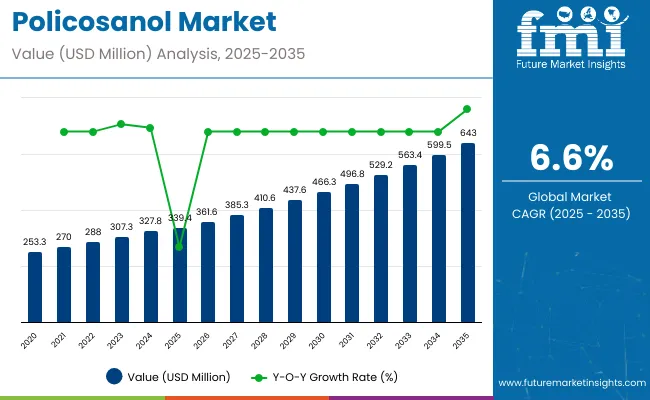

The policosanol market is projected to expand steadily from USD 339.4 million in 2025 to USD 643 million by 2035, advancing at a CAGR of 6.6%. This growth reflects increasing consumer interest in natural, plant-based health supplements, growing adoption in dietary supplements, and expanding applications in nutraceutical formulations. The market demonstrates a consistent upward trajectory, with demand driven by rising awareness of cardiovascular health benefits, preference for clean-label products, and fortified supplement variants appealing to health-conscious consumers worldwide.

By 2030, the market is forecasted to reach approximately USD 466.4 million, reflecting a steady climb through the first half of the decade. The absolute dollar growth between 2025 and 2035 is expected to be around USD 303.6 million, indicating robust and reliable expansion. Market growth is considered back-loaded, with greater adoption of Policosanol in dietary supplements, functional foods, and nutraceuticals anticipated in the latter half of the timeline.

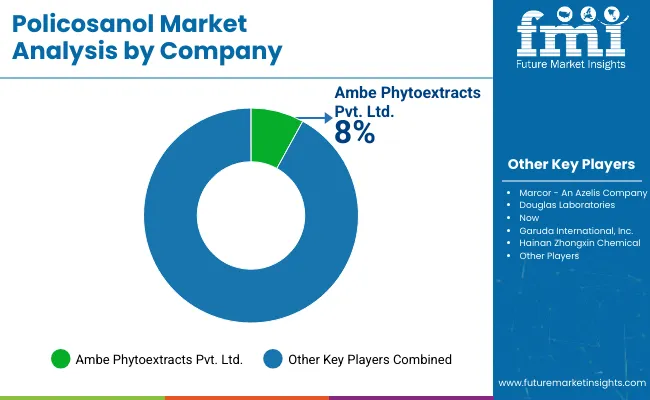

Leading companies such as AmbePhytoextractsPvt. Ltd., Marcor (An Azelis Company), Douglas Laboratories, Now Foods, and Garuda International Inc. are consolidating their positions by expanding extraction capacities and investing in advanced technologies. Their innovation pipelines focus on high-purity Policosanol extracts, gluten-free formulations, and fortified health supplements, enabling stronger penetration into health-conscious and premium consumer segments. Market performance will remain closely linked to extraction standards, product quality, regulatory compliance, and sustainable sourcing practices, which will shape competitive dynamics across global regions.

| Metric | Value |

|---|---|

| Estimated Value in 2025 (E) | USD 339.4 million |

| Forecast Value in 2035 (F) | USD 643 million |

| Forecast CAGR (2025 to 2035) | 6.6% |

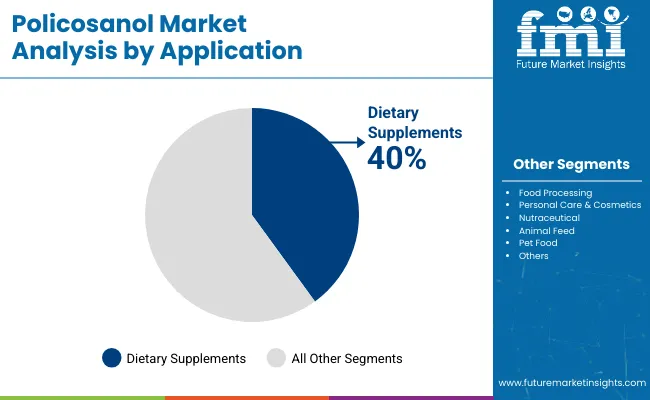

The market holds 40% of the dietary supplements market, supported by its role in cholesterol management and cardiovascular health formulations. It accounts for around 32% of the nutraceutical ingredients market, backed by its incorporation in functional foods and wellness products targeting lipid profile improvement. The market contributes nearly 28% to the pharmaceutical excipients market, particularly for cholesterol-lowering therapies, metabolic health drugs, and lipid-modulating formulations. It holds close to 21% of the cosmetic and personal care ingredients market, where policosanol is used in skin creams, anti-aging products, and emulsions. The share in the plant-derived bioactives market reaches about 34%, reflecting its recognition among formulators seeking natural wax alcohols derived from sugarcane and other renewable sources for health-promoting applications.

The market is evolving with advancements in Supercritical CO₂ extraction technology enhancing product purity and efficacy. Companies are expanding their portfolios with fortified and specialty Policosanol products, including gluten-free and organic variants. Strategic partnerships with healthcare brands, retailers, and online supplement platforms are broadening market reach and reshaping distribution channels, positioning Policosanol as a preferred ingredient in natural health and premium dietary supplements.

The market is growing due to increasing consumer demand for natural, plant-based health supplements that support cardiovascular wellness and overall health. Rising awareness of the benefits of Policosanol in managing cholesterol levels and promoting heart health is driving adoption across dietary supplements and nutraceuticals. Advances in extraction technologies, particularly Supercritical CO₂ extraction, have improved product purity and quality, enhancing consumer trust and appeal.

Growing interest in clean-label, fortified, and gluten-free supplements is further expanding the market’s reach. Innovation in product formulations and diversification, including organic and specialty Policosanol supplements, are meeting evolving health-conscious consumer preferences. As global health and wellness trends continue to evolve, and as major players invest in quality assurance, sustainable sourcing, and expanded distribution, the outlook for the Policosanol market remains strongly positive, with broad acceptance expected across regional and international markets.

The market is segmented by source, grade, extraction process, application, and region. By source, the market is divided into sugarcane wax, beeswax, rice bran, wheat germ, and others (cereal grains, grasses). Based on grade, the market is categorized into 0.90 Policosanol, 0.95 Policosanol, and 0.99 Policosanol. In terms of extraction process, the market is bifurcated into solvent extraction and supercritical carbon dioxide extraction. By application, the market is segmented into food processing, personal care & cosmetics, dietary supplements, nutraceutical, animal feed, and pet food. Regionally, the market is classified into North America, Latin America, Europe, East Asia, South Asia, Oceania, and the Middle East & Africa.

The most lucrative segment in the market by extraction process is supercritical CO₂ Extraction, commanding over 85% of the market share. This method outperforms traditional solvent extraction due to its environmentally friendly nature, eliminating the use of harmful chemicals and reducing environmental impact. It produces high-purity, solvent-free Policosanol, which retains the bioactive compounds essential for therapeutic efficacy. This superior quality appeals to premium dietary supplement manufacturers and health-conscious consumers seeking safe and natural products.

Additionally, Supercritical CO₂ extraction offers greater efficiency and consistency in yield, making it ideal for large-scale commercial production. Regulatory bodies also favor this method due to its safety profile, leading to broader acceptance in global markets. As consumer demand grows for clean-label, natural health supplements, Supercritical CO₂ extraction’s prominence is expected to strengthen further, driving innovation and market expansion in the Policosanol industry well into the forecast period.

Dietary supplements stand out as the most lucrative and is projected to 40% market share in the application segment. This segment benefits from escalating consumer interest in natural and effective solutions for cholesterol management and cardiovascular health, which are major global health concerns. Although the exact market share is undisclosed, dietary supplements clearly outpace other applications such as food processing, personal care & cosmetics, nutraceuticals, animal feed, and pet food. The increasing shift toward preventive healthcare and wellness, along with growing scientific evidence supporting the efficacy of Policosanol, underpins the segment’s rapid growth.

Consumers are increasingly favoring natural, plant-based ingredients with proven health benefits, making dietary supplements the primary avenue for Policosanol consumption. This trend is expected to continue driving the market expansion through 2035, as manufacturers introduce innovative formulations and broaden distribution channels to meet the rising demand for heart-healthy and clean-label supplements worldwide.

From 2025 to 2035, the market is driven by rising consumer demand for natural, plant-based health supplements. Preference for high-purity and eco-friendly Policosanol products, especially those extracted through Supercritical CO₂ methods, has pushed manufacturers to invest in advanced technologies. This shift helps meet evolving health needs and broadens product portfolios, positioning key players competitively. The increasing emphasis on clean-label, safe supplements supports market expansion, encouraging innovation in extraction and formulation processes to offer effective cardiovascular health solutions.

Growing Consumer Health Awareness Drives Market Growth

Consumer focus on heart health and preventive care is a major growth catalyst for Policosanol. Awareness around cholesterol management and cardiovascular benefits elevates demand for Policosanol dietary supplements. Manufacturers are enhancing quality with improved extraction and formulation to address safety and efficacy. This growing health consciousness fuels the market, encouraging diversified products aligned with consumer expectations. The rising trend for natural, plant-derived ingredients further solidifies dietary supplements as the primary driver of industry growth.

Innovation in Product Development Expands Market Opportunities

Advances in extraction and formulation technologies have expanded Policosanol’s market beyond traditional users. Innovations like gluten-free and fortified supplements enhance bioavailability, purity, and shelf life, attracting a broader consumer base. These improvements create new prospects in dietary supplements, nutraceuticals, and personal care sectors. Companies adopting sustainable sourcing and strict quality certifications gain an edge, appealing to environmentally conscious and health-aware customers. This trend towards innovation and sustainability supports robust, long-term market growth and diversification of applications globally.

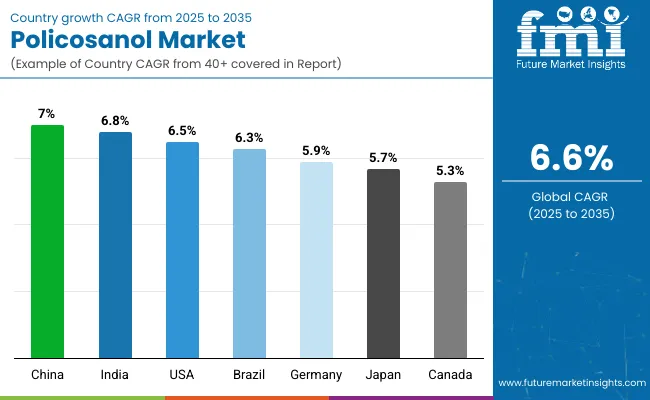

| Countries | CAGR (%) |

|---|---|

| China | 7.0% |

| India | 6.8% |

| United States | 6.5% |

| Brazil | 6.3% |

| Germany | 5.9% |

| Japan | 5.7% |

| Canada | 5.3% |

The market is expanding globally with varied growth rates reflecting regional dynamics. China leads with the highest CAGR of 7.0%, driven by strong government support, advanced extraction technology investments, and a large aging population focused on cardiovascular health. India follows closely at 6.8%, fueled by herbal wellness popularity and improved distribution infrastructure. The USA market grows steadily at 6.5%, propelled by consumer awareness and strict regulatory standards. Brazil’s market expands at 6.3%, supported by urbanization and collaborations enhancing quality and reach.

Germany and Japan exhibit moderate growth rates of 5.9% and 5.7%, respectively, influenced by mature healthcare systems and aging populations. South Korea’s market grows at 5.5%, benefiting from wellness trends and e-commerce penetration. Canada and Australia have slightly lower CAGRs of 5.3% and 5.1%, supported by preventive healthcare focus and sustainable product preferences. Overall, Asia leads growth while mature markets show steady, sustainable expansion.

The report covers an in-depth analysis of 40+ countries; seven top-performing OECD countries are highlighted below.

Revenue from policosanol in China is experiencing rapid growth, with a strong CAGR of 7.0%. This growth is driven by increased consumer health awareness and demand for natural supplements. Government support for traditional medicine and natural health initiatives further catalyzes market expansion. The country benefits from a large aging population with rising cardiovascular health concerns. Urbanization and improving healthcare infrastructure have enhanced product accessibility.

Chinese manufacturers are investing heavily in advanced extraction technologies, particularly Supercritical CO₂ methods, boosting production efficiency and quality. Expansion of domestic and international distribution networks also strengthens China’s market position. Moreover, e-commerce platforms are playing a crucial role in increasing consumer reach. The market is poised for sustained growth as these factors converge.

Sales of policosanol in India are growing at a CAGR of 6.8%, propelled by the rising popularity of herbal medicine combined with scientific endorsement of Policosanol’s health benefits. The expanding middle class and health-conscious urban population drive demand. Government initiatives supporting Ayurvedic and herbal wellness products create a favorable environment. Improved distribution and logistics infrastructure ensure wider market penetration, including rural areas. Local manufacturers are increasing production capacities with new investments in research and development. Online sales channels are becoming crucial for reaching diverse consumers. The growing awareness of preventive healthcare and lifestyle diseases further supports market expansion. Strategic collaborations and exports also contribute to India’s rising market dominance globally.

The USA policosanol revenue shows steady growth with a CAGR of 6.5%, driven largely by consumer awareness surrounding cholesterol management and heart health. Regulatory frameworks ensure high product safety and efficacy, enhancing consumer trust. The expansion of online retail and specialty health stores significantly increases accessibility. Innovation in clean-label, fortified supplement formulations appeals to health-conscious buyers. Large supplement manufacturers invest heavily in marketing, distribution channels, and product innovation. Growing demand for plant-based, natural alternatives bolsters market growth. The aging population and rising health concerns contribute to increasing supplement adoption. Sustainable production practices resonate well with USA consumers, further supporting market expansion.

Policosanol revenue in Brazil shows steady growth with a CAGR of 6.3%, fueled by rising health consciousness and urbanization. Increasing lifestyle-related health issues lead to greater supplement consumption. Collaborations between local manufacturers and international companies improve product quality and enhance distribution networks. Expansion of retail outlets and e-commerce channels broadens market accessibility. Government policies encouraging use of natural wellness products further support demand. Investments in extraction technology and quality control elevate the product standards. Consumer preference for natural cardiovascular health supplements grows steadily. The developing healthcare infrastructure helps increase market penetration in urban and semi-urban regions.

Revenue from policosanol in Germany is expected to grow at a CAGR of 5.9%. The country benefits from stringent regulatory standards that ensure high product efficacy and consumer confidence. An aging population focused on preventive healthcare expands demand for heart health supplements. Specialty health stores and pharmacies serve as major distribution channels. Growing consumer interest in sustainable and organic products shapes market preferences. German manufacturers emphasize quality certifications and product transparency. The increasing inclination towards natural supplements aligns with health trends. Investments in product innovation and clean-label formulations enhance the market’s appeal among discerning consumers. The country’s infrastructure supports efficient supply chain and distribution.

Sales of policosanol in Japan are expected to grow at a CAGR of 5.7%, driven by a large elderly population focused on preventive cardiovascular health. The country's advanced healthcare infrastructure supports widespread supplement use. Consumers prioritize high-quality, science-backed wellness products, raising demand for pure Policosanol extracts. Government initiatives promote aging health and natural supplementation, enhancing market conditions. Manufacturers invest in innovative product development, including easily consumable formulations. Retail pharmacy chains and e-commerce platforms facilitate broad market penetration. Sustainability and safety certifications influence purchasing decisions, reinforcing consumer confidence.

Sales of policosanol in Canada are expected to grow at a CAGR of 5.3%, driven by increasing consumer interest in natural and plant-based health supplements. The country’s well-established healthcare system supports preventive healthcare, encouraging supplement use. Growing awareness of cardiovascular diseases fuels demand for cholesterol management products like Policosanol. The expanding retail and online channels facilitate easy access to supplements. Canadian consumers prefer clean-label and non-GMO ingredients, prompting manufacturers to innovate with fortified and organic formulations. Government regulations ensure product safety and quality, enhancing consumer confidence. Strategic collaborations between local and international companies help expand product availability and awareness in diverse markets.

The market is moderately consolidated, with key players competing through advanced extraction technologies, product innovation, and regional market penetration. Leading companies such as AmbePhytoextractsPvt. Ltd. and Marcor dominate by leveraging large-scale production capabilities and diverse Policosanol formulations targeted at dietary supplements, nutraceuticals, and personal care sectors. Their strengths include superior Supercritical CO₂ extraction processes, stringent quality control, and well-established distribution networks.

Companies like Douglas Laboratories and Now Foods focus on cost-effective production, supply chain efficiency, and meeting rising demand for high-purity, gluten-free, and organic Policosanol products in global markets. Regional players prioritize sustainable sourcing, product authenticity, and tailored solutions for niche markets, particularly in Asia, North America, and Europe.

Barriers to entry remain moderate due to the need for specialized extraction expertise, regulatory compliance, and quality assurance. Competitive advantage increasingly depends on innovation in purification techniques, sustainable raw material sourcing, and adaptability to diverse consumer preferences and evolving global regulations.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 339.4 Million |

| Source | Sugarcane Wax, Beeswax, Rice Bran, Wheat Germ, Others (Cereal Grains, Grasses) |

| Grade | 0.90 Policosanol , 0.95 Policosanol , and 0.99 Policosanol |

| Extraction Process | Solvent Extraction and Supercritical Carbon Dioxide Extraction |

| Application | Food Processing, Personal Care & Cosmetics, Dietary Supplements, Nutraceutical, Animal Feed, Pet Food |

| Regions Covered | North America, Latin America, Asia Pacific, Europe, Middle East & Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, Brazil, Australia and 40+ countries |

| Key Companies Profiled | Ambe Phytoextracts Pvt. Ltd., Marcor - An Azelis Company, Douglas Laboratories, Now, Garuda International, Inc , Hainan Zhongxin Chemical, Herblink Biotech Corporation, Huzhou Shengma Biochem Co. Ltd., India Glycols Ltd., Laboratories Dalmer S.A., Nutritopper Biotechnology, Risun Bio-Tech Inc., Sami Labs Ltd. ( Sabinsa Group) |

| Additional Attributes | Revenue by source and application, demand for cardiovascular and dietary supplements, expansion in retail and e-commerce channels, innovations in extraction and formulation techniques, increasing focus on sustainable sourcing and product efficacy |

The global policosanol market is estimated to be valued at USD 0.3 billion in 2025.

The market size for the policosanol market is projected to reach USD 0.6 billion by 2035.

The policosanol market is expected to grow at a 6.6% CAGR between 2025 and 2035.

The key product types in policosanol market are sugarcane wax, beeswax, rice bran, wheat germ and others (cereal grains, grasses).

In terms of grade, 0.90 policosanol segment to command 47.6% share in the policosanol market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA