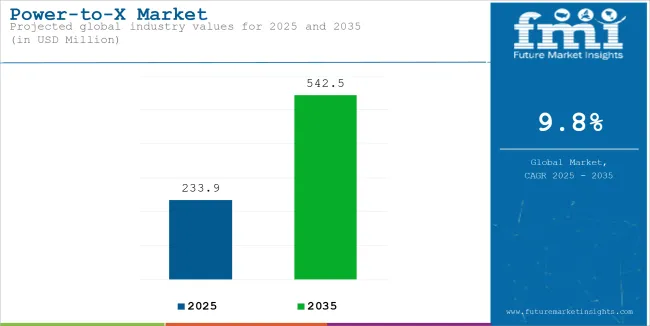

The global sales of Power-to-X are anticipated to reach USD 213.0 million by 2024, with a growing demand increase from end users at 9.8% CAGR over the forecast period. The market value is forecast to grow from USD 233.9 million in 2025 to USD 542.5 million by 2035.

The research report on the power-to-X market states that the proliferating demand for green hydrogen and other forms of green energy among industries, corporations, and organizations are the major sources that gain traction for the market. Thus, the advanced technology that converts or transforms one type of energy into another has become prevalent.

Power-to-X technology is a collective term that denotes any type of power conversion. Governments are investing huge capital into green energy projects that produce fossil fuels identical to save their population from pollution.

| Attributes | Key Insights |

|---|---|

| Market Value, 2024 | USD 213.0 Million |

| Estimated Market Value, 2025 | USD 233.9 Million |

| Projected Market Value, 2035 | USD 542.5 Million |

| Market Value CAGR (2025 to 2035) | 9.8% |

Majorly, technology that converts electricity into carbon-neutral synthetic fuels like synthetic natural gas, hydrogen, and liquid fuels. The process through which the energy is converted is known as electrolysis.

Being an essential part of the green transition, power-to-X technology is anticipated to reach each industry’s doorstep during the forecast period. Therefore, technology has become so flexible that it can integrate with automotive, manufacturing, energy storage, and other industries for the application of cleaner and greener power.

The technology work on the principle of creating identical fossil fuels that work like them without emitting any carbon or other pollutants. For example, the synthesis process with carbon creates e-diesel, e-methanol, e-kerosene, e-demethylates, and e-methane can be obtained and further applied in heavy transports. While the synthesis process with nitrogen provides fertilizers such as e-ammonia which is used.

The industries add the power-to-X technology in their portfolio to help produce clean energy while also spreading awareness among end users to use green power. Electrical heating, for instance, typically uses Power-to-X. Utilizing electricity, like in the case of a boiler generates heat for space heating or hot water.

The table below presents a comparative assessment of the variation in CAGR over six months for the base year (2024) and current year (2025) for the global Power-to-X market.

This analysis reveals crucial shifts in market performance and indicates revenue realization patterns, thus providing stakeholders with a better vision of the market growth trajectory over the year. The first half of the year, or H1, spans from January to June. The second half, H2, includes the months from July to December.

The below table presents the expected CAGR for the global Power-to-X sales over several semi-annual periods spanning from 2024 to 2034. In the first half (H1) from 2024 to 2034, the business is predicted to surge at a CAGR of 9.3%, followed by a slightly higher growth rate of 10% in the second half (H2).

| Particular | Value CAGR |

|---|---|

| H1 | 9.3% (2024 to 2034) |

| H2 | 10% (2024 to 2034) |

| H1 | 9.4% (2025 to 2035) |

| H2 | 10.2% (2025 to 2035) |

Moving into the subsequent period, from H1 2025 to H2 2035, the CAGR is projected to increase slightly to 9.4% in the first half and remain relatively moderate at 10.2% in the second half. In the first half (H1) the market witnessed an increase of 10 BPS while in the second half (H2), the market witnessed an increase of 20 BPS.

Power-to-X Technology: Revolutionizing Green Energy Solutions Across Diverse Industries

The major factor driving the demand for power-to-X technology is the wide range of industries that the technology caters to. The synthesis of Co2 which is the major gas responsible for climate change can also be utilized through technology itself. Furthermore, the growing demand for energy, especially green energy, has pushed organizations and governments to look for alternatives.

Apart from solar and electrical mediums, technology that transforms one power source into another becomes helpful. The rising demand for green hydrogen and ammonia has directly uplifted the sales of power-to-x technology as the resources for these elements have started shrinking.

From refining petroleum, and producing fertilizers to treating metals and food processing, the application of hydrogen is higher than its counterparts. The same hydrogen can be produced through the power-to-x process with the use of wind energy.

The produced hydrogen is used in manufacturing the battery cells for electric vehicles that further saves the environment from carbon emissions. Thus, the lookout for a platform that transforms the energy and makes it suitable for the power requirements has ended up on power-to-x technology.

Surge in Green Hydrogen Production

The global Power-to-X (P2X) market is witnessing a significant shift toward green hydrogen production, driven by its potential to decarbonize energy-intensive sectors such as transportation, industrial manufacturing, and power generation.

Green hydrogen, produced through electrolysis powered by renewable energy sources, is emerging as a clean and sustainable alternative to fossil fuels. Governments and organizations worldwide are investing heavily in green hydrogen infrastructure to meet net-zero emissions targets and align with global sustainability goals.

Countries such as Germany, Japan, and Australia are leading the green hydrogen revolution by launching large-scale projects and providing subsidies to accelerate adoption.

For instance, the European Union’s hydrogen strategy includes an investment of over €430 billion by 2030 to establish a hydrogen economy. The declining cost of electrolyzers and advancements in renewable energy technologies further bolster the production of green hydrogen, making it a viable option for both developed and emerging markets.

Integration of Carbon Capture and Utilization (CCU) Technologies

Another prominent trend in the Power-to-X market is the integration of carbon capture and utilization (CCU) technologies to create sustainable value chains. P2X solutions now incorporate CCU to convert captured CO₂ into value-added products such as synthetic fuels, chemicals, and building materials. This approach not only addresses global emission reduction targets but also creates economic opportunities by transforming waste CO₂ into useful commodities.

With regulatory bodies emphasizing carbon neutrality, industries like petrochemicals, cement, and aviation are increasingly adopting CCU-enabled P2X solutions.

Partnerships between P2X technology providers and heavy emitters are growing, with companies like Siemens Energy and Carbon Clean leading the charge. This trend underscores the evolving role of P2X in building a circular and sustainable economy.

Advancements in Renewable Energy and Electrolysis Technologies

Advancements in renewable energy generation and electrolysis technologies are another key driver for the growth of the P2X market. Renewable energy sources such as solar, wind, and hydropower have become more accessible and affordable due to technological innovations and economies of scale.

This has significantly enhanced the feasibility of P2X technologies, which rely on surplus renewable energy to produce green hydrogen and synthetic fuels through electrolysis.

The cost of electrolyzers, a critical component in hydrogen production, has decreased dramatically over the past decade due to technological improvements and increased production capacity. Companies are now focusing on scaling up electrolyzer capacities and improving their efficiency to cater to growing demand. For example, Siemens Energy and ITM Power are developing large-scale electrolyzers to support green hydrogen production.

Additionally, energy storage through P2X is addressing the intermittency challenges of renewable energy, ensuring a stable and reliable energy supply. The ability of P2X to store excess renewable energy as hydrogen or synthetic fuels offers a viable solution to integrate renewables into the grid, further enhancing its adoption.

Between 2020 and 2024, the global Power-to-X (P2X) market experienced steady growth, primarily driven by the rising adoption of renewable energy and the push for decarbonization across industries.

During this period, governments and industries increased investments in green hydrogen and synthetic fuel projects, particularly in Europe and North America, to meet climate goals. However, the market faced challenges such as high implementation costs and limited infrastructure, which slowed widespread adoption in emerging economies.

From 2025 to 2035, the demand for P2X technology is expected to accelerate significantly, fueled by advancements in renewable energy storage, declining costs of electrolyzers, and favorable government policies.

The growing focus on achieving net-zero emissions will lead to the rapid adoption of green hydrogen as a key energy carrier, particularly in sectors like transportation, industrial manufacturing, and power generation. Emerging markets in Asia-Pacific, the Middle East, and Africa are anticipated to contribute substantially to this growth, driven by large-scale renewable energy projects.

Tier 1 companies include industry leaders with annual revenues exceeding USD 100 Million. These companies are currently capturing a significant share of 40% to 45% globally. These frontrunners are characterized by high production capacity and a wide product portfolio. They are distinguished by extensive expertise in manufacturing and a broad geographical reach, underpinned by a robust consumer base.

These firms provide a wide range of products and utilize the latest technology to meet regulatory standards. Prominent companies within Tier 1 include Siemens Energy, ITM Power, Ørsted A/S, Mitsubishi Heavy Industries, NEL ASA, Ballard Power Systems and others.

Tier 2 includes most of the small-scale companies operating at the local level-serving niche Power-to-X vendors with low revenue. These companies are notably oriented toward fulfilling local demands.

They are small-scale players and have limited geographical reach. Tier 2, within this context, is recognized as an unorganized segment, denoting a sector characterized by a lack of extensive structure and formalization when compared to organized competitors.

The section below covers the analysis of the Power-to-X industry in different countries. Demand analysis of key countries in several regions of the globe, including North America, Asia Pacific, Europe, and others, is provided. The USA is anticipated to remain at the forefront in North America, with a value share of 72.7% in 2035. In South Asia, India is projected to witness a CAGR of 8.5% through 2035.

| Countries | CAGR 2025 to 2035 |

|---|---|

| The USA | 4.1% |

| India | 3.8% |

| China | 3.4% |

| Germany | 2.9% |

| Japan | 2.5% |

Germany is positioned as a global leader in the Power-to-X (P2X) market, driven by its robust renewable energy infrastructure, technological advancements, and strong government commitment to decarbonization. The country is at the forefront of green hydrogen production, supported by the European Union’s Green Deal and Germany’s National Hydrogen Strategy, which allocates €9 billion for hydrogen development.

Germany’s extensive wind and solar energy capacity ensures a stable and abundant renewable energy supply, crucial for P2X technologies. The country is leveraging this advantage to develop large-scale electrolyzer plants and integrate P2X solutions into its industrial, transportation, and energy storage sectors.

Germany’s heavy industries, such as steel and chemicals, are rapidly adopting green hydrogen and synthetic fuels to meet stringent carbon-neutral targets.

Germany’s focus on research and innovation fosters collaborations between academia, industries, and government institutions, further driving technological advancements. The country’s leadership in renewable energy policies, coupled with its industrial might, positions it as a key player in the global P2X market.

The United States is emerging as a major market for P2X technologies, fueled by its ambitious climate goals and diverse industrial applications. The Biden Administration’s commitment to achieving net-zero emissions by 2050 has catalyzed significant investments in renewable energy and hydrogen infrastructure.

The USA benefits from abundant renewable resources, including wind and solar, particularly in states like Texas and California, which are leading green hydrogen initiatives. The country’s substantial energy demand and large-scale industrial operations create immense opportunities for P2X technologies to decarbonize sectors like petrochemicals, transportation, and power generation.

Additionally, federal funding and incentives, such as the Hydrogen Shot initiative under the Department of Energy, aim to reduce the cost of green hydrogen production and accelerate P2X adoption. Collaborations between public and private sectors further enhance innovation and commercialization, making the USA a rapidly growing market for P2X.

China’s growth in the Power-to-X market is underpinned by its massive energy demand, industrial growth, and strong focus on renewable energy development. As the world’s largest emitter of greenhouse gases, China is prioritizing P2X technologies to reduce its carbon footprint and transition to cleaner energy systems.

The government’s ambitious goals, including achieving carbon neutrality by 2060 and peaking emissions before 2030, drive significant investments in renewable energy and hydrogen infrastructure. China leads the world in installed wind and solar capacity, providing a solid foundation for P2X applications.

China’s industrial base, particularly in steel, cement, and chemical manufacturing, creates robust demand for green hydrogen and synthetic fuels. Moreover, the country’s Belt and Road Initiative emphasizes clean energy projects, fostering regional collaborations in P2X technology development. With strong government support and industrial integration, China is set to dominate the global P2X market.

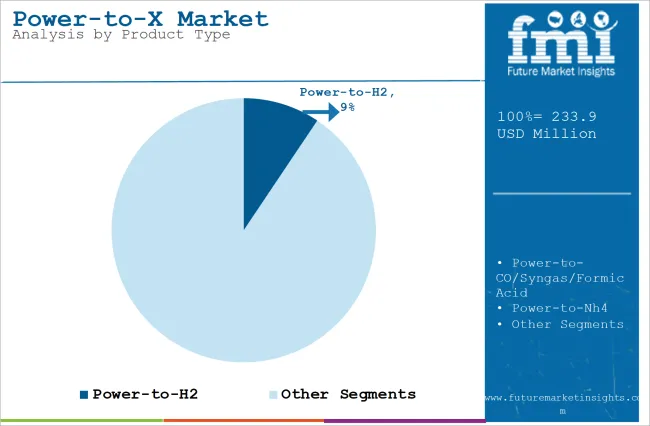

This section below examines the value shares of the leading segments in the industry. In terms of product type, the power-to-hydrogen segment is expected to have the Highest Market Share during the Forecast Period and generate a CAGR of around 9.4% in 2025.

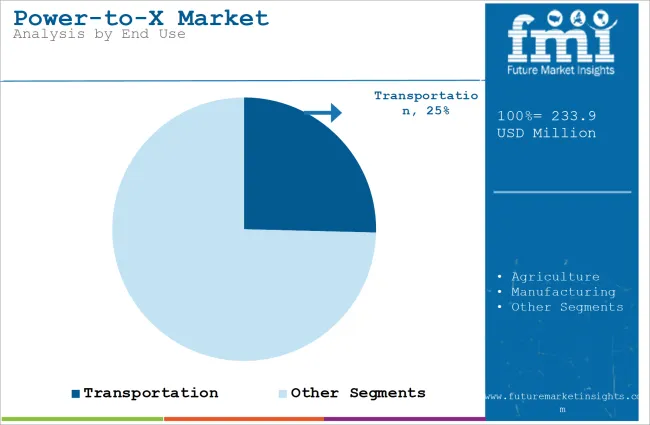

Based on the end use, the Transportation segment is projected to account for a share of 25.4% in 2025. The analysis would enable potential clients to make effective business decisions for investment purposes.

| Segment | Value CAGR (2025) |

|---|---|

| Power-to-hydrogen (product type) | 9.4% |

The type of category is led by the power-to-hydrogen segment as hydrogen is in high demand while the resources for it are low. The wide range of applications is related to hydrogens such as in power vehicles, the power industry, heating homes, and other industrial applications.

The new study explains that the advanced ptoX nanoparticles and hybrid chemicals state for efficient hydrogen evolution. The process is further supported by the carbon nanotube. This saves the procedure duration and creates larger volumes of hydrogen.

Green hydrogen produced can be the bridge to transform green electricity into transportation fuel. The major players are anticipated to use wind energy for hydrogen conversion through PtoX technology. Agencies and research organizations know that hydrogen can be highly utilized for the formation of green and clean power.

| Segment | Value Share (2025) |

|---|---|

| Transportation (end use) | 25.4% |

The transportation sector is expected to have the largest market share in the power-to-X industry, owing to rising demand for green energy solutions and the sector's major contribution to global carbon emissions. Power-to-X technology, which converts renewable energy into alternative fuels such as green hydrogen and synthetic fuels, is gaining popularity as a sustainable approach for decarbonizing transportation.

Green hydrogen, created via the power-to-X process with renewable energy sources such as wind or solar, is emerging as a clean and efficient fuel for fuel cell vehicles such as buses, trucks, and trains. Furthermore, synthetic fuels produced using power-to-X are compatible with existing internal combustion engines, allowing for a smooth transition to sustainable energy without requiring significant infrastructure upgrades.

The growing adoption of electric vehicles (EVs) further boosts the demand for hydrogen produced through power-to-X, as it is utilized in manufacturing battery cells. Moreover, governments and industries worldwide are implementing stricter regulations and initiatives to reduce emissions in transportation, further driving the adoption of green fuels.

The Power-to-X (P2X) market is moderately competitive, with a mix of global leaders, established players, and emerging companies driving innovation and adoption. The competitive landscape is characterized by significant investments in research and development, strategic collaborations, and the establishment of large-scale renewable energy projects to expand market presence.

Global leaders such as Siemens Energy, Ørsted A/S, and Mitsubishi Heavy Industries dominate the market with their advanced technologies, large-scale project execution capabilities, and extensive global reach. These companies focus on leveraging renewable energy sources to produce green hydrogen, synthetic fuels, and energy storage solutions.

Their competitive advantage lies in their ability to undertake integrated projects that cater to multiple industries, including transportation, power generation, and chemicals.

Established players like ITM Power, NEL ASA, and McPhy Energy are focusing on scaling up electrolyzer manufacturing and forming partnerships with energy companies to strengthen their market position. These players have a significant presence in regional markets and are increasingly adopting strategies like mergers and acquisitions to expand their portfolios.

Emerging companies such as Sunfire GmbH and Enapter are gaining traction by developing innovative and niche solutions for small-scale applications and specific industrial needs. They focus on modular P2X systems that are cost-effective and easily deployable.

Industry Updates

In terms of product type, the industry is segmented into Power-to-H2, Power-to-CO/Syngas/Formic Acid, Power-to-Nh4, Power-to-Methane, Power-to-Methanol and Power-to-H2O2

By end use, the industry is segmented into transportation, agriculture, manufacturing, industry, residential and others.

Regions considered in the study are North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia, and the Middle East and Africa.

The industry was valued at USD 213.0 Million in 2024.

The industry is set to reach USD 233.9 Million in 2025.

The industry value is anticipated to rise at 9.8% CAGR through 2035.

The industry is anticipated to reach USD 542.5 Million by 2035.

China accounts for 17.2% of the global Power-to-X market revenue share alone.

India is predicted to witness the highest CAGR of 8.5% in the Power-to-X market.

Table 1: Global Market Value (US$ million) Forecast by Region, 2018 to 2033

Table 2: Global Market Value (US$ million) Forecast by Type, 2018 to 2033

Table 3: Global Market Value (US$ million) Forecast by End-Use, 2018 to 2033

Table 4: North America Market Value (US$ million) Forecast by Country, 2018 to 2033

Table 5: North America Market Value (US$ million) Forecast by Type, 2018 to 2033

Table 6: North America Market Value (US$ million) Forecast by End-Use, 2018 to 2033

Table 7: Latin America Market Value (US$ million) Forecast by Country, 2018 to 2033

Table 8: Latin America Market Value (US$ million) Forecast by Type, 2018 to 2033

Table 9: Latin America Market Value (US$ million) Forecast by End-Use, 2018 to 2033

Table 10: Europe Market Value (US$ million) Forecast by Country, 2018 to 2033

Table 11: Europe Market Value (US$ million) Forecast by Type, 2018 to 2033

Table 12: Europe Market Value (US$ million) Forecast by End-Use, 2018 to 2033

Table 13: South Asia Market Value (US$ million) Forecast by Country, 2018 to 2033

Table 14: South Asia Market Value (US$ million) Forecast by Type, 2018 to 2033

Table 15: South Asia Market Value (US$ million) Forecast by End-Use, 2018 to 2033

Table 16: East Asia Market Value (US$ million) Forecast by Country, 2018 to 2033

Table 17: East Asia Market Value (US$ million) Forecast by Type, 2018 to 2033

Table 18: East Asia Market Value (US$ million) Forecast by End-Use, 2018 to 2033

Table 19: Oceania Market Value (US$ million) Forecast by Country, 2018 to 2033

Table 20: Oceania Market Value (US$ million) Forecast by Type, 2018 to 2033

Table 21: Oceania Market Value (US$ million) Forecast by End-Use, 2018 to 2033

Table 22: MEA Market Value (US$ million) Forecast by Country, 2018 to 2033

Table 23: MEA Market Value (US$ million) Forecast by Type, 2018 to 2033

Table 24: MEA Market Value (US$ million) Forecast by End-Use, 2018 to 2033

Figure 1: Global Market Value (US$ million) by Type, 2023 to 2033

Figure 2: Global Market Value (US$ million) by End-Use, 2023 to 2033

Figure 3: Global Market Value (US$ million) by Region, 2023 to 2033

Figure 4: Global Market Value (US$ million) Analysis by Region, 2018 to 2033

Figure 5: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 6: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 7: Global Market Value (US$ million) Analysis by Type, 2018 to 2033

Figure 8: Global Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 9: Global Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 10: Global Market Value (US$ million) Analysis by End-Use, 2018 to 2033

Figure 11: Global Market Value Share (%) and BPS Analysis by End-Use, 2023 to 2033

Figure 12: Global Market Y-o-Y Growth (%) Projections by End-Use, 2023 to 2033

Figure 13: Global Market Attractiveness by Type, 2023 to 2033

Figure 14: Global Market Attractiveness by End-Use, 2023 to 2033

Figure 15: Global Market Attractiveness by Region, 2023 to 2033

Figure 16: North America Market Value (US$ million) by Type, 2023 to 2033

Figure 17: North America Market Value (US$ million) by End-Use, 2023 to 2033

Figure 18: North America Market Value (US$ million) by Country, 2023 to 2033

Figure 19: North America Market Value (US$ million) Analysis by Country, 2018 to 2033

Figure 20: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 21: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 22: North America Market Value (US$ million) Analysis by Type, 2018 to 2033

Figure 23: North America Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 24: North America Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 25: North America Market Value (US$ million) Analysis by End-Use, 2018 to 2033

Figure 26: North America Market Value Share (%) and BPS Analysis by End-Use, 2023 to 2033

Figure 27: North America Market Y-o-Y Growth (%) Projections by End-Use, 2023 to 2033

Figure 28: North America Market Attractiveness by Type, 2023 to 2033

Figure 29: North America Market Attractiveness by End-Use, 2023 to 2033

Figure 30: North America Market Attractiveness by Country, 2023 to 2033

Figure 31: Latin America Market Value (US$ million) by Type, 2023 to 2033

Figure 32: Latin America Market Value (US$ million) by End-Use, 2023 to 2033

Figure 33: Latin America Market Value (US$ million) by Country, 2023 to 2033

Figure 34: Latin America Market Value (US$ million) Analysis by Country, 2018 to 2033

Figure 35: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 36: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 37: Latin America Market Value (US$ million) Analysis by Type, 2018 to 2033

Figure 38: Latin America Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 39: Latin America Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 40: Latin America Market Value (US$ million) Analysis by End-Use, 2018 to 2033

Figure 41: Latin America Market Value Share (%) and BPS Analysis by End-Use, 2023 to 2033

Figure 42: Latin America Market Y-o-Y Growth (%) Projections by End-Use, 2023 to 2033

Figure 43: Latin America Market Attractiveness by Type, 2023 to 2033

Figure 44: Latin America Market Attractiveness by End-Use, 2023 to 2033

Figure 45: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 46: Europe Market Value (US$ million) by Type, 2023 to 2033

Figure 47: Europe Market Value (US$ million) by End-Use, 2023 to 2033

Figure 48: Europe Market Value (US$ million) by Country, 2023 to 2033

Figure 49: Europe Market Value (US$ million) Analysis by Country, 2018 to 2033

Figure 50: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 51: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 52: Europe Market Value (US$ million) Analysis by Type, 2018 to 2033

Figure 53: Europe Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 54: Europe Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 55: Europe Market Value (US$ million) Analysis by End-Use, 2018 to 2033

Figure 56: Europe Market Value Share (%) and BPS Analysis by End-Use, 2023 to 2033

Figure 57: Europe Market Y-o-Y Growth (%) Projections by End-Use, 2023 to 2033

Figure 58: Europe Market Attractiveness by Type, 2023 to 2033

Figure 59: Europe Market Attractiveness by End-Use, 2023 to 2033

Figure 60: Europe Market Attractiveness by Country, 2023 to 2033

Figure 61: South Asia Market Value (US$ million) by Type, 2023 to 2033

Figure 62: South Asia Market Value (US$ million) by End-Use, 2023 to 2033

Figure 63: South Asia Market Value (US$ million) by Country, 2023 to 2033

Figure 64: South Asia Market Value (US$ million) Analysis by Country, 2018 to 2033

Figure 65: South Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 66: South Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 67: South Asia Market Value (US$ million) Analysis by Type, 2018 to 2033

Figure 68: South Asia Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 69: South Asia Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 70: South Asia Market Value (US$ million) Analysis by End-Use, 2018 to 2033

Figure 71: South Asia Market Value Share (%) and BPS Analysis by End-Use, 2023 to 2033

Figure 72: South Asia Market Y-o-Y Growth (%) Projections by End-Use, 2023 to 2033

Figure 73: South Asia Market Attractiveness by Type, 2023 to 2033

Figure 74: South Asia Market Attractiveness by End-Use, 2023 to 2033

Figure 75: South Asia Market Attractiveness by Country, 2023 to 2033

Figure 76: East Asia Market Value (US$ million) by Type, 2023 to 2033

Figure 77: East Asia Market Value (US$ million) by End-Use, 2023 to 2033

Figure 78: East Asia Market Value (US$ million) by Country, 2023 to 2033

Figure 79: East Asia Market Value (US$ million) Analysis by Country, 2018 to 2033

Figure 80: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 81: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 82: East Asia Market Value (US$ million) Analysis by Type, 2018 to 2033

Figure 83: East Asia Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 84: East Asia Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 85: East Asia Market Value (US$ million) Analysis by End-Use, 2018 to 2033

Figure 86: East Asia Market Value Share (%) and BPS Analysis by End-Use, 2023 to 2033

Figure 87: East Asia Market Y-o-Y Growth (%) Projections by End-Use, 2023 to 2033

Figure 88: East Asia Market Attractiveness by Type, 2023 to 2033

Figure 89: East Asia Market Attractiveness by End-Use, 2023 to 2033

Figure 90: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 91: Oceania Market Value (US$ million) by Type, 2023 to 2033

Figure 92: Oceania Market Value (US$ million) by End-Use, 2023 to 2033

Figure 93: Oceania Market Value (US$ million) by Country, 2023 to 2033

Figure 94: Oceania Market Value (US$ million) Analysis by Country, 2018 to 2033

Figure 95: Oceania Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 96: Oceania Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 97: Oceania Market Value (US$ million) Analysis by Type, 2018 to 2033

Figure 98: Oceania Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 99: Oceania Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 100: Oceania Market Value (US$ million) Analysis by End-Use, 2018 to 2033

Figure 101: Oceania Market Value Share (%) and BPS Analysis by End-Use, 2023 to 2033

Figure 102: Oceania Market Y-o-Y Growth (%) Projections by End-Use, 2023 to 2033

Figure 103: Oceania Market Attractiveness by Type, 2023 to 2033

Figure 104: Oceania Market Attractiveness by End-Use, 2023 to 2033

Figure 105: Oceania Market Attractiveness by Country, 2023 to 2033

Figure 106: MEA Market Value (US$ million) by Type, 2023 to 2033

Figure 107: MEA Market Value (US$ million) by End-Use, 2023 to 2033

Figure 108: MEA Market Value (US$ million) by Country, 2023 to 2033

Figure 109: MEA Market Value (US$ million) Analysis by Country, 2018 to 2033

Figure 110: MEA Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 111: MEA Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 112: MEA Market Value (US$ million) Analysis by Type, 2018 to 2033

Figure 113: MEA Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 114: MEA Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 115: MEA Market Value (US$ million) Analysis by End-Use, 2018 to 2033

Figure 116: MEA Market Value Share (%) and BPS Analysis by End-Use, 2023 to 2033

Figure 117: MEA Market Y-o-Y Growth (%) Projections by End-Use, 2023 to 2033

Figure 118: MEA Market Attractiveness by Type, 2023 to 2033

Figure 119: MEA Market Attractiveness by End-Use, 2023 to 2033

Figure 120: MEA Market Attractiveness by Country, 2023 to 2033

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA