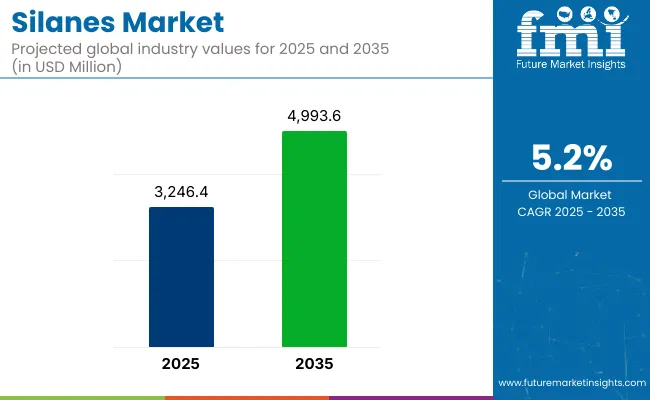

The global silanes market is estimated at USD 3,246.4 million in 2025 and is forecast to expand to USD 4,993.6 million by 2035, registering a CAGR of 5.2%.

Market growth is driven by demand across adhesives, sealants, coatings, and polymer treatment industries, with increasing application in coupling, crosslinking, and surface modification processes.

Silanes are being adopted across construction, automotive, electronics, and renewable energy sectors, where their performance-enhancing properties are supporting product longevity and system efficiency. In construction applications, silane-based formulations are used in concrete protection, waterproofing systems, and joint sealants. Their role in forming hydrophobic barriers has been applied in tunnel linings, parking structures, and highways to mitigate corrosion from moisture and de-icing salts. These use cases are aligned with efforts to extend infrastructure lifespans while reducing lifecycle maintenance costs.

In automotive manufacturing, silane coupling agents are enabling the integration of silica into tire treads, improving fuel economy by reducing rolling resistance while maintaining traction and wear performance. Tire manufacturers have expanded silane incorporation to meet regulatory targets on vehicle emissions and energy efficiency. Beyond tires, silanes are contributing to improved adhesion in structural adhesives, glass bonding, and underbody coatings, particularly in electric vehicle platforms.

The semiconductor industry continues to rely on silanes in advanced fabrication environments. High-purity silanes such as tetraethyl orthosilicate (TEOS), trichlorosilane, and dichlorosilane are being used in thin-film deposition processes for microelectronic circuits, passivation layers, and solar-grade polysilicon production. Demand is supported by ongoing investments in chip manufacturing across Asia-Pacific, including Taiwan, South Korea, and China, as well as in solar photovoltaic panel production.

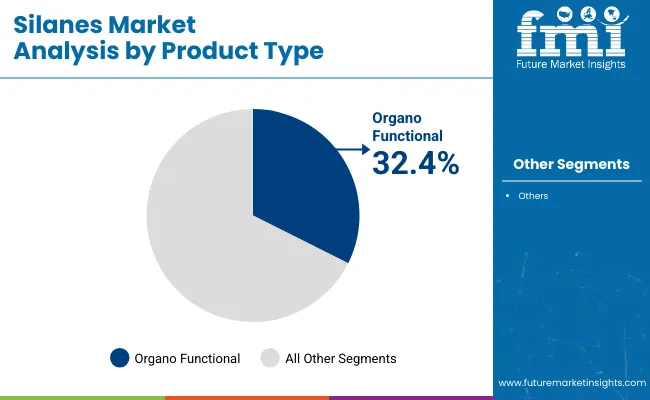

Organo functional silanes are projected to account for 32.4% of the market share in 2025 and are expected to grow at a CAGR of 5.4% through 2035. These silanes possess functional groups such as amino, epoxy, or methacryloxy, which enable chemical bonding between organic polymers and inorganic surfaces. Their use is prevalent in adhesives and sealants, fiber-reinforced composites, and moisture-curable coatings.

Organo functional silanes enhance dispersion of fillers, reinforce adhesion to substrates, and improve weathering resistance. Common application areas include construction sealants, automotive coatings, electronics encapsulants, and wire insulation. In composite manufacturing, these silanes help increase mechanical integrity and dimensional stability. Key markets include China, the USA., and Germany, where infrastructure and automotive production is substantial. Their performance across multiple substrate types supports growing adoption in multi-material bonding solutions.

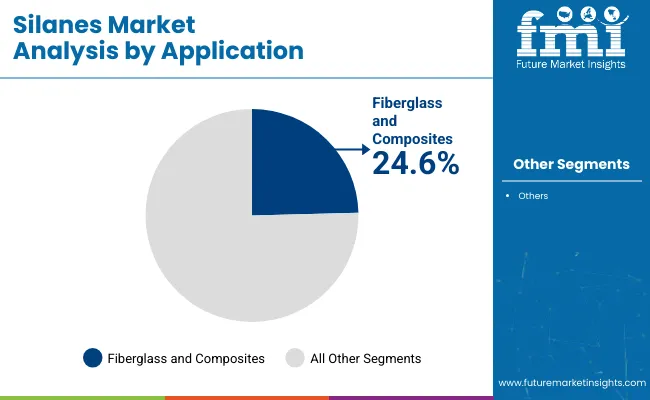

The fiberglass and composites segment is projected to hold 24.6% of the market share in 2025 and is expected to grow at a CAGR of 5.6% through 2035. Silanes are essential in surface treatment of glass fibers, enabling improved matrix-fiber bonding and tensile strength in composite applications.

These materials are widely used in construction panels, automotive body parts, wind turbine blades, and industrial structures. Silanes enhance fiber wet-out, reduce void formation, and ensure consistent performance under mechanical stress.

Their use is expanding as demand for lightweight, corrosion-resistant alternatives to metal increases across sectors. Asia Pacific and North America are key regions driving growth through investments in infrastructure, renewable energy, and transportation. Silane-treated composites are preferred for their stability under variable environmental conditions and their ability to maintain structural integrity over long lifespans in high-performance systems.

Challenges: Raw Material Price Fluctuations, Regulatory Restrictions, and Complex Handling Requirements

High volatility in the prices of raw materials, particularly silicon-based compounds, is likely to hamper the stability of production costs and final pricing in the silanes market. Manufacturers must meet and continue to follow Environmental Protection Agency (EPA) and Occupational Safety and Health Administration (OSHA) standards which makes operation at a premium cost for chemical, automotive, and semiconductor industries.

Furthermore, the naturally high reactivity and susceptibility to storage conditions for silanes lead to certain complexities in handling and transportation, necessitating specialized containment and distribution processes.

Opportunities: Growth in Adhesives, Coatings, and Semiconductor Applications

The market segment is expanding even with the challenges, as there is increasing demand for silane-based adhesives, coatings, and sealants in automotive, construction, and electronics industries. Silanes are widely used in paints, rubber production and composites, mainly for surface treatment, adhesion promotion and corrosion resistance.

High-purity functional silanes are becoming increasingly important in a cross-section of industries with the highest observed growth in semiconductor and electronics development, particularly in sectors related to chip fabrication, organic light-emitting diode (OLED) displays and optical fiber coatings.

In addition, increasing requirements for sustainable coatings and green construction solutions have created a rise in opportunities for environmentally-friendly, low-VOC silane formulations.

In addition to such application of substrate create synergies to further drive the economies of this smart market, moreover, advancements in silane-modified polymer requisite for high-performance sealants and automotive lightweighting fee-based application are also among the significant drivers facilitating market expansion.

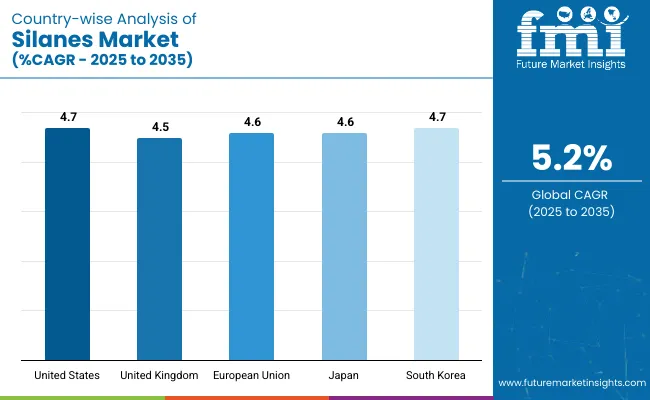

Growing demand for high-performance coatings, automotive composites, and semiconductor-grade silanes are contributing to the growth of the silanes market in the USA They are widely harnessed for eco-friendly silane coatings in infrastructure projects as well as energy-efficient glass production, which is stirring the growth of the market. Novel machine learning-augmented material optimization techniques advance silane generation for the next generation of silane formulations.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 4.7% |

Growing emphasis on sustainable building materials, major developments in wind power projects, and demand for high-durability silane coatings is projected to enable stead growth in the UK market. Innovative solutions are in high demand in the field of adhesives, paints, and protective coatings due to the growing need for low-carbon chemical production and bio-based silane derivatives.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 4.5% |

The silanes market in Europe is driven by stringent environmental regulations, rapid growth in automotive electrification, and a strong growth in smart coatings.

Germany, France and Italy are among the leaders in hydrophobic silane applications in this sector, in addition to lightweight composite materials and solar energy coatings. Market trends are being shaped by the growing demand for bio-based and recyclable industrial chemicals.

| Region | CAGR (2025 to 2035) |

|---|---|

| EU | 4.6% |

In Japan, the increasing investments towards semiconductor-grade silane coatings, anti-fingerprint display coatings, AI-enhanced material research, and others have been propelling the country's silanes market. Its technological leadership in nano-coatings and smart surface treatments is generating demand for ultra-thin protective silane films and self-repairing coatings.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 4.6% |

Demand for silanes is projected to increase in South Korea as consumer electronics, automotive, and solar energy applications are booming. Hydrophobic silane coatings for flexible displays, AI-optimized formulations within the automotive adhesive sphere, and high-performance semiconductor-grade silanes are some of the advancements set to influence the future world of this market.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 4.7% |

The silanes market faces operational challenges due to moisture sensitivity, requiring specialized storage and strict handling. Companies are incurring higher logistics and safety compliance costs to meet regulatory standards from OSHA and REACH. Supply chain fluctuations for key silicon-based feedstocks are impacting pricing and procurement strategies. As industries focus on material compatibility, energy efficiency, and durability, silanes are increasingly used as functional additives in high-performance applications, driving market growth.

The overall market size for the silanes market was USD 3,246.4 Million in 2025.

The silanes market is expected to reach USD 4,993.6 Million in 2035.

The demand for silanes is rising due to their increasing use in adhesives, sealants, and coatings for enhanced durability and performance. The expansion of the automotive, construction, and electronics industries is further driving market growth.

The top 5 countries driving the development of the silanes market are the USA, China, Germany, Japan, and India.

Organo Functional and Mono/Chloro Silanes are expected to command a significant share over the assessment period.

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.