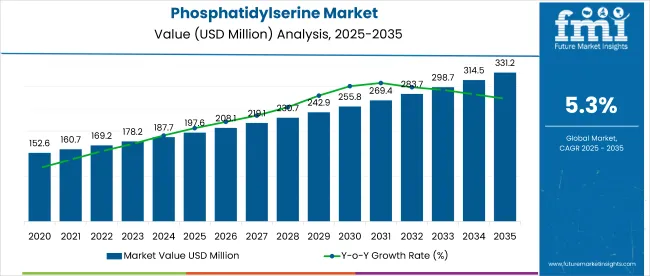

The global phosphatidylserine market is projected to grow from USD 197.6 million in 2025 to USD 331.9 million by 2035, registering a CAGR of 5.3%. Market expansion is being driven by the growing demand for cognitive health supplements and rising awareness about mental well-being.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 197.6 million |

| Industry Value (2035F) | USD 331.9 million |

| CAGR (2025 to 2035) | 5.3% |

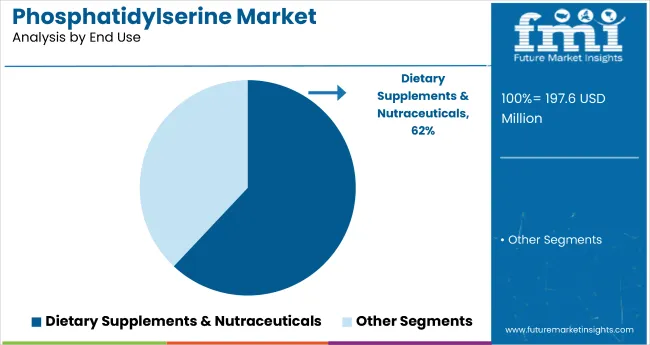

As consumers increasingly adopt dietary supplements to combat age-related memory decline and stress, phosphatidylserine-based products are witnessing significant traction. The ingredient is gaining popularity across functional foods, nutraceuticals, and pharmaceutical applications due to its proven benefits in enhancing brain function and treating cognitive disorders.

The market holds a dominant 62% share in the global cognitive health supplements market, driven by its strong efficacy in enhancing memory and mental focus. Within the dietary supplements market, it accounts for 2%, while in the broader functional food ingredients market, its share stands at around 6%.

It contributes roughly 4% to the growing nootropics market and about 3% to the overall nutraceuticals market. In the expansive health and wellness products market, phosphatidylserine holds a minimal share of less than 0.03%. Its targeted application in brain health continues to solidify its position within these niche categories.

Regulatory frameworks influencing the market include the United States Food and Drug Administration's GRAS (Generally Recognized as Safe) status for phosphatidylserine, which allows its incorporation in functional foods and supplements. In the European Union, it is regulated under EFSA guidelines for novel food ingredients, ensuring product safety and health claim validation.

These global standards, combined with region-specific regulations like India’s FSSAI norms for nutraceuticals and dietary supplements, are pushing manufacturers to develop high-purity, plant-based phosphatidylserine products. This is expected to further boost consumer trust and drive long-term market growth.

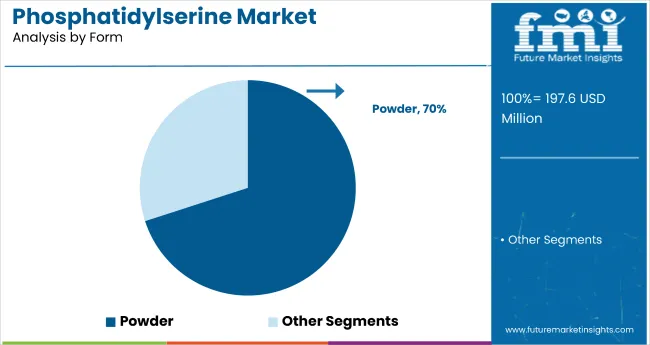

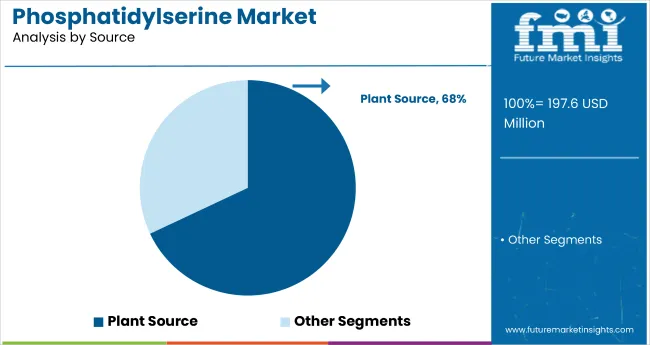

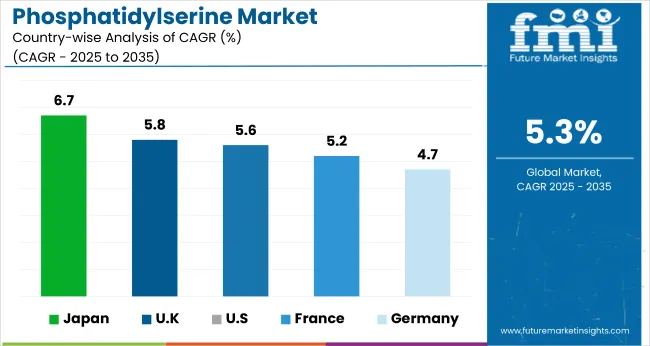

Japan is projected to be the fastest-growing market, expected to expand at a CAGR of 6.7% from 2025 to 2035. Powder will lead the form segment with a 70% share, while plant-based will dominate the source segment with a 68% share. The USA and Germany markets are also expected to grow steadily at CAGRs of 5.6% and 4.7%, respectively.

The global market is segmented by form, end use, grade, nature, source, and region. By form, the market is divided into powder and liquid. In terms of end use, the market includes functional foods, dietary supplements & nutraceuticals, and cosmetic & personal care.

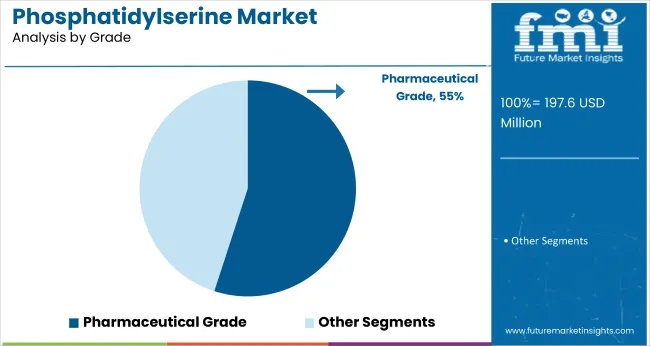

Based on grade, the market is segmented into food grade and pharmaceutical grade. By nature, the market is categorized into organic and conventional. In terms of source, the market is divided into plant source (soybean, sunflower, and other plant sources) and animal-derived. Regionally, the market is classified into North America, Latin America, Europe, East Asia, South Asia, Oceania, Middle East and Africa.

Pharmaceutical grade is projected to lead the grade segment with a 55% market share by 2025, supported by its high purity and suitability for clinical and therapeutic applications. Its widespread use in injectable formulations, vaccine stabilizers, and nutraceutical products further enhances its demand across regulated pharmaceutical manufacturing environments.

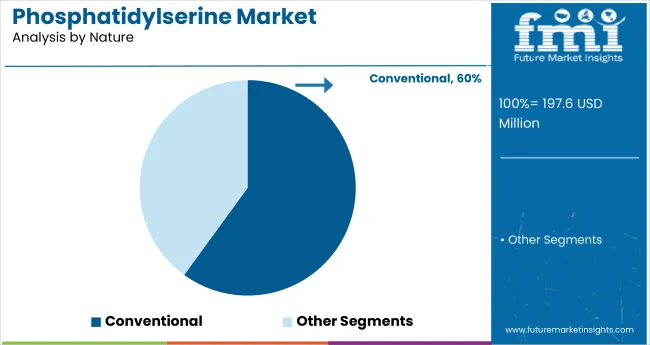

Conventional is projected to capture 60% of the market share by 2025, driven by its wide availability, affordability, and established use in large-scale supplement production. Its consistent supply chain, regulatory familiarity, and ease of formulation across diverse product formats contribute to its dominance in both emerging and developed markets.

Plant source is expected to dominate the source segment with a 68% market share by 2025, supported by rising demand for vegan, allergen-free, and sustainable supplement alternatives. Increased consumer awareness of environmental impact, clean-label preferences, and regulatory support for botanical ingredients further reinforce its growing adoption across global nutraceutical and dietary supplement markets.

The global phosphatidylserine market is witnessing steady growth, driven by rising consumer awareness regarding cognitive health and increasing demand for dietary supplements targeting memory enhancement. Phosphatidylserine plays a vital role in supporting brain function, making it a key ingredient in nutraceutical and functional food formulations.

Recent Trends in the Phosphatidylserine Market

Challenges in the Phosphatidylserine Market

Japan phosphatidylserine market growth is supported by elderly care innovation, functional nutrition trends, and regulatory support, making it the fastest-growing OECD market at 6.7% CAGR. Germany and France maintain consistent demand driven by EU nutraceutical regulations and funding for wellness innovation under national health initiatives. In contrast, developed economies such as the USA (5.6% CAGR), UK (5.8%), and Japan (6.7%) are expected to grow at a steady 0.89-1.26x of the global growth rate.

The UK follows, supported by rising demand for vegan nootropics and digital retail growth. The USA maintains steady momentum due to widespread use of over-the-counter supplements and regulatory backing through GRAS status. France shows consistent expansion, fueled by national wellness policies and interest in brain health support. Germany, while slightly behind, continues to see stable demand through pharmacy channels and clean-label trends.

The report covers in-depth analysis of 40+ countries; five top-performing OECD countries are highlighted below.

The Japan phosphatidylserine revenue is growing at a CAGR of 6.7% from 2025 to 2035. Growth is driven by the nation’s aging population, proactive health culture, and advancements in functional nutrition. Japan integrates phosphatidylserine into fortified foods, beverages, and memory supplements.

Sales of phosphatidylserine in Germany are expected to expand at a CAGR of 4.7% during the forecast period, slightly below the global average but driven by regulatory factors. EU-approved health claims and clean-label trends support its use in pharmacy-sold cognitive supplements. Demand is primarily driven by aging consumers and wellness-focused professionals.

The French phosphatidylserine market is projected to grow at a CAGR of 5.2% during the forecast period, in line with the global average. Demand is driven by increasing brain health awareness, national wellness policies, and workplace stress prevention initiatives. Functional foods and over the counter (OTC) supplements remain the primary application segments.

The USA phosphatidylserine market is projected to grow at a CAGR of 5.6% from 2025 to 2035, translating to 1.06x the global growth rate. Demand is driven by high awareness of memory support supplements and widespread access to nutraceuticals. The FDA’s GRAS status enables its use in a variety of functional products, including cereals, beverages, and capsules.

The UK phosphatidylserine market is projected to grow at a CAGR of 5.8% from 2025 to 2035, representing the fastest growth among top OECD nations at 1.09x the global pace. This growth is supported by rising demand for vegan brain health products and nootropics. Supplements targeting focus and memory are gaining traction among middle-aged and senior consumers.

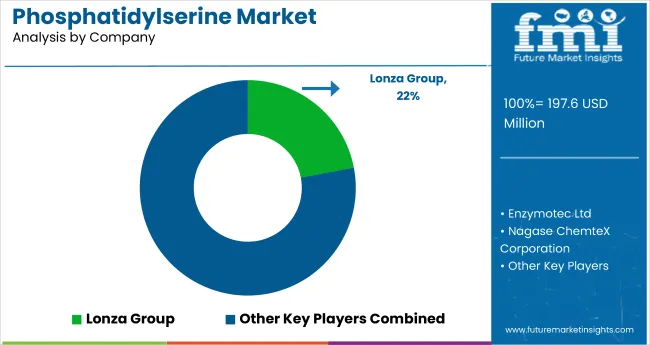

The global market is moderately consolidated, with key players such as Lonza Group, Enzymotec Ltd, Lipogen Products Ltd, Doosan Corporation, and Novastell leading the global supply landscape. These companies offer pharmaceutical and food-grade phosphatidylserine solutions that support cognitive health, memory enhancement, and functional food applications. Lonza Group focuses on high-purity, plant-derived ingredients for the nutraceutical sector, while Enzymotec Ltd and Lipogen Products Ltd specialize in brain health formulations backed by clinical studies.

Doosan Corporation delivers advanced phospholipid manufacturing capabilities, and Novastell supports clean-label, soy and sunflower-derived sourcing. Other prominent players such as Nagase ChemteX Corporation, Bontac Bio-engineering Co. Ltd., ECA Healthcare, Lipoid GmbH, and Chemi Nutra LLC contribute through targeted innovations, including organic, vegan-certified, and encapsulated phosphatidylserine for enhanced bioavailability.

Recent Phosphatidylserine Industry News

| Report Attributes | Details |

|---|---|

| Market Size (2025) | USD 197.6 million |

| Projected Market Size (2035) | USD 331.9 million |

| CAGR (2025 to 2035) | 5.3% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Report Parameter | USD million for value/volume in metric tons |

| Form Analyzed | Powder and Liquid |

| End Use Analyzed | Functional Foods, Dietary Supplements & Nutraceuticals, and Cosmetic & Personal Care |

| Grade Analyzed | Food Grade and Pharmaceutical Grade |

| Nature Analyzed | Organic and Conventional |

| Source Analyzed | Plant Source (Soybean, Sunflower, Other Plant Sources) and Animal-Derived |

| Regions Covered | North America, Latin America, Europe, East Asia, South Asia, Oceania, Middle East and Africa |

| Countries Covered | United States, United Kingdom, Germany, France, Japan, China, India, Brazil, South Korea, Australia and 40+ countries |

| Key Players Influencing the Market | Lonza Group, Enzymotec Ltd, Lipogen Products Ltd., Doosan Corporation, Novastell, Nagase ChemteX Corporation, Bontac Bio-engineering Co. Ltd., ECA Healthcare, Inc., Lipoid GmbH, Chemi Nutra LLC |

| Additional Attributes | Dollar sales by form and grade, share by source, regional demand outlook, functional ingredient trends, clean-label innovation, competitive landscape benchmarking |

The global phosphatidylserine market is estimated to be valued at USD 197.6 million in 2025.

The market size for the phosphatidylserine market is projected to reach USD 331.2 million by 2035.

The phosphatidylserine market is expected to grow at a 5.3% CAGR between 2025 and 2035.

The key product types in phosphatidylserine market are powder and liquid.

In terms of end use, functional foods segment to command 47.6% share in the phosphatidylserine market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA