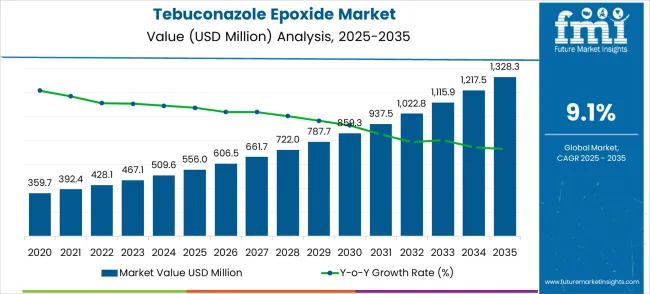

The tebuconazole epoxide market is expected to expand from USD 556.0 million in 2025 to USD 1,328.3 million by 2035, growing at a CAGR of 9.1%. Over the first five years, from 2025 to 2030, the market grows steadily, moving from USD 359.7 million in 2025 to USD 556.0 million in 2030. During this period, annual increments remain consistent, progressing from USD 392.4 million in 2026 to USD 467.1 million in 2029. This early phase is largely driven by increasing demand in agriculture for effective crop protection, as well as regulatory approvals and growing awareness of the benefits of tebuconazole-based solutions in pest management.

In the second half of the decade, from 2030 to 2035, the market experiences accelerated growth, with values moving from USD 556.0 million to USD 1,328.3 million. Between 2030 and 2035, the market is projected to expand from USD 606.5 million in 2031 to USD 1,217.5 million in 2034. Factors such as technological advancements in chemical formulations, the expansion of applications in agriculture, and the increasing demand for crop protection products with minimal environmental impact contribute to this rapid growth. By 2035, the market is expected to reach USD 1,328.3 million, reflecting the ongoing adoption of tebuconazole epoxide-based solutions and their increasing use in various agrochemical applications across different regions.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 556.0 million |

| Forecast Value in (2035F) | USD 1,328.3 million |

| Forecast CAGR (2025 to 2035) | 9.1% |

The tebuconazole epoxide market plays a significant role within the broader agricultural chemicals industry, with a growing demand driven by the need for effective crop protection. In the agricultural chemicals market, the share of tebuconazole epoxide is around 3-5%, as fungicides like tebuconazole epoxide become increasingly important for safeguarding crops against fungal diseases. The rise in the need for crop protection, especially in high-value crops such as cereals and fruits, supports this market's growth. In the pesticide market, tebuconazole epoxide contributes approximately 4-6%, reflecting its vital role in protecting crops from various fungal pathogens that can otherwise reduce yields and quality.

In the crop protection market, tebuconazole epoxide holds about 5-7% of the market share. Its use in preventing crop loss from fungal infections, thereby ensuring higher crop yields, has positioned it as a key player in modern agricultural practices. In the food production market, the share of tebuconazole epoxide is around 2-4%, as its application in food crops helps improve productivity and ensures food safety. This is particularly crucial as the global demand for food rises, and farmers seek reliable crop protection solutions. Finally, in the environmental safety market, tebuconazole epoxide represents 1-3%, as it plays a part in environmentally safer, more green farming practices.

Market expansion is being supported by the increasing global demand for food security and the corresponding need for high-efficacy fungicides that can provide superior disease control and crop yield protection while maintaining environmental compliance across various agricultural applications. Modern agrochemical manufacturers are increasingly focused on implementing intermediate solutions that can enhance product performance, improve biological activity, and provide consistent quality in advanced crop protection formulations. Tebuconazole epoxide's proven ability to deliver exceptional fungicidal activity, superior synthesis versatility, and reliable intermediate properties make them essential components for contemporary agrochemical manufacturing and crop protection solutions.

The growing emphasis on integrated pest management is driving demand for tebuconazole epoxide that can support advanced fungicide formulations, reduce application rates, and enable effective disease control with minimal environmental impact. Agricultural chemical processors' preference for intermediates that combine biological efficacy with synthetic efficiency and cost-effectiveness is creating opportunities for innovative tebuconazole epoxide implementations. The rising influence of precision agriculture and green farming trends is also contributing to increased adoption of tebuconazole epoxide that can provide advanced agrochemical solutions without compromising crop protection effectiveness or environmental safety.

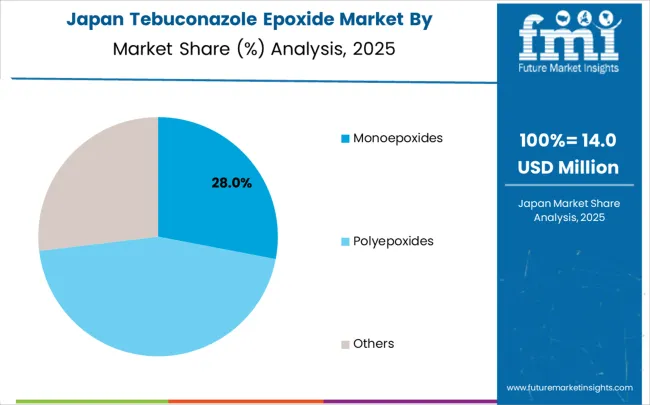

The market is segmented by type, application, and region. By type, the market is divided into monoepoxides, polyepoxides, and others. Based on application, the market is categorized into agrochemical industry, scientific research, fine chemical industry, and others. Regionally, the market is divided into North America, Europe, East Asia, South Asia & Pacific, Latin America, and the Middle East & Africa.

The monoepoxides segment is projected to account for 72.0% of the tebuconazole epoxide market in 2025, reaffirming its position as the leading type category. Agrochemical manufacturers increasingly utilize monoepoxides for their superior synthesis efficiency, proven reaction selectivity, and convenience in fungicide intermediate production applications across crop protection formulations, pharmaceutical synthesis, and specialty chemical manufacturing. Monoepoxide technology's established synthetic capabilities and consistent quality output directly address the industrial requirements for reliable chemical intermediates and operational efficiency in large-scale agrochemical production.

This type segment forms the foundation of modern agrochemical intermediate operations, as it represents the compound class with the greatest synthetic utility and established market demand across multiple chemical categories and manufacturing applications. Manufacturer investments in enhanced monoepoxide synthesis technologies and purity control systems continue to strengthen adoption among chemical producers. With companies prioritizing consistent reaction performance and proven synthetic reliability, monoepoxides align with both operational efficiency objectives and product quality requirements, making them the central component of comprehensive agrochemical intermediate strategies.

The agrochemical industry is projected to represent 65.0% of tebuconazole epoxide demand in 2025, underscoring its critical role as the primary industrial consumer of specialty chemical intermediates for fungicide manufacturing and crop protection product development. Agrochemical companies prefer tebuconazole epoxide for their exceptional biological activity, superior synthesis versatility, and ability to enhance product formulations while reducing manufacturing complexity and improving fungicidal efficacy. Positioned as essential intermediates for modern agrochemical manufacturing, tebuconazole epoxide offers both synthetic advantages and performance benefits.

The segment is supported by continuous innovation in crop protection product development and the growing availability of specialized synthesis technologies that enable premium agrochemical production with enhanced biological activity and environmental compliance requirements. Agrochemical manufacturers are investing in advanced intermediate systems to support large-scale production and quality assurance for next-generation fungicide formulations. As food security becomes more critical and green agriculture practices increase, the agrochemical industry will continue to dominate the end-user market while supporting advanced intermediate utilization and product innovation strategies.

The tebuconazole epoxide market is advancing rapidly due to increasing demand for effective crop protection solutions and growing adoption of specialty chemical intermediates that provide enhanced biological activity and synthesis efficiency across diverse agrochemical applications. The market faces challenges, including regulatory compliance requirements, environmental safety considerations, and the need for advanced synthesis technology investments. Innovation in green manufacturing processes and environmentally compliant formulations continues to influence product development and market expansion patterns.

The growing adoption of polyepoxide formulations and enhanced synthetic processing methods is enabling chemical manufacturers to produce premium tebuconazole epoxide with superior purity levels, enhanced biological activity, and advanced synthesis efficiency capabilities. Advanced synthesis systems provide improved product quality while allowing more efficient processing and consistent output across various chemical applications and reaction conditions. Manufacturers are increasingly recognizing the competitive advantages of advanced synthesis capabilities for product differentiation and premium market positioning in demanding agrochemical segments.

Modern tebuconazole epoxide producers are incorporating environmentally compliant manufacturing processes and eco-conscious production systems to enhance product quality, reduce environmental impact, and ensure consistent regulatory compliance for agrochemical customers. These technologies improve manufacturing eco-efficiency while enabling new applications, including reduced-impact formulations and environmentally friendly synthesis methods. Advanced green integration also allows manufacturers to support premium positioning and environmental responsibility beyond traditional chemical intermediate manufacturing capabilities.

| Country | CAGR (2025-2035) |

|---|---|

| China | 12.3% |

| India | 11.4% |

| Germany | 10.5% |

| Brazil | 9.6% |

| USA | 8.6% |

| UK | 7.7% |

| Japan | 6.8% |

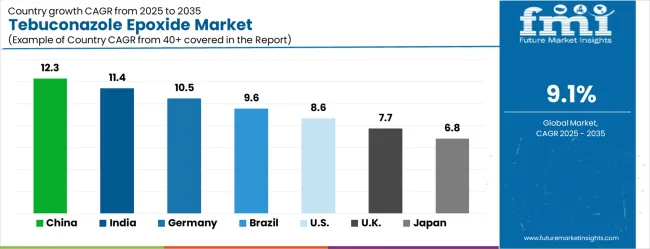

The tebuconazole epoxide market is experiencing strong growth globally, with China leading at a 12.3% CAGR through 2035, driven by the expanding agrochemical manufacturing industry, growing production capabilities, and significant investment in chemical intermediate infrastructure development. India follows at 11.4%, supported by large-scale agricultural chemical manufacturing, emerging synthesis facilities, and growing domestic demand for crop protection intermediates.

Germany shows growth at 10.5%, emphasizing technological innovation and premium chemical development. Brazil records 9.6%, focusing on agricultural expansion and chemical manufacturing modernization. The USA demonstrates 8.6% growth, prioritizing advanced manufacturing technologies and high-performance intermediate supply. The UK exhibits 7.7% growth, emphasizing chemical manufacturing capabilities and quality intermediate adoption. Japan shows 6.8% growth, supported by precision chemical manufacturing excellence and advanced synthesis technology innovation.

The report covers an in-depth analysis of 40+ countries, with top-performing countries highlighted below.

Revenue from tebuconazole epoxide in China is projected to exhibit exceptional growth with a CAGR of 12.3% through 2035, driven by expanding chemical manufacturing infrastructure and rapidly growing agrochemical production capabilities supported by government industrial development initiatives. The country's abundant chemical manufacturing capacity and increasing investment in synthesis technology are creating substantial demand for advanced intermediate solutions. Major agrochemical companies and chemical manufacturers are establishing comprehensive synthesis capabilities to serve both domestic and international markets.

The tebuconazole epoxide market in India is forecasted to expand at a CAGR of 11.4%, supported by the country's growing chemical manufacturing capacity, emerging agrochemical production facilities, and increasing domestic demand for advanced crop protection intermediates and specialty chemicals. The country's developing chemical supply chain and growing agrochemical industry are driving demand for sophisticated intermediate capabilities. International technology providers and domestic manufacturers are establishing extensive production and distribution capabilities to address the growing demand for tebuconazole epoxide products.

Revenue from tebuconazole epoxide in Germany is expanding at a CAGR of 10.5%, supported by the country's advanced chemical industry, strong emphasis on technological innovation, and robust demand for high-performance intermediates among quality-focused manufacturers. The nation's mature chemical manufacturing sector and high adoption of advanced synthesis technologies are driving sophisticated intermediate capabilities throughout the supply chain. Leading manufacturers and technology providers are investing extensively in premium intermediate development and advanced synthesis methods to serve both domestic and export markets.

The sale of tebuconazole epoxide in Brazil is growing at a CAGR of 9.6%, driven by expanding agricultural chemical manufacturing infrastructure, increasing crop protection industry modernization patterns, and growing investment in advanced intermediate technology development. The country's developing chemical resources and modernization of manufacturing facilities are supporting demand for advanced intermediate technologies across major production regions. Chemical manufacturers and agrochemical companies are establishing comprehensive capabilities to serve both domestic agricultural centers and emerging export markets.

Demand for tebuconazole epoxide in the USA is expanding at a CAGR of 8.6%, supported by the country's advanced chemical manufacturing industry, emphasis on high-performance intermediate supply, and strong demand for sophisticated agrochemical solutions among technology-focused companies. The USA's established chemical sector and technological expertise are supporting investment in advanced intermediate capabilities throughout major production centers. Industry leaders are establishing comprehensive quality management systems to serve both domestic and export markets with premium intermediate solutions.

Revenue from tebuconazole epoxide in the UK is growing at a CAGR of 7.7%, driven by the country's chemical manufacturing industry, emphasis on quality intermediate adoption, and strong demand for high-performance chemical solutions among established producers. The UK's mature chemical sector and focus on technological excellence are supporting investment in advanced intermediate capabilities throughout major industrial centers. Manufacturing companies are establishing comprehensive intermediate systems to serve both domestic and international markets with quality chemical solutions.

The tebuconazole epoxide market in Japan is expected to expand at a CAGR of 6.8%, supported by the country's focus on precision manufacturing excellence, advanced chemical applications, and strong preference for high-quality intermediate solutions. Japan's sophisticated chemical manufacturing industry and emphasis on synthesis precision are driving demand for advanced intermediate technologies including tebuconazole epoxide systems and high-purity processing methods. Leading manufacturers are investing in specialized capabilities to serve chemical production, agrochemical manufacturing, and precision intermediate applications with premium chemical offerings.

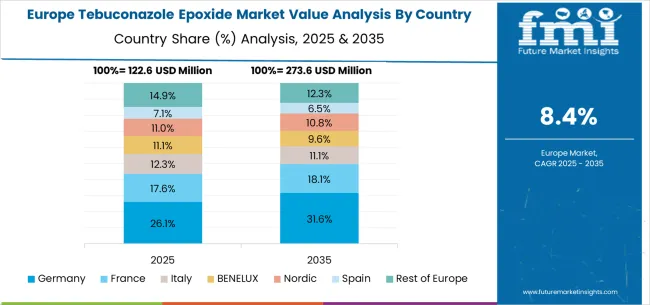

The tebuconazole epoxide market in Europe is projected to grow from USD 122.3 million in 2025 to USD 292.2 million by 2035, registering a CAGR of 9.1% over the forecast period. Germany is expected to maintain its leadership position with a 25.0% market share in 2025, declining slightly to 24.5% by 2035, supported by its strong chemical manufacturing industry, advanced synthesis facilities, and comprehensive agrochemical intermediate supply network serving major European markets.

France follows with an 18.5% share in 2025, projected to reach 18.8% by 2035, driven by robust demand for tebuconazole epoxide in agrochemical manufacturing, pharmaceutical synthesis, and specialty chemical applications, combined with established chemical traditions incorporating advanced intermediates. The United Kingdom holds a 16.0% share in 2025, expected to decrease to 15.7% by 2035, supported by strong chemical manufacturing demand but facing challenges from competitive pressures and industrial restructuring. Italy commands a 14.0% share in 2025, projected to reach 14.2% by 2035, while Spain accounts for 12.5% in 2025, expected to reach 12.8% by 2035. The Netherlands maintains a 4.5% share in 2025, growing to 4.7% by 2035. The Rest of Europe region, including Nordic countries, Eastern Europe, Portugal, Belgium, Switzerland, and Austria, is anticipated to gain momentum, expanding its collective share from 9.5% to 9.3% by 2035, attributed to increasing adoption of advanced agrochemicals in Nordic countries and growing chemical manufacturing activities across Eastern European markets implementing industrial modernization programs.

The tebuconazole epoxide market is characterized by competition among established chemical manufacturers, specialized agrochemical companies, and integrated intermediate solution providers. Companies are investing in advanced synthesis technology research, process optimization, quality control systems, and comprehensive product portfolios to deliver consistent, high-quality, and cost-effective tebuconazole epoxide solutions. Innovation in synthesis processes, green manufacturing, and environmental compliance is central to strengthening market position and competitive advantage.

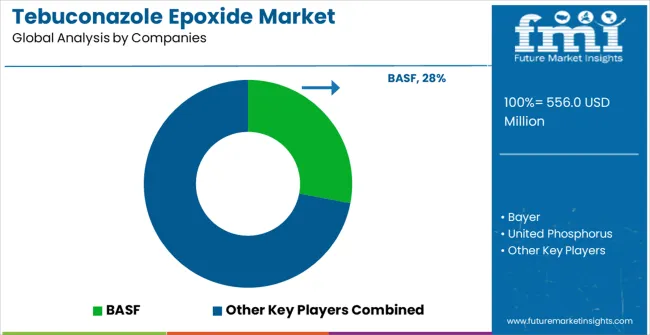

BASF leads the market with a strong market share, offering comprehensive chemical solutions with a focus on agrochemical applications and advanced synthesis systems. Bayer provides specialized agrochemical capabilities with an emphasis on crop protection formulations and manufacturing efficiency. United Phosphorus delivers innovative chemical solutions with a focus on high-performance applications and product versatility. Gharda Chemicals specializes in chemical manufacturing and advanced intermediate solutions for agrochemical markets. Syngenta focuses on crop protection technology and integrated chemical operations. Rallis offers specialized tebuconazole epoxide products with emphasis on Asian markets and agricultural applications.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 556.0 million |

| Type | Monoepoxides, Polyepoxides, Others |

| Application | Agrochemical Industry, Scientific Research, Fine Chemical Industry, Others |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, India, Brazil, Australia and 40+ countries |

| Key Companies Profiled | BASF, Bayer, United Phosphorus, Gharda Chemicals, Syngenta, and Rallis |

| Additional Attributes | Dollar sales by type and application category, regional demand trends, competitive landscape, technological advancements in synthesis systems, process innovation, green manufacturing development, and quality optimization |

Application:

Europe

East Asia

South Asia & Pacific

Latin America

Middle East & Africa

The global tebuconazole epoxide market is estimated to be valued at USD 556.0 million in 2025.

The market size for the tebuconazole epoxide market is projected to reach USD 1,328.3 million by 2035.

The tebuconazole epoxide market is expected to grow at a 9.1% CAGR between 2025 and 2035.

The key product types in tebuconazole epoxide market are monoepoxides, polyepoxides and others.

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA