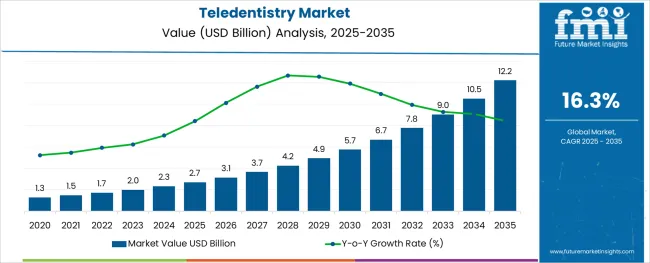

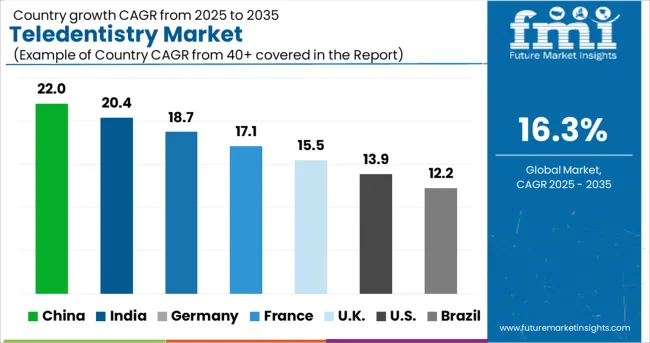

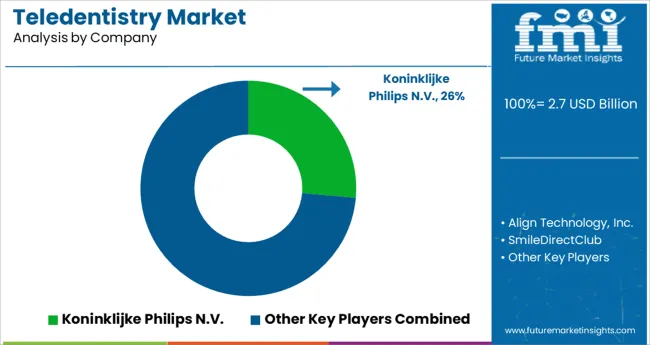

The Teledentistry Market is estimated to be valued at USD 2.7 billion in 2025 and is projected to reach USD 12.2 billion by 2035, registering a compound annual growth rate (CAGR) of 16.3% over the forecast period.

The teledentistry market is experiencing robust expansion driven by advancements in digital health infrastructure, rising awareness of remote dental care accessibility, and the growing emphasis on patient centric care delivery. Increasing smartphone penetration, coupled with the demand for timely oral health consultations, has accelerated adoption across both developed and emerging economies.

Governments and healthcare organizations are recognizing the value of teledentistry in reaching underserved populations, particularly in rural and low access regions. Integration with electronic health records, AI powered diagnostics, and seamless scheduling tools have further enhanced the utility and reliability of remote dental platforms.

The ongoing focus on reducing in person visits without compromising care quality, along with cost efficiency and real time communication, is positioning teledentistry as a foundational element of modern oral healthcare systems.

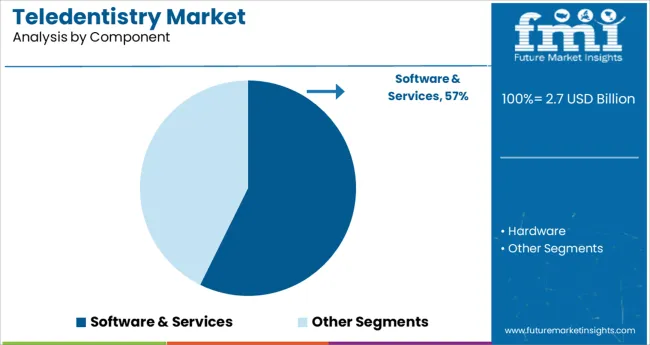

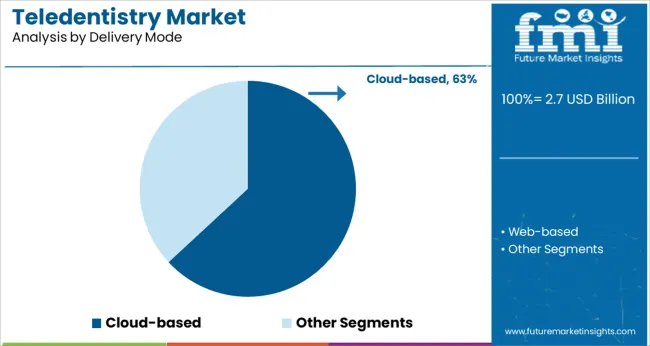

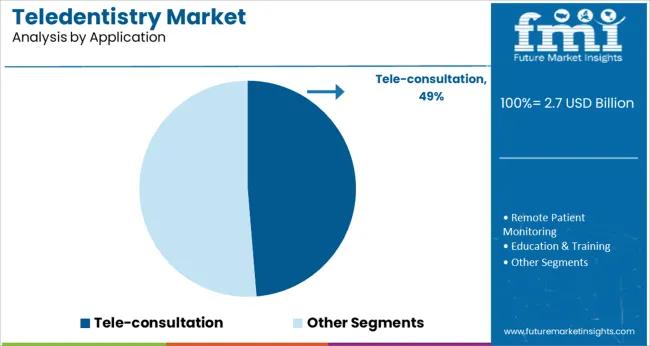

The market is segmented by Component, Delivery Mode, Application, and End Use and region. By Component, the market is divided into Software & Services and Hardware. In terms of Delivery Mode, the market is classified into Cloud-based and Web-based. Based on Application, the market is segmented into Tele-consultation, Remote Patient Monitoring, and Education & Training.

By End Use, the market is divided into Providers, Patients, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The software and services segment is anticipated to account for 57.30% of total market revenue by 2025 within the component category, marking it as the most significant contributor. This growth is supported by the rising demand for virtual care platforms that offer scheduling, consultation management, diagnostics, and digital recordkeeping in one integrated interface.

As dental practices increasingly adopt digital transformation strategies, the need for robust, scalable, and compliant software solutions has become essential. Subscription based service models and cloud integration capabilities are further encouraging adoption.

The services component, which includes technical support, training, and integration assistance, ensures optimal platform performance and user experience. These factors collectively contribute to the continued dominance of software and services in enabling end to end teledental care delivery.

The cloud based segment is projected to represent 63.10% of total market revenue by 2025 within the delivery mode category, establishing itself as the leading deployment model. This is driven by its ability to offer flexibility, scalability, and real time data access across diverse clinical settings.

Cloud based systems allow dental professionals to access patient records, treatment plans, and diagnostic tools from any location, streamlining care coordination and improving responsiveness. The model also supports automatic software updates, data backup, and regulatory compliance management without the need for significant onsite infrastructure.

As practices seek cost effective, secure, and interoperable solutions, cloud deployment continues to gain traction as the preferred choice for teledentistry platforms.

The tele consultation segment is expected to hold 48.70% of total market revenue by 2025 within the application category, making it the foremost area of use. This segment’s leadership is driven by the widespread need for remote dental advice, triage, and follow up care, particularly in regions with limited in person access to dental specialists.

Patients benefit from timely consultations for issues ranging from oral hygiene to emergency pain management, reducing the burden on physical clinics and enhancing service reach. Dental professionals use tele consultations to assess cases, provide guidance, and determine the necessity of in office visits, thereby improving efficiency and reducing care delays.

The convenience, cost savings, and accessibility associated with tele consultation have firmly positioned it as the primary use case within the evolving teledentistry market.

In addition, dental virtual visits have enabled the reach of oral healthcare in underserved areas of developing countries. Furthermore, rising technology penetration has a significant impact on the entire healthcare system, including telehealth services such as teledentistry.

Growing efforts by notable players to set themselves apart from competitors have increased support for technological advancements in teledentistry at the lowest cost possible, which has ultimately led to industry growth. In addition, improved patient safety and, perhaps, increased convenience of remote dental care are prominent market drivers.

The versatility of Telemedicine Technology boosting the growth of Teledentistry

Telemedicine technologies such as teledentistry are considered the most versatile to deliver dental care, dental education, and telemonitoring remotely at a distance. This enables wide access to patient-centric care in remote locations ensuring the safety of patients from the viral transmission.

Laws pertaining to teledentistry along with reimbursement policies restraining market growth

Thus, not following the rules and regulations according to the law may lead to penalties. Lack of knowledge regarding the reimbursement policies of teledentistry services is creating confusion and obstacles to the growth of the market.

Internet of Things making teledentistry feasible in North America

The growth of this market is estimated to grow owing to key driving factors such as the growth in the interventions by public-private organizations for improving oral health and increasing adoption of teledentistry across North America.

In addition, the growth of developing technology along with integrating the Internet of Things to improve the overall dental treatment experience, especially in the remote model is working in the favor of the market. Thus, North America is expected to hold a substantial market share in the teledentistry market.

Technology increasing accessibility to teledentistry in the Asia Pacific

Largely developing and underdeveloped regions in the Asia Pacific region are contributing to the growth of the teledentistry market. As accessibility to rural areas is difficult, the intervention of technology is playing a key role in the growth of the market. Moreover, consumers too have shown a keen inclination towards investing in teledentistry owing to favorable results.

Furthermore, the penetration of 5G services along with the increasing use of the internet of things is favoring the growth of the teledentistry market in the Asia Pacific. Moreover, the growth of the Asia Pacific teledentistry market can be attributed to growing government initiatives in teledentistry.

IT Companies and rising Healthcare Expenditures driving Teledentistry Market Growth

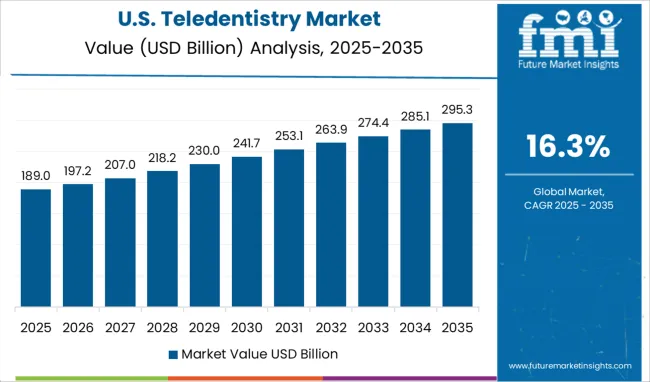

The presence of a large number of key players operating in the USA with better teledentistry solutions is contributing to the growth of the teledentistry market. In addition, the high healthcare IT expenditure, excellent internet connectivity, wide usage of smartphones, and growing awareness regarding virtual dental care among the general public are driving the overall growth of the market.

The constant development of cloud-based platforms and their emergence in developing teledentistry companies are fueling the industry's growth. Thus, the US is expected to possess a 40% market share of the teledentistry market in 2025.

Demand for dental treatments spurring the growth of Teledentistry in India

India is anticipated to register the fastest CAGR during the forecast period due to the improving penetration of mobile health in dental practices. The growing demand for convenient dental treatments in remote and rural areas of the region is supporting the growth of the market.

Furthermore, increasing investments in the healthcare sector in countries such as India are expected to boost the market growth. Thus, India is expected to possess a 35% market share in the teledentistry market in 2025.

Internet of Things creating lucrative opportunities for software and services segment

The rising adoption of wirelessly connected care technologies in dental healthcare, initiatives by key companies, and the availability of a large number of dental software and services is increasing the dependency on wireless technology. In addition, the integration of the Internet of Things is positively influencing the demand for the teledentistry market.

The increasing number of people adopting teledentistry software due to its convenience and cost-effectiveness is anticipated to drive the market over the forecast period. The software and services segment is expected to dominate the teledentistry market by accumulating a market for 73% market share for teledentistry market.

The hardware segment is estimated to register the fastest growth rate over the forecast period owing to technological advancements in launching new dental care hardware in the market. Some of the dental hardware such as electric toothbrushes that send feedback on oral health to teledentistry software are highly aiding the therapeutic application of tele-dental mode.

Easy accessibility increasing dependency on cloud-based technology for teledentistry

The factors contributing to the growth include the introduction of technologically advanced cloud-computing teledentistry solutions and increasing awareness among dental practitioners and patients to adopt cloud-based software to record health data and store it effortlessly.

In addition, the easy accessibility with large bandwidth, storage, and recovery capacity with high safety assurance is fueling the growth of the segment. The cloud-based segment is expected to possess 65% market share in 2025.

The web-based segment is anticipated to witness significant growth from 2025 to 2035 owing to the emergence of web-based teledentistry applications and their wide adoption among end-users. The high penetration of smartphones in rural and remote locations is enhancing access to dental healthcare. The cost-effectiveness and seamless user interface offered in this virtual care platform are supporting the rapid growth of the segment.

Ease of reaching patients influencing demand for Teleconsultations

The remote patient monitoring segment is anticipated to register the fastest CAGR of 16.6% from 2025 to 2035 owing to the rising dental consciousness among the adult population, coupled with the convenience of undergoing dental treatments from home. The availability of a significant number of self-monitoring dental care software coupled with hardware is helping people in gaining oral care without reaching dentists. Such factors are anticipated to boost segment growth.

The efficiency of data management increasing demand on providers

The growing adoption rate of teledentistry platforms among dental providers reduces the disease burden in dental facilities. In addition, the teledentistry software provides seamless access to patients’ dental records with improved data management and real-time quality reporting, which improves its usage among healthcare providers. Thus, the provider's segment is expected to dominate the market and account for a revenue share of over 45% in 2025

The patient segment is anticipated to register the fastest growth rate over the forecast period owing to the increasing number of smartphone users and growing active subscribers to teledentistry solutions. In addition, the better accessibility with high internet connectivity, feasibility, and affordability of dental consultations through virtual mode is making people adopt such platforms more as compared to walk-in dental consultations.

The market is highly competitive. The key players are involved in new solution launches, software and services innovations, acquisitions, and partnerships to gain a competitive edge over each other. Such activities are expected to support the rapid growth of the market.

| Report Attribute | Details |

|---|---|

| Market Value in 2025 | USD 1.45 Billion |

| Market Value in 2035 | USD 6.56 Billion |

| Growth Rate | CAGR of 16.3% from 2025 to 2035 |

| Base Year for Estimation | 2024 |

| Historical Data | 2020 to 2024 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | Revenue in billion and CAGR from 2025 to 2035 |

| Report Coverage | Revenue Forecast, Volume Forecast, Company Ranking, Competitive Landscape, Growth Factors, Trends, and Pricing Analysis |

| Segments Covered | Component, Delivery Mode, Application, End Use, Region |

| Regions Covered | North America; Latin America; Europe; South Asia; East Asia; Oceania; Middle East and Africa (MEA) |

| Key Countries Profiled | USA, Canada, Brazil, Argentina, Germany, UK, France, Spain, Italy, India, Malaysia, Singapore, Thailand, China, Japan, South Korea, Australia, New Zealand, GCC, South Africa, Israel |

| Key Companies Profiled | Koninklijke Philips N.V.; Align Technology, Inc.; SmileDirectClub; MouthWatch, LLC; Dentulu, Inc.; Denteractive Solutions Inc.; Toothpick; Smile Virtual LLC; Virtudent, Inc.; Straight Teeth Direct |

| Customization | Available Upon Request |

The global teledentistry market is estimated to be valued at USD 2.7 billion in 2025.

It is projected to reach USD 12.2 billion by 2035.

The market is expected to grow at a 16.3% CAGR between 2025 and 2035.

The key product types are software & services and hardware.

cloud-based segment is expected to dominate with a 63.1% industry share in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA