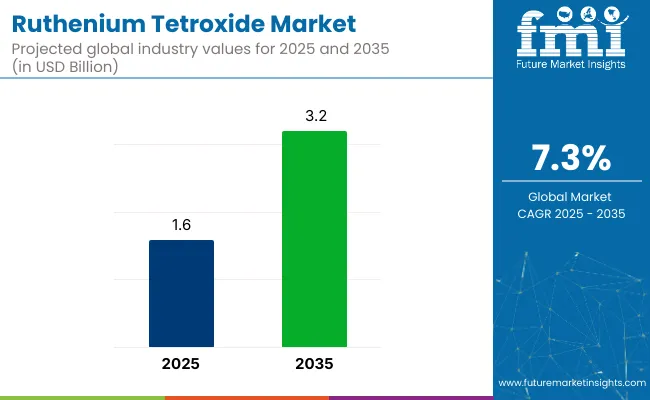

The ruthenium tetroxide market is valued at USD 1.6 billion in 2025 and is slated to reach USD 3.2 billion by 2035, at a CAGR of 7.3%. Its demand is driven by increasing usage in semiconductor manufacturing, chemical synthesis, and forensic applications.

| Metric | Value |

|---|---|

| Estimated Market Size (2025) | USD 1.6 Billion |

| Projected Market Size (2035) | USD 3.2 Billion |

| CAGR (2025 to 2035) | 7.3% |

Growth is being observed as companies adopt ruthenium-based catalysts for specialty chemical oxidation and integrate ruthenium materials in advanced chip fabrication for improved conductivity and microcircuit performance.

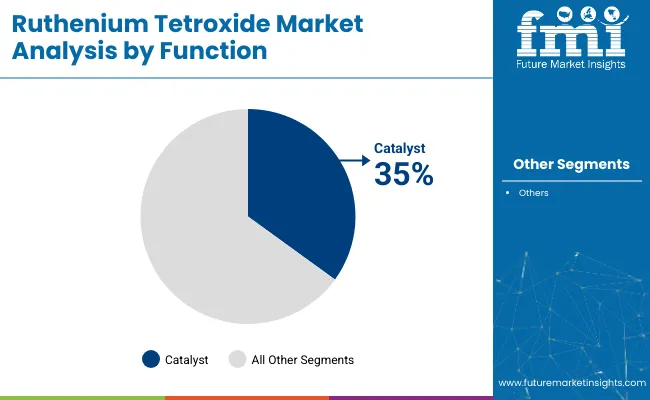

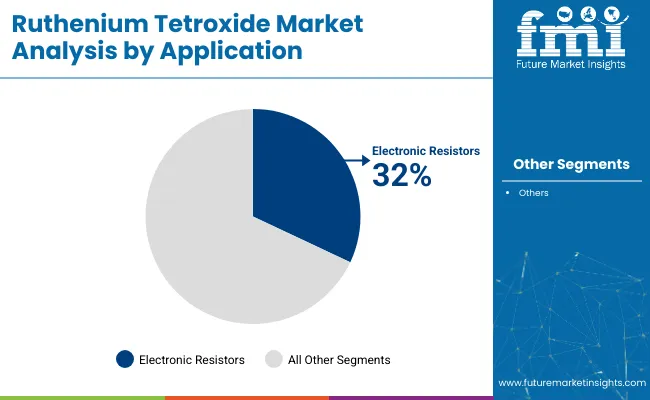

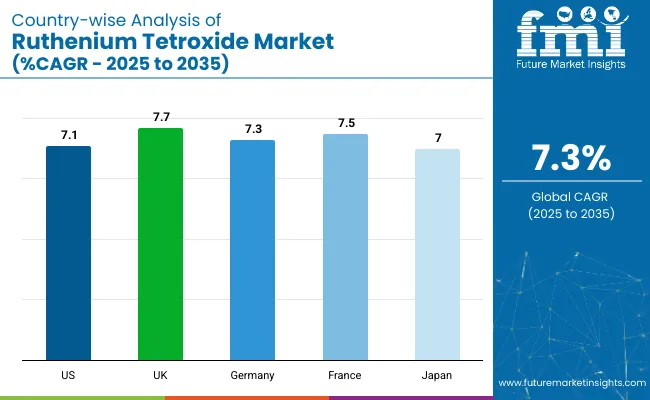

In 2025, catalyst function is expected to dominate the market with over 35% share due to its critical use in pharmaceutical oxidation processes and specialty chemical synthesis. Electronic resistors are projected to remain the largest application segment with approximately 32% market share, driven by demand from consumer electronics, 5G network components, and electric vehicle battery management systems. UK is forecasted to register the fastest growth with a CAGR of 7.7% due to strong semiconductor manufacturing investments.

The market has been witnessing innovations focused on safer ruthenium processing, including encapsulated catalysts and stabilized compounds to mitigate toxicity and volatility risks. Research on recycling ruthenium from industrial waste streams is being advanced to ensure sustainability and reduce reliance on primary mining. These innovations are expected to enhance operational efficiency while aligning with environmental safety standards.

Ruthenium tetroxide holds an estimated 18% to 22% share in the ruthenium compounds market, primarily due to its unique oxidative and catalytic properties. Within the broader precious metal compounds market, it contributes around 6% to 8%, reflecting its niche yet critical role in specialized reactions.

In the inorganic chemicals market, its share remains limited at below 1%, given the market's vast scope. It accounts for approximately 3% to 5% in the specialty chemicals market and around 4% in the chemical reagents segment, while its share in catalysts and electronics chemicals markets is estimated at 2% to 3%, largely in R&D and niche applications.

Additionally, opportunities are arising from the growing use of ruthenium tetroxide in dye-sensitized solar cells (DSSC). Its application as a light-absorbing dye in flexible and transparent solar panels is expected to gain traction due to rising demand for cost-effective renewable energy solutions. This emerging use case is being explored extensively by manufacturers aiming to enhance solar panel efficiency and market viability.

The market is segmented into function, application, and region. By function, the market is divided into chemical intermediate, staining agent, resisting agent, catalyst, and others. Based on application, the market is categorized into electronic resistors, metal alloys, solar cells, pharmaceuticals, and others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia Pacific, and Middle East and Africa.

Catalyst function has been projected to dominate the function segment, accounting for over 35% of the global market share by 2025. Ruthenium tetroxide has been extensively used as an oxidation catalyst in pharmaceutical synthesis, aiding in complex organic reactions for antiviral and chemotherapy drugs.

Electronic resistors are expected to lead the application segment, capturing approximately 32% market share in 2025. Ruthenium-based resistors have been widely used in consumer electronics, high-frequency telecommunications, and electric vehicles for their stable conductive properties.

The ruthenium tetroxide market has been experiencing steady growth, driven by increasing demand for advanced semiconductor materials, specialty chemical oxidation catalysts, and forensic analysis applications.

Recent Trends in the Ruthenium Tetroxide Market

Challenges in the Ruthenium Tetroxide Market

The UK leads the ruthenium tetroxide market with a projected CAGR of 7.7% from 2025 to 2035, driven by pharmaceutical synthesis, REACH compliance, and academic R&D. France follows closely at 7.5%, supported by semiconductor adoption and green oxidation technologies. Germany, with a 7.3% CAGR, benefits from a strong chemical base and semiconductor integration.

The USA market is growing at 7.1%, fueled by semiconductor and pharmaceutical demand alongside rising green chemistry investments. Japan registers a 7.0% CAGR, with growth led by semiconductor and solar cell applications. Across all countries, sustainability, advanced materials, and electronic-grade applications are key market drivers.

The report covers in-depth analysis of 40+ countries; five top-performing OECD countries are highlighted below.

The ruthenium tetroxide demand in the USA is projected to grow at a CAGR of 7.1% from 2025 to 2035. Growth has been supported by rising demand for high-performance semiconductors, oxidation catalysts in pharmaceuticals, and forensic chemical analysis.

The UK ruthenium tetroxide market is forecast to expand at a CAGR of 7.7% over the forecast period. Demand has been driven by chemical manufacturing, pharmaceutical synthesis, and increased research into eco-friendly oxidation catalysts.

Ruthenium tetroxide demand in Germany is projected to grow at a CAGR of 7.3% between 2025 and 2035. The nation’s strong chemical and semiconductor industries have been boosting demand for ruthenium-based materials.

France’s ruthenium tetroxide sales are expected to grow at a CAGR of 7.5% from 2025 to 2035. Growth has been supported by rising demand in pharmaceuticals, semiconductor materials, and advanced oxidation processes for specialty chemicals.

Ruthenium tetroxide sales in Japan are forecast to grow at a CAGR of 7.0% through 2035. Growth has been driven by semiconductor manufacturing, advanced materials, and dye-sensitized solar cells (DSSC) applications.

The ruthenium tetroxide market is moderately consolidated, with global leaders and niche regional producers shaping competitive dynamics through product purity, advanced manufacturing technologies, and safety-focused process innovations.

Tier-one firms, such as Hubei Jusheng Technology Co., Ltd., J&K Scientific, ESPI Metals, Krastsvetmet, American Elements, Aspira Chemicals, METAKEM GmbH, and Tokyo Chemical Industry have been focusing on high-purity catalyst production, technological R&D for safer compounds, and expanding applications in semiconductor, pharmaceutical, and material science sectors.

| Report Attributes | Details |

|---|---|

| Current Total Market Size (2025) | USD 1.6 billion |

| Projected Market Size (2035) | USD 3.2 billion |

| CAGR (2025 to 2035) | 7.3% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Market Analysis Parameters | Revenue in USD billion / Volume in metric tons |

| By Function | Chemical Intermediate, Staining Agent, Resisting Agent, Catalyst, Others |

| By Application | Electronic Resistors, Metal Alloys, Solar Cells, Pharmaceuticals, Others |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia Pacific, Middle East and Africa |

| Countries Covered | United States, United Kingdom, Germany, France, Japan, South Korea, China, Brazil, India, Italy |

| Key Players | Hubei Jusheng Technology Co., Ltd., J&K Scientific, ESPI Metals, Krastsvetmet , American Elements, Aspira Chemicals, METAKEM GmbH, Tokyo Chemical Industry, BOC Sciences, Henan CoreyChem . |

| Additional Attributes | Market share analysis by function and application, country-wise CAGR analysis, and brand positioning insights |

The market is expected to reach USD 3.2 billion by 2035.

The global market is projected to grow at a CAGR of 7.3% during this period.

Catalyst function is expected to lead with over 35% market share in 2025.

Electronic resistors are expected to hold approximately 32% of the market share in 2025.

UK is anticipated to be the fastest-growing market with a CAGR of 7.7% through 2035.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA