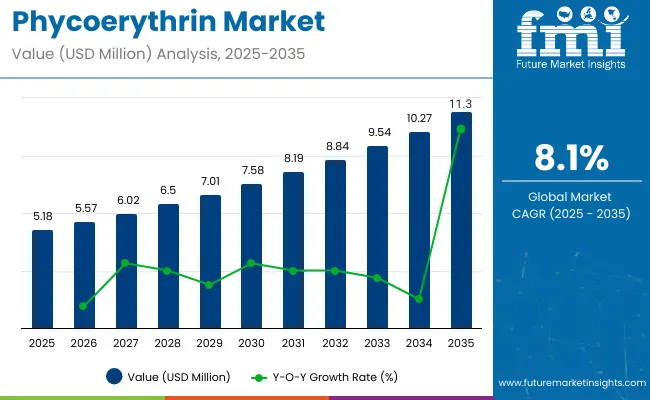

The global phycoerythrin market is anticipated to grow from USD 5.18 million in 2025 to approximately USD 11.30 million by 2035, registering a CAGR of 8.1% over the forecast period. The estimated market size for 2024 is USD 4.79 million. Growth in the phycoerythrin market is being propelled by rising global demand for natural colorants, fluorescent markers, and bio-based compounds across sectors such as biotechnology, food, pharmaceuticals, and cosmetics.

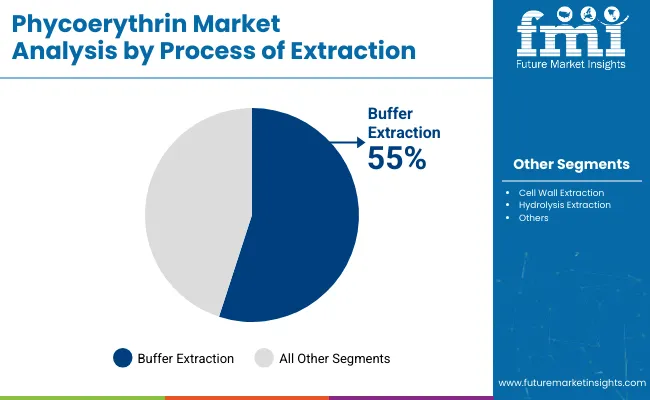

The buffer extraction process is gaining strong preference among manufacturers due to its ability to yield high-purity phycoerythrin while preserving protein integrity and fluorescence stability. It accounts for the highest share at 55%, reflecting its efficiency in large-scale processing.

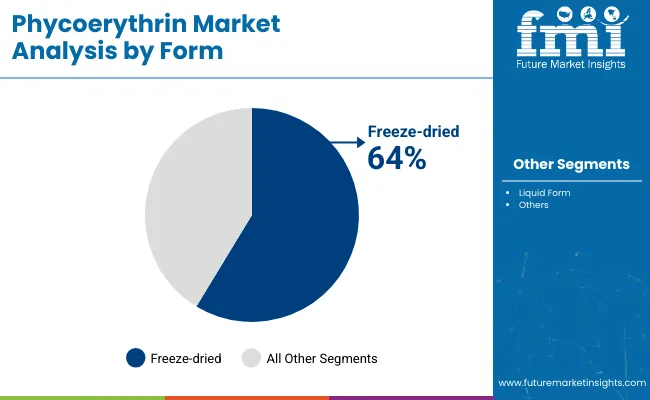

In terms of physical form, freeze-dried phycoerythrin is the dominant product, contributing 64% of total sales. Its longer shelf life, ease of reconstitution, and superior stability in transport and formulation make it the preferred format for diagnostic kits, research reagents, and cosmetic blends.

Application-wise, the pharmaceutical industry remains the key end user, leveraging phycoerythrin for its natural origin, non-toxic properties, and effectiveness in fluorescence-based diagnostics, particularly in immunoassays and clinical research. Regionally, North America leads the global phycoerythrin market, supported by advanced biotechnology research, regulatory acceptance of natural additives, and robust infrastructure for life sciences innovation.

In a 2024 interview with Food Ingredients First, Dr. Emily Thompson, senior researcher at the Institute of Natural Products, observed that the growing shift toward clean-label and plant-based ingredients is rapidly accelerating commercial adoption of natural pigments, including phycoerythrin, across multiple consumer-facing industries.

As industries continue to prioritize sustainability, natural functionality, and label transparency, the phycoerythrin market is expected to witness continued expansion, powered by ongoing technological innovation and increased interest in bio-based solutions.

Phycoerythrin trade is emerging as a niche but rapidly growing segment within the broader natural colorants market. Its unique properties as a vibrant red pigment sourced from red algae make it highly sought after in food, cosmetics, pharmaceuticals, and biotechnology industries. The trade is largely driven by countries with abundant red algae resources such as China, Indonesia, and Japan, which export raw and processed phycoerythrin to global markets.

Major Exporting Countries: Key exporters include China, Indonesia, Japan, and South Korea. These countries have developed expertise in harvesting and processing red algae to extract phycoerythrin efficiently. Their exports cater to manufacturers in Europe, North America, and emerging markets looking for natural, sustainable color solutions.

Major Importing Countries: Leading importers include the United States, Germany, France, South Korea, and India. These countries demand phycoerythrin for use in natural food colorants, cosmetics, and pharmaceutical applications. Increasing regulatory restrictions on synthetic dyes and rising consumer preference for natural ingredients are boosting imports. The growth of clean-label products and sustainable sourcing further support import demand.

Phycoerythrin, a natural pigment extracted from red algae, is regulated by various government authorities to ensure its safe and sustainable use across food, cosmetic, and pharmaceutical industries. Regulatory frameworks focus on maintaining high standards for purity, toxicity, and labeling while safeguarding environmental resources through sustainable harvesting practices. Agencies such as the FDA, EFSA, and EMA enforce these regulations to protect consumer health and promote environmentally responsible production, facilitating the growth of phycoerythrin in global markets.

Food Safety and Additive Regulations: Regulatory bodies such as the U.S. Food and Drug Administration (FDA) and the European Food Safety Authority (EFSA) oversee the approval and use of phycoerythrin as a food colorant. It must comply with strict standards regarding purity, toxicity, and permissible usage levels to ensure consumer safety. Novel food regulations may also apply, requiring thorough safety assessments before market entry.

Cosmetic and Pharmaceutical Compliance: For cosmetic and pharmaceutical applications, phycoerythrin must meet standards set by regulatory agencies including the FDA, European Medicines Agency (EMA), and equivalent authorities worldwide. These standards cover ingredient safety, labeling accuracy, and manufacturing practices to guarantee product efficacy and safety.

Environmental and Sustainability Guidelines: Harvesting of red algae for phycoerythrin extraction is regulated to prevent overexploitation and protect marine ecosystems. Environmental agencies may impose restrictions or require sustainable sourcing certifications. Compliance with environmental laws and eco-friendly manufacturing processes is increasingly emphasized.

The phycoerythrin market is gaining notable traction as demand for natural pigments intensifies in biopharmaceuticals, food diagnostics, and research applications. Buffer extraction has emerged as the preferred method, enabling high pigment stability and purity. Meanwhile, freeze-dried phycoerythrin is dominating the form segment due to its superior shelf life, solubility, and versatility across applications.

Buffer extraction is expected to command 55% of the phycoerythrin industry by 2025, cementing its role as the go-to method for obtaining high-integrity pigment. The technique enables gentle isolation of phycoerythrin from red algae and cyanobacteria without compromising its fluorescence properties-an essential trait for diagnostics and cell imaging.

The method’s ability to preserve protein structure and functionality has attracted global producers such as Sigma-Aldrich, Seta BioMedicals, and Algapharma Biotech, who continue to enhance extraction protocols for greater yield and consistency. It also aligns well with downstream applications like flow cytometry, biosensors, and fluorescence-based assays.

As industries prioritize clean-label ingredients and high-purity bioactives, buffer-based extraction stands out for scalability, reproducibility, and environmental friendliness. Innovations in microfiltration and cold-processing are further improving the method’s sustainability profile. In a landscape where precision and purity are non-negotiable, buffer extraction offers both, making it the backbone of modern phycoerythrin production across high-value sectors.

Freeze-dried phycoerythrin is projected to dominate the phycoerythrin market by form in 2025, capturing a substantial 64.0% market share. This format preserves the pigment’s bioactivity and allows for extended shelf life without refrigeration-qualities highly valued in pharmaceutical and research-grade applications.

Freeze-drying, or lyophilization, ensures stability during long-distance transport and harsh storage conditions, which is crucial for maintaining assay accuracy in clinical and laboratory settings. Companies such as Thermo Fisher Scientific, Cyanotech Corporation, and Dainippon Ink and Chemicals are leading this trend, offering freeze-dried variants tailored for diagnostic kits, fluorescence microscopy, and biomarker discovery.

This form’s solubility and ease of reconstitution make it the preferred choice in high-throughput environments. It also supports precision dosing and consistent spectral performance, vital for multiplex assays and real-time detection platforms. As the push toward high-purity, lab-grade bioactives intensifies, freeze-dried phycoerythrin is positioned not just as a format-but as the future standard-across scientific, diagnostic, and biopharma workflows.

The phycoerythrin market is expanding steadily due to increasing demand from nutraceuticals, biopharmaceuticals, and cosmetic formulations. Its natural origin, superior fluorescence, and clean-label appeal are fueling adoption. However, high extraction costs, stability issues, and scale-up limitations challenge wider commercialization. Opportunities lie in plant-based colorants, diagnostics, and algae-based protein systems, while threats stem from synthetic substitutes and volatile raw material supply.

Natural Fluorescent Properties Fuel Growth in Biotech & Food

The rising demand for natural colorants and fluorescent tracers is driving adoption of phycoerythrin across life sciences, food and beverage, and diagnostics. Its bright pink-red hue and high quantum yield make it an ideal option for immunofluorescence assays, flow cytometry, and biosensors. In food, it offers a natural alternative to synthetic dyes, aligning with clean-label trends.

The growing preference for algae-derived ingredients in functional foods, plant-based beverages, and cosmetics is further amplifying its appeal. Regulatory approvals in North America, Europe, and parts of Asia-Pacific are enhancing its commercial viability. As sustainability and bio-based inputs become strategic priorities, phycoerythrin is gaining ground as a dual-purpose molecule-colorant and functional ingredient.

Low Stability and High Processing Cost Limit Mass Production

Despite its benefits, phycoerythrin faces critical challenges related to thermal sensitivity, light instability, and cost-intensive purification. Extracted primarily from red algae like Porphyridium cruentum, its production demands tight environmental controls and specialized handling to prevent pigment degradation.

These issues hinder scalability and limit its shelf life, especially in high-heat applications. Additionally, downstream processing-including ultrafiltration, chromatography, and lyophilization-adds significant costs. Startups and smaller manufacturers often lack the infrastructure to maintain consistent quality at competitive prices. These constraints make the market highly price-sensitive and restrict broader industrial use beyond niche diagnostic or high-value cosmetic applications.

Algae-Based Food Systems Open New Application Frontiers

The rapid development of algae-based food systems and plant-derived protein innovations is unlocking new potential for phycoerythrin as both a colorant and bioactive agent. In plant-based meats, beverages, and dairy alternatives, it provides both visual appeal and antioxidant benefits. Its use in functional wellness products and marine-derived nutraceuticals is also expanding.

Meanwhile, synthetic biology and fermentation-based pigment production are being explored to improve yields and reduce dependency on natural sources. This wave of biotechnological advancement is expected to create new revenue streams for phycoerythrin manufacturers across food tech, biotech, and personal care sectors.

Synthetic Alternatives and Algal Supply Chain Risks Threaten Growth

The increasing availability of synthetic fluorescent dyes and artificial colorants poses a threat to the phycoerythrin market, particularly in diagnostic and analytical applications. These synthetic alternatives often offer longer shelf life, consistent fluorescence, and easier storage-at lower cost. Additionally, supply chain vulnerabilities tied to algal biomass cultivation-including weather dependency, contamination risks, and seasonal variability-affect long-term supply stability.

Countries relying on imports for raw material face cost spikes and inconsistent quality. Without robust upstream controls and diversified cultivation practices, the market remains vulnerable to raw material shocks and regulatory restrictions, especially in Europe and North America.

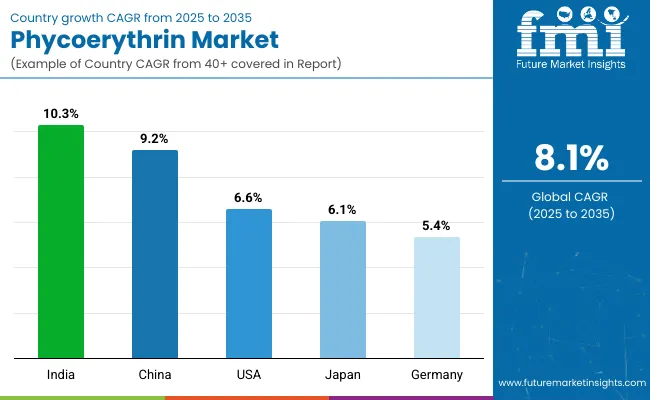

The phycoerythrin market is witnessing widespread global demand as industries shift toward clean-label colorants, diagnostic reagents, and bio-functional ingredients. While India and China take the lead in scalable, cost-effective production, the United States, Germany, and Japan are advancing high-purity formulations for specialized use in biotech and clinical research.

The United States phycoerythrin market is forecast to grow at a CAGR of 6.6% from 2025 to 2035, with growth driven by rising adoption across clinical diagnostics, immunology research, and functional nutrition. Phycoerythrin is a key component in flow cytometry, fluorescent tagging, and biosensing technologies-integral to cancer research and immune profiling.

The country’s thriving biotech ecosystem, supported by NIH and private-sector funding, ensures sustained demand for high-purity, lab-grade pigments. Additionally, manufacturers are integrating enzyme-aided extraction, freeze-drying, and cold-chain logistics to meet the needs of pharmaceutical and research customers. The clean-label food movement also plays a role, with beverage and nutraceutical brands turning to phycoerythrin as a plant-based red pigment alternative to synthetic dyes.

Domestic innovation in algae farming systems is slowly reducing import reliance, improving resilience and scalability. As the USA pushes forward with molecular diagnostics and sustainable labeling, demand for clinical-grade phycoerythrin is expected to steadily expand across both health and consumer sectors.

The Germany phycoerythrin market is projected to grow at a CAGR of 5.4% between 2025 and 2035, supported by strong integration of natural colorants in food processing and advanced applications in life sciences. Germany’s food industry is transitioning toward clean-label and allergen-free formulations, increasing the adoption of phycoerythrin in beverages, bakery products, and dairy alternatives.

Additionally, its world-class research institutes and biotech firms are actively incorporating the pigment in genomic tagging, protein detection, and molecular diagnostics. Sustainability is a key theme, with producers exploring closed-loop algal cultivation systems and solvent-free extraction to align with the EU’s green chemistry directives.

German companies are also driving innovation in cryoprotectant stabilization to improve the pigment’s shelf life and maintain fluorescence under clinical conditions. As regulatory standards tighten around artificial additives in food and cosmetics, phycoerythrin is expected to gain greater traction. With robust R&D funding, institutional collaborations, and a shift toward functional bioactives, Germany remains a strategic market for high-quality, EU-compliant phycoerythrin applications.

The India phycoerythrin market is expected to register a CAGR of 10.3% from 2025 to 2035, positioning the country as one of the fastest-growing suppliers in the global pigment ecosystem. India’s competitive edge lies in its low production costs, favorable climatic conditions for algae cultivation, and expanding base of nutraceutical and diagnostic manufacturers.

Domestic companies are ramping up spirulina and red algae processing capabilities, aiming to serve both local demand and global supply contracts. Phycoerythrin is increasingly used in dietary supplements, vegan food coloring, and clinical assay kits, especially as clean-label trends gain momentum in India’s urban health-conscious population. Government incentives under schemes like Startup India and Biotech Parks are encouraging investments in precision extraction technologies, such as ultrafiltration and enzyme-assisted separation.

Additionally, India’s robust pharma-export ecosystem provides an ideal platform for high-grade pigment exports to Europe, the Middle East, and Southeast Asia. As demand for natural, non-toxic, and multifunctional ingredients accelerates, India is poised to become a central hub in the phycoerythrin value chain.

The China phycoerythrin market is anticipated to grow at an estimated CAGR of 9.2% between 2025 and 2035, driven by rapid developments in algal biotechnology, molecular diagnostics, and functional beverage production. China’s large-scale investment in photobioreactors, biorefinery systems, and automated harvesting has enabled the efficient extraction of high-yield phycobiliproteins, including phycoerythrin.

In the clinical space, the pigment is widely adopted in biosensors, immunoassays, and fluorescence-guided imaging, reflecting its increasing role in precision medicine. The country’s food and beverage industry is also incorporating phycoerythrin into fortified drinks and dietary supplements, capitalizing on the rising demand for plant-based, antioxidant-rich colorants.

Regulatory support under China's Marine Economy Development Plan and Five-Year Biotech Strategy is further accelerating innovation and commercialization. Domestic firms are also targeting the export market with competitively priced formulations aimed at Southeast Asia and Latin America. With advancements in strain engineering and downstream processing, China is establishing itself as a scalable yet increasingly sophisticated player in the global phycoerythrin market.

The Japan phycoerythrin market is forecast to grow at a CAGR of 6.1% from 2025 to 2035, supported by the country’s high standards in clinical diagnostics, cosmeceuticals, and precision fermentation. Phycoerythrin’s superior fluorescence and stability make it valuable for cell analysis, antibody labeling, and high-sensitivity immunoassays-critical to Japan’s aging healthcare landscape.

Japanese R&D institutions and biotech firms prioritize ultra-pure, pharma-grade formulations, often incorporating enzyme-treated algae extracts to ensure consistency and bioavailability. In the food and wellness sectors, the pigment is increasingly used in functional beverages, marine-derived supplements, and anti-aging solutions, aligned with consumer preferences for traceable and non-synthetic ingredients.

Innovation in freeze-drying, microencapsulation, and low-heat processing techniques ensures pigment stability in diverse product formats. Japan’s commitment to clean technology and circular bioeconomy principles is encouraging greater domestic sourcing and lab-based pigment production. As clinical and consumer demands converge, Japan will continue to lead in niche, high-precision applications of phycoerythrin across multiple verticals.

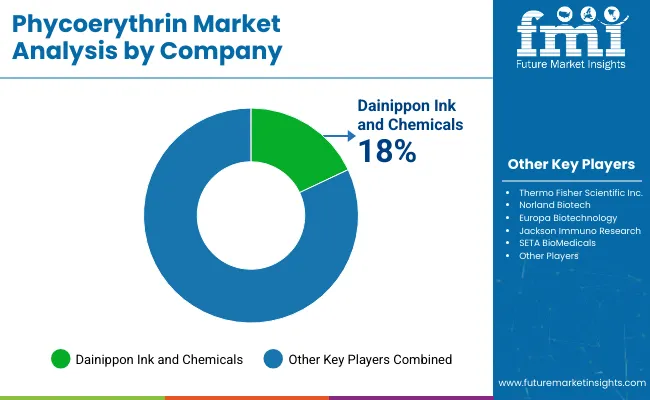

Tier 1 players in the phycoerythrin industry include global biotechnology and life sciences companies such as Thermo Fisher Scientific, Agilent Technologies, Sigma-Aldrich (Merck KGaA), and DIC Corporation. These firms offer high-purity phycoerythrin products for applications in diagnostics, research, and food industries.

For instance, Thermo Fisher Scientific has expanded its offerings to include phycoerythrin products targeting research and diagnostic markets. Tier 2 category comprises of companies like Phyco-Biotech GmbH, Cyanotech Corporation, and Zhejiang Binmei Biotechnology Co., Ltd., which focus on specialized applications and regional markets.

These firms leverage advanced extraction and purification technologies to produce phycoerythrin for various industries. The third tier includes regional and niche players such as Algapharma Biotech Corp., Norland Products Inc., and SETA BioMedicals, which cater to specific market segments with customized solutions.

The market is moderately consolidated, with Tier 1 companies holding significant shares due to their global reach and continuous innovation. Entry barriers are high, stemming from substantial capital requirements, technological expertise, and the need for established distribution networks. However, opportunities exist for specialized players to thrive in niche segments by offering customized solutions and agile services.

In 2024, a study published in the Biology and Life Sciences Forum detailed the successful extraction and characterization of phycoerythrin (PE) from the marine microalga Porphyridium purpureum. The researchers achieved a high purity index of 6.05, highlighting the pigment’s quality and potential use.

The study further examined the encapsulation of PE to enhance its stability in food applications, positioning it as a promising natural colorant and antioxidant. This work reflects increasing scientific interest in microalgae-derived phycoerythrin as a clean-label ingredient, especially in the context of rising demand for plant-based and functional food solutions.

| Report Attributes | Details |

|---|---|

| Market Size (2024) | USD 4.79 million |

| Current Total Market Size (2025) | USD 5.18 million |

| Projected Market Size (2035) | USD 11.30 million |

| CAGR (2025 to 2035) | 8.1% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD million for value |

| Extraction Processes Analyzed (Segment 1) | Buffer Extraction, Cell Wall Extraction, Hydrolysis Extraction |

| Forms Analyzed (Segment 2) | Freeze Dried, Liquid Form |

| Product Types Analyzed (Segment 3) | R-PE, B-PE, C-PE |

| End Use Applications Analyzed (Segment 4) | Pharmaceutical Industry, Food Industry, Cosmetics Industry, Diagnostic Industry, Biotechnology, Agricultural Industry |

| Regions Covered | North America; Latin America; Western Europe; Eastern Europe; South Asia & Pacific; East Asia; Central Asia; Balkan and Baltic Countries; Russia and Belarus; Middle East & Africa |

| Countries Covered | United States, Canada, Brazil, Germany, France, United Kingdom, Italy, Poland, China, Japan, India, South Korea, Australia, UAE, South Africa |

| Key Players influencing the Phycoerythrin Market | Thermo Fisher Scientific Inc., Dainippon Ink and Chemicals, Norland Biotech, Europa Biotechnology, Jackson Immuno Research, SETA BioMedicals, Assay Biotech Company Inc., R&D Systems Inc., Binmei Biotechnology, Columbia Bioscience |

| Additional Attributes | Dollar sales led by R-PE, freeze-dried form seeing demand, food industry driving growth, biotechnology fueling usage, North America holding volume share, diagnostics expanding market base |

As per the process of Extraction, the industry has been categorized into Buffer Extraction, Cell Wall Extraction, and Hydrolysis Extraction.

This segment is further categorized into Freeze dried and Liquid form

This segment is further categorized into R-PE, B-PE, and C-PE

This segment is further categorized into the Pharmaceutical Industry, Food Industry, Cosmetics Industry, Diagnostic Industry, Biotechnology, and Agricultural Industry.

The market spans North America, Latin America, Western Europe, Eastern Europe, South Asia & Pacific, East Asia, Central Asia, Balkan and Baltic Countries, Russia and Belarus, and The Middle East & Africa.

The market is expected to reach USD 5.18 million in 2025.

Sales in the market are projected to grow steadily, reaching approximately USD 11.30 million by 2035.

India is anticipated to lead with a CAGR of 10.3% during the forecast period.

Buffer extraction type is a leading segment by extraction method.

Major companies include Thermo Fisher Scientific Inc., Dainippon Ink and Chemicals, Norland Biotech, Europa Biotechnology, Jackson Immuno Research, SETA BioMedicals, Assay Biotech Company Inc., R&D Systems Inc., Binmei Biotechnology, Columbia Bioscience.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA