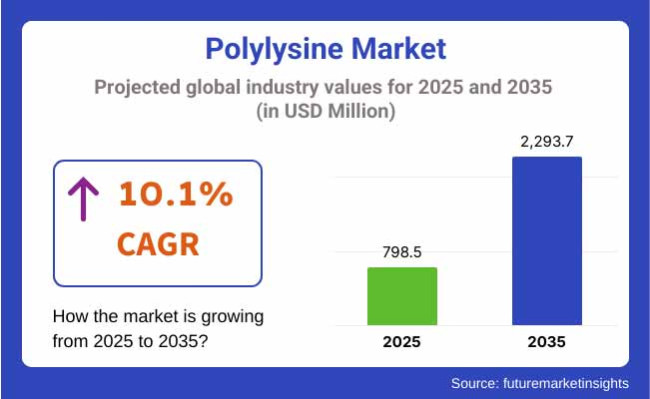

Polylysine world market was USD 728.6 million in 2024. Polylysine market would be year-over-year growth of 9.6% in 2025, i.e., world market would be USD 798.5 million in 2025. World sales would achieve a CAGR of 10.1% during the forecast period 2025 to 2035 and thus reach the market value of USD 2,293.7 million in 2035.

One of the most important growth drivers in the polylysine market is the growing application of the product as a natural food and beverage preservative. Polylysine is a natural food preservative that is an antimicrobial and has widespread application to enhance food based on shelf life for quality as well as safety.

Rising demand for clean-label food and minimally processed food has been the most influential factor to enhance the usage of natural preservatives compared to artificial preservatives. Consumers are increasingly looking at food ingredients, and this is placing pressure on non-toxic, biodegradable, and environmentally friendly methods of preservation and thus are influencing the polylysine market.

Alongside, greater food safety and microbial contamination have resulted in a greater use of polylysine by the food industry in the production of food. Demand for safe food with shelf life has been hastened in developed economies with strict regulation of food safety since it compels them to utilize efficient antimicrobial products. Greater use of polylysine has been recorded in North America and developed economies of Europe with emphasis on bakery food, ready-to-eat food, and dairy food.

Polylysine finds extensive use in the cosmetics and personal care market as anti-microbial agent and skin-conditioning agent. Healthy growth for the market will be driven by global demand for natural and organic cosmetics. Increasing demand of bio-degradable and green raw material in personal care business is propelling massive use of polylysine-based solutions.

Apart from this, uses of polylysine in drug delivery systems, tissue engineering, and wound healing are being considered by the pharmaceutical industry in a highly optimistic light. Biodegradability and biocompatibility of polylysine make it an even more viable use for the medical industry. Growth of the pharmaceutical and biotech sectors in the Asian-Pacific and North American economies will provide favourable opportunities to the manufacturers of polylysine in the immediate future.

Below table illustrates comparative study of six-month CAGR and variance between run year (2025) and base year (2024) of world polylysine market. Detailed study illustrates variance in performance along with trends in realization of revenue, thereby providing clear picture to stakeholders regarding trend in growth of the year.

| Particulars | Value CAGR |

|---|---|

| H1 (2024 to 2034) | 9.5% |

| H2 (2024 to 2034) | 9.8% |

| H1 (2025 to 2035) | 10.0% |

| H2 (2025 to 2035) | 10.1% |

During the first half (H1) of the years 2025 to 2035, the company will be expanding at a CAGR of 10.0% and even at an even higher rate of 10.1% for the subsequent half (H2) of the same years. And then for the second time period, H1 2025 to H2 2035, the CAGR would be calculated to rise to 10.0% for the initial half and even very high at 10.1% for the subsequent half. During H1 of the forecast period, the industry gained 50 BPS and during H2, business gained 30 BPS.

Polylysine market across the world is to expand over the next decade at a fast rate with extensive usage in food, pharmaceutical, and cosmetic industries. Other demand for organic food additives, increased growth in the biotechnology industry, and increased awareness towards clean-labeling are some of the major market trends in their favor. North America and Asia-Pacific would be the most profitable markets apart from that one, where customer demand for eco-friendly and improved preservation would be higher.

Tier 1 possesses high brand value, high value revenue, competitive, and stable firms at the market level. They invest significantly in product research and development, advertisement, to project their global presence. JNC Corporation enjoys a monopoly in the market because of its rich heritage as a chemical and biotech solution developer since it possesses a heritage in chemistry and biotech solutions.

Merck & Co., Inc. is also among the industry participants who have made themselves one of the largest polylysine manufacturers by embracing novel bioprocessing technology and automation to realize optimal efficiency. The players are fortifying their position in the market even further through strategic alliances and eco-friendly measures.

Tier 2 are low market share businesses to Tier 1 but low income. Jiangsu Yiming Biological Technology Co., Ltd. is one that has established itself as a player in the field of biotechnology by way of exporting high-quality polylysine products utilized in other industrial procedures.

Zhengzhou Bainafo Bioengineering Co., Ltd., one of the market leaders in natural food preservative and polylysine safety products, is one of the others that qualify to make it into this list. These two companies are competing on product innovation and differentiation grounds and can penetrate specialty niches like preservatives with food safety and clean-label. Through quality and tailor-made solutions, they can capture loyal customers.

Tier 3 consists of new and small companies in the polylysine sector. They lack traditional marketing channels but employ new and non-traditional business models to grow at a very rapid rate. Some of the new firms that are engaged in the production of polylysine through biotechnology include Nanjing Shineking Biotech Co., Ltd. which deals with specialty application solutions.

Zhangshu Lion Biotechnology Co., Ltd. is among the new firms growing its market share step by step online and direct-to-consumer. Tier 3 firms use web media, home markets, and green-marketing weapons fighting to match the giants and build loyal customers.

Growing Demand for Natural Preservatives

Shift: Natural food and drink preservatives and clean-label is what is being called for more by consumers. Natural antimicrobial polylysine agent is being called for more due to man-made ingredients. Europe, the USA, and Japan are leading the charge in demand due to the fact that it is business as usual today with food companies to be processing foods in minimal way and using clean-label food.

Strategic Response: JNC Corporation and Chengdu Jinkai Biology are among high-purity ε-polylysine importers to meet such demand. USA food processors are enriching minimally processed foods and organic foods with polylysine, driving 12% adoption growth. Polylysine is growing in fermented food, primarily soy food, in Japan for the purpose of shelf life extension without denaturing natural status. In Europe, businesses began reformulating processed meat and dairy with ε-polylysine as a clean-label antimicrobial to strengthen clean-label positioning.

Increasing Use in Vegan and Plant-Based Foods

Shift: Certain other preservatives are increasing with the increasing demand for plant foods. Polylysine, plant antimicrobial from bacterial fermentation, is increasingly being utilized as a natural antimicrobial. Ready-to-eat Australian, European, and North American food, meat substitute, and plant milk have been increasing the demand for polylysine.

Strategic Response: Beyond Meat and Impossible Foods are adding ε-polylysine to food products for preservation with improved stability and shelf life. Alpro and Oatly in the EU market also added additional utilization of polylysine in oat and almond milk-type dairy-free milk alternatives so that there will be 10% loss on spoilage. Polylysine is increasingly being adopted by Australian plant food industries to maintain increased levels of food safety without diminishing the vegan-friendly nature.

Refashioning Pharmaceutical and Nutraceutical Drugs for Long-term Treatment

Shift: Pharmaceutical and nutraceutical companies are using the antimicrobial and bioactive property of polylysine for product functionality and shelf life for longer periods. America, China, and India have witnessed explosive growth in the application of polylysine in the functional food business, dietary supplements, probiotics, and protein powder business. Polylysine use in the business of bioavailability and as a probiotic stabilizer has also fueled applications to health and medicine sectors.

Strategic Response: Lonza and Capsugel introduced polylysine-based coated capsules to enhance probiotics for enhanced stability. Polylysine-based immune supplements were introduced by leading Chinese supplement manufacturers, while functional nutritionals increased market share by 15%. Indian drug houses also tested polylysine as an excipient in stabilizers of vegetable protein powder used to impart shelf life without affecting the stability of nutrients.

Increased Use in Cosmetics and Personal Care Products

Shift: They are moving towards bio preservatives and naturalness in the cosmeceutical and skincare industry. Polylysine's water holding property along with its anti-microbial property has guided natural skincare brands towards the product. The trend is most common in France, America, and Korea, where the clean beauty demand is more than ever.

Strategic Response: L'Oréal and The Estée Lauder Companies have introduced polylysine-based preservative systems in their natural beauty product range rewarding 8% greener skin care. Polylysine has also crossed South Korean K-beauty creams and serums with companies seizing its two-way antimicrobial as well as moisturizing potential. Luxury French companies began introducing polylysine-based age-reversing cosmetics that are challenging shelf stability as well as green consumers.

Blistering Application in Biodegradable Packaging and Coatings

Shift: The transition to green packaging is inducing growing demand for plant-based antimicrobial coatings with extended shelf life and less plastic usage. Edible films and biodegradable polylysine films for food packaging are more in demand, particularly in the United States, Germany, and Japan, where single-use plastics are being banned.

Strategic Response: Multination packaging companies such as Sealed Air and Amcor are making investments in polylysine antimicrobial films, with growing demand at an 11% pace. Polylysine-enriched biodegradable vegetable and fruit packaging that increases shelf life with little plastic used to bare minimum has been created by Japanese researchers. Polylysine-infused bakery and dairy food-based coatings are being tested by German supermarket chains in a bid to prevent around 7% of food from going to waste.

Approval by Regulations Creates Global Adoption

Shift: Increased approval and certification by regulators pushed polylysine onto the global markets. Polylysine was approved and certified by EFSA, FDA, and China National Medical Products Administration to be used in the majority of the markets, which increased higher use in most of the markets.

Strategic Response: JNC Corporation also received additional GRAS status approvals in the USA for additional food applications, which stimulated market demand for polylysine in the natural preservatives market. Chinese polylysine producers were approved for long-term use in nutraceuticals, rising 14% in use in functional foods. Regulators streamlined approvals and also drove a revolution in clean-label product innovation with the use of polylysine.

Efficient Supply Chains and Competitive Pricing

Shift: With increasing demand for polylysine, the most effective method of production and established supply chains are the business model. Firms have therefore been investing efforts in minimizing the cost of fermentation processes while striving to bring polylysine into price levels.

Strategic Response: Chinese producers like Chengdu Jinkai Biology increased fermentation capacity to reduce cost by 9%. Strategic cooperative arrangements' collaborative partnerships by indigenous players made polylysine bulk food application manufacturing cost-free. Polylysine bulk sales through European markets dropped by 7% for mid-scale food enterprises' extension of coverage using clean-label preservatives.

The global polylysine market will see unprecedented growth over the next ten years with further use as a natural food and beverage additive preservative, drug application, cosmetics, and biotechnology.

Compound Annual Growth Rate (CAGR) of leading markets for 2025 to 2035 are as follows:

| Countries | CAGR (2025 to 2035) |

|---|---|

| USA | 7.6% |

| Germany | 6.8% |

| China | 8.2% |

| Japan | 5.9% |

| India | 9.1% |

United States presents a big market for polylysine because of its very large food and beverages industry that is becoming more and more interested in employing natural preservatives as it attempts to catch up with the consumers' clean-label foods demand. Consumers are now more and more health- and wellness-oriented, and so it has compelled them to avoid foods containing artificial additives, and polylysine is one of them at position number one on the list.

Government regulatory agencies such as the Food and Drug Administration (FDA) also sanctioned polylysine as a safe food additive to be used, and its application increased further. Stiffness tests of safety and FDA approval motivate food industries to feel confident enough to apply polylysine to all the foods such as baked food, dairy food, and ready-to-eat food.

The USA pharmaceutical industry also facilitates business growth by employing polylysine as carrier drug and stabilizer drug formulation. Biocompatibility and biodegradability of the molecule impart proper applications in medicine under regulatory monitoring of drug safety legislation and drug efficacy legislation. Biotechnology technology technological innovation has increased productivity of production of new ways of making polylysine, lowering costs and prices. This has opened up opportunity for small- and medium-sized enterprises to enter the industry, resulting in competition and innovation.

Chinese polylysine is expanding at a very high rate with increasing demand due to the rapid industrialization, urbanization, and food consumption pattern change in the nation. Increasing demand for convenience food and processed food drove the demand for efficient preservatives, and hence polylysine was the initial choice.

Government patronage of the biotechnology and fermentation industry has allowed local production of polylysine and reduced the extent of dependency on importation in a bid to achieve domestic-based self-sufficiency. Initiatives such as the Made in China 2025 encourage high-tech industries such as the production of biotechnology polylysine in every region.

More and more, there has been a common feeling about food purity and safety, and the consumer is searching for safe and natural preservatives. Polylysine efficacy and safety are such a common feeling including the use of all foods.

Chinese personal and beauty care market is providing growth opportunity to polylysine, which is used based on antimicrobial activity and as a conditioner. Growth of middle-class population at a rate that is quite astronomically high along with rising disposable incomes is driving demand for high-end cosmetic products, thus pushing the market further ahead.

India is a high-growth and emerging polylysine market because of the fast-growing development of the food processing sector, expansion of health consciousness, and business-friendly policy of the India government. India possesses a significantly large number of young consumers who have a trend of package and convenience foods looking for efficient methods of preservation.

Indian government policies such as Pradhan Mantri Kisan Sampada Yojana (PMKSY) policies to foster the food processing sector and thus creating indirectly demand for such types of food items such as polylysine. They get space in infrastructure and technology with a great business climate resulting in market growth.

Since consumers were more concerned about the misuse of chemical preservatives, consumers preferred to opt for alternatives from the natural segment to replace it. Polylysine is a natural preservative and not an exception case here as well, for which polylysine is applied to all types of food.

Indian biotech and pharma industries also use polylysine applications in drug delivery formulation and formulation stabilizers. The material is biocompatible and stable, and these are good enough reasons to use the material for such applications, and hence the market grows.

| Segment | Value Share (2025) |

|---|---|

| Powder (By Form) | 68.2% |

Polylysine powder is the most desirable market segment because of its stability, simplicity of handling and higher usage in various industries. Polylysine is a natural antibacterial peptide and is used in preservation and bioactivity in various industries, primarily food and beverage, pharmacy, and cosmetics industry.

Polylysine powder has handling ease advantage over highly water-soluble liquids, shelf life, and dry addition. Food/drink and pharmaceutical industry applications of polylysine powder are mainly for making long shelf life in processed food, ready-to-use food, and milk food against microbial growth inhibition and oxidation. Polylysine powder has been utilized in the drug industry with application of its use as drug preparation, bio adhesives, and tissue engineering.

Other than this, polylysine powder has extended its use in immunostimulant and gut with efficacy. It is more frequently utilized as a food additive and functional food to facilitate consumers in shifting to growing demand for natural preservatives and bioactives.

| Segment | Value Share (2025) |

|---|---|

| Food and Beverage (By Application) | 54.7% |

The biggest use of polylysine is food and beverages as a preservative and antimicrobial. As the trend in the food and beverage market worldwide is changing toward the use of natural and clean-label preservatives, polylysine is emerging as the most valued safe and functional replacement for chemical preservatives such as potassium sorbate and sodium benzoate.

One of the best reasons why food and beverages grow with polylysine is increased shelf life, reduced food and beverage processing. While customers would be prevented urbanization and moving towards convenience, food industries are looking for quality and natural alternatives to leverage increased shelf life without sacrificing the quality of food.

They are very prone to microbial spoilage and natural antimicrobial substances such as polylysine are widely used for quality and freshness preservation during transportation and storage. Apart from this, processed meat and ready-to-eat food are also interest foods whose preservation polylysine is.

More and more people becoming interested in other meat foods prepared using plant, natural preservatives are also being demanded more and more, and thus polylysine is the best item to be added while preparing such food in order to make it safe and healthy.

Polylysine Market is controlled by market giants such as Merck & Co., Inc., Jiangsu Yiming Biological Technology Co., Ltd., Thomas Scientific, JNC Corporation, Siveele B.V., Zhengzhou Bainafo Bioengineering Co., Ltd., Ensince, Okuna Chemical Industries Co., Nanjing Shineking Biotech Co., Ltd., and Zhangshu Lion Biotechnology Co., Ltd.

They are dominating through product innovation in new applications of food preservative, pharmaceutical, and cosmetic uses, through strategic research & development, and process optimization of fermentation. Natural food and drink preservative demand is facing growing market for polylysine since it is showing antimicrobial activity towards fungus and bacteria. The firms are striving to raise production, product quality, and offer clean solutions in the way of going green and clean label.

The market also shows remarkable growth in applications of polylysine as a food preservative, especially in processed meat, dairy, and ready-to-eat food, as it has improved antimicrobial activity for shelf life and product quality improvement.

Companies are investing billions of dollars in biotechnological research for improved efficiency of the product process, lowering production costs, and easy large-scale industrialization. Secondly, polylysine of drug grade is also rapidly advancing into drug delivery, wound dressing, and antimicrobial film, thus reviving medical and healthcare uses of polylysine.

For instance:

The industry has been categorized into Powder and Liquid.

This segment is further categorized into Food & Beverage, Pharmaceuticals, Nutraceuticals, Cosmetics & Personal Care, Pet Food, and Animal Feed.

The market is analyzed across North America, Latin America, Western Europe, Eastern Europe, South Asia & Pacific, East Asia, Central Asia, Balkan & Baltic Countries, Russia & Belarus, and the Middle East & Africa.

The global industry is estimated at a value of USD 798.5 million in 2025.

Sales increased at 9.4% CAGR between 2020 and 2024.

Some of the leaders in this industry include Merck & Co., Inc., Jiangsu Yiming Biological Technology Co., Ltd., Thomas Scientific, JNC Corporation, Siveele B.V., Zhengzhou Bainafo Bioengineering Co., Ltd., Ensince, Okuna Chemical Industries Co., Nanjing Shineking Biotech Co., Ltd., Zhangshu Lion Biotechnology Co., Ltd., and Other Players.

The Asia-Pacific region is anticipated to maintain a significant market share, driven by increasing demand for natural preservatives in the food and beverage industry.

The industry is projected to grow at a forecast CAGR of 10.1% from 2025 to 2035.

Table 1: Global Market Value (US$ million) Forecast by Region, 2019 to 2034

Table 2: Global Market Volume (MT) Forecast by Region, 2019 to 2034

Table 3: Global Market Value (US$ million) Forecast by Form, 2019 to 2034

Table 4: Global Market Volume (MT) Forecast by Form, 2019 to 2034

Table 5: Global Market Value (US$ million) Forecast by Application, 2019 to 2034

Table 6: Global Market Volume (MT) Forecast by Application, 2019 to 2034

Table 7: North America Market Value (US$ million) Forecast by Country, 2019 to 2034

Table 8: North America Market Volume (MT) Forecast by Country, 2019 to 2034

Table 9: North America Market Value (US$ million) Forecast by Form, 2019 to 2034

Table 10: North America Market Volume (MT) Forecast by Form, 2019 to 2034

Table 11: North America Market Value (US$ million) Forecast by Application, 2019 to 2034

Table 12: North America Market Volume (MT) Forecast by Application, 2019 to 2034

Table 13: Latin America Market Value (US$ million) Forecast by Country, 2019 to 2034

Table 14: Latin America Market Volume (MT) Forecast by Country, 2019 to 2034

Table 15: Latin America Market Value (US$ million) Forecast by Form, 2019 to 2034

Table 16: Latin America Market Volume (MT) Forecast by Form, 2019 to 2034

Table 17: Latin America Market Value (US$ million) Forecast by Application, 2019 to 2034

Table 18: Latin America Market Volume (MT) Forecast by Application, 2019 to 2034

Table 19: Europe Market Value (US$ million) Forecast by Country, 2019 to 2034

Table 20: Europe Market Volume (MT) Forecast by Country, 2019 to 2034

Table 21: Europe Market Value (US$ million) Forecast by Form, 2019 to 2034

Table 22: Europe Market Volume (MT) Forecast by Form, 2019 to 2034

Table 23: Europe Market Value (US$ million) Forecast by Application, 2019 to 2034

Table 24: Europe Market Volume (MT) Forecast by Application, 2019 to 2034

Table 25: East Asia Market Value (US$ million) Forecast by Country, 2019 to 2034

Table 26: East Asia Market Volume (MT) Forecast by Country, 2019 to 2034

Table 27: East Asia Market Value (US$ million) Forecast by Form, 2019 to 2034

Table 28: East Asia Market Volume (MT) Forecast by Form, 2019 to 2034

Table 29: East Asia Market Value (US$ million) Forecast by Application, 2019 to 2034

Table 30: East Asia Market Volume (MT) Forecast by Application, 2019 to 2034

Table 31: South Asia Market Value (US$ million) Forecast by Country, 2019 to 2034

Table 32: South Asia Market Volume (MT) Forecast by Country, 2019 to 2034

Table 33: South Asia Market Value (US$ million) Forecast by Form, 2019 to 2034

Table 34: South Asia Market Volume (MT) Forecast by Form, 2019 to 2034

Table 35: South Asia Market Value (US$ million) Forecast by Application, 2019 to 2034

Table 36: South Asia Market Volume (MT) Forecast by Application, 2019 to 2034

Table 37: Oceania Market Value (US$ million) Forecast by Country, 2019 to 2034

Table 38: Oceania Market Volume (MT) Forecast by Country, 2019 to 2034

Table 39: Oceania Market Value (US$ million) Forecast by Form, 2019 to 2034

Table 40: Oceania Market Volume (MT) Forecast by Form, 2019 to 2034

Table 41: Oceania Market Value (US$ million) Forecast by Application, 2019 to 2034

Table 42: Oceania Market Volume (MT) Forecast by Application, 2019 to 2034

Table 43: Middle East & Africa Market Value (US$ million) Forecast by Country, 2019 to 2034

Table 44: Middle East & Africa Market Volume (MT) Forecast by Country, 2019 to 2034

Table 45: Middle East & Africa Market Value (US$ million) Forecast by Form, 2019 to 2034

Table 46: Middle East & Africa Market Volume (MT) Forecast by Form, 2019 to 2034

Table 47: Middle East & Africa Market Value (US$ million) Forecast by Application, 2019 to 2034

Table 48: Middle East & Africa Market Volume (MT) Forecast by Application, 2019 to 2034

Figure 1: Global Market Value (US$ million) by Form, 2024 to 2034

Figure 2: Global Market Value (US$ million) by Application, 2024 to 2034

Figure 3: Global Market Value (US$ million) by Region, 2024 to 2034

Figure 4: Global Market Value (US$ million) Analysis by Region, 2019 to 2034

Figure 5: Global Market Volume (MT) Analysis by Region, 2019 to 2034

Figure 6: Global Market Value Share (%) and BPS Analysis by Region, 2024 to 2034

Figure 7: Global Market Y-o-Y Growth (%) Projections by Region, 2024 to 2034

Figure 8: Global Market Value (US$ million) Analysis by Form, 2019 to 2034

Figure 9: Global Market Volume (MT) Analysis by Form, 2019 to 2034

Figure 10: Global Market Value Share (%) and BPS Analysis by Form, 2024 to 2034

Figure 11: Global Market Y-o-Y Growth (%) Projections by Form, 2024 to 2034

Figure 12: Global Market Value (US$ million) Analysis by Application, 2019 to 2034

Figure 13: Global Market Volume (MT) Analysis by Application, 2019 to 2034

Figure 14: Global Market Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 15: Global Market Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 16: Global Market Attractiveness by Form, 2024 to 2034

Figure 17: Global Market Attractiveness by Application, 2024 to 2034

Figure 18: Global Market Attractiveness by Region, 2024 to 2034

Figure 19: North America Market Value (US$ million) by Form, 2024 to 2034

Figure 20: North America Market Value (US$ million) by Application, 2024 to 2034

Figure 21: North America Market Value (US$ million) by Country, 2024 to 2034

Figure 22: North America Market Value (US$ million) Analysis by Country, 2019 to 2034

Figure 23: North America Market Volume (MT) Analysis by Country, 2019 to 2034

Figure 24: North America Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 25: North America Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 26: North America Market Value (US$ million) Analysis by Form, 2019 to 2034

Figure 27: North America Market Volume (MT) Analysis by Form, 2019 to 2034

Figure 28: North America Market Value Share (%) and BPS Analysis by Form, 2024 to 2034

Figure 29: North America Market Y-o-Y Growth (%) Projections by Form, 2024 to 2034

Figure 30: North America Market Value (US$ million) Analysis by Application, 2019 to 2034

Figure 31: North America Market Volume (MT) Analysis by Application, 2019 to 2034

Figure 32: North America Market Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 33: North America Market Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 34: North America Market Attractiveness by Form, 2024 to 2034

Figure 35: North America Market Attractiveness by Application, 2024 to 2034

Figure 36: North America Market Attractiveness by Country, 2024 to 2034

Figure 37: Latin America Market Value (US$ million) by Form, 2024 to 2034

Figure 38: Latin America Market Value (US$ million) by Application, 2024 to 2034

Figure 39: Latin America Market Value (US$ million) by Country, 2024 to 2034

Figure 40: Latin America Market Value (US$ million) Analysis by Country, 2019 to 2034

Figure 41: Latin America Market Volume (MT) Analysis by Country, 2019 to 2034

Figure 42: Latin America Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 43: Latin America Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 44: Latin America Market Value (US$ million) Analysis by Form, 2019 to 2034

Figure 45: Latin America Market Volume (MT) Analysis by Form, 2019 to 2034

Figure 46: Latin America Market Value Share (%) and BPS Analysis by Form, 2024 to 2034

Figure 47: Latin America Market Y-o-Y Growth (%) Projections by Form, 2024 to 2034

Figure 48: Latin America Market Value (US$ million) Analysis by Application, 2019 to 2034

Figure 49: Latin America Market Volume (MT) Analysis by Application, 2019 to 2034

Figure 50: Latin America Market Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 51: Latin America Market Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 52: Latin America Market Attractiveness by Form, 2024 to 2034

Figure 53: Latin America Market Attractiveness by Application, 2024 to 2034

Figure 54: Latin America Market Attractiveness by Country, 2024 to 2034

Figure 55: Europe Market Value (US$ million) by Form, 2024 to 2034

Figure 56: Europe Market Value (US$ million) by Application, 2024 to 2034

Figure 57: Europe Market Value (US$ million) by Country, 2024 to 2034

Figure 58: Europe Market Value (US$ million) Analysis by Country, 2019 to 2034

Figure 59: Europe Market Volume (MT) Analysis by Country, 2019 to 2034

Figure 60: Europe Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 61: Europe Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 62: Europe Market Value (US$ million) Analysis by Form, 2019 to 2034

Figure 63: Europe Market Volume (MT) Analysis by Form, 2019 to 2034

Figure 64: Europe Market Value Share (%) and BPS Analysis by Form, 2024 to 2034

Figure 65: Europe Market Y-o-Y Growth (%) Projections by Form, 2024 to 2034

Figure 66: Europe Market Value (US$ million) Analysis by Application, 2019 to 2034

Figure 67: Europe Market Volume (MT) Analysis by Application, 2019 to 2034

Figure 68: Europe Market Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 69: Europe Market Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 70: Europe Market Attractiveness by Form, 2024 to 2034

Figure 71: Europe Market Attractiveness by Application, 2024 to 2034

Figure 72: Europe Market Attractiveness by Country, 2024 to 2034

Figure 73: East Asia Market Value (US$ million) by Form, 2024 to 2034

Figure 74: East Asia Market Value (US$ million) by Application, 2024 to 2034

Figure 75: East Asia Market Value (US$ million) by Country, 2024 to 2034

Figure 76: East Asia Market Value (US$ million) Analysis by Country, 2019 to 2034

Figure 77: East Asia Market Volume (MT) Analysis by Country, 2019 to 2034

Figure 78: East Asia Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 79: East Asia Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 80: East Asia Market Value (US$ million) Analysis by Form, 2019 to 2034

Figure 81: East Asia Market Volume (MT) Analysis by Form, 2019 to 2034

Figure 82: East Asia Market Value Share (%) and BPS Analysis by Form, 2024 to 2034

Figure 83: East Asia Market Y-o-Y Growth (%) Projections by Form, 2024 to 2034

Figure 84: East Asia Market Value (US$ million) Analysis by Application, 2019 to 2034

Figure 85: East Asia Market Volume (MT) Analysis by Application, 2019 to 2034

Figure 86: East Asia Market Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 87: East Asia Market Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 88: East Asia Market Attractiveness by Form, 2024 to 2034

Figure 89: East Asia Market Attractiveness by Application, 2024 to 2034

Figure 90: East Asia Market Attractiveness by Country, 2024 to 2034

Figure 91: South Asia Market Value (US$ million) by Form, 2024 to 2034

Figure 92: South Asia Market Value (US$ million) by Application, 2024 to 2034

Figure 93: South Asia Market Value (US$ million) by Country, 2024 to 2034

Figure 94: South Asia Market Value (US$ million) Analysis by Country, 2019 to 2034

Figure 95: South Asia Market Volume (MT) Analysis by Country, 2019 to 2034

Figure 96: South Asia Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 97: South Asia Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 98: South Asia Market Value (US$ million) Analysis by Form, 2019 to 2034

Figure 99: South Asia Market Volume (MT) Analysis by Form, 2019 to 2034

Figure 100: South Asia Market Value Share (%) and BPS Analysis by Form, 2024 to 2034

Figure 101: South Asia Market Y-o-Y Growth (%) Projections by Form, 2024 to 2034

Figure 102: South Asia Market Value (US$ million) Analysis by Application, 2019 to 2034

Figure 103: South Asia Market Volume (MT) Analysis by Application, 2019 to 2034

Figure 104: South Asia Market Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 105: South Asia Market Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 106: South Asia Market Attractiveness by Form, 2024 to 2034

Figure 107: South Asia Market Attractiveness by Application, 2024 to 2034

Figure 108: South Asia Market Attractiveness by Country, 2024 to 2034

Figure 109: Oceania Market Value (US$ million) by Form, 2024 to 2034

Figure 110: Oceania Market Value (US$ million) by Application, 2024 to 2034

Figure 111: Oceania Market Value (US$ million) by Country, 2024 to 2034

Figure 112: Oceania Market Value (US$ million) Analysis by Country, 2019 to 2034

Figure 113: Oceania Market Volume (MT) Analysis by Country, 2019 to 2034

Figure 114: Oceania Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 115: Oceania Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 116: Oceania Market Value (US$ million) Analysis by Form, 2019 to 2034

Figure 117: Oceania Market Volume (MT) Analysis by Form, 2019 to 2034

Figure 118: Oceania Market Value Share (%) and BPS Analysis by Form, 2024 to 2034

Figure 119: Oceania Market Y-o-Y Growth (%) Projections by Form, 2024 to 2034

Figure 120: Oceania Market Value (US$ million) Analysis by Application, 2019 to 2034

Figure 121: Oceania Market Volume (MT) Analysis by Application, 2019 to 2034

Figure 122: Oceania Market Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 123: Oceania Market Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 124: Oceania Market Attractiveness by Form, 2024 to 2034

Figure 125: Oceania Market Attractiveness by Application, 2024 to 2034

Figure 126: Oceania Market Attractiveness by Country, 2024 to 2034

Figure 127: Middle East & Africa Market Value (US$ million) by Form, 2024 to 2034

Figure 128: Middle East & Africa Market Value (US$ million) by Application, 2024 to 2034

Figure 129: Middle East & Africa Market Value (US$ million) by Country, 2024 to 2034

Figure 130: Middle East & Africa Market Value (US$ million) Analysis by Country, 2019 to 2034

Figure 131: Middle East & Africa Market Volume (MT) Analysis by Country, 2019 to 2034

Figure 132: Middle East & Africa Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 133: Middle East & Africa Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 134: Middle East & Africa Market Value (US$ million) Analysis by Form, 2019 to 2034

Figure 135: Middle East & Africa Market Volume (MT) Analysis by Form, 2019 to 2034

Figure 136: Middle East & Africa Market Value Share (%) and BPS Analysis by Form, 2024 to 2034

Figure 137: Middle East & Africa Market Y-o-Y Growth (%) Projections by Form, 2024 to 2034

Figure 138: Middle East & Africa Market Value (US$ million) Analysis by Application, 2019 to 2034

Figure 139: Middle East & Africa Market Volume (MT) Analysis by Application, 2019 to 2034

Figure 140: Middle East & Africa Market Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 141: Middle East & Africa Market Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 142: Middle East & Africa Market Attractiveness by Form, 2024 to 2034

Figure 143: Middle East & Africa Market Attractiveness by Application, 2024 to 2034

Figure 144: Middle East & Africa Market Attractiveness by Country, 2024 to 2034

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA