of remote teams, as well as facilitate real-time collaboration.

The country is also home to numerous technology startups and digital service providers who are innovating on AI-powered PBX functionalities, real-time analytics, and mobile integration. As the planet readjusts post-pandemic, demand for secure, cloud-native, communication solutions will only continue to drive the trajectory of the market well into the next decade.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 10.9% |

The Cloud PBX (Private Branch Exchange) market is a competitive landscape fuelled by rising demand for scalable, cost-effective, and cloud-integrated communication systems among enterprises, SMEs, call centers, and government organizations.

PBX systems provide for the routing of calls internally, management of external lines, and advanced communication capabilities, for both traditional on premise infrastructure and hosted VoIP solution environments. Nonetheless, leveraging on features required for modern business communication, the key players specializing in hybrid PBX models, unified communications integration, and SIP trunking capabilities. Widespread global telecom network equipment suppliers, VoIP technology providers, and enterprise communication technology developers make up the market.

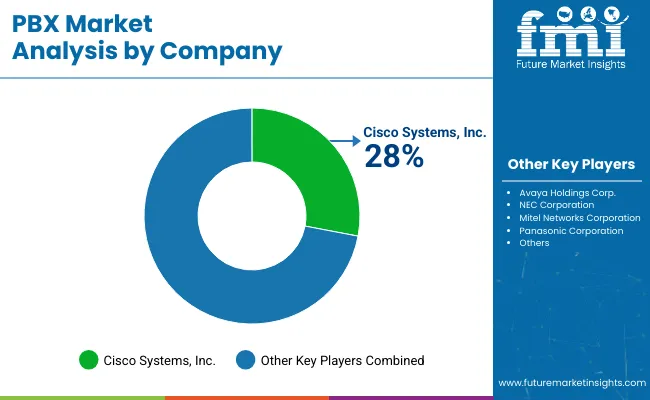

Cisco leads in enterprise PBX solutions, offering cloud-based platforms and unified communications systems with robust security and global scalability.

Avaya provides hybrid PBX systems and cloud telephony platforms, enabling seamless voice and video communication for remote and in-office teams.

NEC delivers cost-effective and modular PBX systems, widely adopted in SMEs, educational institutions, and hospitality sectors for integrated communications.

Mitel offers flexible PBX architectures, combining on premise and cloud systems to serve multi-location businesses and customer support environments.

Panasonic focuses on compact PBX systems for small and medium-sized businesses, facilitating migration from analog to digital and VoIP-based communication.

Several other companies contribute to the PBX market, focusing on hosted VoIP, SIP-based communication, and all-in-one unified communication platforms:

| Report Attributes | Details |

|---|---|

| Current Total Market Size (2025) | USD 44.26 billion |

| Projected Market Size (2035) | USD 124.54 billion |

| CAGR (2025 to 2035) | 10.9% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD Billion for value |

| PBX Type Segments Analyzed (Segment 1) | On-premises PBX, Cloud-Based PBX (Hosted PBX), Hybrid PBX (Traditional PBX + VoIP) |

| Solution Segments Analyzed (Segment 2) | PBX Devices, PBX Servers, VoIP Gateways, VoIP Phone Systems, PBX Software, Services (IP Telephony Services, Unified Communication Services, Technology Consulting, Support and Maintenance) |

| Enterprise Size Segments Analyzed (Segment 3) | Small Offices (1 to 9 employees), Small Enterprises (10 to 99 employees), Medium-sized Enterprises (100 to 499 employees), Large Enterprises (500 to 999 employees), Very Large Enterprises (1,000+ employees) |

| Industry Segments Analyzed (Segment 4) | Finance (Banking, Insurance, Investment/Securities), Manufacturing and Resources (Discrete Manufacturing, Process Manufacturing, Resource Industries, Agriculture), Distribution Services (Retail, Wholesales, Transportation/Logistics Services, Warehousing & Storage, Shipping), Services (IT/Professional Services, Consumer and Personal Services, Media/Entertainment & Publishing, Travel & Hospitality, Legal Services), Public Sector (Government, Education, Healthcare, Aerospace & Defense, Non-Profit), Infrastructure (Telecommunication, Energy & Utilities, Building & Construction) |

| Regions Covered | North America; Latin America; Europe; East Asia; South Asia & Pacific; Middle East and Africa |

| Countries Covered | United States, Canada, Mexico, Brazil, Argentina, Germany, France, United Kingdom, Italy, Spain, Netherlands, China, India, Japan, South Korea, Australia & New Zealand (ANZ), GCC countries, South Africa |

| Key Players influencing the PBX Market | Cisco Systems, Poly, Panasonic |

| Additional Attributes | Dollar sales by PBX type and solution, Cloud-based PBX adoption trends, VoIP gateway demand growth, Influence of unified communication in enterprise transformation, Rise in IP telephony services in SMEs and large enterprises, Technology consulting and managed services growth |

The overall market size for the PBX market was USD 44.26 billion in 2025.

The PBX market is expected to reach USD 124.54 billion in 2035.

The increasing adoption of cloud-based communication systems, rising demand for scalable and cost-effective telephony solutions, and growing shift toward VoIP technologies fuel the PBX market during the forecast period.

The top 5 countries driving the development of the PBX market are the USA, UK, European Union, Japan, and South Korea.

VoIP phone systems and PBX software lead market growth to command a significant share over the assessment period.

Table 1: Global Market Value (US$ Million) Analysis (2018 to 2022) By Type

Table 2: Global Market Value (US$ Million) Forecast (2023 to 2033) By Type

Table 3: Global Market Value (US$ Million) Analysis (2018 to 2022) By Solution

Table 4: Global Market Value (US$ Million) Forecast (2023 to 2033) By Solution

Table 5: Global Market Value (US$ Million) Analysis (2018 to 2022) By Enterprise Size

Table 6: Global Market Value (US$ Million) Forecast (2023 to 2033) By Enterprise Size

Table 7: Global Market Value (US$ Million) Analysis (2018 to 2022) By Industry

Table 8: Global Market Value (US$ Million) Forecast (2023 to 2033) By Industry

Table 9: Global Market Value (US$ Million) Analysis (2018 to 2022) By Region

Table 10: Global Market Value (US$ Million) Forecast (2023 to 2033) By Region

Table 11: North America Market Value (US$ Million) Analysis (2018 to 2022) By Type

Table 12: North America Market Value (US$ Million) Forecast (2023 to 2033) By Type

Table 13: North America Market Value (US$ Million) Analysis (2018 to 2022) By Solution

Table 14: North America Market Value (US$ Million) Forecast (2023 to 2033) By Solution

Table 15: North America Market Value (US$ Million) Analysis (2018 to 2022) By Enterprise Size

Table 16: North America Market Value (US$ Million) Forecast (2023 to 2033) By Enterprise Size

Table 17: North America Market Value (US$ Million) Analysis (2018 to 2022) By Industry

Table 18: North America Market Value (US$ Million) Forecast (2023 to 2033) By Industry

Table 19: North America Market Value (US$ Million) Analysis (2018 to 2022) by Country

Table 20: North America Market Value (US$ Million) Forecast (2023 to 2033) by Country

Table 21: Latin America Market Value (US$ Million) Analysis (2018 to 2022) By Type

Table 22: Latin America Market Value (US$ Million) Forecast (2023 to 2033) By Type

Table 23: Latin America Market Value (US$ Million) Analysis (2018 to 2022) By Solution

Table 24: Latin America Market Value (US$ Million) Forecast (2023 to 2033) By Solution

Table 25: Latin America Market Value (US$ Million) Analysis (2018 to 2022) By Enterprise Size

Table 26: Latin America Market Value (US$ Million) Forecast (2023 to 2033) By Enterprise Size

Table 27: Latin America Market Value (US$ Million) Analysis (2018 to 2022) By Industry

Table 28: Latin America Market Value (US$ Million) Forecast (2023 to 2033) By Industry

Table 29: Latin America Market Value (US$ Million) Analysis (2018 to 2022) by Country

Table 30: Latin America Market Value (US$ Million) Forecast (2023 to 2033) by Country

Table 31: Europe Market Value (US$ Million) Analysis (2018 to 2022) By Type

Table 32: Europe Market Value (US$ Million) Forecast (2023 to 2033) By Type

Table 33: Europe Market Value (US$ Million) Analysis (2018 to 2022) By Solution

Table 34: Europe Market Value (US$ Million) Forecast (2023 to 2033) By Solution

Table 35: Europe Market Value (US$ Million) Analysis (2018 to 2022) By Enterprise Size

Table 36: Europe Market Value (US$ Million) Forecast (2023 to 2033) By Enterprise Size

Table 37: Europe Market Value (US$ Million) Analysis (2018 to 2022) By Industry

Table 38: Europe Market Value (US$ Million) Forecast (2023 to 2033) By Industry

Table 39: Europe Market Value (US$ Million) Analysis (2018 to 2022) by Country

Table 40: Europe Market Value (US$ Million) Forecast (2023 to 2033) by Country

Table 41: South Asia & Pacific Market Value (US$ Million) Analysis (2018 to 2022) By Type

Table 42: South Asia & Pacific Market Value (US$ Million) Forecast (2023 to 2033) By Type

Table 43: South Asia & Pacific Market Value (US$ Million) Analysis (2018 to 2022) By Solution

Table 44: South Asia & Pacific Market Value (US$ Million) Forecast (2023 to 2033) By Solution

Table 45: South Asia & Pacific Market Value (US$ Million) Analysis (2018 to 2022) By Enterprise Size

Table 46: South Asia & Pacific Market Value (US$ Million) Forecast (2023 to 2033) By Enterprise Size

Table 47: South Asia & Pacific Market Value (US$ Million) Analysis (2018 to 2022) By Industry

Table 48: South Asia & Pacific Market Value (US$ Million) Forecast (2023 to 2033) By Industry

Table 49: South Asia & Pacific Market Value (US$ Million) Analysis (2018 to 2022) by Country

Table 50: South Asia & Pacific Market Value (US$ Million) Forecast (2023 to 2033) by Country

Table 51: East Asia Market Value (US$ Million) Analysis (2018 to 2022) By Type

Table 52: East Asia Market Value (US$ Million) Forecast (2023 to 2033) By Type

Table 53: East Asia Market Value (US$ Million) Analysis (2018 to 2022) By Solution

Table 54: East Asia Market Value (US$ Million) Forecast (2023 to 2033) By Solution

Table 55: East Asia Market Value (US$ Million) Analysis (2018 to 2022) By Enterprise Size

Table 56: East Asia Market Value (US$ Million) Forecast (2023 to 2033) By Enterprise Size

Table 57: East Asia Market Value (US$ Million) Analysis (2018 to 2022) By Industry

Table 58: East Asia Market Value (US$ Million) Forecast (2023 to 2033) By Industry

Table 59: East Asia Market Value (US$ Million) Analysis (2018 to 2022) by Country

Table 60: East Asia Market Value (US$ Million) Forecast (2023 to 2033) by Country

Table 61: Middle East and Africa Market Value (US$ Million) Analysis (2018 to 2022) By Type

Table 62: Middle East and Africa Market Value (US$ Million) Forecast (2023 to 2033) By Type

Table 63: Middle East and Africa Market Value (US$ Million) Analysis (2018 to 2022) By Solution

Table 64: Middle East and Africa Market Value (US$ Million) Forecast (2023 to 2033) By Solution

Table 65: Middle East and Africa Market Value (US$ Million) Analysis (2018 to 2022) By Enterprise Size

Table 66: Middle East and Africa Market Value (US$ Million) Forecast (2023 to 2033) By Enterprise Size

Table 67: Middle East and Africa Market Value (US$ Million) Analysis (2018 to 2022) By Industry

Table 68: Middle East and Africa Market Value (US$ Million) Forecast (2023 to 2033) By Industry

Table 69: Middle East and Africa Market Value (US$ Million) Analysis (2018 to 2022) by Country

Table 70: Middle East and Africa Market Value (US$ Million) Forecast (2023 to 2033) by Country

Figure 1: Global Market Size (US$ Million) and Y-o-Y Growth Rate from 2023 to 2033

Figure 2: Global Market Size and Y-o-Y Growth Rate from 2023 to 2033

Figure 3: Global Market Value (US$ Million), 2018 to 2022

Figure 4: Global Market Value (US$ Million), 2023 to 2033

Figure 5: Global Market Value Share Analysis (2023 to 2033) By Type

Figure 6: Global Market Value Y-o-Y Growth Trend Analysis (2018 to 2033) By Type

Figure 7: Global Market Attractiveness By Type

Figure 8: Global Market Value Share Analysis (2023 to 2033) By Solution

Figure 9: Global Market Value Y-o-Y Growth Trend Analysis (2018 to 2033) By Solution

Figure 10: Global Market Attractiveness By Solution

Figure 11: Global Market Value Share Analysis (2023 to 2033) By Enterprise Size

Figure 12: Global Market Value Y-o-Y Growth Trend Analysis (2018 to 2033) By Enterprise Size

Figure 13: Global Market Attractiveness By Enterprise Size

Figure 14: Global Market Value Share Analysis (2023 to 2033) By Industry

Figure 15: Global Market Value Y-o-Y Growth Trend Analysis (2018 to 2033) By Industry

Figure 16: Global Market Attractiveness By Industry

Figure 17: Global Market Value Share Analysis (2023 to 2033) By Region

Figure 18: Global Market Value Y-o-Y Growth Trend Analysis (2018 to 2033) By Region

Figure 19: Global Market Attractiveness By Region

Figure 20: North America Market Absolute $ Opportunity (US$ Million), 2018 to 2033

Figure 21: Latin America Market Absolute $ Opportunity (US$ Million), 2018 to 2033

Figure 22: Europe Market Absolute $ Opportunity (US$ Million), 2018 to 2033

Figure 23: East Asia Market Absolute $ Opportunity (US$ Million), 2018- 2033

Figure 24: South Asia & Pacific Market Absolute $ Opportunity (US$ Million), 2018 to 2033

Figure 25: Middle East & Africa Market Absolute $ Opportunity (US$ Million), 2018 to 2033

Figure 26: North America Market Value (US$ Million), 2018 to 2022

Figure 27: North America Market Value (US$ Million), 2023 to 2033

Figure 28: North America Market Value Share Analysis (2023 to 2033) By Type

Figure 29: North America Market Value Y-o-Y Growth Trend Analysis (2018 to 2033) By Type

Figure 30: North America Market Attractiveness By Type

Figure 31: North America Market Value Share Analysis (2023 to 2033) By Solution

Figure 32: North America Market Value Y-o-Y Growth Trend Analysis (2018 to 2033) By Solution

Figure 33: North America Market Attractiveness By Solution

Figure 34: North America Market Value Share Analysis (2023 to 2033) By Enterprise Size

Figure 35: North America Market Value Y-o-Y Growth Trend Analysis (2018 to 2033) By Enterprise Size

Figure 36: North America Market Attractiveness By Enterprise Size

Figure 37: North America Market Value Share Analysis (2023 to 2033) By Industry

Figure 38: North America Market Value Y-o-Y Growth Trend Analysis (2018 to 2033) By Industry

Figure 39: North America Market Attractiveness By Industry

Figure 40: North America Market Value Share Analysis (2023 to 2033) by Country

Figure 41: North America Market Value Y-o-Y Growth Trend Analysis (2018 to 2033) by Country

Figure 42: North America Market Attractiveness by Country

Figure 43: United States Market Absolute $ Opportunity (US$ Million), 2018 to 2033

Figure 44: Canada Market Absolute $ Opportunity (US$ Million), 2018 to 2033

Figure 45: Latin America Market Value (US$ Million), 2018 to 2022

Figure 46: Latin America Market Value (US$ Million), 2023 to 2033

Figure 47: Latin America Market Value Share Analysis (2023 to 2033) By Type

Figure 48: Latin America Market Value Y-o-Y Growth Trend Analysis (2018 to 2033) By Type

Figure 49: Latin America Market Attractiveness By Type

Figure 50: Latin America Market Value Share Analysis (2023 to 2033) By Solution

Figure 51: Latin America Market Value Y-o-Y Growth Trend Analysis (2018 to 2033) By Solution

Figure 52: Latin America Market Attractiveness By Solution

Figure 53: Latin America Market Value Share Analysis (2023 to 2033) By Enterprise Size

Figure 54: Latin America Market Value Y-o-Y Growth Trend Analysis (2018 to 2033) By Enterprise Size

Figure 55: Latin America Market Attractiveness By Enterprise Size

Figure 56: Latin America Market Value Share Analysis (2023 to 2033) By Industry

Figure 57: Latin America Market Value Y-o-Y Growth Trend Analysis (2018 to 2033) By Industry

Figure 58: Latin America Market Attractiveness By Industry

Figure 59: Latin America Market Value Share Analysis (2023 to 2033) by Country

Figure 60: Latin America Market Value Y-o-Y Growth Trend Analysis (2018 to 2033) by Country

Figure 61: Latin America Market Attractiveness by Country

Figure 62: Brazil Market Absolute $ Opportunity (US$ Million), 2018 to 2033

Figure 63: Mexico Market Absolute $ Opportunity (US$ Million), 2018 to 2033

Figure 64: Rest of Latin America Market Absolute $ Opportunity (US$ Million), 2018 to 2033

Figure 65: Europe Market Value (US$ Million), 2018 to 2022

Figure 66: Europe Market Value (US$ Million), 2023 to 2033

Figure 67: Europe Market Value Share Analysis (2023 to 2033) By Type

Figure 68: Europe Market Value Y-o-Y Growth Trend Analysis (2018 to 2033) By Type

Figure 69: Europe Market Attractiveness By Type

Figure 70: Europe Market Value Share Analysis (2023 to 2033) By Solution

Figure 71: Europe Market Value Y-o-Y Growth Trend Analysis (2018 to 2033) By Solution

Figure 72: Europe Market Attractiveness By Solution

Figure 73: Europe Market Value Share Analysis (2023 to 2033) By Enterprise Size

Figure 74: Europe Market Value Y-o-Y Growth Trend Analysis (2018 to 2033) By Enterprise Size

Figure 75: Europe Market Attractiveness By Enterprise Size

Figure 76: Europe Market Value Share Analysis (2023 to 2033) By Industry

Figure 77: Europe Market Value Y-o-Y Growth Trend Analysis (2018 to 2033) By Industry

Figure 78: Europe Market Attractiveness By Industry

Figure 79: Europe Market Value Share Analysis (2023 to 2033) by Country

Figure 80: Europe Market Value Y-o-Y Growth Trend Analysis (2018 to 2033) by Country

Figure 81: Europe Market Attractiveness by Country

Figure 82: Germany Market Absolute $ Opportunity (US$ Million), 2018 to 2033

Figure 83: Italy Market Absolute $ Opportunity (US$ Million), 2018 to 2033

Figure 84: France Market Absolute $ Opportunity (US$ Million), 2018 to 2033

Figure 85: United Kingdom Market Absolute $ Opportunity (US$ Million), 2018 to 2033

Figure 86: Spain Market Absolute $ Opportunity (US$ Million), 2018 to 2033

Figure 87: BENELUX Market Absolute $ Opportunity (US$ Million), 2018 to 2033

Figure 88: Russia Market Absolute $ Opportunity (US$ Million), 2018 to 2033

Figure 89: Rest of Europe Market Absolute $ Opportunity (US$ Million), 2018 to 2033

Figure 90: South Asia & Pacific Market Value (US$ Million), 2018 to 2022

Figure 91: South Asia & Pacific Market Value (US$ Million), 2023 to 2033

Figure 92: South Asia & Pacific Market Value Share Analysis (2023 to 2033) By Type

Figure 93: South Asia & Pacific Market Value Y-o-Y Growth Trend Analysis (2018 to 2033) By Type

Figure 94: South Asia & Pacific Market Attractiveness By Type

Figure 95: South Asia & Pacific Market Value Share Analysis (2023 to 2033) By Solution

Figure 96: South Asia & Pacific Market Value Y-o-Y Growth Trend Analysis (2018 to 2033) By Solution

Figure 97: South Asia & Pacific Market Attractiveness By Solution

Figure 98: South Asia & Pacific Market Value Share Analysis (2023 to 2033) By Enterprise Size

Figure 99: South Asia & Pacific Market Value Y-o-Y Growth Trend Analysis (2018 to 2033) By Enterprise Size

Figure 100: South Asia & Pacific Market Attractiveness By Enterprise Size

Figure 101: South Asia & Pacific Market Value Share Analysis (2023 to 2033) By Industry

Figure 102: South Asia & Pacific Market Value Y-o-Y Growth Trend Analysis (2018 to 2033) By Industry

Figure 103: South Asia & Pacific Market Attractiveness By Industry

Figure 104: South Asia & Pacific Market Value Share Analysis (2023 to 2033) by Country

Figure 105: South Asia & Pacific Market Value Y-o-Y Growth Trend Analysis (2018 to 2033) by Country

Figure 106: South Asia & Pacific Market Attractiveness by Country

Figure 107: India Market Absolute $ Opportunity (US$ Million), 2018 to 2033

Figure 108: Indonesia Market Absolute $ Opportunity (US$ Million), 2018 to 2033

Figure 109: Malaysia Market Absolute $ Opportunity (US$ Million), 2018 to 2033

Figure 110: Singapore Market Absolute $ Opportunity (US$ Million), 2018 to 2033

Figure 111: Australia& New Zealand Market Absolute $ Opportunity (US$ Million), 2018 to 2033

Figure 112: Rest of South Asia & Pacific Market Absolute $ Opportunity (US$ Million), 2018 to 2033

Figure 113: East Asia Market Value (US$ Million), 2018 to 2022

Figure 114: East Asia Market Value (US$ Million), 2023 to 2033

Figure 115: East Asia Market Value Share Analysis (2023 to 2033) By Type

Figure 116: East Asia Market Value Y-o-Y Growth Trend Analysis (2018 to 2033) By Type

Figure 117: East Asia Market Attractiveness By Type

Figure 118: East Asia Market Value Share Analysis (2023 to 2033) By Solution

Figure 119: East Asia Market Value Y-o-Y Growth Trend Analysis (2018 to 2033) By Solution

Figure 120: East Asia Market Attractiveness By Solution

Figure 121: East Asia Market Value Share Analysis (2023 to 2033) By Enterprise Size

Figure 122: East Asia Market Value Y-o-Y Growth Trend Analysis (2018 to 2033) By Enterprise Size

Figure 123: East Asia Market Attractiveness By Enterprise Size

Figure 124: East Asia Market Value Share Analysis (2023 to 2033) By Industry

Figure 125: East Asia Market Value Y-o-Y Growth Trend Analysis (2018 to 2033) By Industry

Figure 126: East Asia Market Attractiveness By Industry

Figure 127: East Asia Market Value Share Analysis (2023 to 2033) by Country

Figure 128: East Asia Market Value Y-o-Y Growth Trend Analysis (2018 to 2033) by Country

Figure 129: East Asia Market Attractiveness by Country

Figure 130: China Market Absolute $ Opportunity (US$ Million), 2018 to 2033

Figure 131: Japan Market Absolute $ Opportunity (US$ Million), 2018 to 2033

Figure 132: South Korea Market Absolute $ Opportunity (US$ Million), 2018 to 2033

Figure 133: Middle East and Africa Market Value (US$ Million), 2018 to 2022

Figure 134: Middle East and Africa Market Value (US$ Million), 2023 to 2033

Figure 135: Middle East and Africa Market Value Share Analysis (2023 to 2033) By Type

Figure 136: Middle East and Africa Market Value Y-o-Y Growth Trend Analysis (2018 to 2033) By Type

Figure 137: Middle East and Africa Market Attractiveness By Type

Figure 138: Middle East and Africa Market Value Share Analysis (2023 to 2033) By Solution

Figure 139: Middle East and Africa Market Value Y-o-Y Growth Trend Analysis (2018 to 2033) By Solution

Figure 140: Middle East and Africa Market Attractiveness By Solution

Figure 141: Middle East and Africa Market Value Share Analysis (2023 to 2033) By Enterprise Size

Figure 142: Middle East and Africa Market Value Y-o-Y Growth Trend Analysis (2018 to 2033) By Enterprise Size

Figure 143: Middle East and Africa Market Attractiveness By Enterprise Size

Figure 144: Middle East and Africa Market Value Share Analysis (2023 to 2033) By Industry

Figure 145: Middle East and Africa Market Value Y-o-Y Growth Trend Analysis (2018 to 2033) By Industry

Figure 146: Middle East and Africa Market Attractiveness By Industry

Figure 147: Middle East and Africa Market Value Share Analysis (2023 to 2033) by Country

Figure 148: Middle East and Africa Market Value Y-o-Y Growth Trend Analysis (2018 to 2033) by Country

Figure 149: Middle East and Africa Market Attractiveness by Country

Figure 150: GCC Countries Market Absolute $ Opportunity (US$ Million), 2018 to 2033

Figure 151: Turkiye Market Absolute $ Opportunity (US$ Million), 2018 to 2033

Figure 152: South Africa Market Absolute $ Opportunity (US$ Million), 2018 to 2033

Figure 153: Rest of Middle East and Africa Market Absolute $ Opportunity (US$ Million), 2018 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

IP PBX Market Analysis - Size, Share, and Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA