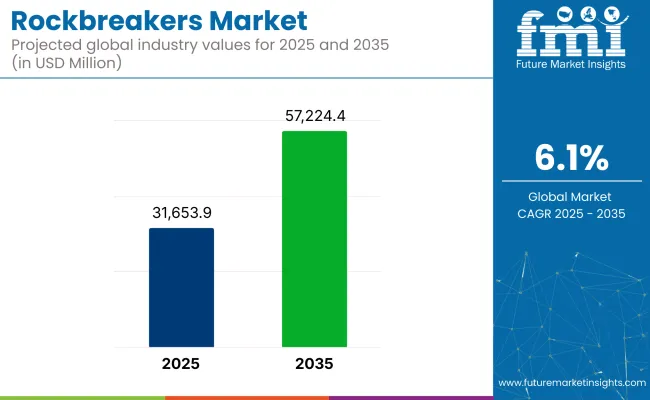

The rockbreakers market is poised for steady growth between 2025 and 2035, driven by increasing demand in mining, quarrying, construction, and demolition activities. The market is projected to grow from USD 31,653.9 million in 2025 to USD 57,224.4 million by 2035, reflecting a CAGR of 6.1% over the forecast period.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 31,653.9 million |

| Industry Value (2035F) | USD 57,224.4 million |

| CAGR (2025 to 2035) | 6.1% |

Rockbreakers play a crucial role in heavy-duty excavation and material processing by fracturing oversized rocks, concrete, and hard surfaces. The increasing use of hydraulic rockbreakers, advanced automation in mining equipment, and rising infrastructure projects is fueling market expansion.

AI integrated rockbreaking equipment is set to-evolutionize the landscape of rockbreaking machinery, from automated rockbreaking machinery and remote-controlled demolition equipment to hydraulic hammers with low energy consumption, resulting in enhanced efficiency, safety, and sustainability.

Increased investments in mining exploration, underground excavation, and material extraction projects are driven by the increases in aggregate, mineral, and metals demand globally. Similar government-sponsored projects, from smart cities to road expansions and urban infrastructure, are also supporting the growing adoption of advanced rockbreaking solutions.

Electricity-powered rockbreakers, AI-based optimization of impact force, and automated hydraulic breaker attachments are among technological advancements fuelling operational efficiency, shrinking environmental impact, and contributing to worker safety in elevated-risk excavation zones.

North America continues to be one of the largest markets for rockbreakers, fueled by the proliferation of mining activities, rising investments in infrastructure, and technological advancements in hydraulic breaker attachments. Strong demand in coal mining, mining of metals and large-scale construction projects are driving sales of heavy-duty rockbreaking machinery in the United States and Canada.

As a result, the market grows with the implementation of smart mining solutions, artificial intelligence-based excavating equipment and eco-friendly hydraulic rockbreaking machines. Furthermore, government projects supporting clean energy transition and renewable infrastructure development are fuelling the demand for rockbreakers used in aggregate and cement production.

Germany, France, the UK, and Italy investments in sustainable mining, underground tunnel expansion, quarrying activities are driving demand for energy-efficient rockbreaking solutions across Europe, resulting in steady growth across the region. The European Union’s strict emissions rules and worker safety requirements are pushing the transition to low-noise, electric powered and remote controlled rockbreakers.

Being one of the leading producers of construction equipment in Germany, it is now concentrating on developing AI-based machinery for devices used in rockbreaking applications. High-efficiency hydraulic rockbreakers are also counting on the UK and France, as well the two countries are placing high priority on modernized mining operations and rail tunnel expansions.

The Asia-Pacific region is the most opportunistic market, China, India, Australia, and Japan are the leaders in mining exploration industries, infrastructure expansion, and other material extraction industries. Demand for heavy-duty rockbreaking solutions across the region is growing substantially due to the region’s surging urbanization, government-supported construction projects, as well as demand for minerals and aggregates.

China's extensive coal mining and metal extraction activities are driving investments in large-impact hydraulic breakers as well as automated excavation systems. Further, the construction of smart cities, rails, and roads in India are contributing to the consistent growth of the market. Meanwhile, Japan and Australia are also collaborating to create new approaches to rockbreaking with advanced mining efficiency, autonomous excavation technologies, and AI-driven integration of rockbreakers, all resulting in more technological innovation for environmentally efficient next-generation rockbreaking solutions.

Gradual growth in the mining & infrastructure sectors in emerging markets such as Brazil, Mexico, Saudi Arabia & South Africa, resulting in increased adoption of advanced rockbreaking equipment. With the oil & gas infrastructure, tunnel excavation, and road networks seeing significant investments in the Middle East, the demand for high-durability hydraulic breakers is riding on the waves of these projects.

The growing mining industry in Latin America, especially in Brazil and Mexico, is increasing the demand for strong and effective rockbreaking machinery. The market is further expanding due to Africa’s focus on mining exploration, cement production, and underground drilling.

Challenges

High Operational & Maintenance Costs

Rockbreaking machinery requires high initial investment, frequent maintenance, and specialized operators, making it a cost-intensive solution for small and medium enterprises (SMEs). Continues to incur ongoing operational expenses due to the wear and tear of hydraulic components and cycles, replacement of hammers and higher fuel consumption.

Also, spare part availability and equipment downtime along with performance inefficiencies in older hydraulic breaker models may cause increased repair costs and decreased productivity.

Stringent Environmental & Safety Regulations

Governments worldwide are enforcing strict regulations on emissions, noise pollution, and worker safety in mining and construction sites, posing challenges for traditional fuel-powered rockbreakers. Compliance with guidelines such as the Occupational Safety and Health Administration (OSHA) and European Union (EU) environmental standards and carbon footprint development policies has fueled an innovation drive toward eco-friendly, low noise and energy-efficient rockbreaking products amongst manufacturers.

Transitioning towards electric-powered rockbreakers and AI-assisted demolition equipment may present opportunities but these come with heavy R&D investment and infrastructure upgrades.

Opportunities

Advancements in Smart & Automated Rockbreaking Technologies

AI-powered rockbreaking gear, remote-controlled demolition systems, and real-time force optimization are being employed to improve efficiency and safety in mining and excavation projects. AI-based machines are gaining momentum, for instance, smart mining and construction applications are on the rise due to the popularity of autonomous hydraulic breakers with GPS tracking and IoT-based monitoring systems.

Innovation partnerships with enhanced data analytics, predictive maintenance, and improved excavation force control in automated rockbreaking will better position manufacturers to serve high-precision projects.

Growth in Infrastructure Development & Mining Exploration

Governments and private firms are doubling down on mining operations, road construction, and urban infrastructure as megacities grow, large-scale transportation projects expand and global appetites for raw materials increase.

New market opportunities arise from high-performance rockbreaking requirements for rail tunnels, underground metros, and large-scale dam projects. Growth in mining of lithium, copper, and rare earth metals is putting pressure on mining companies to scale up operations in mineral-rich regions, and this will create demand for hard-impact and long-lasting hydraulic breakers.

Sustainable & Energy-Efficient Rockbreaking Solutions

There is an increasing trend in less restrictive construction equipment, such as eco-friendly construction machinery, electric-powered hydraulic breakers, noise-reduced demolition tools, and more. Top companies are prioritizing the technological advancement of rockbreakers considering the low-emission, higher-efficiency operations along with smart energy consumption optimization.

Hydraulic energy recovery system design, self-lubrication device design, and automatic impact force control are expected to decrease fuel consumption and improve breaker longevity while reducing environmental impact.

The rockbreakers market experienced steady growth from 2020 to 2024, driven by rising mining activities, infrastructure developments, and increasing requirement for efficient rock excavation equipment. And as global urbanization and large-scale construction projects broadened, so too did the need for advanced rockbreaking solutions. To this end, the market profited from hydraulic breaker technology advances, robotics, and energy-efficient frameworks that made work more productive and naturally neighborly.

Looking forward to 2025 to 2035, he global rockbreakers market is set to build upon this momentum given the projected investments in smart mining technologies, sustainable construction solutions and automation. AI, IoT-enabled monitoring systems, and greener designs will create new standards of efficiency and performance in rockbreaking operations. Moreover, governments tightening their regulations on emission and environmental impact will push the manufacturers towards the growth of electric and hybrid rockbreakers to fulfil the sustainability goals.

Comparative Market Analysis

| Market Shift | 2020 to 2024 |

|---|---|

| Regulatory Landscape | Adhering to health and safety regulations for mining and construction. |

| Technological Advancements | Hydraulic breakers with improved durability and power efficiency. |

| Industry-Specific Demand | Strong demand for mining, construction and quarrying section. |

| Sustainability & Circular Economy | Initial steps towards reducing fuel consumption and emissions. |

| Market Growth Drivers | Emerging infrastructure projects around the globe, the booming mining industry, and rapid technological advances. |

| Market Shift | 2025 to 2035 |

|---|---|

| Regulatory Landscape | New emission control actions and sustainability requirements for equipment manufacturers. |

| Technological Advancements | AI-based diagnostics, autonomous operations, IoT monitoring integration. |

| Industry-Specific Demand | Diversification into renewable energy projects, tunneling and smart city infrastructure. |

| Sustainability & Circular Economy | Highly integrated and connected solutions for large-scale activity such as electric and hybrid rockbreakers, recycling, and waste reduction initiatives. |

| Market Growth Drivers | Highly integrated and connected solutions for large-scale activity such as electric and hybrid rockbreakers, and waste reduction initiatives. |

Growth of the rockbreakers market in the USA can be attributed to the booming construction sector, ongoing large-scale mining projects, and infrastructure modernization efforts in the country. The high-performance rockbreaking equipment is on patients' minds due to the growing demand for aggregates and minerals, stemming from increase in construction activities.

The growth of fuel-efficient and low-emission hydraulic breakers is driven by government investments in road construction, tunneling and energy projects, and stricter environmental regulations. The growth in the variable frequency drive market is being aided by improvements in automation and the development of remote-controlled rockbreakers in order to improve safety and efficiency.

| Country | CAGR (2025 to 2035) |

|---|---|

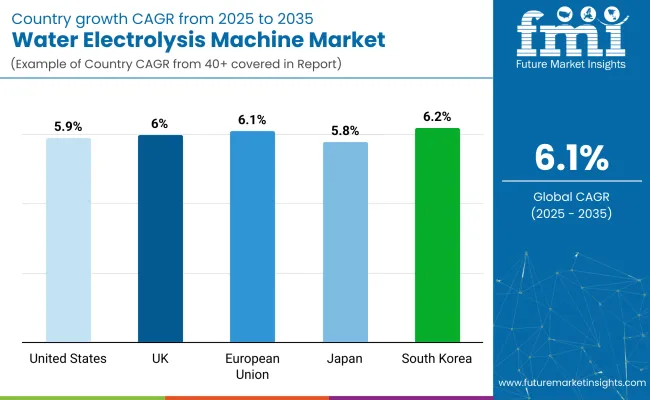

| United States | 5.9% |

The UK rockbreakers market is growing due to the development of infrastructure projects, demand for aggregates, and modernization of the construction industry. Efforts being made by the government towards smart infrastructure and urban redevelopment are surging demand for efficient rockbreaking solutions.

The transition to sustainable machinery such as low-emission hydraulic rockbreakers and noise reduction technologies is finally making traction. The growing adoption of robotic and automated rockbreaking systems in underground mining and tunneling helps drive the growth of the market.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 6.0% |

Investments in mining, infrastructure development, and renewable energy projects are driving the growth of the European Union rockbreakers market. With smart cities and transportation networks on the rise, the need for aggregates, concrete, and other construction materials is also on the rise.

Tight EU legislation surrounding emissions and noise pollution is driving electric and hybrid-powered rockbreakers into development and implementation. Finally, the increasing automation trend in construction and mining operations is driving the demand for AI-powered and remotely-operated rockbreaking systems.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union | 6.1% |

Japan rockbreakers market is projected to witness stable growth attributed to Japan's investment in infrastructure resiliency, seismic retrofitting, and underground tunnel construction. With the emphasis on earthquake-resistant structures and smart city construction, demand for high-efficiency rock breaking solutions is rising.

Spring and hydraulic rockbreakers are advanced mechanisms that are integrated with innovative IoT based monitoring technology by Japanese manufacturers to improve the efficiency and longevity of the rockbreaker. Until then, in the ground-breaking realm, remote-controlled automated rockbreaking systems and similar solutions are becoming big in the mining industry to enhance safety and precision.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 5.8% |

South Korea’s rockbreakers market is growing rapidly due to large-scale urbanization projects, expanding mining operations, and government investments in construction and infrastructure development. Growing demand for efficient rockbreaking solutions in tunneling and road construction is supporting the growth of this market segment.

The focus on smart construction equipment leads to the uptake of advanced hydraulic rockbreakers due to better work and energy-efficient gear in the readymix, expressed by their relatively small contribution in the new world of machinery. The presence of key heavy equipment manufacturers and ongoing innovations in automation and robotics are additional factors contributing to the market growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 6.2% |

Hydraulic Rock Hammers Lead in Efficiency and Versatility

Hydraulic rock hammers are among the most widely used rockbreakers, valued for their efficiency, power, and adaptability in construction and mining applications. These hammers are often fitted to excavators and used to break rock formations, moving in a steady up/down motion. Their versatility in confined spaces and harsh environments makes them ideal for quarrying, tunneling and demolition work.

They also operate on technological improvements such as noise reduction, automatic lubrication systems, energy recovery mechanisms, etc. Adoption of hydraulic rock hammers is expected to grow with increasing infrastructure development projects, particularly in regions with expanding urban landscapes. Furthermore, next-generation hydraulic hammers with enhanced impact energy and lower maintenance costs contribute to market expansion and are essential for large-scale excavation projects.

Expanding Grouts and Mortars Gain Traction for Controlled Demolition

Expanding grouts and mortars provide an environmentally friendly, non-explosive alternative for breaking rock, making them ideal for controlled demolition applications. Such products expand internally within pre-drilled holes, applying pressure that splits the surrounding rock, all without the use of heavy machinery or explosives. They have important advantages in urban construction due to the vibration and noise restrictions.

Moreover, also the Expansion grouts and the Expansion mortars are being utilized in the underground mining where the main obstacle is safety associated with explosive materials. The growing focus of sales and marketing teams toward expanding grouts & mortars and the tight environmental and safety regulations imposed by various regulatory bodies are expected to fuel steady growth of the global grouts & mortars market.

Moreover, their capacity to mitigate harm to adjacent constructions render them an appealing option for heritage building renovations, tunneling operations, and high-density metropolitan build.

Infrastructure Construction & Excavation Drives Market Demand

Roadways, bridges, tunnels, and railways requiring efficient rock-breaking solutions emphasize infrastructure construction and excavation as a significant end-use segment for the rockbreakers market. However, the robust development of economy and cities has accelerated the demand for advanced rock breaking technology over the years. Hydraulic hammers, rock splitters, and pyrotechnic products are used by civil engineering workers involved in the physical alteration of landscapes and the creation of foundations, roads, and water and sewage systems.

Moreover, the demand for rockbreakers in infrastructure development is further driven by the growing smart city projects and urban redevelopment programs. Furthermore, as the construction sector is prefabricating and modularizing on a larger scale, the need for efficient excavation and foundation preparation has propelled usage of high-performance rockbreaking equipment and its components.

Mining Sector Relies on Advanced Rockbreakers for Productivity Gains

Mining is one of the biggest consumers of rockbreakers, as many mineral extraction processes involve breaking through hard rock formations. Devices like hydraulic rock splitters, explosives, and hand-held breakers are used to fracture rock for open-pit and underground mining operations. Increased demand for precious metals, rare earth elements and construction materials will necessitate more mining, leading to yet more growth in the rock-breaking equipment market.

As sustainability of operations comes centre stage, manufacturers are also advancing the development of energy-efficient and lower emissions rockbreakers that improve the safety of operations and lower the environmental impact. Az Backing up its commitment to the resource sector, Epiroc also says that the demand for high-performance rockbreakers will continue to grow significantly as mining operations expand, especially in resource-rich areas.

Also automated rockbreakers, remotely operated demolition tools, and AI-based diagnostics for equipment are innovating mining operations by increasing safety, reducing downtime, and enhancing energy utilization.

The Rockbreakers market is experiencing steady growth, driven by increasing demand in mining, construction, and infrastructure development sectors. Rockbreakers, also known as hydraulic breakers or hammer breakers, are essential for breaking large rocks and concrete in quarrying, demolition, and excavation projects.

Increase in mechanization across industries and demand for efficient material handling solutions are driving demand for rockbreakers. Moreover, the development of urban areas and growing number of infrastructure projects like roads, tunnels, and bridges is also supporting the growth of the market.

Technological advancements, such as powered rockbreaking technology and monitoring support become inherent features. Firms are paying for sturdy, energy-saving designs that have greater staying power and less need for upkeep.

Due to a rise in stricter regulations on impact on habitats around building and mining industries of the past, the market is also moving towards the concept of green rockbreaking where noise and vibrations are little or no. This has led manufacturers to concentrate on sustainable product solution design including electric powered rockbreakers and hybrid system offerings focused on minimized carbon emissions.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Epiroc AB | 18-22% |

| Sandvik AB | 15-18% |

| Furukawa Rock Drill Co., Ltd. | 10-14% |

| Indeco Ind. S.p.A. | 8-12% |

| Montabert (Komatsu) | 5-9% |

| Other Companies (combined) | 40-45% |

| Company Name | Key Offerings/Activities |

|---|---|

| Epiroc AB | Designs performance hydraulic rockbreakers for mining and construction, automating the entire process with remote technology. |

| Sandvik AB | Expert in intelligent monitoring systems & energy efficiency, innovative rockbreaking propitious. |

| Furukawa Rock Drill Co., Ltd. | Decreases parabolic path using hydraulic interlink system equipped with quality assemblies and advanced impact control system for optimized productivity and durability. |

| Indeco Ind. S.p.A. | Specializes in environmentally friendly hydraulic breakers that minimize noise and vibration for a safer work environment and regulatory compliance. |

| Montabert (Komatsu) | Operates high-performance, high-precision rockbreaking attachments ideal for tough excavation conditions. |

Key Company Insights

Epiroc AB

Epiroc AB is a leading provider of hydraulic rockbreakers, offering cutting-edge solutions for mining and construction applications. The company is known for its automated rockbreaking systems that improve safety and productivity.

Epiroc's remote-controlled rockbreakers minimize the risk to operators in hazardous environments. The company is also investing in energy-efficient technologies to improve equipment performance with less fuel consumption and emissions. Its focus on sustainability is part of its innovation for the development of electric rockbreakers, which support industry to shift towards greener equipment.

Sandvik AB

Sandvik AB delivers intelligent rockbreaking technologies with smart monitoring systems for enhanced equipment performance and maintenance. Mechanism of automatic adjustment for the time of shutting down of the hydraulic breaker at the precise moment.

Chris Wright, integrated solutions manager, Sandvik comments, 'Our work with rockbreakers has not only been grounded in customer support but also a commitment to sustainability, which has resulted in our integrated solutions producing energy-saving rockbreakers that meet increasingly stringent environmental regulations. They may also provide tailored solutions for various rock formations and mines, enhancing productivity and lowering operational costs.

Furukawa Rock Drill Co., Ltd.

Furukawa Rock Drill Co., Ltd. is a key player in the hydraulic breaker market, providing high-performance solutions for heavy-duty applications. A company that specializes in designing long-lasting, impact-resistance rockbreakers that are friendly with hydraulic control systems.

Furukawa expertise includes innovation-spanning impact absorption techniques that maximize the life of its rockbreaking machines thanks to RDF investment. This company just would not stop growing and expanding, forming global partnerships for that and international training programs, so that every operator gets the most out of their equipment.

Indeco Ind. S.p.A

Indeco Ind. S.p.A. specializes in the manufacture of hydraulic breakers that are not only gentle on the environment, but also do not compromise on operator safety or excessive noise. The company develops high-efficiency breakers that reduce vibrations and enhance fuel efficiency.

Indeco is involved into environmental respect bolstered by its development of low-emission hydraulic systems that can also match international standards in this area. It also emphasizes intelligent monitoring and telematics systems that deliver real-time data on equipment performance, empowering operators to recognize issues before they result in downtime.

Montabert (Komatsu)

Montabert, part of the Komatsu family, the producer and designer of high-precision rockbreaking alternates; these serve to be an efficient solution to the excavation process. Hydraulic breakers from the company offer high performance in demanding conditions, such as mining and demolition,'s hydraulic.

Montabert combines innovative hydraulic control features that enhance productivity and minimize wear and tear on equipment. By continuously investing in R&D the company can develop impact energy more efficient and produce rockbreaking solutions that are lower maintenance and give higher operational performance.

In terms of Product Type, the industry is divided into Hydraulic Rock Hammers, Hydraulic Rock Splitters, Hand Held Breakers, Expanding Grouts and Mortars, Explosives and Pyrotechnic Products.

In terms of End Use, the industry is divided into Residential Construction & Excavation, Commercial Construction & Excavation, Industrial Construction & Excavation, Infrastructure Construction & Excavation and Mining.

The report covers key regions, including North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia, and the Middle East and Africa (MEA).

The global rockbreakers market is projected to reach USD 31,653.9 million by the end of 2025.

The market is anticipated to grow at a CAGR of 6.1% over the forecast period.

By 2035, the rockbreakers market is expected to reach USD 57,224.4 million.

The Hydraulic Rock Hammers segment is expected to hold a significant share due to its widespread usage in mining and construction applications, high efficiency in breaking hard rock formations, and increasing infrastructure development projects globally.

Key players in the rockbreakers market include Epiroc AB, Sandvik AB, Indeco Ind. SpA, Montabert SAS, Furukawa Rock Drill Co. Ltd., Rammer, Okada Aiyon Corporation, Breaker Technology Ltd., and Atlas Copco.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA