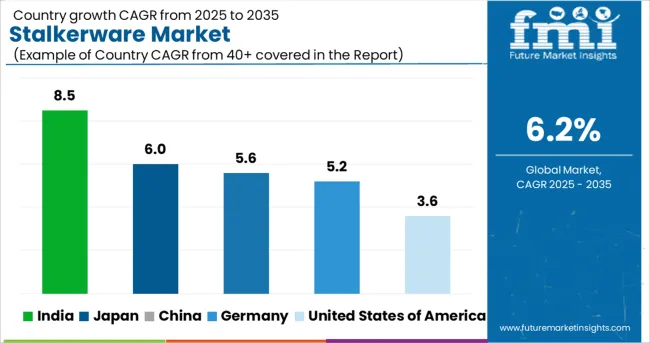

The Stalkerware Market is estimated to be valued at USD 145.3 million in 2025 and is projected to reach USD 265.1 million by 2035, registering a compound annual growth rate (CAGR) of 6.2% over the forecast period.

The stalkerware market is undergoing notable growth driven by rising digital surveillance activities, increasing smartphone penetration, and heightened demand for monitoring tools among individuals. The widespread use of mobile devices coupled with the growing availability of covert tracking applications has expanded the reach of stalkerware solutions.

Shifts in personal relationships, concerns over child and partner monitoring, and the need for digital oversight have created conditions favoring market expansion. Evolving functionalities such as real-time tracking, remote access, and stealth operations are enhancing the appeal of these platforms to end users.

The future trajectory is expected to benefit from continuous advancements in application concealment techniques, more sophisticated monitoring features, and broader accessibility across geographies. Challenges related to regulatory scrutiny and privacy awareness are being counterbalanced by persistent user demand, paving the way for sustained adoption and market maturity.

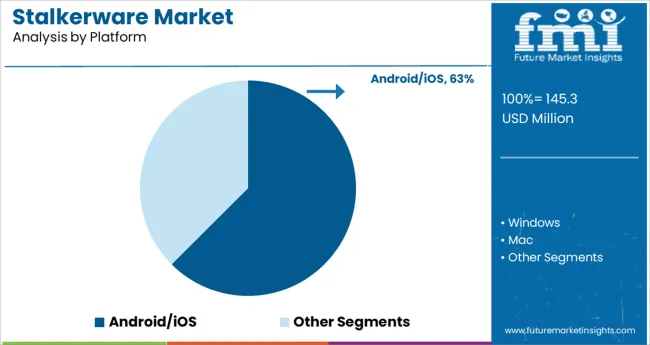

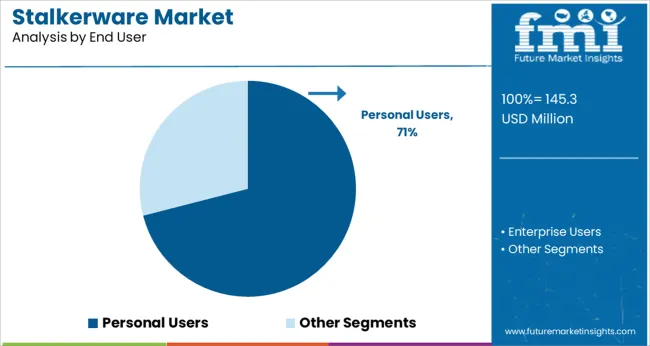

The market is segmented by Platform and End User and region. By Platform, the market is divided into Android/iOS, Windows, and Mac. In terms of End User, the market is classified into Personal Users and Enterprise Users. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

When segmented by platform, the Android iOS segment is anticipated to hold 62.5% of the total market revenue in 2025, establishing itself as the dominant platform segment. This leadership has been reinforced by the ubiquity of smartphones and the technical feasibility of deploying stalkerware applications on these operating systems.

The open architecture of Android in particular has enabled the development and installation of feature-rich surveillance tools with minimal restrictions, while improvements in iOS exploitation techniques have expanded the reach of monitoring capabilities on Apple devices. Enhanced compatibility, continuous software updates, and the ability to operate discreetly on widely used mobile platforms have strengthened the position of this segment.

Additionally, the convenience of accessing and controlling monitoring tools through familiar operating systems has further contributed to their widespread adoption, consolidating the Android iOS segment’s market leadership.

Segmented by end user, the personal users segment is projected to command 71.0% of the stalkerware market revenue in 2025, maintaining its status as the leading end user group. This prominence has been driven by the high demand among individuals seeking to monitor personal relationships, ensure family safety, and safeguard against perceived risks.

The accessibility of stalkerware applications through online channels and their ease of use have made them particularly attractive to non-professional users. The ability to deploy these tools without specialized knowledge combined with the desire for real-time information about partners, children, or acquaintances has amplified adoption among personal users.

Additionally, heightened concerns over trust, security, and personal well-being in an increasingly connected world have fueled the segment’s dominance. The affordability and stealthy nature of these solutions have further reinforced the preference of personal users for stalkerware tools, sustaining their leadership in the market.

Penetration of Mobile Device Applications and Platforms is Expanding

Increasing smartphone penetration, and technological breakthroughs in security organizations. Companies are implementing Bring-Your-Own-Device (BYOD) policies to make work easier. This also enhances the data and malware threat simultaneously, boosting the security possibilities of the firm.

New mobile applications and platforms employees work on while following the work-from-home technique necessitate numerous security levels. New manufacturers are becoming more exact and accurate in monitoring and scanning data while minimizing false alerts, which is driving sales of stalkerware systems.

With the increased usage of mobile device applications, the industry provides numerous prospects for developers and other component firms, including improved device security. The stalkerware business also provides opportunities for program developers who specialize in specific types of malware such as ransomware.

These components work together to repair or remove a certain file that contains a bug or malware that can affect the processing units. Other possibilities include integration with IoT and artificial intelligence. This strengthens and adapts stalkerware systems' monitoring operations, allowing them to filter malware while correcting and deleting the rest.

Absence of technical knowledge

The largest obstacle to the expansion of the stalkerware market is the high capital investment and incompetent staff. Along with this, new varieties of malware that are challenging for suppliers to monitor and track are complicating the development process.

Markets had suffered from the pandemic's negative effects, which included eroding their financial underpinning and making them dependent on corporate borrowing in order to survive. Therefore, the company's budget does not allow for the purchase of stalkerware systems. Additionally, the underqualified IT workforce is incapable of handling stalkerware.

The majority of firms experience stalkerware, viral attacks, and cyberattacks. The businesses are creating ways to combat the most recent infections in the panels. These platforms include real-time scanning systems that enable the device to keep track of every file that is stored or browsed online.

With the use of sophisticated tools, boot scans also assist the devices in thoroughly cleaning the systems. Government and commercial sector research and development initiatives aid in the collection of various sorts of data as well as the analysis and identification of malware in the system.

The adoption of stalkerware and built-in system security management programs is impeding market expansion. The use of substitute techniques like closed-loop malware eradication solutions further limits the spread of sales of stalkerware tools into new markets.

As the pandemic had harmed the corporate spaces' financial structure, businesses have switched to free platforms. It is important to locate and challenging to analyze the information gathered about any malware.

Wireless communications and other systems require security, and it is anticipated that security concerns are anticipated to grow more significant and pervasive across a wide range of devices. Price, power, performance, and consistency are a few of the numerous concerns while creating stalkerware solutions.

Due to the different security needs of manufacturers, most stalkerware suppliers continue to struggle with common security architecture. The process is made even more complicated by the fact that the solution suppliers need content from both security engineers and embedded system designers.

Additionally, the ability to supply cryptographic keys to mobile devices while they are being manufactured reduces a considerable risk for mobile device chipmakers.

The platforms and end-user segments are used to segment the stalkerware market. These groups are further broken into more compact divisions, each of which holds a unique market area in a separate region. Multiple components with different supply chains, marketing channels, and distribution routes are held in segments.

By End User (2025):

| Segment Name | Artists/Individuals |

|---|---|

| Share | 64.0% |

| CAGR | 6.2% |

| Segment Name | Enterprise Users |

|---|---|

| Share | 26.0% |

| CAGR | 5.0% |

| Segment Name | Educational Users |

|---|---|

| Share | 10.0% |

| CAGR | 4.6% |

The stalkerware market is made up of artists/individuals, enterprise users, and educational users. Most stalkerware programs run in the background after being downloaded, offering real-time defense against malware attacks. The stalkerware keeps track of every application behavior and alerts any dubious behavior.

Following fresh malware and ransomware assaults, businesses are spending a lot of money upgrading their stalkerware solutions. On the other hand, it is anticipated that during the assessment period, the artists/individuals segment is poised to have the fastest increase.

By Platform (2025)

| Segment Name | Android/iOS |

|---|---|

| Share | 55.0% |

| CAGR | 5.6% |

| Segment Name | Windows |

|---|---|

| Share | 20.0% |

| CAGR | 2.3% |

| Segment Name | Mac |

|---|---|

| Share | 25.0% |

| CAGR | 3.5% |

According to platforms, the market for stalkerware is segmented as android/iOs, windows, and Mac. The android / iOs segment is to have the highest market share as well as a prominent CAGR of 5.6% for the forecast period.

Android/iOS:

In order to identify and scan programs available through the Google Play store, Google uses the Google Bouncer malware scanner. AVG Technologies, McAfee, Inc., and Lookout Mobile Security are just a few mobile security companies that have provided stalkerware software for Android handsets.

iOS was created specifically for Apple hardware. Although it's said that this operating system is more secure than Android, recently, malware like XcodeGhost, WireLurker, Masque Attack, Oleg Pliss Ransom Case, and SSL Flaw have taken advantage of the system and compromised data for Apple smartphone devices.

Windows:

In order to compete with Android and iOS-based smartphones, Microsoft Corporation introduced the Windows operating system for mobile devices. For Windows mobile devices, stalkerware software is offered by a number of vendors, including Symantec Corporation and Kaspersky Lab.

| Region | North America |

|---|---|

| Share | 30.0% |

| CAGR | 4.0% |

| Region | Latin America |

|---|---|

| Share | 4.5% |

| CAGR | 4.7% |

| Region | Europe |

|---|---|

| Share | 16.3% |

| CAGR | 5.2% |

| Region | East Asia |

|---|---|

| Share | 24.5% |

| CAGR | 6.2% |

| Region | South Asia & Pacific |

|---|---|

| Share | 18.3% |

| CAGR | 8.5% |

| Region | Middle East and Africa (MEA) |

|---|---|

| Share | 6.5% |

| CAGR | 4.2% |

| Country | India |

|---|---|

| Share | 8.3% |

| CAGR | 8.5% |

| Country | China |

|---|---|

| Share | 16.3% |

| CAGR | 5.6% |

| Country | Japan |

|---|---|

| Share | 10.6% |

| CAGR | 6.0% |

Due to the region's sizable middle class's improved purchasing power, mobile phone, tablet, and laptop sales have remained strong throughout Asia Pacific. To enter this fast-changing industry, cybersecurity vendors are concentrating on expanding their footprint in the Asia Pacific. Future suppliers are anticipated to benefit from growth prospects in the Asia Pacific excluding Japan's (APEJ) stalkerware industry.

China

A sizable portion of the region's mobile users resides in China, which is also threatened by a variety of malware threats. Qihoo 360 reports that 302,000 new mobile malware variants were discovered on the Android platform during the month of January 2020.

India

Customers of Indian banks in Mumbai are being alerted to the possibility that malware disguising itself as a Flash player could steal their mobile banking credentials.

The alert comes after Quick Heal Security Labs issued a warning stating that it had discovered an Android Banking Trojan that targets over 232 banking apps, including those provided by Indian lenders. The virus is referred to as Android.banker.A2f8a.

Increasing Digitalization to Benefit Market Growth

| Country | United States of America |

|---|---|

| Share | 28.3% |

| CAGR | 3.6% |

Due to the region's increasing digitalization, North America was the largest market, and this trend is expected to continue during the forecast period. Stalkerware software demand is expected to drive growth in the stalkerware sector. The region is estimated to account for 34.2% of the total market.

North America is expected to be the next dominant region with high stalkerware market adoption rates during the forecast period. With rapid technological advancement and an increasing number of businesses in North America, the region's demand for stalkerware software is likely to increase. Rising mobile phone, tablet, and laptop sales in the region contribute to the market's expansion.

Stalkerware System Used in Europe's Growing Commercial Sector Fuels Rapid Adoption

| Country | Germany |

|---|---|

| Share | 13.3% |

| CAGR | 5.2% |

Europe is expected to provide the market with significant potential opportunities due to the region's expanding commercial sector, according to Future Market Insights. The stalkerware industry is anticipated to grow gradually over the anticipated time frame.

The growth of cybercrime in the area has led to an expansion of the stalkerware sector. The European market makes up 23.1% of the global market. The number of businesses and organizations in the nation is growing as technological investments rise. The European market benefits from the presence of significant manufacturers and suppliers in the stalkerware industry.

In the stalkerware market, the following prominent start-ups are:

Norton -

Numerous great software programs made by the well-known security company Norton, which millions of people use, are available today. One such device from this manufacturer is Norton Power Eraser. Malware may be completely removed from your machine using this top-notch antivirus tool. With the help of its robust scanning module, it gets rid of any hazardous files that are deeply embedded in your device. To protect you in 2025, it might also get rid of malware programs, adware toolbars, and other risks. Android, iOS, Windows, and Mac devices are all compatible with it.

BullGuard Antivirus -

You can fully safeguard your system with BullGuard Antivirus, one of the best antimalware programs of 2025. Beginners may utilize it easily because of the user interface's simplicity.

Among its numerous features are a firewall, the best antivirus module, social media protection, and the best password manager. Additionally, this software offers a powerful parental control feature.

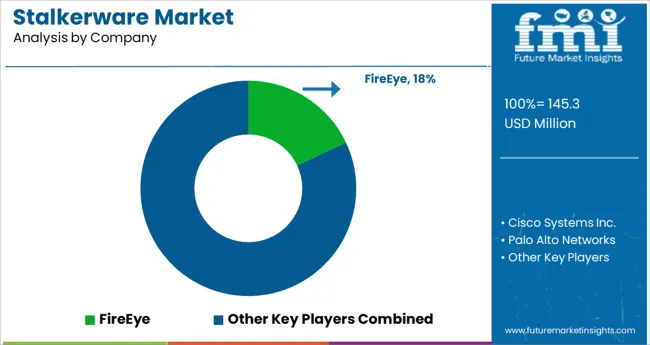

The FMI study on the global market indicates that as new cutting-edge technology is integrated, it creates stalkerware market opportunities for new major firms to compete and experiment with their stalkerware software.

Due to the cutting-edge solutions provided by the leading industry providers, the market is fragmented and heading toward consolidation.

The distribution channels are being expanded by brands, and new tools like AI and machine learning are being integrated into them (ML). Key players work together and integrate with other important companies in order to improve client satisfaction. This increases the demand for stalkerware in new areas.

Recent Development:

Release

| Company | Details |

|---|---|

| FireEye | FireEye has released stalkerware software that includes real-time scanning and a high-security firewall. This increases the demand for stalkerware services. |

| Cisco | Cisco has released its safe malware analytics service as part of its threat grid initiative, which provides prioritized threats and edge-to-endpoint integration, boosting sales of stalkerware systems. |

| Avast | Avast announced the release of its annual Threat Landscape Report in January 2020. The key security issues that customers face in 2020 are covered in detail in this research. The Avast Threats Labs Team gathers and compiles the threats. |

Collaboration

| Company | Details |

|---|---|

| Kaspersky | Kaspersky announced the opening of its first Transparency Center in Asia Pacific in collaboration with CyberSecurity Malaysia in 2020 to enable partners and government stakeholders with a safe portal to inspect the source code of the company's solutions. |

The global stalkerware market is estimated to be valued at USD 145.3 million in 2025.

It is projected to reach USD 265.1 million by 2035.

The market is expected to grow at a 6.2% CAGR between 2025 and 2035.

The key product types are android/ios, windows and mac.

personal users segment is expected to dominate with a 71.0% industry share in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA