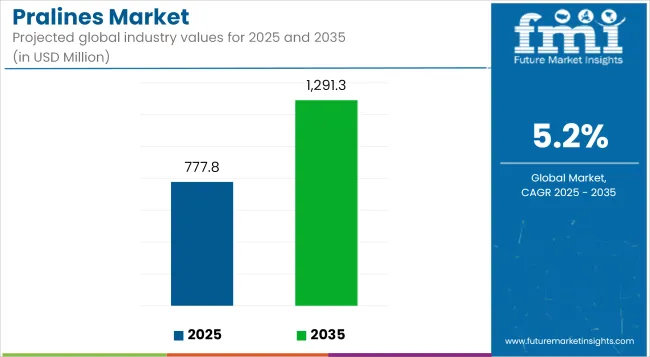

Surging demand is expected to elevate the global pralines market from USD 777.8 million in 2025 to approximately USD 1,291.3 million by 2035, translating to a CAGR of 5.2% over the decade. This growth trajectory reflects the enduring consumer attraction to indulgent confections with premium positioning.

| Attributes | Description |

|---|---|

| Estimated Size (2025E) | USD 777.8 million |

| Projected Value (2035F) | USD 1,291.3 million |

| CAGR (2025 to 2035) | 5.2% |

The market is benefitting from increasing disposable incomes and a heightened demand for artisanal and gourmet chocolate formats across retail and travel-exclusive channels. Pralines have firmly secured their place as both everyday indulgence and premium gifting solutions, with rising traction in seasonal and festive occasions.

Growth in the pralines sector is being reinforced by the diversification of flavor profiles, incorporation of region-specific ingredients, and sustained innovation in packaging aesthetics. However, the market continues to face constraints from high production costs, limited shelf-life for preservative-free variants, and strong competition from alternative chocolate-based offerings.

Demand for clean-label, gluten-free, and vegan pralines is intensifying, pushing manufacturers to reengineer formulations while preserving texture and taste fidelity. Key players are actively adopting sustainable sourcing strategies, particularly in cocoa procurement and recyclable packaging, to align with evolving consumer values. E-commerce platforms are reshaping access, enabling direct-to-consumer channels to thrive, especially in Europe and North America.

Between 2025 and 2035, demand for pralines is expected to expand substantially across Asia-Pacific, propelled by westernization of dessert habits and increased retail shelf space for imported confectionery. The boxed and premium segments are likely to outperform mass offerings due to their perceived giftability and brand story alignment.

Nut-based varieties will continue dominating due to their textural richness and health halo. By 2035, pralines will increasingly feature in personalized and functional confectionery segments, incorporating adaptogens, protein, or reduced sugar claims to appeal to health-conscious consumers without sacrificing indulgence.

The subsequent table is an assessment of the variation in CAGRs (compound annual growth rates) over six months of the base year (2024) and the current year (2025) for the global praline market. The analysis reveals the major changes in the performance and indicates the revenue realization patterns, thus providing the stakeholders a clearer vision of the way the business is expected to grow in a given time. H1, or the first half of the year, spans from January to June. The second part of H2 includes the mooning from July to December.

| Particular | Value CAGR |

|---|---|

| H1 (2024 to 2034) | 4.9% |

| H2 (2024 to 2034) | 5.2% |

| H1 (2025 to 2035) | 5.2% |

| H2 (2025 to 2035) | 5.2% |

In the first half (H1) of the decade from 2025 to 2035, the market is predicted to witness a growth rate of 4.9%, followed by a slight increase to 5.2% in the second half (H2). During the upcoming period from H1 2025 to H2 2035, the CAGR is estimated to stabilize at the same level of 5.2% in both half’s, reflecting the steady demand. In the first half (H1) of the period, the sector showed an improvement of 30 BPS, while in the second half (H2), the business was stable.

With an estimated 28.5% share in 2025, specialty chocolate boutiques remain a strategic sales channel for praline manufacturers aiming to leverage brand storytelling, luxury appeal, and seasonal gifting dynamics. These boutiques often serve as experience centers, particularly in Western Europe and East Asia, where consumers prioritize curated assortments and aesthetic presentation.

Brands such as Neuhaus and Leonidas have retained a premium image through boutique-exclusive launches, co-branded boxes, and limited-edition collections. In markets like France and Belgium, artisanal positioning continues to be supported by the respective national chocolate associations, such as the Belgian Chocolate Code of Quality.

This channel also ensures better margin control and consumer engagement compared to mass retail. However, high rental and operational costs in Tier 1 cities can limit scale. Boutique channels also enable innovations in sustainable packaging and customized offerings that resonate with younger demographics seeking unique experiences.

With increasing foot traffic in travel retail and urban luxury districts, specialty boutiques are likely to reinforce their influence in shaping consumer perception and trial for pralines through immersive product sampling and curated narratives. These outlets are vital for testing new flavor infusions, such as yuzu or cardamom, ahead of broader market rollouts.

Holding an 11.3% share in 2025, foodservice applications of pralines are expected to gain strategic traction as indulgent accompaniments in fine dining and specialty cafés. Premium cafés across Western Europe and East Asia have started integrating single-serve pralines into dessert platings or as standalone after-coffee offerings, capitalizing on both impulse consumption and pairing experiences.

Companies such as Godiva and Lindt have initiated partnerships with luxury hotel chains and in-house cafés to increase brand visibility and expand consumer occasions beyond gifting. This trend is supported by the wider movement in the confectionery sector to align with on-premise experiences.

Regulatory guidelines for allergen disclosure and product sourcing, particularly in the EU under Regulation (EU) No 1169/2011, play a role in shaping the foodservice supply of pralines, encouraging clearer ingredient transparency and sustainability claims.

As cafés diversify their premium chocolate offerings, pralines are becoming increasingly positioned as sensory extensions of the beverage or meal, rather than standalone retail items. This segment also offers potential for growth in miniaturized formats and experimental flavor combinations to cater to a younger urban demographic seeking novel dessert formats.

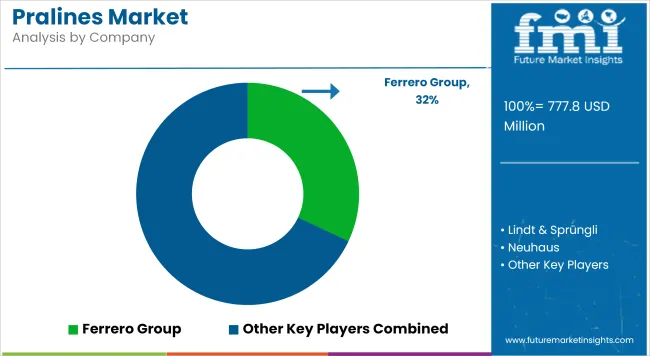

The global pralines market is characterized by a balanced mix of multinational corporations, regional players, and emerging domestic brands. While multinational confectionery giants dominate the premium praline segment, regional players are gaining significant traction due to their ability to cater to local tastes and preferences.

Multinational Corporations (MNCs) have established a strong foothold in the market, making use of their well-developed distribution channels, advanced manufacturing capabilities, and solid brand equity. The focus of these companies is on innovation, resulting in the premiumization of their goods and the expansion of the market in North America, Europe, and Asia-Pacific.

Their partnerships with supermarket chains and online stores are what allow for the consolidation of the company's market position, as they give customers more choices about what pralines to buy, therefore increasing the range on exhibit.

Regional Players, besides, are capitalizing on the demand for organic, gluten-free, and low-sugar pralines, which is a result of the health-conscious consumers. These brands, most of whom are from Europe, especially Belgium, Switzerland, and France, have the history and the skills that make them the leaders in the field of praline craftsmanship.

On the other hand, North American brands are flourishing due to the increase in consumer preferences for organic, gluten-free, and low-sugar products, a move that targets the health-conscious sector. Mexican local firms are also gaining advantage by using the local native ingredients such as traditional nuts and cocoa beans in their product, hence standing out in the global markets.

Chinese Domestic Players are creeping in the market of the premium chocolate segment where they make their entrance with pralines made and infused with traditional ingredients like red bean, matcha, and black sesame. The top players operating in the luxury confectionery market in China are utilizing e-commerce platforms and social media marketing that is driven by local celebs to enhance their engagement with target customers.

Their flexibility in adjusting to the desires of consumers has made them good players in the praline market.

The following table shows the estimated growth rates of the top five territories. These are set to exhibit high consumption through 2035.

| Country | United States |

|---|---|

| Market Volume (USD Million) | USD 222.0 million |

| CAGR (2025 to 2035) | 5.0% |

| Country | Germany |

|---|---|

| Market Volume (USD Million) | USD 152.0 million |

| CAGR (2025 to 2035) | 4.8% |

| Country | United Kingdom |

|---|---|

| Market Volume (USD Million) | USD 134.0 million |

| CAGR (2025 to 2035) | 4.5% |

| Country | China |

|---|---|

| Market Volume (USD Million) | USD 103.0 million |

| CAGR (2025 to 2035) | 5.5% |

| Country | Japan |

|---|---|

| Market Volume (USD Million) | USD 97.0 million |

| CAGR (2025 to 2035) | 4.7% |

The USA is projected to hold its position as the top player in the global praline market, with the expected market volume value reaching around USD 222 million by 2025. In addition, they are to experience a 5% of CAGR rise in their market from 2025 to 2035. This is mainly because of the soaring trend of premium and artisanal candy.

The increasing demand for superior quality pralines is due to the trend of gourmet chocolates and decadent treats. Manufacturers are responding to the needs by broadening their product range, including more flavors and better ingredients, catering to the needs of the high-class consumers.

The trend of giving premium chocolate as a gift during holidays and special occasions has also been a part of the hidden agenda where consumers have been questing for attractive, luxurious, and original pralines. The advent of the Internet and the rise of e-commerce platforms have enabled wider access to confectionery products, such as pralines, thereby propelling market growth in the region.

Germany's pralines market is predicted to show impressive growth, hitting a target market value of nearly USD 152 million by 2025 and a CAGR of 4.8% during the forecast period. Lately, German consumers have been mainly supporting the move towards handmade and organic pralines, as that represents a broader trend of an environmentally friendly and health-conscious society.

Local chocolatiers play a significant role in the market with their commitment to traditional methods and locally sourced organic, sustainably produced ingredients. They are seen as the torchbearers of the product and sourcing culture, which is cited by consumers in Germany as a justification for their premium purchases.

The limited seasonal products presented by the local companies and the previous generation, the trend, which is common during the festive season, is the release of different special one-off pralines, is greatly contributing to the sales. Transparent sourcing practices, like clean labeling, have also played a huge role in boosting consumer trust and loyalty in the German pralines.

China's praline market is projected to be worth USD 103 million in 2025, with a staggering CAGR of 5.5% from 2025 to 2035. The rapid urbanization and the exposure to Western influence have significantly affected the preferences of Chinese consumers in the confectionery segment, leading to a demand for premium chocolate, which is a part of the longer chain.

With the middle class earning higher incomes, they are launching various unique confectionery experiences. International brands are gaining the benefits of this trend by joining the Chinese market mostly through collaboration with local brands and the adaptation of their products to regional tastes.

E-commerce platforms and social media ads were, together with festivals, the main thing people liked the most, and therefore plasticine, once they were given as gifts, with the new look and high quality, were more in demand.

The world market for pralines is expected to witness subtle growth from 2024, when the ripple effect of diverse and premium candy for customers is felt. The market has a mixed population of the biggest global corporations and the up-and-coming local markets, both of which are adopting various application strategies to increase their market space.

The main players are taking steps to keep up with the changing preferences of the consumers by broadening their product ranges, introducing exotic flavors, and stressing the use of premium natural ingredients. The shift/cycle is that businesses like these are becoming eco-friendlier and thus are a force of marketing power to the conscious consumer.

The competition is further intensified with the introduction of artisanal chocolatiers, offering their hand-made praline, which bring a new dimension to the assortment of products.

For Instance

The global pralines market is expected to grow at a CAGR of 5.2% during the forecast period.

The market is projected to reach approximately USD 1,291.3 million by 2035.

The organic segment is expected to witness the highest growth due to increasing consumer demand for clean-label and sustainably sourced confectionery products.

Rising consumer preference for premium chocolates, expanding gifting culture, increased health-conscious purchasing, and e-commerce expansion are key factors contributing to market growth.

Leading players include Ferrero Group, Lindt & Sprüngli, Mondelez International, Neuhaus, Godiva Chocolatier, and Mars Incorporated.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA