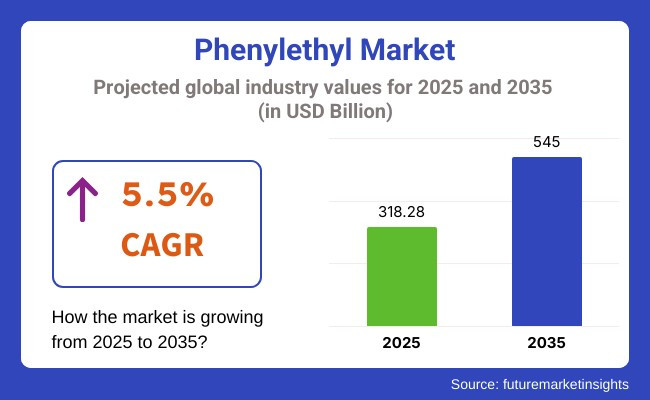

The phenylethyl market valuation is anticipated to grow significantly, with a size of USD 318.28 billion in 2025, likely to reach around USD 545 billion by 2035, growing at a CAGR of 5.5%. Growth is being fueled by increasing demand in the fragrance, pharmaceutical, and fine chemicals industries.

The personal care and fragrance market accounts for a substantial proportion of consumption. Phenylethyl alcohol, for instance, is a key ingredient in high-end fragrances, soaps, lotions, and deodorants. With increasing global expenditure on cosmetics and personal well-being products, the demand for stable, skin-compatible aroma chemicals also increases.

In the field of pharmacy, phenylethylamine and its derivatives serve as active ingredients in decongestants, mood stabilizers, and central nervous system stimulants. Their capacity to regulate neurotransmitter levels makes them valuable in treating neurological and psychological disorders, ranging from depression to attention disorders.

One of the key drivers of growth is the evolution of fine chemical and intermediate manufacture. These compounds find application in dyes, agrochemicals, and polymer manufacturing. They can be adapted to modification based on their chemical composition to fit into specialized formulations for diverse industrial applications.

Biotechnological and green chemistry process innovation is propelling production trends. Enzymatic synthesis and fermentation-based production of these compounds are emerging as cost-effective, sustainable alternatives to traditional petrochemical processes-aligned with global sustainability efforts.

Regulatory focus, especially on safety and allergen labeling for cosmetics and food-grade applications, can interfere with formulation flexibility. Raw material price volatility and the complexity of high-purity synthesis also affect pricing and supply chain uniformity.

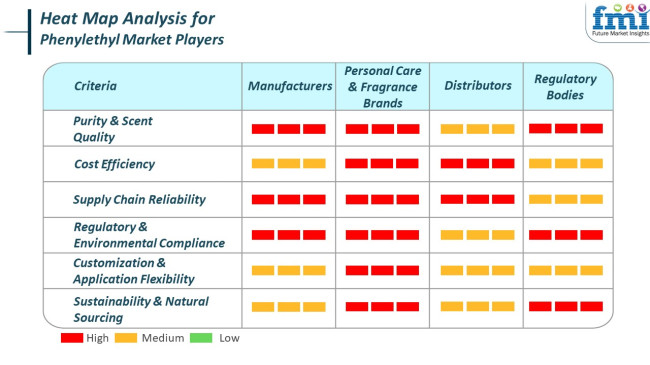

Phenylethyl compounds experience a high demand in perfumery, personal care, food, and pharmaceutical use. The compound has a sweet floral smell (rose-like odor) and does not react with other chemicals. Manufacturers target high purities and characteristic odor profiles, often finding a compromise between synthetic routes and higher-priced but environmentally friendlier natural extraction routes. Production problems follow their performance, conformance, and cost management in their wake.

Distributors cater to a broad cross-section of FMCG and drug industry customers with an emphasis on supply reliability and product range. Their function plays a pivotal role in helping SMEs and local brands access specialty grades in volume. Regulatory agencies play a key role in shaping buying behavior through imposing environmental labeling, EU REACH compliance, and FDA or IFRA standards regarding allergen content. Their regulation is driving the industry towards cleaner, safer, and more traceable alternatives.

Between 2020 and 2024, the industry experienced consistent growth in demand, especially in the fragrance, cosmetics, and food sectors. The sweet, floral-scented chemical remained one of the most sought-after perfume ingredients, personal care ingredients, and flavorings. The increasing demand for natural ingredients in cosmetics and perfumes was a significant trend, propelling the demand for phenylethyl alcohol as a natural, safer alternative to man-made chemicals.

In addition, the increased consumer interest in clean-label and organic products accelerated the compound's usage in the food and beverage industry. Despite the fact that the industry is popular, supply chain failure and problems in sourcing raw materials during the COVID-19 crisis hampered the rate of production.

Long-term in the future up to 2025 to 2035, sales will grow with increased sustainability and innovation focus. Growing demand for natural and plant-based ingredients and increased regulation over synthetic chemicals will see even more companies incorporating phenylethyl alcohol into their formulations.

With consumers becoming ever more sustainability-aware, more emphasis will be given to sustainable sourcing, especially where it is applied in green-certified food and cosmetics products. The convergence of new extraction technologies will further increase the availability and cost-effectiveness of the compounds.

A Comparative Market Shift Analysis (2020 to 2024 vs. 2025 to 2035)

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Increased demand for perfumes, cosmetics, and natural flavorings owing to consumer trends. | Emphasis on sustainability, for example, conversion to plant-based and environmentally friendly sourcing of phenylethyl alcohol. |

| Tempered innovation, with a focus on natural sourcing and clean-label consumer preference. | New emerging extraction technologies and improved production and sourcing methods. |

| Regulatory pressure towards the use of natural, safer ingredients, especially in cosmetics. | Growing regulation of synthetic chemicals spurs demand for natural and green-certified alternatives. |

| Mainly used in cosmetics, perfumery, food and beverages, particularly as a natural ingredient. | Increasing application in sustainable beauty cosmetics, green perfumes, and organic foodstuffs. |

| Depending on foreign suppliers, with certain pandemic-related setbacks impacting the industry. | Increased localized sourcing practices and development of sustainable agriculture and green extraction. |

| Increased demand for natural and non-synthetic ingredients to meet eco-friendly consumer behavior. | Significant focus on environmentally friendly sourcing and green certification, which renders phenylethyl alcohol a sustainable option. |

A major existing risk is price volatility in raw materials, specifically for benzene and ethylene derivatives, which are vital inputs for the manufacture of 2-phenylethanol. Price volatility in these materials influences production costs and manufacturer profit margins.

The industry has to compete with cheaper alternatives like linalool and salicylic acid. There is also increasing strictness in environmental control, whereby chemical manufacturing processes and waste treatment attract greater attention, and that might lead to increasing compliance costs and operating loads.

In the coming years, the industry will be faced with issues concerning the evolution of technologies and changes in consumer demand. With the presence of new and more effective production modes, as well as substitute chemicals, incumbent 2-Phenylethanol products can be substituted, calling for ongoing research and development spending to maintain competitiveness.

Moreover, geopolitical tensions and trade policies could intervene in supply chains globally, impacting access to end-products and raw materials. The susceptibility of the industry's reliance on specific areas to manufacture is an added factor to this.

The 2-Phenylethanol market has several opportunities. However, the players will need to withstand threats because of fluctuations in the price of raw materials, world competition, concerns for the environment, technology changes, and political risks. Forensic action against these threats to avert risks will be necessary for attaining long-term profitability in this erratic industry.

| Countries | Projected CAGR (2025 to 2035) |

|---|---|

| USA | 4.4% |

| UK | 4.2% |

| France | 4.3% |

| Germany | 4.5% |

| Italy | 4.2% |

| South Korea | 4.6% |

| Japan | 4.4% |

| China | 4.8% |

| Australia | 4.3% |

| New Zealand | 4.2% |

The USA will grow at a CAGR of 4.4% between the forecast period of 2025 and 2035, driven primarily by increasing demand in the pharmaceutical and fragrance sectors. The aromatic nature of the compound and its solvent tolerance have made it a significant component in fine fragrances, topical products, and flavoring products. Growing consumer demand for natural and bio-identical aroma chemicals has driven adoption across personal care applications.

Major players such as Sigma-Aldrich, Penta Manufacturing, and Givaudan USA have retained major production capacity and technological advancements in phenyl ethyl derivatives. Consistency in regulations and research partnerships with leading universities are still favoring innovation, particularly in environmentally friendly synthesis routes.

The UK is forecast to grow at a CAGR of 4.2% between 2025 and 2035. Increasing demand for high-quality fragrances and the trend towards artisanal and eco-friendly cosmetic products are fueling the sales. 2-phenylethanol is used as a main component in the fragrance of rose-type fragrances and is widely utilized in niche perfumery and skincare.

Key players such as Treatt plc and CPL Aromas are spending on green chemistry processes to produce compounds that will comply with post-Brexit environmental and safety standards. Additionally, rising demand for pharmaceutical applications such as antiseptics and oral hygiene products is propelling stability in the industry.

France is forecasted to register a CAGR of 4.3% during the forecast period due to its historical leadership in the global fragrance industry. The country's perfume industry-sourced in Grasse-is one of the dominant users of phenylethyl derivatives for high-end and natural fragrance compositions. Demand for such derivatives is amplified by luxury companies prioritizing product differentiation based on fragrance innovation.

Large players like Robertet Group and Mane SA are focusing on sustainable sourcing and biotechnological manufacturing of phenyl ethyl alcohol to meet the increasing demand for traceable and eco-certified components. The pharmaceutical industry also guarantees steady consumption in the form of sedative and antiseptic preparations.

Germany is expected to grow at a CAGR of 4.5% in the years 2025 to 2035. Pharmaceutical and fragrance industries have always shown a strong demand for phenylethyl compounds. The antimicrobial property of the material guarantees its application in topical applications, cleaning agents, and medical products.

BASF SE and Symrise AG are some of the leading firms that deal with the manufacture of high-purity compounds using advanced catalytic and fermentation technology. Compliance with EU chemical safety regulations has made it possible to transition towards sustainable aroma chemistry, further enhancing Germany's role as a supplier in Europe.

Italy is anticipated to have a CAGR of 4.2% over the forecast period from 2025 to 2035. The industry is fueled by the growing use of aromatic chemicals in cosmetics and premium fragrance applications. Traditional perfumery groups in northern Italy continue to need steady supplies of phenylethyl alcohol due to its floral note and fixative properties.

Companies such as Vigon Italia and small-scale perfume producers are putting money into natural sources and bio-based alternatives due to increasing customer needs for clean-label ingredients. Pharmaceutical-grade applications, especially in antiseptic uses and lozenges, also constitute niche growth opportunities.

South Korea is projected to have a CAGR of 4.6% for the forecast period. The industry is led by innovation in the field of skincare and beauty products, where 2-phenylethanol is a fragrance component as well as a mild preservative. The global popularity of the K-beauty segment has been mainly responsible for generating domestic demand for this compound.

Brands such as Cosmax and LG Household & Health Care are increasing R&D activities to incorporate safer, dermatologically acceptable fragrance ingredients. Further, the expansion of pharmaceutical manufacturing, including antiseptics and injectable preparations, is leading to phenylethyl derivative industrial-scale use.

Japan is expected to expand at a CAGR of 4.4%. Cosmetic and pharmaceutical consumer standards are the major drivers for the steady demand for low-toxicity, well-characterized fragrance compounds. 2-phenylethanol is widely used in toners, serums, and therapeutic balms due to its fragrant smell and antiseptic activity.

Large players such as Takasago International Corporation and Kao Corporation are making a biotechnology-based synthesis of aromatic compounds investment areas, promoting cost-friendly and environment-friendly manufacturing. Constant expansion of industry is happening because of a regulatory focus on pure and safe products.

China, too, is poised to lead sales expansion, with the highest CAGR of 4.8%. Growth factors include increased consumption of 2-phenylethanol in mass-market perfumes, personal care, and pharma. Urban disposable incomes, which are increasingly rising, lead to an increasing preference for premium quality hygiene and grooming products.

Key players such as Zhejiang NHU Co. Ltd. and Sinopec are expanding their production capacities to meet domestic and export demand. National policy focus on green chemical development is also encouraging investment in bio-based aromatic alcohols, enhancing sales.

Australia will expand at a 2025 to 2035 CAGR of 4.3%. The rise in clean beauty and botanical cosmetics is driving moderate but sustained growth. The compound's favorable safety profile and fragrance, which are reminiscent of roses, make it an attractive ingredient to large and boutique producers.

Large distributors and importers are entering into supply agreements with European and Asian producers to secure consistent quality and regulatory compliance. The expanding pharmaceutical industry, especially in topical ranges and oral healthcare, offers other avenues of demand.

New Zealand is also expected to record a CAGR of 4.2%. Industry demand is primarily fueled by the natural fragrance and cosmetics industries, where consumers most appreciate sustainability and product purity. 2-phenylethanol is used in organic skincare products and wellness formulas, as well as specialty perfumes.

Manufacturers and distributors maintain close sourcing relationships with Australian and Asian chemical suppliers, which ensure consistent quality control. Government incentives for green chemistry and sustainable manufacturing are anticipated to support further future investment in bio-based ingredients, including phenylethyl derivatives.

By product type, the industry sub-segments comprise Phenyl Ethyl Alcohol, or PEA, which is expected to hold 25% of the revenue share in 2025, while Phenyl Ethyl Acetate will account for 18%.

Phenyl Ethyl Alcohol has a revenue share of 25%, primarily noted for its soft floral note reminiscent of rose and honey. With its pleasing scent and compatibility with a wide array of ingredients, it finds application in the perfume, personal care, and cosmetic product industries. Firmenich, one of the largest fragrance companies, uses PEA in luxury perfumes to support floral notes, creating significant scent character.

Also, PEA is then commercialized by Givaudan and Symrise to develop fragrances for deodorants, lotions, and soaps. In foods, it finds usage in candies, beverages, and baked goods, especially those that might aim for natural floral or fruity flavors. PEA finds application in air fresheners as well, with companies like Procter and Gamble using PEA in their air care products.

Phenyl Ethyl Acetate, with 18% of the overall share, is selected mainly for its strong, sweet, floral, and fruity scent. It finds widespread application in perfumes, cosmetics, and food flavoring. International Flavors & Fragrances (IFF) uses Phenyl Ethyl Acetate in high-end fragrances, which plays an important role in establishing lasting fruity and floral notes.

Takasago International Corporation also uses it in flavors for beverages and sweets, especially to create a consistent and familiar odor in fruit-flavored products. Kraton Polymers also employs it as an important component for specialty chemical formulations to produce sustainable and environmentally friendly scented products.

As the industries shift towards more natural and sustainable ingredients, PEA and PEA acetate are increasingly important as both are obtained from natural sources like flowers and plants. Companies such as Symrise and Kraton Polymers continue to innovate to meet the ever-rising consumer demands for environmentally friendly products. With increasing interest in clean labels and sustainability, these compounds are set to significantly impact their sustained growth in fragrance, flavor, and cosmetics.

The industry is led by pharmaceuticals, which will have a significant 55% share in 2025, while research institutes will hold 30%.

The pharmaceutical industry uses Phenyl Ethyl Alcohol (PEA) as a natural antibacterial and antimicrobial agent with anti-inflammatory properties. According to patent documents, phenylethyl compounds are used by companies such as Pfizer and Novartis in topical formulations in the form of creams, gels, and ointments for treating skin infections, acne, and inflammation.

Due to its ability to mask taste, the compound is useful in a wide range of over-the-counter medications and therapeutics, especially oral medications, where taste consideration is essential. For example, Sanofi uses phenylethyl derivatives to come up with new formulations for pain and dermatological treatments.

The increasing trend for the use of natural and sustainable ingredients in pharmaceuticals has further increased the incorporation of these compounds into skin care products, especially for applications such as acne and eczema, thus fuelling growth for this segment.

Research Institutes contribute 30% of the overall share, which is further relatively active in research with extensive laboratory studies in neurobiology, chemistry, and toxicology, upon which phenyl ethyl compounds enter into research. Such research institutions as Harvard University and MIT frequently explore the pharmacological applications of 2-phenylethanol in the development of drugs, especially concerning neuroprotective and mood-elevating properties.

Institutes also use these derivatives to study plant growth, environmental sciences, and biotechnology. The study of its effects on stress-relieving and cognitive function is gaining further momentum, with Johns Hopkins University concentrating on the therapeutic potential of the compounds in treating disorders of mental health. The growing interest in scientific exploration would mean that plant-based products should be found in phenomenology research in graduate schools and industrial laboratories.

The phenylethyl market is intensely competitive as the major players in this industry base their efforts on purity, supply chain efficiency and regulatory compliance. Businesses invest in research and development to improve product quality and broaden their applications.

Most applications of phenylethyl derivatives are primarily in fragrances, cosmetics, and pharmaceuticals. It comprises chemical manufacturers, pharmaceutical companies, and aroma chemical suppliers, offering competition on innovation and production efficiency.

KdacChem Pvt. Ltd. and NOVORATE BIOTECH CO. LTD. are competitive players that use advanced chemical processing techniques and extensive distribution networks to offer high-purity compounds across the world. Their firm hold in the perfumery and personal care product segment gives them a competitive advantage.

Becton, Dickinson and Company, and Penta Manufacturing Company both serve the medical and industrial segments, supplying phenylethyl in antiseptic grades to pharmaceutical manufacturers. Their rigorous quality control and compliance with international safety standards strengthen their positioning in the industry.

Ungerer & Company and Harmony Organics Pvt Ltd. distinguish themselves by natural and synthetic aroma chemicals for flavor and fragrance industry masters. Further, their long-standing connection with global perfume brands makes their competitive position even stronger. However, continuous innovation in eco-friendly synthesis and the customized product offered for delivery remains one of the key competitive factors in this evolving market.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Kdac Chem Pvt. Ltd. | 20-25% |

| NOVORATE BIOTECH CO. LTD | 15-20% |

| Becton, Dickinson and Company | 12-17% |

| Penta Manufacturing Company | 10-15% |

| Ungerer & Company | 8-12% |

| Other Companies (combined) | 30-40% |

| Company Name | Key Offerings/Activities |

| Kdac Chem Pvt. Ltd. | Specializes in high-purity derivatives for fragrance and cosmetics. |

| NOVORATE BIOTECH CO. LTD | Focuses on biotech-based aroma chemical production for sustainable sourcing. |

| Becton, Dickinson and Company | Supplies antiseptic-grade compounds for medical applications. |

| Penta Manufacturing Company | Produces industrial-grade solutions for pharmaceutical use. |

| Ungerer & Company | Develops natural and synthetic compounds for global perfume brands. |

Key Company Insights

KdacChem Pvt. Ltd. (20-25%)

KdacChemprovides high-purity phenylethyl derivatives that provide fragrance consistency and regulatory approval for international perfume manufacturers.

NOVORATE BIOTECH CO. LTD (15-20%)

NOVORATE BIOTECH is a leading developer of biotech-based aroma chemical synthesis to meet sustainable and eco-friendly perfumery ingredient requirements.

Becton, Dickinson and Company (12-17%)

Becton, Dickinson is known for medical-grade phenyl ethyl solutions targeting antiseptic and pharmaceutical formulas to satisfy rigid health regulations.

Penta Manufacturing Company (10-15%)

Penta Manufacturing provides industrially graded phenylethyl compounds, utilizing strong distribution channels for pharmaceutical as well as chemical industry customers.

Ungerer & Company (8-12%)

Ungerer & Company is well known for its tailor-made aroma chemical solutions, collaborating with top international fragrance manufacturers for proprietary formulations.

Other Key Players (30-40% Combined)

The segmentation is into Phenyl Ethyl Alcohol, Phenyl Ethyl Formate, Phenyl Ethyl Acetate, Phenyl Ethyl Propionate, Phenyl Ethyl Methyl Ether, Phenyl Ethyl Phenyl Acetate, Phenyl Acetaldehyde Dimethyl Acetyl, Phenyl Ethyl Methacrylate, and Phenyl Ethyl Isobutyrate.

The segmentation is into Pharmaceuticals, Research Institutes, and Others.

The report covers North America, Latin America, Western Europe, Eastern Europe, Asia Pacific, Japan, and the Middle East and Africa.

The industry valuation is estimated to reach USD 318.28 billion by 2025.

By 2035, the industry is expected to grow to USD 545.0 billion by 2035, driven by increasing demand for Phenyl Ethyl Alcohol across fragrance, cosmetics, and pharmaceutical applications.

China is expected to grow at a rate of 4.8%, supported by growth in personal care industries and rising consumption of cosmetic and aromatic compounds.

Phenyl Ethyl Alcohol is the leading product segment, attributed to its pleasant floral scent and wide usage in perfumes, soaps, and personal care formulations.

Key players in this market include Kdac Chem Pvt. Ltd., NOVORATE BIOTECH CO. LTD, Becton, Dickinson and Company, Penta Manufacturing Company, Ungerer & Company, and Harmony Organics Pvt Ltd.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA