Between 2025 and 2035 market for Poshtels (Luxury Hostels) will reach new heights and the market is likely to surpass the phenominal figure by the end of year 2035. Into affordable option with very good amenities and social experiences, attracting solo travelers, remote workers, and budget tourists alike. Poshtels which feature modern interiors, private rooms, co-working spaces and upscale communal spaces are intended for a more experience-seeking demographic than traditional hostels. Experiential travel, remote work culture, and social media-driven tourism have contributed to their popularity, and, as a result, demand for poshtels has boomed.

Travelers are looking for accommodations that balance comfort and affordability with a genuine way to engage in the local culture; poshtels fit the bill as a sustainable alternative to hotels and budget lodgings. Even with the rise of their popularity, issues such as regulatory compliance, competition for budget hotels and seasonal demand fluctuations remain. Yet, unique marketing activities, sustainable business practices, and, most importantly, harmonization with smart travel technologies will shape the future of the very industry.

North America continues to be a key area for poshtels, done in particular from the United States of America with Canadians, where budget conscious tourists, backpackers and remote workers are on the lookout for fashionable and community-based stays. From major metropolitan markets like New York, Los Angeles, Toronto and Vancouver, a growing number of poshtel properties are opening to serve domestic and international travelers.

The demand for poshtels in North America is driven by the rise of digital nomadism and co-living trends. Start-up cities and cities where there are greater opportunities for freelancers will be capitalising on hybrid hostel models, with co-working spaces and long-term stay. Moreover, environmental and sustainable hospitality efforts are on the rise, including the poshtel-room types, through which green building materials, energy efficient architecture, and waste reduction mechanisms become the norm.

The poshtel trend is most evident in Europe and especially in cities such as London, Berlin, Amsterdam and Barcelona. For Europeans, the backpacking culture and high volume of intra-European travel leads to widespread adoption of poshtels across the continent.

Several “poshtels” in Europe provide boutique hotel style for hostel prices, catering to young professionals, students and solo travelers in search of affordable lodging with style. Similarly, the flourishing of cultural tourism throughout Europe underpins the growth of social travel accommodations when travelers are looking for networking opportunities as well as comfortable low-cost lodging.

European governments have laws concerning short-term rentals and hostels, enforcing compliance with zoning laws, tax policies, and safety regulations. As a result, poshtel operators incorporate digital booking solutions, AI-powered pricing models, and contactless check-ins to optimize operations and ensure competitive pricing.

Asia-Pacific however is the fastest-growing region for poshtels, driven by burgeoning tourism, higher spending on travel, and an increased focus on experiential stays. Countries like Thailand, Japan, Indonesia, and Vietnam are at the forefront, with instagrammable, design-driven poshtels in major tourist hotspots.

The backpacking culture and budget travel trends lead poshtels to be in favour with young travelers in Southeast Asia. User-friendly customers in Asia-Pacific drive mobile app bookings, Facebook check-ins, and collaborating influencer marketing with poshtel industries. Smart automation, self-check-in kiosks, and AI-powered concierge services are also being deployed across the region's hospitality sector to improve guests’ overall experience.

Challenge

Market Positioning and Operational Efficiency

The poshtels market strives to define its niche, while providing affordable rates without compromising on luxury. Sandwiched between budget hostels and higher-end boutique hotels, poshtels have to find clever ways to stand apart with experiences as much as amenities and to keep costs down. Furthermore, without inflating prices, sustaining first-class service, contemporary amenities, and spaces for social engagement presents a challenge. This also requires navigating tricky regulations, zoning limits and adherence to sustainability measures that can limit their hospital activities. To meet these challenges head-on, operators of poshtels need to expand into efficient property management tools, introduce smart AI-based systems for guest personalization, and adopt eco-friendly practices that can help optimal profitability keeping affordability and exclusivity top of mind.

Opportunity

Growth in Experiential Travel and Digital Nomad Culture

Poshtels are reimaging the concept through features such as co-working spaces, themed interiors, smart booking platforms and AI-powered concierge services. The growing embrace of sustainable hospitality through eco-minded designs, renewable energy, and zero-waste efforts resonates with eco-travellers, too. Those who harness digital connectivity, immersive guest experiences and sustainable lodging practices will thrive within the evolving poshtels segment.

Between 2020 and 2024, increasing popularity of social travel, millennial and Gen Z backpackers, and flexible accommodation models. It improved market visibility, such as the rise of hybrid hospitality concepts combining hostel-style social spaces and boutique hotel comforts. But operational issues like inconsistent occupancy rates, high maintenance costs and competition from traditional hotels and Airbnb-type rentals capped profitability. In response, companies have up-scaled digital check-in solutions, enriched social identity areas, and implemented a flexible rate structure.

Looking ahead to 2025 to 2035, the market characterized by a shift toward the smart hospitality experience, guest customization using AI, and sustainable lodging innovations. VR-enhanced travel previews, AI-powered sleep optimization, and smart room automation these will set a whole new standard for the poshtel experience. Moreover, the rise of community-driven tourism, block chain-based loyalty programs and hyper-personalized guest experiences will add rooster to the industry. AI-Assisted Operations and Immersive Social Networking Features Powered Companies to Invest in Next Gen Sustainable Hospitality Solutions

Market Shifts: A Comparative Analysis (2020 to 2024 vs. 2025 to 2035)

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Compliance with zoning laws and sustainability regulations |

| Technological Advancements | Growth in app-based bookings and digital check-ins |

| Industry Adoption | Increased demand for budget-friendly yet stylish accommodations |

| Supply Chain and Sourcing | Dependence on traditional furniture and hospitality supplies |

| Market Competition | Presence of boutique hotels, hostels, and Airbnb-style rentals |

| Market Growth Drivers | Demand for affordable, stylish, and socially engaging accommodations |

| Sustainability and Energy Efficiency | Initial adoption of energy-efficient appliances and water-saving fixtures |

| Integration of Smart Monitoring | Limited use of guest behaviour tracking and operational analytics |

| Advancements in Hospitality Experience | Traditional hostel-style dorms and shared community spaces |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Expansion of AI-driven compliance tracking, carbon-neutral lodging mandates, and digital security measures. |

| Technological Advancements | Integration of AI-powered concierge services, VR travel previews, and smart room automation. |

| Industry Adoption | Expansion into AI-personalized guest experiences, blockchain-based loyalty programs, and smart hospitality integrations. |

| Supply Chain and Sourcing | Shift toward eco-friendly materials, modular room designs, and energy-efficient building solutions. |

| Market Competition | Rise of hybrid hospitality start-ups, tech-driven lodging solutions, and AI-managed co-living spaces. |

| Market Growth Drivers | Increased investment in smart tourism, AI-enhanced hospitality services, and sustainability-focused lodging solutions. |

| Sustainability and Energy Efficiency | Large-scale implementation of net-zero energy properties, AI-managed waste reduction, and carbon-offset travel initiatives. |

| Integration of Smart Monitoring | AI-driven occupancy forecasting, smart energy management, and personalized guest interaction platforms. |

| Advancements in Hospitality Experience | Evolution of AI-enhanced social networking features, immersive digital travel experiences, and personalized smart lodging solutions. |

The United States in response to millennial and Gen Z travellers seeking affordable, yet stylish, sleeping quarters. Rapid growth of digital nomadism and work-from-anywhere culture are driving demand for co-living and hybrid hospitality concepts and more recently expanding the poshtel segment.

Cities like New York, Los Angeles and Miami are witnessing a scramble for real estate to create upscale hostels that combine boutique-hotel touches with social opportunities. Sustainable tourism initiatives are encouraging travellers to search for eco-friendly, community-driven accommodations like poshtels.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 5.8% |

Cities including London, Manchester, and Edinburgh are experiencing an influx of boutique hostel chains, which have amenities to rival hotels like private en-suite rooms, co-working spaces, and rooftop lounges.

The market growth has also been bolstered by the increasing population of student and young professional’s travellers, who prefer budget, sexier and simpler places as opposed to hotels. This also fits the poshtel model paired with sustainable tourism initiatives the UK.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 5.6% |

The European poshtel market Thanks to growing interest in budget travel, solo tourism and digital nomadisation. Countries such as Spain, France, Germany, and Italy are leading the pack, with poshtel openings in big cities like Barcelona, Paris, Berlin, and Rome.

Thanks to the EU’s robust tourism industry, solid transportation networks, and focus on sustainable travel, it is a ripe market for budget-friendly, but high-end lodging options. Bear in mind that many historic buildings and boutique properties are being transformed into luxury hostels, offering travelling benefits of culture, design and a relatively high cost to spend.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 5.7% |

Demand for themed accommodations, capsule-style poshtels and shared social experiences appeals to both young international travellers and domestic tourists. Japan’s push for sustainable tourism and tech-based accommodation experience is leading to the advent of smart poshtels with digital check-ins, automated services, and AI-fuelled guest experiences.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 5.9% |

The poshtel market in Korea is expanding steadily, fuelled by a combination of increasing domestic and inbound tourism, the influence of K-culture, and an increase in solo travel trends. In fact, Korean cities such as Seoul, Busan, and Jeju Island have seen a boom in the development of poshtels. Noting that emerging co-living and co-working hospitality models are also driving market growth, the report cites an uptick in digitally connected, community-driven accommodations. And the popularity of social media and influencer-driven travel in South Korea.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 5.8% |

Private rooms and family rooms represent a large share of the poshtel (luxury hostel) market as travellers seek midrange price points that offer the comforts of boutique hotels with the social experience of hostels. These new models of accommodation are redefining budget travel by offering stylish, design-led and experience-driven places to stay and are all but essential for a new cohort of modern, experience-hungry travellers, digital nomads and families on a budget.

Perhaps most well-liked of all the accommodation choices in poshtels, these are private rooms where travellers get to have the comfort of affordability and privacy without having to give up access to common social arenas. As opposed to more conventional hostels, which are biased toward having a dormitory mode of life, poshtels are for travellers who want a more intimate and quieter space to sleep in, while still benefiting from the community and networking aspects of a shared facility.

Demand for private rooms in poshtels has exploded as modern travellers increasingly value convenience but also prioritized comfort and community engagement, so you see space-efficient locations with stylish, affordable private accommodations, full-on en-suite bathrooms, and premium bedding. Research shows that nearly two-thirds of poshtel bookings are made by travellers who book private rooms clicked through to their own separate bedrooms rather than shared dormitories, ensuring healthy demand for this market.

While the segment offers benefits for privacy, comfort, and social interaction, higher operational costs for poshtel operators, maintenance for each space, and the price sensitivity in a budget-centric travel market create challenges. But disruptive innovations like AI-enabled customized room-styling preferences, green-focused eco-lodging models, and amortized long-stay rates are increasing operational efficiency, reducing costs and boosting guest experience, all of which mean that the private room segment of poshtel hosting is here to stay and continue to grow into the market.

Family rooms have experienced strong market adoption, particularly in urban poshtels, adventure travel destinations, and family-friendly city centres, as travellers are ever more seeking cost-effective and interactive accommodations for group and family stays. But unlike traditional hotels, which can be costly and lacking design, poshtels feature modern designs, interactive communal spaces and experience-driven amenities that are appealing to families.

The increasing popularity of family travel on a budget, with multi-bed rooms, child-friendly services and shared entertainment spaces, has prompted the adoption of family rooms in poshtels, with families looking for sleek rooms on a budget. Research suggests that more than 40% of family travellers prefer poshtels to hotels, citing lower prices and friendly socialization, so it is a segment that can expect strong demand.

Increasing popularity of multi-generational and experiential family travel with cultural immersion, group activities and experiences in local surroundings, have further enhanced market demand and resulted in wider acceptance of family rooms in poshtels serving extended family holidays.

The rise in adoption has also been helped by the inclusion of child-friendly services such as game zones, interactive learning spaces and family movie nights, which provide parents greater convenience and enhance the overall experience for families on the road.

The rise of flexible family room configurations, multiple bed arrangements, convertible furniture, and distinct sleeping configurations for adults and children have further driven market growth, and multiple bed arrangements are allowing for greater flexibility catering to different family sizes and travel preferences.

Moreover, the trend towards the adoption of themed family accommodations, equipped with rooms designed for adventure, nature-inspired interiors, and interactive storytelling spaces, has further enhanced the growth of the market, owing to better engagement with experience-driven family travellers.

While Family Room has strong points thanks to its affordability, great for family bonding, and more spacious, the segment has a few challenges around the higher maintenance cost with the bigger space, seasonality in demand, and poshtel that still does not have enough inventory, especially in urban. New innovations around AI-adaptive rooms, sustainable family travel programs, and smart kid-friendly hospitality technology are increasing efficiency, guest experience and marketability and ensuring the poshtel space stays a vibrant and expanding space for family rooms going forward.

Travelers are yearning for more efficient online conveniences, flexible reserving governments, and last-minute reservations to ultimately maximize their travel accommodations over these two major market driving segments of the travel booking segment, subsequently growing their global travel booking system market.

These channels provide instant booking confirmation, a plethora of payment choices, and AI-curated, personalised recommendations, making them a top contender for poshtel bookings. Whereas with in-person bookings, online reservations enable travellers to compare prices, read guest reviews, and book accommodations instantly.

Access to mobile-app exclusive discounts, services such as AI-based room customization and automated check-in processes is rapidly becoming more accessible, increasing adoption of online booking platforms for poshtels as tech forward travel shoppers prioritize digital-first immunity from booking disruptions. Online bookings of poshtels represent more than 75% of market bookings which again confirms the strong move in this segment.

With a rise in digital-first travel planning showing price dynamics algorithms, real-time availability tracking, and itinerary suggestions based on artificial intelligence the demand in the market has become stronger, ensuring more users choosing an online booking channel for poshtels.

Although it has several advantages such as convenience, instant booking and digital personalization, the online booking space does come with heavy competition with traditional hotel booking platforms based on price, skepticism from customers on the genuineness of new poshtel brands and legal concerns over data security during online transactions. Fortunately, various innovations from block chain-based booking verifications, AI chat-based travel assistance, and virtual reality (VR) room previewing are increasing customer trust, engagement, and price assurance, thus validating ongoing market growth in online poshtel reservations.

In-person booking has seen broad market adoption, especially in backpacking hubs, last minute travel spots and city-centre poshtels as walk-in guests seek increasingly flexible, no reservation required accommodation. While online reservations can book up almost instantly, booking in person offers same-day availability, more hand-holding on check-in, and a chance to check the room before committing to a stay. Increasing demand for my-pimples-stil-go backpackers, road trippers and off-the-grid adventuring has led to widespread adoption of in-person booking for poshtels, as traveller seek flexible and at-a-moment location options for accommodation.

While it removes the advantages of flexibility, real-time decision-making, and direct guest interaction, the in-person booking segment still faces limitations such as a lack of availability during peak seasons, reliance on walk-in foot traffic, and manual check-in processing. While traditional in-person booking methods may seem slower, more tedious, and less efficient compared to emerging solutions such as self-service kiosks, AI-powered front desk agents, or digital automation processes for check-ins, the poshtel industry is continuously growing to accommodate walk-in guests.

The poshtels market is booming there is growing demand for young people for simple, but fashionable accommodation, for social travel experience and for lodgings that are friendly to digital nomads. From AI-Infused Booking Platforms and Hybrid Co-Living Spaces to Eco-Conscious Hospitality Design, Companies Are Rethinking How They Engage Guests, Operate Services, and Serve the Planet The market comprises global poshtel chains, boutique hostel brands, and online travel aggregators that all call for technological advancements.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Generator Hostels | 18-22% |

| Selina | 12-16% |

| Clink Hostels | 10-14% |

| Freehand Hotels | 8-12% |

| JO&JOE (Accor Group) | 5-9% |

| Other Boutique Poshtels & Independents (combined) | 35-45% |

| Company Name | Key Offerings/Activities |

|---|---|

| Generator Hostels | Develops stylish, design-focused hostels in prime city locations, integrating co-working spaces and social events. |

| Selina | Specializes in co-living and co-working hybrid hostels with wellness programs, surf camps, and digital nomad-friendly amenities. |

| Clink Hostels | Provides budget-friendly luxury hostels with immersive cultural experiences and modern shared living spaces. |

| Freehand Hotels | Offers trendy, upscale hostels blending boutique hotel aesthetics with social accommodation concepts. |

| JO&JOE (Accor Group) | Focuses on urban, tech-savvy poshtels integrating flexible lodging options, digital check-in, and social hubs. |

Generator Hostels (18-22%)

Generator Hostels is tops in the poshtels arena, with boutique hostel accommodations, cool social spaces, co-living capabilities and city-center locations.

Selina (12-16%)

They specializes in hybrid co-living/co-workspaces, community-driven travel, and working with digital nomads.

Clink Hostels (10-14%)

Clink is a new concept for affordable, stylish shared accommodation that combines cultural events, social networking and interactive guest experiences.

Freehand Hotels (8-12%)

Freehand builds luxury hostels with boutique hotel amenities, giving a budget-conscious twist on an upscale, design-forward guest experience.

JO&JOE (5-9%)

Smart, social living spaces with AI-powered guest personalization, eco-friendly lodging doors open to tech-driven hospitality solutions provided.

Other Key Players (35-45% Combined)

Next generation poshtel innovations, AI-powered guest engagement, and sustainable hospitality development can all be attributed to a mix of boutique hostel brands, hospitality start-ups, and independent operators. These include:

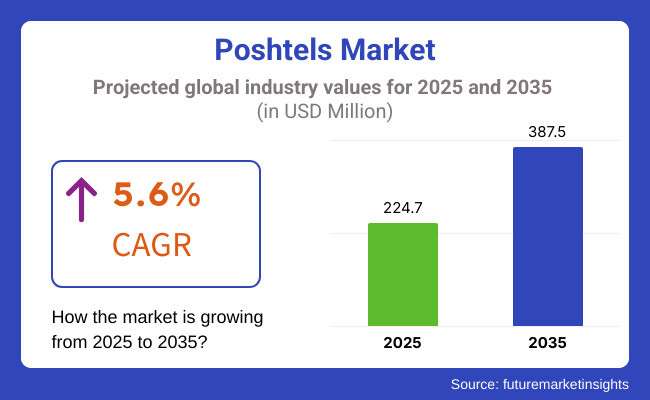

The overall market size for poshtels market was USD 224.7 Million in 2025.

The market poshtels is expected to reach USD 387.5 Million in 2035.

The demand for the poshtels market will grow due to the rising preference for affordable yet stylish accommodations, increasing millennial and Gen Z travel trends, growing demand for social and experiential stays, and the expansion of digital nomad culture, driving innovative hospitality solutions.

The top 5 countries which drives the development of poshtels market are USA, UK, Europe Union, Japan and South Korea.

Private rooms and family rooms drive market to command significant share over the assessment period.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Value (US$ Million) Forecast by Accommodation Type, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Booking Channel, 2018 to 2033

Table 4: Global Market Value (US$ Million) Forecast by Tourist Type, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Tour Type, 2018 to 2033

Table 6: Global Market Value (US$ Million) Forecast by Consumer Orientation, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by Age Group, 2018 to 2033

Table 8: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Accommodation Type, 2018 to 2033

Table 10: North America Market Value (US$ Million) Forecast by Booking Channel, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Tourist Type, 2018 to 2033

Table 12: North America Market Value (US$ Million) Forecast by Tour Type, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by Consumer Orientation, 2018 to 2033

Table 14: North America Market Value (US$ Million) Forecast by Age Group, 2018 to 2033

Table 15: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 16: Latin America Market Value (US$ Million) Forecast by Accommodation Type, 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by Booking Channel, 2018 to 2033

Table 18: Latin America Market Value (US$ Million) Forecast by Tourist Type, 2018 to 2033

Table 19: Latin America Market Value (US$ Million) Forecast by Tour Type, 2018 to 2033

Table 20: Latin America Market Value (US$ Million) Forecast by Consumer Orientation, 2018 to 2033

Table 21: Latin America Market Value (US$ Million) Forecast by Age Group, 2018 to 2033

Table 22: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 23: Western Europe Market Value (US$ Million) Forecast by Accommodation Type, 2018 to 2033

Table 24: Western Europe Market Value (US$ Million) Forecast by Booking Channel, 2018 to 2033

Table 25: Western Europe Market Value (US$ Million) Forecast by Tourist Type, 2018 to 2033

Table 26: Western Europe Market Value (US$ Million) Forecast by Tour Type, 2018 to 2033

Table 27: Western Europe Market Value (US$ Million) Forecast by Consumer Orientation, 2018 to 2033

Table 28: Western Europe Market Value (US$ Million) Forecast by Age Group, 2018 to 2033

Table 29: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 30: Eastern Europe Market Value (US$ Million) Forecast by Accommodation Type, 2018 to 2033

Table 31: Eastern Europe Market Value (US$ Million) Forecast by Booking Channel, 2018 to 2033

Table 32: Eastern Europe Market Value (US$ Million) Forecast by Tourist Type, 2018 to 2033

Table 33: Eastern Europe Market Value (US$ Million) Forecast by Tour Type, 2018 to 2033

Table 34: Eastern Europe Market Value (US$ Million) Forecast by Consumer Orientation, 2018 to 2033

Table 35: Eastern Europe Market Value (US$ Million) Forecast by Age Group, 2018 to 2033

Table 36: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 37: South Asia and Pacific Market Value (US$ Million) Forecast by Accommodation Type, 2018 to 2033

Table 38: South Asia and Pacific Market Value (US$ Million) Forecast by Booking Channel, 2018 to 2033

Table 39: South Asia and Pacific Market Value (US$ Million) Forecast by Tourist Type, 2018 to 2033

Table 40: South Asia and Pacific Market Value (US$ Million) Forecast by Tour Type, 2018 to 2033

Table 41: South Asia and Pacific Market Value (US$ Million) Forecast by Consumer Orientation, 2018 to 2033

Table 42: South Asia and Pacific Market Value (US$ Million) Forecast by Age Group, 2018 to 2033

Table 43: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 44: East Asia Market Value (US$ Million) Forecast by Accommodation Type, 2018 to 2033

Table 45: East Asia Market Value (US$ Million) Forecast by Booking Channel, 2018 to 2033

Table 46: East Asia Market Value (US$ Million) Forecast by Tourist Type, 2018 to 2033

Table 47: East Asia Market Value (US$ Million) Forecast by Tour Type, 2018 to 2033

Table 48: East Asia Market Value (US$ Million) Forecast by Consumer Orientation, 2018 to 2033

Table 49: East Asia Market Value (US$ Million) Forecast by Age Group, 2018 to 2033

Table 50: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 51: Middle East and Africa Market Value (US$ Million) Forecast by Accommodation Type, 2018 to 2033

Table 52: Middle East and Africa Market Value (US$ Million) Forecast by Booking Channel, 2018 to 2033

Table 53: Middle East and Africa Market Value (US$ Million) Forecast by Tourist Type, 2018 to 2033

Table 54: Middle East and Africa Market Value (US$ Million) Forecast by Tour Type, 2018 to 2033

Table 55: Middle East and Africa Market Value (US$ Million) Forecast by Consumer Orientation, 2018 to 2033

Table 56: Middle East and Africa Market Value (US$ Million) Forecast by Age Group, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Accommodation Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Booking Channel, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Tourist Type, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Tour Type, 2023 to 2033

Figure 5: Global Market Value (US$ Million) by Consumer Orientation, 2023 to 2033

Figure 6: Global Market Value (US$ Million) by Age Group, 2023 to 2033

Figure 7: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 8: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 9: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 10: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 11: Global Market Value (US$ Million) Analysis by Accommodation Type, 2018 to 2033

Figure 12: Global Market Value Share (%) and BPS Analysis by Accommodation Type, 2023 to 2033

Figure 13: Global Market Y-o-Y Growth (%) Projections by Accommodation Type, 2023 to 2033

Figure 14: Global Market Value (US$ Million) Analysis by Booking Channel, 2018 to 2033

Figure 15: Global Market Value Share (%) and BPS Analysis by Booking Channel, 2023 to 2033

Figure 16: Global Market Y-o-Y Growth (%) Projections by Booking Channel, 2023 to 2033

Figure 17: Global Market Value (US$ Million) Analysis by Tourist Type, 2018 to 2033

Figure 18: Global Market Value Share (%) and BPS Analysis by Tourist Type, 2023 to 2033

Figure 19: Global Market Y-o-Y Growth (%) Projections by Tourist Type, 2023 to 2033

Figure 20: Global Market Value (US$ Million) Analysis by Tour Type, 2018 to 2033

Figure 21: Global Market Value Share (%) and BPS Analysis by Tour Type, 2023 to 2033

Figure 22: Global Market Y-o-Y Growth (%) Projections by Tour Type, 2023 to 2033

Figure 23: Global Market Value (US$ Million) Analysis by Consumer Orientation, 2018 to 2033

Figure 24: Global Market Value Share (%) and BPS Analysis by Consumer Orientation, 2023 to 2033

Figure 25: Global Market Y-o-Y Growth (%) Projections by Consumer Orientation, 2023 to 2033

Figure 26: Global Market Value (US$ Million) Analysis by Age Group, 2018 to 2033

Figure 27: Global Market Value Share (%) and BPS Analysis by Age Group, 2023 to 2033

Figure 28: Global Market Y-o-Y Growth (%) Projections by Age Group, 2023 to 2033

Figure 29: Global Market Attractiveness by Accommodation Type, 2023 to 2033

Figure 30: Global Market Attractiveness by Booking Channel, 2023 to 2033

Figure 31: Global Market Attractiveness by Tourist Type, 2023 to 2033

Figure 32: Global Market Attractiveness by Tour Type, 2023 to 2033

Figure 33: Global Market Attractiveness by Consumer Orientation, 2023 to 2033

Figure 34: Global Market Attractiveness by Age Group, 2023 to 2033

Figure 35: Global Market Attractiveness by Region, 2023 to 2033

Figure 36: North America Market Value (US$ Million) by Accommodation Type, 2023 to 2033

Figure 37: North America Market Value (US$ Million) by Booking Channel, 2023 to 2033

Figure 38: North America Market Value (US$ Million) by Tourist Type, 2023 to 2033

Figure 39: North America Market Value (US$ Million) by Tour Type, 2023 to 2033

Figure 40: North America Market Value (US$ Million) by Consumer Orientation, 2023 to 2033

Figure 41: North America Market Value (US$ Million) by Age Group, 2023 to 2033

Figure 42: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 43: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 44: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 45: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 46: North America Market Value (US$ Million) Analysis by Accommodation Type, 2018 to 2033

Figure 47: North America Market Value Share (%) and BPS Analysis by Accommodation Type, 2023 to 2033

Figure 48: North America Market Y-o-Y Growth (%) Projections by Accommodation Type, 2023 to 2033

Figure 49: North America Market Value (US$ Million) Analysis by Booking Channel, 2018 to 2033

Figure 50: North America Market Value Share (%) and BPS Analysis by Booking Channel, 2023 to 2033

Figure 51: North America Market Y-o-Y Growth (%) Projections by Booking Channel, 2023 to 2033

Figure 52: North America Market Value (US$ Million) Analysis by Tourist Type, 2018 to 2033

Figure 53: North America Market Value Share (%) and BPS Analysis by Tourist Type, 2023 to 2033

Figure 54: North America Market Y-o-Y Growth (%) Projections by Tourist Type, 2023 to 2033

Figure 55: North America Market Value (US$ Million) Analysis by Tour Type, 2018 to 2033

Figure 56: North America Market Value Share (%) and BPS Analysis by Tour Type, 2023 to 2033

Figure 57: North America Market Y-o-Y Growth (%) Projections by Tour Type, 2023 to 2033

Figure 58: North America Market Value (US$ Million) Analysis by Consumer Orientation, 2018 to 2033

Figure 59: North America Market Value Share (%) and BPS Analysis by Consumer Orientation, 2023 to 2033

Figure 60: North America Market Y-o-Y Growth (%) Projections by Consumer Orientation, 2023 to 2033

Figure 61: North America Market Value (US$ Million) Analysis by Age Group, 2018 to 2033

Figure 62: North America Market Value Share (%) and BPS Analysis by Age Group, 2023 to 2033

Figure 63: North America Market Y-o-Y Growth (%) Projections by Age Group, 2023 to 2033

Figure 64: North America Market Attractiveness by Accommodation Type, 2023 to 2033

Figure 65: North America Market Attractiveness by Booking Channel, 2023 to 2033

Figure 66: North America Market Attractiveness by Tourist Type, 2023 to 2033

Figure 67: North America Market Attractiveness by Tour Type, 2023 to 2033

Figure 68: North America Market Attractiveness by Consumer Orientation, 2023 to 2033

Figure 69: North America Market Attractiveness by Age Group, 2023 to 2033

Figure 70: North America Market Attractiveness by Country, 2023 to 2033

Figure 71: Latin America Market Value (US$ Million) by Accommodation Type, 2023 to 2033

Figure 72: Latin America Market Value (US$ Million) by Booking Channel, 2023 to 2033

Figure 73: Latin America Market Value (US$ Million) by Tourist Type, 2023 to 2033

Figure 74: Latin America Market Value (US$ Million) by Tour Type, 2023 to 2033

Figure 75: Latin America Market Value (US$ Million) by Consumer Orientation, 2023 to 2033

Figure 76: Latin America Market Value (US$ Million) by Age Group, 2023 to 2033

Figure 77: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 78: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 79: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 80: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 81: Latin America Market Value (US$ Million) Analysis by Accommodation Type, 2018 to 2033

Figure 82: Latin America Market Value Share (%) and BPS Analysis by Accommodation Type, 2023 to 2033

Figure 83: Latin America Market Y-o-Y Growth (%) Projections by Accommodation Type, 2023 to 2033

Figure 84: Latin America Market Value (US$ Million) Analysis by Booking Channel, 2018 to 2033

Figure 85: Latin America Market Value Share (%) and BPS Analysis by Booking Channel, 2023 to 2033

Figure 86: Latin America Market Y-o-Y Growth (%) Projections by Booking Channel, 2023 to 2033

Figure 87: Latin America Market Value (US$ Million) Analysis by Tourist Type, 2018 to 2033

Figure 88: Latin America Market Value Share (%) and BPS Analysis by Tourist Type, 2023 to 2033

Figure 89: Latin America Market Y-o-Y Growth (%) Projections by Tourist Type, 2023 to 2033

Figure 90: Latin America Market Value (US$ Million) Analysis by Tour Type, 2018 to 2033

Figure 91: Latin America Market Value Share (%) and BPS Analysis by Tour Type, 2023 to 2033

Figure 92: Latin America Market Y-o-Y Growth (%) Projections by Tour Type, 2023 to 2033

Figure 93: Latin America Market Value (US$ Million) Analysis by Consumer Orientation, 2018 to 2033

Figure 94: Latin America Market Value Share (%) and BPS Analysis by Consumer Orientation, 2023 to 2033

Figure 95: Latin America Market Y-o-Y Growth (%) Projections by Consumer Orientation, 2023 to 2033

Figure 96: Latin America Market Value (US$ Million) Analysis by Age Group, 2018 to 2033

Figure 97: Latin America Market Value Share (%) and BPS Analysis by Age Group, 2023 to 2033

Figure 98: Latin America Market Y-o-Y Growth (%) Projections by Age Group, 2023 to 2033

Figure 99: Latin America Market Attractiveness by Accommodation Type, 2023 to 2033

Figure 100: Latin America Market Attractiveness by Booking Channel, 2023 to 2033

Figure 101: Latin America Market Attractiveness by Tourist Type, 2023 to 2033

Figure 102: Latin America Market Attractiveness by Tour Type, 2023 to 2033

Figure 103: Latin America Market Attractiveness by Consumer Orientation, 2023 to 2033

Figure 104: Latin America Market Attractiveness by Age Group, 2023 to 2033

Figure 105: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 106: Western Europe Market Value (US$ Million) by Accommodation Type, 2023 to 2033

Figure 107: Western Europe Market Value (US$ Million) by Booking Channel, 2023 to 2033

Figure 108: Western Europe Market Value (US$ Million) by Tourist Type, 2023 to 2033

Figure 109: Western Europe Market Value (US$ Million) by Tour Type, 2023 to 2033

Figure 110: Western Europe Market Value (US$ Million) by Consumer Orientation, 2023 to 2033

Figure 111: Western Europe Market Value (US$ Million) by Age Group, 2023 to 2033

Figure 112: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 113: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 114: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 115: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 116: Western Europe Market Value (US$ Million) Analysis by Accommodation Type, 2018 to 2033

Figure 117: Western Europe Market Value Share (%) and BPS Analysis by Accommodation Type, 2023 to 2033

Figure 118: Western Europe Market Y-o-Y Growth (%) Projections by Accommodation Type, 2023 to 2033

Figure 119: Western Europe Market Value (US$ Million) Analysis by Booking Channel, 2018 to 2033

Figure 120: Western Europe Market Value Share (%) and BPS Analysis by Booking Channel, 2023 to 2033

Figure 121: Western Europe Market Y-o-Y Growth (%) Projections by Booking Channel, 2023 to 2033

Figure 122: Western Europe Market Value (US$ Million) Analysis by Tourist Type, 2018 to 2033

Figure 123: Western Europe Market Value Share (%) and BPS Analysis by Tourist Type, 2023 to 2033

Figure 124: Western Europe Market Y-o-Y Growth (%) Projections by Tourist Type, 2023 to 2033

Figure 125: Western Europe Market Value (US$ Million) Analysis by Tour Type, 2018 to 2033

Figure 126: Western Europe Market Value Share (%) and BPS Analysis by Tour Type, 2023 to 2033

Figure 127: Western Europe Market Y-o-Y Growth (%) Projections by Tour Type, 2023 to 2033

Figure 128: Western Europe Market Value (US$ Million) Analysis by Consumer Orientation, 2018 to 2033

Figure 129: Western Europe Market Value Share (%) and BPS Analysis by Consumer Orientation, 2023 to 2033

Figure 130: Western Europe Market Y-o-Y Growth (%) Projections by Consumer Orientation, 2023 to 2033

Figure 131: Western Europe Market Value (US$ Million) Analysis by Age Group, 2018 to 2033

Figure 132: Western Europe Market Value Share (%) and BPS Analysis by Age Group, 2023 to 2033

Figure 133: Western Europe Market Y-o-Y Growth (%) Projections by Age Group, 2023 to 2033

Figure 134: Western Europe Market Attractiveness by Accommodation Type, 2023 to 2033

Figure 135: Western Europe Market Attractiveness by Booking Channel, 2023 to 2033

Figure 136: Western Europe Market Attractiveness by Tourist Type, 2023 to 2033

Figure 137: Western Europe Market Attractiveness by Tour Type, 2023 to 2033

Figure 138: Western Europe Market Attractiveness by Consumer Orientation, 2023 to 2033

Figure 139: Western Europe Market Attractiveness by Age Group, 2023 to 2033

Figure 140: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 141: Eastern Europe Market Value (US$ Million) by Accommodation Type, 2023 to 2033

Figure 142: Eastern Europe Market Value (US$ Million) by Booking Channel, 2023 to 2033

Figure 143: Eastern Europe Market Value (US$ Million) by Tourist Type, 2023 to 2033

Figure 144: Eastern Europe Market Value (US$ Million) by Tour Type, 2023 to 2033

Figure 145: Eastern Europe Market Value (US$ Million) by Consumer Orientation, 2023 to 2033

Figure 146: Eastern Europe Market Value (US$ Million) by Age Group, 2023 to 2033

Figure 147: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 148: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 149: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 150: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 151: Eastern Europe Market Value (US$ Million) Analysis by Accommodation Type, 2018 to 2033

Figure 152: Eastern Europe Market Value Share (%) and BPS Analysis by Accommodation Type, 2023 to 2033

Figure 153: Eastern Europe Market Y-o-Y Growth (%) Projections by Accommodation Type, 2023 to 2033

Figure 154: Eastern Europe Market Value (US$ Million) Analysis by Booking Channel, 2018 to 2033

Figure 155: Eastern Europe Market Value Share (%) and BPS Analysis by Booking Channel, 2023 to 2033

Figure 156: Eastern Europe Market Y-o-Y Growth (%) Projections by Booking Channel, 2023 to 2033

Figure 157: Eastern Europe Market Value (US$ Million) Analysis by Tourist Type, 2018 to 2033

Figure 158: Eastern Europe Market Value Share (%) and BPS Analysis by Tourist Type, 2023 to 2033

Figure 159: Eastern Europe Market Y-o-Y Growth (%) Projections by Tourist Type, 2023 to 2033

Figure 160: Eastern Europe Market Value (US$ Million) Analysis by Tour Type, 2018 to 2033

Figure 161: Eastern Europe Market Value Share (%) and BPS Analysis by Tour Type, 2023 to 2033

Figure 162: Eastern Europe Market Y-o-Y Growth (%) Projections by Tour Type, 2023 to 2033

Figure 163: Eastern Europe Market Value (US$ Million) Analysis by Consumer Orientation, 2018 to 2033

Figure 164: Eastern Europe Market Value Share (%) and BPS Analysis by Consumer Orientation, 2023 to 2033

Figure 165: Eastern Europe Market Y-o-Y Growth (%) Projections by Consumer Orientation, 2023 to 2033

Figure 166: Eastern Europe Market Value (US$ Million) Analysis by Age Group, 2018 to 2033

Figure 167: Eastern Europe Market Value Share (%) and BPS Analysis by Age Group, 2023 to 2033

Figure 168: Eastern Europe Market Y-o-Y Growth (%) Projections by Age Group, 2023 to 2033

Figure 169: Eastern Europe Market Attractiveness by Accommodation Type, 2023 to 2033

Figure 170: Eastern Europe Market Attractiveness by Booking Channel, 2023 to 2033

Figure 171: Eastern Europe Market Attractiveness by Tourist Type, 2023 to 2033

Figure 172: Eastern Europe Market Attractiveness by Tour Type, 2023 to 2033

Figure 173: Eastern Europe Market Attractiveness by Consumer Orientation, 2023 to 2033

Figure 174: Eastern Europe Market Attractiveness by Age Group, 2023 to 2033

Figure 175: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 176: South Asia and Pacific Market Value (US$ Million) by Accommodation Type, 2023 to 2033

Figure 177: South Asia and Pacific Market Value (US$ Million) by Booking Channel, 2023 to 2033

Figure 178: South Asia and Pacific Market Value (US$ Million) by Tourist Type, 2023 to 2033

Figure 179: South Asia and Pacific Market Value (US$ Million) by Tour Type, 2023 to 2033

Figure 180: South Asia and Pacific Market Value (US$ Million) by Consumer Orientation, 2023 to 2033

Figure 181: South Asia and Pacific Market Value (US$ Million) by Age Group, 2023 to 2033

Figure 182: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 183: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 184: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 185: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 186: South Asia and Pacific Market Value (US$ Million) Analysis by Accommodation Type, 2018 to 2033

Figure 187: South Asia and Pacific Market Value Share (%) and BPS Analysis by Accommodation Type, 2023 to 2033

Figure 188: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Accommodation Type, 2023 to 2033

Figure 189: South Asia and Pacific Market Value (US$ Million) Analysis by Booking Channel, 2018 to 2033

Figure 190: South Asia and Pacific Market Value Share (%) and BPS Analysis by Booking Channel, 2023 to 2033

Figure 191: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Booking Channel, 2023 to 2033

Figure 192: South Asia and Pacific Market Value (US$ Million) Analysis by Tourist Type, 2018 to 2033

Figure 193: South Asia and Pacific Market Value Share (%) and BPS Analysis by Tourist Type, 2023 to 2033

Figure 194: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Tourist Type, 2023 to 2033

Figure 195: South Asia and Pacific Market Value (US$ Million) Analysis by Tour Type, 2018 to 2033

Figure 196: South Asia and Pacific Market Value Share (%) and BPS Analysis by Tour Type, 2023 to 2033

Figure 197: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Tour Type, 2023 to 2033

Figure 198: South Asia and Pacific Market Value (US$ Million) Analysis by Consumer Orientation, 2018 to 2033

Figure 199: South Asia and Pacific Market Value Share (%) and BPS Analysis by Consumer Orientation, 2023 to 2033

Figure 200: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Consumer Orientation, 2023 to 2033

Figure 201: South Asia and Pacific Market Value (US$ Million) Analysis by Age Group, 2018 to 2033

Figure 202: South Asia and Pacific Market Value Share (%) and BPS Analysis by Age Group, 2023 to 2033

Figure 203: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Age Group, 2023 to 2033

Figure 204: South Asia and Pacific Market Attractiveness by Accommodation Type, 2023 to 2033

Figure 205: South Asia and Pacific Market Attractiveness by Booking Channel, 2023 to 2033

Figure 206: South Asia and Pacific Market Attractiveness by Tourist Type, 2023 to 2033

Figure 207: South Asia and Pacific Market Attractiveness by Tour Type, 2023 to 2033

Figure 208: South Asia and Pacific Market Attractiveness by Consumer Orientation, 2023 to 2033

Figure 209: South Asia and Pacific Market Attractiveness by Age Group, 2023 to 2033

Figure 210: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 211: East Asia Market Value (US$ Million) by Accommodation Type, 2023 to 2033

Figure 212: East Asia Market Value (US$ Million) by Booking Channel, 2023 to 2033

Figure 213: East Asia Market Value (US$ Million) by Tourist Type, 2023 to 2033

Figure 214: East Asia Market Value (US$ Million) by Tour Type, 2023 to 2033

Figure 215: East Asia Market Value (US$ Million) by Consumer Orientation, 2023 to 2033

Figure 216: East Asia Market Value (US$ Million) by Age Group, 2023 to 2033

Figure 217: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 218: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 219: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 220: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 221: East Asia Market Value (US$ Million) Analysis by Accommodation Type, 2018 to 2033

Figure 222: East Asia Market Value Share (%) and BPS Analysis by Accommodation Type, 2023 to 2033

Figure 223: East Asia Market Y-o-Y Growth (%) Projections by Accommodation Type, 2023 to 2033

Figure 224: East Asia Market Value (US$ Million) Analysis by Booking Channel, 2018 to 2033

Figure 225: East Asia Market Value Share (%) and BPS Analysis by Booking Channel, 2023 to 2033

Figure 226: East Asia Market Y-o-Y Growth (%) Projections by Booking Channel, 2023 to 2033

Figure 227: East Asia Market Value (US$ Million) Analysis by Tourist Type, 2018 to 2033

Figure 228: East Asia Market Value Share (%) and BPS Analysis by Tourist Type, 2023 to 2033

Figure 229: East Asia Market Y-o-Y Growth (%) Projections by Tourist Type, 2023 to 2033

Figure 230: East Asia Market Value (US$ Million) Analysis by Tour Type, 2018 to 2033

Figure 231: East Asia Market Value Share (%) and BPS Analysis by Tour Type, 2023 to 2033

Figure 232: East Asia Market Y-o-Y Growth (%) Projections by Tour Type, 2023 to 2033

Figure 233: East Asia Market Value (US$ Million) Analysis by Consumer Orientation, 2018 to 2033

Figure 234: East Asia Market Value Share (%) and BPS Analysis by Consumer Orientation, 2023 to 2033

Figure 235: East Asia Market Y-o-Y Growth (%) Projections by Consumer Orientation, 2023 to 2033

Figure 236: East Asia Market Value (US$ Million) Analysis by Age Group, 2018 to 2033

Figure 237: East Asia Market Value Share (%) and BPS Analysis by Age Group, 2023 to 2033

Figure 238: East Asia Market Y-o-Y Growth (%) Projections by Age Group, 2023 to 2033

Figure 239: East Asia Market Attractiveness by Accommodation Type, 2023 to 2033

Figure 240: East Asia Market Attractiveness by Booking Channel, 2023 to 2033

Figure 241: East Asia Market Attractiveness by Tourist Type, 2023 to 2033

Figure 242: East Asia Market Attractiveness by Tour Type, 2023 to 2033

Figure 243: East Asia Market Attractiveness by Consumer Orientation, 2023 to 2033

Figure 244: East Asia Market Attractiveness by Age Group, 2023 to 2033

Figure 245: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 246: Middle East and Africa Market Value (US$ Million) by Accommodation Type, 2023 to 2033

Figure 247: Middle East and Africa Market Value (US$ Million) by Booking Channel, 2023 to 2033

Figure 248: Middle East and Africa Market Value (US$ Million) by Tourist Type, 2023 to 2033

Figure 249: Middle East and Africa Market Value (US$ Million) by Tour Type, 2023 to 2033

Figure 250: Middle East and Africa Market Value (US$ Million) by Consumer Orientation, 2023 to 2033

Figure 251: Middle East and Africa Market Value (US$ Million) by Age Group, 2023 to 2033

Figure 252: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 253: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 254: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 255: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 256: Middle East and Africa Market Value (US$ Million) Analysis by Accommodation Type, 2018 to 2033

Figure 257: Middle East and Africa Market Value Share (%) and BPS Analysis by Accommodation Type, 2023 to 2033

Figure 258: Middle East and Africa Market Y-o-Y Growth (%) Projections by Accommodation Type, 2023 to 2033

Figure 259: Middle East and Africa Market Value (US$ Million) Analysis by Booking Channel, 2018 to 2033

Figure 260: Middle East and Africa Market Value Share (%) and BPS Analysis by Booking Channel, 2023 to 2033

Figure 261: Middle East and Africa Market Y-o-Y Growth (%) Projections by Booking Channel, 2023 to 2033

Figure 262: Middle East and Africa Market Value (US$ Million) Analysis by Tourist Type, 2018 to 2033

Figure 263: Middle East and Africa Market Value Share (%) and BPS Analysis by Tourist Type, 2023 to 2033

Figure 264: Middle East and Africa Market Y-o-Y Growth (%) Projections by Tourist Type, 2023 to 2033

Figure 265: Middle East and Africa Market Value (US$ Million) Analysis by Tour Type, 2018 to 2033

Figure 266: Middle East and Africa Market Value Share (%) and BPS Analysis by Tour Type, 2023 to 2033

Figure 267: Middle East and Africa Market Y-o-Y Growth (%) Projections by Tour Type, 2023 to 2033

Figure 268: Middle East and Africa Market Value (US$ Million) Analysis by Consumer Orientation, 2018 to 2033

Figure 269: Middle East and Africa Market Value Share (%) and BPS Analysis by Consumer Orientation, 2023 to 2033

Figure 270: Middle East and Africa Market Y-o-Y Growth (%) Projections by Consumer Orientation, 2023 to 2033

Figure 271: Middle East and Africa Market Value (US$ Million) Analysis by Age Group, 2018 to 2033

Figure 272: Middle East and Africa Market Value Share (%) and BPS Analysis by Age Group, 2023 to 2033

Figure 273: Middle East and Africa Market Y-o-Y Growth (%) Projections by Age Group, 2023 to 2033

Figure 274: Middle East and Africa Market Attractiveness by Accommodation Type, 2023 to 2033

Figure 275: Middle East and Africa Market Attractiveness by Booking Channel, 2023 to 2033

Figure 276: Middle East and Africa Market Attractiveness by Tourist Type, 2023 to 2033

Figure 277: Middle East and Africa Market Attractiveness by Tour Type, 2023 to 2033

Figure 278: Middle East and Africa Market Attractiveness by Consumer Orientation, 2023 to 2033

Figure 279: Middle East and Africa Market Attractiveness by Age Group, 2023 to 2033

Figure 280: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA