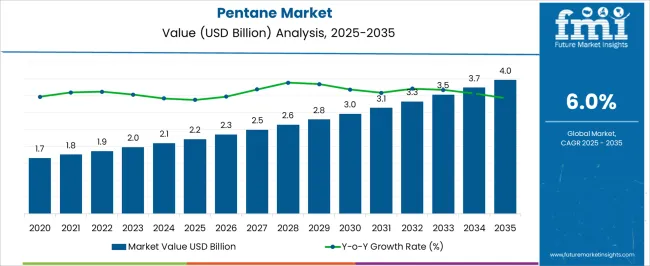

The Pentane Market is estimated to be valued at USD 2.2 billion in 2025 and is projected to reach USD 4.0 billion by 2035, registering a compound annual growth rate (CAGR) of 6.0% over the forecast period.

| Metric | Value |

|---|---|

| Pentane Market Estimated Value in (2025 E) | USD 2.2 billion |

| Pentane Market Forecast Value in (2035 F) | USD 4.0 billion |

| Forecast CAGR (2025 to 2035) | 6.0% |

The Pentane market is witnessing steady expansion driven by its widespread use in industrial and commercial applications. In 2025, the market is strongly influenced by the demand for efficient chemical intermediates and environmentally friendly solvents. Pentane’s low boiling point, volatility, and non-polar characteristics have made it a preferred choice in manufacturing processes and as a component in various chemical formulations.

The market growth is further shaped by increased adoption in the production of insulation materials, refrigerants, and foaming agents, reflecting the growing emphasis on energy-efficient solutions and sustainable industrial practices. Regulatory support for low-global warming potential alternatives is contributing to the preference for pentane in several applications.

Ongoing advancements in production techniques and process optimization have enhanced the availability and cost-effectiveness of pentane, reinforcing its adoption across industries Future growth opportunities are expected in emerging economies, where industrialization, construction, and refrigeration demand continue to rise, creating long-term prospects for the pentane market.

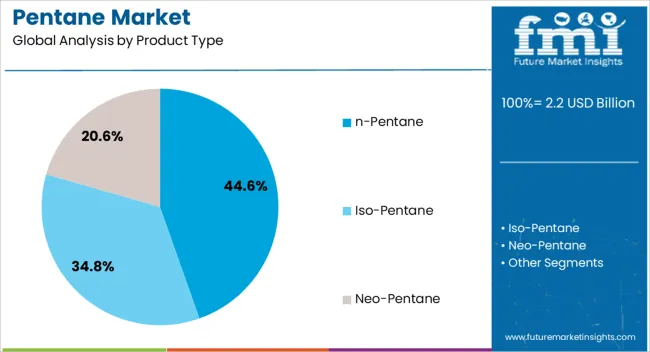

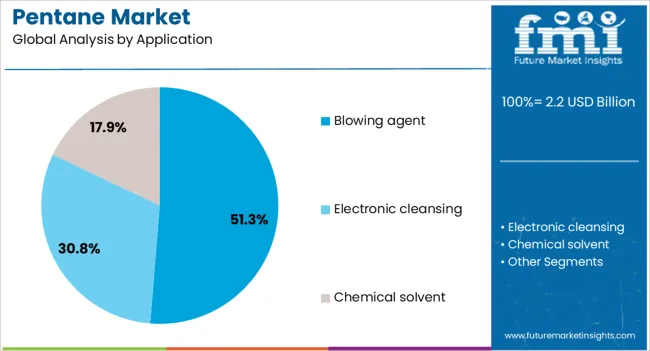

The pentane market is segmented by product type, application, and geographic regions. By product type, pentane market is divided into n-Pentane, Iso-Pentane, and Neo-Pentane. In terms of application, pentane market is classified into Blowing agent, Electronic cleansing, and Chemical solvent. Regionally, the pentane industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The n-Pentane product type is projected to hold 44.60% of the Pentane market revenue share in 2025, positioning it as the leading product type. This prominence is being driven by its chemical stability, high purity, and versatile performance in various industrial processes. n-Pentane is widely utilized in chemical synthesis, as a solvent, and in polymer production, where precise chemical properties are essential.

Its low environmental impact relative to other hydrocarbons has further supported its adoption in applications where regulatory compliance is critical. The demand for n-Pentane has been enhanced by its compatibility with emerging green manufacturing processes and its effectiveness in energy-efficient solutions such as insulation materials.

The ease of handling, consistent performance under varying operational conditions, and scalability of supply have all contributed to its leading position As industries continue to adopt environmentally conscious and high-performance materials, n-Pentane is expected to sustain its market leadership through consistent demand in both established and emerging applications.

The blowing agent application segment is estimated to capture 51.30% of the Pentane market revenue in 2025, establishing it as the dominant application area. This growth is being driven by the increasing demand for energy-efficient insulation materials, especially in the construction and refrigeration sectors. Pentane-based blowing agents are preferred due to their low thermal conductivity, chemical inertness, and compatibility with polymeric matrices such as polyurethane foams.

The use of pentane as a blowing agent has been promoted by regulatory frameworks favoring low-global warming potential solutions, replacing traditional hydrofluorocarbons in foaming processes. Manufacturing processes benefit from pentane’s consistent performance, which enables uniform foam expansion and high structural stability, meeting industry requirements for insulation efficiency and durability.

Rising construction activities and the expansion of cold chain and refrigeration infrastructure have reinforced the demand for pentane in this segment As industries continue to focus on sustainable and energy-efficient materials, the blowing agent application is anticipated to maintain its leading position within the Pentane market.

Bromocyclopentane falls under the category of haloalkanes. Haloalkanes are generally derived from alkanes having one or more halogen compound in their structure. Bromocyclopentane also termed as organobromine and is colorless, odorless liquid. On commercial scale bromocyclopentane is formulated through numerous methods such as free radical halogenation reaction between alkanes & bromine, from alkene & alkynes, nucleophilic substitution of alcohol, and from carboxylic acids.

Out of the above said production process the synthesis of bromocyclopentane on the large is scale is done by free radical reaction of alkanes with bromine. Bromocyclopentane is commercially available with a name of cyclopentyl bromide with different purities level. These purities of the bromocyclopentane is tailor-made according to the need of specific applications. High purity bromocyclopentane means the consumption of the specific product in food & pharmaceutical applications which also include personal care products.

Whereas, low or medium purity products are generally used for industrial applications. Prime reason for selecting bromocyclopentane in numerous application is its higher boiling and melting point when compared to their subsequent alkane class. Properties like increased strength in the bromocyclopentane is imparted by the strong intermolecular forces, the magnitude of the forces is the resultant of high dipole-dipole interaction. Also due to the availability of less number of carbon hydrogen bond the bromocyclopentane shows less flammability than its corresponding alkane.

The market for bromocyclopentane will remain progressive as the market showed notable growth in last few years in terms of revenue generation and the same roadmap is expected to be witnessed in near future. The growth of bromocyclopentane can be attributed with its increased penetration in various application. Also with new product development in the near future the bromocylopentane based products is expected to gain its consumption in niche application and further enhances its application landscape.

Demand of value added coating based on bromocyclopentane and having low VOC content is gaining traction.Also swelling end-use industries such as aerospace, pharmaceutical to name a few creates the demand space for bromocyclopentane products. Several Government initiatives and funding enables the pharmaceutical industry to flourish in the near future in emerging regions. For instance, In India according to Pharma Vision 2025 the government is planning to develop and turning over a country as a global pharmaceutical hub by 2025.

However certain factors & properties of the bromocyclopentane may impendent its growth in the near future. Some of the industrial grade of bromocyclopentane contains toxins, serious pollutants and harmful VOC compound. With the government regulation in developed countries like Europe and USA, consumption of bromocyclopentane is somehow restricted for the formulation of the solvents and refrigerants

China is one of the prominent growing and emerging region across the globe in terms of consumption and production of bromocyclopentane, there are notable number of bromocyclopentane manufacturers who have their manufacturing plants in China. Also the presence of high production base of bromocyclopentane in India and South East Asian countries enables its adequate supply. Japan is showing steady growth as there is limited availability of manufacturers.

With new regulations imposed by the government regarding the low VOC emission, the demand for bromocyclopentane in North America and Western Europe region is somehow stagnant, however implementation of new practices for the formulation of low VOC solvent will offset the challenge in the latter half of the forecasted period.

Eastern Europe, and Latin America are the attractive regions for key manufacturers due to favorable government policies. Middle East and Africa is also entertaining the sizable market share in terms of consumption.

The report is a compilation of first-hand information, qualitative and quantitative assessment by industry analysts, inputs from industry experts and industry participants across the value chain. The report provides in-depth analysis of parent market trends, macro-economic indicators and governing factors along with market attractiveness as per segments. The report also maps the qualitative impact of various market factors on market segments and geographies.

Pentane is a hydrocarbon organic compound that has a gasoline-like odor and is usually burnt as a fuel. Pentane finds numerous industrial applications; for instance, it is used as an ingredient in the production of petroleum. Its primary application is in creating blowing agents, which are in turn used in manufacturing polyesters (foams). Pentane has three isomeric forms, i.e. iso-pentane, n-pentane and neo-pentane, which are generally used in blowing agents, electronic cleansing or as chemical solvents.

The growth of the global pentane market can be attributed to the rapid adoption of automobiles across the globe, which in turn is estimated to step-up the adoption of gasoline. Pentane acts as a blending agent in gasoline, which is augmenting the growth of the gasoline market. Further, for polystyrene and polyurethane, pentane behaves as a blowing agent. Increasing disposable income and the inclination towards higher living standards have changed the lifestyle and buying power of the public, resulting in a jump in the sales of electronic appliances, which require polystyrene and polyurethane foam insulation for cooling purpose.

This in turn is increasing the consumption of pentane in the global market. In addition, pentane and its byproducts are used as refrigerants in electronic appliances (fridge and air conditioners), which is another factor contributing towards the growth of the global pentane market. Therefore, the growth of the electronics industry has a significant impact on the consumption of pentane and is expected to create sizable growth opportunities in the global pentane market over the forecast period.

On the flip side, pentane, being highly volatile and hazardous, evaporates in the environment rapidly at room temperature and burns above 360 Celsius. Also, when mixed with water or vapor, it can be exceedingly flammable. Further, the exposure of pentane to living beings or the environment, particularly aquatic animals, could be harmful as it consists of a high level of volatile organic compounds (VOCs). The presence of VOCs can also damage crops. Furthermore, though pentane has not been classified as carcinogenic, its exposure has an adverse effect. As a result, several regulatory bodies have established and imposed stringent regulations.

For instance, in Europe, pentane pollution is controlled through PPC (pollution, prevention, and control) regulations and UK National Air Quality Strategy. The European Solvents Directive (99/13/EC) also controls the consumption and release of pentane in the environment. Moreover, due to these challenging factors, pentane is gradually being replaced by propylene glycol methyl ether or propylene glycol methyl ether acetate. Also, the handling of pentane requires skilled labor, which could affect the growth of the pentane market to some extent over the forecast period.

Among all regions, North America is anticipated to hold a significant share in the pentane market, owing to the widespread presence of the electronics industry and huge demand for blowing agents in polyester applications. In Asia Pacific, counties such as Japan, South Korea, China, India, and Japan, the demand for pentane is expected to be surplus as a result of the significant presence of electronic manufacturing facilities. Further, the demand for pentane in Europe is likely to subside due to the stringent regulatory scenario; hence, the consumption of pentane could be replaced by propylene glycol methyl ether or propylene glycol methyl ether acetate.

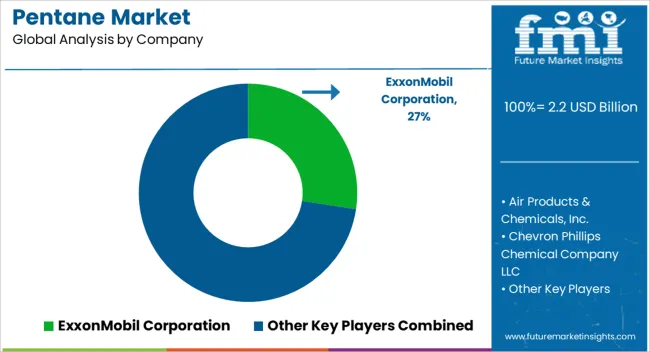

The global pentane market is anticipated to be highly fragmented, owing to the presence of numerous local manufacturers. Examples of some of the market participants in the global pentane market identified across the value chain include:

The pentane research report presents a comprehensive assessment of the pentane market and contains thoughtful insights, facts, historical data, and statistically supported and industry-validated market data. It also contains projections using a suitable set of assumptions and methodologies. The pentane research report provides analysis and information according to market segments such as geographies, application, and industry.

The global pentane report is a compilation of first-hand information, qualitative and quantitative assessment by industry analysts, inputs from industry experts and industry participants across the value chain. The pentane report provides in-depth analysis of parent market trends, macro-economic indicators and governing factors along with pentane market attractiveness as per segments. The pentane report also maps the qualitative impact of various market factors on market segments and geographies.

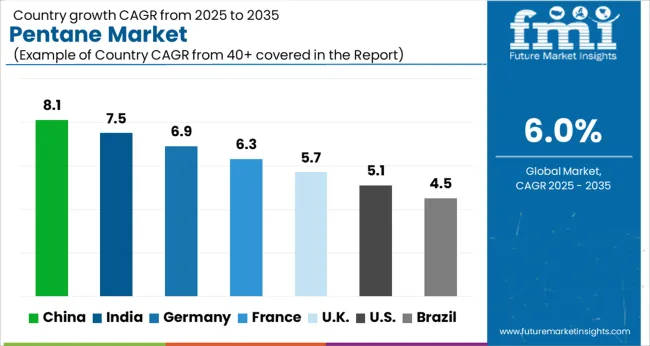

| Country | CAGR |

|---|---|

| China | 8.1% |

| India | 7.5% |

| Germany | 6.9% |

| France | 6.3% |

| UK | 5.7% |

| USA | 5.1% |

| Brazil | 4.5% |

The Pentane Market is expected to register a CAGR of 6.0% during the forecast period, exhibiting varied country level momentum. China leads with the highest CAGR of 8.1%, followed by India at 7.5%. Developed markets such as Germany, France, and the UK continue to expand steadily, while the USA is likely to grow at consistent rates. Brazil posts the lowest CAGR at 4.5%, yet still underscores a broadly positive trajectory for the global Pentane Market. In 2024, Germany held a dominant revenue in the Western Europe market and is expected to grow with a CAGR of 6.9%. The USA Pentane Market is estimated to be valued at USD 754.1 million in 2025 and is anticipated to reach a valuation of USD 1.2 billion by 2035. Sales are projected to rise at a CAGR of 5.1% over the forecast period between 2025 and 2035. While Japan and South Korea markets are estimated to be valued at USD 103.4 million and USD 66.8 million respectively in 2025.

| Item | Value |

|---|---|

| Quantitative Units | USD 2.2 Billion |

| Product Type | n-Pentane, Iso-Pentane, and Neo-Pentane |

| Application | Blowing agent, Electronic cleansing, and Chemical solvent |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | ExxonMobil Corporation, Air Products & Chemicals, Inc., Chevron Phillips Chemical Company LLC, Covestro AG, Datta Hydro-Chem Private Limited, Evonik Industries AG, GJ Chemical, Haltermann Carless Group GmbH, INEOS GROUP HOLDINGS S.A., Junyuan Petroleum Group, Mubychem Group, PENTA s.r.o., Shell PLC, Thermo Fisher Scientific Inc., Univar Solutions LLC, L’AIR LIQUIDE S.A., Merck KGaA, and Junsei Chemical Co., Ltd. |

The global pentane market is estimated to be valued at USD 2.2 billion in 2025.

The market size for the pentane market is projected to reach USD 4.0 billion by 2035.

The pentane market is expected to grow at a 6.0% CAGR between 2025 and 2035.

The key product types in pentane market are n-pentane, iso-pentane and neo-pentane.

In terms of application, blowing agent segment to command 51.3% share in the pentane market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Bromocyclopentane Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA