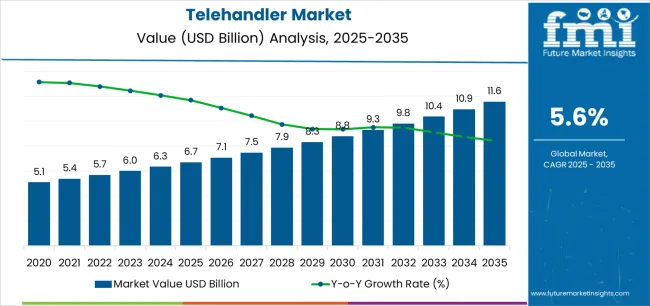

The Telehandler Market is estimated to be valued at USD 6.7 billion in 2025 and is projected to reach USD 11.6 billion by 2035, registering a compound annual growth rate (CAGR) of 5.6% over the forecast period.

The Telehandler market is experiencing strong growth, driven by increasing demand for versatile lifting and material handling equipment across construction, agriculture, and industrial sectors. The adoption of telehandlers is being supported by their multi-functional capabilities, which combine the benefits of forklifts, cranes, and loaders into a single machine, enhancing operational efficiency and reducing equipment costs. Technological advancements, including improved hydraulic systems, extended lift capacities, and enhanced safety features, have expanded their applicability across challenging environments.

Growing infrastructure investments, large-scale construction projects, and the mechanization of agricultural operations are contributing to market expansion. The rental services segment is further enabling cost-effective access to equipment, especially for small and medium enterprises, which reduces upfront capital expenditure and promotes flexible utilization.

As organizations prioritize productivity, efficiency, and safety, telehandlers are being increasingly adopted as essential material handling solutions Continuous innovation in telehandler design, performance optimization, and operator comfort is expected to sustain market growth over the coming decade.

| Metric | Value |

|---|---|

| Telehandler Market Estimated Value in (2025 E) | USD 6.7 billion |

| Telehandler Market Forecast Value in (2035 F) | USD 11.6 billion |

| Forecast CAGR (2025 to 2035) | 5.6% |

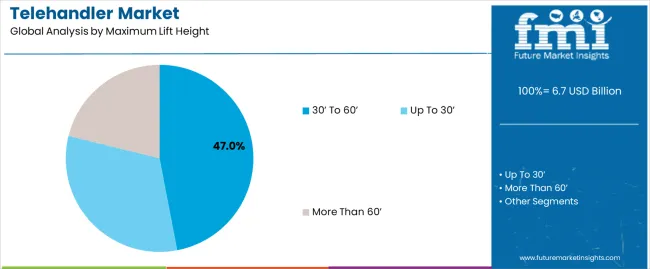

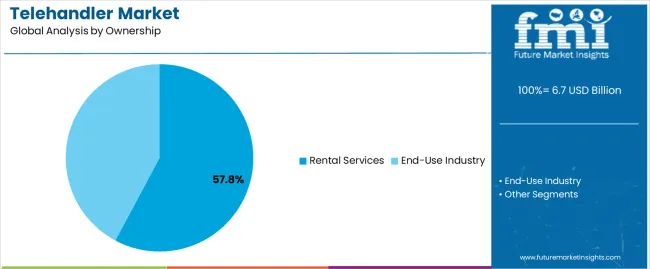

The market is segmented by Maximum Lift Height and Ownership and region. By Maximum Lift Height, the market is divided into 30’ To 60’, Up To 30’, and More Than 60’. In terms of Ownership, the market is classified into Rental Services and End-Use Industry. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The 30’ to 60’ maximum lift height segment is projected to hold 47.0% of the market revenue in 2025, establishing it as the leading category. Growth is being driven by the demand for telehandlers capable of handling medium to high-elevation material lifting in construction sites, warehouses, and agricultural applications. This lift height range provides an optimal balance between reach capability and operational stability, enabling versatile use across multiple environments.

Machines in this category are being increasingly equipped with advanced hydraulic systems, robust chassis designs, and improved operator controls, enhancing both safety and efficiency. The ability to perform lifting, loading, and placement tasks at varying heights without additional equipment reduces operational complexity and costs.

Contractors and facility managers are prioritizing these machines due to their adaptability, reliability, and performance in diverse applications As infrastructure projects expand and multi-level material handling requirements increase, the 30’ to 60’ segment is expected to maintain its leading position, supported by continuous enhancements in safety, durability, and ease of operation.

The rental services ownership segment is anticipated to account for 57.8% of the market revenue in 2025, making it the dominant category. Growth in this segment is driven by the increasing preference for cost-effective equipment access, particularly among small and medium enterprises that aim to reduce upfront capital expenditure. Rental services allow businesses to obtain high-performance telehandlers with flexible usage terms, enabling scaling of operations according to project demands.

This model provides access to machines with advanced features, regular maintenance, and safety compliance, without long-term ownership liabilities. Companies are leveraging rental services to manage operational cash flow efficiently while ensuring availability of equipment for critical projects.

The flexibility, lower financial risk, and immediate deployment offered by rental solutions are further boosting adoption across construction, agriculture, and industrial sectors As demand for telehandlers continues to grow, particularly for projects requiring varying lift heights and capacities, rental services are expected to remain the preferred ownership model, reinforcing market expansion and broadening end-user accessibility.

Proliferation of Electric Telehandlers Paves the Way for Innovation and Sustainability

Several businesses have showcased their adaptability by launching electric telehandlers. Environmental concerns and stricter mandates to minimize emissions are assisting in the shift toward these. These provide benefits, such as less noise pollution and cheaper long-term running costs compared to diesel parallels.

Technological developments in batteries are making these more practical for various uses. These are becoming popular due to their advantages for the environment. They help capacity to increase productivity and fulfill sustainability objectives. For instance, JCB introduced the new 525-60E electric compact telehandler in September 2025 as part of its fully electric e-tech range.

In the similar category of compact telehandlers, Wacker Neuson launched a new compact electric telehandler in November 2025. This new TH412e telehandler is compact and can be used in confined spaces.

Hydrogen and Hydrogen-fuel Cell-based Telehandlers Hit the Market

Hydrogen fuel cell telehandlers are a green alternative to conventional diesel-powered versions. By producing energy onboard via the electrochemical reactions of hydrogen and oxygen, hydrogen fuel cells emit no toxic pollutants and solely create water vapor as a byproduct.

Because of this, these are perfect for application in locations with strict air quality standards, indoor facilities, urban construction sites, and/or protected areas. Furthermore, extensive working ranges and quick refilling times are two benefits of hydrogen fuel cell technology that give operators an effective and sustainable alternative for material handling applications.

In December 2025, Manitou introduced its first-of-its-kind product. The company aims to introduce a 100% hydrogen telehandler by 2029. The hydrogen program is part of the French manufacturer's effort to reduce greenhouse gas emissions from its equipment by 34% per hour by 2035.

| Top Maximum Lift Height | 30’ to 60’ |

|---|---|

| Value Share (2025) | 47% |

In the maximum lift height category, the 30’ to 60’ segment gained 47% of market shares in 2025. Telehandlers with more lift heights are becoming more necessary as vertical construction projects, such as skyscrapers and high-rise buildings, increase globally. These can efficiently facilitate building operations at different heights and reach elevated work areas, and higher levels are essential for construction organizations.

Vertical development tends to be more necessary than horizontal expansion due to urbanization trends and the limited amount of accessible land in metropolitan areas. High lift height telehandlers are crucial for maneuvering through congested areas and reaching lofty building sites where conventional cranes can be too big or too limited.

| Top Lifting Capacity | 3 to 6 |

|---|---|

| Value Share (2025) | 46.20% |

In the lifting capacity category, the 3 to 6 ton segment holds 46.20% of the market share in 2025. The increased demand for telehandlers with lifting capabilities ranging from 3 to 6 tons highlights the expansion potential in the construction, infrastructure development, and industrial sectors.

As construction operations develop internationally and infrastructure projects increase, there is a greater demand for telehandlers to fulfill material handling and lifting requirements across various applications and sectors.

The trend of renting equipment stimulates demand with lifting capacities of three to six tons. These can be rented from organizations that specialize in providing equipment. They fulfill the demands of industrial operators, building contractors, and other end users looking for versatile and reasonably priced equipment.

| Countries | Value CAGR (2025 to 2035) |

|---|---|

| United States | 5.10% |

| Germany | 4.50% |

| Japan | 5.60% |

| China | 4.80% |

| India | 5.60% |

The demand for telehandlers in the United States will amplify at a 5.10% CAGR through 2035. The American government has launched 40,000 projects by introducing a USD 1 trillion infrastructure bill in November 2025.

These are necessary equipment for material handling and construction work. Their demand has increased due to the recent spike in infrastructure investment. The demand is predicted to skyrocket as construction companies increase operations to capitalize on these lucrative contracts. This offers potential for development to equipment rental businesses and manufacturers.

The United States telehandler industry is witnessing a commotion as modern technologies like automation, IoT, and telematics gain applications. Construction enterprises and equipment rental businesses are investing in smart telehandlers with the latest features. This helps to increase operational efficiency, raise safety standards, and improve fleet management procedures.

The sales of telehandlers in Germany will amplify at a 4.50% CAGR through 2035. Telehandler manufacturers can boost revenues by tapping into the agricultural sector because of Germany's booming agriculture industry, which is adopting precision farming techniques and technological innovation.

For jobs like harvesting crops, feeding cattle, and managing agricultural inputs, telehandlers with precision attachments like silage grabs, bale handlers, and GPS-guided forks are in high demand. Telehandlers are also required for biomass handling and renewable energy infrastructure projects in Germany. The country's agricultural industry's embrace of renewable energy solutions, including biogas generation and biomass heating, boosts telehandler sales.

The market growth in Japan is estimated at a 5.60% CAGR through 2035. Japan's construction, agriculture, and manufacturing industries are experiencing a labor crisis. This can be ascribed to the country's aging population and diminishing workforce.

By automating and simplifying material handling activities, telehandlers reduce the need for physical labor, which helps manage labor shortages. Telehandlers are in demand as labor-saving equipment as Japanese firms look to increase production and operational efficiency in the face of manpower restrictions. This presents growth prospects for both manufacturers and service providers.

Telehandler demand in China will surge at a 4.80% CAGR through 2035. The Chinese government is investing in infrastructure development initiatives. These include transportation networks, energy projects, public utilities, highways, railways, and others. These projects are boosting demand for telehandlers in large-scale construction projects.

Telehandlers are crucial equipment for supporting infrastructure development projects. As China continues to invest in infrastructure to boost economic growth and improve connectivity, demand for telehandlers as key construction equipment is projected to stay high. This creates growth prospects for infrastructure manufacturers and suppliers.

Telehandler sales in India will augment at a 5.60% CAGR through 2035. Housing, rural infrastructure development, and independent manufacturing are chief targets for government investments. Programs like the Pradhan Mantri Awas Yojana, Pradhan Mantri Gram Sadak Yojana, and Atmanirbhar Bharat Abhiyan boost sales of telehandlers.

Under these government programs, these are necessary tools for building roads, developing infrastructure, and executing construction projects. This makes the market more advantageous for telehandler providers and manufacturers. The demand in India is stimulated further by incentives, including tax breaks, infrastructure status for certain projects, and GST rebates that promote investments in equipment acquisition.

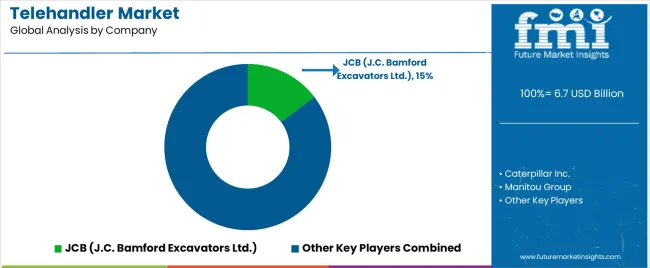

The market is extremely competitive, with corporations like JCB and Caterpillar dominant. These corporations use their brand recognition and worldwide reach to maintain market share. However, regional companies and newcomers are making progress by providing specialized solutions and using technical innovation. Partnerships and technology breakthroughs are significant factors in this landscape, influencing industry players' competitive dynamics and strategic agendas.

Recent Developments

The global telehandler market is estimated to be valued at USD 6.7 billion in 2025.

The market size for the telehandler market is projected to reach USD 11.6 billion by 2035.

The telehandler market is expected to grow at a 5.6% CAGR between 2025 and 2035.

The key product types in telehandler market are 30’ to 60’, up to 30’ and more than 60’.

In terms of ownership, rental services segment to command 57.8% share in the telehandler market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA